Score

JIA証券

https://www.jia-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

Japan

JapanProducts

7

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks、ETFs、Mutual Funds

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

JIA Securities Co., Ltd.

Abbreviation

JIA証券

Platform registered country and region

Company address

Company website

https://www.jia-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

JIA証券 Earnings Calendar

Currency: JPY

Cycle

Q4 FY2023 Earnings

2023/10/30

Revenue(YoY)

6.99B

+174.46%

EPS(YoY)

2.62

+109.31%

JIA証券 Earnings Estimates

Currency: JPY

- DateCycleRevenue/Estimated

- 2023/10/302023/Q35.895B/0

- 2022/10/302022/Q32.973B/0

- 2022/04/272022/Q12.254B/0

- 2021/10/282021/Q34.586B/0

- 2021/04/292021/Q13.732B/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.10%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| JIA Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded r | 1944 |

| Registered Region | Japan |

| Regulatory Status | FSA |

| Product & Services | Bond, equity, investment trust, index futures & options, Japanese Operating Lease Products, JIA funds, Non-listed Company Funds, Real Estate Tokenization Products |

| (Corporate clients) Securitization and Receivables, Wealth Consulting, Financial Advisory, M&A Advisory | |

| Commissions | Equity: 0.1-1.15% + fixed rate depending on trading volume, min 2,200 yen, 10% tax apply |

| Convertible Bonds: 0.1-1% + fixed rate depending on trading volume, min 2,200 yen, max 275,000 yen, 10% tax apply | |

| Foreign Stocks: 0.2-1.25% + fixed rate depending on trading volume, max 1,100,000 yen, 10% tax apply | |

| Customer Service | Address: 〒104-0033 1-5-17 Shinkawa, Chuo-ku, Tokyo Eiha Shinkawa 6F |

| TEL: 03-6280-2251, Weekdays 8:30~17:00 |

JIA Securities Information

Established in 1944, with origins dating back to 1937 under the name Obata Securities, JIA Securities rebranded to its current name in 2021.

Based in Tokyo, it is a prominent financial institution offering a wide range of products and services, including bonds, equities, investment trusts, index futures and options, Japanese Operating Lease Products (JOLP), JIA Funds, Non-listed Company Funds, and Real Estate Tokenization Products.

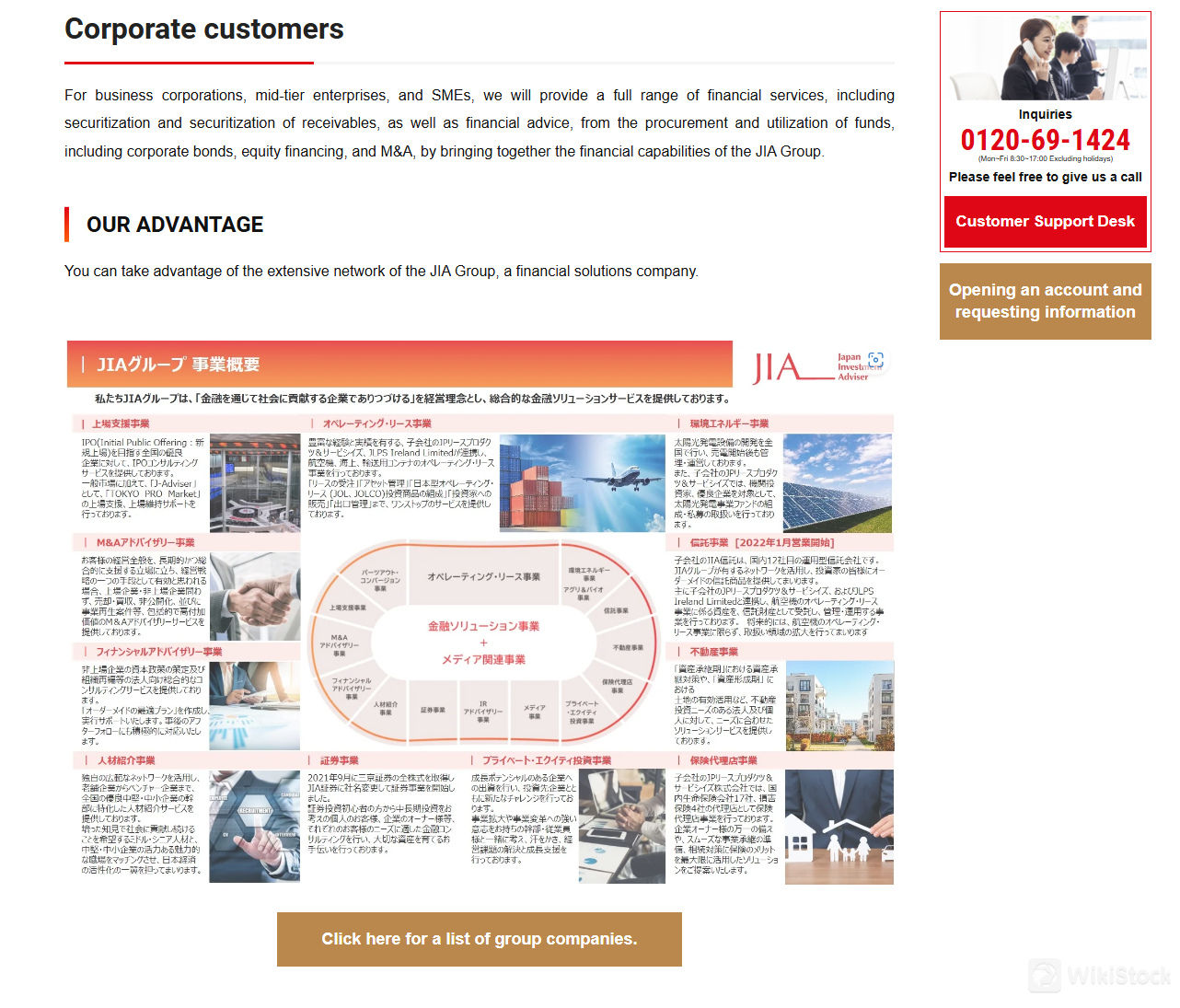

For corporate clients, JIA Securities provides services such as securitization of receivables, wealth consulting, financial advisory, and M&A advisory.

Known for transparent fee structures, JIA Securities utilizes the NISA (Nippon Individual Savings Account) system to offer tax-exempt investment opportunities.

Regulated by Japan's Financial Services Agency (FSA) under license number Director-General of the Kanto Local Finance Bureau (Kinsho) No. 2444, JIA Securities maintains high standards of integrity and credibility in its financial services.

For more detailed information, you can visit their official website: https://www.jia-sec.co.jp/ or contact their customer service directly.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Limited Customer Service Channels |

| Wide Range of Financial Products | |

| Transparent Fee Structures | |

| Tax-Exempt Investments | |

| Extensive Experience |

- Regulatory Oversight: Regulated by Japan's Financial Services Agency (FSA), JIA Securities adheres to rigorous standards.

- Wide Range of Financial Products: JIA Securities offers a comprehensive range of financial products including bonds, equities, investment trusts, index futures and options, and Real Estate Tokenization Products.

- Transparent Fee Structures: The firm provides clarity regarding costs associated with investments, ensuring transparency for clients.

- Tax-Exempt Investments: Utilizing the NISA system, JIA Securities offers tax-exempt investment opportunities, allowing clients to maximize their returns.

- Extensive Experience: Established in 1944 with a rebranding in 2021, JIA Securities boasts decades of experience in the financial sector, providing clients with seasoned expertise. Cons:

- Limited Customer Service Channels: JIA Securities' customer service is primarily accessible via phone and physical address during weekdays, with no support provided through email, live chat, or social media, limiting accessibility for some clients.

- Bonds: JIA Securities offers medium- to long-term bond investments, including a variety of foreign currency bonds in USD, EUR, and MXN.

- Equities: Their equity services encompass domestic stock trading with both spot and margin options, providing expert advice for precise trading. They also offer access to foreign stocks, including US equities and promising emerging market stocks。

- Investment Trusts: For those looking to invest with smaller amounts of capital, JIA Securities provides a range of investment trusts.

- Index Futures and Options:Investors can engage in derivative trading focused on the Nikkei 225 through JIA Securities' index futures and options offerings, allowing for strategic trading based on the movement of the Nikkei average stock price index.

- Japanese Operating Lease Products: JIA Securities offers investment opportunities in Japanese Operating Leases, particularly in the aircraft leasing business. This product is aimed at Japanese corporations seeking tax-efficient investment options.

- JIA Fund: The JIA Fund targets high-performance and early return investments through carefully selected stocks, leveraging JIA Group's unique network and insights.

- Non-listed Company Funds: These funds provide investment opportunities in overseas non-listed companies, offering a diversified approach with a focus on high growth potential.

- Real Estate Tokenization Products: Using JIA Group's real estate management and trust capabilities, JIA Securities offers products based on real estate trust beneficiary rights, enabling investors to participate in the real estate market with tokenized assets.

- Securitization and Receivables: Helping businesses with asset and receivable securitization for enhanced liquidity.

- Financial Advisory: Providing customized advice on asset protection and optimizing internal reserves such as business succession planning, assisting with strategies for smooth management handover, inheritance planning, and long-term business continuity.

- M&A Advisory: Comprehensive support for mergers, acquisitions, and strategic alliances, focusing on maximizing synergies and managing risks.

- Wealth Consulting: Consultations on effective wealth management strategies aligned with business goals.

- Is JIA Securities regulated by any financial authority?

- Yes, JIA Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA), with license no. Director-General of the Kanto Local Finance Bureau (Kinsho) No. 2444.

- What types of products does JIA Securities provide?

- Bonds, equities, investment trusts, index futures and options, and innovative Real Estate Tokenization Products.

- Is JIA Securities suitable for beginners?

- Yes, the company is well regulated by FSA and offers transparent fee structures and educational resources to investors, which is friendly to beginners to start their financial journey.

- Does JIA Securities offer tax-exempt investment options?

- Yes, JIA Securities leverages the NISA (Nippon Individual Savings Account) system to provide tax-exempt investment opportunities for traders.

- What are the main advantages of choosing JIA Securities?

- Clients benefit from JIA Securities' transparent fee structures and extensive financial expertise accumulated since its establishment in 1944.

Is It Safe?

Regulation:

JIA Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of the Kanto Local Finance Bureau (Kinsho) No. 2444, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores JIA Securities 's commitment to integrity and credibility in its services.

Safety Measures:

JIA Securities implements robust security measures to safeguard client information, adhering to stringent privacy policies. These measures include encrypted data transmission, secure server protocols, and restricted access to sensitive information.

What are Securities to Trade with JIA Securities ?

JIA Securities offers a diverse range of financial products and services.

For business corporations, mid-tier enterprises, and SMEs, JIA Securities also offers a wide array of financial services. These include:

Fees Review

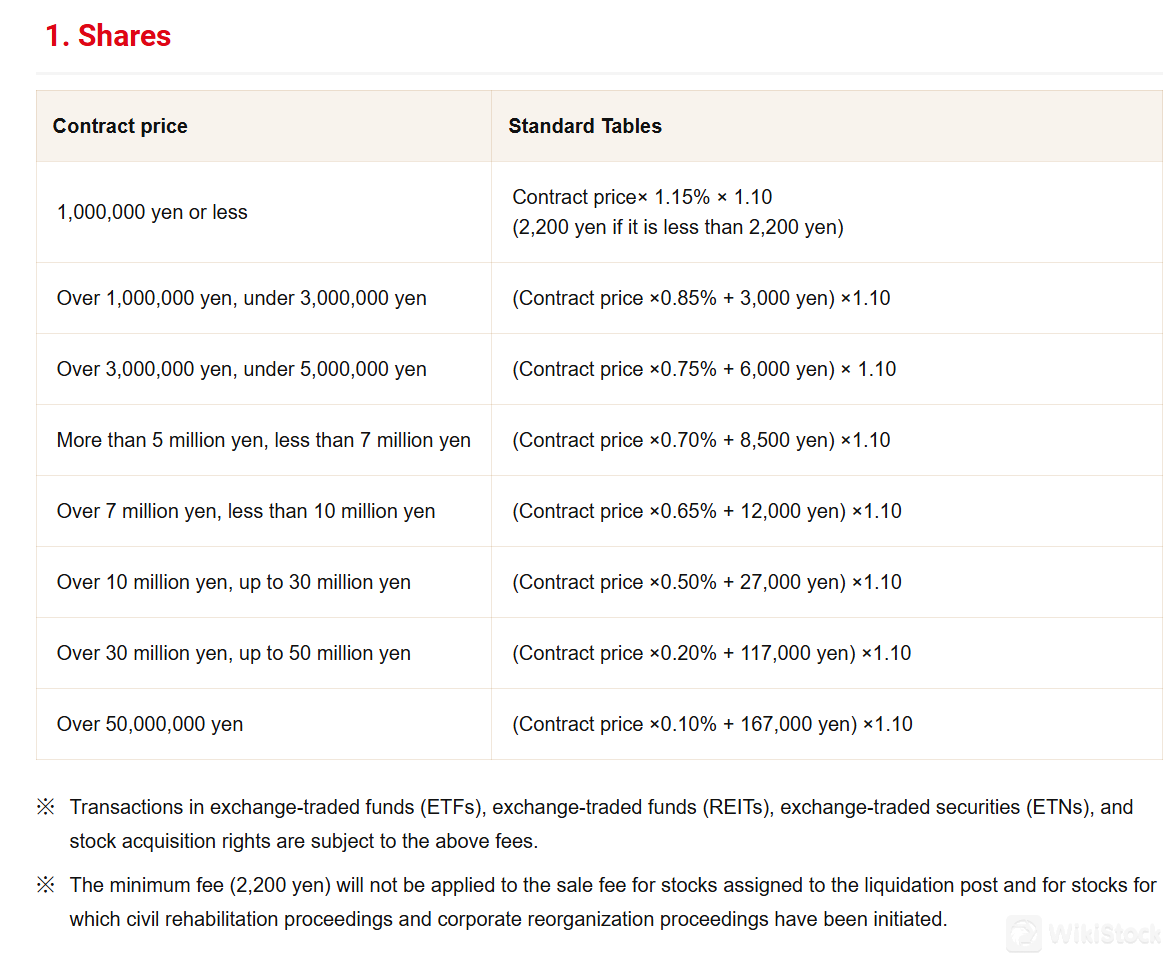

JIA Securities provides a detailed fee structure for various financial transactions.

For equities, the fees range from 1.15% of the transaction value for amounts up to 1 million yen, with a minimum fee of 2,200 yen, to 0.10% plus 167,000 yen for amounts exceeding 50 million yen. 10% tax of these fees applies.

Convertible bonds have a similar tiered fee structure, starting at 1.00% for transactions up to 1 million yen, with a minimum fee of 2,200 yen, to 0.10% plus 165,000 yen for amounts exceeding 50 million yen. 10% tax of these fees applies.

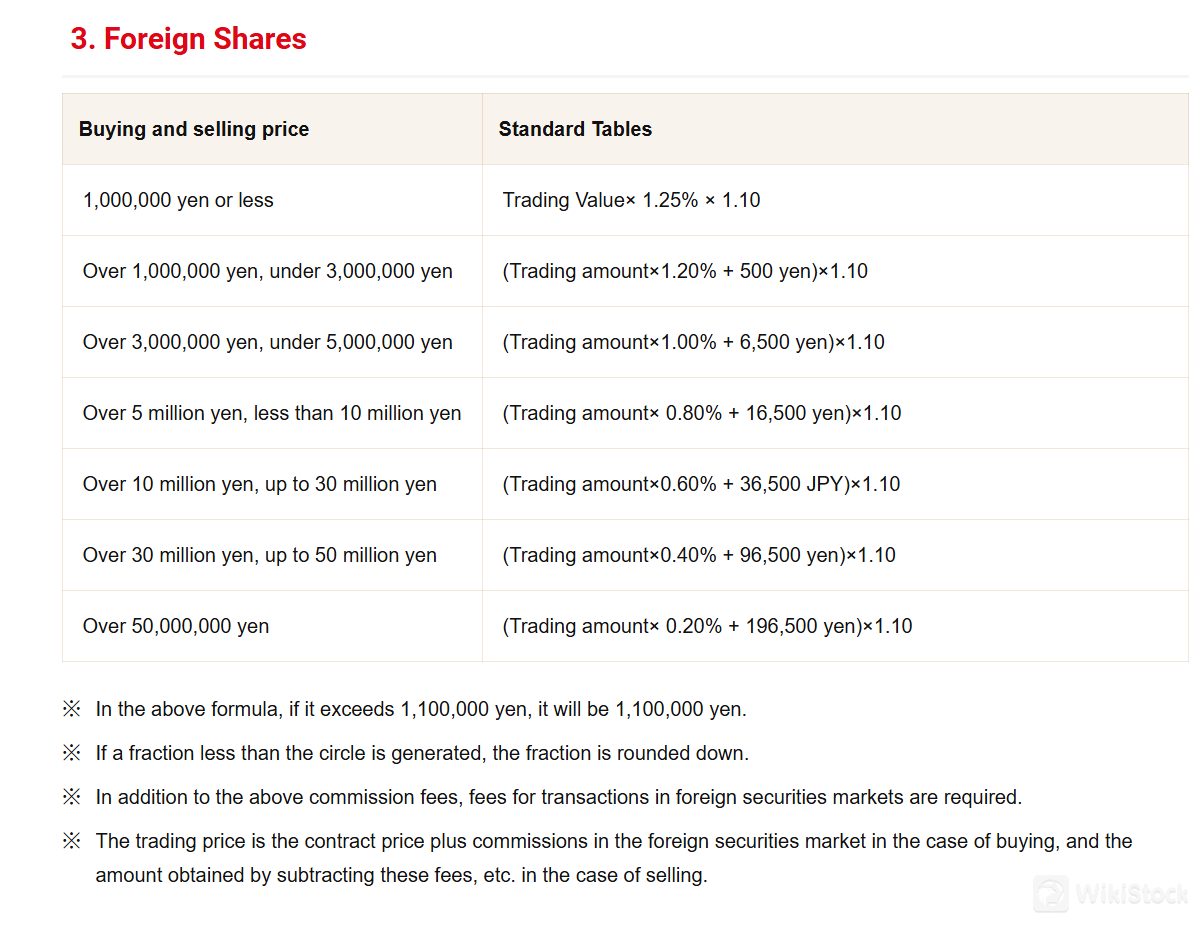

Foreign stock transactions are charged at 1.25% for amounts up to 1 million yen, decreasing to 0.20% plus 196,500 yen for transactions over 50 million yen. 10% tax of these fees applies.

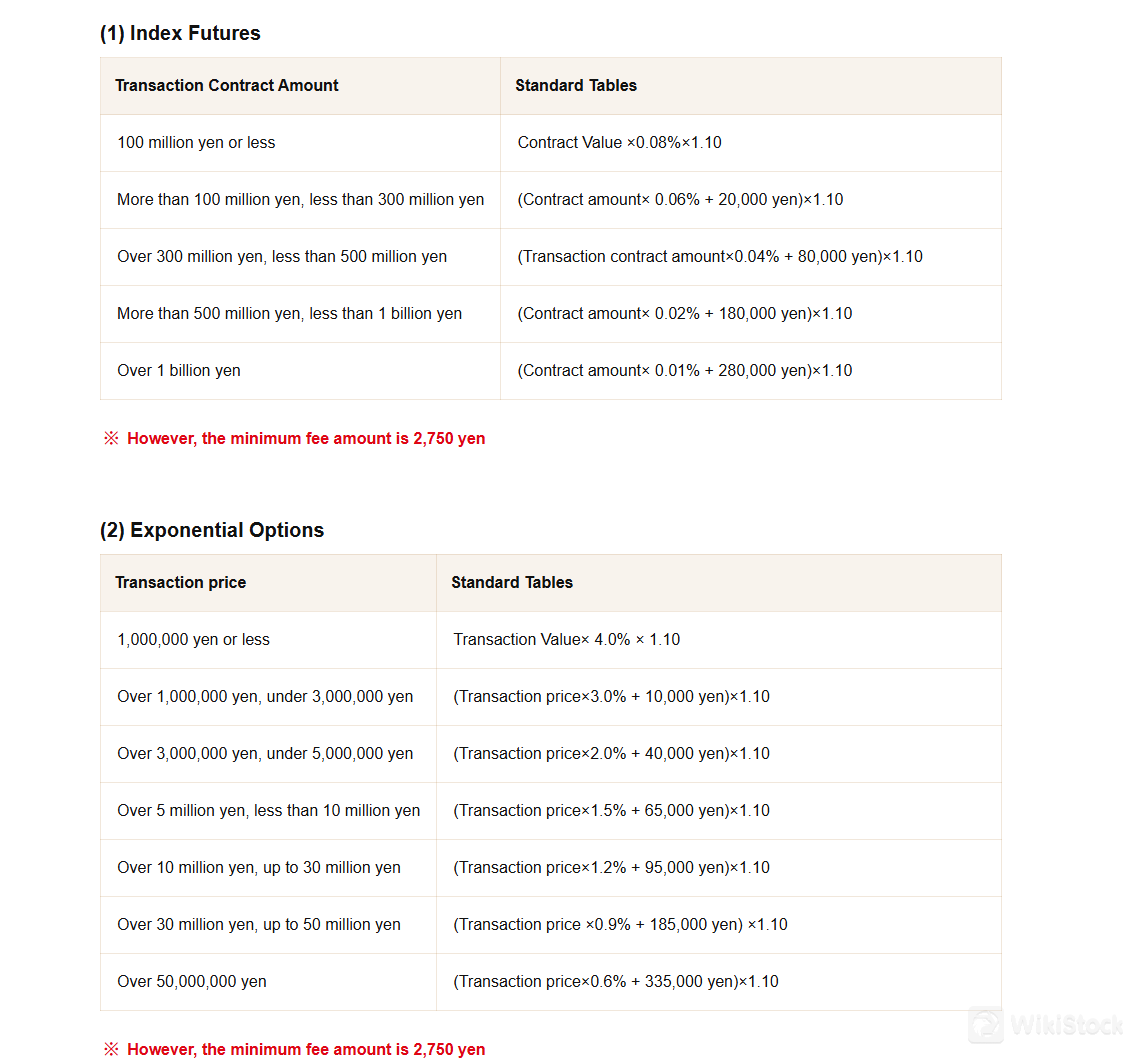

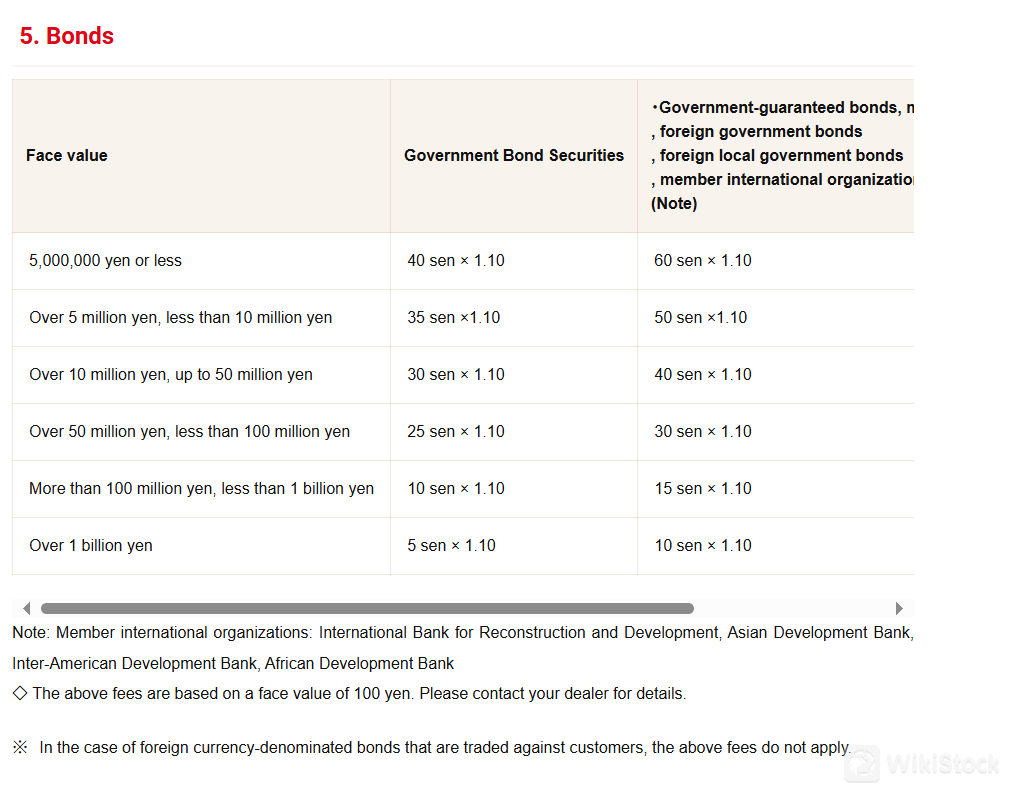

Index futures and options, as well as bonds, also have their own tiered fee structures, with specific minimum fees of ¥2,750 for index futures, ¥2,750 for index options, and ¥0.05 × 1.10 for government bonds.

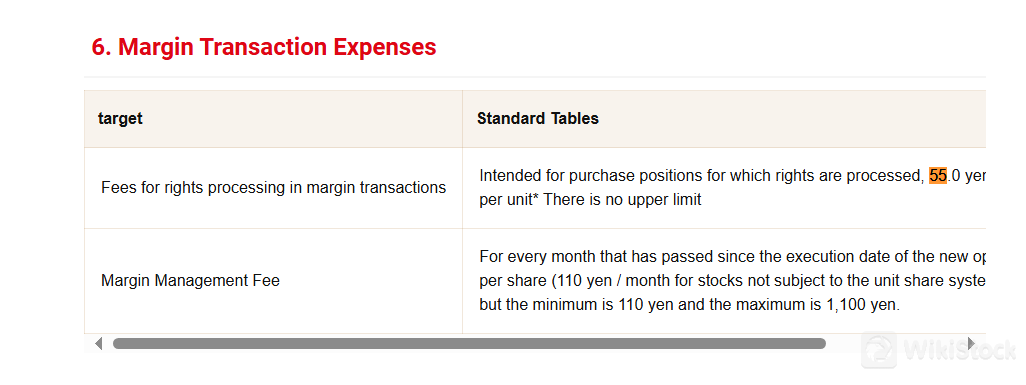

Additionally, there are fees for credit transactions, such as a rights processing fee of ¥55 per unit and a management fee of ¥11 per share per month (minimum ¥110, maximum ¥1,100).

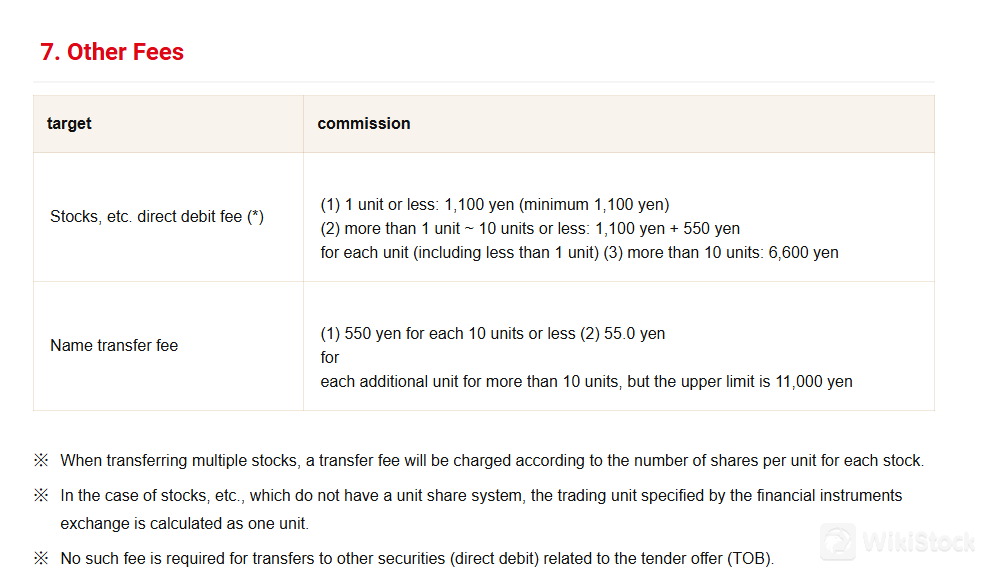

Other miscellaneous services include account transfer fees starting at ¥1,100 per issue and name transfer fees starting at ¥550 per name.

These details ensure transparency for clients. However, for most up-to-date and detailed information of all its products, clients are encouraged to visit the JIA Securities website at https://www.jia-sec.co.jp/service/commission/.

Nisa System

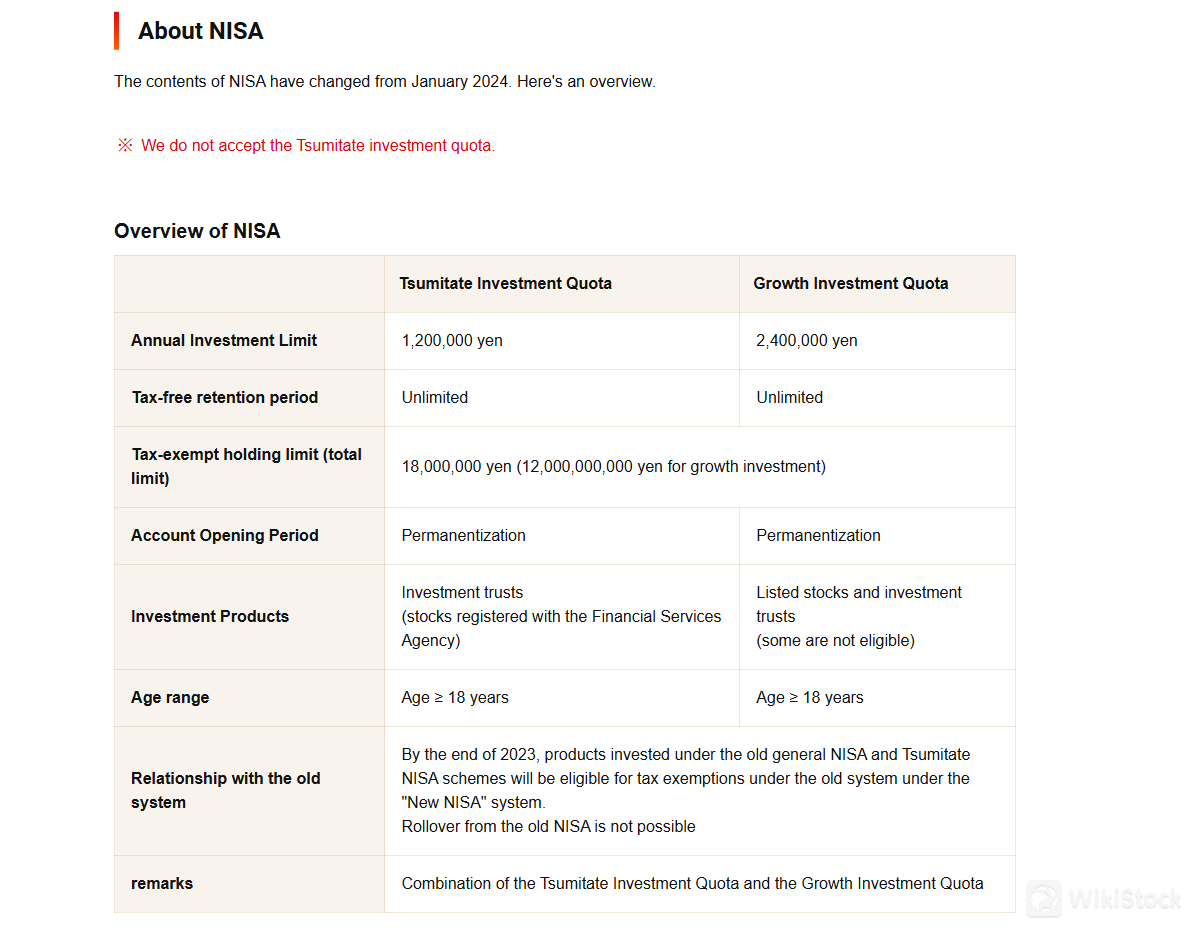

The NISA system offered by JIA Securities allows investors to benefit from tax exemptions on profits generated from investments in financial products such as stocks and mutual funds. Typically, such profits are taxed at around 20%, but investments held in a NISA account are exempt from this tax, providing a significant advantage for investors.

As of January 2024, the NISA system has been updated to include both Tsumitate Investment Quota (not available with JIA Securities) and Growth Investment Quota, with annual investment limits of ¥1,200,000 and ¥2,400,000 respectively. These investments can be held tax-free indefinitely. Additionally, the system has introduced a lifetime tax-exempt holding limit of ¥18,000,000, of which ¥12,000,000 can be allocated to the Growth Investment Quota.

JIA Securities provides a detailed and transparent fee structure for NISA investments. Profits and losses within NISA accounts cannot be combined with those in other accounts, and certain limitations apply, such as the inability to transfer financial products from non-NISA accounts to NISA accounts. Investors can change their financial institution annually, provided the necessary procedures are completed by the end of September.

Research & Education

JIA Securities actively engages its clients through seminars and campaigns aimed at enhancing financial literacy and promoting their services. These educational initiatives provide valuable insights into investment strategies, market trends, and the benefits of utilizing financial products offered by JIA Securities.

By participating in these seminars, clients gain practical knowledge that empowers them to make informed investment decisions tailored to their financial goals.

Customer Service

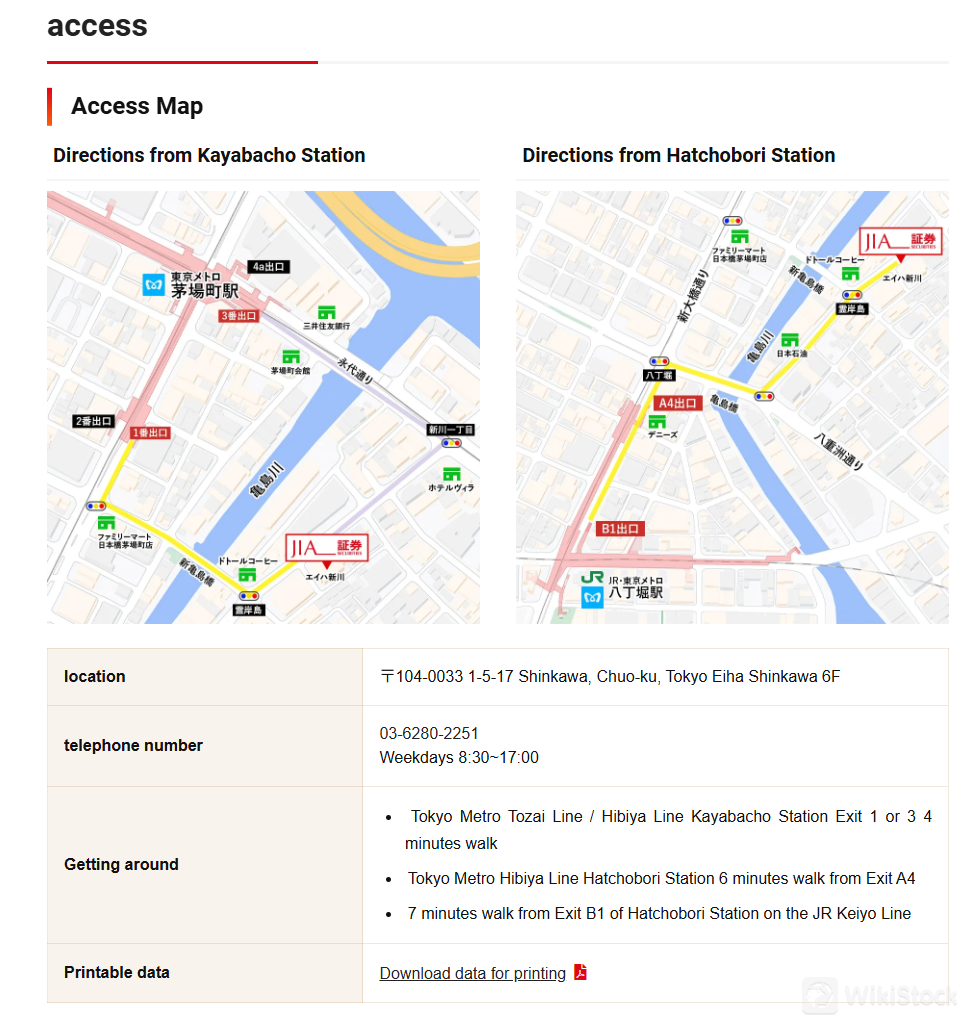

Located at 〒104-0033 1-5-17 Shinkawa, Chuo-ku, Tokyo Eiha Shinkawa 6F, JIA Securities provides customer support primarily through direct contact via phone at 03-6280-2251 during weekdays from 8:30 AM to 5:00 PM.

This limited approach excludes modern communication channels like email, live chat, or social media, hindering accessibility and convenience for clients seeking assistance. Such constraints can pose challenges for timely responses and comprehensive support in today's digital age.

Conclusion

Established in 1944 and rebranded in 2021, JIA Securities is a Tokyo-based financial institution offering a wide range of products including bonds, equities, and innovative offerings like Real Estate Tokenization Products. It also offers wealth management services to corporate clients as well.

Regulated by Japan's Financial Services Agency (FSA) under license number Director-General of the Kanto Local Finance Bureau (Kinsho) No. 2444, it adheres to stringent regulatory standards. Interested clients looking for a regulated and experienced financial partner can consider JIA Securities as a trusted choice in the market.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

Centrade

Score

めぶき証券

Score

浜銀TT証券

Score

おきぎん証券

Score

ワンアジア証券

Score

木村証券

Score

西日本シティTT証券

Score

Kuni Umi AI Securities

Score

静銀ティーエム証券

Score

香川証券

Score