Score

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

China

ChinaProducts

10

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Surpassed 46.75% brokers

Securities license

Obtain 1 securities license(s)

CSRCRegulated

ChinaSecurities Trading License

Brokerage Information

More

Company Name

HUAYUAN SECURITIES CO LTD

Abbreviation

华源证券

Platform registered country and region

Company address

Company website

http://www.jzsec.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 4790

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

China

289660.46%Azerbaijan

74815.61%Macao

4529.44%Tanzania

3527.35%Others

3427.14%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Funding Rate

7.5%

Margin Trading

YES

Regulated Countries

1

Products

10

| Huayuan Securities |  |

| WikiStock Rating | ⭐⭐ |

| Account Minimum | Not specified |

| Fees | Up to 0.3% of the transaction amount for stock trading |

| Account Fees | Transfer fees for different services |

| Interests on uninvested cash | not specified |

| Margin Interest Rates | not specified |

| Mutual Funds Offered | Yes |

| App/Platform | Mobile App/PC |

| Promotions | No |

Huayuan Securities Information

Huayuan Securities is a comprehensive securities company controlled by Wuhan Financial Holding Group with administrative headquarters located in Wuhan, Hubei Province. Huayuan Securities has set up business modules and departments such as wealth management, equity investment bank, fixed income investment bank, asset management, proprietary investment, equity investment, futures business and research business, and has built a competitive full business chain system, and is committed to providing customers with highly specialized comprehensive financial solutions. Huayuan Securities enjoys a good reputation and has a knowledgeable investment team that provides strong protection for clients' accounts and funds.

Pros and Cons of Huayuan Securities

Huayuan Securities enjoys an excellent reputation, operating under regulatory oversight with a knowledgeable investment team implementing robust safeguards for client accounts and funds. Commendably, the firm actively engages in public welfare initiatives and targeted poverty alleviation programs. However, improvements could be made in transparently communicating margin interest rate costs and accessible customer service channels to empower clients with knowledge and support for informed decision-making.

| Pros | Cons |

|

|

|

|

|

|

|

Is Huayuan Securities safe?

Yes, Huayuan Securities is regulated. Huayuan Securities operates under effective regulatory oversight, offering margin interests. While these features are advantageous, it is prudent for prospective clients to conduct thorough research and careful consideration before engaging in trading activities. This proactive approach helps ensure a safer and more secure trading experience.

What are securities to trade with Huayuan Securities?

The business scope of Huayuan Securities covers Investment banking, Asset Management, Fixed income, Wealth business, Market making business, Credit trading, Stock options, Equity investment, Institutional business, Internet business and so on.

Investment bank: As the flagship business of Huayuan Securities, investment banking can be engaged in investment banking business including IPO, refinancing of listed companies, M&A and reorganization, listing recommendation and refinancing on the New Third Board.

Asset management: The Asset Management Committee provides clients with collection, single and other asset management plans, fully docking customer needs, and strives to provide customers with the most comprehensive financial needs services.

Fixed income: The fixed income business specifically includes the main underwriting business of corporate bonds, corporate bonds, financial bonds and other credit bonds and participation in the distribution business, asset securitization business, local government bonds business, corporate bonds entrusted management business.

Wealth business: The brokerage division of the business adheres to the principle of customer first service, providing customers with professional, comprehensive and high-quality financial services.

Market making business: The market making Department provides bilateral quotation services for stock trading for outstanding NEEQ listed enterprises, promotes price discovery and enhances market liquidity, and on this basis, actively provides stock trading consulting services for enterprises in the form of collective bidding transfer and market making transfer.

Credit transaction: The client provides collateral to the securities company, borrows funds to buy listed securities (financing trading) or borrows listed securities and sells them (margin trading).

Stock option: Stock option contracts are standardized contracts established by exchanges that give the buyer the right to buy or sell an agreed stock or an exchange-traded fund (ETF) that tracks a stock index at a specified price at a specified time in the future.

Equity investment: The Equity Investment Department is the equity self-investment department of the company, which deals with equity assets such as stocks and funds. The division is oriented towards long-term value investment and is committed to achieving stable absolute returns for the company's own funds.

Institutional business: Institutional business departments fully integrate the company's investment banking, asset management, securities brokerage, fixed income and other business line resources, committed to providing institutional clients with high-level, all-round, diversified and professional investment and financing solutions.

Internet business: Build a user terminal - investment master, improve the Internet one-stop comprehensive service system, to provide customers with market conditions, wealth management fund products, trading, investment advisory and other services.

Huayuan Securities Fees Review

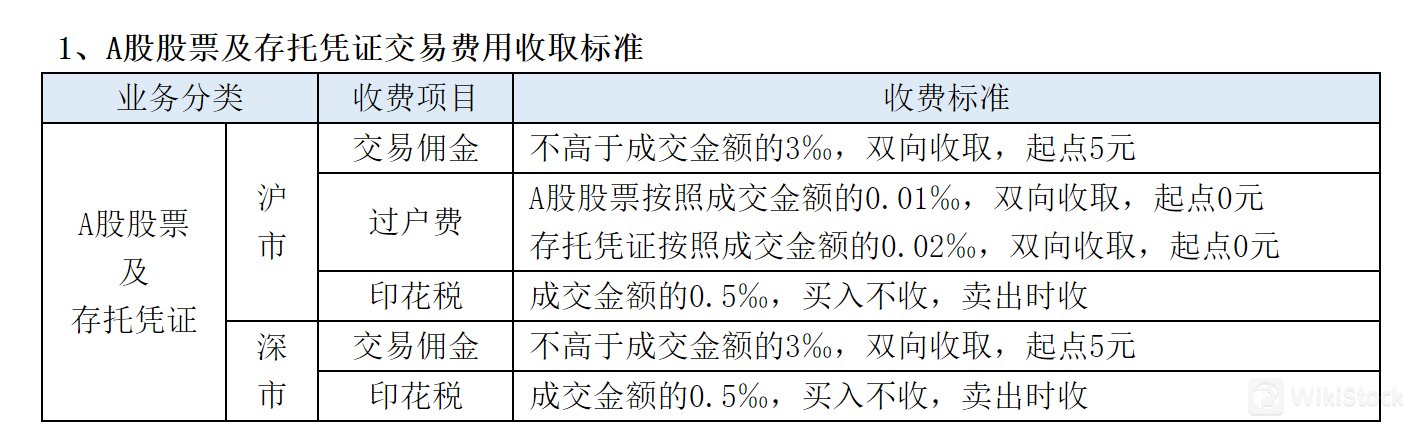

A-share Stocks and Depositary Receipts:

Shanghai and Shenzhen Stock Exchanges:

Commission: Up to 0.3% of the transaction amount, charged both ways, with a minimum of 5 yuan.

Transfer Fee: 0.01‰ for A-shares and 0.02‰ for depositary receipts, charged both ways.

Stamp Duty: 0.5‰ on the transaction amount, charged only on sales.

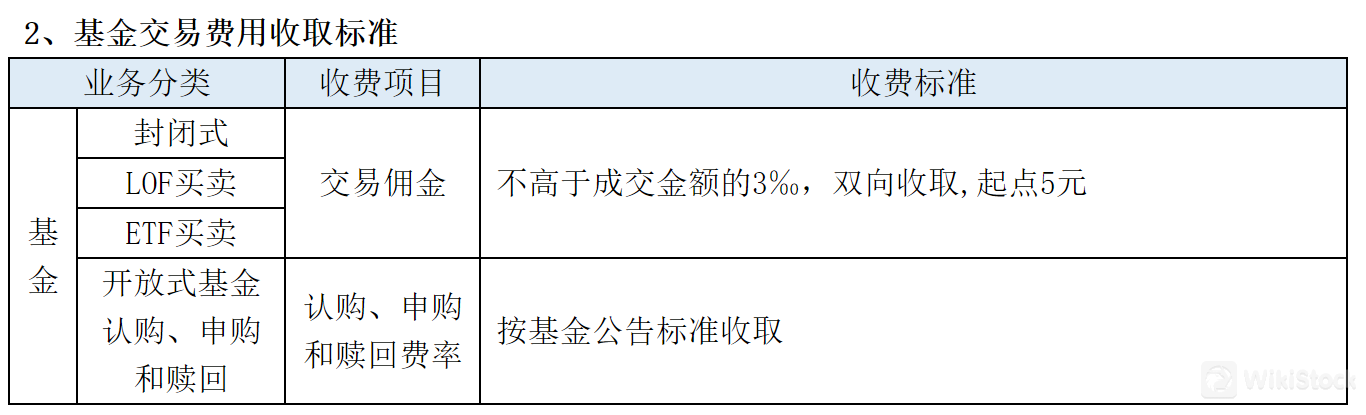

Fund Trading Fees:

Closed-end Funds and ETFs:

Commission: Up to 0.3% of the transaction amount, charged both ways, starting at 5 yuan.

Open-end Funds:Subscription, purchase, and redemption fees are charged as per the fund's announced rates.

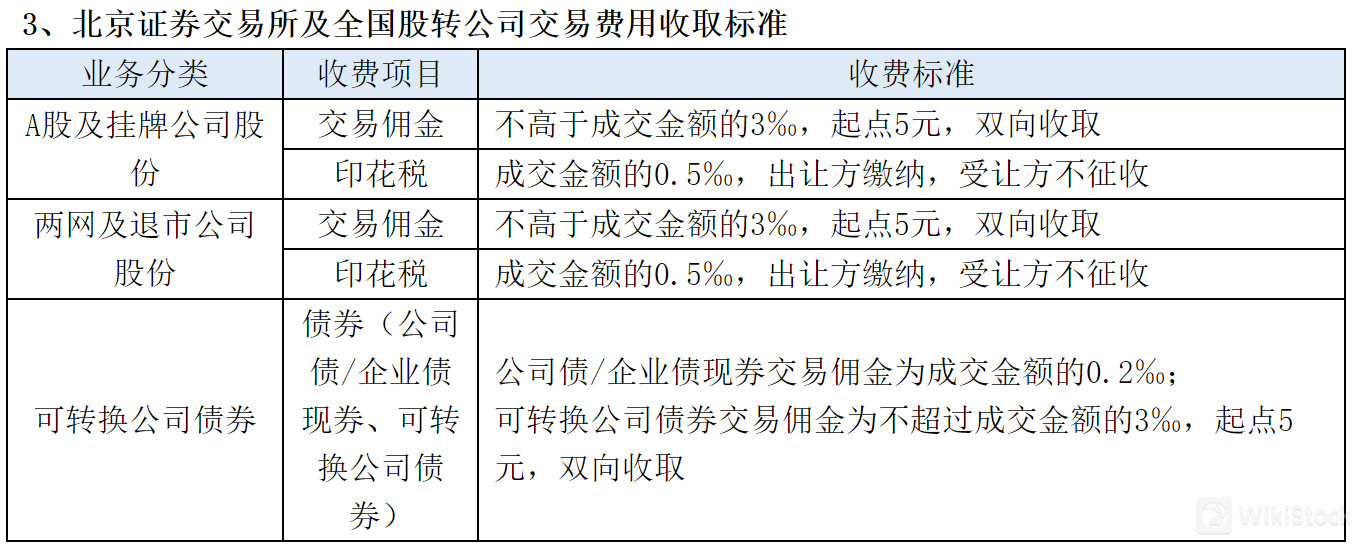

Beijing Stock Exchange and National Equities Exchange and Quotations:

A-shares and Listed Company Shares:

Commission: Up to 0.3% of the transaction amount, with a minimum charge of 5 yuan.

Stamp Duty: 0.5‰ on the transaction amount, paid by the seller only.

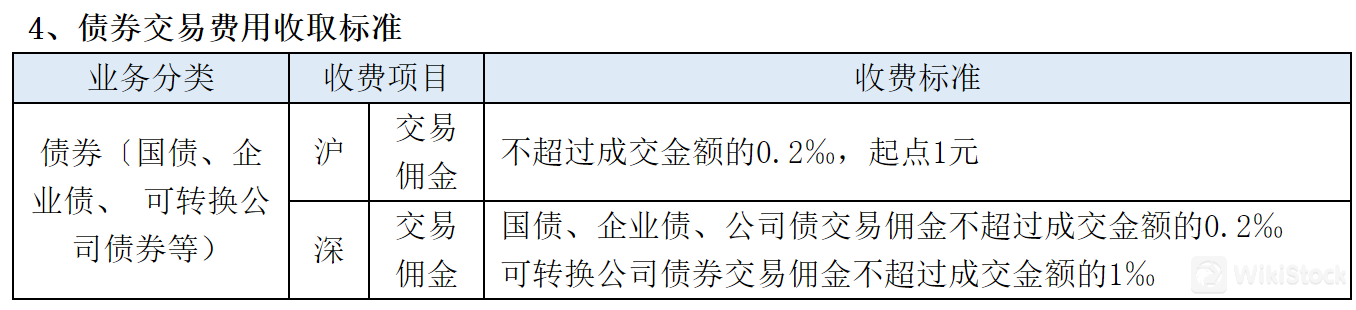

Bond Trading Fees:

Corporate Bonds/Enterprise Bonds/Convertible Bonds:

For corporate bonds/enterprise bonds spot trades, commission is 0.02% of the transaction amount.

For convertible bonds, commission is up to 0.3%, with a minimum charge of 5 yuan.

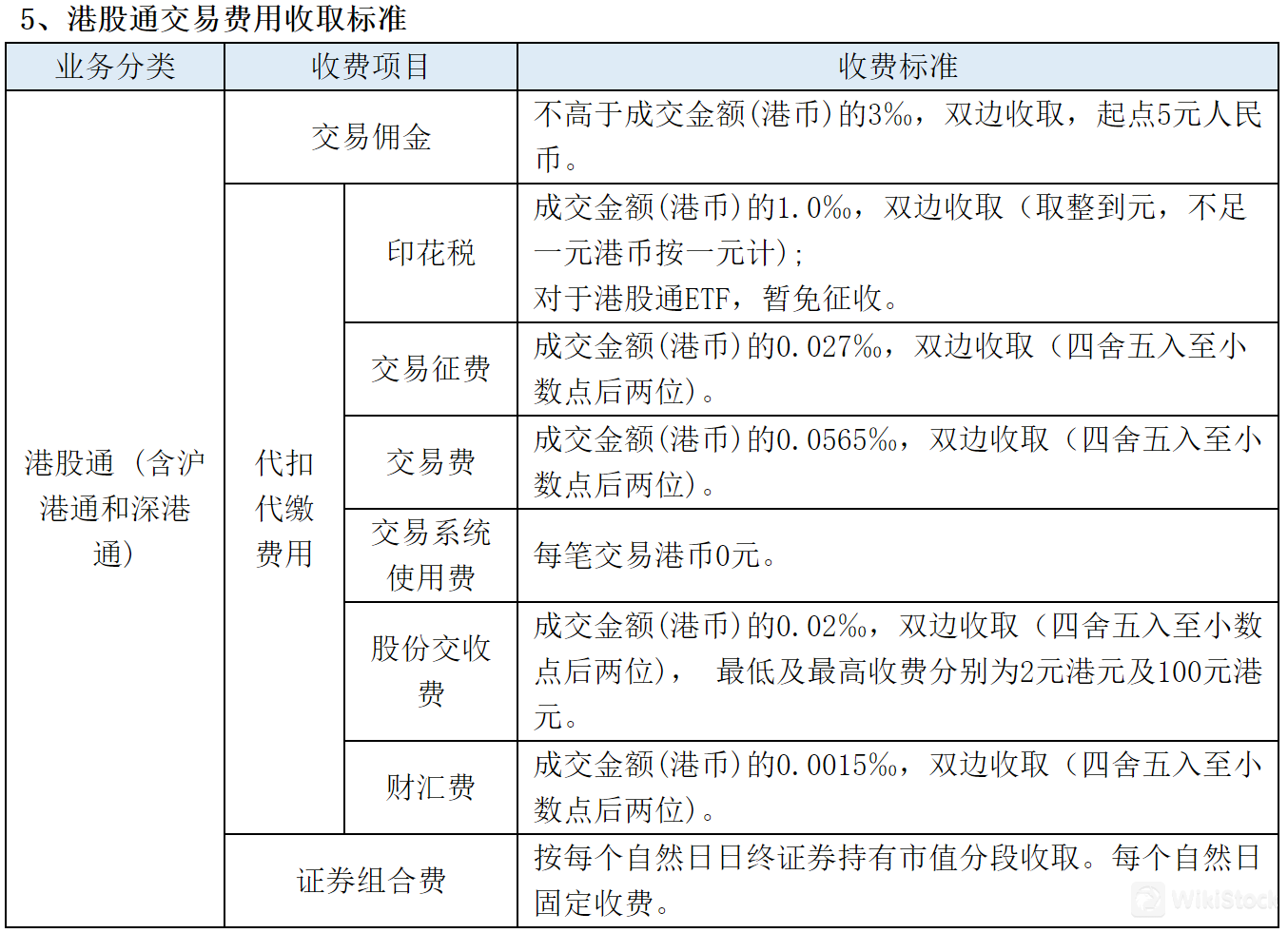

Hong Kong Stock Connect (Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect):

Commission: Up to 0.3% of the transaction amount in HKD, charged both ways, with a minimum of 5 RMB.

Other fees include withholding for stamp duty at 1.0‰ (rounded up to the nearest HKD), trading levy at 0.027‰, trading fee at 0.0565‰, all rounded to two decimal places.

There are additional fees for using trading systems and handling stock transactions.

Huayuan Securities App Review

Huayuan Securities is the account opening and trading integration APP is Huayuan Securities's Internet financial masterpiece. And it's available for download on Android and iOS.

Huayuan Tonghuashun is account opening and trading integration APP is based on flush flush Huayuan securities customized special version. And it's available for download on Android and iOS.

Research and Education

Huayuan Securities provides investor education resources in the investment relationship navigation bar.

Customer Service

The company can be contacted at 95305 by call for any inquiries or assistance.

Conclusion

Huayuan Securities is a comprehensive securities firm controlled by Wuhan Financial Holding Group, headquartered in Wuhan. It offers a wide range of financial services including investment banking, asset management, fixed income, wealth management, market making, credit trading, equity investment, and institutional business. While Huayuan Securities operates under regulatory oversight and implements measures to safeguard client accounts and funds, there are areas for improvement. These include providing clearer communication about margin interest rate costs and providing more convenient customer service channels beyond just phone support.

FAQs

Is Huayuan Securities safe to trade with?

Yes, Huayuan Securities is a regulated securities firm that operates under effective oversight and implements measures to protect client accounts and funds, making it a relatively safe platform for trading activities.

Is Huayuan Securities a good platform for beginners?

While Huayuan Securities offers a comprehensive range of financial services, it may not be the most beginner-friendly platform due to limited customer support options beyond phone support. Beginners may want to consider platforms that provide more learning materials and accessible support channels.

Is Huayuan Securities legit?

Yes, Huayuan Securities is a legitimate and regulated securities company controlled by Wuhan Financial Holding Group, with a good reputation and active engagement in public welfare initiatives.

Is Huayuan Securities good for investing/retirement?

Huayuan Securities offers various investment and asset management services that could potentially be suitable for investing and retirement planning. However, it's crucial for prospective clients to thoroughly research and carefully consider their options, as well as their individual investment goals and risk tolerance, before engaging with any platform for long-term investing or retirement purposes.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China

Years in Business

1-2 years

Products

Securities Lending Fully Paid、Margin Loans、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

--

九证资本

Subsidiary

--

九州期货

Subsidiary

Download App

Review

No ratings

Recommended Brokerage FirmsMore

中山证券

Score

万和证券

Score

东方财富证券

Score

华创证券

Score

爱建证券

Score

东海证券

Score

江海证券

Score

世纪证券

Score

上海证券

Score

川财证券

Score