Nilai

Peringkat indeks

Penilaian Broker

Pengaruh

AA

Indeks pengaruh NO.1

Norwegia

NorwegiaProduk

4

Bonds & Fixed Income、Futures、Options、Stocks

Melampaui 84.21% broker

Lisensi sekuritas

dapatkan 1 lisensi sekuritas

FSADiduga Klon Palsu

SeychellesLisensi Perdagangan Sekuritas

Informasi Pialang

More

Nama perusahaan

Tradeco Limited

Singkatan

T4Trade

Negara dan wilayah terdaftar platform

Alamat perusahaan

Situs Perusahaan

https://www.t4trade.com/id/Periksa kapanpun Anda mau

WikiStock APP

Deteksi sebelumnya: 2024-12-22

- The Seychelles Financial Services Authority peraturan, nomor lisensi SD029, adalah peraturan lepas pantai. Harap waspadai risikonya!

- Peraturan The Seychelles Financial Services Authority (Nomor Lisensi: SD029) yang diklaim oleh perusahaan pialang diduga merupakan perusahaan tiruan, harap waspadai risikonya!

Layanan Broker

Gene Internet

Indeks Gene

Peringkat APP

APP Downloads

- Siklus

- Downloads

- 2024-05

- 0.22M

Aturan: Data yang ditampilkan adalah unduhan APP dalam satu tahun sebelum waktu saat ini.

Popularitas Regiona APP

- Negara/WilayahDownloadsRasio

Lainnya

0.18M60.58%Kerajaan Inggris

2321216.80%Belanda

109175.76%Spanyol

69659.92%Italia

58486.94%

Aturan: Data ditampilkan sebagai unduhan dan pembagian regional APP dalam satu tahun sebelum waktu saat ini.

Fitur broker

Tarif komisi

0%

Margin Trading

YES

Long-Short Equity

YES

Negara yang Diatur

1

| T4Trade |  |

| Peringkat WikiStock | ⭐ |

| Saldo Minimum Akun | Tidak Ditentukan |

| Biaya | Spread rata-rata sebesar 1,1 pip (Akun Privilege) |

| Biaya Akun | Gratis untuk Akun Baru |

| Bunga pada uang tidak terinvestasi | Tidak ditentukan |

| Tingkat Bunga Margin | Tidak ditentukan |

| Reksa Dana yang Ditawarkan | Tidak |

| Aplikasi/Platform | MT4, Tersedia di iOS, Android, dan Web |

| Promosi | Ya |

Apa itu T4Trade?

T4Trade menawarkan opsi perdagangan yang fleksibel dengan persyaratan masuk minimal, dengan ukuran lot minimum sebesar 0,01. Platform ini menyediakan berbagai jenis akun dengan biaya yang bervariasi, termasuk beberapa opsi gratis untuk akun baru. Meskipun detail spesifik tentang bunga pada uang tidak terinvestasi dan tingkat bunga margin tidak disediakan, T4Trade tidak menawarkan reksa dana. Platform ini mendukung platform perdagangan MT4 yang populer, dapat diakses melalui antarmuka iOS, Android, dan web. Selain itu, T4Trade menarik minat trader baru dan yang sudah ada dengan berbagai promosi, menjadikannya pilihan menarik untuk berbagai spektrum trader.

Kelebihan dan Kekurangan T4Trade

T4Trade menawarkan beberapa keuntungan, termasuk kepatuhan terhadap regulasi keuangan, yang memastikan lingkungan perdagangan yang aman. Platform ini memberikan akses ke berbagai kelas aset dan mendukung MetaTrader 4 yang banyak digunakan, tersedia di iOS, Android, Mac, Windows, dan web, meningkatkan aksesibilitas dan kenyamanan bagi para trader. Namun, struktur biaya platform ini bisa kompleks, dan kurang transparan mengenai bunga pada uang tidak terinvestasi, yang mungkin menjadi kekhawatiran bagi beberapa investor.

| Kelebihan | Kekurangan |

|

|

|

|

|

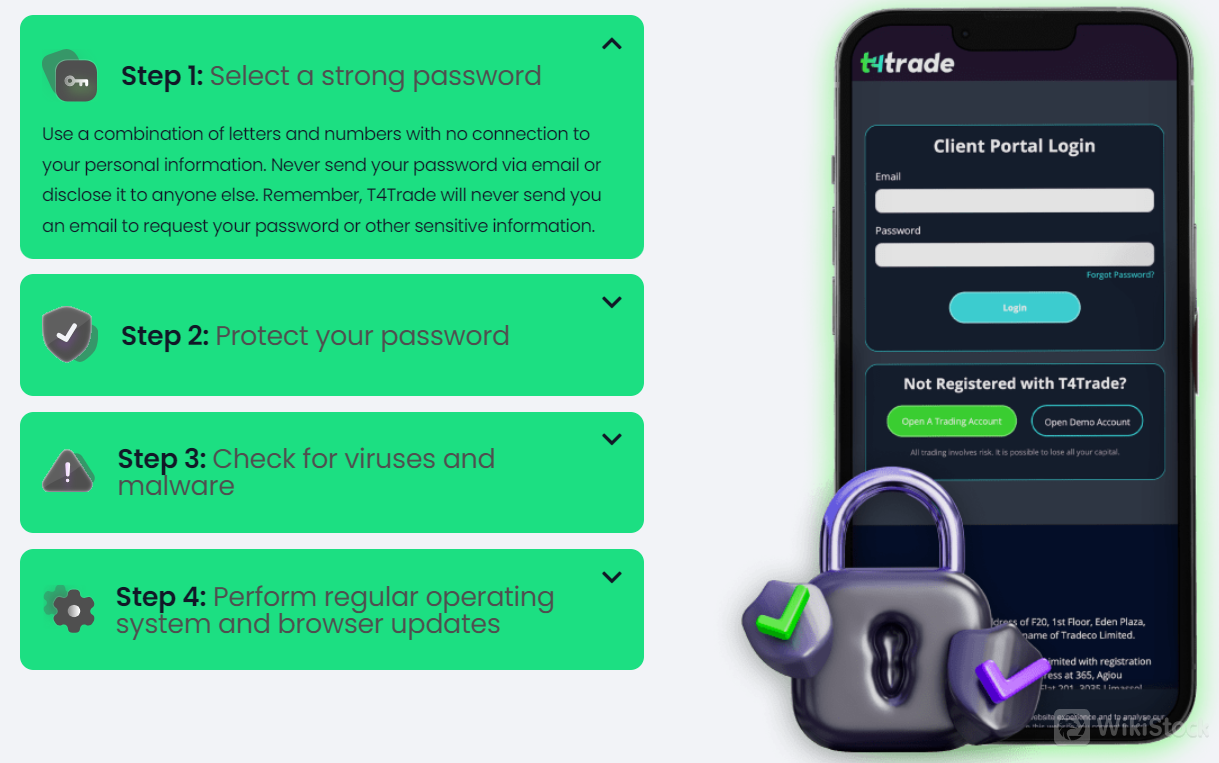

Apakah T4Trade aman?

Tradeco Limited adalah broker-dealer yang terdaftar di Otoritas Jasa Keuangan Seychelles(FSA). Badan regulasi ini diduga sebagai klon.

T4Trade mengutamakan keamanan akun melalui serangkaian langkah keamanan yang direkomendasikan. Para trader disarankan untuk memilih kata sandi yang kuat, menggabungkan huruf dan angka yang tidak terkait dengan informasi pribadi, dan tidak pernah membagikan kata sandi ini melalui email. Memeriksa secara teratur adanya virus dan malware, serta menjaga sistem operasi dan browser tetap terbaru, adalah praktik yang penting untuk melindungi diri dari aktivitas mencurigakan seperti kecepatan internet yang menurun atau iklan pop-up yang tidak terduga. T4Trade menekankan bahwa mereka tidak akan pernah meminta kata sandi atau informasi sensitif melalui email, sehingga para trader tetap waspada terhadap ancaman keamanan potensial.

Apa saja sekuritas yang dapat diperdagangkan dengan T4Trade?

T4Trade menawarkan beragam lebih dari 300 instrumen di enam kelas aset, memberikan kondisi perdagangan yang luar biasa bagi para trader dalam CFD. Pasar yang tersedia termasuk Forex, dengan berbagai pasangan mata uang; Logam, seperti emas dan perak; Indeks, yang mewakili pasar saham global utama; Komoditas, termasuk minyak dan kopi; Futures, untuk strategi perdagangan yang canggih; dan Saham, menawarkan peluang dalam saham perusahaan individual. Pilihan yang luas ini memungkinkan para trader untuk melakukan diversifikasi portofolio mereka dan memanfaatkan berbagai peluang pasar. Namun, T4Trade tidak menyediakan produk seperti reksa dana dan mata uang kripto.

- Forex: Perdagangan mata uang secara langsung, ideal untuk investor yang mencari fluktuasi nilai mata uang dan potensi keuntungan dari perubahan nilai tukar.

- Indeks: Investasi dalam sekeranjang saham yang mewakili pasar atau sektor tertentu, cocok untuk investor yang tertarik pada tren pasar yang lebih luas dan diversifikasi.

- Futures: Perdagangan kontrak untuk membeli atau menjual aset dengan harga yang telah ditentukan di masa depan, menarik bagi investor yang mencari spekulasi harga dan manajemen risiko.

- Logam: Investasi langsung dalam logam mulia seperti emas, perak, dan platinum, cocok untuk investor yang tertarik dalam melindungi diri dari inflasi dan diversifikasi portofolio.

- Spread Rata-rata: 1.8

- Ukuran Lot Minimum: 0.01

- Komisi: Tidak ada

- Spread Rata-rata: 1.6

- Ukuran Lot Minimum: 0.01

- Komisi: Tidak ada

- Spread Rata-rata: 1.1

- Ukuran Lot Minimum: 0.01

- Komisi: Tidak ada

Ulasan Akun T4Trade

T4Trade menawarkan tiga jenis akun: Standar, Premium, dan Privilege. Setiap akun memiliki spread mengambang dan tetap secara langsung, leverage fleksibel hingga 1:1000, dan mendukung mata uang dasar dalam USD, EUR, dan GBP.

Akun Standar:

Akun Premium:

Akun Privilege:

Ulasan Biaya T4Trade

T4Trade menawarkan struktur biaya yang kompetitif di semua jenis akunnya—Standar, Premium, dan Privilege—dengan tidak mengenakan komisi. Kebijakan nol komisi ini konsisten di semua tiga akun, memungkinkan para trader untuk fokus pada strategi perdagangan mereka tanpa khawatir mengenai biaya tambahan dari komisi. Tidak adanya biaya komisi, dikombinasikan dengan spread yang menarik dan pilihan leverage yang fleksibel, membuat T4Trade menjadi pilihan menarik bagi para trader yang memperhatikan biaya.

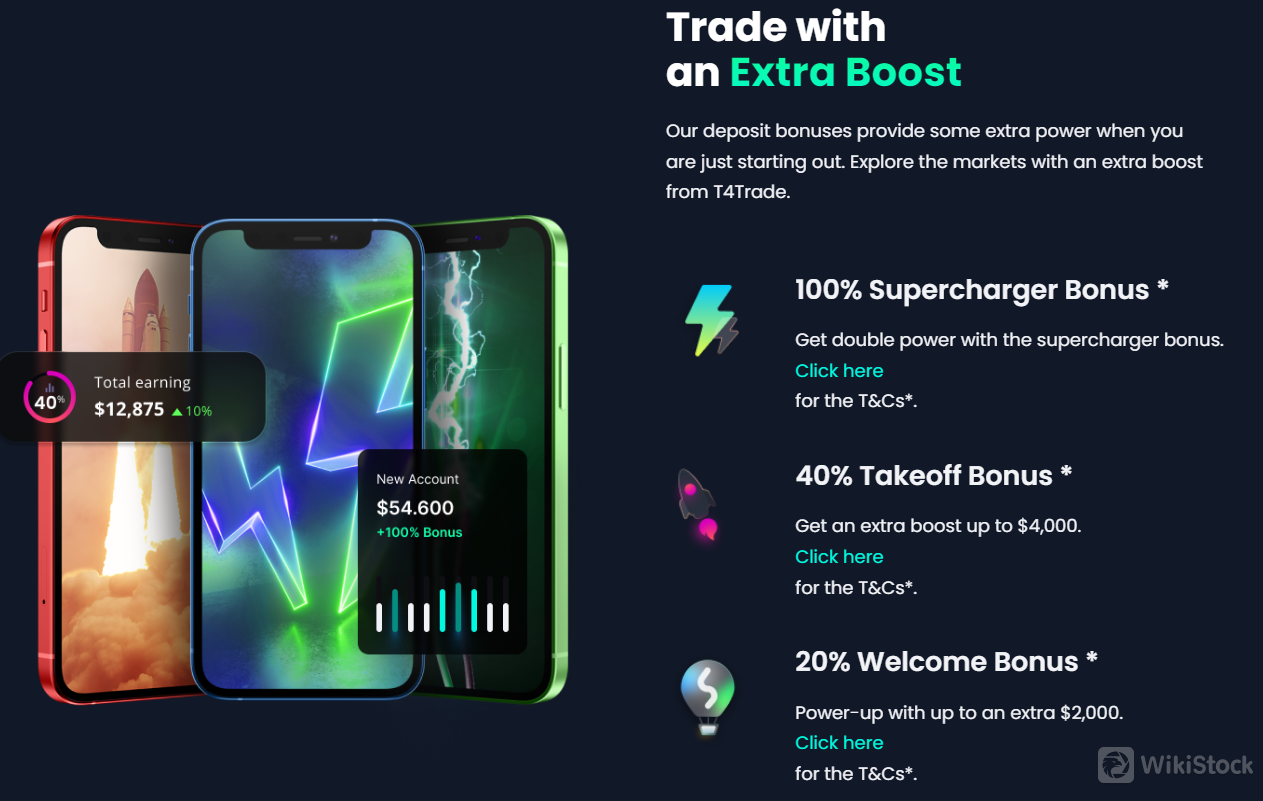

Ulasan Aplikasi T4Trade

Aplikasi T4Trades menawarkan pengalaman perdagangan yang komprehensif, menampilkan bonus deposit yang menarik seperti Bonus Supercharger 100%, Bonus Takeoff 40%, dan Bonus Selamat Datang 20% untuk meningkatkan modal perdagangan. Aplikasi ini mendukung platform MetaTrader 4 (MT4) yang sangat handal, dikenal karena eksekusi cepat, kemudahan penggunaan, dan kemampuan perdagangan otomatis. Selain itu, T4Trade menyediakan MT4 WebTrader, platform berbasis web sepenuhnya dengan fungsionalitas yang sama dengan versi yang dapat diunduh, memungkinkan para trader mengakses akun mereka dari perangkat apa pun tanpa perlu mengunduh. Kombinasi insentif keuangan dan platform perdagangan yang tangguh ini memastikan lingkungan perdagangan yang serbaguna dan efisien.

Penelitian dan Pendidikan

T4Trade meningkatkan pengetahuan perdagangan melalui sumber daya pendidikan yang komprehensif, yang meliputi webinar, podcast, dan video perdagangan. Sumber daya ini dirancang untuk memenuhi kebutuhan para trader di semua tingkatan, memberikan wawasan berharga dan strategi praktis untuk meningkatkan keterampilan perdagangan. Baik Anda seorang pemula yang mencari pengetahuan dasar atau seorang trader berpengalaman yang ingin menyempurnakan teknik Anda, penawaran pendidikan T4Trade memastikan pembelajaran dan pengembangan berkelanjutan dalam dunia perdagangan yang dinamis.

Layanan Pelanggan

T4Trade menawarkan dukungan pelanggan yang luar biasa melalui berbagai saluran, termasuk platform media sosial seperti Facebook, Instagram, TikTok, dan YouTube. Tim dukungan yang berdedikasi tersedia 24/5, memberikan bantuan yang efisien dan informatif untuk memenuhi dan melampaui harapan klien. Dengan bangga menawarkan dukungan multibahasa dalam lebih dari 30 bahasa, T4Trade memastikan bahwa klien menerima bantuan dalam bahasa asli yang disesuaikan dengan kebutuhan mereka. Komitmen ini terhadap aksesibilitas dan layanan berkualitas tinggi memastikan para trader menerima dukungan tak tertandingi untuk setiap pertanyaan, meningkatkan pengalaman perdagangan mereka secara keseluruhan.

Kesimpulan

T4Trade menonjol dengan pilihan perdagangan yang fleksibel dan persyaratan masuk yang minimal, menampilkan ukuran lot minimum 0,01 dan tanpa biaya komisi di semua jenis akunnya. Dukungan platform ini untuk MetaTrader 4 yang banyak digunakan, dapat diakses di berbagai perangkat, meningkatkan daya tariknya, bersama dengan berbagai promosi untuk meningkatkan modal perdagangan. Dengan kekhawatiran regulasi tentang kemungkinan kloning, T4Trade tidak cocok untuk trader pemula. Meskipun menawarkan sumber daya pendidikan yang komprehensif dan dukungan pelanggan yang luar biasa dalam lebih dari 30 bahasa, mungkin tidak menyediakan lingkungan perdagangan yang aman yang dibutuhkan oleh pemula.

Pertanyaan Umum

Apakah T4Trade aman untuk diperdagangkan?

Keamanan T4Trade sebagai platform perdagangan dipertanyakan karena kekhawatiran tentang kemungkinan kloning badan regulasinya. Meskipun Tradeco Limited, perusahaan di balik T4Trade, terdaftar di Otoritas Jasa Keuangan Seychelles (FSA), ini tidak menjamin keamanan penuh. Platform ini menyarankan penggunaan kata sandi yang kuat dan pemeriksaan virus secara teratur untuk mengurangi ancaman keamanan potensial.

Apakah T4Trade merupakan platform yang baik untuk pemula?

T4Trade tidak disarankan untuk pemula. Meskipun menawarkan persyaratan masuk minimal dengan ukuran lot minimum 0,01 dan sumber daya pendidikan yang komprehensif, kekhawatiran regulasi dan masalah keamanan potensial membuatnya tidak cocok untuk trader pemula yang membutuhkan lingkungan perdagangan yang lebih aman dan transparan.

Apakah T4Trade legal?

Legitimitas T4Trade sedang dalam pengawasan. Tradeco Limited terdaftar di Otoritas Jasa Keuangan Seychelles (FSA), tetapi ada kekhawatiran tentang kemungkinan kloning badan regulasi ini. Hal ini mengurangi kepercayaan dan keandalan yang biasanya diberikan oleh pengawasan regulasi.

Apakah T4Trade cocok untuk investasi/pensiun?

T4Trade tidak ideal untuk investasi atau perencanaan pensiun. Platform ini fokus pada perdagangan CFD di berbagai kelas aset seperti Forex, logam, indeks, komoditas, futures, dan saham. Platform ini tidak memiliki reksa dana atau produk investasi pensiun khusus, yang umumnya lebih cocok untuk investasi jangka panjang dan perencanaan pensiun. Selain itu, struktur biaya platform ini tidak jelas, menambah ketidakcocokannya untuk tujuan tersebut.

Peringatan Risiko

Informasi yang disediakan didasarkan pada evaluasi ahli WikiStock terhadap data situs web pialang dan dapat berubah. Selain itu, perdagangan online melibatkan risiko yang besar, yang dapat menyebabkan kerugian total dana yang diinvestasikan, sehingga memahami risiko terkait sebelum terlibat sangat penting.

Lainnya

Registered region

Siprus

Jam kerja

2-5 tahun

Produk

Bonds & Fixed Income、Futures、Options、Stocks

Review

Tidak ada rating

Perusahaan Pialang yang DirekomendasikanMore

XB Prime

Nilai

瑞根富投

Nilai

XLNTrade

Nilai

ZFX

Nilai

BullXmarket

Nilai

Exness

Nilai

Supreme FX

Nilai

Squared Financial

Nilai

Squared Financial

Nilai

Bull Trading Investment

Nilai