Nilai

Peringkat indeks

Penilaian Broker

Pengaruh

C

Indeks pengaruh NO.1

Turki

TurkiProduk

3

Securities Lending Fully Paid、Futures、Stocks

Lisensi sekuritas

dapatkan 1 lisensi sekuritas

CYSECTeregulasi

SiprusLisensi Perdagangan Sekuritas

Informasi Pialang

More

Nama perusahaan

GPB-Financial Services Limited

Singkatan

GPB-Financial Services

Negara dan wilayah terdaftar platform

Alamat perusahaan

Situs Perusahaan

https://www.gpbfs.com.cy/Periksa kapanpun Anda mau

WikiStock APP

Layanan Broker

Gene Internet

Indeks Gene

Peringkat APP

| Layanan Keuangan GPB |  |

| Peringkat WikiStock | ⭐⭐⭐ |

| Layanan | Layanan investasi inti, dan layanan keuangan tambahan |

| Instrumen Keuangan | Efek yang dapat dipindah tangankan, Instrumen pasar uang, Unit dalam usaha investasi kolektif, Derivatif (seperti opsi, futures, swap, perjanjian suku bunga berjangka, dan lain-lain), Kontrak keuangan untuk perbedaan |

Apa itu Layanan Keuangan GPB?

Layanan Keuangan GPB, anak perusahaan Gazprombank (JSC), adalah perusahaan layanan keuangan yang berbasis di Siprus yang didirikan pada tahun 2009. Berlisensi oleh Cyprus Securities and Exchange Commission (CySEC), perusahaan ini menawarkan berbagai layanan investasi, termasuk eksekusi pesanan, penjaminan, dan penasehat keuangan, dengan akses ke pasar modal Rusia dan global. Perusahaan ini mengklaim diarahkan oleh prinsip-prinsip kepercayaan yang baik, kejujuran, rasa hormat, keadilan, dan saling percaya, menempatkan kepentingan klien di atas segalanya.

Kelebihan & Kekurangan Layanan Keuangan GPB

| Kelebihan | Kekurangan |

|

|

|

|

|

Regulasi CySEC: Regulasi oleh CySEC memastikan bahwa perusahaan beroperasi dalam kerangka hukum dan mematuhi pedoman yang ketat, memberikan tingkat keamanan dan perlindungan bagi investor.

Layanan Komprehensif: Perusahaan menawarkan berbagai layanan investasi, termasuk eksekusi pesanan, penjaminan, dan penasehat keuangan, memberikan solusi lengkap bagi kebutuhan investasi klien.

Keanggotaan di LSE: Menjadi anggota London Stock Exchange (LSE) menambah kredibilitas Layanan Keuangan GPB, memberikan jaminan kepada klien mengenai komitmen perusahaan terhadap standar tinggi dan kepatuhan regulasi.

Kekurangan:Informasi Biaya Terbatas: Situs web perusahaan tidak menyediakan informasi terperinci tentang biaya, minimum akun, atau biaya lain yang terkait dengan layanan mereka, yang membuat sulit bagi klien untuk menilai total biaya investasi.

Apakah Layanan Keuangan GPB Aman?

Dengan lisensi No.113/10, regulasi oleh Cyprus Securities and Exchange Commission (CySEC) memberikan tingkat pengawasan dan kepatuhan regulasi, meningkatkan kredibilitas dan memberikan tingkat perlindungan bagi klien. Regulasi ini memastikan bahwa perusahaan beroperasi sesuai dengan standar dan pedoman yang telah ditetapkan, mempromosikan transparansi dan integritas dalam operasinya.

Securities Apa yang Dapat Diperdagangkan dengan Layanan Keuangan GPB?

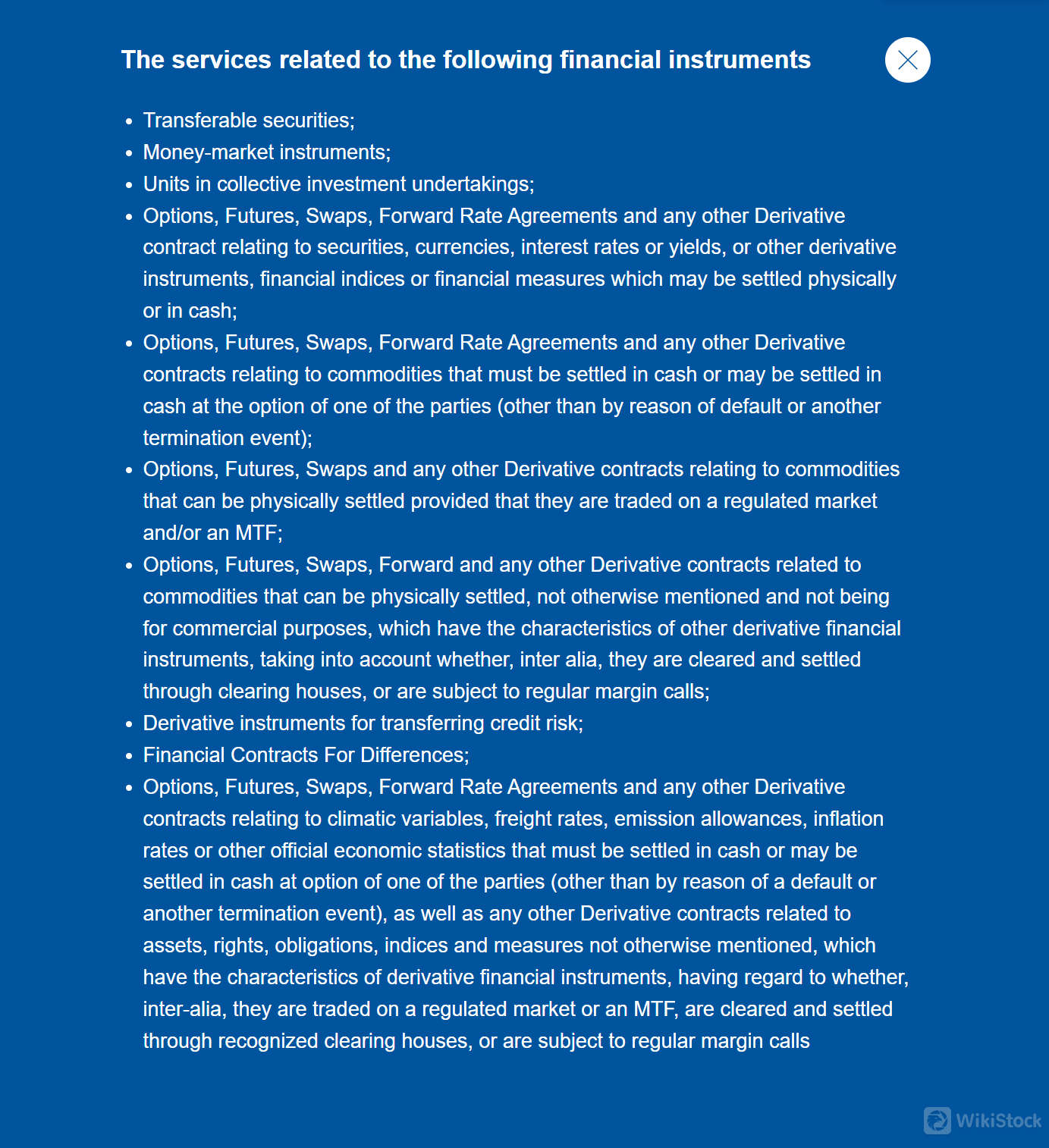

Layanan Keuangan GPB menawarkan berbagai jenis sekuritas untuk diperdagangkan.

Transferable Securities: Ini adalah sekuritas yang dapat diperdagangkan di pasar sekunder, seperti saham dan obligasi.

Instrumen Pasar Uang: Ini adalah sekuritas utang jangka pendek, seperti surat utang negara dan surat dagang, yang sangat likuid dan sering digunakan untuk pembiayaan kebutuhan kas jangka pendek.

Unit dalam Usaha Investasi Bersama: Ini adalah unit atau saham dalam reksa dana atau skema investasi bersama lainnya, yang mengumpulkan dana investor untuk berinvestasi dalam portofolio efek yang terdiversifikasi.

Derivatif: GPB-Financial Services menyediakan akses ke instrumen derivatif seperti opsi, futures, swap, dan perjanjian suku bunga berjangka, yang nilainya berasal dari aset atau indeks yang mendasarinya.

Kontrak Keuangan untuk Perbedaan (CFD): CFD memungkinkan investor untuk berspekulasi pada pergerakan harga berbagai instrumen keuangan, seperti saham, tanpa memiliki aset yang mendasarinya.

Ulasan Layanan GPB-Financial Services

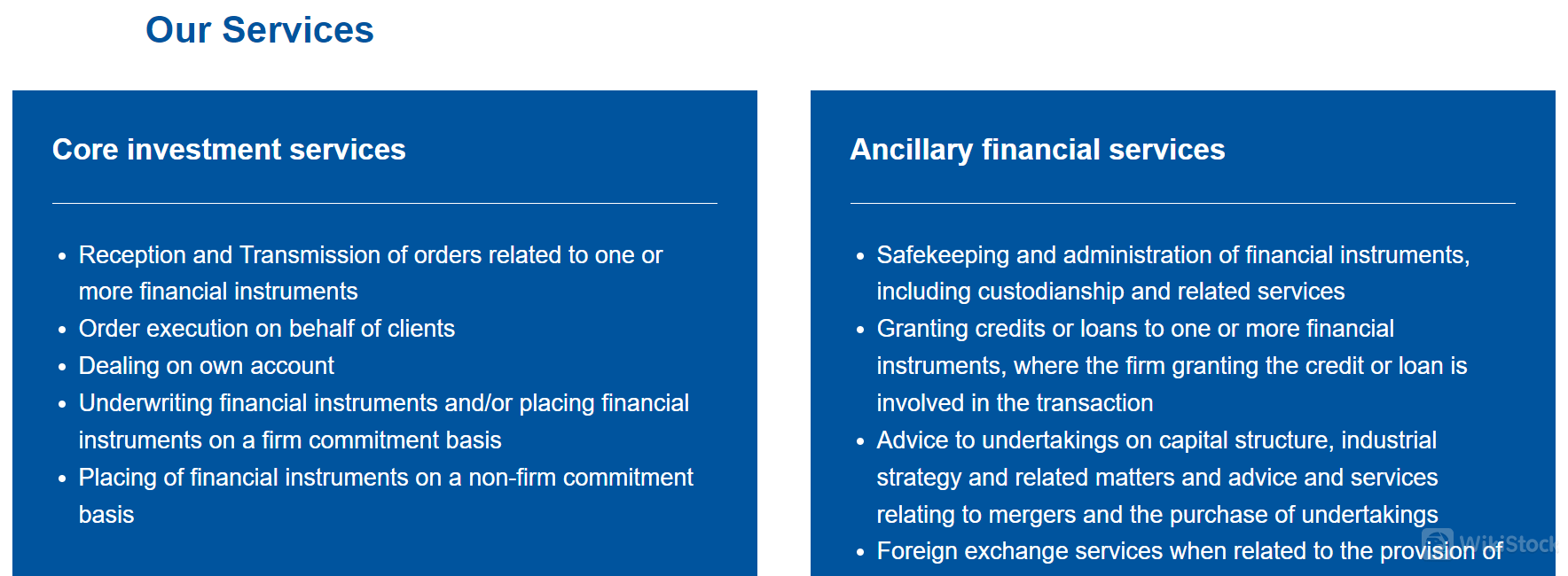

GPB-Financial Services menyediakan berbagai layanan investasi yang komprehensif untuk memenuhi beragam kebutuhan klien. Ini termasuk layanan investasi inti seperti penerimaan dan transmisi pesanan, eksekusi pesanan, dan penanganan atas nama sendiri. Perusahaan ini juga menawarkan penjaminan instrumen keuangan dan penempatan mereka berdasarkan komitmen yang kuat, serta penempatan instrumen keuangan berdasarkan komitmen yang tidak kuat.

Selain layanan investasi inti, GPB-Financial Services menyediakan layanan keuangan tambahan, termasuk penyimpanan aman dan administrasi instrumen keuangan, penjagaan, dan layanan terkait. Perusahaan ini juga menawarkan layanan terkait pemberian kredit atau pinjaman kepada instrumen keuangan, di mana perusahaan yang memberikan kredit atau pinjaman terlibat dalam transaksi tersebut.

Penelitian & Pendidikan

GPB-Financial Services menyediakan MiFID di situs webnya sebagai sumber daya penelitian dan pendidikan bagi kliennya. MiFID adalah kerangka regulasi penting yang mengatur layanan investasi di seluruh Area Ekonomi Eropa (EEA), yang dirancang untuk meningkatkan transparansi pasar, perlindungan investor, dan persaingan. Hal ini penting bagi klien untuk memahami hak dan tanggung jawab mereka di bawah MiFID, memastikan mereka dapat menjelajahi pasar keuangan dengan percaya diri dan kepatuhan.

Layanan Pelanggan

Jika Anda membutuhkan bantuan atau memiliki pertanyaan, GPB-Financial Services dapat dihubungi melalui berbagai departemen.

Untuk masalah terkait pialang, termasuk pertanyaan tentang investasi dan transaksi, Anda dapat menghubungi Departemen Pialang melalui email di brokerage@gpbfs.com.cy atau dengan menelepon +357 25 055 109.

Departemen Kantor Belakang menangani tugas-tugas administratif dan dapat dihubungi di Backoffice@gpbfs.com.cy atau +357 25 055 106 untuk pertanyaan mengenai pengelolaan akun atau dokumentasi.

Untuk masalah terkait kepatuhan atau pertanyaan tentang persyaratan regulasi, Departemen Kepatuhan dapat dihubungi di compliance@gpbfs.com.cy atau +357 25 055 119.

Fungsi Sumber Daya Manusia dapat dihubungi di hr@gpbfs.com.cy atau +357 25 055 100. Mereka dapat memberikan informasi mengenai pemberitahuan privasi untuk pelamar pekerjaan dan menjawab pertanyaan yang Anda miliki.

Selain itu, jika Anda ingin mengunjungi GPB-Financial Services secara langsung atau mengirim surat, alamat fisik mereka adalah 65 Spyrou Kyprianou Ave, Mesa Geitonia, Crystalserve Business Center, Lantai 2, 4003 Limassol, Siprus. Anda dapat menghubungi kantor utama mereka melalui telepon di +357 25 055 000 atau +357 25 055 100, dengan komunikasi faks tersedia di +357 25 055 101.

Kesimpulan

Sebagai kesimpulan, GPB-Financial Services menawarkan berbagai layanan investasi yang diatur oleh Cyprus Securities and Exchange Commission (CySEC), termasuk eksekusi pesanan, penjaminan, dan penasehat keuangan. Meskipun regulasi perusahaan oleh CySEC memberikan tingkat pengawasan dan kredibilitas, informasi biaya yang terbatas dan kurangnya informasi akun yang terperinci menimbulkan beberapa tantangan. Secara keseluruhan, GPB-Financial Services adalah pilihan yang solid jika Anda dapat memahami struktur biaya dan rincian akun.

Pertanyaan yang Sering Diajukan (FAQ)

Apakah GPB-Financial Services diatur?

Ya, GPB-Financial Services diatur oleh Cyprus Securities and Exchange Commission (CySEC).

Apa layanan yang ditawarkan oleh GPB-Financial Services?

GPB-Financial Services menawarkan layanan investasi inti seperti eksekusi pesanan, penjaminan, dan penasehat keuangan, serta layanan keuangan tambahan termasuk penyimpanan aman dan administrasi instrumen keuangan.

Instrumen keuangan apa yang dapat saya perdagangkan dengan GPB-Financial Services?

GPB-Financial Services menawarkan berbagai instrumen keuangan untuk perdagangan, termasuk surat berharga yang dapat dipindah tangankan, instrumen pasar uang, unit dalam usaha investasi kolektif, dan derivatif seperti opsi, futures, dan swap.

Peringatan Risiko

Informasi yang disediakan didasarkan pada evaluasi ahli WikiStock terhadap data situs pialang dan dapat berubah. Selain itu, perdagangan online melibatkan risiko yang signifikan, yang dapat menyebabkan kerugian total dari dana yang diinvestasikan, oleh karena itu memahami risiko terkait sebelum terlibat sangat penting.

Lainnya

Registered region

Siprus

Jam kerja

10-15 tahun

Margin Trading

YES

Negara yang Diatur

1

Produk

Securities Lending Fully Paid、Futures、Stocks

Review

Tidak ada rating

Perusahaan Pialang yang DirekomendasikanMore

Fintailor

Nilai

LIRUNEX

Nilai

Goldenburg

Nilai

Eightplus

Nilai

FIC

Nilai

ZEMBLANCO

Nilai

FIBO Group

Nilai

PRODIGIT

Nilai

APME FX

Nilai

Grandis Securities

Nilai