Nilai

広田証券

https://www.hirota-sec.co.jp/

Website

Peringkat indeks

Penilaian Broker

Pengaruh

B

Indeks pengaruh NO.1

Jepang

JepangProduk

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Lisensi sekuritas

dapatkan 1 lisensi sekuritas

FSATeregulasi

JepangLisensi Perdagangan Sekuritas

Informasi Pialang

More

Nama perusahaan

広田証券株式会社

Singkatan

広田証券

Negara dan wilayah terdaftar platform

Alamat perusahaan

Situs Perusahaan

https://www.hirota-sec.co.jp/Periksa kapanpun Anda mau

WikiStock APP

Layanan Broker

Gene Internet

Indeks Gene

Peringkat APP

Fitur broker

Tarif komisi

0.2%

Tingkat pendanaan

1.15%

Margin Trading

YES

Negara yang Diatur

1

| Hirota Securities |  |

| Peringkat WikiStock | ⭐️⭐️⭐️⭐️ |

| Biaya | bervariasi tergantung pada jenis sekuritas dan jumlah transaksi |

| Biaya Akun | Tidak ada biaya pembukaan akun |

| Aplikasi/Platform | Tidak ada aplikasi |

Informasi Hirota Securities

Hirota Securities membedakan dirinya sebagai penyedia layanan keuangan komprehensif di Jepang, menawarkan berbagai solusi investasi yang dipersonalisasi dan keahlian perencanaan keuangan. Perusahaan ini fokus pada pengelolaan aset, meliputi saham, obligasi, dan reksa dana.

Kelebihan & Kekurangan Hirota Securities

| Kelebihan | Kekurangan |

| Layanan Personalisasi | Tidak Ada Platform Online |

| Regulasi Formal | Sumber Daya Pendidikan Terbatas |

| Biaya Tinggi | |

| Jangkauan Geografis Terbatas |

Layanan Personalisasi: Hirota Securities memprioritaskan konsultasi tatap muka dengan para ahli yang menawarkan strategi pengelolaan aset.

Regulasi Formal: Terdaftar di Badan Layanan Keuangan Jepang (FSA) memberikan beberapa jaminan bahwa mereka sah dan beroperasi di bawah pengawasan regulasi.

Kekurangan:Tidak Ada Platform Online: Tidak ada platform online untuk perdagangan atau pengelolaan akun. Ini merupakan kekurangan bagi mereka yang lebih suka pengalaman investasi digital.

Sumber Daya Pendidikan Terbatas: Fokusnya adalah pada konsultasi tatap muka, dengan kurangnya sumber daya online yang tersedia seperti laporan riset, artikel, atau alat pendidikan. Ini dapat membatasi pilihan untuk pembelajaran mandiri.

Biaya Tinggi: Struktur komisi mereka cenderung lebih tinggi dibandingkan beberapa pesaing.

Jangkauan Geografis Terbatas: Jaringan cabang mereka terpusat di Jepang, terutama di wilayah Kyoto dan Shiga.

Apakah Hirota Securities Aman?

Hirota Securities terdaftar di Otoritas Jasa Keuangan Jepang (FSA) dengan Nomor Lisensi: Kinki Finance Bureau Director (Sekuritas) No. 33. Ini menunjukkan bahwa Hirota Securities diotorisasi untuk melakukan bisnis sekuritas di Jepang dan tunduk pada regulasi dan pengawasan FSA.

OJK adalah lembaga pemerintah independen yang bertanggung jawab untuk mengatur industri jasa keuangan di Jepang, termasuk sekuritas, perbankan, dan asuransi. Tujuannya termasuk menjaga stabilitas sistem keuangan, melindungi investor, dan mempromosikan pasar yang adil dan efisien.

Apa itu Sekuritas yang Diperdagangkan dengan Hirota Securities?

Informasi yang disediakan menunjukkan bahwa Hirota Securities menawarkan lebih dari sekedar perdagangan sekuritas tradisional.

- Manajemen Aset: Mereka fokus pada perencanaan investasi yang dipersonalisasi dan pengelolaan portofolio. Ini melibatkan rekomendasi berbagai sekuritas yang sesuai dengan tujuan dan toleransi risiko pelanggan, termasuk saham, obligasi, atau reksa dana.

- Pendidikan Investasi: Mereka mengakui risiko inherent dalam berinvestasi dan bertujuan untuk mendidik klien, terutama investor pemula, untuk membangun kepercayaan dalam mengarungi pasar keuangan.

- Perencanaan Pensiun: Hirota Securities menawarkan panduan tentang penggunaan investasi saham untuk melengkapi pensiun dan mengamankan masa depan keuangan setelah pensiun.

- Perencanaan Warisan: Hirota Securities membantu dengan strategi seperti pewarisan dan pemberian hadiah, melibatkan alokasi aset dengan berbagai sekuritas untuk memastikan transfer kekayaan yang lancar kepada orang-orang terkasih pelanggan.

- Prapendaftaran Online: Hirota Securities memiliki formulir pembukaan akun online yang memungkinkan klien untuk mengirimkan informasi dasar secara elektronik. Ini mempercepat proses aplikasi tatap muka.

- Aplikasi Tatap Muka: Pelanggan dapat mengunjungi cabang Hirota Securities atau memiliki anggota staf mengunjungi mereka untuk menyelesaikan proses pembukaan akun. Ini akan melibatkan pengisian formulir aplikasi fisik dan membahas opsi akun yang sesuai dengan seorang perwakilan.

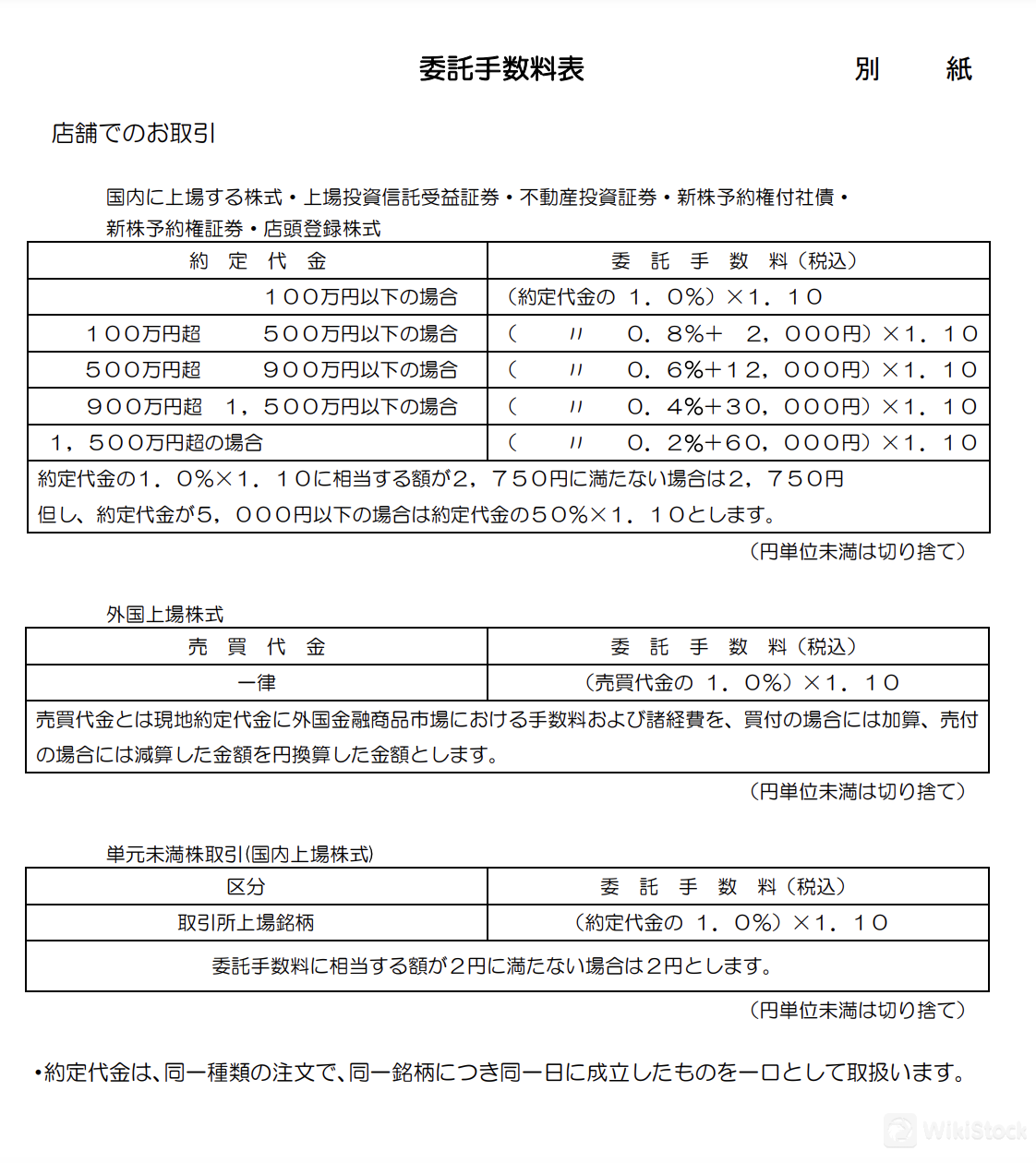

- Saham, Investasi Amanah, Sekuritas Investasi Real Estate, Waran Langganan Saham Baru, Saham OTC:

- 2.750 yen jika biaya komisi yang dihitung kurang dari 2.750 yen

- 50% dari jumlah transaksi (termasuk pajak) jika jumlah transaksi 5.000 yen atau kurang

- 1,0% (termasuk pajak) dari jumlah transaksi untuk transaksi hingga 1 juta yen

- 0,8% (termasuk pajak) dari jumlah transaksi + 2.000 yen untuk transaksi di atas 1 juta yen dan hingga 5 juta yen

- 0,6% (termasuk pajak) dari jumlah transaksi + 12.000 yen untuk transaksi di atas 5 juta yen dan hingga 9 juta yen

- 0,4% (termasuk pajak) dari jumlah transaksi + 30.000 yen untuk transaksi di atas 9 juta yen dan hingga 15 juta yen

- 0,2% (termasuk pajak) dari jumlah transaksi + 60.000 yen untuk transaksi di atas 15 juta yen

- Biaya Komisi Minimum:

- 2.750 yen jika biaya komisi yang dihitung kurang dari 2.750 yen

- 50% dari jumlah transaksi (termasuk pajak) jika jumlah transaksi 5.000 yen atau kurang

- Saham: 1,0% (termasuk pajak) dari jumlah transaksi

- Konsultasi Gratis: Alat pendidikan utama mereka adalah konsultasi gratis di cabang. Para ahli dapat menjawab pertanyaan dan kekhawatiran, menawarkan panduan tentang strategi pengelolaan aset yang sesuai dengan kebutuhan dan tujuan individu pelanggan.

- FAQ: Hirota Securities memiliki bagian Pertanyaan yang Sering Diajukan (FAQ) di situs web mereka yang dapat menjawab pertanyaan dasar tentang akun, transaksi, dan topik umum lainnya.

Akun Hirota Securities

Proses pembukaan akun menyoroti dua pilihan:

Ulasan Biaya Hirota Securities

Biaya pialang Hirota Securities bervariasi tergantung pada jenis sekuritas dan jumlah transaksi.

Sekuritas DomestikPenelitian & Pendidikan

Hirota Securities memberikan prioritas panduan personalisasi daripada sumber daya penelitian dan pendidikan yang mendalam.

Layanan Pelanggan

Hirota Securities memberikan prioritas konsultasi melalui telepon dan email untuk layanan pelanggan. Mereka memiliki cabang di beberapa lokasi di Jepang, termasuk Osaka (2 cabang), Tokyo (1 cabang), Hyogo (4 cabang), dan Shiga (3 cabang). Setelah mengisi formulir online, pelanggan dapat menekan tombol kirim untuk mengirim email.| Alamat | Tel | Fax | |

| Kantor Pusat | 〒541-0041 大阪府大阪市中央区北浜1丁目1番24号 | 06-6201-1181 | 06-6229-2752 |

| Cabang Ibaraki | 〒567-0829 大阪府茨木市双葉町8番22号 | 072-632-1181 | 072-632-1552 |

| Cabang Tokyo | 〒103-0025 東京都中央区日本橋茅場町1丁目7番3号 | 03-3667-1181 | 03-3667-0573 |

| Cabang Kobe | 〒651-0087 神戸市中央区御幸通6丁目1番20号 GEETEX ASCENT BLDG 8階 | 078-261-1181 | 078-232-1060 |

| Cabang Sumoto | 〒656-0026 兵庫県洲本市栄町2丁目3番35号 | 0799-24-1181(洲本支店・南あわじ出張所共通) | 0799-24-1188(洲本支店) |

| 南あわじ出張所 〒656-0461 兵庫県南あわじ市市円行寺150 | 0799-42-5501(南あわじ出張所) | ||

| Cabang Kawanishi | 〒666-0016 兵庫県川西市中央町8番8号 アメニティ川西ビル5階 | 072-756-1181 | 072-756-1186 |

| Kantor Penjualan Woody Town | 〒669-1322 兵庫県三田市すずかけ台2丁目3番1号 | 079-562-1181 | 079-565-7816 |

| Cabang Yokaichi | 〒527-0012 滋賀県東近江市八日市本町2番18号 | 0748-22-1212 | 0748-23-1212 |

| Cabang Kusatsu | 〒525-0032 滋賀県草津市大路2丁目1番53号 | 077-565-1212 | 077-564-5657 |

| Kantor Penjualan Otsu | 〒520-0043 滋賀県大津市中央2丁目2番18号 | 077-526-1313 | 077-525-5174 |

Kesimpulan

Hirota Securities menawarkan pilihan menarik bagi investor Jepang yang mencari pendekatan personal dalam pengelolaan kekayaan. Fokus mereka pada konsultasi tatap muka dengan para ahli dan panduan potensial untuk berbagai kebutuhan, mulai dari investasi pertama hingga perencanaan pensiun, dapat berharga. Terdaftar di FSA menambahkan tingkat keabsahan. Namun, kurangnya platform online yang jelas dan sumber daya pendidikan terbatas di luar konsultasi adalah kekurangan bagi investor yang mahir dalam teknologi atau mereka yang mencari penelitian independen. Selain itu, biaya yang lebih tinggi dibandingkan dengan pesaing memerlukan pertimbangan yang hati-hati.

FAQ

Apakah Hirota Securities aman untuk diperdagangkan?

Ya, terdaftar di Badan Layanan Keuangan (FSA) Jepang memberikan beberapa jaminan.

Apakah Hirota Securities merupakan platform yang baik untuk pemula?

Ya. Hirota Securities menawarkan konsultasi dengan para ahli yang dapat menjelaskan dasar-dasar investasi. Pemula juga dapat mendapatkan panduan tanpa biaya.

Apakah Hirota Securities baik untuk investasi/pensiun?

Hirota Securities menawarkan konsultasi untuk perencanaan pensiun, tetapi biaya yang lebih tinggi dan sumber daya online yang terbatas memerlukan pertimbangan.

Peringatan Risiko

Informasi yang disediakan didasarkan pada evaluasi ahli WikiStock terhadap data situs web perusahaan pialang dan dapat berubah. Selain itu, perdagangan online melibatkan risiko yang besar, yang dapat menyebabkan kerugian total dana yang diinvestasikan, sehingga memahami risiko terkait sebelum terlibat sangat penting.

Lainnya

Registered region

Jepang

Jam kerja

Lebih dari 20 tahun

Produk

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

Tidak ada rating

Perusahaan Pialang yang DirekomendasikanMore

内藤証券株式会社

Nilai

Ichiyoshi Securities

Nilai

丸八証券株式会社

Nilai

ひろぎん証券

Nilai

三木証券

Nilai

JTG証券

Nilai

JIA証券

Nilai

山和証券株式会社

Nilai

寿証券

Nilai

八十二証券

Nilai