スコア

レーティング

会社鑑定

影響力

C

影響力指数 NO.1

香港、中国

香港、中国取引品種

1

Futures

取引商ライセンス

1件ライセンスを保有

香港、中国SFCデリバティブ取引ライセンス

会社情報

More

会社名

CORPORATE BROKERS LIMITED

社名略語

協聯證券

会社登録国・地域

会社所在地

会社のウェブサイト

http://cblhk.com/いつでも確認することが可能です

WikiStock APP

インターネット遺伝子

遺伝子インデックス

アプリのスコア

アプリのダウンロード数

- サイクル

- ダウンロード数

- 2024-05

- 15299

集計ルール:データは現時点におけるアプリの過去1年間のダウンロード数を示します。

アプリの地区の人気度

- 国/地域ダウンロード数比率

その他

983528.52%香港、中国

258133.77%マリ

108614.21%マカオ、中国

101313.25%カメルーン

78410.25%

集計ルール:データはアプリの現時点における過去1年間のアプリのダウンロード数と地域でのシェアを示します。

会社特徴

New Stock Trading

Yes

Margin Trading

YES

規制されている国数量

1

取引可能商品

1

| Corporate Brokers |  |

| WikiStocks Rating | ⭐⭐⭐ |

| 未投資現金の利息 | 手数料:HK株式:交渉(最低:HK$100);深セン株式:交渉(最低:100元);指数:最低12ドル;オプション:最低10ドル |

| 口座手数料 | 非アクティブ口座手数料:年50ドル |

| 未投資現金の利息 | 3.20% |

| 提供される共同基金 | はい |

| プラットフォーム/アプリ | Corporate Brokersオンライン取引プラットフォーム/モバイルアプリ |

| プロモーション | モバイル/オンライン取引プロモーション(預金手数料と取引手数料が0になります) |

Corporate Brokers情報

Corporate Brokersは、競争力のある交渉手数料率を提供する独自のオンライン取引プラットフォームを特徴とする金融サービスプロバイダであり、香港および深センの株式、指数、オプション取引に焦点を当てています。

彼らは、共同基金などのサービスや、モバイル/オンライン取引のための預金手数料と取引手数料が0であるなどの特典など、さまざまな投資の好みを満たしています。

彼らのプラットフォームは堅牢で使いやすく、多様な市場へのアクセスを向上させていますが、非アクティブ口座手数料は、活発でない投資家にとって懸念事項となる可能性があります。

メリットとデメリット

| メリット | デメリット |

| SFCによる規制 | 交渉手数料 |

| 独自の取引プラットフォーム(Corporate Brokersオンライン取引プラットフォーム/モバイルアプリ) | 取引手数料の要求 |

| 複数の証券取引(株式、先物、債券) | 限られたカスタマーサポート(メールなし) |

| ユーザー向けのプロモーション | 複雑な手数料構造 |

メリット:

Corporate BrokersはSFCによって規制されており、モバイルおよびWebからアクセス可能な独自の取引プラットフォームを提供しており、株式、先物、債券などさまざまな証券をサポートしています。彼らはまた、取引コストを削減する魅力的なプロモーションを提供しています。

デメリット:

Corporate Brokersの手数料構造は複雑であり、交渉可能な手数料により予測不可能な取引コストが発生します。彼らはまた、取引手数料を課し、メールのコミュニケーションがないため、カスタマーサポートのオプションが限られており、一部のユーザーには魅力的ではありません。

Corporate Brokersは安全ですか?

規制:

Corporate Brokersは、1989年に設立された信頼性のある金融規制機関である香港証券先物委員会(SFC)によって規制されています。ブローカーのSFCライセンス番号はAAK110です。

資金の安全性:

香港の証券先物委員会(SFC)によって規制されているCorporate Brokersは、適切な財務リソースの維持や顧客資金の保護策の実施など、厳格な財務および運営基準を遵守する必要があります。

安全対策:

ブローカーは、データの送受信や保存に暗号化技術を使用するなど、資金とクライアント情報のセキュリティに関して業界標準のプラクティスを実施しています。ただし、提供された情報には、暗号化や情報漏洩を防ぐための具体的なアカウント安全対策に関する明示的な詳細は記載されていません。

Corporate Brokersとはどのような証券で取引できますか?

Corporate Brokersは、クライアントに対して多様な証券取引オプションを提供しています。

香港株式: Corporate Brokersは、アジア有数の金融市場の1つである香港証券取引所に上場している様々な香港株式の取引を可能にし、クライアントがポートフォリオを多様化するための道を提供しています。

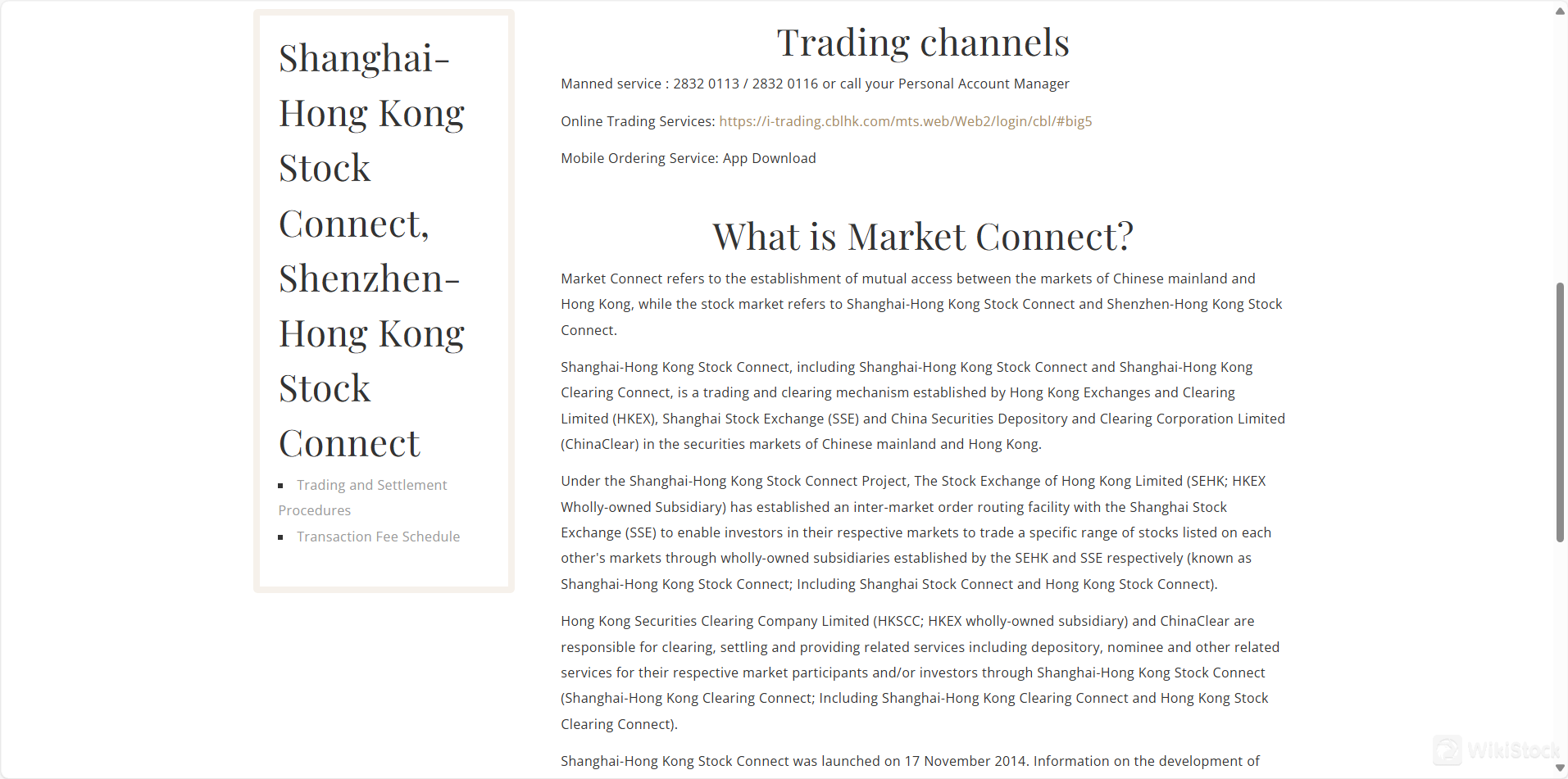

上海香港ストックコネクトおよび深セン香港ストックコネクト: これらのプログラムにより、Corporate Brokersのクライアントは、上海証券取引所および深セン証券取引所に上場している株式を、香港のプラットフォームを通じて直接取引することができます。この国境を越えた取引は、投資機会を広げ、中国本土の経済成長に触れる機会を提供します。

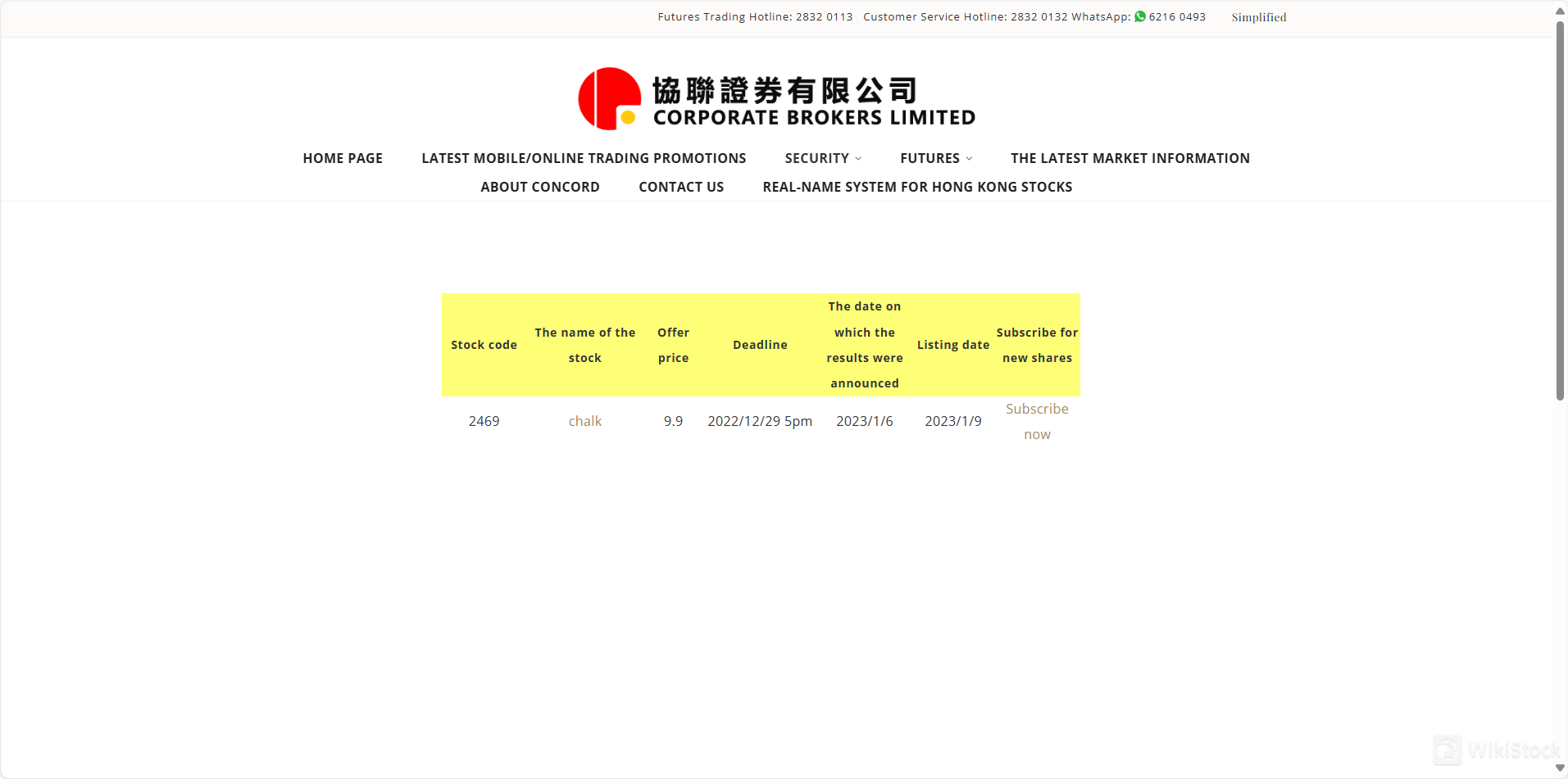

IPOサブスクリプション: Corporate Brokersは、クライアントに新規上場企業の株式に投資する機会を提供し、株式市場での早期段階での株式購入を可能にします。

現金および株式預金: この会社は、現金および株式の簡単な預金サービスをサポートしており、トレーディングアカウントの効率的な管理と投資活動の資金調達の柔軟性を可能にしています。

マージン取引: Corporate Brokersは、明確な要件を詳細に説明し、マージンコールを適切に処理するマージン取引サービスを提供しています。この施設により、クライアントは現金以上の金額で取引することができ、投資リターンを増やす一方でリスクも増やすことができます。

Corporate Brokersアカウントレビュー

Concord Securitiesは、異なる取引ニーズに対応するために設計された2つの主要なアカウントタイプを提供しています:

現金取引アカウント:このアカウントタイプは、借入せずに口座にある資金を使用して証券取引を行いたいクライアントに適しています。取引する前に、クライアントは口座に十分な資金があることを確認する必要があります。

マージン取引アカウント:このアカウントでは、クライアントは証券の購入にブローカーから資金を借りることができ、現金口座のみでは制御できないより大きなポジションを持つことができます。これにより、投資リターンを増やす可能性があります。

証券取引アカウント:これは、証券取引に参加したい個人および法人のクライアントに適しています。個人または共同口座の場合、必要な書類には香港身分証明書またはパスポートのコピー、および居住地の証明が含まれます。法人口座の場合、設立証明書、事業登録証明書、および最近の監査済み財務諸表などの追加の書類が必要です。

先物取引口座:先物取引に興味のある方は、証券口座と同様の必要書類を提出し、Concord Securitiesのオフィスで先物取引口座取引契約書に署名する手続きが必要です。個人の場合は身分証明書と住所証明書、法人の場合は法人の書類が必要です。

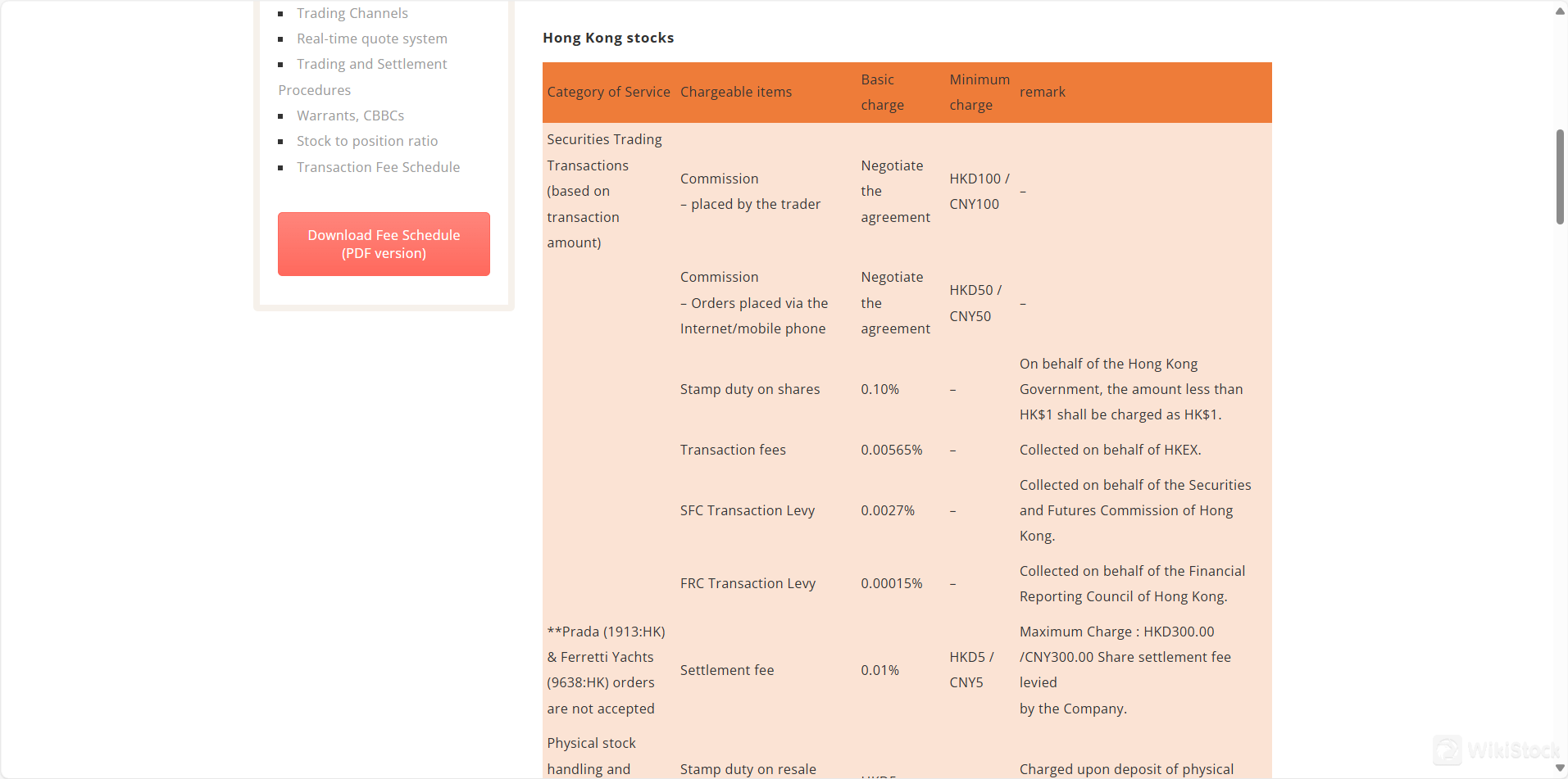

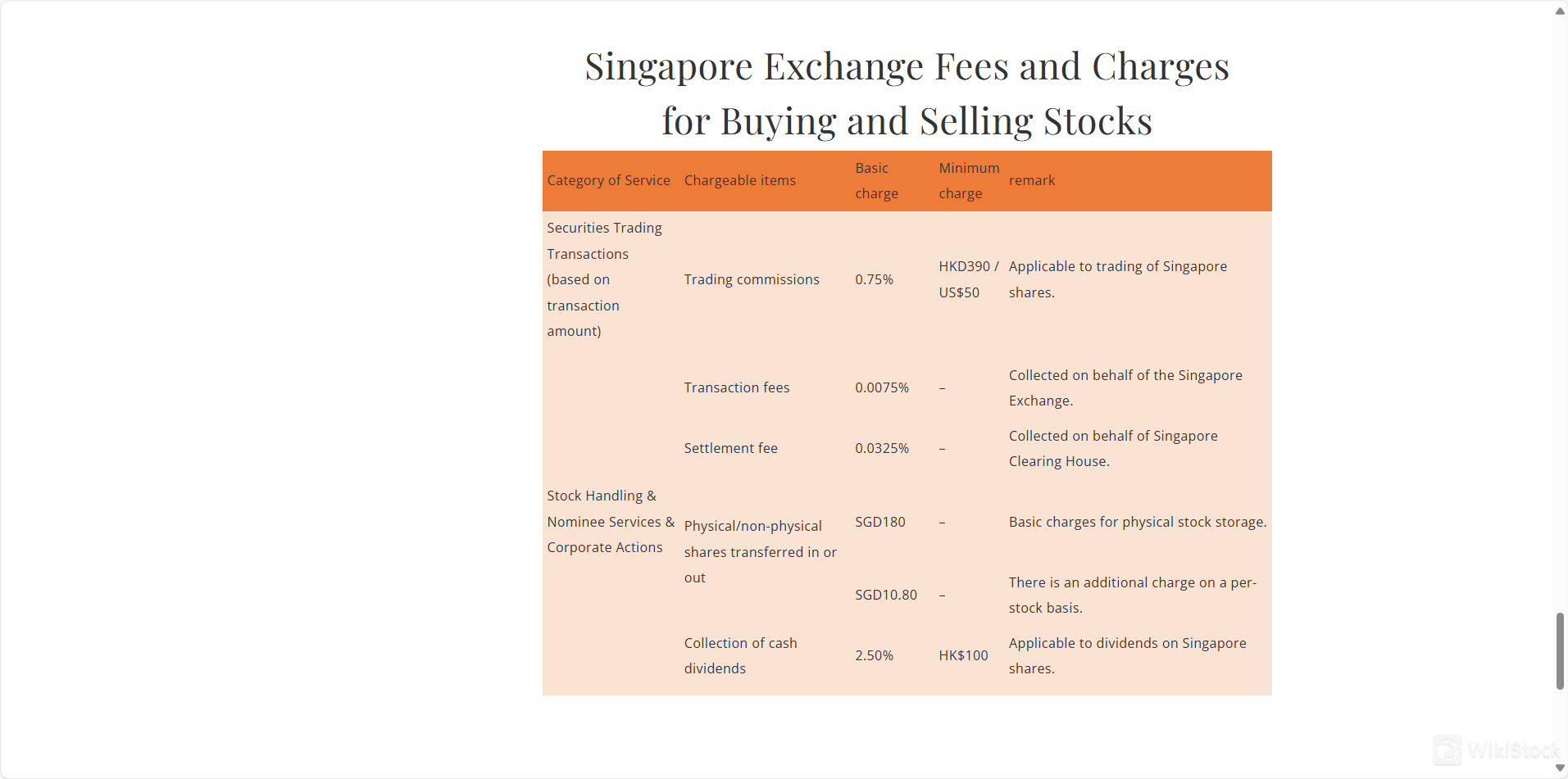

手数料:注文方法に基づいて交渉され、トレーダーによる取引の場合は最低HKD100 / CNY100、インターネットまたは携帯電話を介して行われる取引の場合は最低HKD50 / CNY50がかかります。

株式の印紙税:取引金額の0.10%が課金されます。HK$1未満の場合はHK$1に切り上げられ、香港政府に代わって徴収されます。

取引手数料:取引金額の0.00565%が香港証券取引所に代わって徴収されます。

SFC取引手数料:取引金額の0.0027%が香港証券先物委員会に代わって徴収されます。

FRC取引手数料:取引金額の0.00015%が香港会計および財務報告評議会に代わって徴収されます。

決済手数料:取引金額の0.01%で、最低HKD5 / CNY5、最大HKD300 / CNY300がConcord Securitiesによって徴収されます。

株式の物理的な引き出し:1板ロットあたりHKD5で、奇数ロットは1ロットとして扱われます。

決済指示:前日の終値の総額に基づく0.05%の手数料で、最低HKD200がかかります。

投資家決済指示(ISI):前日の終値に基づく総額の0.01%の手数料で、最低HKD20がかかります。

マルチカウンター転送指示:申請ごとにHKD50の一律手数料がかかります。

株式の登録と転送:1株あたりHKD5で、最低HKD200がかかります。

仲介手数料:電話取引とオンライン取引の両方で個別に交渉されます。

印紙税:取引金額の0.10%で、取引金額が$1.00未満の場合は香港政府によって$1.00が徴収されます。

取引手数料:取引金額の0.0027%が証券先物委員会(SFC)によって徴収されます。

FRC取引手数料:取引金額の0.00015%が会計および財務報告評議会によって徴収されます。

取引手数料:取引金額の0.005%が香港証券取引所によって徴収されます。

中央決済処理手数料:取引金額の0.005%が中央クリアリングハウスと金輝証券によって徴収されます。

配当/ボーナス転送手数料:配当/ボーナス株の受け取りには手数料$50がかかります。初回は1ロットあたり$2.50で、2回目以降は免除されますが、株式の純増がある場合は400ロット以上の場合に1ロットあたり$1.50が請求されます。

配当金またはボーナス株の追跡:個別に交渉され、印紙税、成績手数料、転送手数料などの関連サービス料金がかかります。

上場企業行動費用:每一手股票0.80美元,包括股票交換、配股、私有化和收購接受等活動。

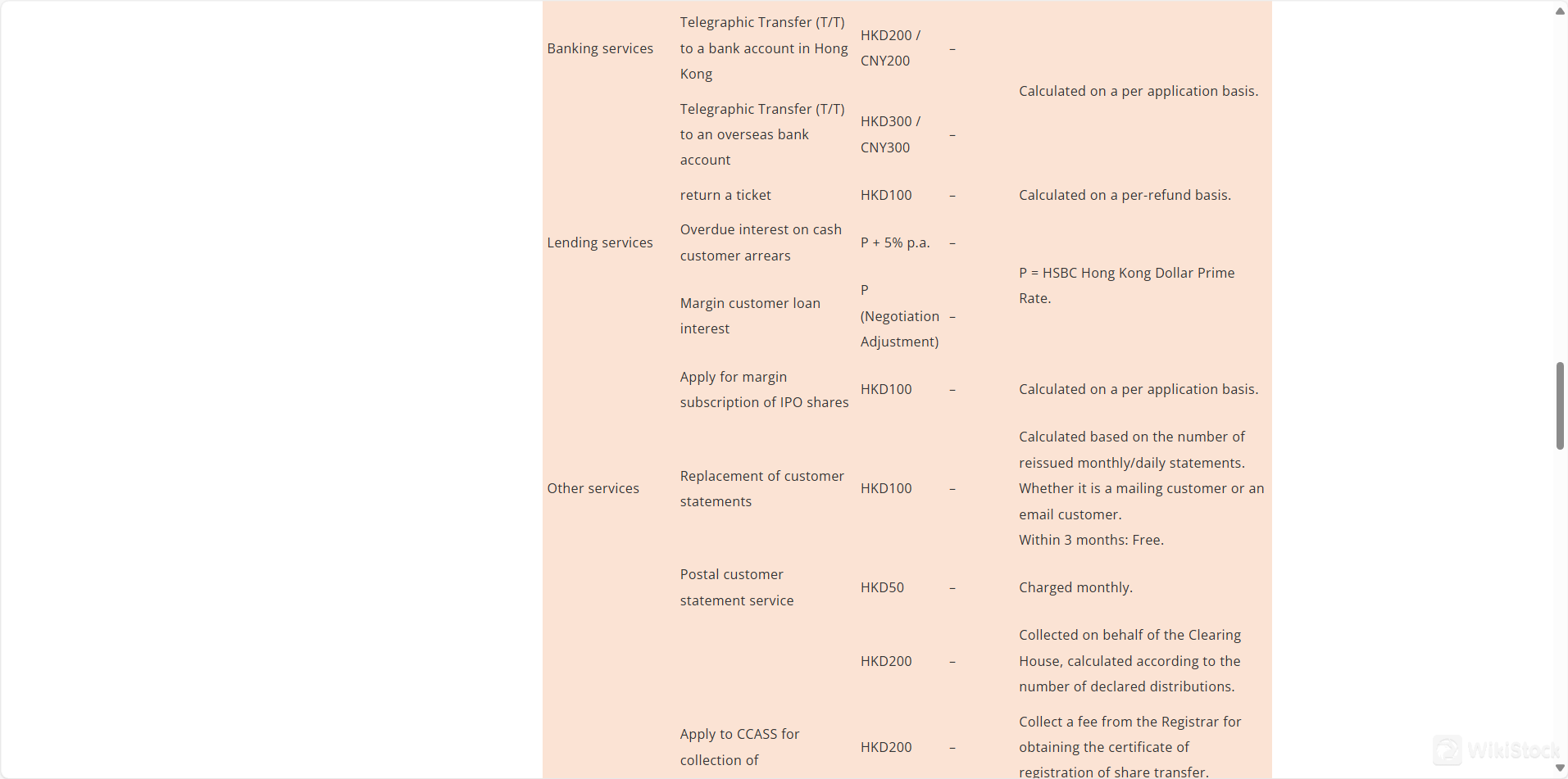

電匯:根據協商個別收費,並受到銀行費用的影響。

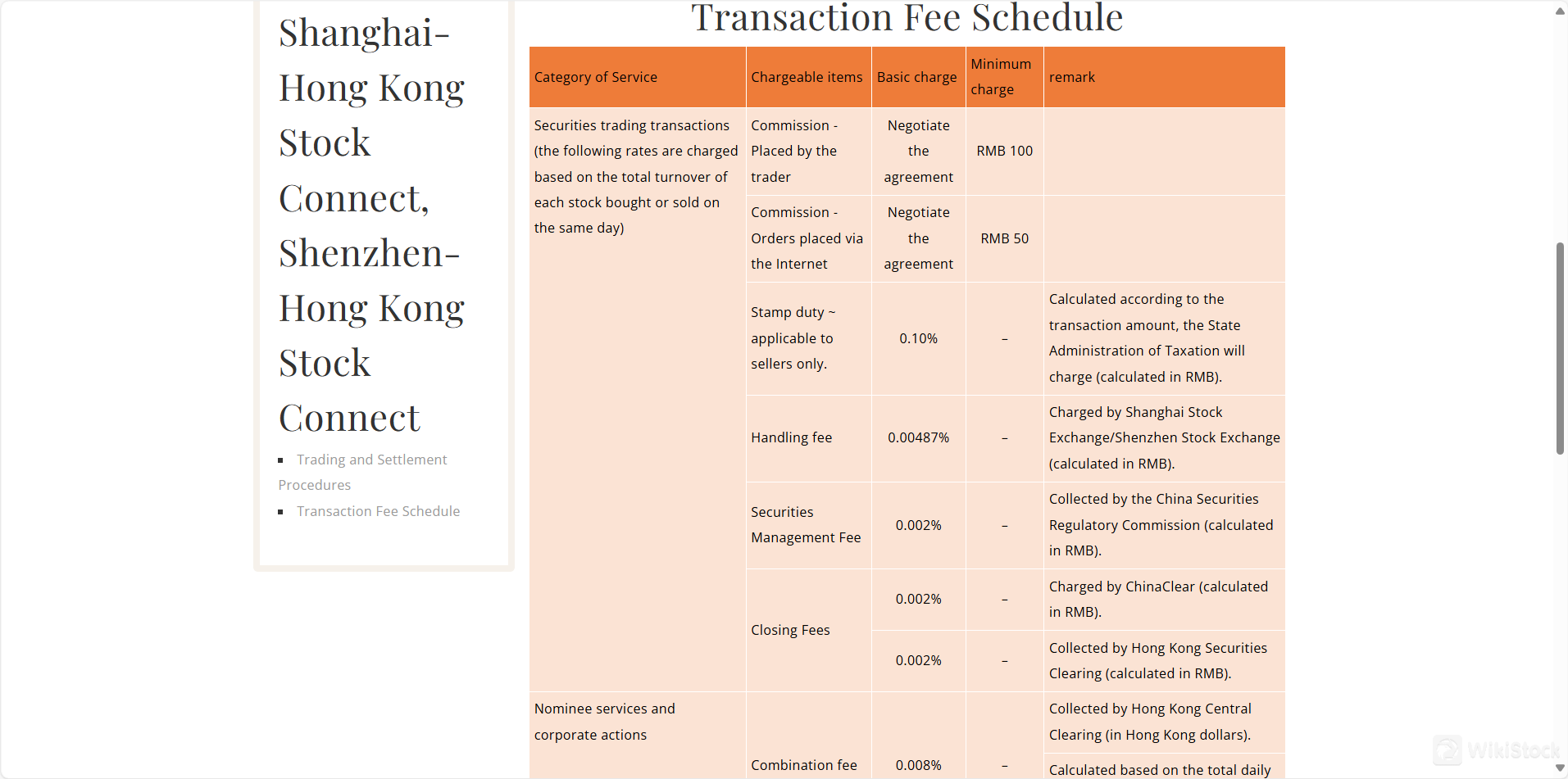

佣金:

對於交易者下單的交易:收費根據協議進行,最低收費為人民幣100。

對於通過互聯網下單的交易:收費也根據協議進行,最低收費為人民幣50。

股票印花稅:

僅適用於賣方,按交易金額的0.10%計算。此費用由國家稅務總局收取。

手續費:

上海證券交易所或深圳證券交易所按交易金額的0.00487%收取。

證券管理費:

由中國證券監督管理委員會按0.002%的比例收取。

結算費:

收取0.002%的費用,由中國銀行清算和香港證券交易所清算收取。

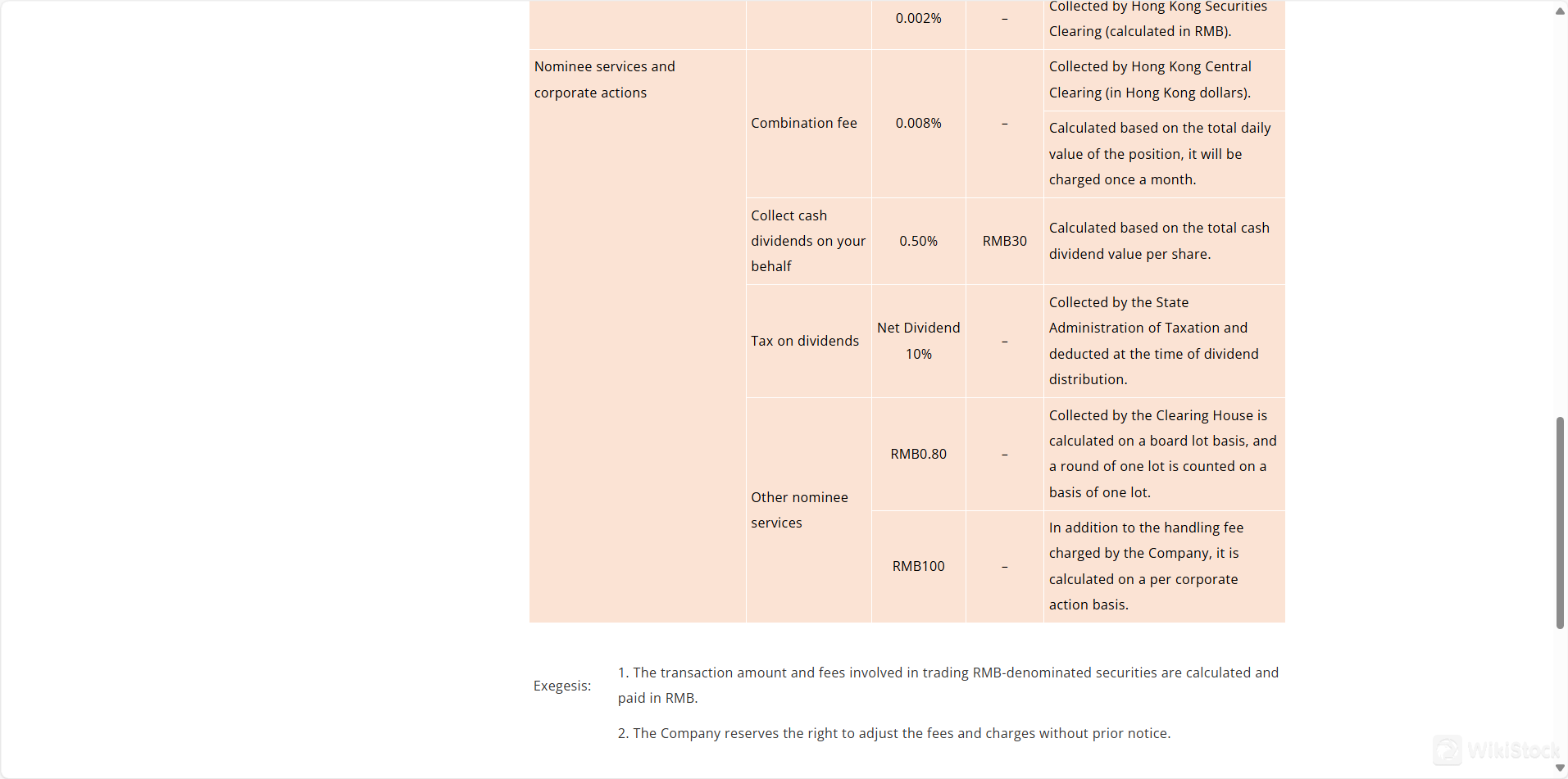

組合費:

按持倉每日總價值的0.008%收取,由香港中央結算每月收取。

股息收取費:

每股股息總金額的0.50%收取,最低費用為人民幣30。

股息稅:

由國家稅務總局在股息分配時扣除10%的淨股息稅。

其他代名人服務:

按每一手股票收取人民幣0.80的標準費用,由清算所收取。

法人行動ごとに追加のRMB 100の手数料が発生します。この手数料は、会社が請求する手数料に加えて発生します。

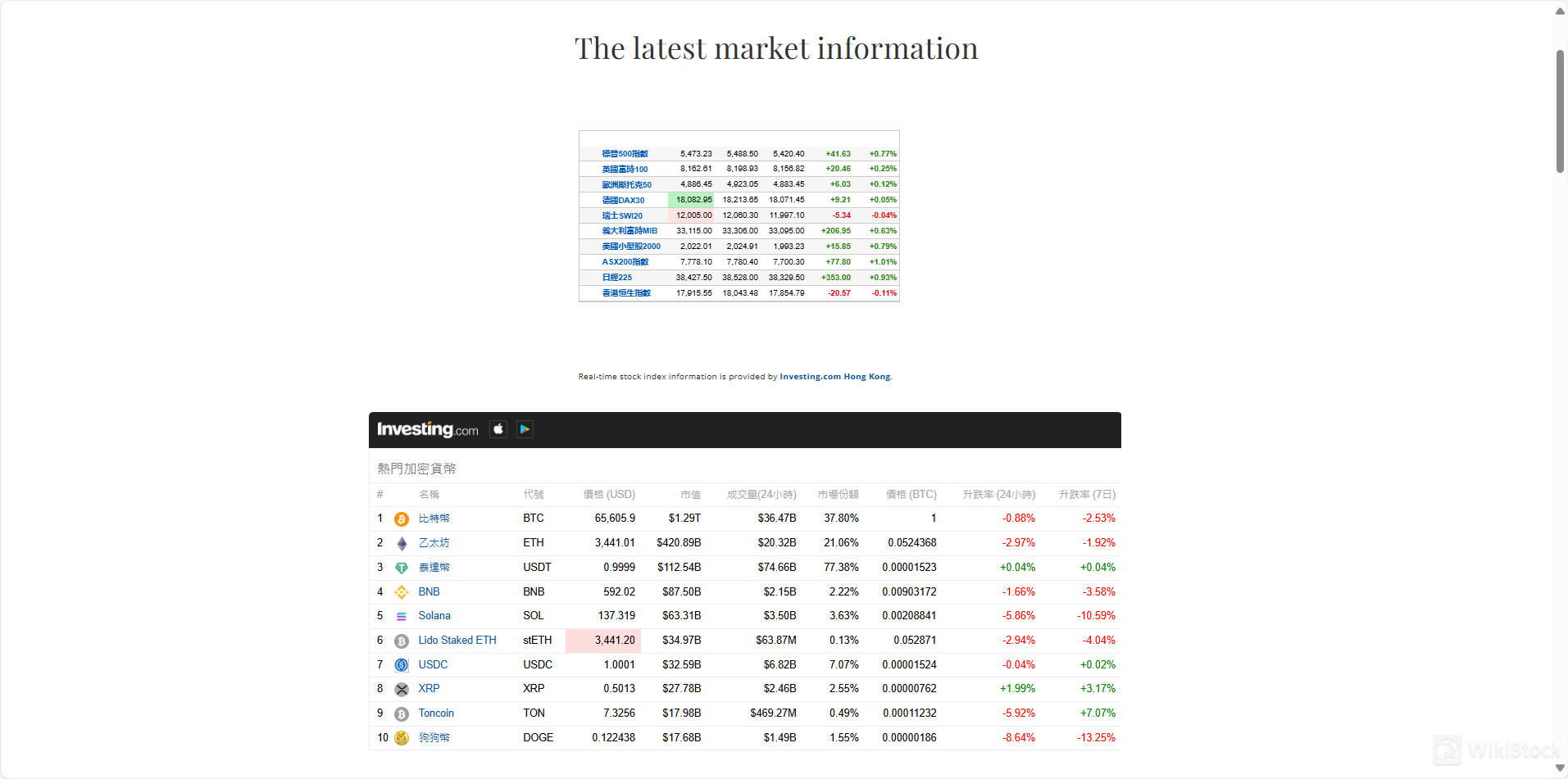

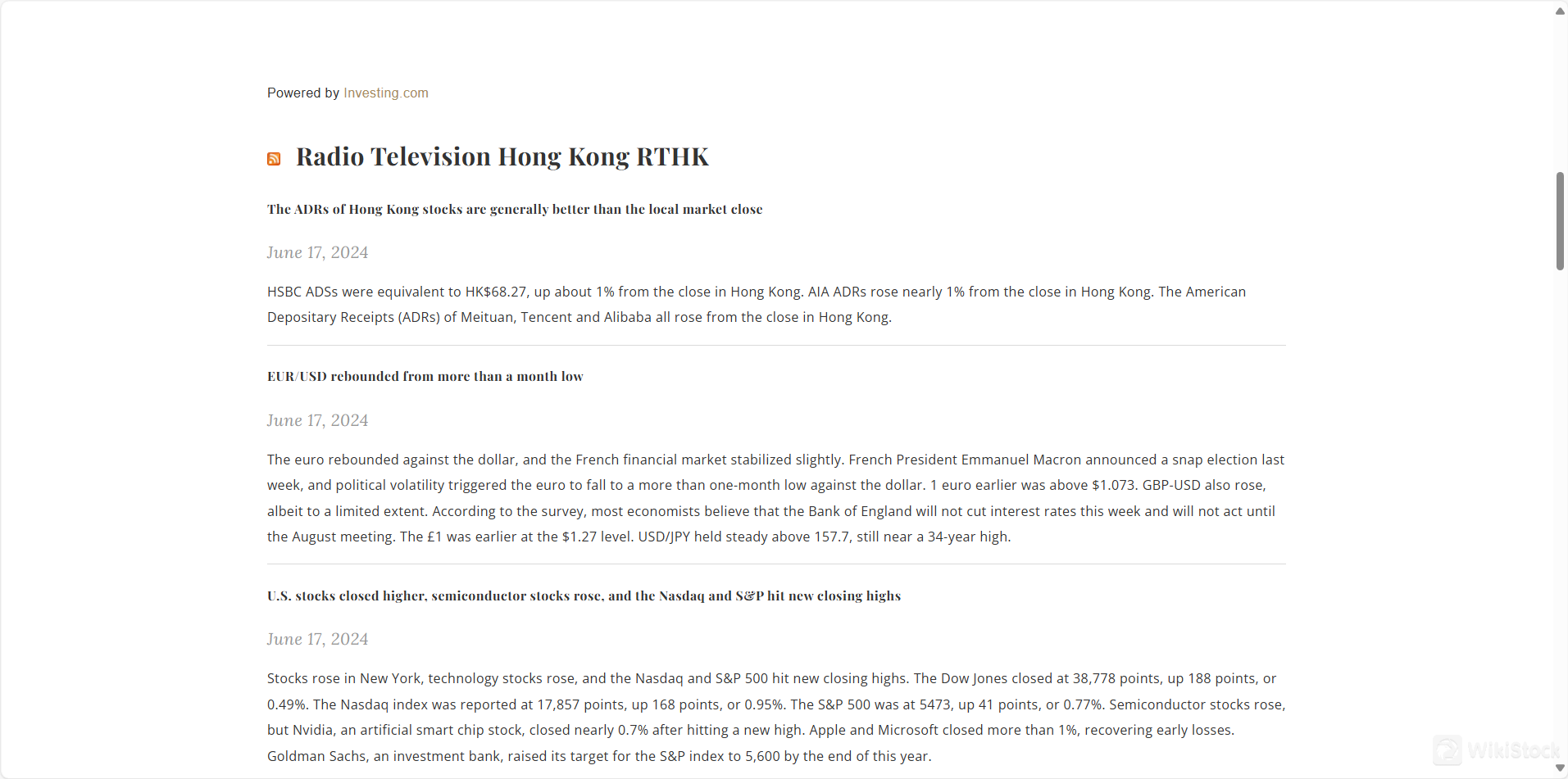

リアルタイム市場情報:Investing.com Hong KongとRadio Television Hong Kong(RTHK)のRSSフィードとの提携により、リアルタイムの株価指数の更新と市場トレンドを提供しています。

グローバル市場パフォーマンスの更新:米国預託証券(ADRs)のパフォーマンスを追跡し、現地市場の終値との比較を報告します。

通貨の動向:EUR/USDやGBP/USDなどの重要な通貨ペアの動向についての洞察を提供し、これらの通貨に影響を与える経済イベントの最新情報を提供します。

株式市場のトレンド:米国株式市場の動向を日々更新し、テクノロジーや半導体などの主要な指数やセクターの動きを強調します。

経済と企業ニュース:市場に影響を与える経済データの発表、企業の動向、地政学的な出来事についてタイムリーなニュースを提供します。

教育コンテンツ:詳細なニュース記事と分析を通じて、プラットフォームは市場の動きや投資戦略の意味についてユーザーに教育を行います。

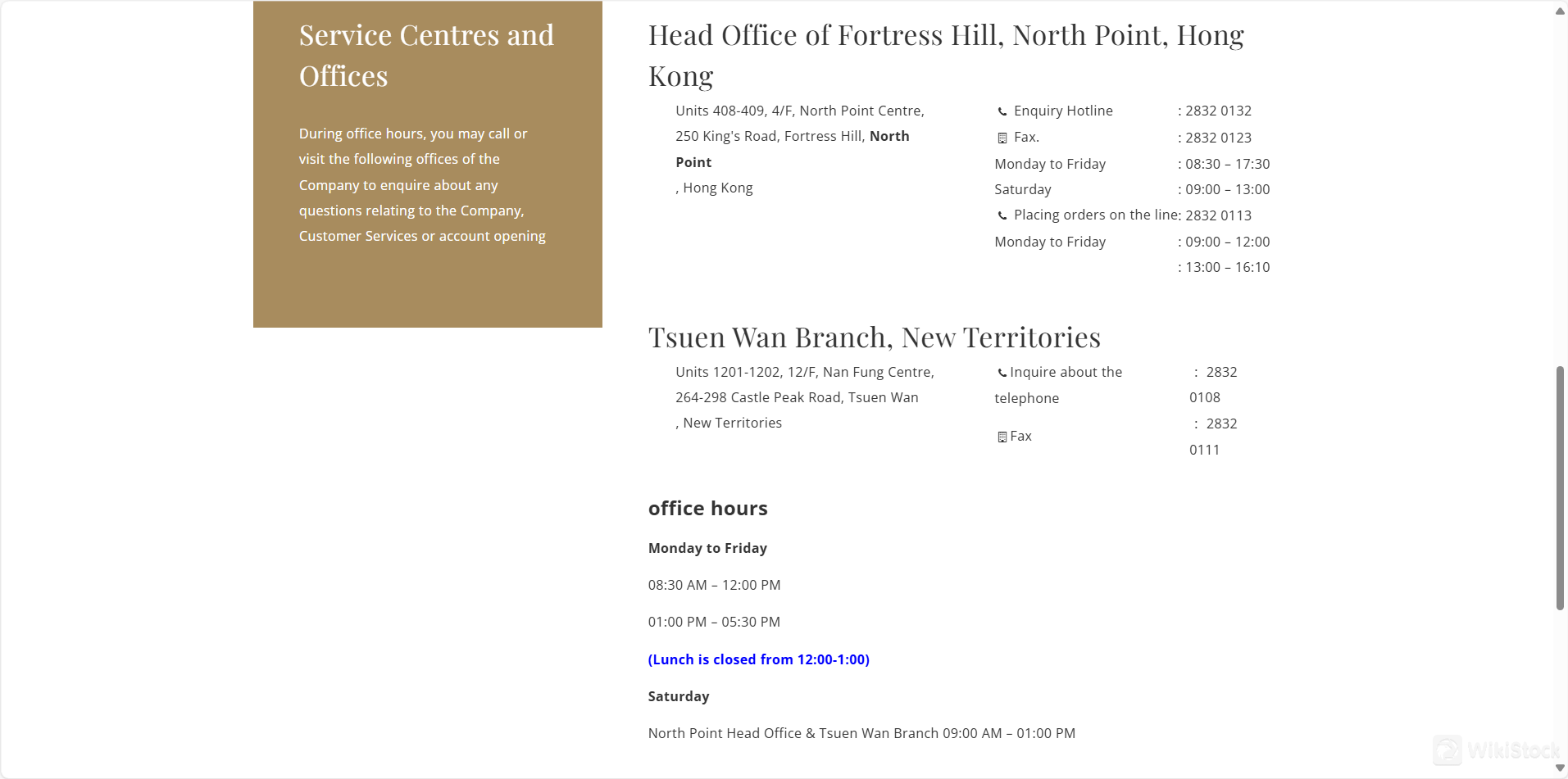

住所:香港北角のフォートレスヒル、キングズロード250号、ノースポイントタウンセンター4階408-409室

電話番号:2832 0132

FAX番号:2832 0123

営業時間:月曜日から金曜日:08:30-17:30、土曜日:09:00-13:00

先物取引ホットライン:2832 0113

取引時間:月曜日から金曜日:09:00-12:00、13:00-16:10

住所:新界荃湾、青山道264-298号南豐中心12階1201-1202室

電話番号:2832 0108

FAX番号:2832 0111

営業時間:月曜日から金曜日:08:30-12:00、13:00-17:30(昼休み:12:00-13:00)、土曜日:09:00-13:00

先物取引ホットライン:2832 0113(月-金:09:00-12:00、13:00-16:10)

ファンド取引については、Concord Securitiesはさらに2つの主要な取引アカウントを提供しています:

法人ブローカー手数料の見直し

HKEX 証券取引取引:

株式の物理的な取り扱いと決済サービス:

証券取引(地元の株式/株券):

ノミネートサービス(地元の株式/ワラント):

銀行服務:

| 服務類別 | 收費項目 | 基本收費 | 最低收費 | 備註 |

| 證券交易交易 | ||||

| 由交易者下單的佣金 | 協商 | 港幣100 / 人民幣100 | ||

| 通過互聯網/手機下單的佣金 | 協商 | 港幣50 / 人民幣50 | ||

| 股票印花稅 | 0.10% | – | 代表香港政府收取。 | |

| 交易費 | 0.01% | – | 代表香港交易所收取。 | |

| 證監會交易徵費 | 0.00% | – | 代表香港證券及期貨事務監察委員會收取。 | |

| 財務報告委員會交易徵費 | 0.00% | – | 代表香港財務報告委員會收取。 | |

| 結算費 | 0.01% | 港幣5 / 人民幣5 | 最高收費:港幣300.00 / 人民幣300.00,由公司徵收的股份結算費。 |

代名人服務和企業行動:

| カテゴリー | 課金アイテム | 基本料金 | 最低料金 | 備考 |

| 証券取引取引 | 手数料 - トレーダー発行 | 交渉 | RMB 100 | 契約に基づいて交渉されます |

| 手数料 - インターネット注文 | 交渉 | RMB 50 | 契約に基づいて交渉されます | |

| 印紙税 | 0.10% | - | 売り手に適用され、取引金額によって計算されます | |

| 手数料 | 0.00% | - | 上海/深セン証券取引所によって請求されます | |

| 証券管理手数料 | 0.00% | - | 中国証券監督管理委員会によって徴収されます | |

| 清算手数料 | 0.00% | - | 中国銀行清算および香港証券清算によって請求されます | |

| 名義人サービスおよび法人行動 | 組み合わせ料金 | 0.01% | - | 月次、ポジションの合計日次価値に基づく |

| 現金配当金の受け取り | 0.50% | RMB 30 | 株式ごとの現金配当金の合計金額に基づいて計算されます | |

| 配当金に対する税金 | 純配当金の10% | - | 国家税務総局によって徴収されます | |

| その他の名義人サービス | RMB 0.80 | - | ボードロットごとに、清算所によって請求されます | |

| 法人行動手数料 | RMB 100 | - | 手数料に追加され、法人行動ごとに請求されます |

インデックス先物契約手数料構造:

Concord Securitiesは、インデックス先物取引のためのさまざまな手数料を請求しています。ハンセン指数先物については、デイセッションクロージングでは$60/$20、それ以外では$100/$50の手数料がかかります。SFC徴収額は$0.54で、取引所徴収額は$10.00です。ミニ先物や国有企業、HSCEIミニ先物などの他のインデックス先物も同様の構造を持っていますが、取引規模と商品の市場特性に応じて手数料と徴収額が異なります。

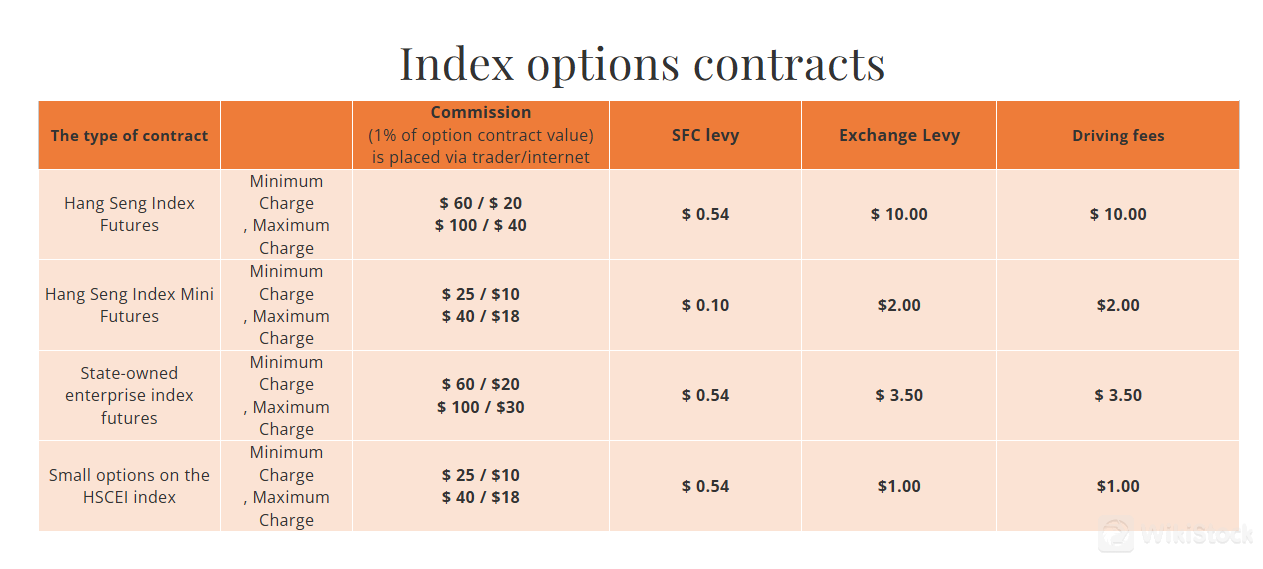

インデックスオプション契約手数料構造:

ハンセン指数などの指数に対するオプション取引は、取引がデイセッションかどうかによって手数料が異なります。手数料は$25/$10から$100/$40までの範囲で変動します。これらの取引には、オプションの市場ポジションに相関するSFC徴収額と取引所徴収額に加えて、運用処理に関連する追加の手数料も発生します。

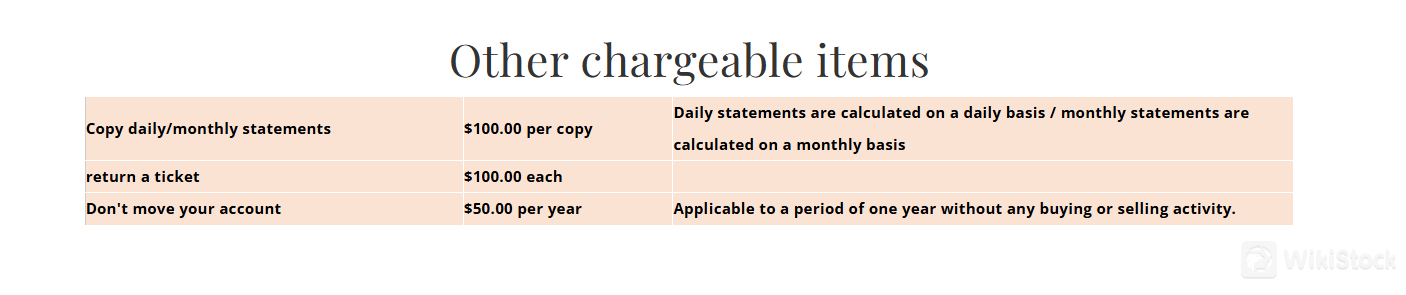

追加料金:

取引に加えて、Concord Securitiesは、毎日または月次の明細書のコピーに対して1部あたり100ドルの発行手数料や、チケットの返品手数料として1件あたり100ドルの手数料を課しています。取引活動がない口座には、1年ごとに50ドルの非活動手数料が課され、クライアントが関与するか非アクティブな口座を閉鎖することを保証しています。

| 契約の種類 | 手数料(当日約定/非当日約定) | SFC徴収金 | 取引所徴収金 | 自動決済手数料および清算手数料 |

| インデックス先物(ハンセン指数) | 60ドル/100ドル、20ドル/50ドル | 0.54ドル | 10.00ドル | 100ドル/50ドル、10ドル |

| ミニ先物(ハンセン指数ミニ) | 25ドル/40ドル、12ドル/20ドル | 0.10ドル | 3.50ドル | 40ドル/20ドル、3.5ドル |

| 国有企業指数先物 | 60ドル/100ドル、20ドル/30ドル | 0.54ドル | 3.50ドル | 100ドル/30ドル、3.5ドル |

| インデックスオプション契約 | 最低料金、最大料金 | |||

| 60ドル/100ドル、20ドル/40ドル、25ドル/10ドル、40ドル/18ドル | 0.54ドル、0.10ドル | 10.00ドル、2.00ドル | 10.00ドル、2.00ドル |

企業ブローカー取引プラットフォームのレビュー

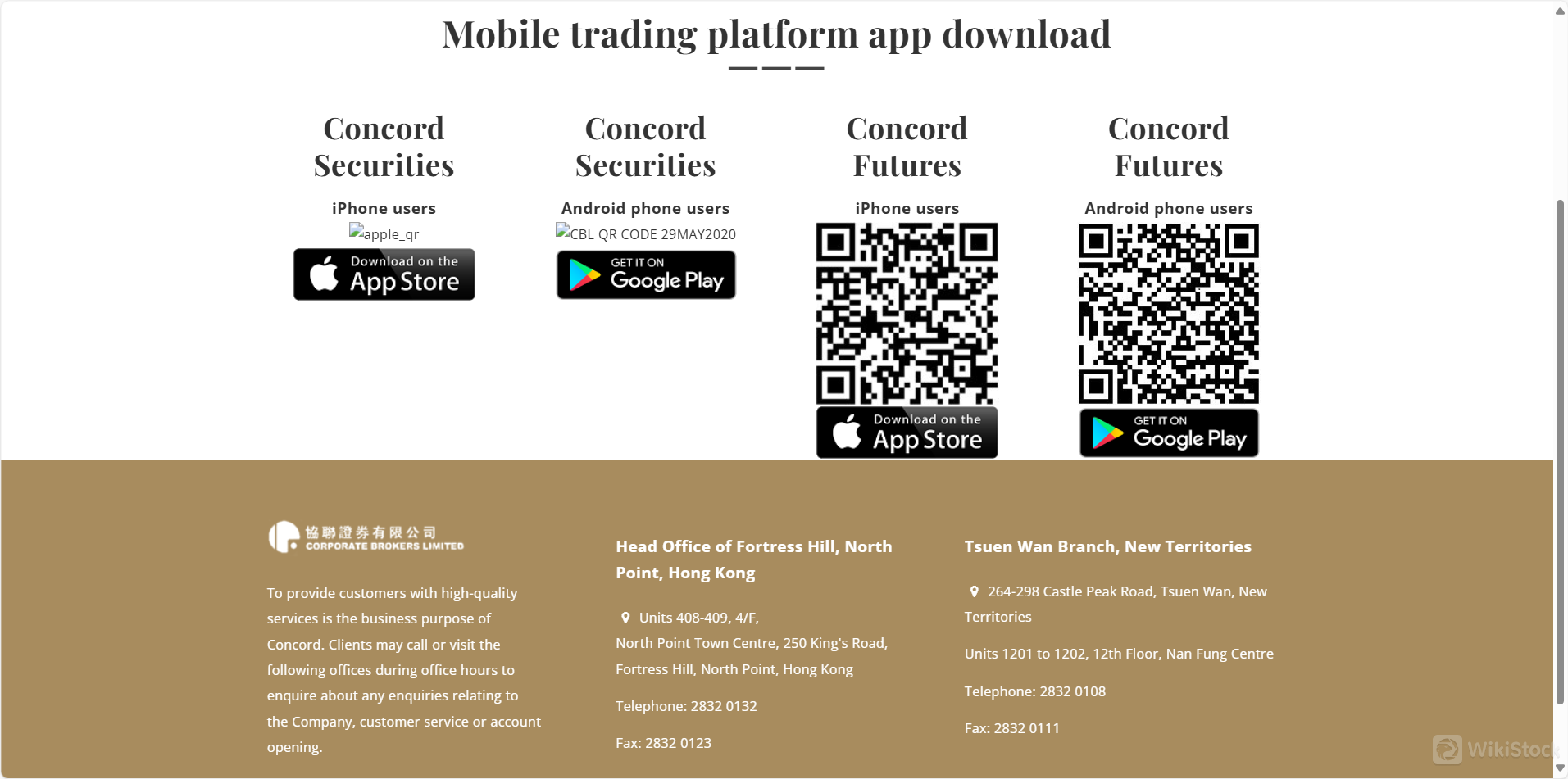

Concord Securitiesは、クライアントが効率的に証券取引に参加できる堅牢なオンライン取引プラットフォームを提供しています。このプラットフォームはインターネットとモバイルデバイスの両方からアクセスでき、移動中の便利な取引が可能です。プラットフォームはリアルタイム取引をサポートし、最新の市場情報を提供しており、カジュアルなトレーダーと真剣なトレーダーの両方にとって重要なツールです。

Concord Securitiesは、証券取引と先物取引の両方に対応したモバイル取引アプリを提供しています。iPhoneとAndroidユーザーは、各プラットフォーム用に提供された特定のQRコードを使用してこれらのアプリをダウンロードすることができます。これらのアプリは安全で使いやすい取引体験を提供するよう設計されており、クライアントはモバイルデバイスから効率的に投資を管理し、取引を実行することができます。

プロモーション

Concord Securitiesは、モバイルおよびオンライン取引向けの魅力的なプロモーションを提供しています。特に、アクティブなトレーダーにとってコストを大幅に削減できるプラットフォーム利用料の永久免除を提供しています。

さらに、預託手数料や取引処理手数料は一切かかりませんので、より費用対効果の高い取引が可能です。

IPOに興味のあるクライアント向けに、Concord Securitiesはグレーマーケット取引サービスも提供しており、公式上場前の株式取引を可能にしています。詳細については、カスタマーサービスホットラインでラムさんにお問い合わせください。

リサーチ&教育

Concord Securitiesは、投資家向けにさまざまなリサーチおよび教育リソースを提供しています:

カスタマーサービス

Concord Securitiesは、クライアントに高品質なサービスを提供することに取り組んでいます。

本社 - 香港北角のフォートレスヒル

将来の取引に関するお問い合わせは、次の番号までお電話ください:

ツェンワン支店 - 新界

| オフィス | 住所 | 連絡先番号 | FAX番号 | 営業時間 |

| 本社 - 北ポイント | 香港北角のフォートレスヒル、キングズロード250号、ノースポイントタウンセンター4階408-409室 | 2832 0132 | 2832 0123 | 月-金:08:30-17:30、土:09:00-13:00 |

| ツェンワン支店 | 新界荃湾、青山道264-298号南豐中心12階1201-1202室 | 2832 0108 | 2832 0111 | 月-金:08:30-12:00、13:00-17:30(昼休み:12:00-13:00)、土:09:00-13:00 |

その他の連絡先:

結論

Corporate Securitiesは、多様な顧客に対応する堅牢なサービスを提供することで、金融サービス業界で注目されています。SFCの規制を受けており、デスクトップとモバイルの両方のユーザー向けに利用可能な独自のオンライン取引プラットフォームとともに、安全な取引環境を提供しています。

Corporate Securitiesは、株式や先物などのさまざまな証券取引オプション、マージン取引やIPOの申し込みなどの専門サービスを提供することを自負しており、個人および法人のクライアントにとって多目的な選択肢となっています。

よくある質問

1. Corporate Securitiesはどのような種類の取引口座を提供していますか?

Corporate Securitiesは、キャッシュ取引口座とマージン取引口座の両方を提供しており、さまざまな投資家のニーズと取引戦略に対応しています。

2. サポートのためにCorporate Securitiesにどのように連絡すればよいですか?

お客様は、ノースポイントとツェンワンのオフィス場所を通じて、2832 0132のホットラインでカスタマーサービスに連絡することができます。また、WhatsAppサポートや先物取引ホットラインも特定のお問い合わせに対応しています。

3. Corporate Securitiesは現在どのようなプロモーションを提供していますか?

はい、Corporate Securitiesは定期的にプラットフォーム利用料の永久免除、預託手数料の免除、特定の取引活動に対する取引手数料のゼロなどのプロモーションを提供しています。

リスク警告

提供される情報は、WikiStockの専門家によるブローカーのウェブサイトデータの評価に基づいており、変更される可能性があります。また、オンライン取引には大きなリスクが伴い、投資資金の全額損失につながる可能性があるため、関連するリスクを理解することが重要です。

その他情報

登記国

香港、中国

経営時間

20年以上

取引可能商品

Futures

関連企業

国

会社名

関連企業

--

協聯期貨有限公司

グループ会社

評判

コメントなし

推奨する証券会社More

金山金融

スコア

Halcyon

スコア

晉商證券

スコア

泓福證券

スコア

Koala Securities

スコア

Sunfund

スコア

Goldbridge Securities

スコア

Wan Lung Securities

スコア

信亨金控

スコア

滿好證券

スコア