スコア

レーティング

会社鑑定

影響力

A

影響力指数 NO.1

台湾、中国

台湾、中国取引品種

2

Futures、Stocks

76.11%FX会社を上回る

取引商ライセンス

1件ライセンスを保有

台湾、中国SFB証券取引ライセンス

会社情報

More

会社名

MasterLink Securities Limited

社名略語

MasterLink Securities

会社登録国・地域

会社所在地

いつでも確認することが可能です

WikiStock APP

インターネット遺伝子

遺伝子インデックス

アプリのスコア

会社特徴

コミッション率

0.1425%

New Stock Trading

Yes

Margin Trading

YES

Long-Short Equity

YES

注意:本レビューで提供される情報は、会社のサービスやポリシーの絶え間ない更新のため、変更される可能性があります。また、このレビューが生成された日付も重要な要素となる場合があります。情報はその後変更されている可能性があるため、読者はいかなる決定や行動を行う前に、常に会社に直接最新の情報を確認することをお勧めします。本レビューで提供される情報の使用に関する責任は、読者に帰属します。

このレビューでは、画像とテキストの内容に相違がある場合、テキストの内容が優先されます。ただし、詳細な相談のために公式ウェブサイトを開くことをお勧めします。

| MasterLink Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| 仲介手数料(香港マニュアル) | 0.50% |

| 印紙税(香港マニュアル) | 0.10% |

| 取引手数料(香港マニュアル) | 0.0027% + 0.00015%(FRC手数料) |

| 金融サービス局手数料(香港マニュアル) | 0.00565% |

| 決済手数料(香港マニュアル) | Plu0.002%(最小:HKD 2、最大:HKD 200) |

| 提供される共同基金 | 記載なし |

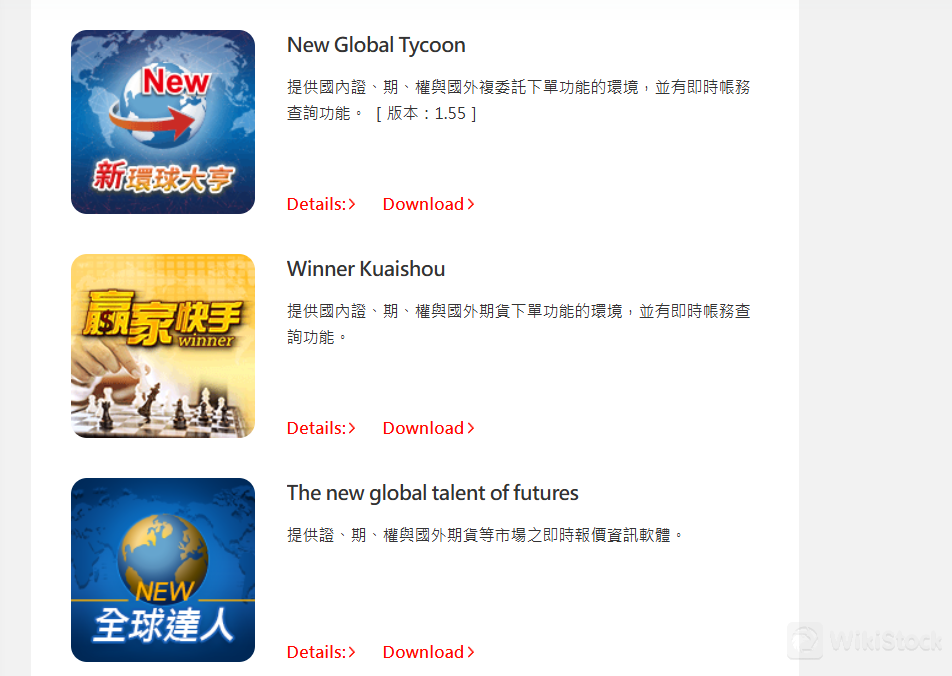

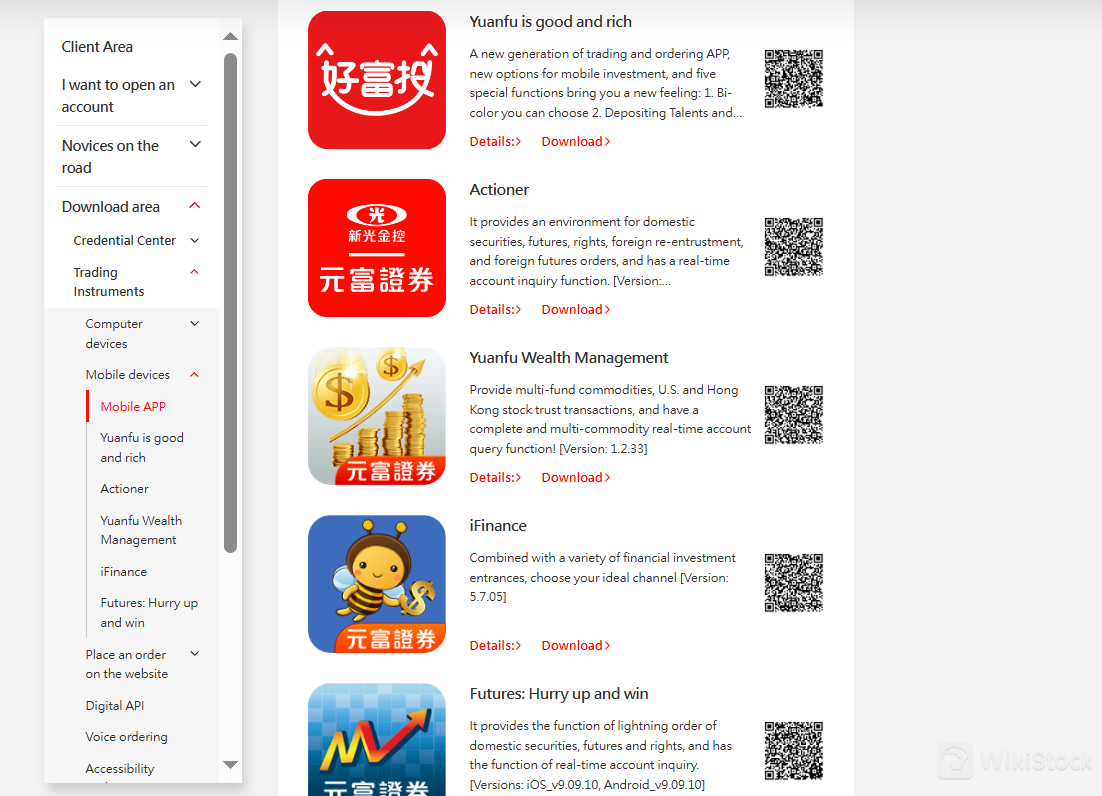

| アプリ/プラットフォーム | コンピュータ取引ソフトウェア:New GlobalTycoon、Winner Kuaishou、およびThe New GlobalTalent of Futures;モバイルアプリ:Yuanfu is good andrich、Actioner、Yuanfu wealth Management、iFinance、Futures:Hurry upand win |

| プロモーション | 利用可能 |

MasterLink Securitiesの情報

MasterLink Securitiesは、中国台湾証券先物局(SFB)によって監督される規制された証券会社です。幅広い金融サービスに特化し、MasterLink Securitiesは台湾株式、先物取引、海外株式、債券、ワラント、保険商品を含む多様な投資機会を提供しています。

メリットとデメリット

| メリット | デメリット |

| 中国台湾SFBによる規制 | 共同基金の利用可能性が限られている |

| 多様な投資オプションの範囲 | |

| 高度な取引プラットフォーム | |

| 包括的な投資家教育 |

中国台湾SFBによる規制:中国台湾証券先物局(SFB)による規制は、MasterLink Securitiesが投資家保護のための厳格なガイドラインの下で運営されることを保証します。

多様な投資オプションの範囲:台湾株式、先物、海外株式、債券、ワラント、保険商品など、幅広い投資商品を提供しています。

高度な取引プラットフォーム:異なる投資家のニーズに合わせた洗練されたデスクトップおよびモバイル取引プラットフォームを提供しています。

包括的な投資家教育:市場分析や企業レポートなどの充実した教育リソースを提供し、投資家が情報に基づいた意思決定能力を持つことを支援します。

デメリット相互ファンドの利用可能性が限られています:MasterLink Securitiesは、相互ファンドの提供について明示的に言及しておらず、この資産クラスを好む投資家の多様化オプションを制限しています。

MasterLink Securitiesは信頼できますか?

MasterLink Securitiesは、中国台湾証券先物局(SFB)の監督の下で規制されており、ライセンスNo. 5920を保持しています。この規制フレームワークにより、同社は投資家を保護し、金融市場の誠実性を維持するために厳格な基準に従うことが保証されています。

MasterLink Securitiesで取引できる証券は何ですか?

MasterLink Securitiesは、幅広い取引インストゥルメントを提供しています。

地元市場に興味のある方には、MasterLinkは台湾株への広範なアクセスを提供し、アジアでダイナミックな経済に参加することができます。また、先物取引も提供しており、さまざまな契約でポジションをヘッジしたり、市場の動きに対して投機したりすることができます。

地元の提供にとどまらず、MasterLink Securitiesは海外株式の取引を容易にし、国際的な株式でポートフォリオを多様化する機会を投資家に提供しています。彼らのウェルスマネジメントサービスは、個別の投資戦略と専門的なアドバイザリーサービスを通じて、クライアントが自分の財務目標を達成するのをサポートするようにカスタマイズされています。さらに、MasterLinkはワラントも提供しており、投資家はポジションをレバレッジし、リターンを向上させることができます。

固定収益投資家向けに、MasterLinkは債券へのアクセスを提供し、安定した収入源と多様化の利点を提供しています。彼らの保険製品は、クライアントの資産を保護し、金融の安全性を確保するために設計されています。MasterLinkはまた、株式の売買を容易にする証券代理店としても機能しています。

MasterLink Securitiesはアンダーライティングにも関与し、新しい証券発行を通じて企業の資本調達を支援しています。さらに、彼らはオフショア証券ユニット(OSU)を運営しており、中華民国内に独立した会計ユニットを設置したライセンスを持つ証券会社です。このユニットは「国際金融業務規則」に従って「国際証券業務」を運営し、国際証券の発行と取引を容易にしています。

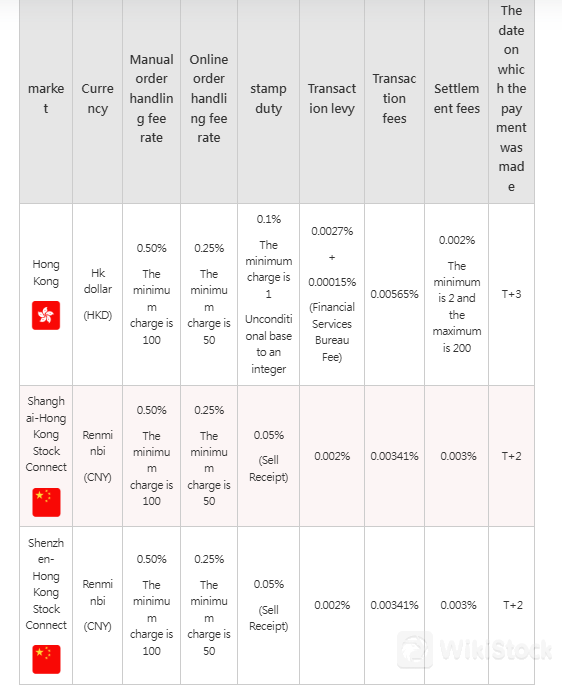

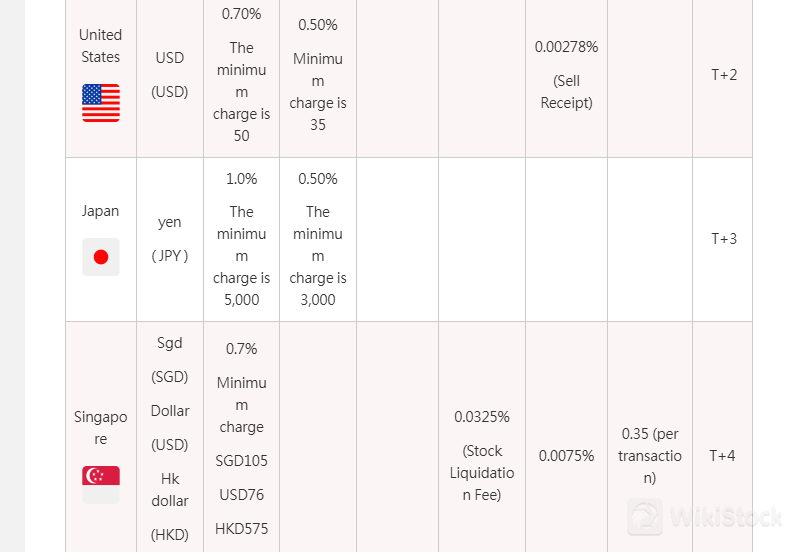

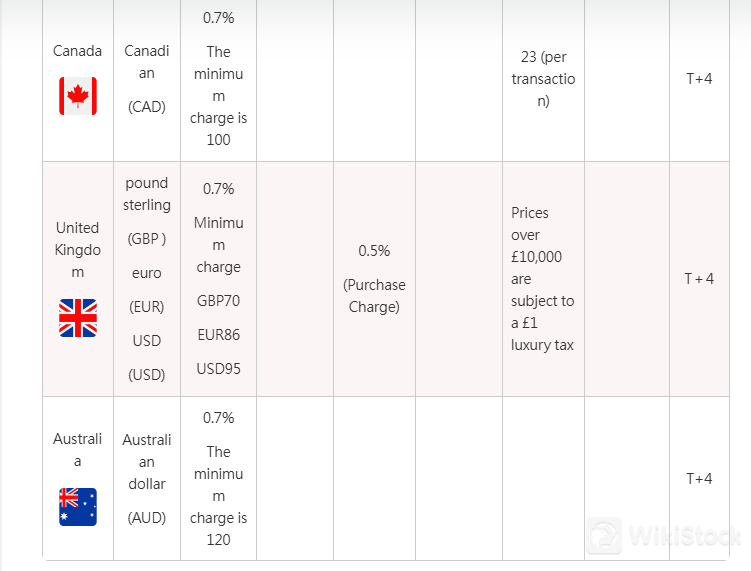

MasterLink Securities手数料レビュー

MasterLink Securitiesは、さまざまなグローバル市場で透明性のある競争力のある海外株式取引手数料を提供しています。

香港では、手動注文の場合は0.50%で最低手数料はHKD 100、オンライン注文の場合は0.25%で最低手数料はHKD 50です。 印紙税は0.1%で最低料金は1で、追加料金には取引手数料が0.0027%プラス0.00015%、さらに金融サービス局手数料が0.00565%が含まれます。

決済手数料は0.002%で、最低HKD 2、最大HKD 200で、T+3で決済されます。

上海-香港および深セン-香港ストックコネクトを介した取引の場合、手数料には0.50%の手数料(最低料金はCNY 100)と取引手数料0.002%および0.00341%が含まれ、T+2で決済されます。

アメリカ合衆国では、手動注文の場合は0.70%で最低手数料はUSD 50、オンライン注文の場合は0.50%で最低手数料はUSD 35、さらに売り受け手数料は0.00278%で、T+2で決済されます。これらの構造化された手数料は、MasterLink Securitiesと取引する国際投資家にとって明確さと信頼性を確保します。

より具体的な料金体系については、公式ウェブサイトまたは添付のスクリーンショットでご確認いただけます。

MasterLink Securitiesアプリのレビュー

MasterLink Securitiesは、高度な取引プラットフォームとモバイルアプリケーションのスイートを提供しています。

彼らのコンピュータ取引ソフトウェアには、New GlobalTycoon、Winner Kuaishou、およびThe New GlobalTalent of Futuresが含まれています。New GlobalTycoonは、幅広い投資を管理するための洗練されたツールと分析機能を備えた包括的な取引環境を提供します。

Winner Kuaishouは、迅速かつ効率的な取引を目指したものであり、リアルタイムのパフォーマンスと迅速な実行を求めるアクティブトレーダーに最適です。The New GlobalTalent of Futuresは、先物取引者を対象に、先物市場の複雑さに対応するための専門機能を提供しています。

デスクトップソフトウェアに加えて、MasterLink Securitiesはさまざまなモバイルアプリケーションも提供しており、投資家がポートフォリオを管理し、移動中に情報を把握できるようにしています。 Yuanfu Is Good And RichとYuanfu Wealth Managementは、個人のファイナンスと投資管理のための強力なツールを提供しています。

Actionerは、リアルタイムで取引を実行し、市場の動きを監視するためのダイナミックなプラットフォームです。 iFinanceは、金融ニュース、市場データ、個人の口座情報にアクセスするためのユーザーフレンドリーなインターフェースを提供します。先物取引者向けには、Futures: Hurry Up And Winアプリが、スピードと精度で先物を追跡および取引するための専門機能を提供しています。

リサーチ&教育

MasterLink Securitiesは、包括的な市場洞察を提供するために設計された豊富な教育リソースを提供しています。彼らの提供物には、すべてのユーザーがアクセスできる台湾モーニングブリーフィングが含まれており、市場のトレンドや経済の動向に関するタイムリーなアップデートを提供しています。

より詳細な分析については、MasterLink Securitiesは企業レポートと業界分析を提供しています。これらのレポートは、ログイン後にアクセスでき、個々の企業とセクターの詳細な評価を提供し、徹底的な調査と専門家の分析に基づいて投資家が情報を元にした明確な意思決定を行うのに役立ちます。

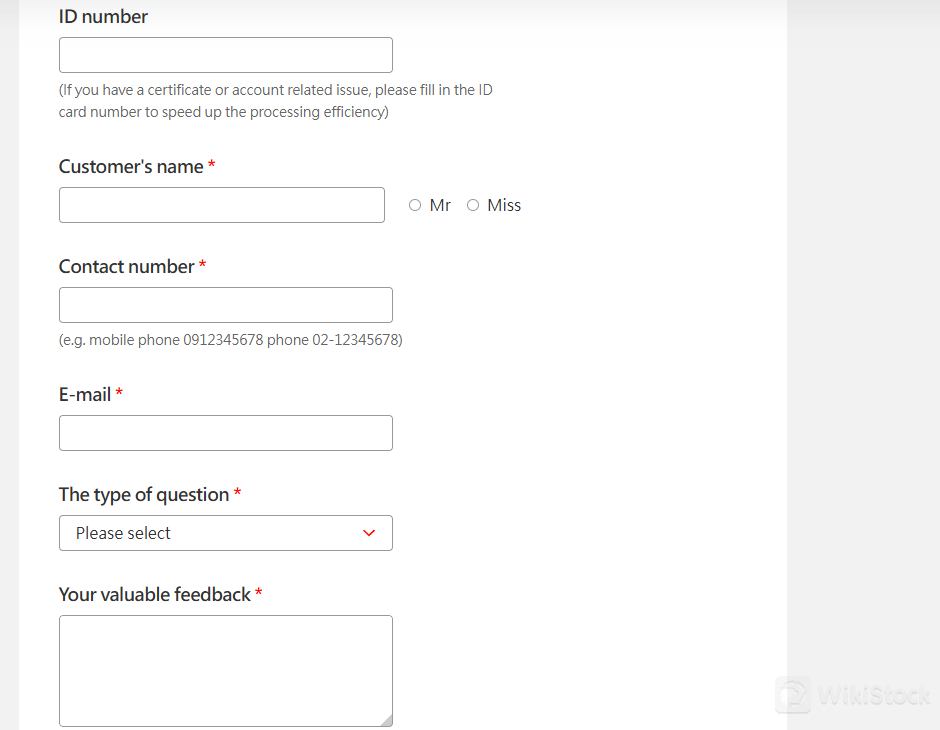

カスタマーサービス

MasterLink Securitiesは包括的でアクセスしやすいカスタマーサポートネットワークを提供しています。サポートチームには、さまざまなチャンネルを通じて簡単に連絡することができます。

カスタマーサービスホットライン:0800-088-148

携帯電話および外国のお客様用:(02) 2708-3972

外国先物顧客サービスエリア:0800-003-458

メール:service@masterlink.com.tw

住所:台北市大安区復興南路1段209号3F(台湾)

営業時間:午前8時〜午後6時(台湾株式営業日)

お問い合わせフォーム

結論

結論として、MasterLink Securitiesは、多様な金融商品への規制されたアクセスを求める投資家にとって、堅固な顧客サービスネットワークと規制の遵守への取り組みをサポートする頼もしい選択肢を提供しています。今は、このブローカーを選ぶか他のオプションを探索するかを決めるのはあなた次第です。このレビューが意思決定プロセスに少し光を当てることを願っています。

よくある質問

MasterLink Securitiesは初心者に適していますか?

MasterLink Securitiesは、使いやすいプラットフォーム、教育リソース、包括的な顧客サポートにより、初心者に適しています。

MasterLink Securitiesは信頼できますか?

はい、MasterLink SecuritiesはSFBによって規制されています。

MasterLink Securitiesで取引できる証券の種類は何ですか?

台湾株式、先物、海外株式、債券、ワラント、保険商品などが取引できます。

リスク警告

提供される情報は、WikiStockの専門家によるブローカーのウェブサイトデータの評価に基づいており、変更される可能性があります。また、オンライン取引には大きなリスクが伴い、投資資金の全額損失につながる可能性があるため、関連するリスクを理解してから取引に参加することが重要です。

その他情報

登記国

台湾、中国

経営時間

20年以上

取引可能商品

Futures、Stocks

関連企業

国

会社名

関連企業

--

MasterLink Venture Management Corporation

子会社

--

MasterLink Venture Capital Corporation

子会社

--

MasterLink Securities (HK) Corp., Ltd.

子会社

--

MasterLink Investment Advisory Corp Tianjin

子会社

--

MasterLink Venture Management Corporation Tianji

子会社

--

MasterLink Venture Capital Corporation Tianjin

子会社

--

MasterLink Insurance Agency Co., Ltd.

子会社

--

MasterLink Futures Co., Ltd.

子会社

--

MasterLink Securities Investment Advisory Corp.

子会社

評判

コメントなし

推奨する証券会社More

Yuanta Securities

スコア

Concord Securities

スコア

PSC

スコア

OSC

スコア

Fubon Securities

スコア

E.SUN Securities

スコア

兆豐證券

スコア

HORIZON SECURITIES

スコア

Grand Fortune Securities

スコア

大展證券

スコア