スコア

レーティング

会社鑑定

影響力

AAA

影響力指数 NO.1

アメリカ合衆国

アメリカ合衆国取引品種

9

Securities Lending Fully Paid、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

97.97%FX会社を上回る

取引商ライセンス

4件ライセンスを保有

アメリカ合衆国FINRA証券取引ライセンス

オーストラリアASIC証券取引ライセンス

イギリスFCA証券取引ライセンス

香港、中国SFC証券取引ライセンス

グローバルシーツ

![]() 1のFX会社席がある

1のFX会社席がある

アメリカ合衆国 Nasdaq

HSBC SECURITIES (USA) INC

会社情報

More

会社名

HSBC Bank USA, N.A.

社名略語

HSBC

会社登録国・地域

会社所在地

Youtube

http://youtube.com/hsbcusaいつでも確認することが可能です

WikiStock APP

インターネット遺伝子

遺伝子インデックス

アプリのスコア

アプリのダウンロード数

- サイクル

- ダウンロード数

- 2024-05

- 1.28M

集計ルール:データは現時点におけるアプリの過去1年間のダウンロード数を示します。

アプリの地区の人気度

- 国/地域ダウンロード数比率

イギリス

0.96M74.77%その他

0.28M21.86%香港、中国

227151.77%インド

205871.60%

集計ルール:データはアプリの現時点における過去1年間のアプリのダウンロード数と地域でのシェアを示します。

会社特徴

コミッション率

0.25%

最低入金額

$50

融資利率

1.25%

現金預金の利率

2%

New Stock Trading

Yes

Margin Trading

YES

Long-Short Equity

YES

規制されている国数量

4

| HSBC レビューサマリー | |

| 営業年数 | 1865 |

| 登録地域 | イギリス |

| 規制状況 | FINRA、ASIC |

| 取引可能な証券およびサービス | 株式、上場投資信託(ETF)、共同基金、構造化商品、固定収益証券、金融および自己指向型のブローカージサービス |

| 口座の種類 | 米国口座、HSBCチェックまたは貯蓄口座、HSBCグローバルマネーアカウント |

| プラットフォーム/アプリ | モバイルバンキングアプリ |

| カスタマーサービス | 電話、ライブチャット |

| 入金および出金方法 | ATMおよび小切手入金 |

HSBC の概要

多幣種功能:在最多6種不同貨幣中管理資金。

與現有HSBC帳戶連接:從連接的HSBC帳戶向您的全球貨幣帳戶添加資金。

國際交易:將資金匯款到您自己的HSBC帳戶或他人的HSBC帳戶。

デイリー取引制限: 自分のHSBC口座への振込は最大USD 200,000、他のHSBC口座への振込は最大USD 50,000です。

HSBC は、世界最大の銀行および金融サービス機関の一つとして知られており、1865年以来、アメリカ人に対してグローバルな機会を提供してきました。株式から固定収益証券、クレジットカードから住宅ローンまで、HSBC は取引可能な証券、サービス、借入ソリューションのスイートを提供し、個人が自分の財務目標を達成するのを支援しています。HSBC のオンラインバンキングプラットフォームとモバイルアプリにより、顧客はいつでもどこでも簡単に自分の財務を管理することができます。

詳細な情報については、公式ウェブサイトをご覧いただくか、直接カスタマーサービスにお問い合わせください。

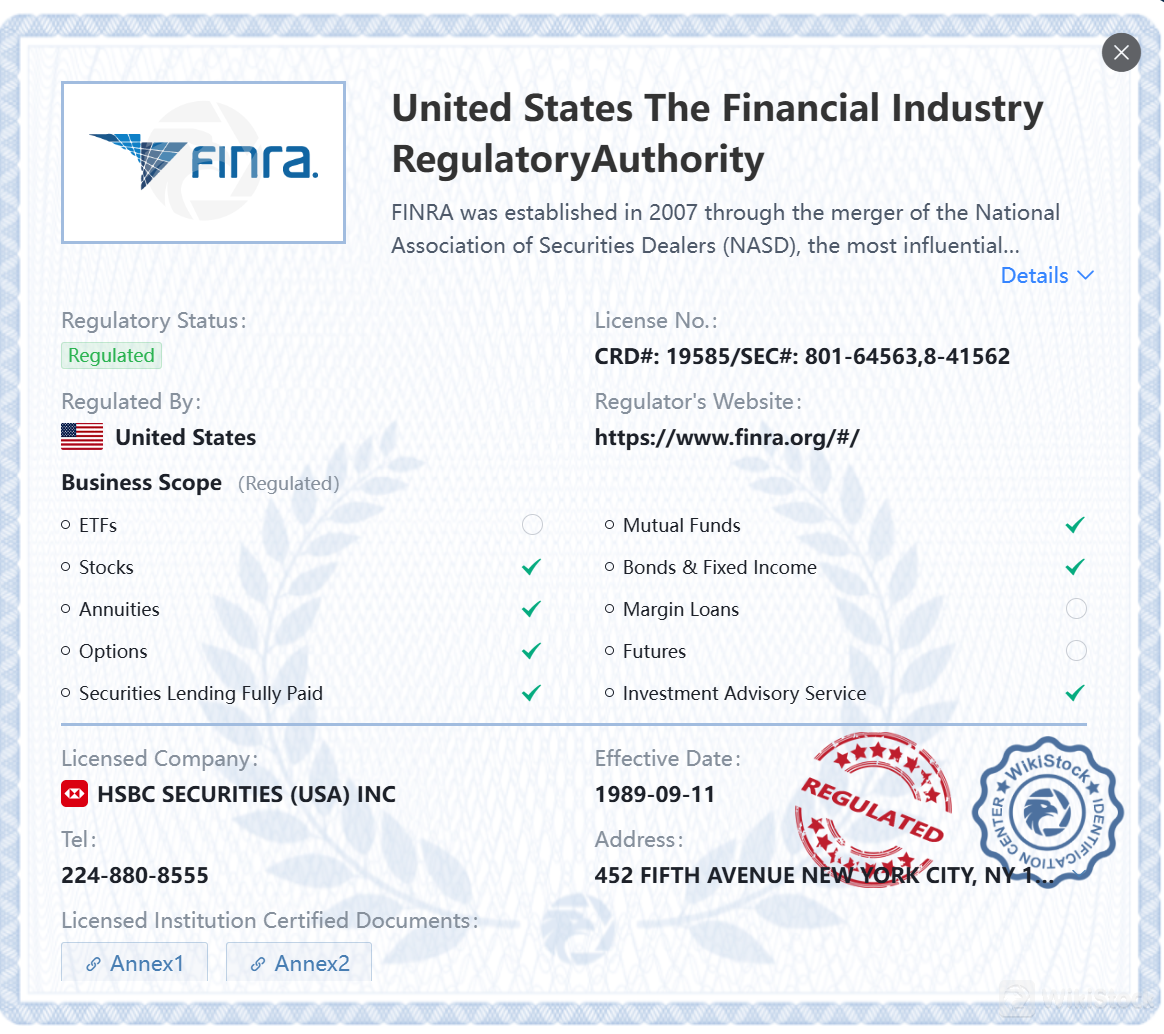

規制状況

HSBC は、2つの主要な金融規制当局である米国金融業規制機構(FINRA)およびオーストラリア証券投資委員会(ASIC)の監督下で運営しています。

FINRA のライセンス番号は CRD#: 19585 および SEC#: 801-64563,8-41562 です。

HSBC の ASIC のライセンス番号は 232595 です。これらの規制機関は、HSBC の業務を監視し、業界の規制を遵守し、投資家の利益を保護するために重要な役割を果たしています。

| メリット | デメリット |

| グローバルな存在感 | 料金について言及されていない |

| 幅広いサービスの提供 | |

| 便利なバンキングプラットフォーム | |

| さまざまな教育リソースとツール |

- グローバルな存在感: HSBC のグローバルな存在感により、顧客は異なる国や地域での銀行サービスや機会にアクセスすることができ、国際旅行者や在外米国人にとって便利です。

- 幅広いサービスの提供: HSBC は、クレジットカード、チェックおよび貯蓄口座、投資商品、借入ソリューションなど、多様な銀行および金融サービスを提供しており、さまざまな金融ニーズと好みに対応しています。

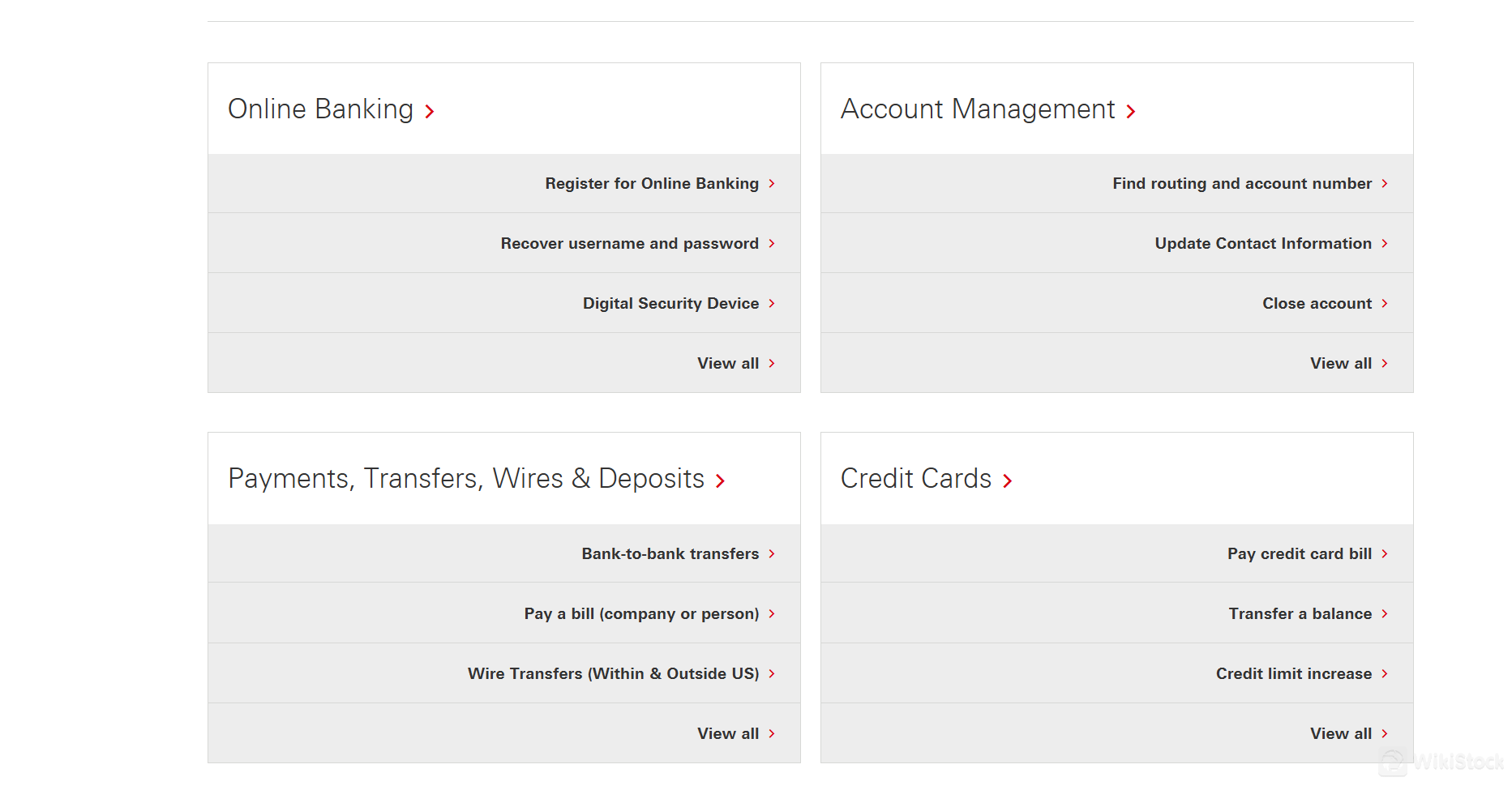

- 便利なバンキングプラットフォーム: HSBC のオンラインバンキングプラットフォームとモバイルアプリは、顧客が口座に簡単にアクセスできるようにし、財務を管理したり、資金を送金したり、請求書を支払ったり、さまざまな銀行業務をいつでもどこでも行うことができます。

- 各種教育資源和工具:HSBC提供教育資源和工具,幫助客戶提升他們的金融素養,並對他們的財務、投資和銀行服務做出明智的決策。

缺點:- 未提及的費用:HSBC對於各種服務和帳戶收取的費用缺乏透明度,可能會給客戶帶來不確定性或意外的成本,影響他們的整體銀行體驗。

可交易證券

HSBC提供多樣化的可交易證券,包括股票、交易所交易基金(ETF)、共同基金、結構性產品和固定收益工具。

股票代表對公司的所有權,為投資者提供參與其增長和盈利能力的機會。 ETF是在股票交易所交易的投資基金,通常跟踪特定的指數、商品或資產類別。

共同基金從多個投資者那裡籌集資金,投資於由專業投資組合經理管理的多元化證券組合。 結構性產品是與基礎資產表現相關的具有獨特回報的金融工具,提供定制的風險回報概况。 固定收益證券包括債券和其他債務工具,提供定期利息支付和到期時的本金返還。

除了這些可交易證券外,HSBC還提供各種其他金融服務,如保險、年金、個人退休賬戶(IRA)、教育儲蓄計劃和自助經紀服務,為投資者提供全面的選擇,滿足他們的投資和財務規劃需求。

HSBC提供多種銀行服務,旨在滿足客戶多樣化的金融需求。這些服務包括信用卡,為持卡人提供便捷的支付選項和潛在的獎勵。此外,HSBC還提供支票帳戶,作為管理日常財務的中心樞紐,包括存款、取款和賬單支付。

對於希望增加儲蓄的客戶,HSBC提供各種選擇,如Premier Relationship Savings和常規儲蓄賬戶。 Premier Relationship Savings為符合條件的客戶提供增強的福利和功能,而儲蓄賬戶則提供一種簡單的方式來儲蓄並賺取存款利息。存款證書(CD)提供固定的利率,用於指定期限,為增加儲蓄提供安全的方式。

HSBC還提供借貸解決方案,幫助客戶實現他們的財務目標,包括個人貸款、抵押貸款和信用額度。這些借貸選擇根據個人需求量身定制,提供靈活性和競爭性利率。

此外,HSBC的網上銀行平台使客戶能夠方便地管理他們的賬戶,查看對賬單,轉賬,支付賬單和執行其他銀行業務,無論是在家中還是在外出時。

HSBC提供多種帳戶類型,以滿足不同客戶的需求:

- 美國居民帳戶:此帳戶專為美國居民設計,提供支票和儲蓄賬戶等基本銀行服務。

- HSBC支票或儲蓄賬戶:這些帳戶是管理日常財務的基礎。它們提供借記卡、網上銀行和ATM訪問等功能。

- HSBC全球貨幣帳戶:這是一個預付的多幣種帳戶,可通過HSBC移動銀行應用程序使用。

HSBCはモバイルバンキングアプリを通じてオンラインサービスを提供しており、さまざまな金融サービスやツールに便利にアクセスできます。ユーザーは簡単に投資を管理し、ポートフォリオや保有情報を表示し、市場のトレンドについて最新情報を得ることができます。さらに、このアプリでは顧客が個人情報を更新できるため、正確なコミュニケーションチャネルを確保できます。

住宅ローンやHELOC口座の保有者には、支払い詳細や現在の支払い期日など、詳細な口座情報へのアクセスが提供されます。Apple iOSまたはAndroidデバイス上であれば、ユーザーはいつでもどこでもHSBCのモバイルプラットフォームの利点を享受することができます。

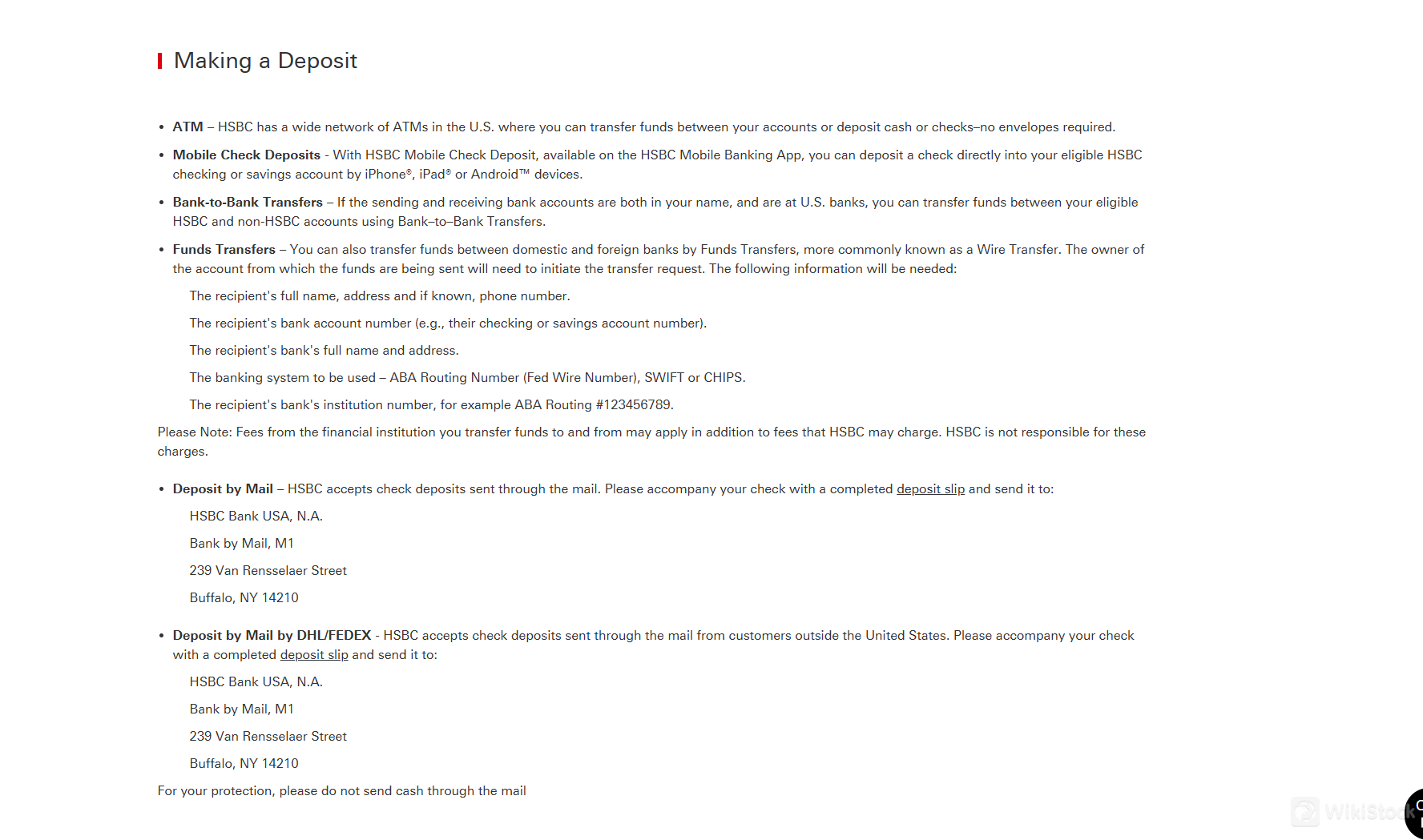

資金の入金には、顧客はいくつかのオプションを利用することができます。まず、HSBCは全米に広がるATMネットワークを持っており、ユーザーは口座間で資金を移動したり、現金や小切手を封筒なしで預け入れることができます。さらに、顧客はHSBCモバイルバンキングアプリを利用して、モバイル小切手預け入れ機能を使用して、対象のHSBCの普通預金口座や貯蓄口座に直接小切手を便利に預け入れることができます。

従来の方法を好む方には、HSBCは完成した預金伝票とともに、国内外から送られてくる小切手の預け入れも受け付けています。

HSBCはライブチャットを提供しています。ライブチャットを利用すると、顧客は迅速に質問に回答を得たり、問題を解決するためのヘルプを受けることができます。これは便利で効果的なコミュニケーションチャネルであり、顧客満足度を向上させ、売上を増やすことができます。

顧客は以下の情報を使用してカスタマーサービスに連絡することができます:

電話: 888.662.4722

716.841.6866 (24時間対応)

教育リソース

HSBCは、投資家が情報とツールを備えて正しい金融の決定をするための教育リソースを提供しています。FAQセクションでは一般的な質問に答え、HSBCのサービスを効果的に活用するための明確で簡潔な回答を提供しています。オンラインバンキング、口座管理、支払い、送金など、多くの側面についてクライアントが学ぶことができます。クライアントはhttps://www.us.hsbc.com/help/をクリックして必要な回答を得ることができます。

まとめると、HSBCは銀行業界での堅実な存在であり、顧客の多様な金融ニーズに応えるために設計されたさまざまなサービスとソリューションを提供しています。グローバルな存在感、多様な銀行オプション、便利なプラットフォーム、教育リソースなどの利点を提供しています。ただし、手数料の透明性の問題など、課題も抱えています。

一言で言えば、HSBCはグローバルな銀行業務において貴重な機会を提供していますが、個々の金融ニーズに最適な選択肢を確認するためには注意深く考慮し、比較する必要があります。

よくある質問(FAQ)

| 質問1: | HSBCはどの金融機関によって規制されていますか? |

| 回答1: | はい。FINRAとASICによって規制されています。 |

| 質問2: | HSBCのカスタマーサポートチームにはどのように連絡すればよいですか? |

| 回答2: | 電話、888.662.4722および716.841.6866(24時間対応)およびライブチャットで連絡することができます。 |

| 質問3: | HSBCはどのプラットフォームを提供していますか? |

| 回答3: | モバイルバンキングアプリを提供しています。 |

| 質問4: | HSBCでどのような証券に投資できますか? |

| 回答4: | HSBCは株式、上場投資信託(ETF)、共同基金、ストラクチャードプロダクト、固定収益証券、金融および自己指向型のブローカーサービスを提供しています。 |

リスク警告

オンライン取引には重大なリスクが伴い、投資した資本をすべて失う可能性があります。すべてのトレーダーや投資家に適しているわけではありません。リスクを理解し、このレビューで提供される情報は会社のサービスやポリシーの絶え間ない更新により変更される可能性があることに注意してください。

その他情報

登記国

アメリカ合衆国

経営時間

20年以上

取引可能商品

Securities Lending Fully Paid、Annuities、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

関連企業

国

会社名

関連企業

アメリカ合衆国

HSBC Securities (USA) Inc

グループ会社

--

HSBC Bank Canada

グループ会社

--

HSBC Broking Services (Asia) Limited

グループ会社

評判

好評

好評推奨する証券会社More

盈寶證券

スコア

Patrons Securities

スコア

瑞豐國際

スコア

RDSCL

スコア

光源金融

スコア

仁和资本

スコア

南匯

スコア

弘歴環球證券

スコア

Look’s Securities Limited

スコア

Core Capital

スコア