スコア

レーティング

会社鑑定

取引品種

3

Securities Lending Fully Paid、Futures、Stocks

取引商ライセンス

1件ライセンスを保有

キプロスCYSEC証券取引ライセンス

会社情報

More

会社名

GO Markets Ltd

社名略語

GO Markets

会社登録国・地域

会社所在地

会社のウェブサイト

https://www.gomarkets.eu/en/いつでも確認することが可能です

WikiStock APP

インターネット遺伝子

遺伝子インデックス

アプリのスコア

アプリのダウンロード数

- サイクル

- ダウンロード数

- 2024-05

- 41.56M

集計ルール:データは現時点におけるアプリの過去1年間のダウンロード数を示します。

アプリの地区の人気度

- 国/地域ダウンロード数比率

その他

38.74M66.10%イラン

0.94M11.25%アメリカ合衆国

0.83M10.03%南アフリカ

0.62M7.50%ナイジェリア

0.43M5.12%

集計ルール:データはアプリの現時点における過去1年間のアプリのダウンロード数と地域でのシェアを示します。

会社特徴

最低入金額

$100

Margin Trading

YES

Long-Short Equity

YES

規制されている国数量

1

| GO Markets |  |

| WikiStock Rating | ⭐⭐⭐ |

| Founded | 2006 |

| Registered Region | Cyprus |

| Regulatory Status | CYSEC |

| Product | Forex, Commodities, Metals, Indices, Shares, Cryptocurrencies, Treasuries, ETFs |

| Account Minimum | 100 EUR / USD |

| Commission | 0 for Standard Account, €2.00 per side on standard lot for Plus+ Account |

| Fees | No deposit/withdrawal fees |

| App/Platform | MT4/5 |

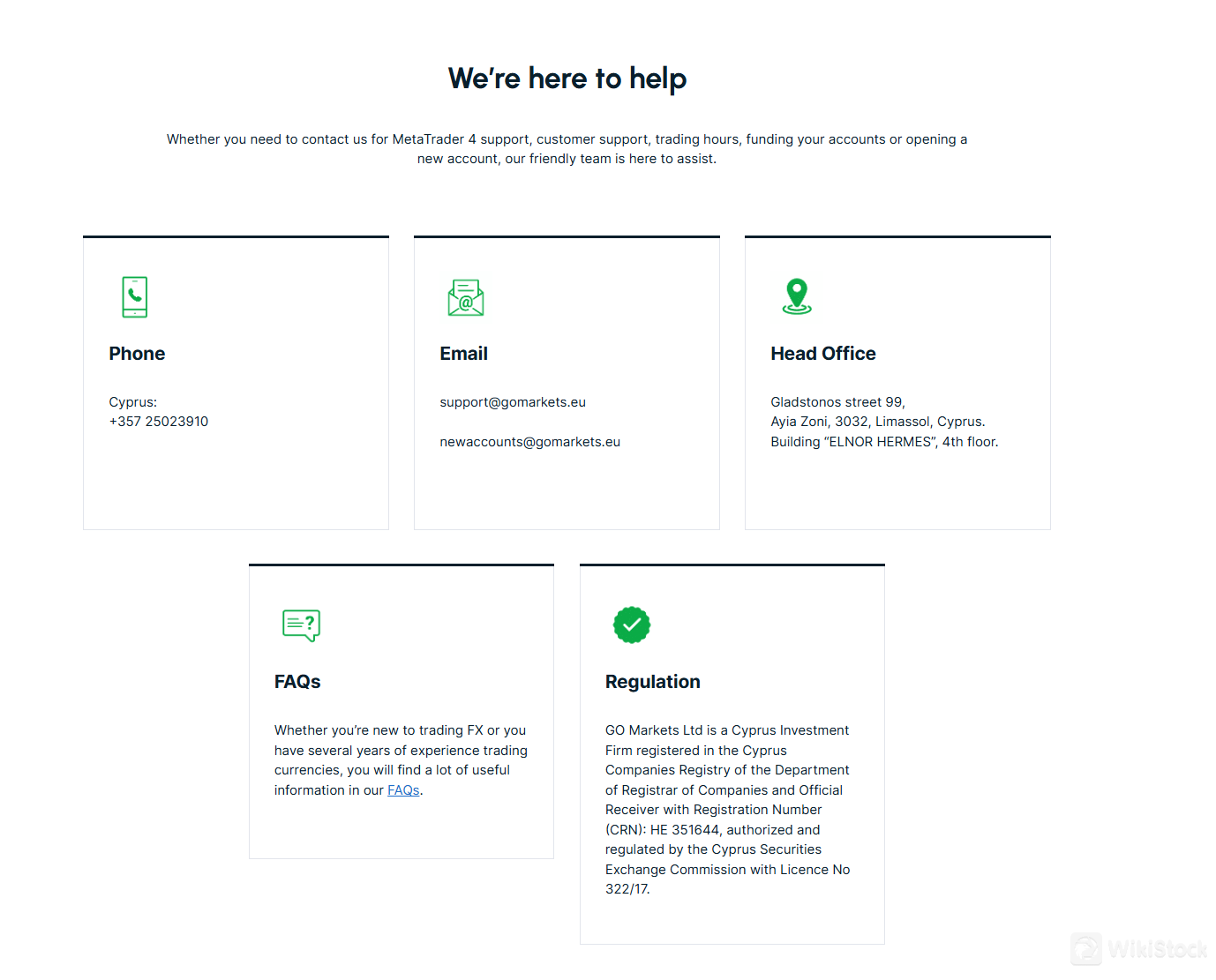

| Customer Service | Address: Gladstonos street 99, Ayia Zoni, 3032, Limassol, Cyprus. Building “ELNOR HERMES”, 4th floor. |

| Live chat, contact form, FAQ | |

| Email: support@gomarkets.eu; newaccounts@gomarkets.eu | |

| Social media: Facebook, Twitter, LinkedIn, YouTube, Instagram |

GO Markets Information

Founded in 2006 in Cyprus, GO Markets Ltd provides a diverse array of trading services across Forex, Commodities, Metals, Indices, Shares, Cryptocurrencies, Treasuries, and ETFs. The firm operates with a minimum account requirement of 100 EUR/USD and offers two account types: a Standard Account with zero commission and a Plus+ Account with a commission of €2.00 per side on standard lots. There are no deposit or withdrawal fees, enhancing cost-efficiency for clients. GO Markets utilizes the popular MT4 and MT5 platforms for trading.

As a Cyprus Investment Firm (CIF), GO Markets Ltd is regulated by CySEC under license number 322/17, ensuring compliance with stringent regulatory standards that bolster the company's credibility and reliability in financial markets.

For more detailed information, you can visit their official website: https://www.gomarkets.eu/en/ or contact their customer service directly.

Pros & Cons

| Pros | Cons |

| CYSEC Regulation | Restricted Services |

| Wide Range of Instruments | Commissions Charged |

| Advanced Trading Platforms (MT4/5) | |

| Educational Resources | |

| Demo Account Available |

CYSEC Regulation: GO Marketsはキプロス証券取引委員会(CySEC)の下でキプロス投資会社(CIF)として規制されており、クライアントに規制環境とクライアント保護を提供しています。

幅広い取引商品: GO Marketsは、外国為替、指数、商品、暗号通貨、株式CFDなど、多様な取引商品を提供しています。

高度な取引プラットフォーム: このブローカーは、高度なチャートツール、自動取引機能、カスタマイズオプションで知られるMetaTrader 4(MT4)およびMetaTrader 5(MT5)をサポートしています。

教育資源:GO Markets提供了一個全面的教育中心,包括課程、網絡研討會和市場分析報告。

模擬帳戶可用:GO Markets為初學者和有經驗的交易者提供了一個模擬帳戶,以練習他們的交易策略並熟悉交易,而不冒真實資本的風險。

缺點:服務受限:GO Markets不向歐盟以外的客戶提供投資和附屬服務,從地理上限制了他們的服務可用性。

收取佣金:雖然不收取內部存款和提款費用,但向非澳大利亞銀行提款可能會產生中介銀行的額外費用,而且該公司從其Plus+帳戶收取每手2歐元的佣金,增加了客戶的交易成本。

安全性如何?

監管:

GO Markets在塞浦路斯證券交易委員會(CYSEC)的監管監督下運營,許可證號為322/17,展示了其在金融業務中保持最高標準的承諾。這種監管遵從強調了GO Markets在服務中的誠信和可信性。

安全措施:

GO Markets通過嚴格的措施優先保護客戶資金。

客戶資金與公司資金分開,確保它們在信譽良好的銀行中分開保存。這種分離保護客戶資金免受GO Markets破產的影響。

此外,為了管理風險,GO Markets實施追加保證金和強制平倉水平。追加保證金在帳戶資金低於所需水平時提醒交易者,促使他們增加資金以維持倉位。強制平倉水平在帳戶資金低於指定閾值時自動關閉交易,以防止進一步損失。

GO Markets可以交易的證券有哪些?

GO Markets提供了一套全面的差價合約(CFD)產品,旨在滿足全球金融市場上不同的交易偏好和策略。

對於外匯交易者,GO Markets提供超過50種貨幣對的交易機會,具有有競爭力的點差和最高30:1的槓桿選項。

指數CFD允許投資者在主要股市指數(如富時100和美國500)的波動中進行交易,而無需擁有相應的基礎資產,提供最高20:1的多空交易機會。

加密貨幣CFD提供對熱門數字貨幣的交易機會,可在全天24小時進行交易,槓桿選項最高可達2:1。

此外,GO Markets還提供金屬CFD(如黃金和白銀)、商品CFD(涵蓋石油等資源)和國債CFD(允許進入全球債券市場),槓桿最高可達5:1。

通過ETF CFD,投資者可以通過跟踪指數或資產類別實現投資組合的多樣化,享受最高5:1的多空交易機會。

此外,GO Markets還提供美國股票的延長交易時間,使交易者能夠利用盤前和盤後交易時間。槓桿最高可達5:1,交易者可以通過較小的投資控制更大的倉位,並且可以在數百種澳大利亞、美國和香港股票上進行多空交易。

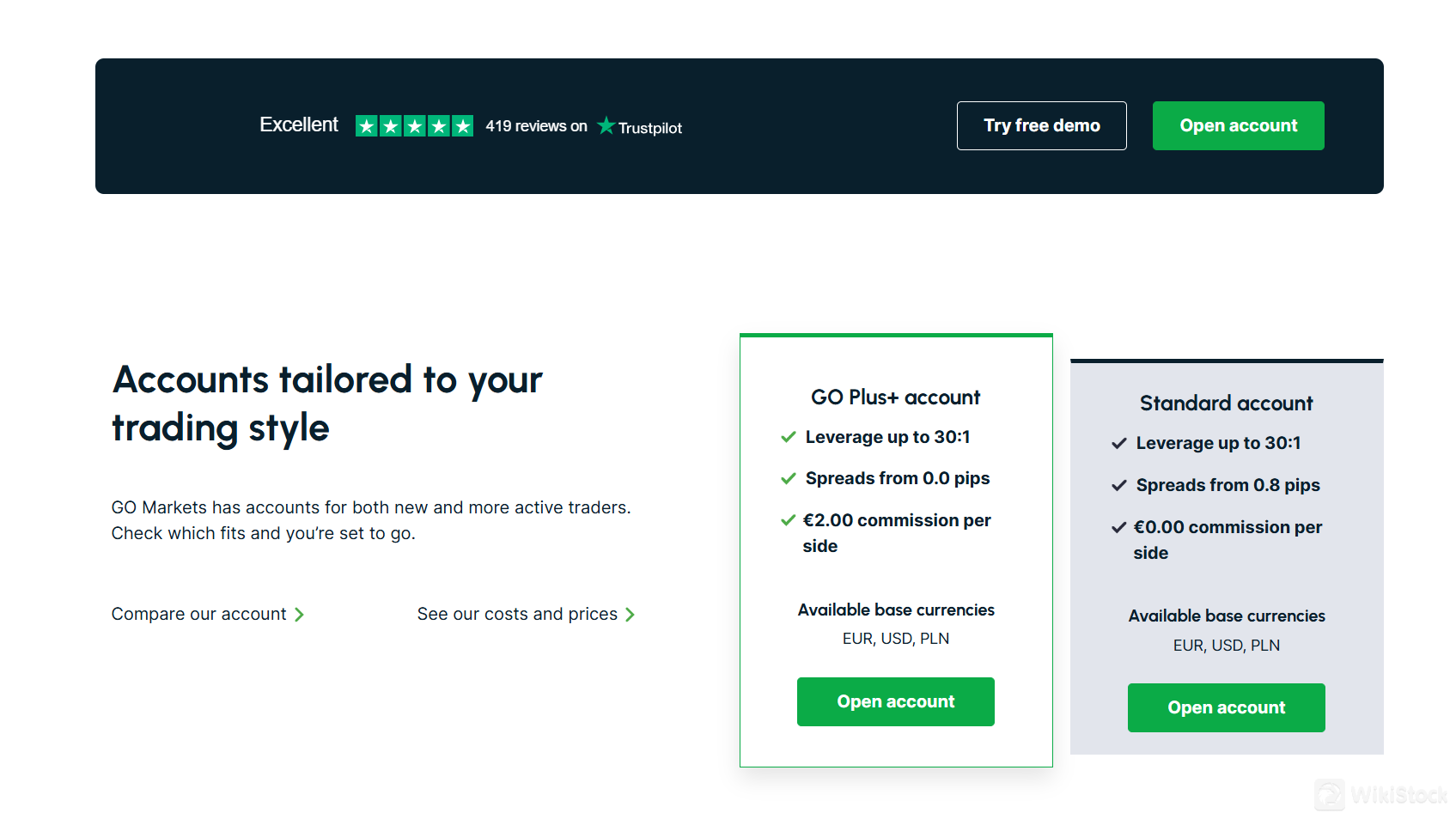

帳戶

GO Markets提供兩種不同的實盤帳戶,以滿足不同的交易偏好:Plus+帳戶和標準帳戶。這兩種帳戶都可以交易超過50種外匯貨幣對、指數和商品,槓桿選項最高可達30:1,最小交易量為0.01手。客戶可以從全天24小時的支持中受益,並選擇專屬帳戶經理。允許使用專家顧問(EA)進行自動交易策略,並提供免費的虛擬私人服務器(VPS)托管,以實現不間斷的交易。允許剃頭策略,使GO Markets帳戶適用於各種交易風格。

ベース通貨にはEUR、USD、およびPLNが含まれており、グローバルな取引の好みに対応しています。 最低入金要件は100 EUR/USDです。さらに、トレーダーはデモ口座を使用してGO Marketsを探索することができ、実際の資金を投入する前にリスクのない環境で取引戦略を練習し、洗練させることができます。

手数料のレビュー

GO Marketsは、クライアントのコストを最小限に抑えるために透明な手数料ポリシーを維持しています。

Visa/Mastercard、Skrill、Neteller、または銀行振込には内部入金手数料はかかりません、また、GO Marketsからの引き出しも無料です。ただし、オーストラリア以外の銀行への引き出しには中間手数料と受取手数料が発生する場合があります。

取引コストは異なります: Plus+アカウントは標準ロットで0.0ピップからのスプレッドと1サイドあたり€2.00の手数料を提供し、より狭いスプレッドに適しています。 スタンダードアカウントはスプレッドが1.0ピップからで手数料はありません、より広いスプレッドでの費用対効果の高い取引に適しています。

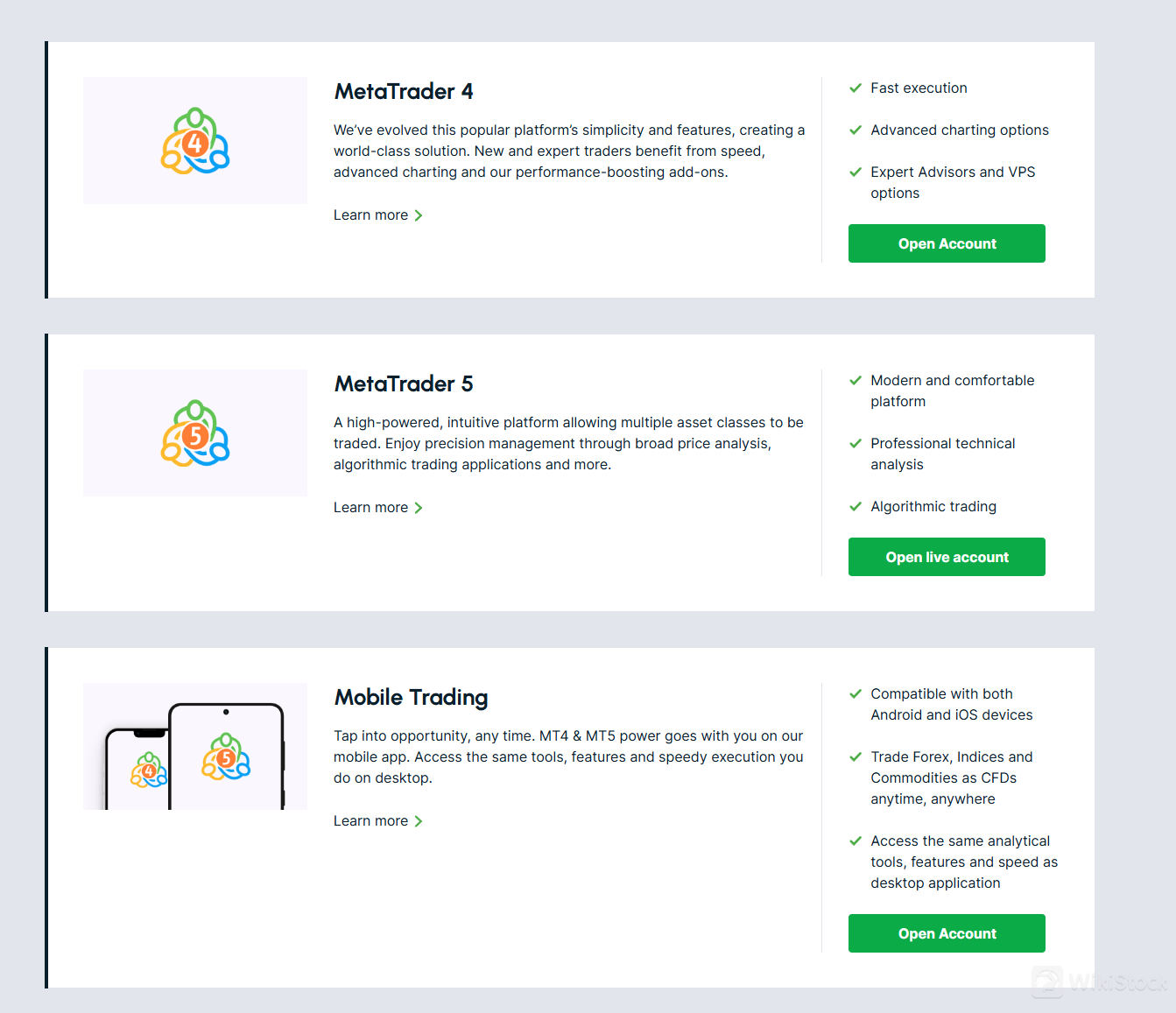

アプリのレビュー

GO Marketsは、MetaTrader 4(MT4)およびMetaTrader 5(MT5)プラットフォームを通じて堅牢な取引ソリューションを提供しています。

MT4は高速な実行と高度なチャートツールを提供し、Expert Advisors(EA)およびVirtual Private Server(VPS)オプションによる自動取引戦略を補完します。一方、MT5はForex、指数、商品を含む広範な資産クラスのカバレッジを備え、プロの技術分析ツールとアルゴリズム取引機能によって取引能力を向上させます。

両プラットフォームはデスクトップおよびモバイルデバイス(AndroidおよびiOS)で利用可能であり、トレーダーは一貫したスピードと分析能力を備えたプラットフォームを介していつでもどこでも市場の機会にアクセスし、ポートフォリオを管理することができます。

取引ツール

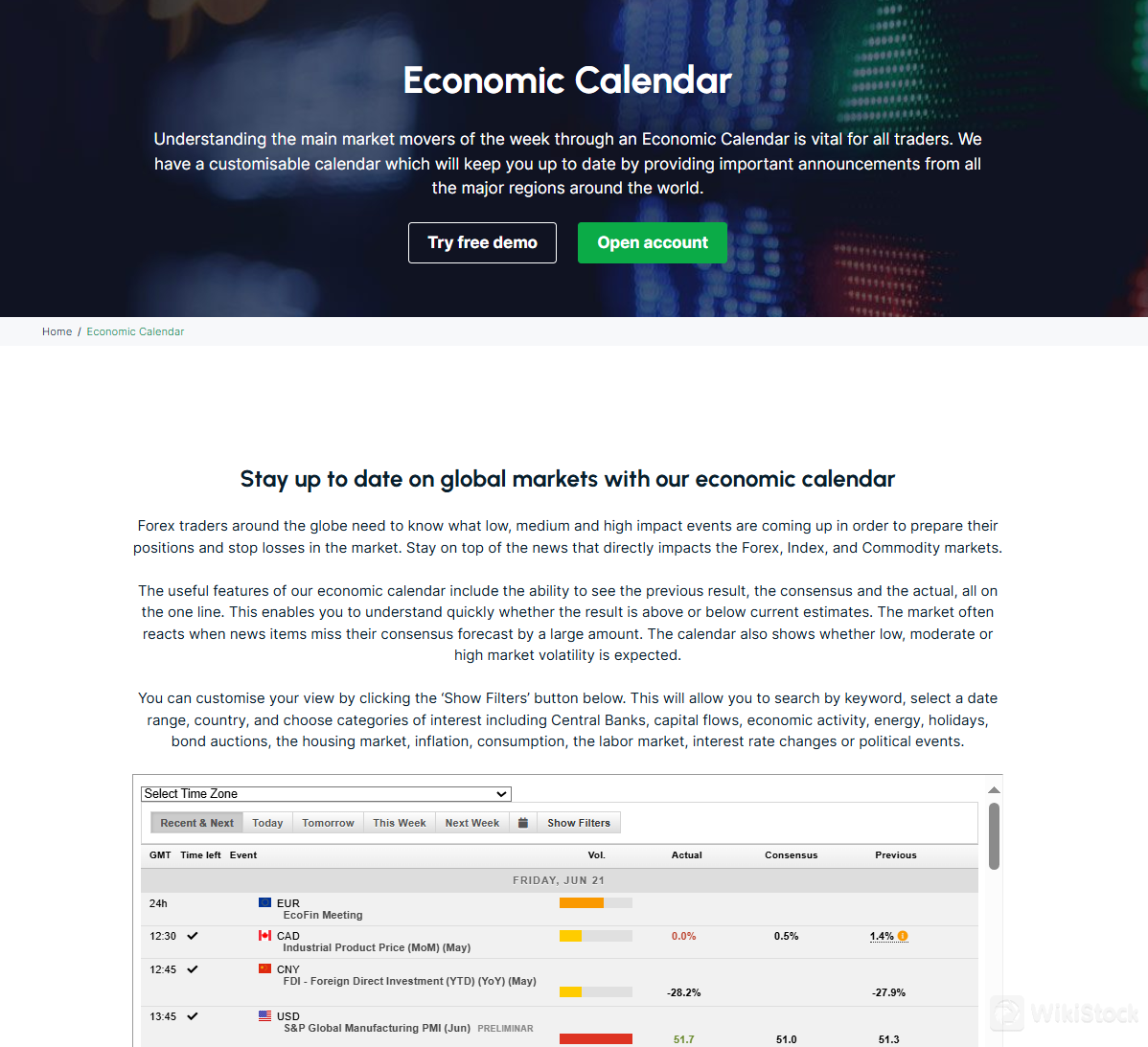

GO Marketsは、トレーダーに堅牢な経済カレンダーを提供し、世界中の重要な市場動向イベントについて情報を提供します。このカスタマイズ可能なカレンダーは、主要なグローバル地域からの重要な発表を集約し、Forex、指数、商品市場に影響を与える経済指標に関するトレーダーの最新情報を確保します。

主な機能には、前回の結果、コンセンサス予測、および実際の結果が1行に表示され、期待からの逸脱の迅速な評価を容易にすることが含まれます。

カレンダーはまた、各イベントに対して市場のボラティリティレベル(低、中、高)を予測し、トレーダーが潜在的な価格変動を予測するのに役立ちます。

キーワード検索、日付範囲、国、中央銀行の決定や経済活動などの特定のイベントカテゴリのフィルタリングを通じてカスタマイズが可能なGO Marketsの経済カレンダーは、トレーダーが将来の経済データに基づいて効果的に取引戦略を計画し調整することを可能にします。

リサーチ&教育

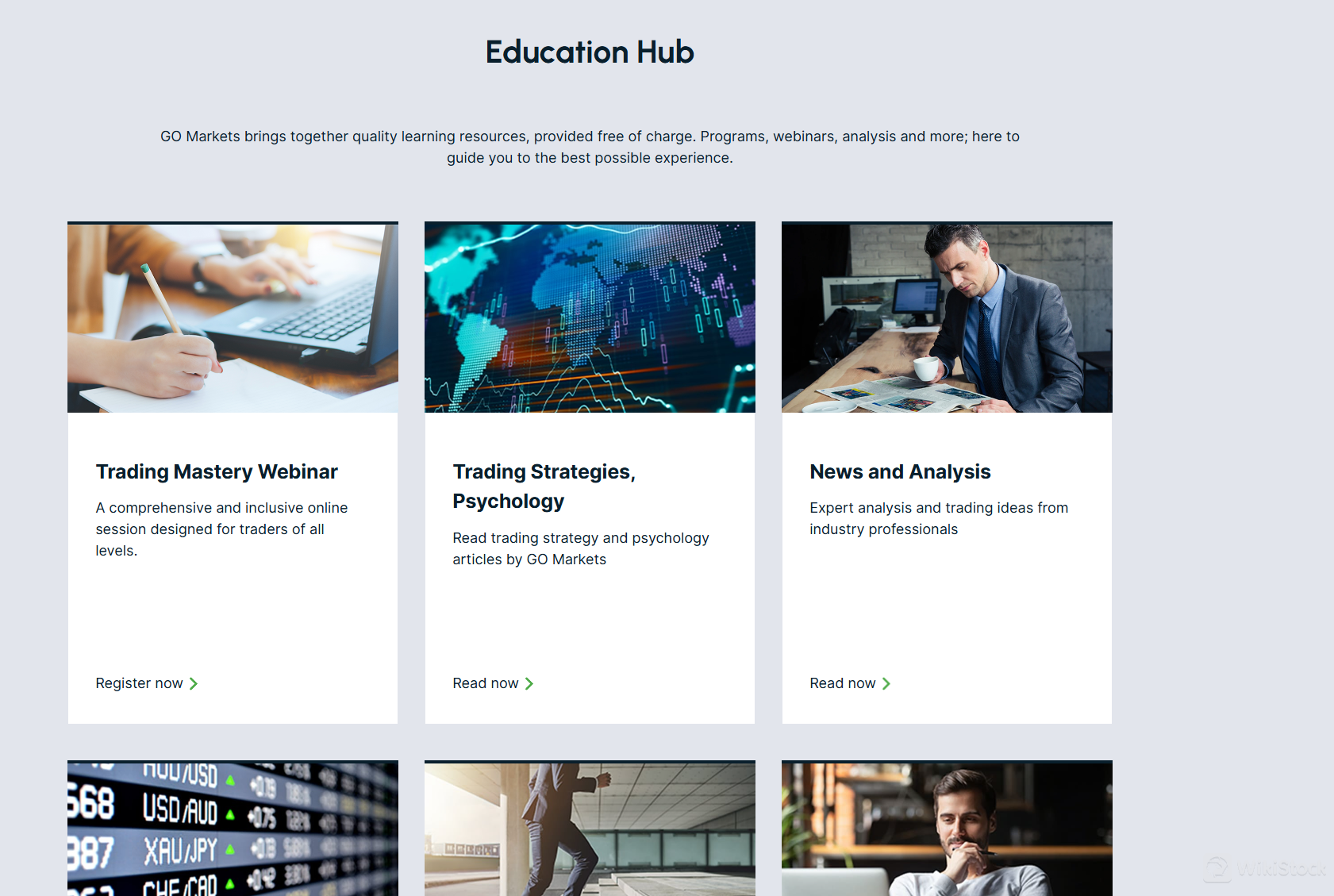

GO Marketsは、教育ハブを通じて幅広い研究および教育リソースを提供しています。

トレーダーは、Forex取引の初級から上級までのトピックをカバーする教育コースなどの質の高い学習教材にアクセスすることができます。

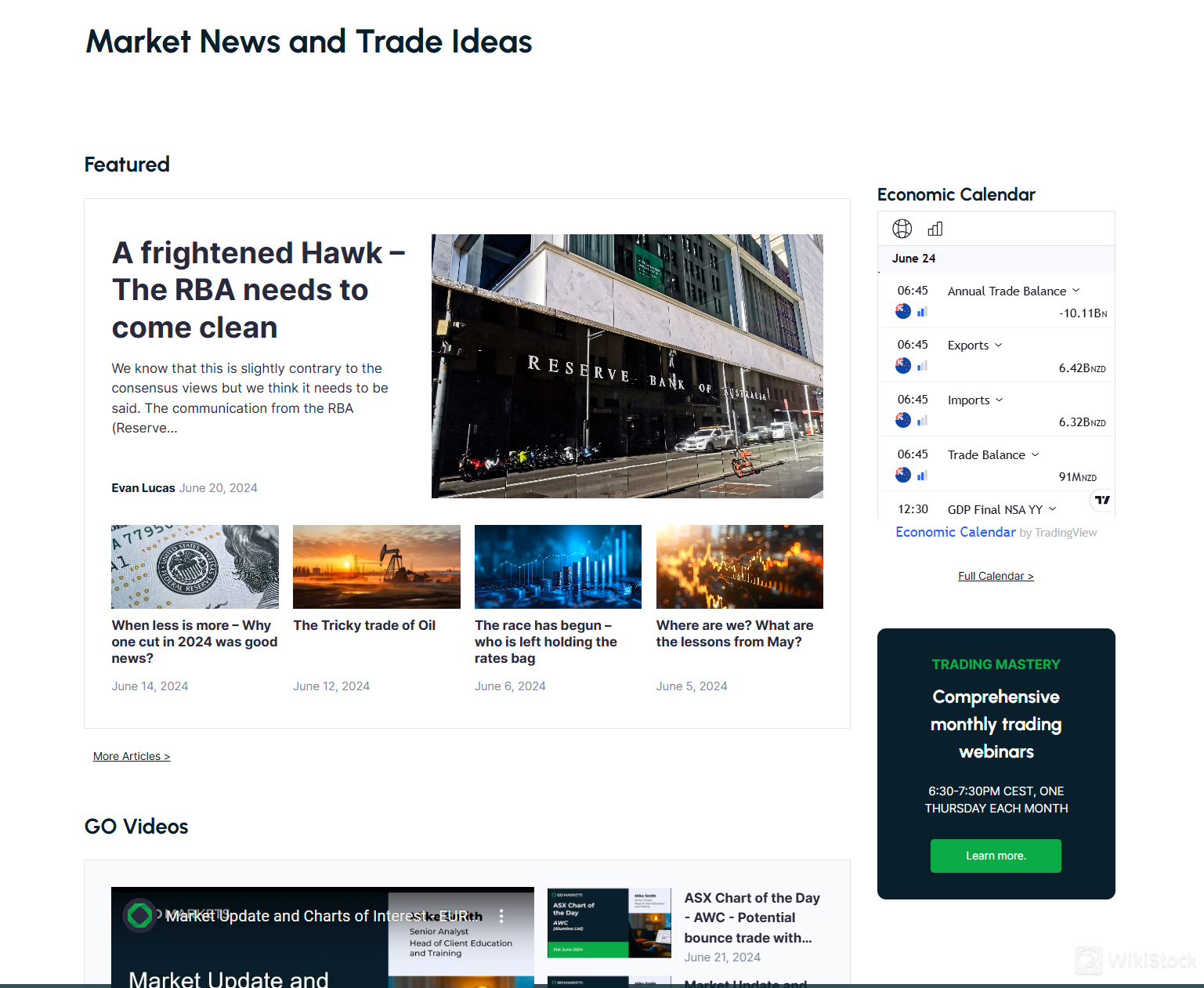

さらに、GO Marketsは業界の専門家によるウェビナー、市場分析レポート、記事やビデオを通じてトレーダーが市場のトレンドや動向について情報を得るのを支援しています。

カスタマーサービス

GO Marketsはキプロス、リマソール、アイア・ゾニ、グラドストノス通り99番地、ELNOR HERMESビル4階に所在しています。

お客様は+357 25023910までお電話いただくことで直接のサポートを受けることができます。

書面でのお問い合わせには、ウェブサイト上で利用できるお問い合わせフォームを利用することもでき、迅速に対応されます。

さらに、ウェブサイト上で包括的なFAQセクションが利用可能であり、よくある質問やお問い合わせに対する回答が提供されています。

リアルタイムのサポートには、GO Marketsはライブチャット機能を提供しており、クライアントは直接サポート担当者とチャットすることができます。

より個別のサポートやアカウントに関する質問については、クライアントはsupport@gomarkets.euまたはnewaccounts@gomarkets.euのメールアドレスでGO Marketsに連絡することもできます。

GO MarketsはFacebook、Twitter、LinkedIn、YouTube、Instagramなどのソーシャルメディアプラットフォームでも積極的に活動しており、さらなるコミュニケーションとサポートの手段を提供しています。

まとめ

GO Marketsは、外国為替、指数、商品、仮想通貨などを含む幅広い取引商品を提供する金融市場で信頼されるプロバイダーとして際立っています。

GO Marketsの本社はキプロスのリマソールにあり、キプロス証券取引委員会(CySEC)のライセンス番号322/17に基づき、キプロス投資会社(CIF)として厳格な規制の下で運営されています。この規制の監督は、透明性、セキュリティ、および顧客保護の高い基準を維持する彼らの取り組みを裏付けています。

高度な取引プラットフォーム、競争力のある価格設定、専任のカスタマーサポートを備えたGO Marketsは、金融市場を効果的に航海するために必要なツールとリソースを提供し続けています。

よくある質問(FAQ)

1: GO Marketsは金融当局によって規制されていますか?

はい、GO Markets Stockbrokers Ltdはキプロス証券取引委員会(CYSEC)によってライセンス番号322/17で規制されています。

2: GO Marketsはどのような製品を提供していますか?

外国為替、商品、金属、指数、株式、仮想通貨、国債、ETFなど。

3: GO Marketsは初心者に適していますか?

はい、GO Marketsは規制がしっかりしており、初心者にとって有益な金融アドバイザリーサービスを提供しています。

4: GO Marketsはどの取引プラットフォームを提供していますか?

MetaTrader 4(MT4)およびMetaTrader 5(MT5)のプラットフォームを提供しています。

5: 入金および出金オプションはありますか?

Visa/Mastercard、Skrill、Neteller、銀行振込が利用でき、内部手数料はありません。オーストラリア以外の銀行への出金には、中間銀行からの追加料金が発生する場合があります。

6: GO Marketsのサービスにはクライアントの所在地に基づく制限がありますか?

はい、GO Markets Ltdはヨーロッパ連合外に居住するクライアントに対して投資および付随するサービスを提供していません。

リスク警告

オンライン取引には重大なリスクが伴い、投資した資本をすべて失う可能性があります。すべてのトレーダーや投資家に適しているわけではありません。リスクを理解し、このレビューで提供される情報は会社のサービスとポリシーの絶え間ない更新により変更される可能性があることに注意してください。

その他情報

登記国

キプロス

経営時間

5-10年

取引可能商品

Securities Lending Fully Paid、Futures、Stocks

評判

コメントなし

推奨する証券会社More

Banxso

スコア

Amana

スコア

HFM

スコア

EXANTE

スコア

FXCM

スコア

Zetano

スコア

Vstar

スコア

24Fxacademy

スコア

XTB

スコア

TeleTrade Europe

スコア