スコア

レーティング

会社鑑定

取引品種

4

Bonds & Fixed Income、Futures、Options、Stocks

取引商ライセンス

1件ライセンスを保有

イギリスFCA証券取引ライセンス

会社情報

More

会社名

YCM-Invest Ltd

社名略語

YCM-Invest

会社登録国・地域

会社所在地

会社のウェブサイト

https://ycm-invest.com/いつでも確認することが可能です

WikiStock APP

インターネット遺伝子

遺伝子インデックス

アプリのスコア

| YCM-Invest |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Fees | Structured based on the amount deposited |

| Mutual Funds Offered | No |

| App/Platform | MT4,MT5,Currenex, Web Trade, Mobile Trading,and FIX API |

| Promotions | Not available yet |

YCM-Invest Information

YCM-Investは、プロのトレーダーや資産運用家向けにカスタマイズされた幅広い金融サービスを提供するイギリスのブローカー会社です。透明性と誠実さを重視しており、外国為替、貴金属、指数、エネルギー、単一株式、および仮想通貨CFDなど、さまざまな金融市場へのアクセスを提供しています。

同社の取引プラットフォームには、MetaTrader 4(MT4)、MetaTrader 5(MT5)、Currenex、Web Trade、FIX APIなどの業界標準が含まれており、柔軟性と高度な取引機能を提供しています。これらのプラットフォームを通じて、クライアントはポートフォリオを管理し、取引を実行し、リアルタイムの市場データにアクセスすることができます。

YCM-Investの利点と欠点

YCM-Investは、FCAのライセンスを取得しており、厳格な監督と規制基準の遵守を保証するため、高いレベルのセキュリティと規制を提供しています。さらに、YCM-Investは外国為替、貴金属、指数、エネルギー、単一株式、および仮想通貨CFDなど、さまざまな取引インストゥルメントを提供し、さまざまな取引の好みに対応しています。MT4、MT5、Currenex、Web Trade、モバイルトレーディングアプリなど、さまざまな取引プラットフォームの利用可能性により、さまざまなタイプのトレーダーにとって柔軟性と高度な取引ツールが提供されます。

その強みにもかかわらず、YCM-Invest Securitiesには改善の余地があります。ブローカーのウェブサイトには利用可能な口座タイプに関する詳細な情報がなく、見込み客が比較して最適なオプションを選択することが困難です。また、初心者にとっては重要なデメリットとなる、研究や教育リソースが提供されていません。最後に、取引手数料は預入金額に基づいて構成されていますが、小額の預入金に対しては比較的高くなる場合があり、限られた資本を持つトレーダーを desuおくかもしれません。

| 利点 | 欠点 |

| FCAによるライセンスと規制 | 利用可能な口座タイプの詳細情報が不足している |

| 高度なセキュリティ対策(暗号化、多要素認証) | 研究や教育リソースが利用できない |

| 多様な取引インストゥルメント | 小額の預入金に対して比較的高い取引手数料 |

| さまざまな取引プラットフォーム(MT4、MT5、Currenexなど) |

YCM-Investは安全ですか?

規制

YCM-Investは、イギリスの金融行動監視機構(FCA)によって正式にライセンスされ、470392のライセンス番号のもとで規制されています。

資金の安全性

YCM-Investは、独立した口座を維持することにより、顧客の資金の安全性を最優先に考えています。これにより、顧客の資金は会社の運営資金とは別に保管されます。この分離により、ブローカーの破産の場合でも、顧客の資産が保護されます。さらに、YCM-Investは金融サービス補償制度(FSCS)に参加しており、顧客の投資に追加の保護を提供しています。

安全対策

YCM-Investは、顧客の個人情報と財務情報を保護するために、高度な暗号化技術、多要素認証、およびセキュアソケットレイヤー(SSL)プロトコルを採用しています。定期的なセキュリティ監査とコンプライアンスチェックが行われ、潜在的な脅威を検出し軽減するための対策が取られています。同社はFCAによって設定された厳格な規制基準に準拠し、すべての取引活動が公正かつ透明に行われることを保証しています。

YCM-Investで取引できる証券とは?

YCM-Investは、さまざまな投資家の好みや戦略に対応するため、多様な証券を取引する機会を提供しています。

- 外国為替(Forex):顧客は、主要な通貨ペア、マイナーな通貨ペア、エキゾチックな通貨ペアを含む幅広い通貨ペアを取引することができます。このブローカーは競争力のあるスプレッドと深い流動性プールへのアクセスを提供し、効率的かつ費用対効果の高い取引を実現しています。外国為替取引は、MT4、MT5、Currenex、Web Tradeを含むすべての主要プラットフォームでサポートされています。

- 貴金属:YCM-Investは、金、銀、プラチナ、パラジウムなどの貴金属市場へのアクセスを提供しています。これらの市場は多様化や経済的な不確実性へのヘッジの機会を提供します。顧客は競争力のある価格設定とレバレッジオプションを利用することができます。

- 指数:投資家は、S&P 500、NASDAQ、FTSE 100、DAX 30などの主要なグローバル指数を取引することができます。指数取引により、顧客は広範な市場の動きに露出し、ポートフォリオを多様化することができます。YCM-Investは、指数取引に対して狭いスプレッドと柔軟なレバレッジオプションを提供しています。

- エネルギー:YCM-Investは、原油、天然ガス、暖房用燃料油などのエネルギー商品の取引を提供しています。エネルギー市場はそのボラティリティで知られており、収益性の高い取引の機会を提供することがあります。顧客はリアルタイムの市場データと高度なチャートツールにアクセスして、情報に基づいた取引の決定を行うことができます。

- 単一株式:顧客は、NYSE、NASDAQ、LSEなどの主要なグローバル取引所に上場している幅広い個別株を取引することができます。株式取引により、企業固有のニュースやイベントに基づいて利益を上げることができます。YCM-Investは競争力のある手数料と幅広い研究ツールへのアクセスを提供しています。

- 仮想通貨CFD:YCM-Investは、差金決済(CFD)を通じて急速に成長している仮想通貨市場へのアクセスを提供しています。顧客は、Bitcoin、Ethereum、Litecoin、Rippleなどの人気のある仮想通貨を所有せずに取引することができます。これにより、取引戦略の柔軟性が生まれ、上昇相場と下落相場の両方で利益を上げることができます。

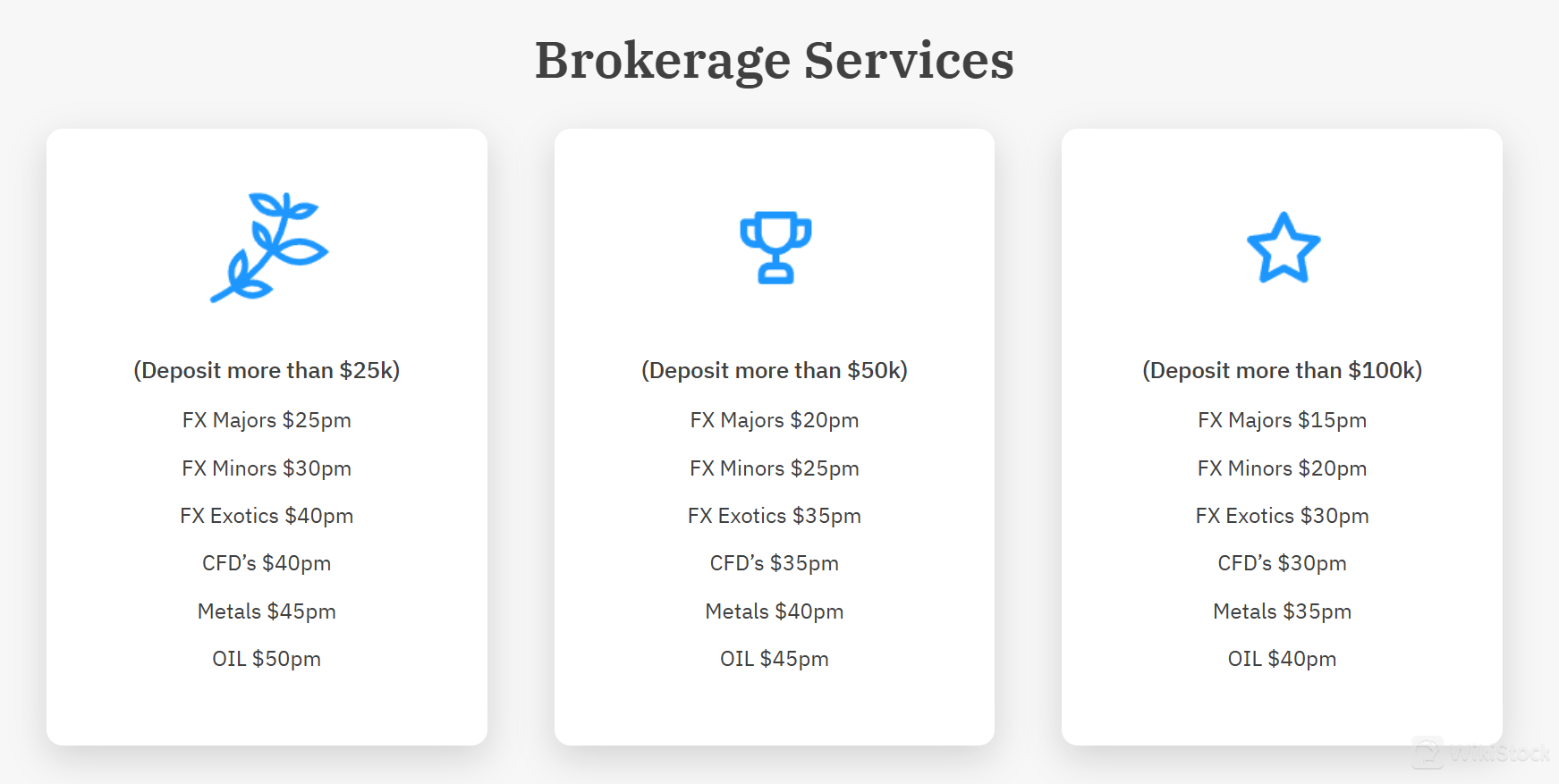

YCM-Invest手数料レビュー

YCM-Investの取引手数料は、顧客が預け入れた金額に基づいて構成されており、階層的な価格設定により、高額な預金に対して低い手数料が提供されます。

25,000ドル以上の預金に対して、FXメジャーの手数料は月額25ドル、FXマイナーの手数料は月額30ドル、FXエキゾチックおよびCFDの手数料は月額40ドル、メタルの手数料は月額45ドル、オイルの手数料は月額50ドルです。

50,000ドルを超える預金に対して、手数料はFXメジャーが月額20ドル、FXマイナーが月額25ドル、FXエキゾチックおよびCFDが月額35ドル、メタルが月額40ドル、オイルが月額45ドルに減額されます。

100,000ドル以上の預金に対して、手数料はFXメジャーが月額15ドル、FXマイナーが月額20ドル、FXエキゾチックおよびCFDが月額30ドル、メタルが月額35ドル、オイルが月額40ドルにさらに削減されます。

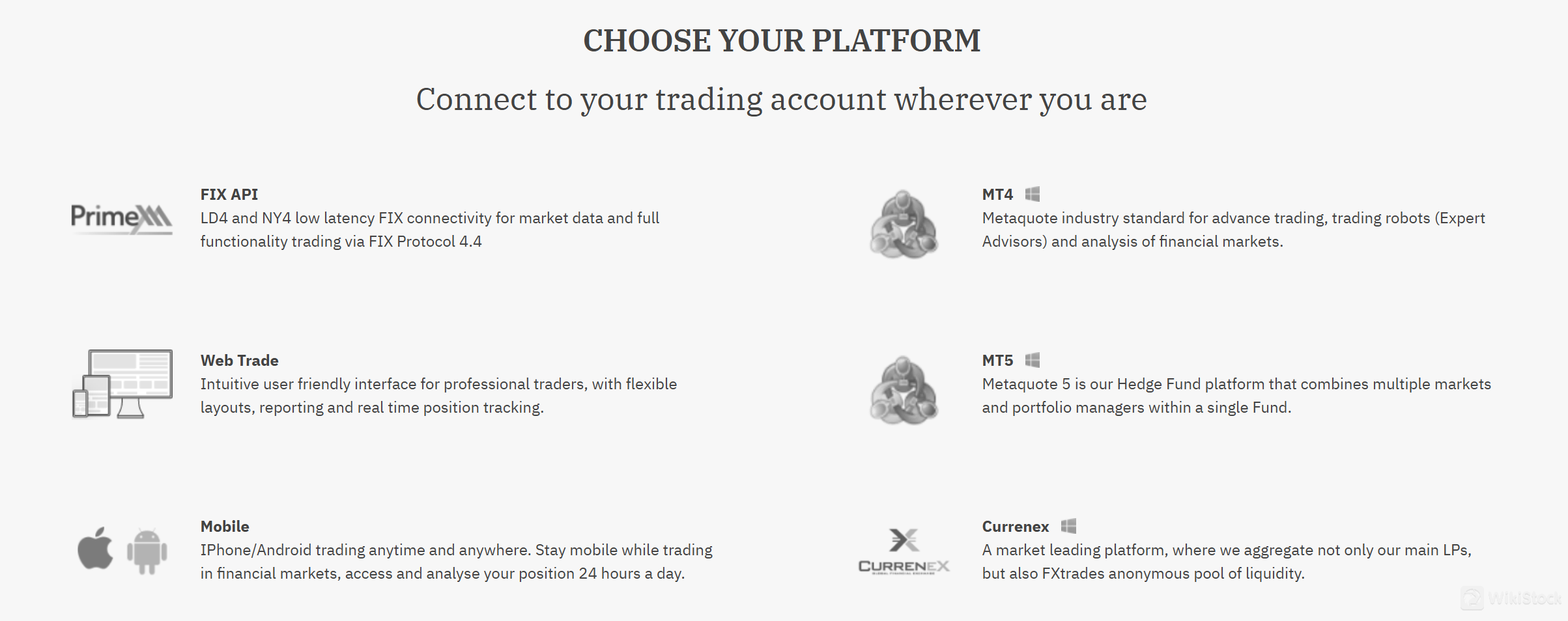

YCM-Investプラットフォームレビュー

YCM-Investは、さまざまなトレーダーのニーズに対応するために設計された取引プラットフォームを提供しています:

- MetaTrader 4(MT4):MT4は、使いやすいインターフェースと高度な取引ツールで知られる人気のあるプラットフォームです。Expert Advisors(EA)を通じた自動取引、高度なチャート機能、複数の注文タイプをサポートしています。MT4はデスクトップ、Web、モバイルデバイスで利用できます。

- MetaTrader 5(MT5):MT5はMT4のアップグレード版であり、さらなる時間枠、高度な注文管理ツール、統合経済カレンダーなどの追加機能を提供しています。MT5は複数の資産クラスでの取引をサポートしており、多様な取引戦略に適しています。

- Currenex:Currenexは、プロのトレーダーや機関投資家向けに設計された高性能取引プラットフォームです。流動性プロバイダへの直接アクセス、低レイテンシの実行、高度な注文ルーティング機能を提供しています。Currenexは高頻度取引や大口取引に最適です。

- Web Trade:YCM-InvestのWeb Tradeプラットフォームは、ウェブブラウザから直接取引するための柔軟で直感的なインターフェースを提供しています。リアルタイムのポジショントラッキング、柔軟なレイアウト、幅広いレポートツールを備えています。Web Tradeはインターネットに接続されたどのデバイスからでもアクセスできます。

- FIX API:FIX APIプラットフォームは、市場データと取引のための低レイテンシ接続を提供します。機関投資家や高頻度トレーダー向けに設計されており、直接市場アクセスと高度な取引機能を必要とする場合に適しています。FIX APIはFIX Protocol 4.4をサポートしており、業界標準との互換性があります。

- モバイルトレーディング:YCM-Investは、iOSおよびAndroidデバイス向けのモバイルトレーディングアプリを提供しており、クライアントは移動中に取引することができます。モバイルアプリでは、すべての取引インストルメント、リアルタイムの市場データ、高度なチャートツール、セキュアな口座管理機能にアクセスできます。

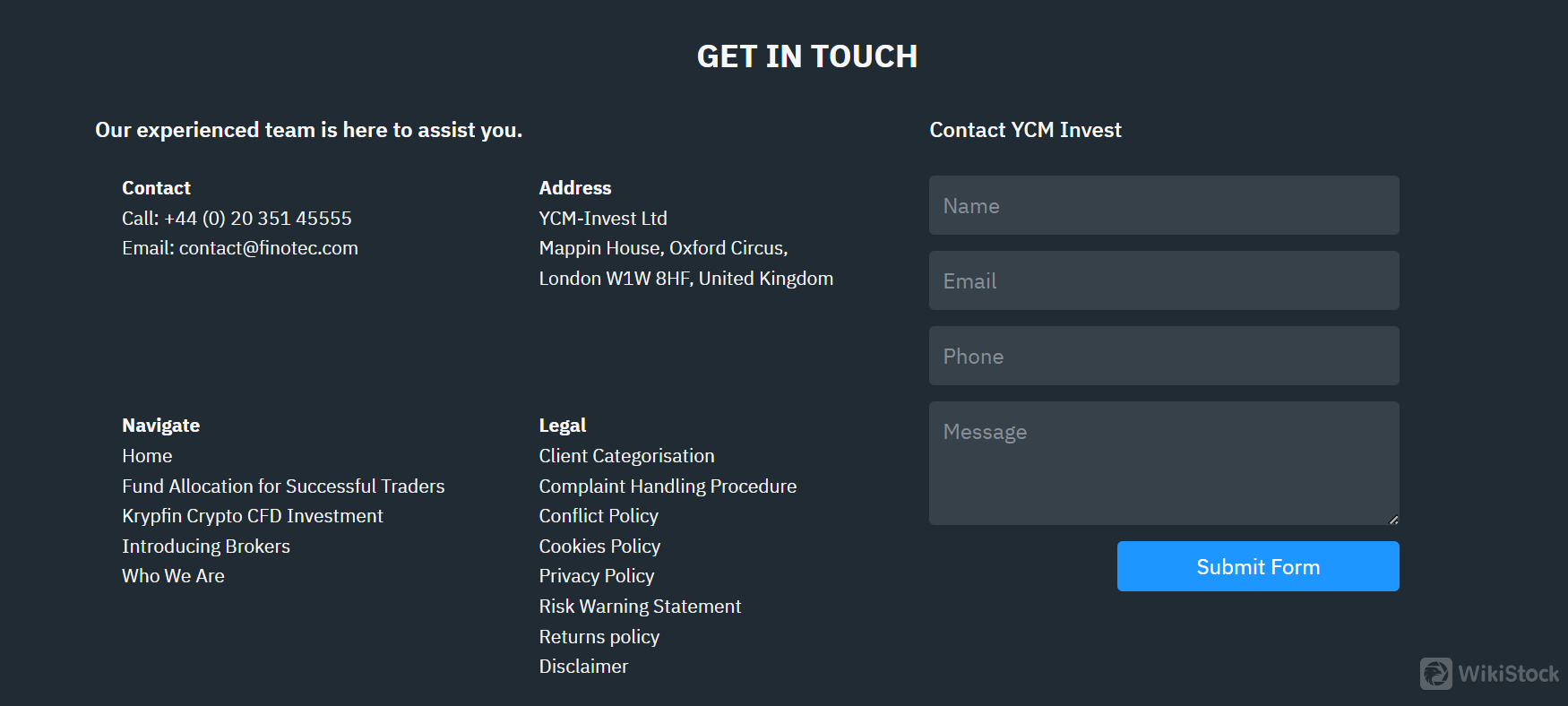

カスタマーサービス

YCM-Investは、メール(contact@finotec.com)、電話サポート(+44 (0) 20 351 45555)、ウェブサイト上のメッセージボックスなど、さまざまなチャネルを通じて優れたカスタマーサービスを提供しています。ブローカーのサポートチームは迅速かつ知識豊富であり、クライアントが遭遇する問題に対応します。

結論

YCM-Investは、FCAの規制により厳格な監督が行われ、セグリゲーションされた口座、暗号化技術、クライアント資金保護のためのFSCSへの参加など、高いセキュリティ対策を提供するなど、重要な利点を提供しています。ブローカーはさまざまな取引インストルメントとプラットフォームを提供し、さまざまな取引の好みに対応しています。

ただし、ウェブサイト上での詳細なアカウントタイプ情報の欠如、研究や教育リソースの不足、および小口入金に対する潜在的に高い取引手数料は、新規および低資本トレーダーにとって抑止要因となる可能性があります。

よくある質問

YCM-Investは規制されたブローカーですか?

はい、YCM-Investはイギリスの金融行動監視機構(FCA)によってライセンスされ、規制されています(ライセンス番号470392)。

YCM-Investで利用可能な取引インストルメントは何ですか?

YCM-Investは、外国為替、貴金属、指数、エネルギー、単一株式、および仮想通貨CFDを提供しており、多様な取引戦略と好みに対応しています。

YCM-Investはどのような取引プラットフォームをサポートしていますか?

YCM-Investは、MetaTrader 4(MT4)、MetaTrader 5(MT5)、Currenex、Web Trade、FIX API、およびiOSおよびAndroid向けのモバイルトレーディングアプリをサポートしています。

リスク警告

WikiStockのブローカーのウェブサイトデータに関する専門的な評価は変更される可能性があり、金融アドバイスとして受け取るべきではありません。オンライン取引には、投資した資本の潜在的な損失を含む重大なリスクが伴います。投資する前にこれらのリスクを十分に理解することが重要です。

その他情報

登記国

イギリス

経営時間

5-10年

Margin Trading

YES

規制されている国数量

1

取引可能商品

Bonds & Fixed Income、Futures、Options、Stocks

Appダウンロード

評判

コメントなし

推奨する証券会社More

Canaccord Genuity

スコア

BlackRock

スコア

Fortrade

スコア

Admirals

スコア

Walker Crips

スコア

Swissquote

スコア

Schroders シュローダー

スコア

XTB

スコア

Blackwell Global

スコア

Trading 212

スコア