คะแนน

Opus

http://www.opus-securities.com.hk/index.php?lang=en

Website

ดัชนีคะแนน

การประเมินนายหน้า

ความหลากหลาย

1

Stocks

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 1

SFCมีแนวโน้มจะเป็นโบร์กเกอร์ที่ถูกปลอมแปลงขึ้น

ฮ่องกงจีนใบอนุญาตซื้อขายหลักทรัพย์

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

Opus Securities Limited

ชื่อย่อบริษัท

Opus

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

ตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

การทดสอบครั้งที่แล้ว: 2024-12-31

- กฎระเบียบ ฮ่องกงจีน Securities and Futures Commission of Hongkong (หมายเลขใบอนุญาต: BFY678) ที่อ้างสิทธิ์โดยบริษัทนายหน้านั้นต้องสงสัยว่าเป็นบริษัทที่แอบอ้าง โปรดระวังความเสี่ยง!

- ได้รับการตรวจสอบแล้วว่าปัจจุบันบริษัทนายหน้าซื้อขายหลักทรัพย์นี้ไม่มีกฎระเบียบที่มีประสิทธิภาพ โปรดระวังความเสี่ยง!

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

คุณสมบัติของโบรกเกอร์

อัตราค่าคอมมิชชั่น

0.15%

New Stock Trading

Yes

ประเทศที่ได้รับการควบคุม

1

ผลิตภัณฑ์ทางการเงิน

1

| Opus |  |

| คะแนน WikiStock | ⭐⭐⭐ |

| ยอดเงินฝากขั้นต่ำ | ไม่ได้ระบุ |

| ค่าธรรมเนียม | การซื้อขายแบบออฟไลน์: 0.25% ของจำนวนธุรกรรม (ขั้นต่ำ 100 ดอลลาร์) และการซื้อขายผ่านอินเทอร์เน็ต: 0.15% (ขั้นต่ำ 70 ดอลลาร์) ของค่าคอมมิชชั่น 0.10% ของจำนวนธุรกรรมของอากรแสตมป์ 0.0027% ของจำนวนธุรกรรมของค่าธรรมเนียมการซื้อขาย และอื่น ๆ |

| แอป/แพลตฟอร์ม | แอปฯ Opus Mobile Trading และแอป Security Token |

| โปรโมชั่น | ไม่มี |

| การสนับสนุนลูกค้า | โทรศัพท์, อีเมล, การส่งข้อความออนไลน์ และแฟกซ์ |

Opus คืออะไร?

Opus Securities Limited เป็นบริษัทจำกัดที่ได้รับใบอนุญาตและอยู่ภายใต้การกำกับดูแลของ SFC และเป็นผู้เข้าร่วมการแลกเปลี่ยนของตลาดหลักทรัพย์แห่งฮ่องกง (ID. 1062) โดยรับรู้ถึงความสำคัญของฮ่องกงในการนำประโยชน์จากนักลงทุนจีนในตลาดระหว่างประเทศ Opus มุ่งมั่นที่จะเป็นส่วนสำคัญในการเชื่อมโยงนักลงทุนจีนกับตลาดทุนโลก

ข้อดีและข้อเสียของ Opus

| ข้อดี | ข้อเสีย |

| ได้รับการกำกับดูแลโดย SFC | ข้อจำกัดในการฝากเงิน |

| บริการครอบคลุมที่ครอบคลุม | |

| การพัฒนาเทคโนโลยี | |

| ตำแหน่งกลยุทธ์ |

ได้รับการกำกับดูแลโดย SFC: Opus ได้รับการกำกับดูแลโดย สำนักงานความปลอดภัยและสิทธิประโยชน์ในการซื้อขายหลักทรัพย์และอนาคต (SFC) และเป็นผู้เข้าร่วมการแลกเปลี่ยนของตลาดหลักทรัพย์แห่งฮ่องกง ซึ่งรับรองว่าดำเนินการภายใต้การตรวจสอบความปลอดภัยอย่างเข้มงวด สิ่งนี้เพิ่มความเชื่อมั่นและความเชื่อถือให้กับลูกค้า

บริการครอบคลุมที่ครอบคลุม: Opus มีการให้บริการทางการเงินที่หลากหลายรวมถึงการโบรกเกอร์หลักทรัพย์ การจัดหาเงินทุนผ่านการจัดอันดับ IPO การจัดวางและการรับรอง และการเก็บรักษาหุ้น

การพัฒนาเทคโนโลยี: บริษัทนี้นำเทคโนโลยีทันสมัยมาใช้งานด้วยแพลตฟอร์มเช่น Opus Mobile Trading Platform และแอป Security Token โดยเครื่องมือเหล่านี้จะให้ความสะดวกและความเข้าถึงสำหรับลูกค้าที่ต้องการการซื้อขายออนไลน์และผ่านโทรศัพท์มือถือ

ตำแหน่งกลยุทธ์: Opus มีฐานที่ตั้งอยู่ในฮ่องกงและใช้ทำเลทางการเงินเพื่อเชื่อมโยงนักลงทุนจีนกับตลาดทุนระดับโลก ตำแหน่งกลยุทธ์นี้ใช้ประโยชน์จากการเติบโตของนักลงทุนจีนในระดับโลก

ข้อเสียของ Opus Securities Limited:ข้อจำกัดในการฝากเงิน: บริษัทไม่รับเงินสดหรือเช็คบุคคลที่สามสำหรับการฝากเงิน สิ่งนี้อาจทำให้ลูกค้าที่ชอบวิธีการโอนเงินแบบดั้งเดิมนี้ไม่สะดวก

Opus ปลอดภัยหรือไม่?

Opus ดำเนินการภายใต้การกำกับดูแลของ สำนักงานความปลอดภัยและสิทธิประโยชน์ในการซื้อขายหลักทรัพย์และอนาคต (SFC) โดยถือใบอนุญาตเลขที่ BFY678 ในฐานะผู้กำกับดูแลทางการเงินที่สำคัญภายในฮ่องกงซึ่งเป็นศูนย์กลางทางการเงินที่มีชื่อเสียงระดับโลก ซึ่ง SFC มีบทบาทสำคัญในการเสริมสร้างและรักษาความสมบูรณ์และความมั่นคงของตลาดหลักทรัพย์และอนาคตในภูมิภาค ภารกิจหลักของ SFC คือการปกป้องสิทธิผู้ลงทุนในขณะที่ส่งเสริมการเติบโตอย่างยั่งยืนของตลาดที่เป็นธรรมและโปร่งใส

SFC ดำเนินการควบคุมอำนวยความสะดวกที่ครอบคลุมทั้งกิจกรรมการซื้อขายหลักทรัพย์และสินค้าฟิวเจอร์ รวมถึงการดูแลผู้เข้าร่วมตลาดเช่นบริษัทหลักทรัพย์ ที่ปรึกษาการลงทุน และผู้จัดการกองทุน ผ่านกรอบกฎระเบียบที่เข้มงวดและการตรวจสอบอย่างต่อเนื่อง SFC รับรองการปฏิบัติตามมาตรฐานกฎระเบียบเพื่อลดความเสี่ยงและเพิ่มความทนทานของตลาดต่อการสะเทือนจากภายนอก

หลักทรัพย์ที่ใช้ในการซื้อขายกับ Opus คืออะไร?

- การฝากเงินและถอนเงินของ Opus

- การฝากหุ้นและการถอนหุ้น

บริการโบรกเกอร์หลักทรัพย์: Opus ให้บริการการซื้อขายหลักทรัพย์ผ่านแพลตฟอร์มการซื้อขายออนไลน์และแอปพลิเคชันบนโทรศัพท์มือถือ พวกเขามีการดำเนินการที่มีประสิทธิภาพและเข้าถึงตลาดต่างๆ

บริการการจัดหาเงินทุนหลักทรัพย์ผ่านการจำนองหลักทรัพย์: บริการนี้ช่วยให้ลูกค้าสามารถใช้เงินกู้เพื่อซื้อขายหลักทรัพย์ได้

การสมัครสมาชิกการเสนอขายครั้งแรก (IPO): Opus ช่วยลูกค้าในการสมัครสมาชิก IPO เพื่อให้พวกเขามีโอกาสลงทุนในระยะเริ่มต้นของการเสนอขาย

การจัดวางและการรับรอง: Opus เข้าร่วมในการจัดวางและการรับรองการออกหลักทรัพย์ เพื่อให้การสนับสนุนที่สำคัญในการนำหลักทรัพย์ใหม่เข้าสู่ตลาด

ผู้คุ้มครองหุ้น: Opus ให้บริการการเก็บรักษาหุ้นของลูกค้าอย่างปลอดภัยเพื่อการจัดการลงทุนที่มีประสิทธิภาพ

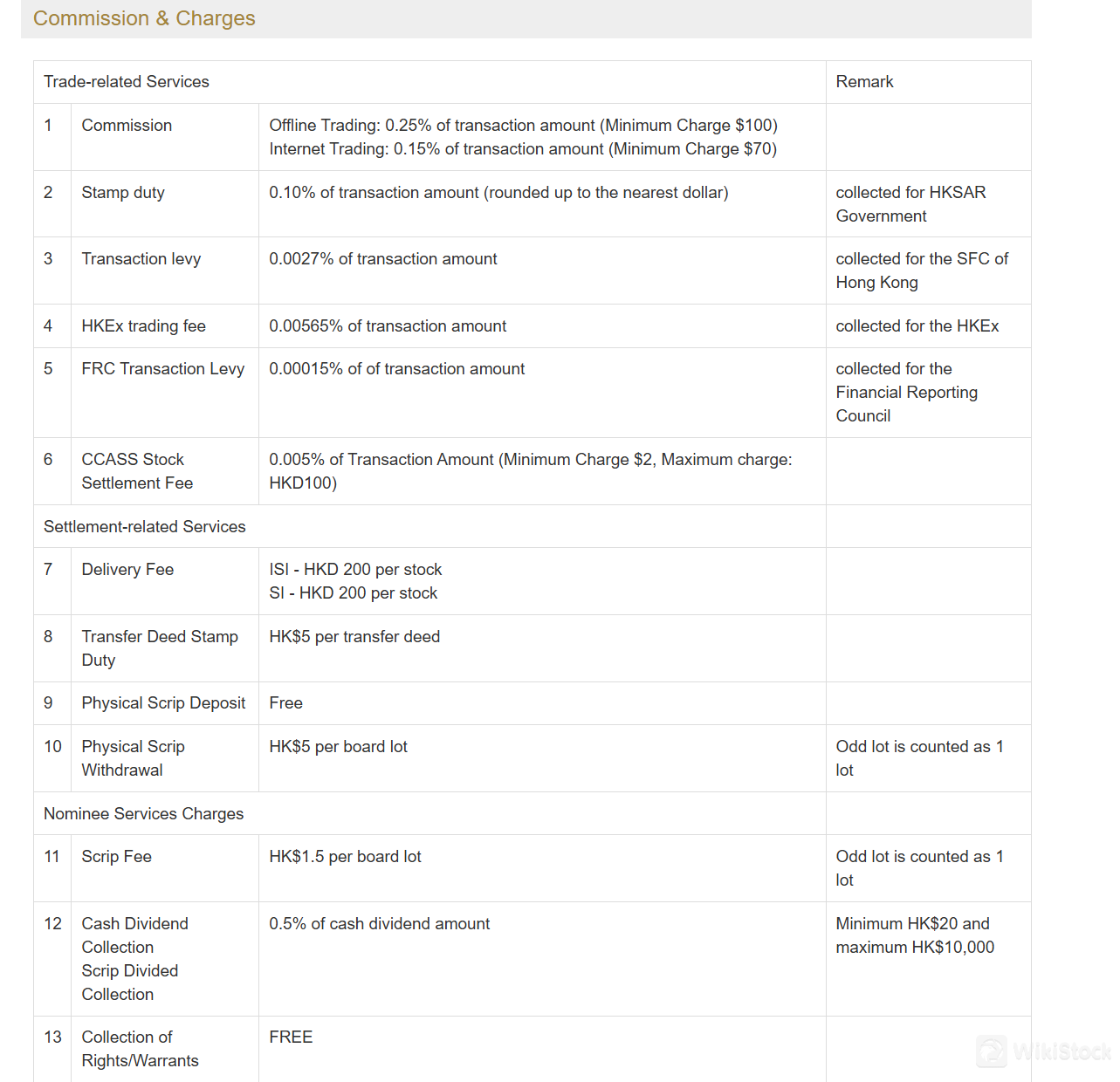

Opus ค่าธรรมเนียมรีวิว

Opus เรียกเก็บค่าธรรมเนียมประเภทต่างๆ เช่น การซื้อขายหลักทรัพย์ การเก็บรักษา และบริการทางด้านการบริหารงานที่เกี่ยวข้องกับการทำธุรกรรมหลักทรัพย์

| ค่าคอมมิชชั่น | การซื้อขายแบบออฟไลน์: 0.25% ของจำนวนเงินที่ทำธุรกรรม (ขั้นต่ำ 100 ดอลลาร์)การซื้อขายผ่านอินเทอร์เน็ต: 0.15% (ขั้นต่ำ 70 ดอลลาร์) |

| อากรแสตมป์ | 0.10% ของจำนวนเงินที่ทำธุรกรรม (ปัดขึ้นถึงดอลลาร์ที่ใกล้ที่สุด) |

| อัตราภาษีการทำธุรกรรม | 0.0027% ของจำนวนเงินที่ทำธุรกรรม (เก็บสำหรับ SFC) |

| ค่าธรรมเนียมการซื้อขาย HKEx | 0.00565% ของจำนวนเงินที่ทำธุรกรรม (เก็บสำหรับ HKEx) |

| ค่าธรรมเนียมการทำธุรกรรม FRC | 0.00015% ของจำนวนเงินที่ทำธุรกรรม (เก็บสำหรับคณะกรรมการการรายงานการเงิน) |

| ค่าธรรมเนียมการตั้งค่าการชำระเงินหลักทรัพย์ผ่าน CCASS | 0.005% ของจำนวนเงินที่ทำธุรกรรม (ขั้นต่ำ 2 ดอลลาร์, สูงสุด 100 ดอลลาร์) |

| ค่าธรรมเนียมการจัดส่งหลักทรัพย์ | ISI: 200 ดอลลาร์ต่อหลักทรัพย์SI: 200 ดอลลาร์ต่อหลักทรัพย์ |

| อากรแสตมป์การโอนหลักทรัพย์ | 5 ดอลลาร์ต่อเอกสารโอน |

| ค่าธรรมเนียมการฝากหลักทรัพย์แบบกายภาพ | ฟรี |

| ค่าธรรมเนียมการถอนหลักทรัพย์แบบกายภาพ | 5 ดอลลาร์ต่อล็อตบอร์ด (ล็อตออดนับเป็น 1 ล็อต) |

| ค่าธรรมเนียมหลักทรัพย์ | 1.5 ดอลลาร์ต่อล็อตบอร์ด (ล็อตออดนับเป็น 1 ล็อต) |

| ค่าธรรมเนียมการเก็บเงินปันผลเงินสด | 0.5% ของจำนวนเงินปันผล (ขั้นต่ำ 20 ดอลลาร์, สูงสุด 10,000 ดอลลาร์) |

| ค่าธรรมเนียมการเก็บสิทธิ์/สวารริต | ฟรี |

| ค่าธรรมเนียมการสมัครสิทธิ์/สวารริต | ค่าธรรมเนียมการจัดการ 100 ดอลลาร์ + 0.80 ดอลลาร์ต่อล็อตบอร์ด (สูงสุด 10,000 ดอลลาร์) |

| ค่าธรรมเนียมการเรียกเก็บเงินปันผล | ค่าธรรมเนียมการจัดการ 500 ดอลลาร์ + 0.5% ของจำนวนเงินสด (ขั้นต่ำ 20 ดอลลาร์, สูงสุด 10,000 ดอลลาร์) |

| ค่าธรรมเนียมการสมัคร IPO | การสมัครเงินสด: 20 ดอลลาร์ต่อคำขอการสมัครการสมัครเงินสดผ่านมาร์จิน: 100 ดอลลาร์ต่อคำขอการสมัคร |

| ค่าธรรมเนียมการเก็บรักษาหลักทรัพย์ | 0.25% ต่อปีของมูลค่าตลาดหลักทรัพย์ (ชำระเป็นรายเดือน)0.012 ดอลลาร์ต่อล็อตบอร์ดต่อเดือน (ขั้นต่ำ 20 ดอลลาร์ต่อเดือน) |

| ค่าธรรมเนียมเช็คที่คืน | 100 ดอลลาร์ต่อธุรกรรม |

| ค่าธรรมเนียมหยุดการชำระเงิน | 100 ดอลลาร์ต่อธุรกรรม |

| ค่าธรรมเนียมการเรียกดูรายงานการเงิน | 20 ดอลลาร์ต่อรายงานฟรีสำหรับ 3 เดือนล่าสุด |

| ค่าธรรมเนียมการโอนเงิน | 200 ดอลลาร์ (ในประเทศ) / 300 ดอลลาร์ (ต่างประเทศ) ต่อธุรกรรม |

Opus Platforms Review

Opus ให้บริการสองแพลตฟอร์มการซื้อขายที่แตกต่างกันที่ออกแบบมาเพื่อตอบสนองความต้องการของนักลงทุนสมัยใหม่: Opus Mobile Trading Platform และ Security Token App แพลตฟอร์มเหล่านี้สามารถดาวน์โหลดได้ทั้งใน Apple Store และ Google Play เพื่อให้สามารถเข้าถึงได้ทั้งในอุปกรณ์ iOS และ Android

Opus Mobile Trading Platform: แพลตฟอร์มนี้มีอินเตอร์เฟซที่ใช้งานง่ายที่ถูกปรับแต่งให้เหมาะสมกับอุปกรณ์เคลื่อนที่ เพื่อให้ลูกค้าสามารถซื้อขายหลักทรัพย์ได้อย่างสะดวกสบายตลอดเวลา มันให้ข้อมูลตลาดแบบเรียลไทม์ คุณสมบัติการส่งคำสั่งอย่างสะดวกและเครื่องมือการจัดการพอร์ตการลงทุนอย่างครบถ้วน Opus Mobile Trading Platform ช่วยให้ผู้ใช้สามารถดำเนินการซื้อขายได้อย่างรวดเร็วและปลอดภัยจากสมาร์ทโฟนหรือแท็บเล็ตของพวกเขา โดยเพิ่มความยืดหยุ่นและความตอบสนองในการจัดการการลงทุนของพวกเขา

แอป Security Token: ออกแบบเพื่อเพิ่มความปลอดภัยและการรับรองตัวตน แอป Security Token เสริมสร้างความมั่นใจให้กับ Opus ในการปกป้องธุรกรรมของลูกค้า มันให้ชั้นความปลอดภัยเพิ่มเติมผ่านการรับรองตัวตนที่ใช้โทเค็น ทำให้การซื้อขายและกิจกรรมบัญชีของลูกค้าได้รับการป้องกันจากการเข้าถึงที่ไม่ได้รับอนุญาต

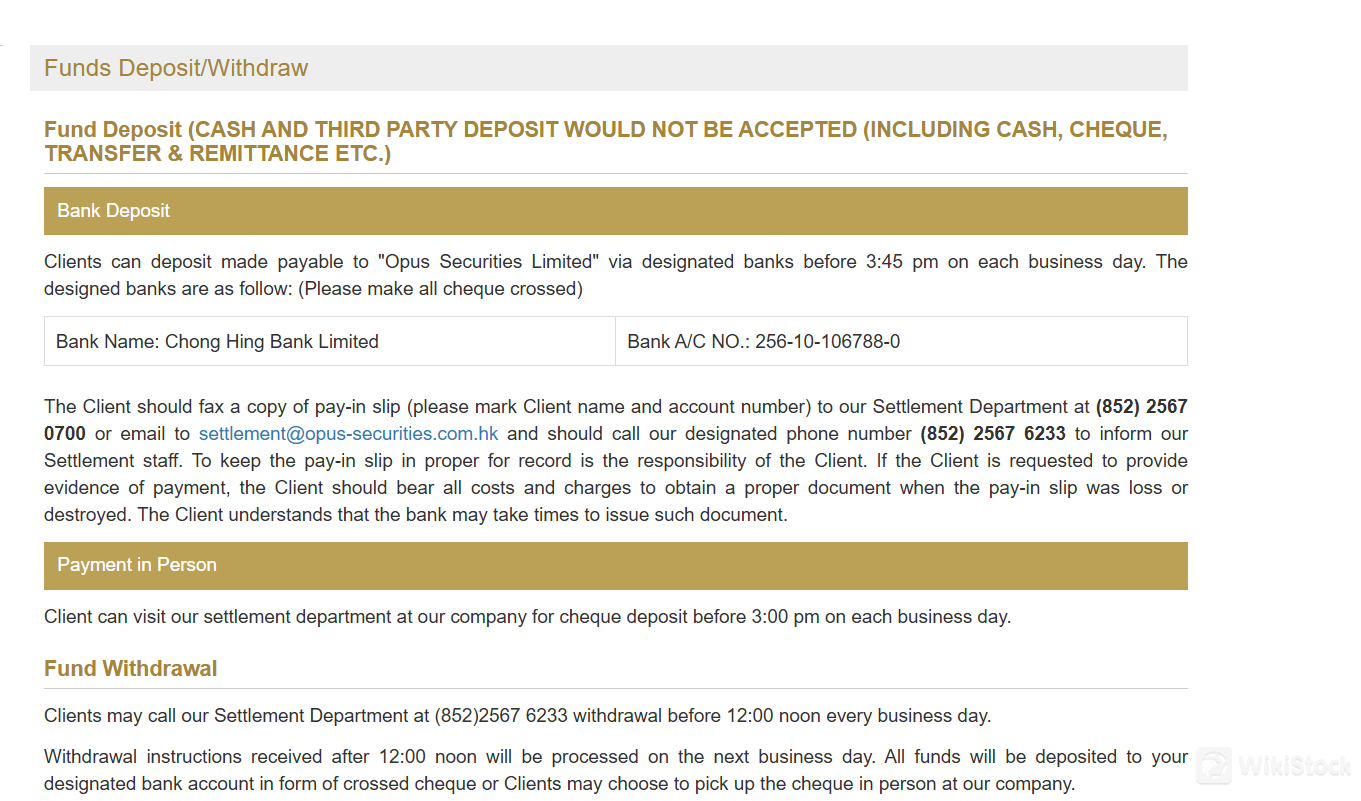

Opus Deposit & Withdrawal Review

การฝากเงิน:

การฝากเงินผ่านธนาคาร: ลูกค้าสามารถฝากเงินที่ชำระให้กับ "Opus Securities Limited" ผ่านธนาคารที่กำหนดไว้ก่อนเวลา 3:45 น. ในแต่ละวันทำการ ตราสารเงินต้องถูกขีดคร่อมและรายละเอียดจะถูกส่งให้แผนกการตลาดทางโทรสารหรืออีเมล

การชำระเงินด้วยตนเอง: ลูกค้ายังสามารถมาเยี่ยมชมแผนกการตลาดของ Opus เพื่อฝากเช็คด้วยตนเองก่อนเวลา 3:00 น. ในวันทำการ

การถอนเงิน:

คำขอการถอนเงินควรแจ้งให้แผนกการตลาดทราบก่อนเวลา 12:00 น. ในวันทำการเพื่อดำเนินการในวันเดียวกัน คำขอที่ได้รับหลังจากเวลานี้จะดำเนินการในวันทำการถัดไป ลูกค้าสามารถรับเงินได้โดยเช็คที่ขีดคร่อมฝากเข้าบัญชีธนาคารที่กำหนดหรือมารับเช็คด้วยตนเอง

การฝากหุ้น:

หุ้นที่เป็นรูปภาพ: ลูกค้าต้องฝากหุ้นที่เป็นรูปภาพด้วยตนเองที่สำนักงานของ Opus เพื่อเหตุผลด้านความปลอดภัย ไม่รับการส่งหุ้นทางไปรษณีย์ ไม่มีค่าธรรมเนียมที่ Opus เรียกเก็บสำหรับการฝากหุ้นทางรูปภาพ แต่มีค่าธรรมเนียมของรัฐบาลต่อหุ้นหรือแบบฟอร์มการโอนต่อ

คำแนะนำในการตลาด: ลูกค้ายังสามารถฝากหุ้นที่ไม่ใช่รูปภาพผ่าน CCASS โดยใช้คำแนะนำในการตลาด (SI) หรือคำแนะนำในการตลาดของนักลงทุน (ISI)

การถอนหุ้น:

หุ้นที่เป็นรูปภาพ: ลูกค้าต้องกรอกและลงลายมือชื่อในใบถอนหลักทรัพย์ที่ระบุรายละเอียดหุ้น มีค่าธรรมเนียมการจัดการและกระบวนการใช้เวลาสูงสุด 7 วันทำการ

คำแนะนำในการตลาด: เช่นเดียวกับการฝากเงิน ลูกค้าสามารถถอนหุ้นที่ไม่ใช่รูปภาพผ่าน CCASS โดยใช้ SI หรือ ISI ค่าธรรมเนียมขึ้นอยู่กับมูลค่าหุ้นในตลาดจากวันก่อนหน้า

บริการลูกค้า

ลูกค้าสามารถเข้าชมสำนักงานหรือติดต่อสายบริการลูกค้าโดยใช้ข้อมูลด้านล่าง:

โทรศัพท์: (852) 2567 0100

โทรสาร: (852) 2567 0700

อีเมล: cs@opus-securities.com.hk

ที่อยู่: ชั้น 8, ตึก EC Healthcare (Central), ถนนคอนโนท 19-20, เซ็นทรัล, ฮ่องกง

นอกจากนี้ลูกค้ายังสามารถติดต่อโบรกเกอร์นี้ผ่านสื่อสังคมออนไลน์ เช่น Twitter, Facebook, Instagram, YouTube และ Linkedin

Opus มีการให้บริการ การส่งข้อความออนไลน์ เป็นส่วนหนึ่งของแพลตฟอร์มการซื้อขายของพวกเขา ซึ่งช่วยให้นักซื้อขายสามารถสื่อสารกับฝ่ายบริการลูกค้าหรือนักซื้อขายคนอื่นๆ โดยตรงผ่านแพลตฟอร์ม

สรุป

ในสรุป Opus Securities Limited เป็นผู้เล่นที่มั่นคงในอุตสาหกรรมบริการทางการเงิน มีประโยชน์จากการควบคุมการกำกับด้านกฎหมายที่แข็งแกร่ง บริการที่หลากหลาย และตำแหน่งกลยุทธ์ที่ดีในฮ่องกง การมุ่งมั่นของพวกเขาในการพัฒนาเทคโนโลยีและการสนับสนุนลูกค้าเพิ่มเติมเสริมสร้างความน่าสนใจ สามารถเพิ่มความน่าสนใจโดยรวมสำหรับนักลงทุนที่กำลังมองหาบริการทางการเงินที่เชื่อถือได้และมีแนวคิดที่ก้าวหน้า

คำถามที่พบบ่อย (FAQs)

Opus ได้รับการควบคุมหรือไม่?

ใช่ มีการควบคุมโดย SFC

Opus มีแพลตฟอร์มใดบ้าง?

มี Opus Mobile Trading Platform และ Security Token App

ฉันสามารถติดต่อ Opus ได้อย่างไร?

คุณสามารถติดต่อผ่านโทรศัพท์: (852) 2567 0100, โทรสาร: (852) 2567 0700, อีเมล: cs@opus-securities.com.hk และการส่งข้อความออนไลน์

ฉันสามารถฝากเงินสดหรือเช็คบุคคลที่สามเข้าบัญชีของฉันได้หรือไม่?

ไม่, Opus Securities ไม่รับเงินสดหรือเงินฝากจากบุคคลที่สามรวมถึงเงินสด, เช็ค, โอนเงิน, และการโอนเงิน

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้มานี้เป็นผลจากการประเมินของผู้เชี่ยวชาญของ WikiStock ต่อข้อมูลเว็บไซต์ของโบรกเกอร์และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการเสี่ยงที่สูง อาจ导致สูญเสียเงินลงทุนทั้งหมด ดังนั้นการเข้าใจความเสี่ยงที่เกี่ยวข้องก่อนเข้ามาเป็นสิ่งสำคัญ

อื่น ๆ

Registered region

ฮ่องกงจีน

ปีในธุรกิจ

5-10 ปี

ผลิตภัณฑ์ทางการเงิน

Stocks

ดาวน์โหลดแอป

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

CIS Group

คะแนน

電訊證券

คะแนน

Harvest Global Investments

คะแนน

Prudential Brokerage

คะแนน

中原證券

คะแนน

天风国际

คะแนน

國農證券

คะแนน

Synerwealth

คะแนน

BaoQiao Partners

คะแนน

CS Wealth

คะแนน