คะแนน

China Credit International Securities

http://www.ccigsec.com.hk/#/home/en_US

Website

ดัชนีคะแนน

การประเมินนายหน้า

ความหลากหลาย

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 1

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตซื้อขายหลักทรัพย์

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

China Credit International Securities Co., Limited

ชื่อย่อบริษัท

China Credit International Securities

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

http://www.ccigsec.com.hk/#/home/en_USตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

| China Credit International Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| App/Platform | ไม่ได้กล่าวถึง |

| Promotions | ไม่ |

| Customer Support | โทรศัพท์, อีเมลและแฟกซ์ |

China Credit International Securities คืออะไร?

China Credit International Securities (CCIS) ให้บริการทางการเงินที่ออกแบบมาสำหรับนักลงทุนทั้งรายบุคคลและสถาบัน พิเศษที่เชี่ยวชาญในการลงทุนในผลิตภัณฑ์ทางการเงินที่หลากหลายรวมถึงหลักทรัพย์ ฟิวเจอร์ ทุนเอกชนและรายได้คงที่ CCIS ดำเนินธุรกิจภายใต้การกำกับดูแลของ SFC พวกเขาให้เครื่องมือวิจัยที่มีความแข็งแกร่งเช่นการเสนอราคาอย่างละเอียด แผนภูมิและเครื่องคัดข้อมูลหุ้น

ข้อดีและข้อเสีย

| ข้อดี | ข้อเสีย |

| ได้รับการควบคุมโดย SFC | โฟกัสทางภูมิศาสตร์ |

| วิจัยและการศึกษาที่แข็งแกร่ง | ข้อมูลจำกัดเกี่ยวกับบัญชี แพลตฟอร์ม และวิธีการจัดการกองทุน |

| ผลิตภัณฑ์การลงทุนที่เชี่ยวชาญ | |

| ติดต่อสื่อสารได้หลายช่องทาง |

ได้รับการควบคุมโดย SFC (Securities and Futures Commission): การได้รับการควบคุมจาก SFC ในฮ่องกงทำให้ CCIS ดำเนินธุรกิจภายใต้มาตรฐานการกำกับที่เข้มงวด มอบความเชื่อมั่นและความปลอดภัยในการให้บริการทางการเงินแก่ลูกค้า

วิจัยและการศึกษาที่แข็งแกร่ง: CCIS เป็นผู้เชี่ยวชาญในการให้บริการวิจัยตลาดอย่างละเอียด ทรัพยากรการศึกษาและเครื่องมือเช่นเครื่องคัดข้อมูลหุ้น สิ่งนี้ช่วยเสริมแรงนักลงทุนด้วยข้อมูลและข้อมูลที่จำเป็นในการตัดสินใจลงทุนที่มีความรู้

ผลิตภัณฑ์การลงทุนที่เชี่ยวชาญ: CCIS นำเสนอผลิตภัณฑ์การลงทุนนวัตกรรมที่เหมาะกับตลาดที่เฉพาะเจาะจง เช่น กองทุนปิดและกองทุนปิดที่มุ่งเน้นภูมิภาคเช่นฮ่องกง สหรัฐอเมริกา และเมียนมาร์ การเชี่ยวชาญนี้เป็นการสะท้อนความคล่องตัวของพวกเขาในการปรับตัวต่อความต้องการของนักลงทุนที่หลากหลายและสภาวะตลาด

ติดต่อสื่อสารได้หลายช่องทาง: พวกเขาให้การสนับสนุนลูกค้าที่สะดวกสบายผ่านช่องทางหลายรูปแบบรวมถึงโทรศัพท์ แฟกซ์ และอีเมล

ข้อเสีย:โฟกัสทางภูมิศาสตร์: ในขณะที่ CCIS โฟกัสที่ภูมิภาคใหญ่จีนและภูมิภาคแปซิฟิกเอเชีย บริการของพวกเขาอาจไม่ครอบคลุมหรือเชี่ยวชาญมากพอสำหรับลูกค้าที่มองหาเกินตลาดเหล่านี้

ข้อมูลจำกัดเกี่ยวกับบัญชี แพลตฟอร์ม และวิธีการจัดการกองทุน: ขาดข้อมูลที่ละเอียดเกี่ยวกับประเภทบัญชีที่เฉพาะเจาะจงของ CCIS แพลตฟอร์มการซื้อขายออนไลน์และวิธีการที่พวกเขาใช้ในการจัดการกองทุน สิ่งนี้อาจทำให้ลูกค้าที่สนใจพบความยากลำบากในการเข้าใจด้านปฏิบัติการของบริการของพวกเขาอย่างเต็มที่

China Credit International Securities ปลอดภัยหรือไม่?

China Credit International Securities ดำเนินการภายใต้การควบคุมของ หน่วยงานกำกับดูแลหลักทรัพย์และประกันภัย (SFC) โดยถือใบอนุญาต เลขที่ BHG531 SFC เป็นหน่วยงานกำกับดูแลทางการเงินที่สำคัญในศูนย์ทางการเงินระดับโลก มีเป้าหมายหลักในการเพิ่มประสิทธิภาพและปกป้องความมั่นคงและความน่าเชื่อถือของตลาดหลักทรัพย์และตลาดฟิวเจอร์ของฮ่องกง วัตถุประสงค์หลักของ SFC คือให้แนวทางในการทำงานของตลาดเหล่านี้ด้วยความโปร่งใส ความเทียบเท่า และความมีประสิทธิภาพ โดยนำไปสู่การเสริมสร้างความเชื่อมั่นของนักลงทุนและเสริมสร้างอุตสาหกรรมโดยรวม SFC มีกรอบกำกับดูแลที่ออกแบบมาเพื่อรักษามาตรฐานการปกครองที่สูงสุด ลดความเสี่ยง และส่งเสริมการเติบโตอย่างยั่งยืน ซึ่งสร้างประโยชน์ต่อนักลงทุนและผู้มีส่วนได้ส่วนเสียในภูมิภาคการเงินของฮ่องกง

China Credit International Securities Services Review

บริษัท China Credit International Securities Services (CCISS) เชี่ยวชาญในการให้บริการผลิตภัณฑ์การลงทุนที่ครอบคลุมทุกภาคส่วน รวมถึง หลักทรัพย์ ฟิวเจอร์ ทุนเอกชน หนี้สินคงที่ ตลาดเงิน และการลงทุนทางเลือก

บริการหลักของพวกเขารวมถึงการจัดการพอร์ตตามต้องการ discretionary portfolio management โดยใช้ทีมลงทุนที่มีประสบการณ์เพื่อให้การวิเคราะห์และการจัดสรรที่กำหนดเองตามความเสี่ยงของลูกค้า สถานการณ์ทางการเงิน วัตถุประสงค์ในการลงทุน และระยะเวลา วิธีนี้มุ่งเน้นการส่งผลตอบแทนที่สม่ำเสมอในตลาด

นอกจากการจัดการพอร์ต CCISS ยังเป็นผู้เชี่ยวชาญในการให้บริการ offshore fund solutions พวกเขานำเสนอผลิตภัณฑ์กองทุนที่แข่งขันได้ที่ปรับให้เหมาะสมสำหรับนักลงทุนรายบุคคลและสถาบัน โดยเฉพาะอย่างยิ่งพวกเขากำลังเปิดกองทุนการลงทุนที่เปิดให้บริการในตลาดหลักทรัพย์ฮ่องกงและสหรัฐอเมริกา รวมถึงกองทุนการลงทุนที่มุ่งเน้นโครงการพัฒนาอสังหาริมทรัพย์ในเมียนมาร์ เป็นการแสดงถึงความคล่องแคล่วในการจับตามโอกาสการลงทุนที่เกิดขึ้นในภูมิภาคเอเชีย-แปซิฟิก

นอกจากนี้ CCISS ดำเนินการแพลตฟอร์มการจัดการกองทุนอย่างครบวงจรที่ช่วยให้ง่ายต่อการสร้างกองทุน การดูแลการปฏิบัติตามกฎระเบียบ การควบคุมความเสี่ยง และการสนับสนุนการดำเนินงาน แพลตฟอร์มที่ให้บริการครอบคลุมนี้ช่วยลดความซับซ้อนในการดูแลกองทุน เช่น เปิดบัญชีธนาคารและโครงสร้างภาษี ทำให้ผู้จัดการกองทุนสามารถ Concentrate ในการสร้างผลตอบแทนที่เหมาะสมสำหรับกองทุนที่เขาดูแล

Research & Education

China Credit International Securities ให้บริการชุดทรัพยากรวิจัยและการศึกษา การวิจัยของพวกเขารวมถึง การเสนอราคาและแผนภูมิที่ละเอียด เพื่อสนับสนุนการวิเคราะห์ทางเทคนิคสำหรับนักเทรด นอกจากนี้พวกเขายังมี stock screener และ analyzers สำหรับเครื่องมือการเงินที่ซับซ้อน เช่น Callable Bull/Bear Contracts (CBBCs) และ warrents เพื่อช่วยให้นักลงทุนประเมินความเสี่ยงและผลตอบแทนที่เป็นไปได้

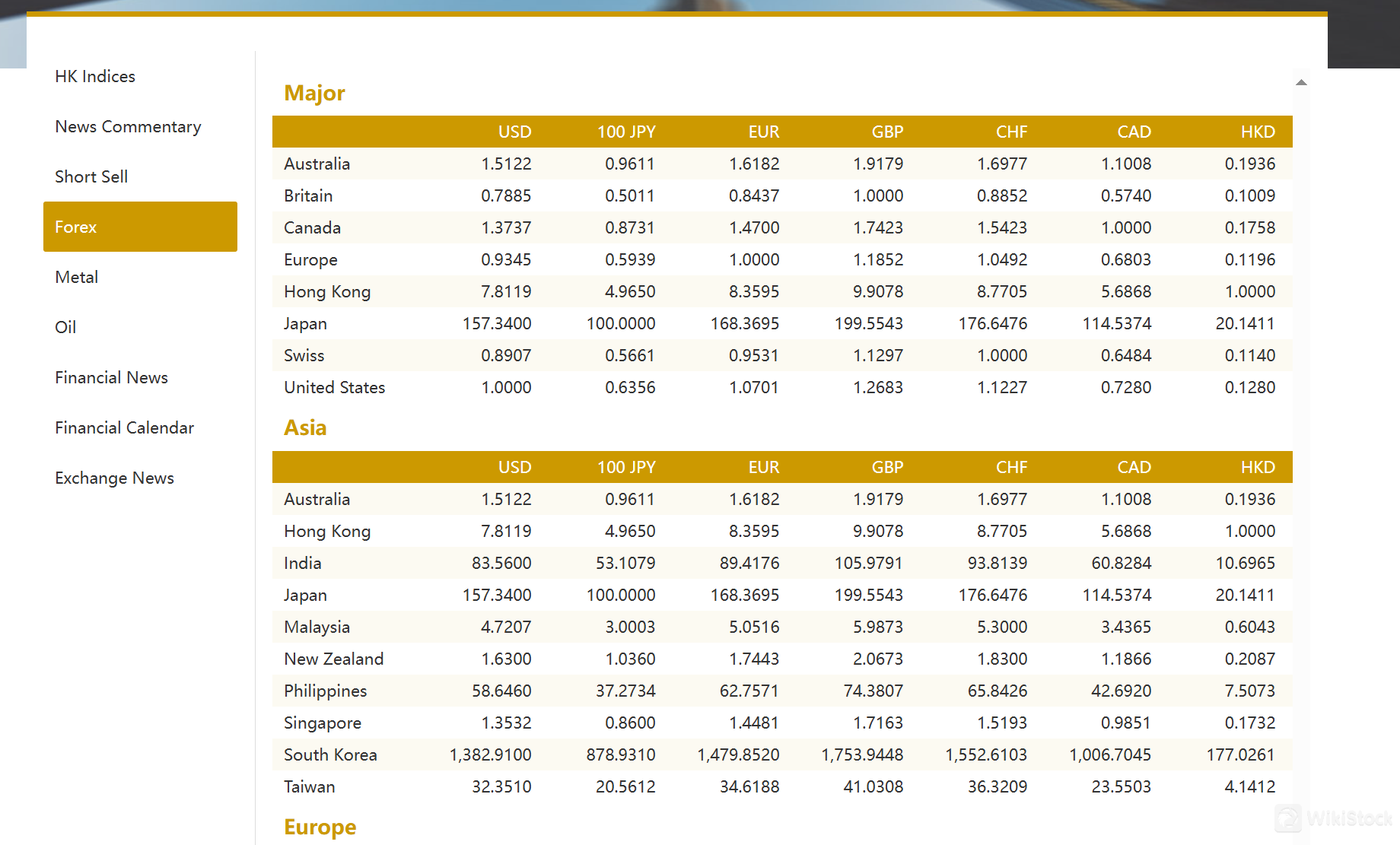

นอกจากนี้ China Credit International Securities ยังให้ข้อมูลตลาด market information อัพเดต เช่น ดัชนีฮ่องกง ข้อมูลการขายหุ้นโดยสั้น และอัตราแลกเปลี่ยนเงินตราต่างประเทศ เพื่อให้ลูกค้าทราบข่าวสารตลาด การครอบคลุมข่าวทางการเงินที่แข็งแกร่งและปฏิทินการเงินที่ละเอียดเพิ่มข้อมูลให้แก่นักลงทุนเกี่ยวกับแนวโน้มของตลาดและเหตุการณ์ที่ส่งผลต่อทิศทางการเงินทั่วโลกทันที

ในเชิงการศึกษา บริษัทนี้ให้ข้อมูล IPO information เพื่อช่วยให้นักลงทุนเข้าใจแนวโน้มของการเสนอขายใหม่และผลกระทบต่อพอร์ตการลงทุน ทรัพยากรการศึกษานี้ช่วยให้ลูกค้ามีการเข้าถึงทรัพยากรที่จำเป็นในการนำทางในตลาดการเงินอย่างมีประสิทธิภาพ

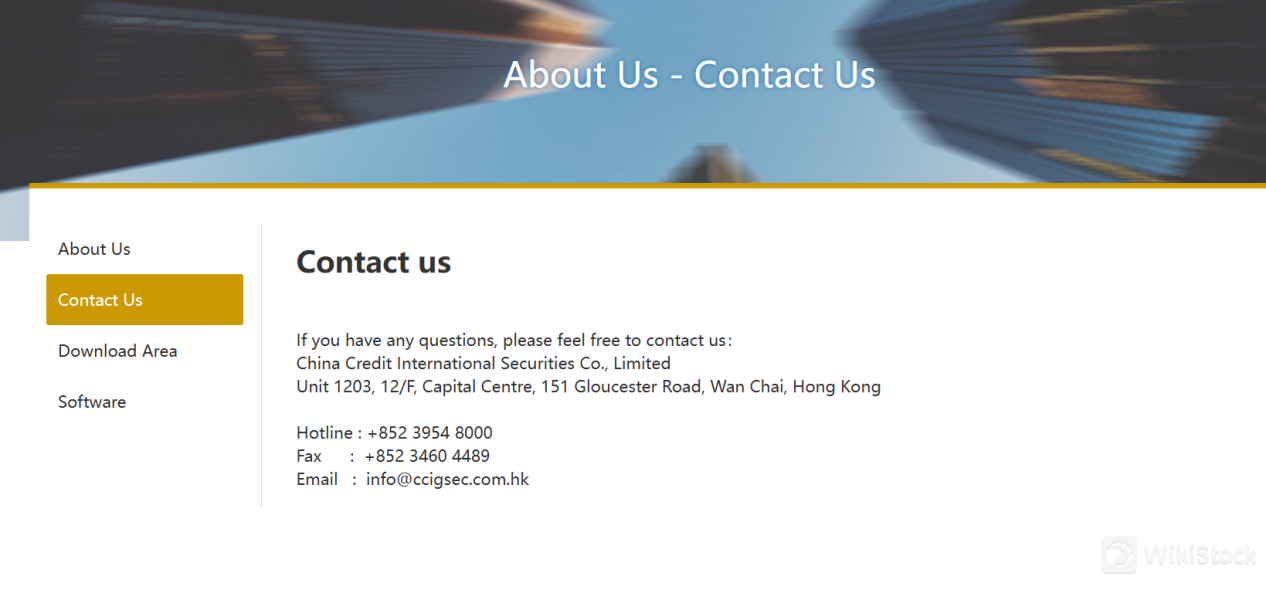

บริการลูกค้า

ลูกค้าสามารถเข้าชมสำนักงานหรือติดต่อสายบริการลูกค้าโดยใช้ข้อมูลดังต่อไปนี้:

โทรศัพท์: +852 3954 8000

แฟกซ์: +852 3460 4489

อีเมล: info@ccigsec.com.hk

ที่อยู่: ห้อง 1203 ชั้น 12 อาคาร Capital Centre ถนน Gloucester 151 แขวง Wan Chai เขตฮ่องกง

สรุป

ในสรุป บริษัท CCIS มีตัวเลือกสำหรับนักลงทุนที่ต้องการบริการทางการเงินที่ได้รับการควบคุมโดยหน่วยงานกำกับการเงิน โดยมีการเน้นที่แข่งขันในภูมิภาคใหญ่ของจีนและภูมิภาคแปซิฟิกเอเชีย บริษัท CCIS มั่นใจในการปฏิบัติตามมาตรฐานที่เข้มงวด เพื่อสร้างความเชื่อมั่นและความเป็นธรรม จุดเด่นของพวกเขาอยู่ในความสามารถในการวิจัยที่แข็งแกร่ง ผลิตภัณฑ์การลงทุนที่เชื่อมโยงกับความต้องการของตลาดที่หลากหลาย และการสนับสนุนลูกค้าที่สามารถเข้าถึงได้ผ่านช่องทางหลายรูปแบบ อย่างไรก็ตาม ลูกค้าอาจพบความท้าทายในการเข้าถึงข้อมูลละเอียดเกี่ยวกับประเภทบัญชีที่เฉพาะเจาะจง แพลตฟอร์ม และวิธีการจัดการกองทุน โดยรวมแล้ว CCIS โดดเด่นด้านความเชี่ยวชาญในภูมิภาคและการปฏิบัติตามกฎระเบียบ แต่อาจมีประโยชน์จากความโปร่งใสที่เพิ่มขึ้นเกี่ยวกับรายละเอียดการดำเนินงานเพื่อให้บริการนักลงทุนที่มีศักยภาพได้ดียิ่งขึ้น

คำถามที่พบบ่อย (FAQs)

CCIS ได้รับการควบคุมหรือไม่?

ใช่ มีการควบคุมโดย SFC

บริการประเภทใดที่ China Credit International Securities ให้บริการ?

มีการให้บริการผลิตภัณฑ์การลงทุน การจัดการพอร์ตการลงทุน การแก้ปัญหากองทุนนอกชายฝั่งและการจัดการกองทุน

วิธีการติดต่อ China Credit International Securities คืออะไร?

คุณสามารถติดต่อได้ทางโทรศัพท์: +852 3954 8000, แฟกซ์: +852 3460 4489 และอีเมล: info@ccigsec.com.hk

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้ไว้เป็นผลมาจากการประเมินของผู้เชี่ยวชาญของ WikiStock จากข้อมูลเว็บไซต์ของโบรกเกอร์และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการเสี่ยงที่สูง อาจ导致สูญเสียทั้งหมดของเงินลงทุน ดังนั้นการเข้าใจความเสี่ยงที่เกี่ยวข้องก่อนที่จะลงมือเป็นสิ่งสำคัญ

อื่น ๆ

Registered region

ฮ่องกงจีน

ปีในธุรกิจ

5-10 ปี

New Stock Trading

Yes

ประเทศที่ได้รับการควบคุม

1

ผลิตภัณฑ์ทางการเงิน

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

ดาวน์โหลดแอป

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

Matrix Securities

คะแนน

NG

คะแนน

常匯證券

คะแนน

興旺證券

คะแนน

ZSL

คะแนน

Cornerstone Securities

คะแนน

GSL

คะแนน

Huayu Securities

คะแนน

Chelsea Securities

คะแนน

West Bull

คะแนน