คะแนน

Silverbricks Securities

http://www.silverbricks.com.hk/

Website

ดัชนีคะแนน

การประเมินนายหน้า

อิทธิพล

D

ดัชนีอิทธิพล NO.1

ฮ่องกงจีน

ฮ่องกงจีนความหลากหลาย

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

เหนือกว่า 2.78% โบรกเกอร์

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 2

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตซื้อขายหลักทรัพย์

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตจัดการกองทุน

ที่นั่งทั่วโลก

![]() เป็นเจ้าของ 1 ที่นั่ง

เป็นเจ้าของ 1 ที่นั่ง

ฮ่องกงจีน HKEX

Seat No. 02128

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

Silverbricks Securities Company Limited

ชื่อย่อบริษัท

Silverbricks Securities

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

http://www.silverbricks.com.hk/ตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

ดาวน์โหลดแอป

- รอบ

- ดาวน์โหลด

- 2024-05

- 1529

กฎ: ข้อมูลที่แสดงคือการดาวน์โหลดแอปในหนึ่งปีก่อนหน้าปัจจุบัน

ความนิยมในระดับภูมิภาคของแอป

- ประเทศ/ภูมิภาคดาวน์โหลดอัตราส่วน

ฮ่องกงจีน

147296.27%ประเทศจีน

442.88%อื่น ๆ

130.85%

กฎ: ข้อมูลจะแสดงเป็นการดาวน์โหลดและส่วนแบ่งภูมิภาคของแอปในหนึ่งปีก่อนปัจจุบัน

คุณสมบัติของโบรกเกอร์

New Stock Trading

Yes

Margin Trading

YES

ประเทศที่ได้รับการควบคุม

1

ผลิตภัณฑ์ทางการเงิน

6

| Silverbricks Securities |  |

| คะแนน WikiStock | ⭐⭐⭐ |

| ยอดเงินฝากขั้นต่ำ | $0 |

| ค่าธรรมเนียม | ค่าคอมมิชชั่นการซื้อขายหลักทรัพย์: ขั้นต่ำ HK$50ค่าบริการการจัดการและการตั้งค่าสัญญาซื้อขายหลักทรัพย์ทางกายภาพและการตั้งค่า: ขั้นต่ำ HK$0ค่าบริการผู้ถือหุ้นและการกระทำของบริษัท: ขั้นต่ำ HK$30ค่าบริการอื่น ๆ: ขั้นต่ำ HK$0ค่าคอมมิชชั่นสินทรัพย์ภายในอนาคตและตัวเลือก: แตกต่างกันตามหัวข้อที่แตกต่างกันการบริหารจัดการสินทรัพย์: ไม่ระบุ |

| ค่าธรรมเนียมบัญชี | แตกต่างกันตามการระบุตัวตนที่แตกต่างกัน |

| ดอกเบี้ยเงินสดที่ไม่ได้ลงทุน | HK$0 |

| อัตราดอกเบี้ยเงินยืม | 0% |

| กองทุนรวมที่มีการเสนอขาย | ใช่ |

| แอป/แพลตฟอร์ม | มีให้บริการบน Google Play, Apple Store และเว็บ |

| โปรโมชั่น | ไม่มี |

สินทรัพย์ Silverbricks คืออะไร?

Silverbricks เป็นโบรกเกอร์ออนไลน์ที่ให้บริการหลากหลายด้านโดยไม่มีข้อกำหนดขั้นต่ำในบัญชี มันให้ค่าธรรมเนียมที่แข่งขันได้รวมถึงค่าคอมมิชชั่นการซื้อขายหลักทรัพย์ขั้นต่ำ HK$50 และค่าใช้จ่ายที่แตกต่างกันสำหรับบริการอื่น ๆ และซื้อขายอนาคต/ตัวเลือก แพลตฟอร์มรองรับกองทุนรวมและดำเนินการด้วยโครงสร้างค่าธรรมเนียมที่เข้าใจง่ายที่ตรงกับการระบุตัวตนของนักลงทุนที่แตกต่างกัน สามารถเข้าถึงได้ผ่านแอปบนมือถือบน Google Play และ Apple Store รวมถึงผ่านแพลตฟอร์มเว็บ เพื่อความสะดวกในการจัดการการลงทุนของผู้ใช้

ข้อดีและข้อเสียของสินทรัพย์ Silverbricks

สินทรัพย์ Silverbricks มีจุดเด่นหลายอย่างรวมถึงการไม่มีข้อกำหนดขั้นต่ำในบัญชีที่ทำให้การลงทุนเป็นไปได้สำหรับทุกคน มันมีค่าธรรมเนียมที่แข่งขันได้ แม้ว่าโครงสร้างค่าธรรมเนียมของมันจะซับซ้อน โดยมีค่าใช้จ่ายที่แตกต่างกันขึ้นอยู่กับประเภทบัญชีและบริการที่ใช้ ความพร้อมใช้งานของแพลตฟอร์มบนหลายแพลตฟอร์ม - Google Play, Apple Store และเว็บ - เพิ่มความสะดวกสบายให้แก่ผู้ใช้ อย่างไรก็ตาม ข้อเสียที่อาจเกิดขึ้นคือข้อมูลที่จำกัดเกี่ยวกับการซื้อขายอนาคตและตัวเลือกซึ่งอาจไม่สามารถพอใจนักซื้อขายที่มีความต้องการข้อมูลละเอียดอย่างละเอียด

| ข้อดี | ข้อเสีย |

|

|

|

|

|

|

สินทรัพย์ Silverbricks ปลอดภัยหรือไม่?

กฎระเบียบ

Silverbricks Securities ได้รับใบอนุญาตและควบคุมโดย สำนักงานหลักทรัพย์และอนุพันธ์ของฮ่องกงในจีน (SFC) ภายใต้หมายเลขใบอนุญาต BLN458 และ BNJ665

สิ่งที่เป็นหลักทรัพย์ในการซื้อขายกับ Silverbricks Securities

Silverbricks Securities ให้บริการผลิตภัณฑ์การลงทุนที่หลากหลายรวมถึง หุ้น, ตัวเลือก และ ฟิวเจอร์ อย่างไรก็ตาม ปัจจุบันไม่มีการเสนอซื้อขาย หุ้นตราสารหนี้หรือซื้อขายเงินตราต่างประเทศ จำกัดขอบเขตสำหรับนักลงทุนที่สนใจในกลุ่มสินทรัพย์เหล่านี้

นอกจากผลิตภัณฑ์เหล่านี้ Silverbricks Securities ยังให้บริการการบริหารจัดการสินทรัพย์

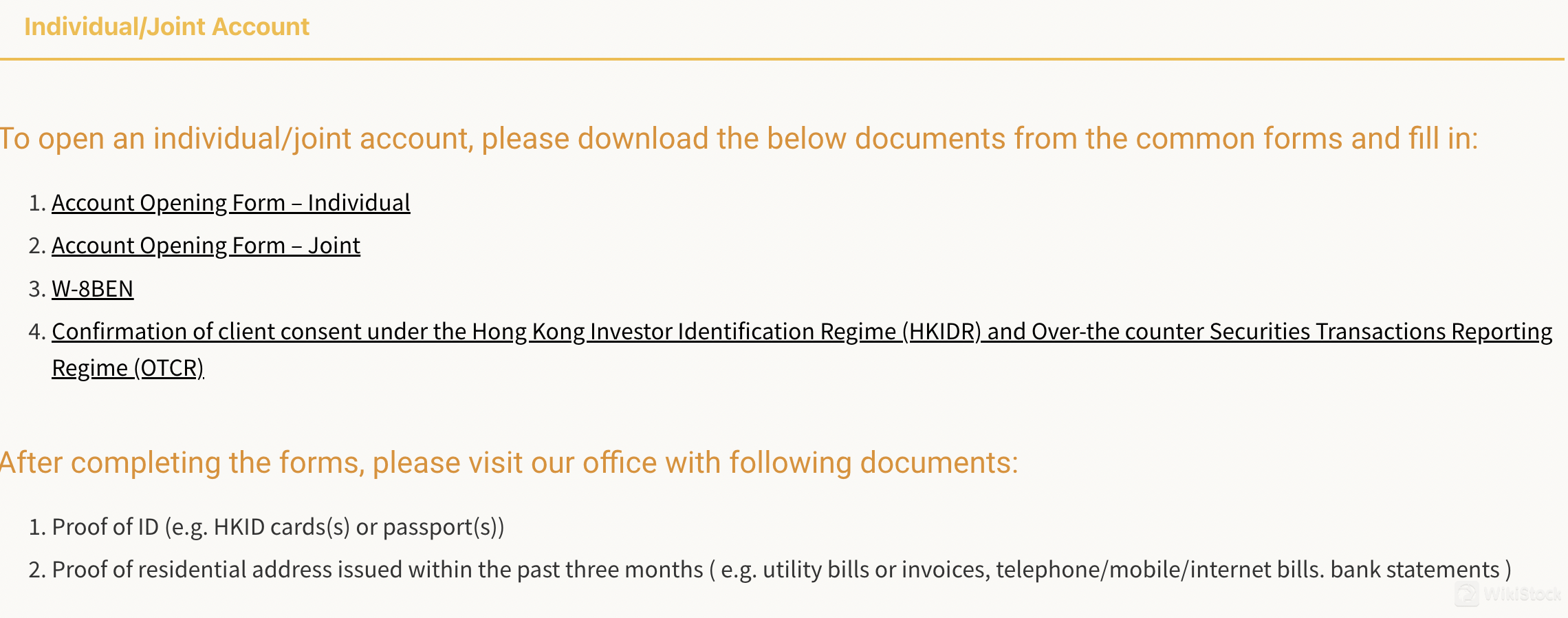

บัญชี Silverbricks Securities

Silverbricks Securities มีชนิดบัญชีที่หลากหลายเพื่อเข้ากับความต้องการของนักลงทุนที่แตกต่างกัน บัญชีบุคคลและบัญชีร่วมสามารถใช้ได้สำหรับนักลงทุนส่วนบุคคลที่ต้องการจัดการการลงทุนของตนเองหรือร่วมกับคู่สมรสหรือคู่ค้า บัญชีเหล่านี้ช่วยให้บุคคลสามารถซื้อขายหลักทรัพย์และเข้าถึงผลิตภัณฑ์การลงทุนต่างๆ ที่ Silverbricks นำเสนอ นอกจากนี้ยังมีการให้บริการบัญชีบริษัทสำหรับธุรกิจและองค์กรที่ต้องการจัดการการลงทุนและใช้ประโยชน์จากโอกาสในตลาด แต่ละประเภทของบัญชีถูกออกแบบให้เหมาะสมเพื่อให้ได้ความยืดหยุ่นและเข้าถึงบริการของแพลตฟอร์ม โดยให้นักลงทุนสามารถปรับกลยุทธ์การลงทุนของตนให้เข้ากับเป้าหมายการเงินและความชอบใจของตน

ค่าธรรมเนียม Silverbricks Securities

Silverbricks Securities มีโครงสร้างค่าธรรมเนียมโปร่งใสสำหรับการซื้อขายหลักทรัพย์ ค่าคอมมิชชั่นสำหรับการซื้อขายทางโทรศัพท์และอินเทอร์เน็ตสามารถเจรจาได้โดยมีค่าธรรมเนียมขั้นต่ำ 50 ดอลลาร์ฮ่องกง ค่าธรรมเนียม CCASS เท่ากับ 0.01% ของจำนวนธุรกรรม ระหว่าง 3 ดอลลาร์ฮ่องกงถึง 300 ดอลลาร์ฮ่องกง อัตราอากรแสตมป์เท่ากับ 0.1% ของมูลค่า ปัดเศษขึ้นเป็นพันดอลลาร์ฮ่องกง ค่าธรรมเนียมเพิ่มเติมประกอบด้วยค่าภาษีธุรกรรม 0.0027% ค่าธรรมเนียมการซื้อขาย 0.00565% และค่าธรรมเนียมธุรกรรม FRC 0.00015% นอกจากนี้ Silverbricks Securities ยังให้บริการฝากเก็บฟรี เพิ่มความน่าสนใจสำหรับนักลงทุนที่ต้องการประหยัดค่าใช้จ่าย

Silverbricks Securities ให้บริการด้านการจัดการและการตั้งค่าสลิปทรัพย์อย่างครบวงจร สำหรับการฝากหุ้น มีการเรียกเก็บอากรแสตมป์ในอัตรา HK$5 ต่อใบรับรองหรือเอกสารการโอน โดยไม่มีค่าฝากเก็บรักษา การถอนหุ้นมีค่าธรรมเนียมการดำเนินการในอัตรา HK$5 ต่อล็อตบอร์ด (หรือสำหรับล็อตที่ไม่เป็นจำนวนเต็ม) และค่าธรรมเนียมการจัดการแบบคงที่ในอัตรา HK$150 โดยไม่คำนึงถึงจำนวนหุ้น ค่าธรรมเนียมคำสั่งซื้อขายหุ้นผ่าน CCASS สำหรับการฝากหุ้นฟรี ในขณะที่การถอนหุ้นมีค่าใช้จ่าย 0.03% ของมูลค่าหุ้น (ขั้นต่ำ HK$3) รวมถึงค่าธรรมเนียมการจัดการในอัตรา HK$100 ต่อหุ้น การทำธุรกรรมคำสั่งซื้อขายหุ้นผ่าน Investor Settlement Instruction สำหรับการฝากฟรี และมีค่าธรรมเนียมต่อหุ้น HK$30 สำหรับการถอน

Silverbricks Securities ยังให้บริการด้านการเป็นผู้รับมอบอำนาจและการจัดการกิจกรรมบริษัทอย่างครบวงจร การเก็บเงินปันผลมีค่าธรรมเนียม 0.50% (ขั้นต่ำ HK$30, สูงสุด HK$5,000) รวมถึงค่าธรรมเนียมสลิปต่อล็อตบอร์ดในอัตรา HK$2 การเก็บเงินโบนัสและสิทธิ์มีค่าธรรมเนียมการจัดการแบบคงที่ในอัตรา HK$30 และค่าธรรมเนียมสลิปต่อล็อตบอร์ดในอัตรา HK$2 การสมัครสิทธิ์ การแปลงสิทธิ์ใบสำคัญและการเสนอเงินสดมีค่าใช้จ่าย HK$30 ต่อรายการ รวมถึงค่าธรรมเนียมกิจกรรมบริษัทเพิ่มเติม ในอัตรา HK$1 ต่อล็อตบอร์ด การเสนอเงินสดยังมีค่าธรรมเนียมแสตมป์ในอัตรา 0.13% การเรียกเก็บเงินปันผลมีค่าใช้จ่าย 0.50% ของจำนวนเงินทั้งหมด (ขั้นต่ำ HK$30, สูงสุด HK$5,000) รวมถึงค่าธรรมเนียมการจัดการในอัตรา HK$500

การสมัคร IPO, การหยุดเช็คและการคืนเช็คมีค่าธรรมเนียมการจัดการแบบคงที่ในอัตรา HK$100 การทำซ้ำของรายงานฉบับเดิมฟรีภายใน 3 เดือน และค่าธรรมเนียม HK$30 ต่อชุดต่อมา การยืนยันการตรวจสอบมีค่าใช้จ่ายในอัตรา HK$200 ต่อจดหมาย บริษัทไม่เรียกเก็บดอกเบี้ยในยอดเงินคงเหลือ อัตราดอกเบี้ยเกินกำหนดการชำระเงินคืออัตราดอกเบี้ยหลัก + 8% สำหรับบัญชีผู้เก็บรักษาและอัตราดอกเบี้ยหลัก + 4.625% (ต่อรองได้) สำหรับบัญชีมาร์จิน บริการโอนเงินผ่าน CHATS (ยกเว้นธนาคารจีนฮ่องกง) มีราคา HK$300 สำหรับสกุลเงินท้องถิ่นและ HK$400 สำหรับการทำธุรกรรมสกุลเงินต่างประเทศหลังเวลา 11 โมงเช้า โครงสร้างค่าธรรมเนียมนี้สมดุลกับการเข้าถึงและการกำหนดราคาที่แข่งขันสำหรับบริการทางการเงินรองที่หลากหลาย

รีวิวแอปพลิเคชัน Silverbricks Securities

Silverbricks Securities มีแอปพลิเคชันที่ใช้งานง่ายสะดวกสำหรับอุปกรณ์ Android ใน Google Play และอุปกรณ์ iOS ใน Apple Store นอกจากนี้ยังมีแพลตฟอร์มเว็บของตนเองอีกด้วย แอปพลิเคชันนี้ให้การเข้าถึงที่สะดวกสบายสำหรับนักลงทุนในการจัดการพอร์ตการซื้อขายและการติดตามแนวโน้มของตลาดได้ทุกที่ ด้วยอินเตอร์เฟซที่เรียบง่ายและฟังก์ชันที่แข็งแกร่งผู้ใช้สามารถทราบข้อมูลเกี่ยวกับการลงทุนของตนและตัดสินใจทันเวลาจากอุปกรณ์มือถือหรือคอมพิวเตอร์เดสก์ท็อปของพวกเขา

บริการลูกค้า

ลูกค้าสามารถติดต่อ Silverbricks Securities ผ่านช่องทางต่อไปนี้:

ที่อยู่ : ห้อง 1004-1006, ชั้น 10, อาคาร Shun Tak Centre, ตึก China Merchants Tower, ถนนคอนโนทราคลองเฉิน, เฉินวาน, ฮ่องกง

หมายเลขโทรศัพท์ : (852) 3998 5120

หมายเลขแฟกซ์ : (852) 3618 4832

สรุป

ในสรุป Silverbricks Securities นำเสนอแพลตฟอร์มโบรกเกอร์ที่หลากหลายและเข้าถึงได้ง่ายโดยไม่มีข้อกำหนดขั้นต่ำในบัญชี มีประเภทบัญชีที่หลากหลายและค่าธรรมเนียมที่แข่งขัน อินเทอร์เฟซที่ใช้งานง่ายบนมือถือและเว็บ ร่วมกับเครื่องมือการซื้อขายที่ทนทาน ทำให้เหมาะสำหรับนักเทรดและนักลงทุนระดับเริ่มต้นถึงระดับกลางที่ต้องการความยืดหยุ่นและคุ้มค่า แม้ว่าแพลตฟอร์มจะเหมาะสำหรับการซื้อขายหุ้น กองทุน ETF และตัวเลือกพื้นฐาน แต่นักเทรดระดับสูงกว่าที่กำลังจะซื้อขายสินค้าซับซ้อนหรือต้องการเครื่องมือวิจัยที่เป็นมากกว่าอาจพบว่าข้อเสนอจำกัด

คำถามที่พบบ่อย

ว่า Silverbricks Securities เป็นแพลตฟอร์มที่ดีสำหรับผู้เริ่มต้นหรือไม่?

Silverbricks Securities ถือว่าเหมาะสำหรับผู้เริ่มต้นเนื่องจากมีอินเทอร์เฟซที่ใช้งานง่ายและทรัพยากรการศึกษา อย่างไรก็ตาม ผู้เริ่มต้นควรทำการวิจัยอย่างละเอียดและเข้าใจโครงสร้างค่าธรรมเนียมของแพลตฟอร์ม บริการที่มี และการสนับสนุนลูกค้าก่อนตัดสินใจ

ว่า Silverbricks Securities เป็นแพลตฟอร์มที่ถูกต้องหรือไม่?

ตั้งแต่การอัปเดตครั้งล่าสุดในมกราคม 2022 Silverbricks Securities ยังไม่ได้รับความรู้จักอย่างแพร่หลาย ในการกำหนดความถูกต้องของมัน คุณควรตรวจสอบว่ามีการลงทะเบียนกับหน่วยงานกำกับดูแลทางการเงินที่เกี่ยวข้องในประเทศของคุณ อ่านรีวิวจากผู้ใช้งานอื่น ๆ และตรวจสอบว่ามันตรงตามมาตรฐานอุตสาหกรรมสำหรับความปลอดภัยและความโปร่งใส

ว่า Silverbricks Securities เหมาะสำหรับการลงทุน/เกษียณหรือไม่?

ความเหมาะสมของ Silverbricks Securities สำหรับการลงทุนหรือเกษียณขึ้นอยู่กับหลายปัจจัย รวมถึงช่วงของตัวเลือกการลงทุนที่มี ค่าธรรมเนียมที่เรียกเก็บ คุณภาพการบริการลูกค้า และว่ามันมีบัญชีหรือบริการที่เกี่ยวกับการเกษียณหรือไม่ ควรทำการเปรียบเทียบกับแพลตฟอร์มอื่น ๆ และปรึกษากับที่ปรึกษาทางการเงินเพื่อตัดสินใจที่มีข้อมูลเพียงพอเพื่อให้สอดคล้องกับเป้าหมายการลงทุนและความต้องการของคุณเอง

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้ไว้เป็นผลจากการประเมินของผู้เชี่ยวชาญของ WikiStock จากข้อมูลเว็บไซต์ของโบรกเกอร์และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการเสี่ยงที่สูง อาจ导致การสูญเสียเงินลงทุนทั้งหมด ดังนั้นการเข้าใจความเสี่ยงที่เกี่ยวข้องก่อนที่จะเข้ามาเป็นสิ่งสำคัญ

อื่น ๆ

Registered region

ฮ่องกงจีน

ปีในธุรกิจ

1-2 ปี

ผลิตภัณฑ์ทางการเงิน

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

瑞达国际

คะแนน

Huajin International

คะแนน

CLSA

คะแนน

Sanfull Securities

คะแนน

DL Securities

คะแนน

嘉信

คะแนน

GF Holdings (HK)

คะแนน

China Taiping

คะแนน

Capital Securities

คะแนน

乾立亨證券

คะแนน