คะแนน

ดัชนีคะแนน

การประเมินนายหน้า

อิทธิพล

C

ดัชนีอิทธิพล NO.1

ชิลี

ชิลีความหลากหลาย

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 2

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตซื้อขายหลักทรัพย์

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตซื้อขายสัญญาซื้อขายล่วงหน้า

ที่นั่งทั่วโลก

![]() เป็นเจ้าของ 1 ที่นั่ง

เป็นเจ้าของ 1 ที่นั่ง

ฮ่องกงจีน HKEX

Seat No. 01209

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

Mason Group Holdings Limited

ชื่อย่อบริษัท

MGHL

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

https://www.masonsec.com/en/ตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

| Aspects | ข้อมูล |

| ชื่อบริษัท | MGHL |

| ปีในธุรกิจ | 1-2 ปี |

| เขตลงทะเบียน | จีนฮ่องกง |

| สถานะกฎหมาย | อยู่ในการควบคุมของ SFC |

| หลักทรัพย์ที่สามารถซื้อขายได้ | หลักทรัพย์ฮ่องกง, หลักทรัพย์ทั่วโลก, ฟิวเจอร์, ตัวเลือก |

| บริการ | Shanghai-Hong Kong / Shenzhen-Hong Kong stock Connect, ราคาสตรีมมิ่งแบบเรียลไทม์ |

| การซื้อขายเงินทุน | ใช่ |

| การซื้อขายหุ้นใหม่ | ใช่ |

| แพลตฟอร์ม/แอป | SP Trader, SP Trader Mobile, Mason Trade APP |

| โปรโมชั่น | โบนัสสูงสุด 300 ดอลลาร์ |

| ฝากเงินและถอนเงิน | โอนเงินผ่านธนาคาร (HSBC, BOC, DBS) |

| บริการลูกค้า | อีเมล: cs@masonhk.com, โทรศัพท์: (852) 2218-2818 |

| ทรัพยากรการศึกษา | สัมมนาการลงทุน |

MGHL คืออะไร?

MGHL เป็นบริษัทหลักทรัพย์ฮ่องกง ซึ่งเน้นในการซื้อขายหลักทรัพย์และฟิวเจอร์ มีฐานที่จีนฮ่องกงและดำเนินธุรกิจมา1-2 ปี อยู่ในการควบคุมของ SFC บริษัทนี้ให้บริการการซื้อขายหลักทรัพย์ฮ่องกงและทั่วโลก, ฟิวเจอร์, และตัวเลือก และให้บริการเช่นShanghai-Hong Kong/Shenzhen-Hong Kong stock Connect และราคาสตรีมมิ่งแบบเรียลไทม์

พวกเขาสนับสนุนการซื้อขายเงินทุนและหุ้นใหม่ โดยใช้แพลตฟอร์มเช่น SP Trader, SP Trader Mobile และ Mason Trade APP โปรโมชั่นปัจจุบันรวมถึงโบนัสสูงสุด 300 ดอลลาร์ และลูกค้าสามารถดำเนินการธุรกรรมผ่านทางการโอนเงินผ่านธนาคาร HSBC, BOC และ DBS

MGHL ให้บริการลูกค้าทางอีเมลและโทรศัพท์ และมีโอกาสในการศึกษาผ่านสัมมนาการลงทุน

สถานะกฎหมาย

MGHL ได้รับการควบคุมภายใต้หมายเลขใบอนุญาต AAC086 จาก สำนักงานกองทรัพย์และกองฟิวเจอร์ (SFC) ของฮ่องกง ใบอนุญาตนี้รับรองว่า MGHL ปฏิบัติตามกรอบกฎหมายและแนวปฏิบัติที่ควบคุมการซื้อขายหลักทรัพย์และฟิวเจอร์ในตลาดฮ่องกง

นอกจากนี้ MGHL ยังได้รับใบอนุญาตกฎหมายอีกหนึ่งใบ หมายเลข AAG007 ที่ออกโดย สำนักงานกองทรัพย์และกองฟิวเจอร์ (SFC) ของฮ่องกง ใบอนุญาตนี้ยืนยันว่า MGHL ปฏิบัติตามมาตรฐานที่เข้มงวดที่จำเป็นสำหรับการดำเนินงานทางการเงินภายในฮ่องกง ย้ำให้เห็นถึงความมุ่งมั่นของบริษัทในการรักษามาตรฐานการปฏิบัติอาชีพระดับสูงและการรักษาความปลอดภัยของการลงทุนของลูกค้า

ข้อดีและข้อเสีย

| ข้อดี | ข้อเสีย |

| บริการเชื่อมต่อสะดวกสบายของตลาดหลักทรัพย์ในภูมิภาคและฮ่องกง | ไม่มีการสนับสนุนตลอด 24 ชั่วโมง |

| อยู่ในการควบคุมของ SFC | โครงสร้างค่าธรรมเนียมที่ไม่แน่นอน |

| สินทรัพย์ที่ซื้อขายได้หลากหลาย | วิธีการฝากเงินและถอนเงินจำกัด (โอนเงินผ่านธนาคารเท่านั้น) |

| โบนัสการแนะนำสูงสุด 300 ดอลลาร์ | |

| แพลตฟอร์มการซื้อขายเวอร์ชันมือถือ |

ข้อดี:

MGHL ได้รับการควบคุมโดยสำนักงานกองทรัพย์และกองฟิวเจอร์ (SFC) บริษัทนี้มีการซื้อขายสินทรัพย์ที่หลากหลายและแพลตฟอร์มการซื้อขายบนมือถือ เพิ่มความสะดวกในการซื้อขาย โบนัสการแนะนำสูงสุด 300 ดอลลาร์ ยังเป็นสิ่งที่น่าสนใจสำหรับลูกค้าใหม่

ข้อเสีย:

บริษัทขาดการสนับสนุนลูกค้าตลอด 24 ชั่วโมง ซึ่งอาจทำให้ลูกค้าที่ต้องการความช่วยเหลือในช่วงเวลาหลังเวลาทำการไม่สะดวกสบาย โครงสร้างค่าธรรมเนียมไม่ชัดเจน อาจเป็นปัจจัยที่ยับยั้งลูกค้าเนื่องจากขาดความโปร่งใสในการคิดค่าใช้จ่าย นอกจากนี้ ตัวเลือกการฝากเงินและถอนเงินถูกจำกัดเฉพาะการโอนเงินผ่านธนาคาร จำกัดความยืดหยุ่นในการจัดการกองทุน

หลักทรัพย์ที่สามารถซื้อขายได้

MGHL ให้ลูกค้ามีโอกาสที่จะซื้อขายหลักทรัพย์ในฮ่องกง ซึ่งรวมถึง หุ้นที่บัญชีในตลาดหลักทรัพย์ฮ่องกง นี้จะช่วยให้นักลงทุนสามารถเข้าถึงตลาดทางการเงินที่เป็นหนึ่งในตลาดทางการเงินที่มีความเคลื่อนไหวและมีความสำคัญที่สุดในเอเชีย ดึงดูดผู้ที่สนใจในสาขาที่หลากหลายตั้งแต่การเงินไปจนถึงเทคโนโลยี

นอกจากการเสนอขายในตลาดในประเทศ MGHL ยังให้บริการซื้อขายหลักทรัพย์ทั่วโลก นี้ช่วยให้นักลงทุนสามารถแจกแจงพอร์ตโดยการลงทุนในหุ้นและพันธบัตรระหว่างประเทศ ขยายการเผชิญหน้ากับตลาดทางการเงินระดับโลกและสถานการณ์เศรษฐกิจที่หลากหลาย

การซื้อขายสินค้าภายในอนาคต เป็นส่วนสำคัญอีกอย่างหนึ่งของบริการของ MGHL ที่ช่วยให้ลูกค้าสามารถพยากรณ์หรือป้องกันค่าความคาดหวังในอนาคตของสินค้าหลากหลายชนิด เช่น สินค้าโภคภัณฑ์ ดัชนี และเครื่องมือทางการเงิน สินค้าภายในอนาคตเป็นเครื่องมือสำคัญในการจัดการความเสี่ยงและใช้ประโยชน์จากการพยากรณ์ตลาด

สุดท้าย MGHL ยังให้บริการการซื้อขายตัวเลือก ซึ่งให้นักลงทุนสิทธิ์ แต่ไม่ใช่หน้าที่ ในการซื้อหรือขายสินทรัพย์ใต้สิทธิ์ในราคาที่กำหนดก่อนตัวเลือกหมดอายุ

บริการ

MGHL ให้บริการสองบริการที่สำคัญเพื่อเสริมสร้างความสามารถในการซื้อขายและการเข้าถึงตลาดสำหรับลูกค้าของตน:

Shanghai-Hong Kong/Shenzhen-Hong Kong Stock Connect: บริการนี้ช่วยให้นักลงทุนสามารถซื้อขายหุ้นที่มีคุณสมบัติที่เหมาะสมบนตลาดในซัมเจียงและเฉินเจียงผ่านแพลตฟอร์มฮ่องกง สร้างสะพานเชื่อมระหว่างตลาดหลักทรัพย์ในภาคบ้านและนักลงทุนระหว่างประเทศ ส facilitation การซื้อขายข้ามพรมแดนและการเสนอโอกาสการลงทุนที่กว้างขึ้นในหุ้นจีน

Real-Time Streaming Quotes: MGHL ให้บริการราคาสตรีมมิ่งแบบเรียลไทม์ ช่วยให้นักเทรดเข้าถึงราคาตลาดที่อัพเดตล่าสุดได้ทันที สิ่งนี้เป็นสิ่งสำคัญสำหรับการตัดสินใจที่มีข้อมูลทันเวลาในตลาดที่เคลื่อนไหวอย่างรวดเร็ว ในการให้ความสำคัญในการตอบสนองอย่างรวดเร็วต่อการเปลี่ยนแปลงในตลาดและการนำไปใช้โอกาสในการซื้อขาย

Mason Trade: นี่เป็นแพลตฟอร์มการซื้อขายและแอปพลิเคชันที่เพิ่งเปิดตัวอย่างใหม่ ออกแบบเพื่อสนับสนุนลูกค้าในการซื้อขายในตลาดหลายแห่งตลอดเวลาและทุกที่ Mason Trade ให้ความสามารถเช่นการซื้อขายในตลาดต่างๆผ่านแอปพลิเคชันเดียวกัน ตรวจสอบสถานะบัญชีและธุรกรรม ตั้งค่าการรับรองความถูกต้องสองขั้นตอน (2FA) และส่งเสริมการเปิดบัญชีออนไลน์สำหรับหลักทรัพย์และสินค้าภายในอนาคต

SP Trader และ SP Trader Mobile: แพลตฟอร์มเหล่านี้ถูกออกแบบมาเฉพาะสำหรับการซื้อขายสินค้าฟิวเจอร์และออปชัน SP Trader เป็นซอฟต์แวร์ที่สามารถดาวน์โหลดได้ซึ่งเข้ากันได้กับ Microsoft Windows และมีสภาพแวดล้อมการซื้อขายที่เสถียรและยืดหยุ่น แพลตฟอร์มนี้มีฟังก์ชันการเพิ่มประสิทธิภาพ เช่น เรียกดูสถานะตลาดล่าสุด การตรวจสอบกำไรและขาดทุนแบบเรียลไทม์ การติดต่อโดยตรงกับผู้ทำตลาดเพื่อสอบถามราคา และความสามารถในการตรวจสอบหุ้นที่ชื่นชอบในเวลาเดียวกัน

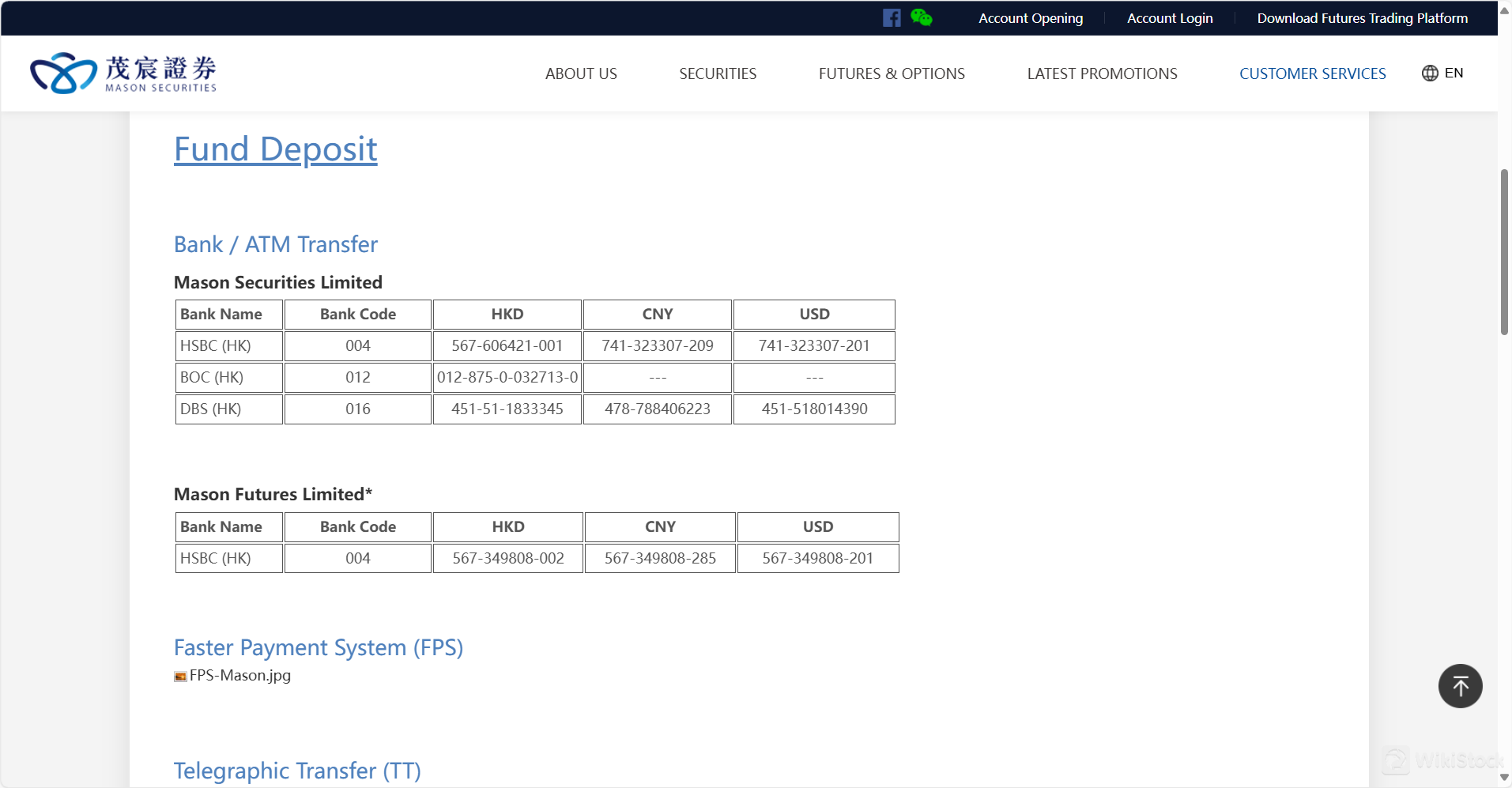

โอนเงินผ่านธนาคาร/ATM: ลูกค้าสามารถฝากเงินเข้าบัญชีของพวกเขาผ่านการโอนเงินผ่านธนาคารหรือ ATM โดยใช้รายละเอียดดังต่อไปนี้:

HSBC (HK), BOC (HK), และ DBS (HK) สำหรับ Mason Securities Limited ในสกุลเงินเช่น HKD, CNY, และ USD

HSBC (HK) สำหรับ Mason Futures Limited ในสกุลเงิน HKD และ CNY โดยส่วนใหญ่เน้นการซื้อขายในตลาดฟิวเจอร์ฮ่องกง (HKFE)

ระบบชำระเงินที่รวดเร็ว (FPS): วิธีนี้อาจถูกแสดงโดยการกล่าวถึง "FPS-Mason.jpg" ซึ่งแสดงให้เห็นถึงภาพหรือรหัสคิวอาร์สำหรับการทำธุรกรรมที่ง่ายขึ้นผ่าน FPS

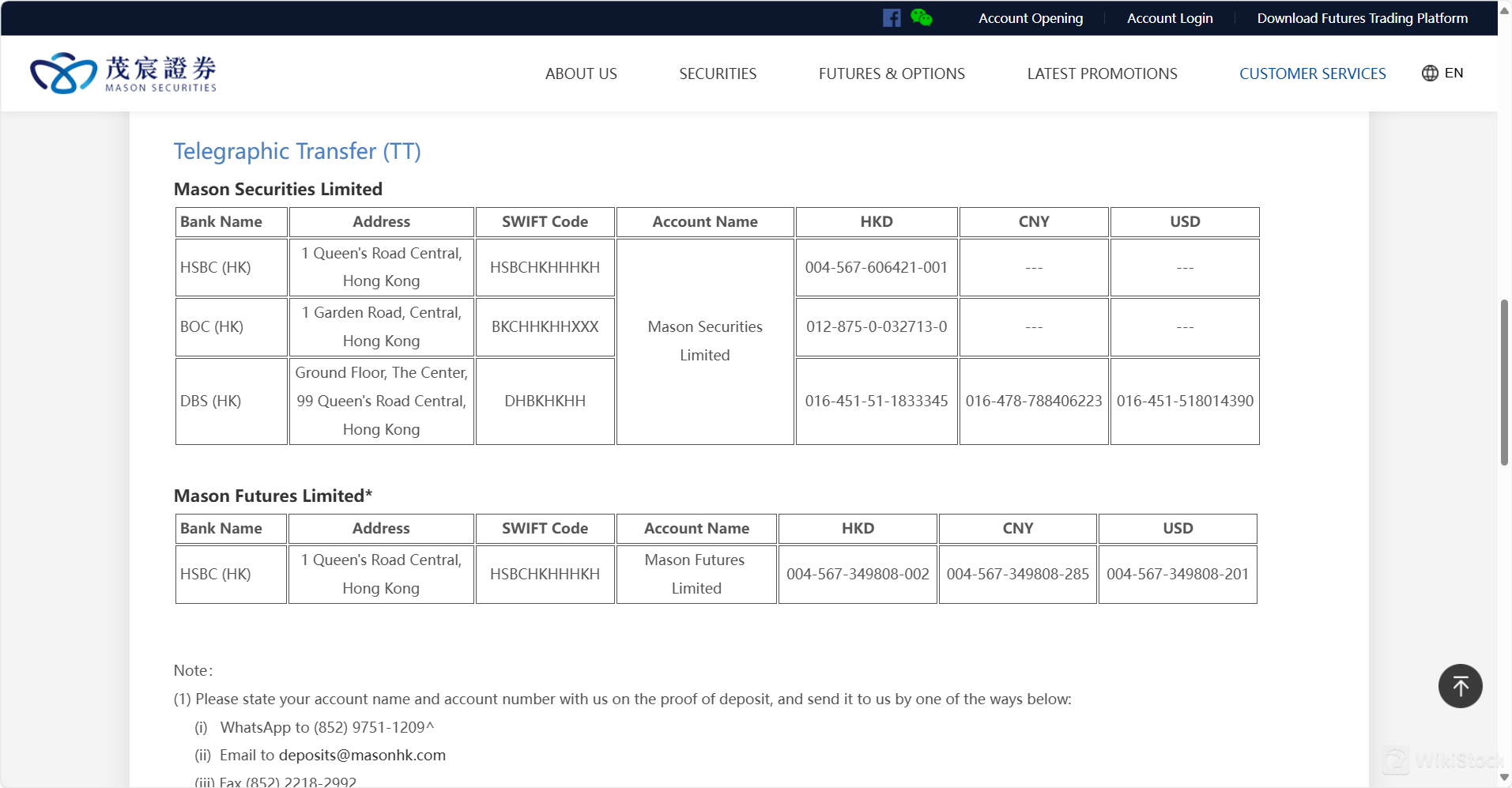

โอนเงินผ่านทางสายโทรเลข (TT): สำหรับการโอนเงินระหว่างประเทศหรือการโอนเงินขนาดใหญ่ลูกค้าสามารถใช้การโอนเงินผ่านทางสายโทรเลขโดยใช้รายละเอียดที่ให้ไว้สำหรับธนาคารเช่น HSBC, BOC, และ DBS รหัสสวิฟต์และชื่อบัญชีที่เฉพาะเจาะจงสำหรับ Mason Securities Limited และ Mason Futures Limited ถูกแสดงเพื่อให้สะดวกในการทำการโอนเงินเหล่านี้

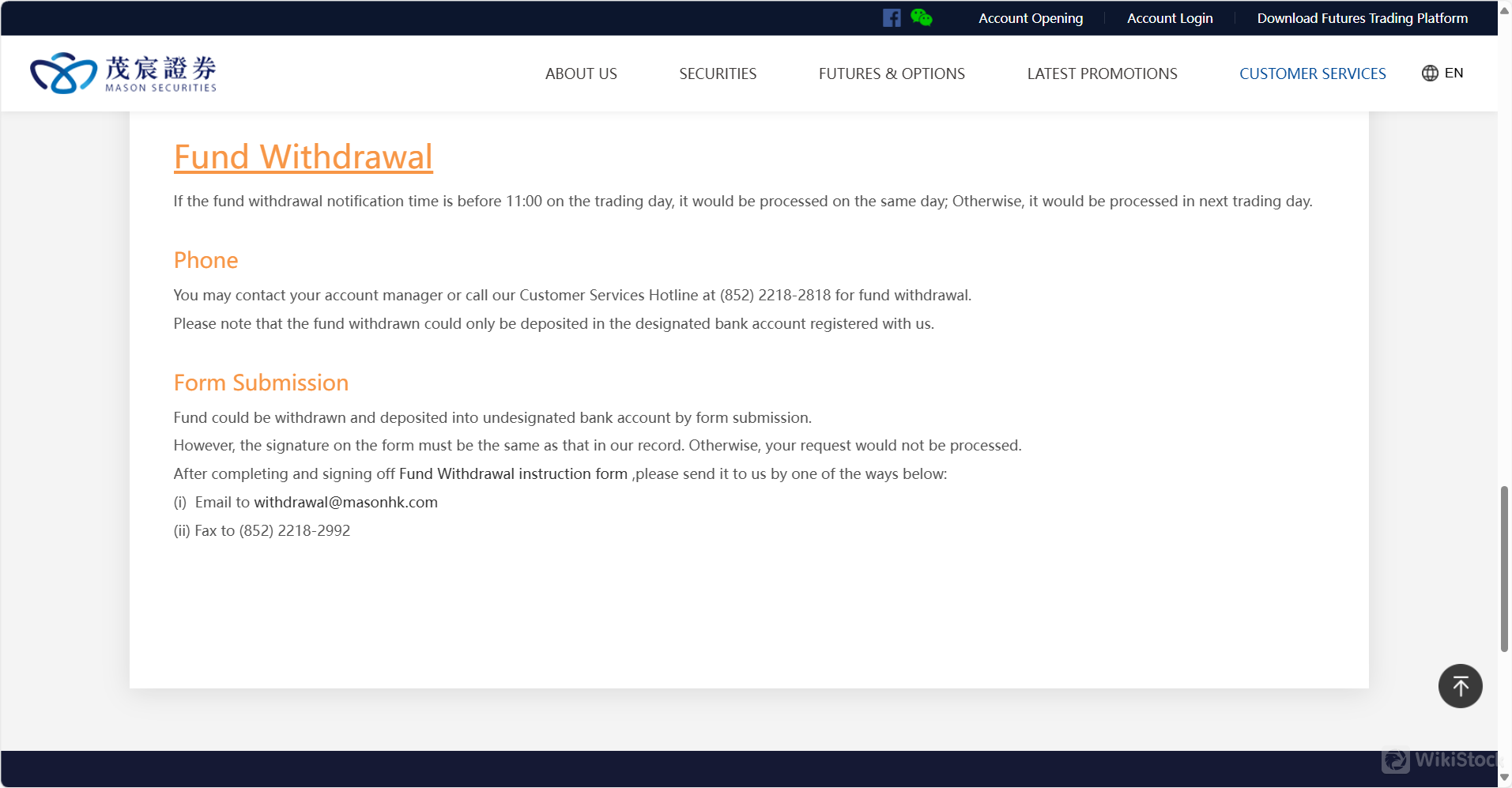

การถอนเงินสามารถเริ่มต้นได้ทางโทรศัพท์โดยการติดต่อผู้จัดการบัญชีหรือเบอร์โทรศัพท์บริการลูกค้า กระบวนการจะเร่งรัดขึ้นหากเวลาแจ้งเตือนก่อนเวลา 11:00 ในวันซื้อขาย โดยมีการประมวลผลในวันเดียวกัน มิฉะนั้นจะถูกประมวลผลในวันซื้อขายถัดไป

เงินสามารถถอนได้เฉพาะไปยังบัญชีธนาคารที่ระบุไว้ในโปรไฟล์ของลูกค้า มีตัวเลือกในการถอนไปยังบัญชีที่ไม่ได้ระบุโดยการส่งแบบฟอร์มซึ่งต้องมีลายเซ็นต์ที่ตรงกับบันทึกเพื่อให้มั่นใจในเรื่องความปลอดภัย

เมื่อฝากเงินโดยเฉพาะอย่างยิ่งผ่านเช็ค ลูกค้าจะต้องส่งสำเนาเช็คและใบเสร็จฝาก สำหรับการฝากเงินและถอนเงินลูกค้าต้องรับรองว่ามีการสื่อสารใบรับฝากหรือคำแนะนำการถอนเงินผ่าน WhatsApp, อีเมลหรือแฟกซ์โดยใช้รายละเอียดการติดต่อที่ให้ไว้

แพลตฟอร์ม/แอปพลิเคชัน

แพลตฟอร์มการซื้อขายที่ Mason Securities Limited นำเสนอประกอบด้วย:

โปรโมชั่น

Mason Securities Limited มีการส่งเสริมการตลาดโดยให้โบนัสที่อ้างอิงกันอยู่ในขณะนี้ ซึ่งอาจจะให้ลูกค้าใหม่และลูกค้าเก่าได้รับเงินโบนัสสูงสุดถึง $300

ฝากเงินและถอนเงิน

Mason Securities Limited และ Mason Futures Limited มีตัวเลือกหลายรูปแบบสำหรับการฝากเงินและถอนเงินเพื่อตอบสนองความต้องการของลูกค้า นี่คือภาพรวมอย่างละเอียด:

วิธีการฝากเงิน:

วิธีการถอนเงิน:

หมายเหตุเกี่ยวกับการจัดการกับเงินทุน:

บริการลูกค้า

Mason Securities Limited มีการสนับสนุนลูกค้าทางหลายช่องทาง

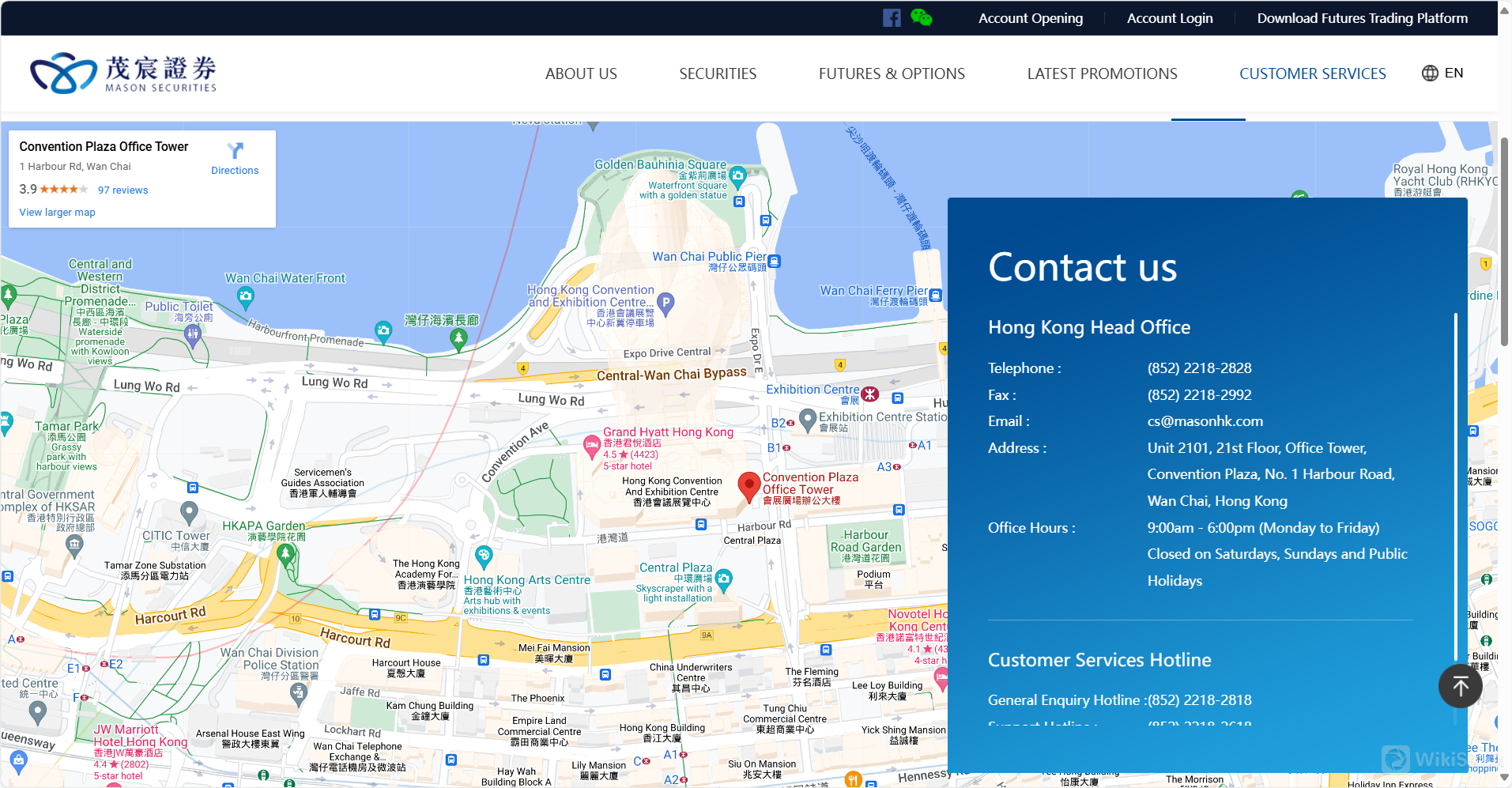

ลูกค้าสามารถติดต่อทีมบริการลูกค้าผ่านเบอร์โทรศัพท์ฮอตไลน์ที่ (852) 2218-2818 เพื่อขอความช่วยเหลือทันทีหรือส่งคำถามไปที่อีเมลของพวกเขาที่ cs@masonhk.com

เพิ่มเติมที่อยู่ทางกายภาพของบริษัทตั้งอยู่ที่ ห้อง 2101 ชั้น 21 อาคารสำนักงาน คอนเวนชั่นพลาซ่า ถนนฮาร์เบอร์ 1 แขวงวันชาย เขตฮ่องกง ที่ลูกค้าสามารถมาเยี่ยมชมเพื่อรับการสนับสนุนและบริการแบบตัวต่อตัวได้

ทรัพยากรการศึกษา

Mason Securities Limited ให้ทรัพยากรการศึกษาเพื่อเสริมสร้างความรู้ในการลงทุนและทักษะการซื้อขายของลูกค้า หนึ่งในสิ่งที่นำเสนอเป็นสัมมนาการลงทุนซึ่งอาจครอบคลุมหลากหัวข้อที่เกี่ยวข้องกับตลาดทางการเงิน กลยุทธ์การลงทุน การวิเคราะห์ตลาด และอาจเป็นเรื่องที่เฉพาะเจาะจงในการซื้อขายหลายประเภทของหลักทรัพย์และสินทรัพย์อนุพันธ์

สัมมนาเหล่านี้เป็นเครื่องมือมีค่าสำหรับนักลงทุนทั้งมือใหม่และมืออาชีพ ให้ข้อมูลและความรู้ที่เป็นประโยชน์ในการตัดสินใจลงทุนอย่างมีเหตุผลและเพิ่มประสิทธิภาพในการซื้อขาย

สรุป

Mason Securities Limited ให้บริการทางการเงินหลากหลายรูปแบบรวมถึงแพลตฟอร์มการซื้อขายที่หลากหลายเช่น Mason Trade และ SP Trader และตัวเลือกการสนับสนุนลูกค้าที่แข็งแกร่ง

พวกเขานำเสนอวิธีการฝากเงินและถอนเงินที่หลากหลายรวมถึงการโอนเงินผ่านธนาคารและ FPS ที่เหมาะสมสำหรับลูกค้าทั้งในประเทศและต่างประเทศ บริษัทยังเน้นการศึกษาของลูกค้าผ่านการสัมมนาการลงทุนเพื่อเสริมสร้างความรู้ในการซื้อขายของนักลงทุน

คำถามที่พบบ่อย

คำถาม: แพลตฟอร์มการซื้อขายที่ Mason Securities Limited มีอะไรบ้าง?

คำตอบ: Mason Securities ให้บริการแอปมือถือ Mason Trade และแพลตฟอร์ม SP Trader ซึ่งสนับสนุนการซื้อขายในตลาดต่างๆ และมีฟังก์ชันเช่นสถานะตลาดแบบเรียลไทม์และการรับรองด้วยปัจจัยสองอย่าง

คำถาม: ฉันจะฝากเงินเข้าบัญชี Mason Securities ได้อย่างไร?

คำตอบ: สามารถฝากเงินผ่านการโอนเงินผ่านธนาคาร/ATM, ระบบการชำระเงินที่รวดเร็ว (FPS), และการโอนเงินทางไปรษณีย์ (TT) โดยใช้รายละเอียดธนาคารที่ระบุสำหรับ HSBC, BOC, และ DBS

คำถาม: มีทรัพยากรการศึกษาที่ให้บริการให้กับลูกค้าหรือไม่?

คำตอบ: ใช่ Mason Securities มีการสัมมนาการลงทุนที่ให้คำแนะนำและการวิเคราะห์ที่เป็นมืออาชีพและเป็นที่นิยมเพื่อช่วยให้ลูกค้าตัดสินใจอย่างมีเหตุผล

คำถาม: ข้อมูลติดต่อบริการลูกค้าของ Mason Securities คืออะไร?

คำตอบ: ลูกค้าสามารถติดต่อ Mason Securities ผ่านทางอีเมลที่ cs@masonhk.com หรือโทรศัพท์ได้ที่ (852) 2218-2818 เพื่อขอความช่วยเหลือ

อื่น ๆ

Registered region

ฮ่องกงจีน

ปีในธุรกิจ

2-5 ปี

อัตราค่าคอมมิชชั่น

0%

ประเทศที่ได้รับการควบคุม

1

ผลิตภัณฑ์ทางการเงิน

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

ธุรกิจที่เกี่ยวข้อง

ประเทศ

Company name

สมาคม

ฮ่องกงจีน

Mason Futures Limited

กลุ่มบริษัท

ฮ่องกงจีน

Mason Securities Limited

กลุ่มบริษัท

--

Mason Financial Group Limited

กลุ่มบริษัท

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

Lukfook Financial

คะแนน

Wing Fung Financial

คะแนน

HGNH International

คะแนน

Arta Global Markets

คะแนน

PC Securities

คะแนน

昊天國際金融

คะแนน

名匯集團

คะแนน

越证控股

คะแนน

Kingston Financial Group

คะแนน

Sinofortune Group

คะแนน