คะแนน

Tiger Faith Holdings

https://www.tigerfaith.com.hk/en/d_index.html

Website

ดัชนีคะแนน

การประเมินนายหน้า

ความหลากหลาย

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 2

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตซื้อขายหลักทรัพย์

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตจัดการกองทุน

ที่นั่งทั่วโลก

![]() เป็นเจ้าของ 1 ที่นั่ง

เป็นเจ้าของ 1 ที่นั่ง

ฮ่องกงจีน HKEX

Seat No. 02138

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

Tiger Faith Holdings Limited

ชื่อย่อบริษัท

Tiger Faith Holdings

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

https://www.tigerfaith.com.hk/en/d_index.htmlตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

คุณสมบัติของโบรกเกอร์

อัตราค่าคอมมิชชั่น

0.25%

Funding Rate

4%

New Stock Trading

Yes

Margin Trading

YES

| Tiger Faith Securities |  |

| คะแนน WikiStocks | ⭐⭐⭐ |

| ค่าธรรมเนียม | 0.1% ของยอดเงินที่หมุนเวียน |

| ดอกเบี้ยเงินสดที่ไม่ได้ลงทุน | N/A |

| กองทุนรวมที่มี | ใช่ |

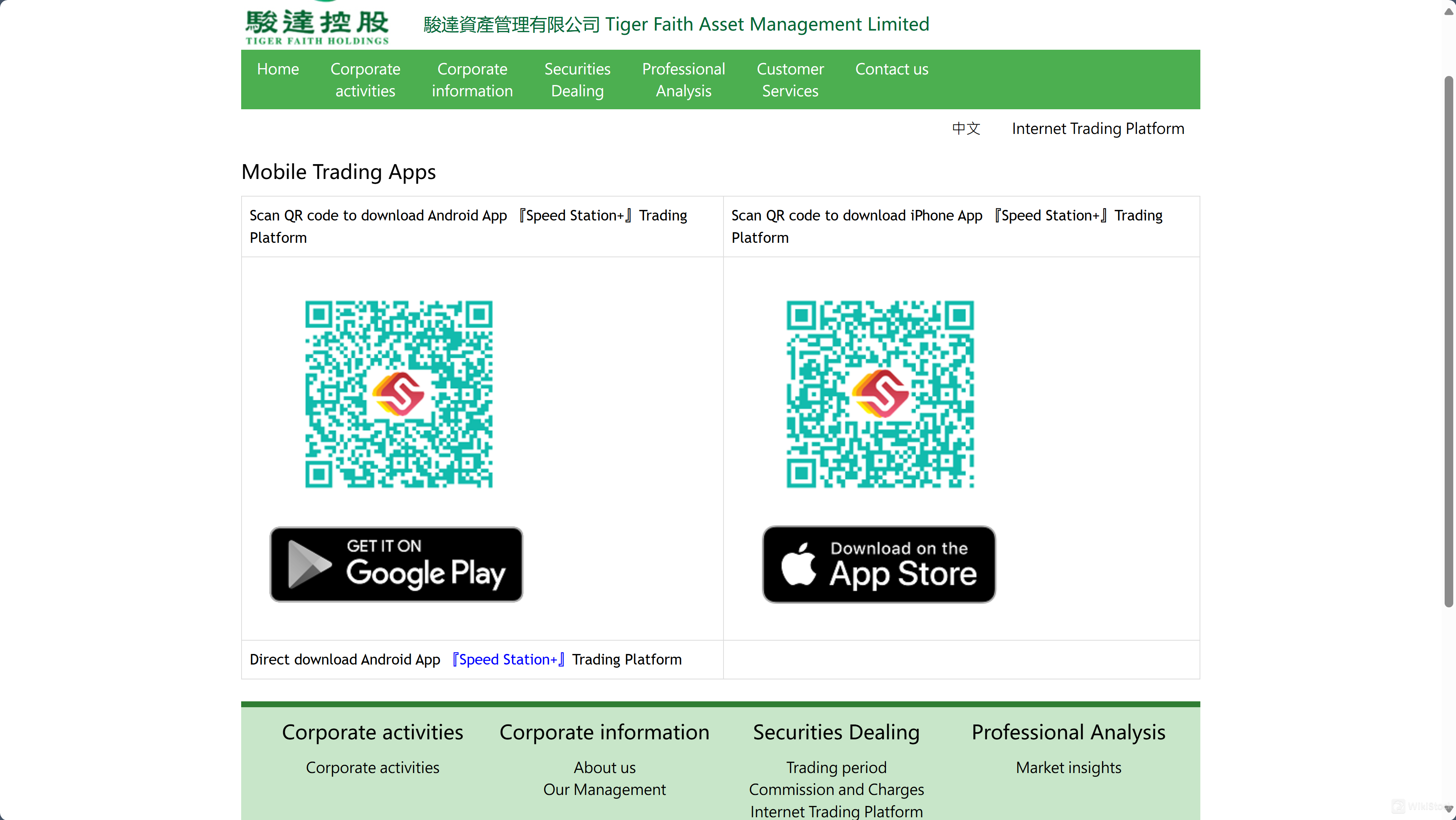

| แพลตฟอร์ม/แอปพลิเคชัน | Speed Station+(Android,IOS) |

| โปรโมชั่น | N/A |

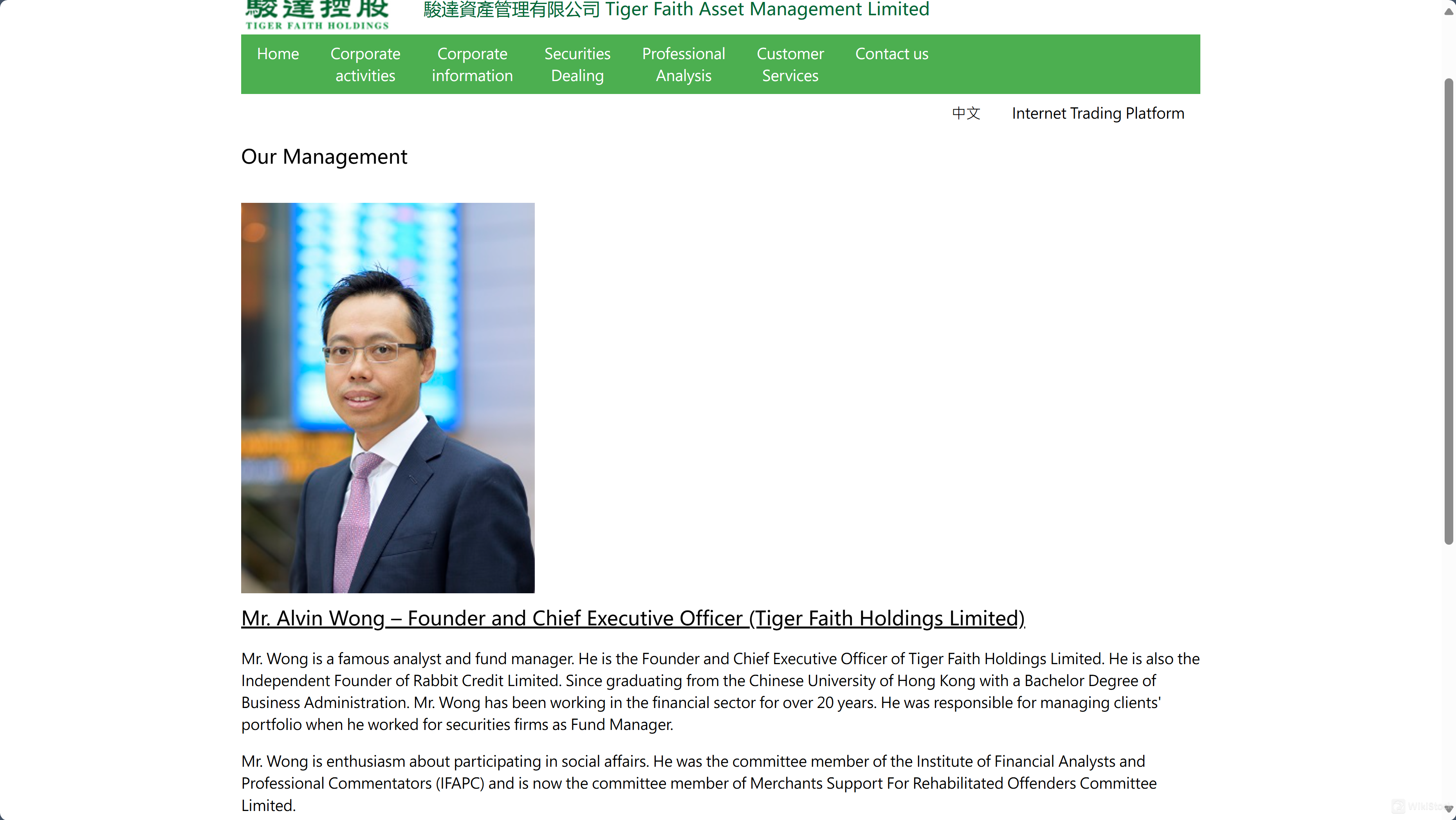

Tiger Faith Securities คืออะไร?

Tiger Faith Securities เป็นผู้ให้บริการทางการเงินที่มีชื่อเสียงด้วยโครงสร้างค่าธรรมเนียมที่ต่ำและแข่งขัน โดยเรียกเก็บเพียง 0.1% จากยอดเงินที่หมุนเวียนในการทำธุรกรรม

บริษัทนี้มีแพลตฟอร์มการซื้อขายที่ใช้งานง่ายชื่อ Speed Station+ ที่สามารถใช้ได้ทั้งบนอุปกรณ์ Android และ iOS ซึ่งเป็นที่นิยมของนักลงทุนที่ชำนาญด้านเทคโนโลยี

อย่างไรก็ตาม บริษัทไม่ให้ดอกเบี้ยในเงินสดที่ไม่ได้ลงทุน ซึ่งอาจเป็นข้อเสียสำหรับผู้ที่ต้องการรับผลตอบแทนจากยอดคงเหลือที่ไม่ได้ใช้งาน

ข้อดีและข้อเสีย

| ข้อดี | ข้อเสีย |

| มีหลากหลายหลักทรัพย์ที่สามารถซื้อขายได้ (หุ้น พันธบัตร กองทุน ETF และอื่นๆ) | กระบวนการเปิดบัญชีซับซ้อน (ต้องใช้แบบฟอร์มหลายแบบ) |

| ได้รับการควบคุมโดย SFC | ฝากเงินเฉพาะผ่านการโอนเงินผ่านธนาคารเท่านั้น |

| แพลตฟอร์มการซื้อขายที่ไม่ซ้ำซ้อน (Speed Station+ Trading APP) | เว็บไซต์ไม่สะดวกสำหรับผู้ใช้ใหม่ |

| ค่าคอมมิชชั่นต่ำ (0.1%) | |

| มีการวิเคราะห์ตลาดอย่างมืออาชีพ |

ข้อดี:

บริษัทนี้มีหลากหลายหลักทรัพย์ที่สามารถซื้อขายได้และค่าคอมมิชชั่นต่ำที่ 0.1% ทำให้เป็นที่น่าสนใจทางการเงิน บริษัทได้รับการควบคุมโดย SFC เพื่อให้มั่นใจได้ว่ามีความน่าเชื่อถือและมีแพลตฟอร์มการซื้อขายที่ไม่ซ้ำซ้อนเช่น Speed Station และแอปพลิเคชันที่เฉพาะเจาะจง เพิ่มประสบการณ์การใช้งานของผู้ใช้ นอกจากนี้ยังมีการวิเคราะห์ตลาดอย่างมืออาชีพเพื่อช่วยในการตัดสินใจการซื้อขายที่มีข้อมูลอย่างถูกต้อง

ข้อเสีย:

กระบวนการตั้งค่าบัญชีซับซ้อน ต้องใช้แบบฟอร์มหลายแบบ ซึ่งอาจก่อให้ผู้ใช้ใหม่ลังเล การฝากเงินจำกัดเฉพาะการโอนเงินผ่านธนาคาร จำกัดความยืดหยุ่นในตัวเลือกการเงิน นอกจากนี้เว็บไซต์ไม่เหมาะสำหรับผู้ใช้ใหม่ อาจทำให้ซับซ้อนในการเริ่มต้นประสบการณ์การซื้อขายของพวกเขา

Tiger Faith Securities ปลอดภัยหรือไม่?

กฎหมาย:

Tiger Faith Securities ได้รับการควบคุมโดยหน่วยงานกำกับดูแลหลักทรัพย์และอนุพันธ์ (SFC) ของฮ่องกง ภายใต้หมายเลขใบอนุญาต BLB524 และ BLB522 SFC เป็นหน่วยงานกำกับดูแลที่เป็นอิสระที่รับผิดชอบในการตรวจสอบตลาดหลักทรัพย์และอนุพันธ์ในฮ่องกง เพื่อให้มั่นใจว่ากิจกรรมทางการเงินจะดำเนินไปด้วยความซื่อสัตย์และปฏิบัติตามมาตรฐานที่เข้มงวด

ความปลอดภัยของเงินทุน:

แม้ว่ารายละเอียดเฉพาะเกี่ยวกับการประกันเงินทุนของลูกค้าและจำนวนเงินที่คุ้มครองจะไม่ได้ระบุ การควบคุมโดย SFC โดยทั่วไปกำหนดมาตรฐานที่เข้มงวดเกี่ยวกับการจัดการและการปกป้องสินทรัพย์ของลูกค้าเพื่อให้มั่นใจในความปลอดภัยของสินทรัพย์ในกรณีที่มีความไม่มั่นคงทางการเงินหรือการล้มละลายของบริษัท

มาตรการความปลอดภัย:

Tiger Faith Securities ใช้เทคโนโลยีการเข้ารหัสเพื่อป้องกันการเก็บเงินและรักษาข้อมูลลูกค้าที่เป็นความลับ บริษัทนี้ใช้มาตรการรักษาความปลอดภัยที่เข้มงวดเพื่อป้องกันการเข้าถึงที่ไม่ได้รับอนุญาตและการละเมิดข้อมูล อย่างไรก็ตาม รายละเอียดเฉพาะเกี่ยวกับเทคโนโลยีเหล่านี้และมาตรการความปลอดภัยเพิ่มเติมไม่ได้ระบุในข้อมูลที่มีอยู่

หลักทรัพย์ที่สามารถซื้อขายกับ Tiger Faith Securities คืออะไร?

Tiger Faith Securities มีหลากหลายหลักทรัพย์ที่สามารถซื้อขายได้

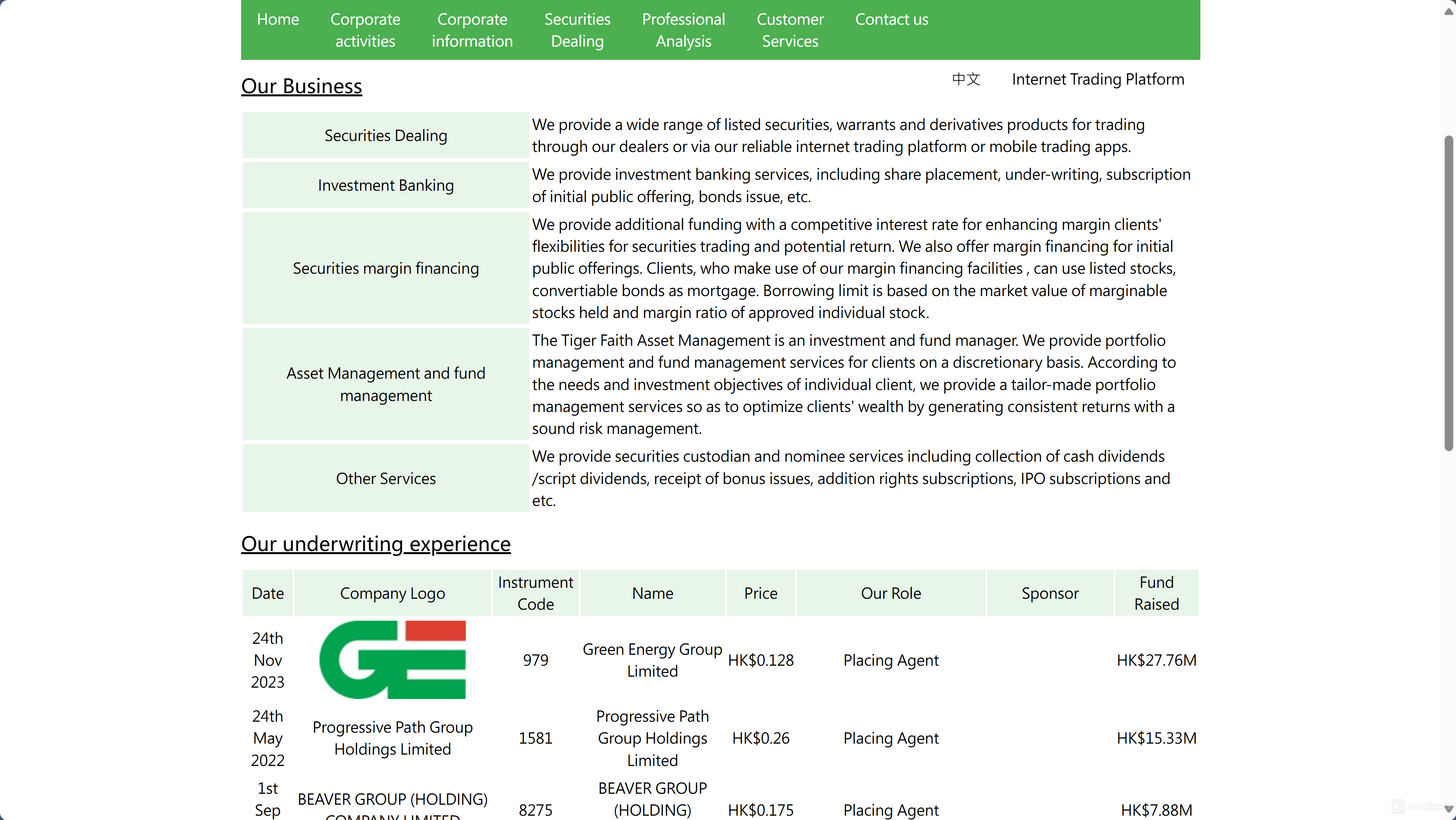

หลักทรัพย์ที่ลงทะเบียน:

ลูกค้าสามารถเข้าถึงหลากหลายหลักทรัพย์เพื่อให้มีตัวเลือกมากพอในการแยกแยะพอร์ตการลงทุนของพวกเขา บริการนี้สามารถใช้งานได้ผ่านแพลตฟอร์มการซื้อขายทางอินเทอร์เน็ตที่เชื่อถือได้และแอปพลิเคชันการซื้อขายบนมือถือ

วอร์แรนต์และสินทรัพย์อนุพันธ์:

นอกจากหลักทรัพย์ที่ลงทะเบียนแล้ว ทาง Tiger Faith Securities ยังให้โอกาสในการซื้อขายวอร์แรนต์และสินทรัพย์อนุพันธ์ สินทรัพย์ทางการเงินเหล่านี้ช่วยให้ลูกค้าสามารถมีกลยุทธ์การซื้อขายที่ซับซ้อนมากขึ้น มอบโอกาสในการได้รับผลตอบแทนที่สูงขึ้นและความสามารถในการป้องกันการลงทุนที่มีอยู่แล้ว

บริการธนาคารการลงทุน:

Tiger Faith Securities ยังมีกิจกรรมทางการลงทุนธนาคารรวมทั้งการจัดวางหุ้น การรับรอง และการสมัครสมาชิกสำหรับการเสนอขายครั้งแรก (IPO) และพันธบัตร บริการนี้สนับสนุนบริษัทในการระดมทุนและนักลงทุนในการเข้าถึงโอกาสตลาดใหม่

การจัดหาเงินทุนผ่านการกู้ยืมเงิน:

เพื่อเพิ่มความยืดหยุ่นในการซื้อขายและผลตอบแทนที่เป็นไปได้ Tiger Faith Securities ให้บริการการกู้ยืมเงินผ่านการจัดหาเงินทุนที่มีอัตราดอกเบี้ยแข่งขัน ลูกค้าสามารถใช้หลักทรัพย์ที่ลงทะเบียนและพันธบัตรแปลงสภาพเป็นหลักประกัน เพื่อเพิ่มการเล่นหุ้นในกลยุทธ์การลงทุนและการเข้าร่วม IPO

การบริหารจัดการสินทรัพย์และกองทุน:

Tiger Faith Asset Management ให้บริการการบริหารจัดการพอร์ตการลงทุนและการบริหารจัดการกองทุนตามความต้องการของลูกค้าและวัตถุประสงค์ โดยการปรับกลยุทธ์การลงทุนให้เข้ากันกับความต้องการและวัตถุประสงค์ของลูกค้าแต่ละราย เพื่อเพิ่มความมั่นคงของทรัพย์สินและสร้างผลตอบแทนที่สม่ำเสมอในขณะที่จัดการความเสี่ยงอย่างมีประสิทธิภาพ

บริการผู้ถือหุ้นและผู้แทนชื่อในการลงทุน:

Tiger Faith Securities ให้บริการผู้ถือหุ้นและผู้แทนชื่อในการลงทุน รวมถึงการเก็บเงินปันผลเงินสดและหุ้นส่วน การรับสิทธิปันผลโบนัส และการสนับสนุนการสมัครสมาชิกสิทธิและ IPO บริการเหล่านี้ช่วยให้การจัดการหลักทรัพย์และประโยชน์ที่เกี่ยวข้องของลูกค้าเป็นไปอย่างมีประสิทธิภาพและปลอดภัย

บทวิจารณ์บัญชี Tiger Faith Securities

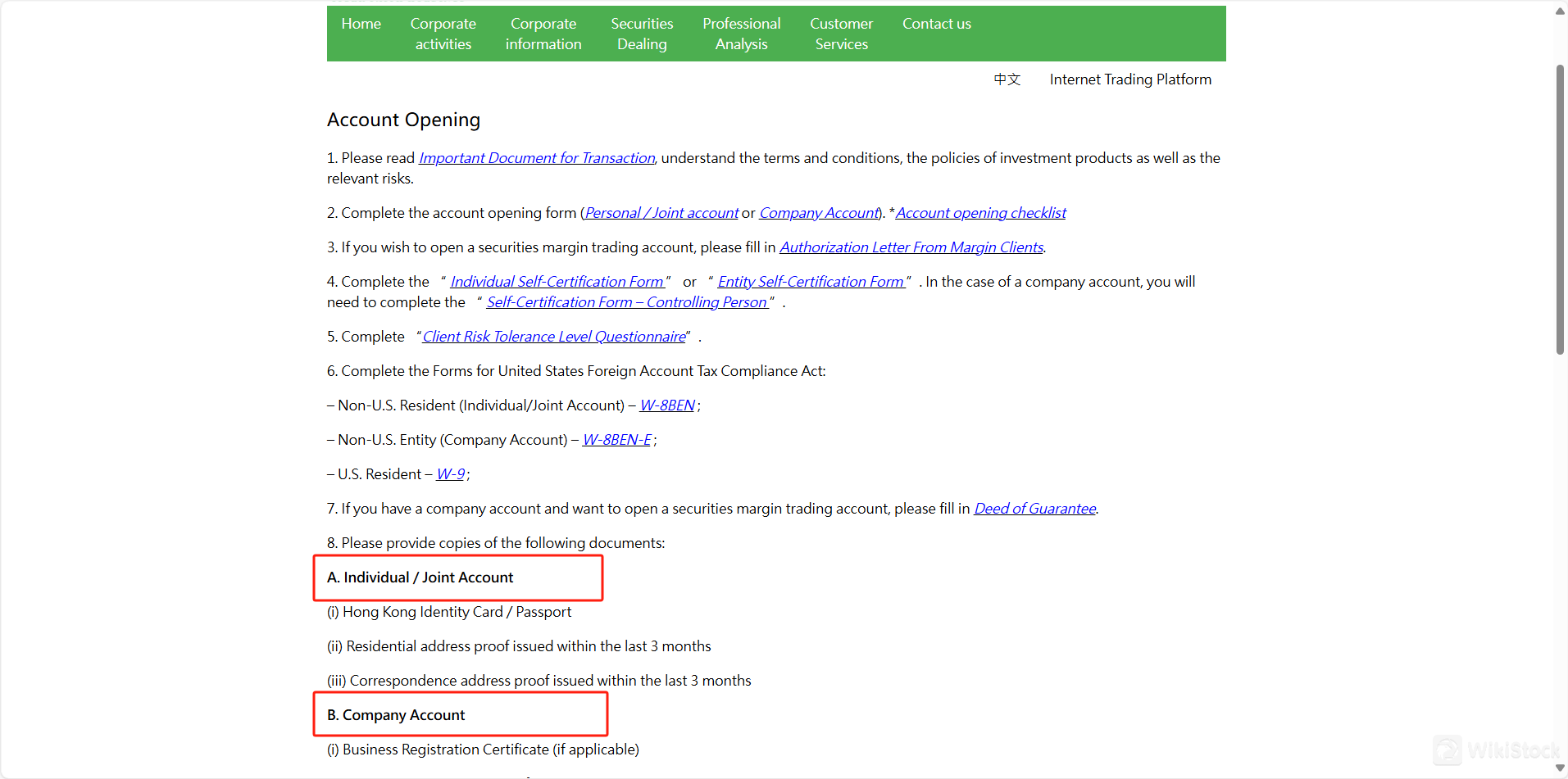

Tiger Faith Securities Limited ให้บริการบัญชีสองประเภทหลักสำหรับลูกค้าของพวกเขา

บัญชีส่วนบุคคล / บัญชีร่วม: ประเภทบัญชีนี้ออกแบบสำหรับนักลงทุนรายบุคคลหรือร่วมกันระหว่างบุคคล ผู้ถือบัญชีจำเป็นต้องกรอกแบบฟอร์มเปิดบัญชี ให้ข้อมูลแสดงตัวตนเช่นบัตรประจำตัวประชาชนหรือหนังสือเดินทาง และให้หลักฐานที่แสดงที่อยู่ที่อาศัยและที่อยู่สำหรับการสื่อสารในช่วงสามเดือนที่ผ่านมา

บัญชีบริษัท: ออกแบบสำหรับนิติบุคคล บัญชีนี้ต้องการเอกสารที่เพิ่มเติมมากขึ้นรวมถึงหนังสือรับรองการลงทะเบียนธุรกิจ หนังสือรับรองการลงทะเบียนบริษัท หนังสือรับรองการจัดตั้งและการรับรองต่าง ๆ สำหรับกรรมการและบุคคลที่ได้รับอนุญาต บัญชีนี้ยังต้องการการกรอกแบบฟอร์มที่เฉพาะเจาะจงเช่น "แบบฟอร์มการรับรองตนเองของ Entity" และ "แบบฟอร์มการรับรองตนเอง - บุคคลที่ควบคุม" เพื่อตอบสนองความต้องการทางกฎหมายและการปฏิบัติตามกฎระเบียบ

บทวิจารณ์ค่าธรรมเนียม Tiger Faith Securities

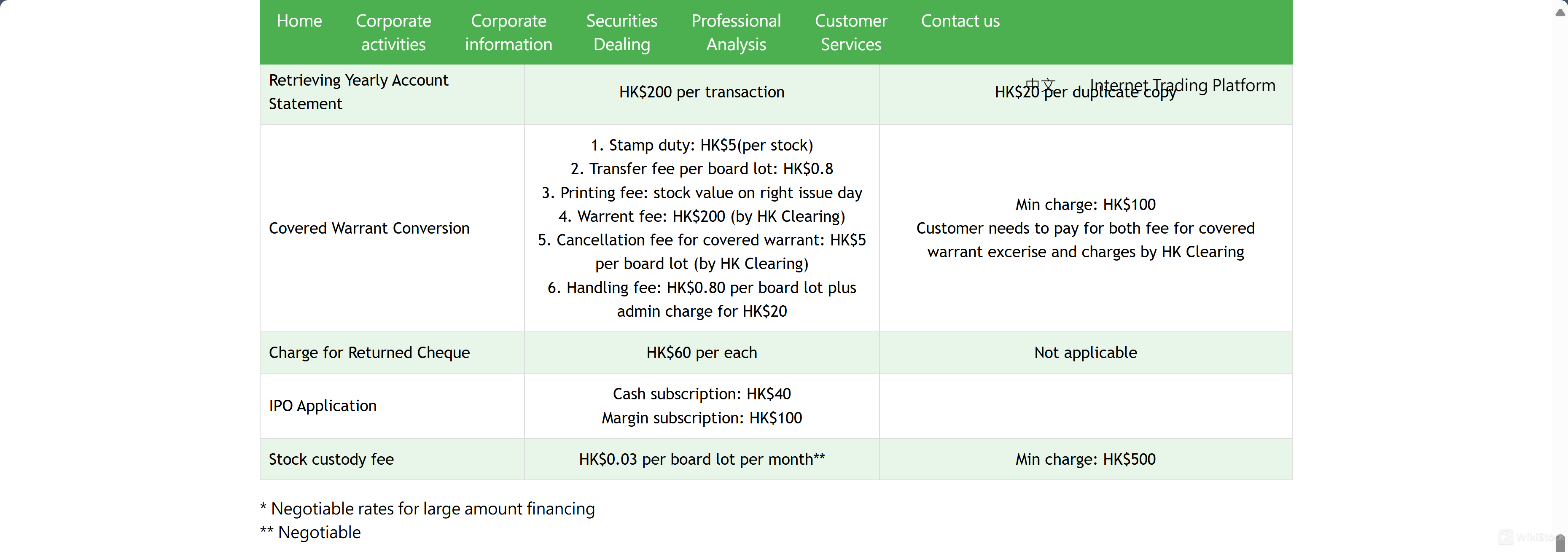

Tiger Faith มีโครงสร้างค่าธรรมเนียมที่ครอบคลุมอย่างละเอียดสำหรับผู้ใช้งานของตน

โครงสร้างค่าธรรมเนียมการซื้อขาย:

Tiger Faith Securities เรียกเก็บค่าธรรมเนียมการซื้อขายต่าง ๆ รวมถึงอากรแสตมป์ 0.1% ของมูลค่าการเทิร์นโอเวอร์ ค่าธรรมเนียมลูกค้า CCASS และค่าธรรมเนียม HKSCC 0.01% โดยมีขั้นต่ำที่ HK$10 ค่าธรรมเนียมการทำธุรกรรม 0.0027% และค่าธรรมเนียมการซื้อขาย 0.00565% ซึ่งเก็บรวมให้แทนหน่วยงานที่เกี่ยวข้อง ค่าคอมมิชชั่นคิดเป็น 0.25% ของมูลค่าการเทิร์นโอเวอร์ โดยมีขั้นต่ำที่ HK$85

ค่าคอมมิชชั่น:

ค่าคอมมิชชั่นสำหรับการซื้อขายถูกกำหนดไว้ที่ 0.25% ของมูลค่าการเทิร์นโอเวอร์ โดยมีค่าธรรมเนียมขั้นต่ำที่ HK$85 อัตราดอกเบี้ยเพิ่มเติมสำหรับยอดค้างชำระในบัญชีเงินสดและบัญชีผู้ถือหุ้นรวมถึงการให้กู้ยืมบัญชีมาร์จินคำนวณจากอัตราดอกเบี้ยหลักของธนาคารพร้อม 4%

โครงสร้างค่าบริการผู้แทนชื่อ:

บริการผู้แทนที่ Tiger Faith Securities รวมถึงค่าธรรมเนียมต่างๆ เช่น ค่าธรรมเนียม Scrip ที่ 2 ดอลลาร์ฮ่องกงต่อล็อตบอร์ดพร้อมขั้นต่ำที่ 20 ดอลลาร์ฮ่องกง, ค่าธรรมเนียมการโอนกรรมสิทธิ์ที่ 5 ดอลลาร์ฮ่องกงต่อเอกสาร, และค่าธรรมเนียมการเก็บเงินปันผลที่เรียกเก็บ 0.35% ของจำนวนเงินปันผล นอกจากนี้บริษัทยังเรียกเก็บค่าธรรมเนียมการจัดการสิทธิ์และการเสนอซื้อรับรองในอัตรา 1 ดอลลาร์ฮ่องกงต่อล็อตบอร์ดพร้อมค่าธรรมเนียมขั้นต่ำที่ 100 ดอลลาร์ฮ่องกง และค่าธรรมเนียมการถอนหุ้นทางกายภาพที่ 5 ดอลลาร์ฮ่องกงต่อล็อตบอร์ดพร้อมค่าธรรมเนียมขั้นต่ำที่ 20 ดอลลาร์ฮ่องกง

| หมวดหมู่บริการ | รายละเอียดบริการ | ค่าธรรมเนียม | จำนวนเงินขั้นต่ำ/สูงสุดและหมายเหตุ |

| แผนการเรียกเก็บค่าธรรมเนียมการซื้อขาย | อากรแสตมป์ | 0.1% ของมูลค่าการซื้อขาย | ขั้นต่ำ 1 ดอลลาร์ฮ่องกง, เรียกเก็บแทนรัฐบาลฮ่องกง |

| แผนการเรียกเก็บค่าธรรมเนียมการซื้อขาย | ค่าธรรมเนียมลูกค้า CCASS และค่าธรรมเนียม HKSCC | 0.01% ของมูลค่าการซื้อขาย | ขั้นต่ำ 10 ดอลลาร์ฮ่องกง, เรียกเก็บแทน CCASS |

| แผนการเรียกเก็บค่าธรรมเนียมการซื้อขาย | ค่าธรรมเนียมการทำธุรกรรม | 0.0027% ของมูลค่าการซื้อขาย | เรียกเก็บแทน SFC |

| แผนการเรียกเก็บค่าธรรมเนียมการซื้อขาย | ค่าธรรมเนียมการซื้อขาย | 0.00565% ของมูลค่าการซื้อขาย | เรียกเก็บแทน HKEx |

| ค่าคอมมิชชั่น | คอมมิชชั่นทั่วไป | 0.25% ของมูลค่าการซื้อขาย | ขั้นต่ำ 85 ดอลลาร์ฮ่องกง |

| ค่าคอมมิชชั่น | ดอกเบี้ยค้างชำระบัญชีเงินสด/ผู้ถือหุ้น | อัตราดอกเบี้ยหลัก + 4% | - |

| ค่าคอมมิชชั่น | อัตราดอกเบี้ยการให้กู้บัญชีมาร์จิ้น | อัตราดอกเบี้ยหลัก + 4% | - |

| ค่าบริการผู้แทนที่ | ค่าธรรมเนียม Scrip | 2 ดอลลาร์ฮ่องกงต่อล็อตบอร์ด | ขั้นต่ำ 20 ดอลลาร์ฮ่องกง |

| ค่าบริการผู้แทนที่ | ค่าธรรมเนียมการโอนหุ้น | 5 ดอลลาร์ฮ่องกงต่อเอกสาร | เรียกเก็บโดยกรมรายได้ฮ่องกง |

| ค่าบริการผู้แทนที่ | ค่าธรรมเนียมการเก็บเงินปันผล | 0.35% ของจำนวนเงินปันผล | เรียกเก็บเพิ่มอีก 0.12% โดย HK Clearing |

| ค่าบริการผู้แทนที่ | ค่าธรรมเนียมการจัดการสิทธิ์ในการเสนอซื้อรับรอง/การเสนอซื้อรับรองการเข้าครอบครอง | 1 ดอลลาร์ฮ่องกงต่อล็อตบอร์ด | ขั้นต่ำ 100 ดอลลาร์ฮ่องกง |

| ค่าบริการผู้แทนที่ | ค่าธรรมเนียมธนาคาร (ตัวเลือก) | 50 ดอลลาร์ฮ่องกง | - |

| ค่าบริการผู้แทนที่ | ค่าธรรมเนียมการถอนหุ้น - ทางกายภาพ | 5 ดอลลาร์ฮ่องกงต่อล็อตบอร์ด | ขั้นต่ำ 20 ดอลลาร์ฮ่องกง, เรียกเก็บโดย HK Clearing |

| ค่าบริการผู้แทนที่ | ค่าเรียกร้องเงินปันผลและเงินปันผลโบนัส | 1% ของจำนวนเงินปันผล | ขั้นต่ำ 200 ดอลลาร์ฮ่องกง, รวมค่าใช้จ่ายดูแลระบบ |

| ค่าบริการผู้แทนที่ | ค่าธรรมเนียมการฝากผ่าน CCASS | 0.005% ของมูลค่าหุ้น | ขั้นต่ำ 10 ดอลลาร์ฮ่องกง, ค่าธรรมเนียมการจัดการ 100 ดอลลาร์ฮ่องกงต่อธุรกรรม |

| ค่าบริการผู้แทนที่ | การจัดการธุรกรรม OTC | 0.25% ของมูลค่าการซื้อขาย | ขั้นต่ำ 100 ดอลลาร์ฮ่องกง, ติดต่อโบรกเกอร์สำหรับธุรกรรมขนาดใหญ่ |

| ค่าบริการผู้แทนที่ | ค่าธรรมเนียมการฝากหุ้น | 2.5 ดอลลาร์ฮ่องกงต่อล็อตบอร์ด | ค่าธรรมเนียมขั้นต่ำสำหรับ 1 ล็อตบอร์ด, รวมการฝากหุ้นทั้งหมด |

| ค่าบริการผู้แทนที่ | การเรียกดูรายงานบัญชีประจำปี | 200 ดอลลาร์ฮ่องกงต่อธุรกรรม | 20 ดอลลาร์ฮ่องกงต่อสำเนาซ้ำ |

| ค่าบริการผู้แทนที่ | การแปลงสิทธิ์ใบสำคัญรับรองที่ครอบครอง | ค่าธรรมเนียมต่างๆ | รวมอากรแสตมป์, ค่าธรรมเนียมการโอน และค่าใช้จ่ายที่เกี่ยวข้องอื่นๆ, ขั้นต่ำ 100 ดอลลาร์ฮ่องกง |

| ค่าบริการผู้แทนที่ | ค่าธรรมเนียมเช็คที่คืน | 60 ดอลลาร์ฮ่องกงต่อเช็ค | - |

| ค่าบริการผู้แทนที่ | การสมัคร IPO | 40 ดอลลาร์ฮ่องกงสำหรับเงินสด, 100 ดอลลาร์ฮ่องกงสำหรับมาร์จิ้น | - |

| ค่าบริการผู้แทนที่ | ค่าธรรมเนียมการเก็บรักษาหุ้น | 0.03 ดอลลาร์ฮ่องกงต่อล็อตบอร์ด | ขั้นต่ำ 500 ดอลลาร์ฮ่องกง, อัตราค่าธรรมเนียมเจรจาต่อมูลค่าใหญ่ได้ต่อรอง |

บทวิจารณ์เกี่ยวกับแพลตฟอร์มการซื้อขายของ Tiger Faith Securities

Tiger Faith มี Speed Station+ เป็นแพลตฟอร์มการซื้อขายของตน

แอปพลิเคชันการซื้อขายบนมือถือ:

Tiger Faith Securities ให้บริการแอปพลิเคชันการซื้อขายผ่านมือถือที่ชื่อว่า "Speed Station+" ซึ่งสามารถใช้งานได้ทั้งบน Android และ iPhone ผู้ใช้สามารถดาวน์โหลดแอปพลิเคชันโดยตรงจากเว็บไซต์ของพวกเขาโดยการสแกนรหัส QR

แพลตฟอร์มการซื้อขายผ่านอินเทอร์เน็ต:

นอกจากแอปพลิเคชันบนมือถือแล้ว Tiger Faith Securities ยังให้บริการแพลตฟอร์มการซื้อขายผ่านอินเทอร์เน็ตที่เชื่อถือได้ แพลตฟอร์มนี้ช่วยให้ผู้ใช้สามารถซื้อขายหลากหลายหลักทรัพย์ที่เปิดเผย หลักทรัพย์รับรอง และผลิตภัณฑ์ทางอนุพันธ์ได้อย่างมีประสิทธิภาพ

คุณสมบัติ:

แพลตฟอร์มการซื้อขายถูกออกแบบมาเพื่อให้บริการการวิเคราะห์และข้อมูลตลาดอย่างมืออาชีพเพื่อช่วยลูกค้าในการตัดสินใจการลงทุนที่มีข้อมูลสมเหตุสมผล นอกจากนี้ยังมีการสนับสนุนบริการลูกค้าต่างๆ เช่น เปิดบัญชี ฝากถอนเงิน และเข้าถึงแบบฟอร์มและคำถามที่พบบ่อย

การวิจัยและการศึกษา

Tiger Faith Securities ให้บริการการวิเคราะห์มืออาชีพและข้อมูลตลาดเพื่อสนับสนุนลูกค้าในการตัดสินใจการลงทุนที่มีข้อมูลสมเหตุสมผล

พวกเขานำเสนอรายงานการวิจัยและทรัพยากรการศึกษาที่ออกแบบมาเพื่อเสริมสร้างความรู้และความเชี่ยวชาญของลูกค้า

ทรัพยากรเหล่านี้รวมถึงข้อมูลตลาด กลยุทธ์การลงทุน และการวิเคราะห์ละเอียดเกี่ยวกับหลายหลักทรัพย์และเงื่อนไขตลาด จุดมุ่งหมายคือการให้ความสามารถในการตัดสินใจให้ลูกค้าสามารถปรับแต่งพอร์ตการลงทุนของตนและบรรลุวัตถุประสงค์ทางการเงินได้

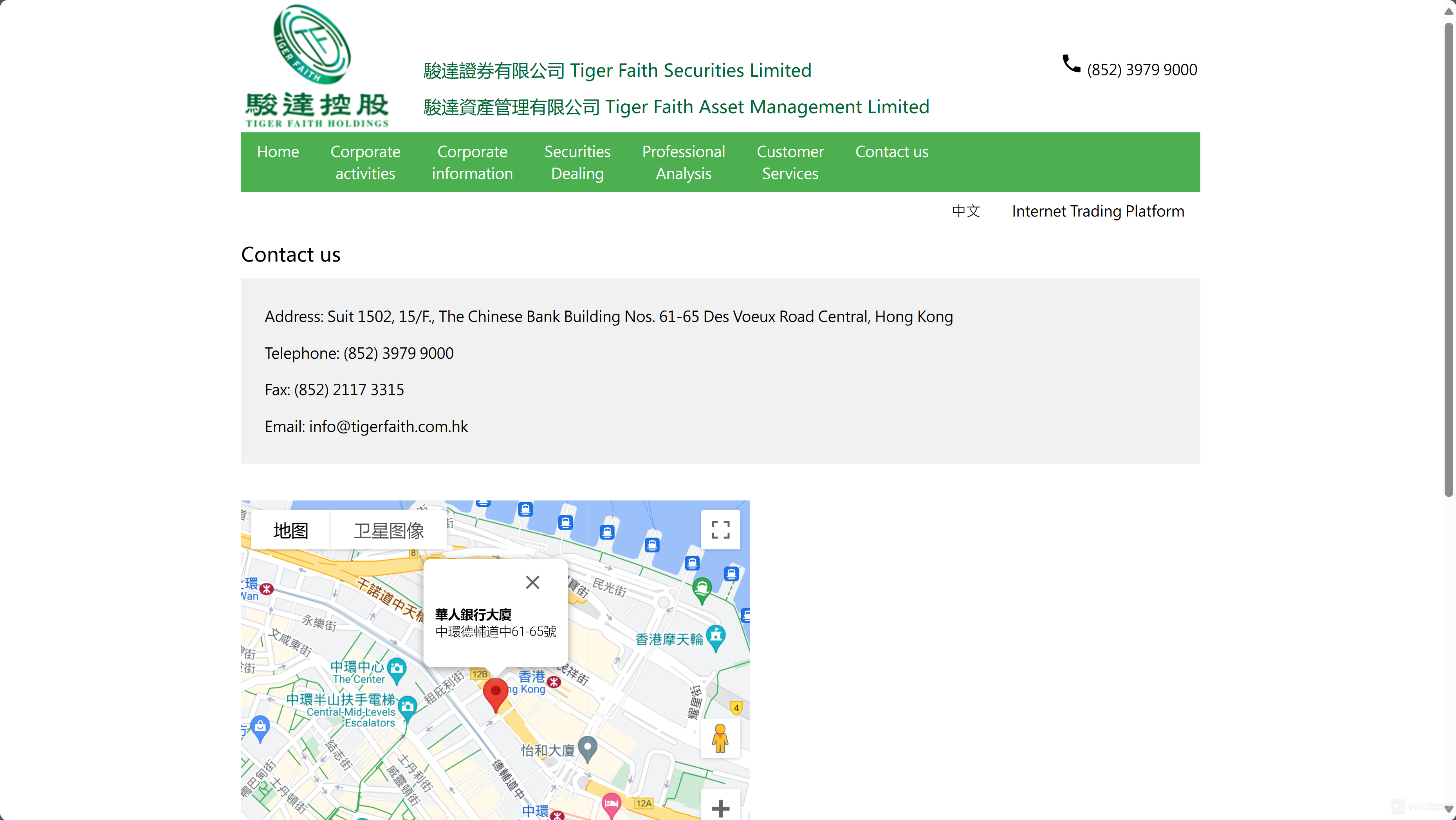

บริการลูกค้า

Tiger Faith Securities ให้บริการบริการสนับสนุนลูกค้า ลูกค้าสามารถติดต่อบริษัทผ่านโทรศัพท์ที่ (852) 3979 9000 แฟกซ์ที่ (852) 2117 3315 หรืออีเมลที่ info@tigerfaith.com.hk

สำนักงานของบริษัทตั้งอยู่ที่ Suite 1502, 15/F, The Chinese Bank Building, Nos. 61-65 Des Voeux Road Central, Hong Kong

พวกเขาให้ความช่วยเหลือในการเปิดบัญชี การฝากถอนเงิน และมีส่วนสำหรับคำถามที่พบบ่อยและแบบฟอร์มต่างๆ เพื่อตอบสนองคำถามที่พบบ่อย ทีมสนับสนุนจะให้ความช่วยเหลือทันเวลาและมีประสิทธิภาพสำหรับความต้องการในการซื้อขายและบัญชีของลูกค้า

สรุป

Tiger Faith Securities ที่ได้รับการควบคุมโดย SFC ให้บริการในหลากหลายบริการทางการเงินรวมถึงการซื้อขายหลักทรัพย์ การบริหารจัดการทรัพย์สิน และการจัดทำเงินทุนส่วนเกิน

ด้วยแพลตฟอร์มการซื้อขาย Speed Station+ ที่เป็นเอกสิทธิ์ของพวกเขาที่มีให้บริการทั้งบน Android และ iOS พวกเขาให้ส่วนติดต่อง่ายในการซื้อขายหลากหลายหลักทรัพย์

บริษัทนี้มีชื่อเสียงด้านการวิเคราะห์ตลาดอาชีพและอัตราค่าคอมมิชชั่นต่ำ ทำให้เป็นทางเลือกที่น่าสนใจสำหรับนักลงทุน อย่างไรก็ตาม บริษัทขาดการสนับสนุนลูกค้าตลอด 24 ชั่วโมงและมีข้อจำกัดในวิธีการฝากเงินบางอย่าง

คำถามที่พบบ่อย

1. แพลตฟอร์มการซื้อขายที่ Tiger Faith Securities มีอะไรบ้าง?

Tiger Faith Securities มีแพลตฟอร์มการซื้อขาย Speed Station+ ที่มีให้บริการทั้งบน Android และ iOS

2. ค่าคอมมิชชั่นการซื้อขายเป็นเท่าไร?

ค่าคอมมิชชั่นคิดเป็น 0.25% ของมูลค่าการซื้อขายพร้อมค่าธรรมเนียมขั้นต่ำที่ 85.00 ดอลลาร์ฮ่องกง

3. ฉันจะติดต่อฝ่ายบริการลูกค้าได้อย่างไร?

คุณสามารถติดต่อฝ่ายบริการลูกค้าผ่านโทรศัพท์ที่ (852) 3979 9000 หรืออีเมลที่ info@tigerfaith.com.hk

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้ไว้เป็นผลจากการประเมินข้อมูลเว็บไซต์ของโบรกเกอร์โดยผู้เชี่ยวชาญของ WikiStock และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการลงทุนที่มีความเสี่ยงสูง อาจ导致สูญเสียเงินลงทุนทั้งหมด ดังนั้นความเข้าใจความเสี่ยงที่เกี่ยวข้องก่อนที่จะลงมือเป็นสิ่งสำคัญ

อื่น ๆ

Registered region

ฮ่องกงจีน

ปีในธุรกิจ

2-5 ปี

ผลิตภัณฑ์ทางการเงิน

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

ธุรกิจที่เกี่ยวข้อง

ประเทศ

Company name

สมาคม

--

Tiger Faith Securities Limited

บริษัทย่อย

--

Tiger Faith Asset Management Limited

บริษัทย่อย

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

瑞达国际

คะแนน

Huajin International

คะแนน

CLSA

คะแนน

Sanfull Securities

คะแนน

DL Securities

คะแนน

嘉信

คะแนน

GF Holdings (HK)

คะแนน

China Taiping

คะแนน

Capital Securities

คะแนน

乾立亨證券

คะแนน