คะแนน

Open Securities

https://www.opensecltd.com/?lang=en

Website

ดัชนีคะแนน

การประเมินนายหน้า

อิทธิพล

C

ดัชนีอิทธิพล NO.1

ไต้หวัน

ไต้หวันความหลากหลาย

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

เหนือกว่า 18.31% โบรกเกอร์

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 2

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตซื้อขายหลักทรัพย์

SFCอยู่ในการกำกับดูแล

ฮ่องกงจีนใบอนุญาตจัดการกองทุน

ที่นั่งทั่วโลก

![]() เป็นเจ้าของ 1 ที่นั่ง

เป็นเจ้าของ 1 ที่นั่ง

ฮ่องกงจีน HKEX

Seat No. 01608

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

Open Securities Limited

ชื่อย่อบริษัท

Open Securities

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

https://www.opensecltd.com/?lang=enตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

ดาวน์โหลดแอป

- รอบ

- ดาวน์โหลด

- 2024-05

- 2468

กฎ: ข้อมูลที่แสดงคือการดาวน์โหลดแอปในหนึ่งปีก่อนหน้าปัจจุบัน

ความนิยมในระดับภูมิภาคของแอป

- ประเทศ/ภูมิภาคดาวน์โหลดอัตราส่วน

ฮ่องกงจีน

147859.89%โกตดิวัวร์

98439.87%อื่น ๆ

60.24%

กฎ: ข้อมูลจะแสดงเป็นการดาวน์โหลดและส่วนแบ่งภูมิภาคของแอปในหนึ่งปีก่อนปัจจุบัน

คุณสมบัติของโบรกเกอร์

อัตราค่าคอมมิชชั่น

0.25%

New Stock Trading

Yes

Margin Trading

YES

ประเทศที่ได้รับการควบคุม

1

| Open Securities |  |

| คะแนน WikiStock | ⭐⭐⭐ |

| ยอดเงินฝากขั้นต่ำ | HKD 10,000 |

| ค่าธรรมเนียม | ต่อรายการ 0.25% ของยอดธุรกรรม (ค่าธรรมเนียมขั้นต่ำแตกต่างกันไปตามตลาด) |

| ค่าบริการบัญชี | ไม่มีค่าบริการบัญชี; มีค่าธรรมเนียมอื่น ๆ (เช่น ค่าเช็คคืน, ค่าสมัคร IPO) |

| อัตราดอกเบี้ยเงินกู้ | เปลี่ยนแปลงได้ ขึ้นอยู่กับเงื่อนไขตลาดและข้อตกลงกับลูกค้า |

| แอป/แพลตฟอร์ม | แอป iOS และ Android, แพลตฟอร์ม Winner Trade บนเดสก์ท็อป |

| โปรโมชั่น | ยังไม่มี |

Open Securities คืออะไร?

Open Securities เป็นบริษัทโบรกเกอร์ที่ตั้งอยู่ในฮ่องกงซึ่งได้รับการควบคุมจาก SFC โดยมีค่าธรรมเนียมต่ำและแอปการซื้อขายที่ใช้งานง่ายสำหรับ iOS และ Android แพลตฟอร์มนี้มีมาตรการรักษาความปลอดภัยที่แข็งแกร่งเพื่อป้องกันข้อมูลลูกค้าและเงินทุน อย่างไรก็ตาม บริษัทขาดรายละเอียดเฉพาะเกี่ยวกับความคุ้มครองประกันสำหรับเงินทุนของลูกค้า

ข้อดีและข้อเสียของ Open Securities

Open Securities มีข้อดีหลากหลายรวมถึงการควบคุมอย่างเข้มงวดโดย SFC การใช้เทคโนโลยีการเข้ารหัสเพื่อป้องกันข้อมูลลูกค้าและความเป็นไปได้ที่จะแยกเงินทุนของลูกค้าเพื่อเพิ่มความปลอดภัย อย่างไรก็ตาม บริษัทไม่ได้ให้ข้อมูลเฉพาะเกี่ยวกับความคุ้มครองประกันสำหรับเงินทุนของลูกค้าและโปรโตคอลความปลอดภัยที่ละเอียดอ่อน ซึ่งอาจเป็นปัญหาสำหรับนักลงทุนบางคน

| ข้อดี | ข้อเสีย |

|

|

|

|

|

|

|

Open Securities เป็นแพลตฟอร์มการลงทุนที่ถือว่าปลอดภัยเนื่องจากได้รับการควบคุมโดย SFC ใช้บัญชีที่แยกกันสำหรับเงินทุนของลูกค้าและใช้เทคโนโลยีการเข้ารหัสที่แข็งแกร่งเพื่อป้องกันข้อมูล อย่างไรก็ตาม ขาดรายละเอียดเฉพาะเกี่ยวกับความคุ้มครองประกันและโปรโตคอลความปลอดภัยที่ละเอียดอ่อนอาจเป็นปัญหาสำหรับนักลงทุนบางคน

Open Securities ปลอดภัยหรือไม่?

กฎหมายและระเบียบ

Open Securities ได้รับการควบคุมโดยสำนักงานความปลอดภัยและอนาคตทางการเงิน (SFC) ของฮ่องกง ทำให้ปฏิบัติตามมาตรฐานเข้มงวดและกฎหมายท้องถิ่นเพื่อให้ความคุ้มครองแก่นักลงทุน

ความปลอดภัยของเงินทุน

เงินทุนของลูกค้ามีความเป็นไปได้สูงที่จะถูกเก็บไว้ในบัญชีที่แยกกัน เพื่อให้ไม่ถูกใช้สำหรับค่าใช้จ่ายของบริษัทและสามารถถอนได้ตลอดเวลา อย่างไรก็ตาม บริษัทไม่ได้ให้ข้อมูลเฉพาะเกี่ยวกับความคุ้มครองประกันสำหรับเงินทุนของลูกค้า

มาตรการรักษาความปลอดภัย

Open Securities ใช้เทคโนโลยีการเข้ารหัสเพื่อป้องกันข้อมูลลูกค้าและใช้มาตรการรักษาความปลอดภัยที่แข็งแกร่งเพื่อป้องกันการเข้าถึงที่ไม่ได้รับอนุญาตและการรั่วไหลของข้อมูล

หลักทรัพย์ที่สามารถซื้อขายกับ Open Securities คืออะไร?

Open Securities มีชุดความหลากหลายของตัวเลือกการลงทุนรวมถึง ฟิวเจอร์สฮ่องกง, หุ้นฮ่องกง และหุ้นสหรัฐอเมริกา

ฟิวเจอร์สฮ่องกง

Open Securities ให้การเข้าถึงสู่ตลาดฟิวเจอร์สฮ่องกง ที่ช่วยให้นักลงทุนสามารถซื้อขายสัญญาซึ่งเป็นสินทรัพย์ใต้สิ่งที่อยู่ภายในได้ ซึ่งรวมถึงดัชนี สินค้า และอัตราดอกเบี้ย การซื้อขายสัญญาซึ่งเสนอโอกาสในการได้รับผลตอบแทนสูง โอกาสในการเลือกใช้เงินกู้ และการป้องกันความผันผวนของตลาด

หุ้นฮ่องกง

นักลงทุนสามารถซื้อขายหุ้นฮ่องกงผ่าน Open Securities ซึ่งเข้าถึงหุ้นของบริษัทที่มีการจดทะเบียนในตลาดหลักทรัพย์ฮ่องกง (HKEX) ตลาดนี้มีชื่อเสียงด้านหลากหลายอุตสาหกรรม รวมถึงการเงิน เทคโนโลยี และอสังหาริมทรัพย์ การซื้อขายหุ้นฮ่องกงเสนอโอกาสในการกระจายพอร์ตโดยใช้เงินลงทุนและการเผชิญหน้ากับการเติบโตทางเศรษฐกิจในภูมิภาคเอเชีย-แปซิฟิก

หุ้นสหรัฐอเมริกา

Open Securities ยังส facilitates การซื้อขายหุ้นสหรัฐอเมริกา ที่ช่วยให้นักลงทุนสามารถซื้อขายหุ้นของบริษัทที่มีการจดทะเบียนในตลาดหลักทรัพย์สำคัญในสหรัฐอเมริกา เช่น NYSE และ NASDAQ ตลาดหลักทรัพย์สหรัฐอเมริกาเป็นที่อยู่ของบริษัทที่ใหญ่ที่สุดและมีอิทธิพลมากที่สุดในโลก ซึ่งมีโอกาสในการเติบโตและรายได้ผ่านเงินปันผล

Open Securities มีสินค้าที่หลากหลาย ที่ช่วยให้นักลงทุนปรับแต่งพอร์ตโดยใช้เป้าหมายการเงินและความเสี่ยงที่เหมาะสม

บัญชี Open Securities

บัญชีรายบุคคลและบัญชีร่วม

บัญชีเงินสด

บัญชีเงินสดใช้สำหรับการซื้อขายหุ้นฮ่องกงและธุรกรรมสามารถทำได้โดยใช้เงินที่มีอยู่ในบัญชี ในการเปิดบัญชีเงินสด คุณต้องให้เอกสารต่อไปนี้: บัตรประจำตัวประชาชนของผู้พักอาศัยในฮ่องกงหรือต่างประเทศ สำเนาหนังสือเดินทางที่ถูกต้อง สำเนาใบอนุญาตเดินทาง และหลักฐานที่อยู่ เช่น ใบแจ้งหนี้สาธารณะหรือรายการเครดิตธนาคารในช่วงสามเดือนที่ผ่านมา คุณยังต้องกรอกและส่งแบบฟอร์มใบสมัครเปิดบัญชีสำหรับบัญชีรายบุคคลหรือบัญชีร่วมจาก Open Securities Ltd.

บัญชีมาร์จิน

บัญชีมาร์จินช่วยให้คุณซื้อขายโดยใช้เครดิตมาร์จินนอกเหนือจากฟังก์ชันของบัญชีเงินสด เอกสารที่จำเป็นสำหรับการเปิดบัญชีมาร์จินเหมือนกับบัญชีเงินสด นอกจากนี้คุณยังต้องกรอกแบบฟอร์มใบสมัครเปิดบัญชีมาร์จินสำหรับบัญชีรายบุคคลหรือบัญชีร่วมจาก Open Securities Ltd.

สำหรับการเปิดบัญชีบริษัท โปรดติดต่อผู้จัดการลูกค้าของบริษัทนี้ทางโทรศัพท์หรือเข้ามาที่สำนักงานของเราเพื่อขอข้อมูลที่จำเป็น

วิธีการสมัคร

คุณสามารถสมัครเปิดบัญชีได้ในหนึ่งในวิธีสามวิธีดังต่อไปนี้:

1. ดาวน์โหลดและส่งทางไปรษณีย์: ดาวน์โหลดแบบฟอร์มการเปิดบัญชี อ้างอิงตัวอย่างแบบฟอร์ม พิมพ์ กรอกข้อมูล และลงลายมือชื่อ ส่งแบบฟอร์มต้นฉบับพร้อมสำเนาเอกสารที่จำเป็นไปยังบริษัทของเรา พนักงานจัดการลูกค้าของเราจะติดต่อคุณหลังจากตรวจสอบคำขอของคุณ

2. มาเยือนด้วยตนเอง: มาเยือนสำนักงานของเราเพื่อดำเนินการเปิดบัญชี นำสำเนาเอกสารที่จำเป็นมาด้วย ชั่วโมงบริการของเราคือวันจันทร์ถึงวันศุกร์ เวลา 9:00 น. ถึง 18:00 น. เราปิดให้บริการวันเสาร์ อาทิตย์และวันหยุดราชการ

3. นัดหมาย: นัดหมายทางโทรศัพท์ที่ (852) 3405-7355 หรือทางอีเมลที่ cs@opensecltd.com

Open Securities การทบทวนค่าธรรมเนียม

ตลาดฮ่องกง (HKD)

สำหรับการซื้อขายในตลาดฮ่องกง Open Securities เรียกเก็บค่าคอมมิชชั่นที่ต่อรองได้ ซึ่งมักจะกำหนดที่ 0.25% ของจำนวนธุรกรรม โดยมีค่าธรรมเนียมขั้นต่ำที่ HK$100 นอกจากนี้ยังมีอากรแสตมป์ที่ HK$1.30 สำหรับทุก HK$1,000 ของจำนวนธุรกรรม ซึ่งจะถูกชำระโดยผู้ซื้อและผู้ขาย ยังมีค่าธรรมเนียมอื่น ๆ รวมถึงค่าธรรมเนียมภายในการซื้อขาย 0.0027% ค่าธรรมเนียมการซื้อขาย 0.00565% และค่าธรรมเนียม CCASS 0.002% ของจำนวนธุรกรรม โดยมีค่าธรรมเนียมขั้นต่ำที่ HK$2.00 และสูงสุดที่ HK$100.00

หุ้น A ของซานเซียนและหุ้น A ของเซินเจิ้น (CNY)

สำหรับการซื้อขายหุ้น A ของซานเซียนและหุ้น A ของเซินเจิ้นผ่านโปรแกรม Stock Connect ค่าคอมมิชชั่นสามารถต่อรองได้และมักจะกำหนดที่ 0.25% ของจำนวนธุรกรรม โดยมีค่าธรรมเนียมขั้นต่ำที่ CNY50 ผู้ขายต้องชำระอากรแสตมป์ 0.10% ของจำนวนธุรกรรม ทั้งสองฝ่ายของธุรกรรมต้องเสียค่าธรรมเนียมการจัดการหลักทรัพย์ 0.002% ค่าธรรมเนียมการจัดการ 0.00487% และค่าธรรมเนียมการโอน 0.004%

USA Market (USD)

เมื่อซื้อขายหุ้นในสหรัฐอเมริกา ค่าคอมมิชชั่นโบรกเกอร์สามารถต่อรองได้และโดยทั่วไปอยู่ที่ 0.25% ของจำนวนธุรกรรม โดยมีค่าธรรมเนียมขั้นต่ำที่ US$20 นอกจากนี้ยังมีค่าธรรมเนียมเพิ่มเติมในจำนวน US$0.01 ต่อหุ้นหากราคาตกต่ำกว่า US$5

ตลาดอื่น ๆ

ค่าธรรมเนียมสำหรับตลาดอื่น ๆ แตกต่างกันไป ตัวอย่างเช่นการซื้อขายในตลาดสหราชอาณาจักรมีค่าธรรมเนียมโบรกเกอร์อยู่ที่ 1.25% ของจำนวนธุรกรรม โดยมีค่าธรรมเนียมขั้นต่ำที่ GBP£15 นอกจากนี้ยังมีอากรแสตมป์อยู่ที่ 0.5% ของจำนวนธุรกรรมสำหรับการซื้อ และอากรเพิ่มเติมที่ GBP£1 หากจำนวนรวมเกิน GBP£10,000

ค่าธรรมเนียมการตั้งบัญชีและการเก็บรักษาหลักทรัพย์

Open Securities ยังเรียกเก็บค่าธรรมเนียมสำหรับการตั้งบัญชีและการเก็บรักษาหลักทรัพย์ สำหรับหุ้นฮ่องกง ค่าอากรแสตมป์การโอนคือ HK$5.00 ต่อเอกสารโอน และค่าธรรมเนียมคำสั่งการชำระเงินคือ HK$50.00 ต่อธุรกรรมสำหรับคำสั่งการส่งมอบ ค่าธรรมเนียมการเก็บรักษาและค่าธรรมเนียมการฝากหุ้นถูกยกเว้น ค่าธรรมเนียมการถอนหุ้นแบบกากบาทคือ HK$3.50 ต่อชุดหุ้นพร้อมค่าธรรมเนียมการจัดการ HK$50.00

ค่าธรรมเนียมการเก็บเงินปันผล

สำหรับการเก็บเงินปันผล ค่าธรรมเนียมทั่วไปคือ 0.50% ของจำนวนเงินปันผล โดยมีค่าธรรมเนียมขั้นต่ำที่แตกต่างกันตามตลาด เช่น ค่าธรรมเนียมขั้นต่ำคือ HK$25.00 สำหรับหุ้นฮ่องกง US$3.20 สำหรับหุ้นสหรัฐอเมริกา และ HK$25.00 สำหรับหุ้นเซินเจิ้น B

ค่าธรรมเนียมอื่น ๆ

ค่าธรรมเนียมอื่น ๆ รวมถึงค่าธรรมเนียมเช็คคืนที่ HK$200.00 ต่อเช็คคืนและค่าธรรมเนียมในการสมัคร IPO ซึ่งคือ HK$50.00 สำหรับการสมัครที่ไม่ได้รับการรับรองการเงินและ HK$100.00 สำหรับการสมัครที่ได้รับการรับรองการเงิน ยังมีค่าธรรมเนียมสำหรับการวางหุ้นและการยกเลิก GDR ในตลาด OTC

โครงสร้างค่าธรรมเนียมของ Open Securities ครอบคลุมการให้บริการและตลาดหลากหลาย ทำให้ลูกค้าทราบถึงค่าใช้จ่ายที่เป็นไปได้ทั้งหมดที่เกี่ยวข้องกับการซื้อขายและการลงทุนของพวกเขา

Open Securities App Review

iOS Mobile App

Open Securities ให้แพลตฟอร์มการซื้อขายสำหรับอุปกรณ์ iOS ซึ่งสามารถดาวน์โหลดได้จาก Apple App Store ผู้ใช้สามารถค้นหา "Open Securities" ในร้านค้าเพื่อค้นหาและติดตั้งแอปพลิเคชัน แพลตฟอร์มนี้ช่วยให้นักลงทุนสามารถซื้อขายได้ทุกที่โดยให้ข้อมูลราคาแบบเรียลไทม์และความสามารถในการทำธุรกรรมอย่างราบรื่นโดยตรงจาก iPhone หรือ iPad ของพวกเขา

Android Mobile App

สำหรับผู้ใช้ Android Open Securities มีแพลตฟอร์มการซื้อขายที่มีให้บริการใน Google Play โดยการค้นหา "Open Securitie" ใน Google Play Store นักลงทุนสามารถดาวน์โหลดแอปพลิเคชันและเข้าถึงแพลตฟอร์มการซื้อขายได้ นอกจากนี้ ยังสามารถดาวน์โหลดแพลตฟอร์มโดยตรงโดยสแกนรหัส QR เพื่อความสะดวกในการติดตั้งเวอร์ชัน APK

แพลตฟอร์มการซื้อขายบนเดสก์ท็อป

Winner Trade

Winner Trade เป็นซอฟต์แวร์การซื้อขายที่ออกแบบมาเพื่อตอบสนองความต้องการของนักซื้อขายสินค้าฟิวเจอร์ทั้งผู้เชี่ยวชาญและผู้เริ่มต้นในการซื้อขายออนไลน์ แพลตฟอร์มนี้สามารถปรับแต่งได้สูงเพื่อเข้ากันกับนิสัยการซื้อขายแต่ละคนและมีการให้ข้อมูลราคาแบบเรียลไทม์และธุรกรรมที่ซิงค์กับตลาดเพื่อให้ไม่มีความล่าช้า

ความต้องการของระบบสำหรับ Winner Trade:

ระบบปฏิบัติการ: Windows 2000 Service Pack 3, Windows XP Service Pack 2, Windows Vista, Windows 7, Windows Server 2003, หรือ Windows Server 2008

เบราว์เซอร์: IE 5.01 หรือใหม่กว่านั้น

หน่วยประมวลผล: Intel Pentium 4 หรือสูงกว่านั้น

ฮาร์ดไดรฟ์: อย่างน้อย 40GB ของพื้นที่ว่าง

หน่วยความจำ: อย่างน้อย 2GB RAM

ความละเอียด: 1028x768 หรือสูงกว่านั้น

อินเทอร์เน็ต: การเชื่อมต่อความเร็วสูง

ซอฟต์แวร์ที่จำเป็น: Microsoft Windows XP Professional หรือสูงกว่านั้น, Microsoft .NET 2.0

Open Securities ให้บริการแพลตฟอร์มการซื้อขายที่หลากหลายสำหรับผู้ใช้ทั้งบนมือถือและเดสก์ท็อป แอปบน iOS และ Android จะให้ความยืดหยุ่นในการซื้อขายทุกที่ ในขณะที่แพลตฟอร์ม Winner Trade บนเดสก์ท็อปมีคุณสมบัติที่แข็งแกร่งและการซิงโครไนเซชันแบบเรียลไทม์กับตลาด แพลตฟอร์มเหล่านี้เหมาะสำหรับนักลงทุนที่หลากหลาย ตั้งแต่นักเทรดมืออาชีพจนถึงผู้เริ่มต้น ให้ประสบการณ์การซื้อขายที่ราบรื่นและมีประสิทธิภาพ

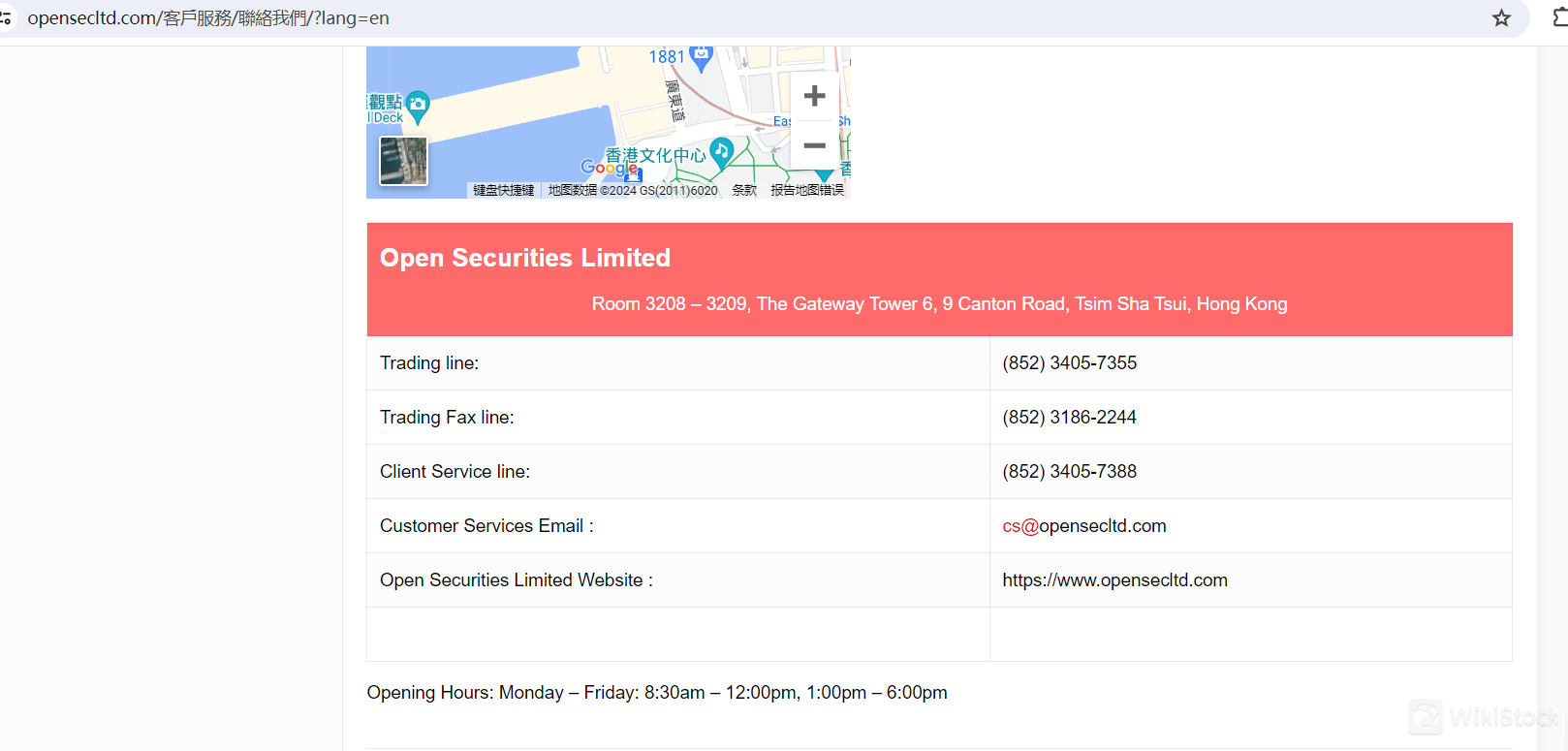

บริการลูกค้า

Open Securities Limited ให้บริการสนับสนุนลูกค้าอย่างครบวงจรเพื่อให้ลูกค้าได้รับความช่วยเหลือที่ต้องการ ตั้งอยู่ที่ห้อง 3208 - 3209 อาคารเดอะเกตเวย์ 6 ถนนคานท์ 9 จังหวัดจีนฮ่องกง Open Securities มีวิธีการติดต่อหลายวิธี

ข้อมูลการติดต่อ:

Trading Line: สำหรับการสอบถามเกี่ยวกับการซื้อขาย โทร (852) 3405-7355.

Trading Fax Line: ส่งแฟกซ์ไปที่ (852) 3186-2244.

Client Service Line: สำหรับบริการทั่วไป โทร (852) 3405-7388.

Customer Service Email: อีเมลล์ cs@opensecltd.com.

เว็บไซต์: เยี่ยมชม https://www.opensecltd.com เพื่อข้อมูลเพิ่มเติม

เวลาเปิดทำการ:

จันทร์ถึงศุกร์:

เช้า: 8:30 น. - 12:00 น.

บ่าย: 1:00 น. - 6:00 น.

Open Securities Limited รับประกันว่าลูกค้าสามารถรับการสนับสนุนได้อย่างง่ายดายผ่านโทรศัพท์ แฟกซ์ อีเมลล์ หรือทรัพยากรออนไลน์ ให้บริการรวดเร็วและมีประสิทธิภาพในช่วงเวลาทำการ

สรุป

Open Securities Limited เป็นบริษัทหลักทรัพย์ในฮ่องกงที่ได้รับการควบคุมโดย SFC มีค่าธรรมเนียมต่ำ มีแอปซื้อขายที่ใช้งานง่ายสำหรับ iOS และ Android และมีมาตรการรักษาความปลอดภัยที่แข็งแกร่งสำหรับข้อมูลลูกค้าและเงินทุน แม้ว่าจะขาดรายละเอียดเฉพาะเกี่ยวกับความคุ้มครองประกันสำหรับเงินลูกค้า บริษัทยังให้การสนับสนุนลูกค้าอย่างครบวงจรและแพลตฟอร์มการซื้อขายที่หลากหลาย ทำให้เป็นทางเลือกที่น่าเชื่อถือสำหรับนักลงทุน

คำถามที่พบบ่อย

Open Securities เป็นเว็บไซต์ที่ปลอดภัยในการซื้อขายหรือไม่?

Open Securities ได้รับการควบคุมโดยหน่วยงานกำกับดูแลหลักทรัพย์และอนุพันธ์ (SFC) ของฮ่องกง รับรองความเป็นไปตามมาตรฐานการกำกับดูแลที่เข้มงวด บริษัทใช้เทคโนโลยีการเข้ารหัสที่แข็งแกร่งและอาจแยกเงินลูกค้าเพื่อเพิ่มความปลอดภัย อย่างไรก็ตาม ไม่ได้ระบุรายละเอียดเฉพาะเกี่ยวกับความคุ้มครองประกันสำหรับเงินลูกค้า

Open Securities เป็นแพลตฟอร์มที่ดีสำหรับผู้เริ่มต้นหรือไม่?

ใช่ Open Securities มีแอปซื้อขายที่ใช้งานง่ายสำหรับทั้ง iOS และ Android ทำให้เข้าถึงได้ง่ายสำหรับผู้เริ่มต้น แพลตฟอร์มยังให้การสนับสนุนอย่างครบวงจรและมีตัวเลือกการลงทุนหลากหลาย ซึ่งสามารถช่วยให้นักลงทุนใหม่เริ่มต้นได้

Open Securities เป็นโบรกเกอร์ที่ถูกต้องหรือไม่?

ใช่ Open Securities เป็นบริษัทโบรกเกอร์ที่ได้รับการควบคุมโดย SFC ในฮ่องกง การควบคุมรับรองว่า บริษัทดำเนินธุรกิจในเกณฑ์ที่ถูกต้องตามกฎหมายและให้ระดับความคุ้มครองสำหรับนักลงทุน

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้ไว้เป็นผลจากการประเมินของผู้เชี่ยวชาญของ WikiStock เกี่ยวกับข้อมูลเว็บไซต์ของโบรกเกอร์และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการลงทุนที่มีความเสี่ยงสูง อาจ导致สูญเสียเงินลงทุนทั้งหมด ดังนั้นความเข้าใจเกี่ยวกับความเสี่ยงที่เกี่ยวข้องก่อนที่จะลงมือเป็นสิ่งสำคัญ

อื่น ๆ

Registered region

ฮ่องกงจีน

ปีในธุรกิจ

2-5 ปี

ผลิตภัณฑ์ทางการเงิน

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

ธุรกิจที่เกี่ยวข้อง

ประเทศ

Company name

สมาคม

--

Open Asset Management Limited

บริษัทย่อย

รีวิว

ดีมาก

ดีมากโบรกเกอร์ที่แนะนําMore

瑞达国际

คะแนน

Huajin International

คะแนน

CLSA

คะแนน

DL Securities

คะแนน

Sanfull Securities

คะแนน

嘉信

คะแนน

GF Holdings (HK)

คะแนน

China Taiping

คะแนน

Capital Securities

คะแนน

乾立亨證券

คะแนน