คะแนน

Forte Securities

https://fortesecurities.com/

Website

ดัชนีคะแนน

การประเมินนายหน้า

ความหลากหลาย

5

Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 1

FCAอยู่ในการกำกับดูแล

สหราชอาณาจักรใบอนุญาตซื้อขายหลักทรัพย์

ที่นั่งทั่วโลก

![]() เป็นเจ้าของ 1 ที่นั่ง

เป็นเจ้าของ 1 ที่นั่ง

สหราชอาณาจักร LSE

Seat No. FOSUGB21

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

Forte Securities Limited

ชื่อย่อบริษัท

Forte Securities

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

https://fortesecurities.com/ตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

| Forte Securities |  |

| คะแนน WikiStock | ⭐⭐⭐ |

| ยอดเงินฝากขั้นต่ำ | N/A |

| ค่าธรรมเนียม | N/A |

| มีกองทุนรวมให้บริการ | ไม่ |

| แอป/แพลตฟอร์ม | N/A |

| โปรโมชั่น | ยังไม่มี |

ข้อมูล Forte Securities

Forte Securities เป็นผู้ให้บริการบริการทางการเงินอย่างเป็นทางการที่มีการเสนอตัวเลือกการซื้อขายและผลิตภัณฑ์ทางการเงินที่หลากหลายให้แก่ลูกค้าทั้งบุคคลและสถาบัน มีการเสนอหลากหลายหลักทรัพย์ที่สามารถซื้อขายได้รวมถึงหลักทรัพย์เงินสด อนุพันธ์ รายได้คงที่ ผลิตภัณฑ์โครงสร้าง อัตราแลกเปลี่ยน สินทรัพย์เสริมเครดิต กองทุน และสกุลเงินดิจิตอล เพื่อตอบสนองความต้องการในการลงทุนและความชอบของลูกค้าที่แตกต่างกัน

อย่างไรก็ตาม เว็บไซต์ของพวกเขาขาดข้อมูลที่ละเอียดเกี่ยวกับประเภทบัญชีและค่าธรรมเนียมการซื้อขายซึ่งอาจเป็นข้อเสียสำหรับลูกค้าที่ต้องการตัดสินใจที่มีข้อมูลที่เพียงพอ

ข้อดีและข้อเสียของ Forte Securities

Forte Securities ได้รับใบอนุญาตจาก UK Financial Conduct Authority (FCA) ซึ่งรับรองความปลอดภัยในการซื้อขายและปฏิบัติตามมาตรฐานอุตสาหกรรมที่เข้มงวด โบรกเกอร์ให้ความสำคัญกับความปลอดภัยของเงินลูกค้าโดยการรักษาบัญชีที่แยกต่างหากเพื่อลดความเสี่ยงจากการใช้งานผิดประเภท นอกจากนี้ Forte Securities ยังมีบริการลูกค้าอย่างเป็นอย่างดีโดยให้ช่องทางการสนับสนุนหลายช่องเพื่อช่วยลูกค้าในการสอบถามข้อมูล โบรกเกอร์มีการเสนอหลากหลายหลักทรัพย์ที่สามารถซื้อขายได้รวมถึงหลักทรัพย์เงินสด อนุพันธ์ รายได้คงที่ ผลิตภัณฑ์โครงสร้าง อัตราแลกเปลี่ยน สินทรัพย์เสริมเครดิต กองทุน และสกุลเงินดิจิตอล

อย่างไรก็ตาม Forte Securities ยังมีข้อจำกัดบางประการ โบรกเกอร์เน้นให้บริการลูกค้าสถาบันและมืออาชีพซึ่งอาจไม่เข้ากับนักลงทุนรายย่อยที่อาจต้องการบริการที่เป็นบุคคล มีข้อบกพร่องที่เป็นที่สังเกตเกี่ยวกับข้อมูลที่ละเอียดเกี่ยวกับประเภทบัญชีและค่าธรรมเนียมการซื้อขายบนเว็บไซต์ของพวกเขา นอกจากนี้ ข้อมูลเกี่ยวกับแพลตฟอร์มการซื้อขายจำกัดซึ่งอาจเป็นปัญหาสำหรับนักเทรดที่ให้ความสำคัญกับความโปร่งใส

| ข้อดี | ข้อเสีย |

| ได้รับการควบคุมโดย FCA | เน้นให้บริการลูกค้าสถาบันและมืออาชีพ |

| บัญชีที่แยกสำหรับเงินลูกค้า | ขาดข้อมูลเกี่ยวกับประเภทบัญชี |

| บริการลูกค้าที่ยอดเยี่ยม | ขาดข้อมูลเกี่ยวกับค่าธรรมเนียมการซื้อขาย |

| มีหลากหลายหลักทรัพย์ที่สามารถซื้อขายได้ | ข้อมูลจำกัดเกี่ยวกับแพลตฟอร์มการซื้อขาย |

Forte Securities ปลอดภัยหรือไม่?

กฎหมาย

Forte Securities ได้รับใบอนุญาตอย่างเป็นทางการและได้รับการควบคุมโดย The United Kingdom Financial Conduct Authority (FCA) ภายใต้หมายเลขใบอนุญาต 478424

ความปลอดภัยของเงินทุน

Forte Securities ให้ความสำคัญกับความปลอดภัยของเงินลูกค้าอย่างเข้มงวด โบรกเกอร์ปฏิบัติตามมาตรฐานการควบคุมอย่างเข้มงวดและรักษา บัญชีที่แยกแยะ สำหรับเงินลูกค้า นั่นหมายความว่าเงินของลูกค้าจะถูกเก็บเกี่ยวกับเงินที่ใช้ในการดำเนินงานของโบรกเกอร์ ลดความเสี่ยงจากการใช้งานผิดประเภท นอกจากนี้ Forte Securities มีความร่วมมือกับสถาบันการเงินในการเก็บเงินเหล่านี้เพื่อให้มั่นใจว่ามีมาตรการรักษาความปลอดภัยที่เป็นที่ยอมรับ

มาตรการความปลอดภัย

เพื่อเสริมความปลอดภัยในการดำเนินการของตนเอง ฟอร์เต้ ซีคิวริตี้ ใช้เทคโนโลยีการเข้ารหัสขั้นสูงเพื่อปกป้องข้อมูลลูกค้าและธุรกรรม โบรกเกอร์ยังนำเข้าใช้ การรับรองตัวตนหลายปัจจัย (MFA) เพื่อให้มีชั้นความปลอดภัยเพิ่มเติมในระหว่างกระบวนการเข้าสู่ระบบ นอกจากนี้ยังมีการตรวจสอบความปลอดภัยและการตรวจสอบความเป็นไปตามกฎระเบียบเป็นประจำเพื่อให้สอดคล้องกับมาตรฐานสูงสุดในการป้องกันข้อมูลและการระบุความเสี่ยงที่เป็นไปได้

หลักทรัพย์ที่ใช้ในการซื้อขายกับฟอร์เต้ ซีคิวริตี้คืออะไร?

Forte Securities ให้บริการหลากหลายประเภทของหลักทรัพย์สำหรับการซื้อขาย ตอบสนองต่อกลยุทธ์การลงทุนและความชื่นชอบที่แตกต่างกัน นี่คือภาพรวมละเอียดเกี่ยวกับตัวเลือกที่มีอยู่:

- Cash Equity: Forte Securities ให้บริการด้านการดำเนินการที่กำหนดเองเพื่อตอบสนองต่อความต้องการที่เปลี่ยนแปลงของตลาดโลก โดยใช้ความเชี่ยวชาญในตลาดที่ลึกซึ้งและเทคโนโลยีที่ทันสมัย บริษัทนำเสนอการดำเนินการสั่งซื้อที่ดีกว่าและการเข้าถึงตลาดโดยตรง การครอบคลุมรวมถึงตลาดยุโรป อเมริกา และเอเชีย ช่วยให้การซื้อขายบล็อกได้อย่างรวดเร็วและมีประสิทธิภาพผ่านเครือข่ายที่กว้างขวาง ซึ่งรวมถึงการซื้อขายบล็อกของหลักทรัพย์ที่ซื้อขายในตลาดแลกเปลี่ยนและการซื้อขายบล็อกในตลาด OTC

- Derivatives: โบรกเกอร์ในบริษัท Forte Securities เชี่ยวชาญในการซื้อขายได้รับความนิยมและไดเวอร์แทรกต่าง ๆ ในตลาด OTC และตลาดที่รายชื่อ บริษัทครอบคลุมตัวเลือกหุ้นและดัชนีมาตรฐาน ETFs delta-one exotics variance และผลิตภัณฑ์ที่เกี่ยวข้องกัน การทำงานร่วมกับธนาคาร ผู้ทำตลาด และสถาบันด้านการซื้อขาย Forte Securities ลดต้นทุนการดำเนินการแม้จะมีข้อจำกัดในความเหลื่อมล้ำของตลาด บริการโบรกเกอร์ที่กำหนดเองสำหรับตัวเลือกหุ้นตอบสนองต่อความต้องการของลูกค้าโดยให้การเข้าถึงตลาดที่ยืดหยุ่น

- Fixed Income: Forte Securities ได้เติบโตจากการเป็นโบรกเกอร์ตราสารหนี้เป็นผู้นำด้านการค้าที่มีสินค้าตราสารหนี้ที่หลากหลาย ทีมการซื้อขายที่มุ่งมั่นให้การมุ่งมั่นและการดำเนินการที่มีความเชื่อมั่น การตกลงการชำระเงินตราสารหนี้จัดการผ่านการจัดระเบียบการล้างบัญชีรูปแบบ B กับผู้มีส่วนร่วมในตลาด เพื่อให้การทำธุรกรรมที่มีความปลอดภัย บริษัทใช้ความเชี่ยวชาญในตลาดที่ลึกซึ้งและโครงสร้างพื้นฐานที่แข็งแกร่งในตลาดตราสารหนี้

- Structured Products: Forte Securities มีความสัมพันธ์กับผู้ออกหลักทรัพย์ใหญ่เพื่อให้สามารถให้อัตราเงินทุนที่หลากหลายขึ้นโดยพิจารณาความต้องการความเสี่ยงของลูกค้า โครงสร้างและทีมผู้เชี่ยวชาญของบริษัท Forte Securities รับประกันราคาที่แข่งขันได้โดยใช้ความแข็งแกร่งของธนาคารหลายแห่ง Forte Securities ครอบคลุมช่วงผลิตภัณฑ์โครงสร้างเพื่อสนับสนุนการป้องกันความเสี่ยง การมีส่วนร่วมในผลการดำเนินงาน การป้องกันทุน การความหลากหลาย และการเพิ่มผลตอบแทน สิ่งนี้ช่วยให้ลูกค้าสามารถใช้กลยุทธ์ที่สอดคล้องกับเป้าหมายการลงทุนของตนได้

- FX: Forte Securities ให้ความเคลื่อนไหวทางเงินทุนต่าง ๆ ในตลาดเงินตราต่างประเทศโดยไม่เปิดเผยตัวตนผ่านโมเดลหน่วยงาน บริษัทให้บริการที่ปรึกษาในการป้องกันความเสี่ยงและสามารถหาและดำเนินการซื้อขายผลิตภัณฑ์เงินทุนที่สำคัญตามต้องการตลาด ตั้งแต่สกุลเงิน G20 จนถึงสกุลเงินที่ไม่เป็นสากลและสกุลเงินในตลาดเกิดขึ้น โต๊ะเงินทุนต่างประเทศที่ร่วมงานกับโบรกเกอร์หลักชั้นนำระดับหนึ่งจัดการตลาดสดและตลาดได้รับการรับรอง (ฟอร์เวิร์ด สวอป ตัวเลือก) ให้การดำเนินงานที่มีประสิทธิภาพผ่านทางช่องทางที่ได้รับการยืนยัน

- Alternative Credit: ผ่านบริษัทในเครือ Menara Capital Forte Securities ให้บริการสิทธิ์เครดิตทางเลือกโดยให้ความสำคัญกับการรวมกันทางการเงิน บริษัท Menara Capital จัดหาโครงสร้างการจัดหาเงินทุน จากนักลงทุนทางเลือก และให้การตรวจสอบและบริการการตรวจสอบ/การบริการหลักประกันเงินกู้ บริษัทจัดหาโอกาสการลงทุนในระดับโลกผ่านการขายหนี้และการรับรองการรับรองการเงินระยะสั้นและการจัดหาเงินทุนที่มีการรับรองผ่าน Security Trust ให้แก่บริษัท การให้บริการนี้สนับสนุนการแก้ปัญหาการจัดหาเงินที่มีนวัตกรรม

- Funds: Forte Securities ให้บริการสิทธิ์การลงทุนผ่านยานพาหนะและกลยุทธ์ต่าง ๆ ที่จัดการภายในกลุ่ม Forte หรือภายนอกผ่านข้อตกลงการกระจายสินทรัพย์ การเสนอของบริษัทรวมถึงใบรับรองการจัดการแบบแอคทีฟ แพลตฟอร์มการลงทุนในตลาดเอกชน และกองทุนรวมภายนอก ช่วงนี้เหมาะสำหรับความชื่นชอบของนักลงทุนที่แตกต่างกัน โดยให้ลูกค้าสามารถค้นหาตัวเลือกที่เหมาะสมในส่วนการจัดการทรัพย์สินของ Forte Securities

- Cryptocurrencies: Forte Securities รวมสกุลเงินดิจิตอลในการเสนอผลิตภัณฑ์ของตน โดยรักษาความสัมพันธ์ที่แข็งแกร่งกับผู้ออกหลักทรัพย์ใหญ่เพื่อให้อัตราเงินทุนที่หลากหลายขึ้นโดยพิจารณาความต้องการความเสี่ยงของลูกค้า บริการโบรกเกอร์สกุลเงินดิจิตอลนี้ปฏิบัติกระบวนการตรวจสอบเช่นเดียวกับคลาสสินทรัพย์อื่น ๆ Forte Securities เห็นว่าสกุลเงินดิจิตอลเป็นคลาสสินทรัพย์ที่มีความเป็นไปได้และรวมอยู่ในพอร์ตโดยใช้บริษัทในเครือเป็นตัวกลางในการเข้าสู่ตลาดที่มั่นใจได้

บริการ

Forte Securities ให้บริการหลากหลายรูปแบบที่ออกแบบมาเพื่อตอบสนองความต้องการของลูกค้าสถาบันและลูกค้ามืออาชีพในตลาดทางการเงิน

การดำเนินการ: Forte Securities ให้บริการด้านการดำเนินการที่หลากหลายในหลักทรัพย์ หนี้สิน ฟอเร็กซ์ และสินทรัพย์อนุพันธ์ โดยดำเนินการโปร่งใสโดยไม่มีการซื้อขายเพื่อตนเอง การจัดการคำสั่งของลูกค้าเพื่อเพิ่มประสิทธิภาพในการซื้อขายกับโบรกเกอร์ที่มีประสบการณ์ในตลาดเหล่านี้ นอกจากนี้ยังให้บริการเข้าถึงตลาดโดยตรง (DMA) ไปยังตลาดหลักที่สำคัญผ่านแพลตฟอร์มที่เชื่อถือได้ เพื่อให้การดำเนินการซื้อขายเป็นเร็วและเป็นเวลาจริง

การเก็บรักษา การล้างเงินและการตกลง: โบรกเกอร์ให้บริการการเก็บรักษา การล้างเงินและการตกลงที่โปร่งใสและปลอดภัยผ่านพันธมิตรระดับต้นๆ นี้จะรักษาทรัพย์สินของลูกค้าและประมวลผลธุรกรรมอย่างราบรื่นและแม่นยำ

ที่ปรึกษาทางการเงิน: Forte Securities ให้คำปรึกษาการลงทุนที่กำหนดเองรวมถึงการเข้าถึง Alpha และบริการเข้าถึงบริษัท บริการที่ออกแบบมาเพื่อช่วยลูกค้าให้บรรลุวัตถุประสงค์การลงทุนของตนโดยการให้ข้อมูลและการเข้าถึงโอกาสตลาดที่ไม่ซ้ำกัน

การจัดการสินทรัพย์: บริษัทนี้ให้บริการด้านการจัดการสินทรัพย์ที่หลากหลายรวมถึงใบรับรองการจัดการแบบใช้งานอย่างเต็มที่ แพลตฟอร์มการลงทุนในตลาดเอกชน และการกระจายกองทุนรวมภายนอก บริการเหล่านี้เหมาะสำหรับความต้องการและกลยุทธ์การลงทุนของนักลงทุนที่หลากหลาย เพื่อให้ลูกค้าสามารถเข้าถึงตัวเลือกการลงทุนที่หลากหลาย

การกำหนดโครงสร้างหนี้: Forte Securities ให้คำปรึกษาอิสระเกี่ยวกับโครงสร้างทุน การจัดหาเงินทุน และการโครงสร้างใหม่ บริการนี้ช่วยให้ลูกค้าปรับปรุงการจัดเตรียมหนี้ของตนและนำทางสู่สถานการณ์ทางการเงินที่ซับซ้อน

การจัดทำหลักทรัพย์: โบรกเกอร์ส facilitates การกระจายทรัพย์สินที่ไม่เหลือเชื่อถือผ่านรูปแบบธุรกิจต่อธุรกิจ (B2B) บริการนี้ช่วยให้ลูกค้าสามารถแปลงทรัพย์สินที่ไม่เหลือเชื่อถือเป็นหลักทรัพย์ที่สามารถซื้อขายได้ เพิ่มความสะดวกในการเงินและความยืดหยุ่นในการลงทุน

สถานที่ซื้อขายที่มีระบบอย่างเป็นระเบียบ (OTF): Forte Securities ดำเนินการ OTF ซึ่งเป็นสถานที่ซื้อขายสำหรับสินทรัพย์อนุพันธ์ทางทุน สินทรัพย์อนุพันธ์เครดิต และพันธบัตร ที่เป็นไปตามระเบียบ MiFID II สถานที่นี้จะให้การซื้อขายที่ได้รับการกำกับดูแลและโปร่งใสสำหรับลูกค้า

บริการลูกค้า

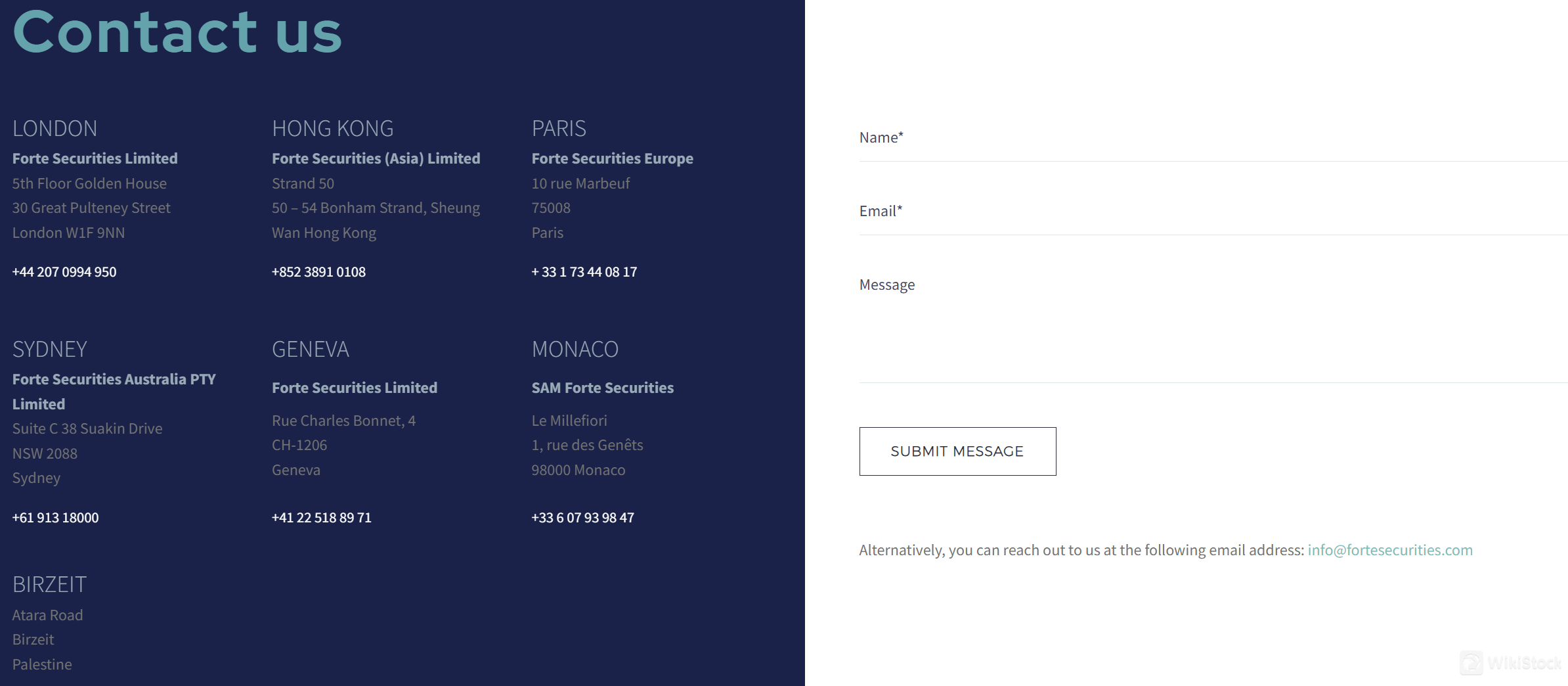

Forte Securities ภูมิใจในการให้บริการลูกค้าที่ยอดเยี่ยม ด้วยทีมสนับสนุนที่มีความพร้อมให้ความช่วยเหลือลูกค้าในการสอบถามและปัญหาของพวกเขา โบรกเกอร์นี้มีช่องทางการสนับสนุนหลายช่องทาง รวมถึง:

- การสนับสนุนทางอีเมล: ลูกค้าสามารถติดต่อทีมสนับสนุนผ่านอีเมล (info@fortesecurities.com) เพื่อสอบถามและขอความช่วยเหลืออย่างละเอียด

- การสนับสนุนทางโทรศัพท์: มีการสนับสนุนโทรศัพท์โดยตรง (+44 (0) 207 0994 950) ที่สามารถให้บริการให้ลูกค้าสนทนากับตัวแทนเพื่อความช่วยเหลือทันที

- กล่องข้อความ: Forte Securities ยังมีกล่องข้อความบนเว็บไซต์ของพวกเขา

สรุป

Forte Securities ได้รับการควบคุมจาก UK Financial Conduct Authority (FCA) เพื่อให้มีสภาพแวดล้อมการซื้อขายที่แข็งแกร่งและมีมาตรฐานการปฏิบัติที่สูง โบรกเกอร์มีความเชี่ยวชาญในการรักษาความปลอดภัยของกองทุนลูกค้า โดยรักษาบัญชีแยกต่างหากและใช้มาตรการรักษาความปลอดภัยขั้นสูง บริษัทนี้มีการเสนอหลากหลายประเภทของหลักทรัพย์ที่สามารถซื้อขายได้ เช่น หุ้นเงินสด อนุพันธ์ รายได้คงที่ ผลิตภัณฑ์โครงสร้าง อัตราแลกเปลี่ยน (FX) สินเชื่อทางเลือก กองทุน และสกุลเงินดิจิตอล ทำให้เป็นตัวเลือกที่หลากหลายสำหรับลูกค้าที่มีความเชี่ยวชาญและสถาบัน บริการลูกค้าที่ยอดเยี่ยมยิ่งขึ้นเพิ่มความน่าสนใจ อย่างไรก็ตาม Forte Securities ยังมีข้อเสียบางประการ เช่น ข้อมูลเกี่ยวกับประเภทบัญชี ค่าธรรมเนียมการซื้อขาย และแพลตฟอร์มการซื้อขายที่จำกัด ซึ่งอาจป้องกันลูกค้าที่ต้องการความโปร่งใสและบริการที่กำหนดเองมากขึ้น

FAQs

Forte Securities เป็นโบรกเกอร์ที่ได้รับการควบคุมหรือไม่?

ใช่ Forte Securities ได้รับการควบคุมจาก Financial Conduct Authority (FCA) ในสหราชอาณาจักร

ฉันสามารถซื้อขายหลักทรัพย์ประเภทใดกับ Forte Securities ได้บ้าง? Forte Securities มีการเสนอหลากหลายประเภทของหลักทรัพย์ที่สามารถซื้อขายได้ เช่น หุ้นเงินสด อนุพันธ์ รายได้คงที่ ผลิตภัณฑ์โครงสร้าง อัตราแลกเปลี่ยน (FX) สินเชื่อทางเลือก กองทุน และสกุลเงินดิจิตอล

Forte Securities ให้บริการลูกค้าดีหรือไม่?ใช่ Forte Securities มีชื่อเสียงด้านบริการลูกค้าที่ดี เสนอการสนับสนุนผ่านช่องทางต่างๆ เช่น อีเมล โทรศัพท์ และกล่องข้อความบนเว็บไซต์เพื่อช่วยเหลือลูกค้าในการสอบถามข้อมูล

คำเตือนเกี่ยวกับความเสี่ยง

การประเมินข้อมูลเว็บไซต์ของโบรกเกอร์จาก WikiStock อาจเปลี่ยนแปลงได้และไม่ควรถือเป็นคำแนะนำทางการเงิน การซื้อขายออนไลน์มีความเสี่ยงสูง รวมถึงความเสี่ยงในการสูญเสียทุนทั้งหมดที่ลงทุน จึงเป็นสิ่งสำคัญที่จะเข้าใจความเสี่ยงเหล่านี้อย่างเต็มที่ก่อนการลงทุน

อื่น ๆ

Registered region

สหราชอาณาจักร

ปีในธุรกิจ

15-20 ปี

ประเทศที่ได้รับการควบคุม

1

ผลิตภัณฑ์ทางการเงิน

Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

ธุรกิจที่เกี่ยวข้อง

ประเทศ

Company name

สมาคม

โมนาโก

SAM Forte Securities

กลุ่มบริษัท

ออสเตรเลีย

Forte Securities Australia PTY Limited

กลุ่มบริษัท

ฝรั่งเศส

Forte Securities Europe

กลุ่มบริษัท

ฮ่องกงจีน

Forte Securities (Asia) Limited

กลุ่มบริษัท

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

Tickmill

คะแนน

Direct TT

คะแนน

Sova Capital

คะแนน

Regency Capital

คะแนน

First btc FX

คะแนน

ActivTrades

คะแนน

Dial-n-Deal

คะแนน

CXM Trading

คะแนน

FXCM

คะแนน

CloexMarket

คะแนน