คะแนน

M4Markets

https://www.m4markets.com/th

Website

ดัชนีคะแนน

การประเมินนายหน้า

ความหลากหลาย

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 3

CYSECอยู่ในการกำกับดูแล

ประเทศไซปรัสใบอนุญาตซื้อขายหลักทรัพย์

FSAการกำกับดูแลในต่างประเทศ

เซเชลส์ใบอนุญาตซื้อขายหลักทรัพย์

DFSAอยู่ในการกำกับดูแล

สหรัฐอาหรับเอมิเรตส์Derivatives Trading License

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

Trinota Markets (Global) Limited

ชื่อย่อบริษัท

M4Markets

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

https://www.m4markets.com/thตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

การทดสอบครั้งที่แล้ว: 2024-12-22

- การกำกับดูแล เซเชลส์ The Seychelles Financial Services Authority ใบอนุญาตเลขที่ SD035 เป็นการกำกับดูแลนอกชายฝั่ง โปรดระวังความเสี่ยง!

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

ดาวน์โหลดแอป

- รอบ

- ดาวน์โหลด

- 2024-05

- 41.56M

กฎ: ข้อมูลที่แสดงคือการดาวน์โหลดแอปในหนึ่งปีก่อนหน้าปัจจุบัน

ความนิยมในระดับภูมิภาคของแอป

- ประเทศ/ภูมิภาคดาวน์โหลดอัตราส่วน

อื่น ๆ

38.74M66.10%อิหร่าน

0.94M11.25%สหรัฐอเมริกา

0.83M10.03%แอฟริกาใต้

0.62M7.50%ประเทศไนจีเรีย

0.43M5.12%

กฎ: ข้อมูลจะแสดงเป็นการดาวน์โหลดและส่วนแบ่งภูมิภาคของแอปในหนึ่งปีก่อนปัจจุบัน

คุณสมบัติของโบรกเกอร์

อัตราค่าคอมมิชชั่น

0%

ฝากขั้นต่ำ

$110

Margin Trading

YES

ประเทศที่ได้รับการควบคุม

3

| M4Markets |  |

| คะแนน WikiStock | ⭐⭐⭐ |

| ยอดเงินฝากขั้นต่ำ | $100 |

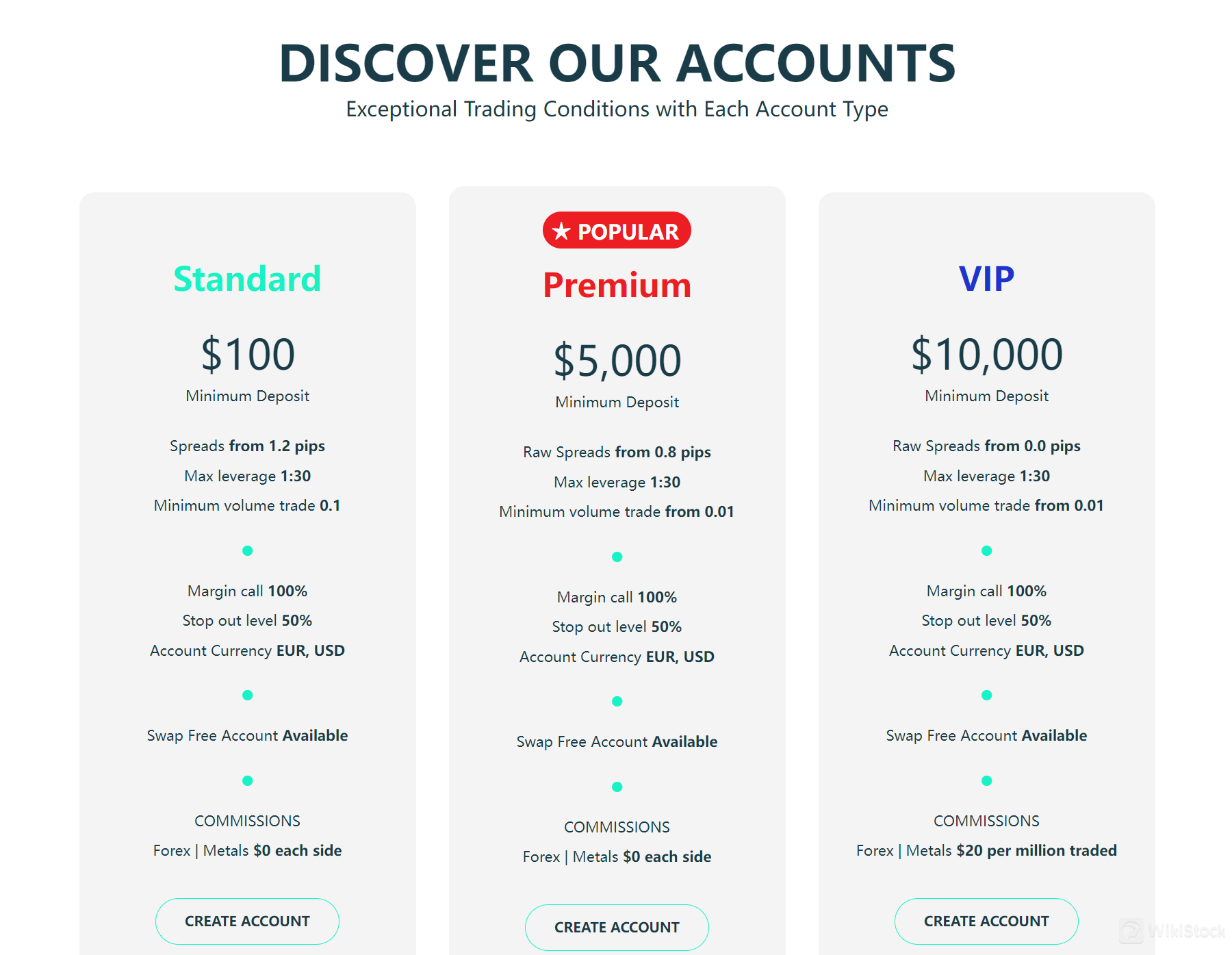

| ค่าธรรมเนียม | คอมมิชชั่น: $0 (สำหรับบัญชีมาตรฐานและบัญชีพรีเมียม), $20 ต่อล้านที่ซื้อขาย (สำหรับบัญชี VIP) |

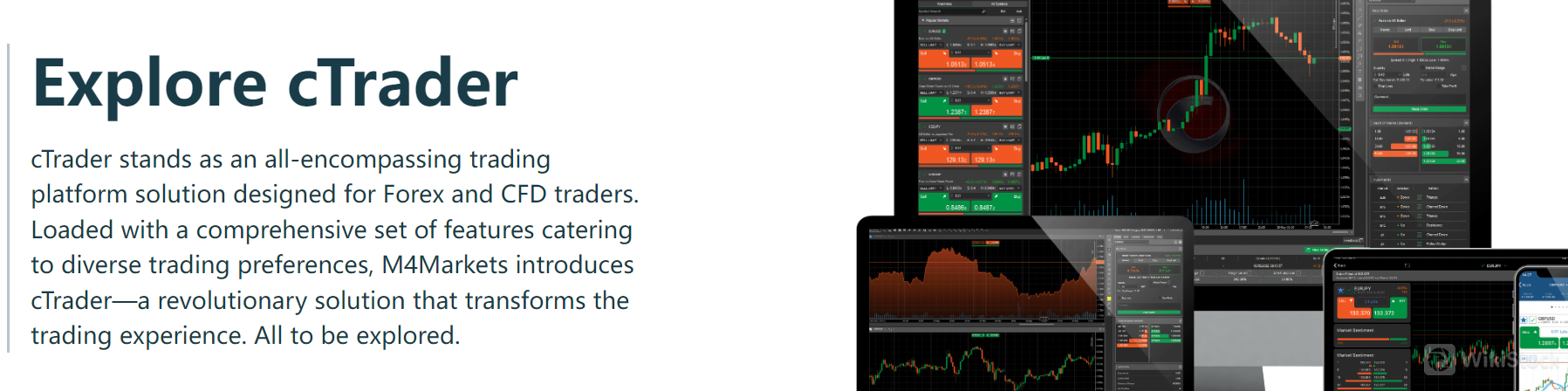

| แอป/แพลตฟอร์ม | cTrader |

M4Markets คืออะไร?

M4Markets เป็นบริษัทโบรกเกอร์ที่ก่อตั้งขึ้นในปี 2019 มีการควบคุมโดย CySEC และมีการควบคุมนอกเขตโดย FSA M4Markets ให้บริการเข้าถึงผลิตภัณฑ์ทางการเงินหลากหลายรูปแบบ รวมถึงหุ้น ฟอเร็กซ์ สินค้าโภคภัณฑ์ ดัชนี และหุ้น ผ่านทั้งสามประเภทบัญชีหลัก คือ มาตรฐาน พรีเมียม และ VIP แต่ละประเภทมีการกระจายตัวและค่าคอมมิชชั่นที่แตกต่างกัน นอกจากนี้ M4Markets ใช้แพลตฟอร์ม cTrader เพื่อให้บริการซื้อขาย

ข้อดีและข้อเสียของ M4Markets

| ข้อดี | ข้อเสีย |

|

|

|

|

|

|

|

การปฏิบัติตามกฎระเบียบ: M4Markets ได้รับการควบคุมโดย CySEC และมีการควบคุมนอกเขตโดย FSA เพื่อให้การปฏิบัติตามมาตรฐานกฎระเบียบที่เข้มงวดและให้นักเทรดมีความมั่นใจ

ช่วงผลิตภัณฑ์ทางการเงินที่หลากหลาย: แพลตฟอร์มนี้มีการเข้าถึงสินทรัพย์ทางการเงินหลากหลายรูปแบบ เช่น หุ้น ฟอเร็กซ์ สินค้าโภคภัณฑ์ ดัชนี และหุ้น ช่วยให้นักเทรดสามารถแยกพอร์ตการลงทุนของตนเองได้

มีหลายประเภทบัญชี: M4Markets ให้บริการสามประเภทบัญชีหลัก คือ มาตรฐาน พรีเมียม และ VIP แต่ละประเภทออกแบบมาเพื่อตอบสนองความต้องการที่แตกต่างกันของนักเทรดที่มีระดับประสบการณ์และความชอบในการซื้อขายที่แตกต่างกัน

แพลตฟอร์มการซื้อขายขั้นสูง: การใช้แพลตฟอร์ม cTrader ช่วยให้นักเทรดได้รับการใช้งานที่ใช้ง่าย มีเครื่องมือกราฟชาร์ตขั้นสูง และความเร็วในการดำเนินการที่รวดเร็ว เพิ่มประสบการณ์การซื้อขายโดยรวม

ข้อเสีย:การเล่นลิมิตเต็มที่: การเลเวอเรจสูงสุด 1:30 ต่ำกว่าที่บางนักเทรดเคยใช้งาน จำกัดกลยุทธ์การซื้อขายของพวกเขา

เขตอำนาจที่ถูกจำกัด: แพลตฟอร์มไม่ให้บริการการซื้อขาย CFD ให้กับผู้อาศัยในเขตอำนาจบางประเทศและประเทศที่ได้รับการลงโทษ จำกัดความเข้าถึงสำหรับนักเทรดในพื้นที่เหล่านั้น

M4Markets ปลอดภัยหรือไม่?

M4Markets มีความปลอดภัยอย่างมาก ด้วยใบอนุญาตการซื้อขายหลักทรัพย์ของสำนักงานคณะกรรมการหลักทรัพย์และแลกเปลี่ยนสกุลเงินของไซปรัส (CySEC) (เลขที่ 301/16) นอกจากนี้ยังได้รับการควบคุมนอกเขตโดย Seychelles Financial Services Authority (FSA) ภายใต้ใบอนุญาตการซื้อขายหลักทรัพย์ของ Seychelles (เลขที่ SD035) การกำหนดเหล่านี้ออกแบบมาเพื่อปกป้องลูกค้าและให้การซื้อขายที่เป็นธรรมและโปร่งใส

นอกจากนี้ M4Markets ยังเก็บเงินของลูกค้าในบัญชีที่แยกจากเงินทุนที่ใช้ในการดำเนินงานของบริษัท การแยกนี้ช่วยปกป้องเงินของลูกค้าในกรณีที่บริษัทเข้าสู่สถานการณ์ล้มละลาย

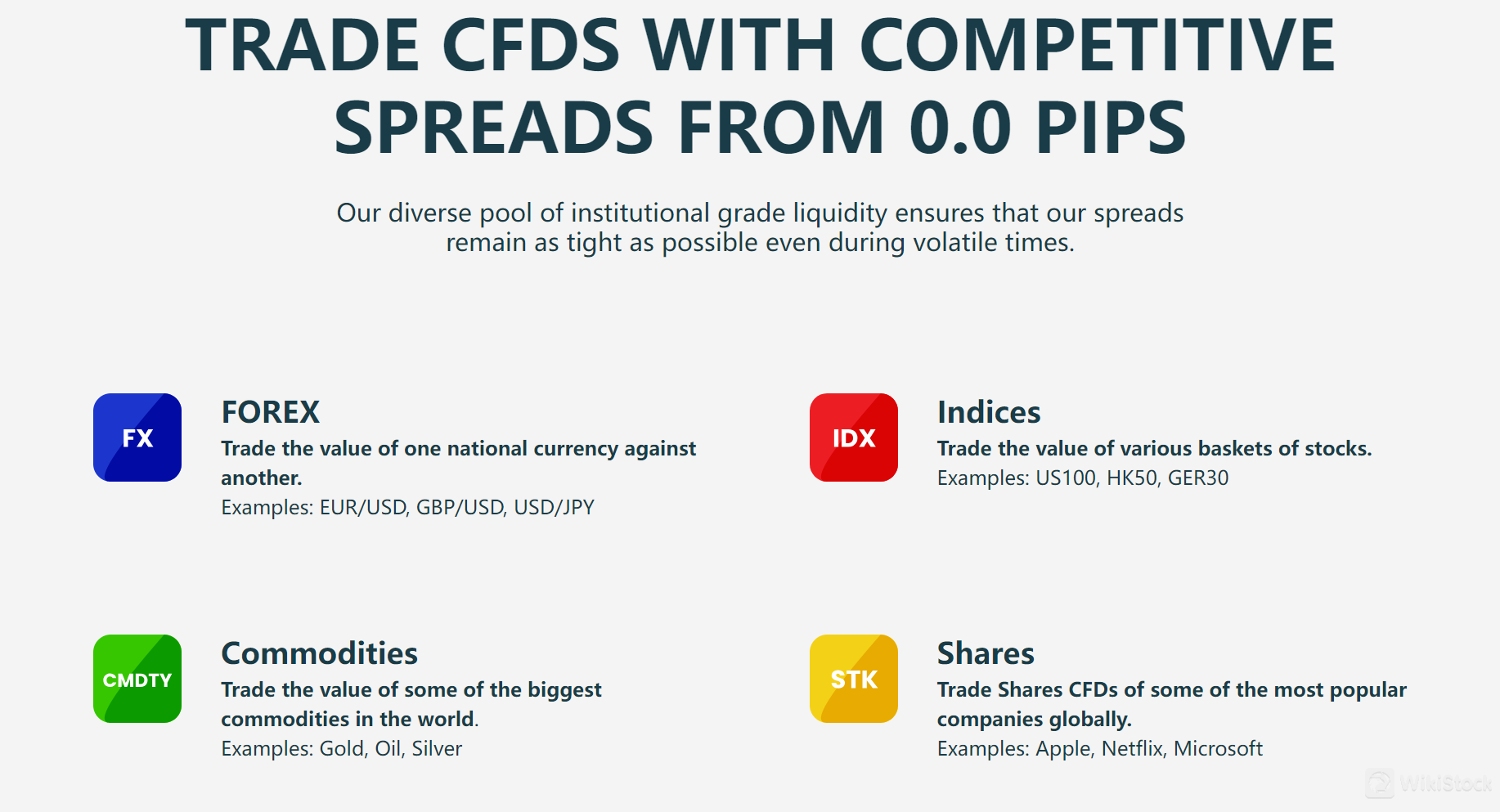

สิทธิ์ในการซื้อขายหลักทรัพย์กับ M4Markets คืออะไร?

M4Markets ให้บริการ สัญญาต่างๆ (CFDs) บนเครื่องมือทางการเงินต่างๆ ที่ช่วยให้คุณสามารถพยากรณ์การเคลื่อนไหวราคาของฟอเร็กซ์ (คู่สกุลเงิน), สินค้า (เช่นทองคำหรือน้ำมัน), ดัชนี (กองทุนรวมที่แสดงถึงกลุ่มตลาด), และหุ้น (บริษัทรายบุคคล) โดยไม่ต้องเป็นเจ้าของสินทรัพย์ใต้สิทธิ์ ช่วงหลากหลายของหลักทรัพย์เหล่านี้จะให้โอกาสมากมายแก่นักเทรดในการเข้าร่วมตลาดการเงินและการนำเสนอกลยุทธ์การซื้อขายต่างๆ

บัญชี M4Markets

M4Markets มีบัญชีประเภททั้งหมดสามประเภทที่เหมาะสำหรับนักเทรดที่มีระดับความชำนาญและการตั้งค่าการซื้อขายที่แตกต่างกัน

บัญชี มาตรฐาน ต้องมีเงินฝากขั้นต่ำ 100 ดอลลาร์ ทำให้เข้าถึงได้สำหรับนักเทรดผู้เริ่มต้นหรือผู้ที่มีทุนจำกัด สำหรับนักเทรดที่มีประสบการณ์มากกว่าหรือมีทุนซื้อขายมากกว่า บัญชี พรีเมียม ต้องมีเงินฝากขั้นต่ำ 5,000 ดอลลาร์ ส่วนบัญชี VIP ต้องมีเงินฝากขั้นต่ำ 10,000 ดอลลาร์ ออกแบบมาสำหรับนักเทรดปริมาณสูงหรือลูกค้าสถาบัน มีการกระจายเบี้ยสุดแน่นอนและคุณสมบัติพรีเมียมอื่นๆ

รีวิวค่าธรรมเนียม M4Markets

ค่าธรรมเนียมของ M4Markets ขึ้นอยู่กับกิจกรรมการซื้อขายและประเภทบัญชีของคุณ ความต่างระหว่างราคาซื้อและราคาขายจะเข้มงวดขึ้นกับบัญชีฝากเงินที่สูงขึ้น (1.2 พิปสำหรับมาตรฐาน > 0.8 พิปสำหรับพรีเมียม > 0.0 พิปสำหรับ VIP) บัญชีมาตรฐานและพรีเมียมสามารถซื้อขายฟอเร็กซ์และโลหะได้โดยไม่มีค่าคอมมิชชั่น ในขณะที่บัญชี VIP มีค่าคอมมิชชั่น 20 ดอลลาร์ต่อล้านการซื้อขาย นอกจากนี้ยังไม่มีค่าธรรมเนียมในการฝากหรือถอน

รีวิวแอป M4Markets

M4Markets ใช้แพลตฟอร์ม cTrader เพื่อให้ประสบการณ์การซื้อขายที่ครอบคลุมและใช้งานง่าย แพลตฟอร์มมีอินเตอร์เฟซที่ใช้งานง่ายและเครื่องมือกราฟชั้นสูง และรองรับการซื้อขายอัตโนมัติผ่าน cAlgo ที่ช่วยให้นักเทรดสามารถสร้างและใช้กลยุทธ์อัลกอริทึมได้ ด้วยความล่าช้าต่ำมากและความเร็วในการดำเนินการที่ยอดเยี่ยม cTrader รับประกันการดำเนินการซื้อขายที่รวดเร็วและแม่นยำ แพลตฟอร์มยังให้ข้อมูลราคาระดับ II เพื่อข้อมูลความลึกของตลาดแบบเต็มรูปแบบ และเครื่องมือการจัดการความเสี่ยงที่แข็งแกร่ง และมีให้บริการบนเดสก์ท็อปและอุปกรณ์มือถือ เพื่อให้นักเทรดสามารถเข้าถึงบัญชีและซื้อขายได้ทุกที่

การวิจัยและการศึกษา

M4Markets มีชุดครบวงจรของทรัพยากรการศึกษา รวมถึง eBook และเว็บินาร์ เพื่อสนับสนุนนักเทรดในการเพิ่มพูนความรู้และทักษะของพวกเขา eBook ครอบคลุมหัวข้อต่างๆ เช่น กลยุทธ์การซื้อขาย การวิเคราะห์ตลาด และการจัดการความเสี่ยง เหมาะสำหรับผู้เริ่มต้นและนักเทรดที่มีประสบการณ์ การเปิดเผยข้อมูลตลาดปัจจุบัน การวิเคราะห์เทคนิค และกลยุทธ์การซื้อขายที่จัดเตรียมโดยนักเทรดและวิเคราะห์ตลาดมืออาชีพ ให้แนวคิดและแสดงความคิดเห็นเกี่ยวกับแนวโน้มตลาดปัจจุบัน การวิเคราะห์เทคนิค และกลยุทธ์การซื้อขาย เสนอแพลตฟอร์มแอ็คทีฟสำหรับการเรียนรู้และอัพเดตกับการพัฒนาตลาด

บริการลูกค้า

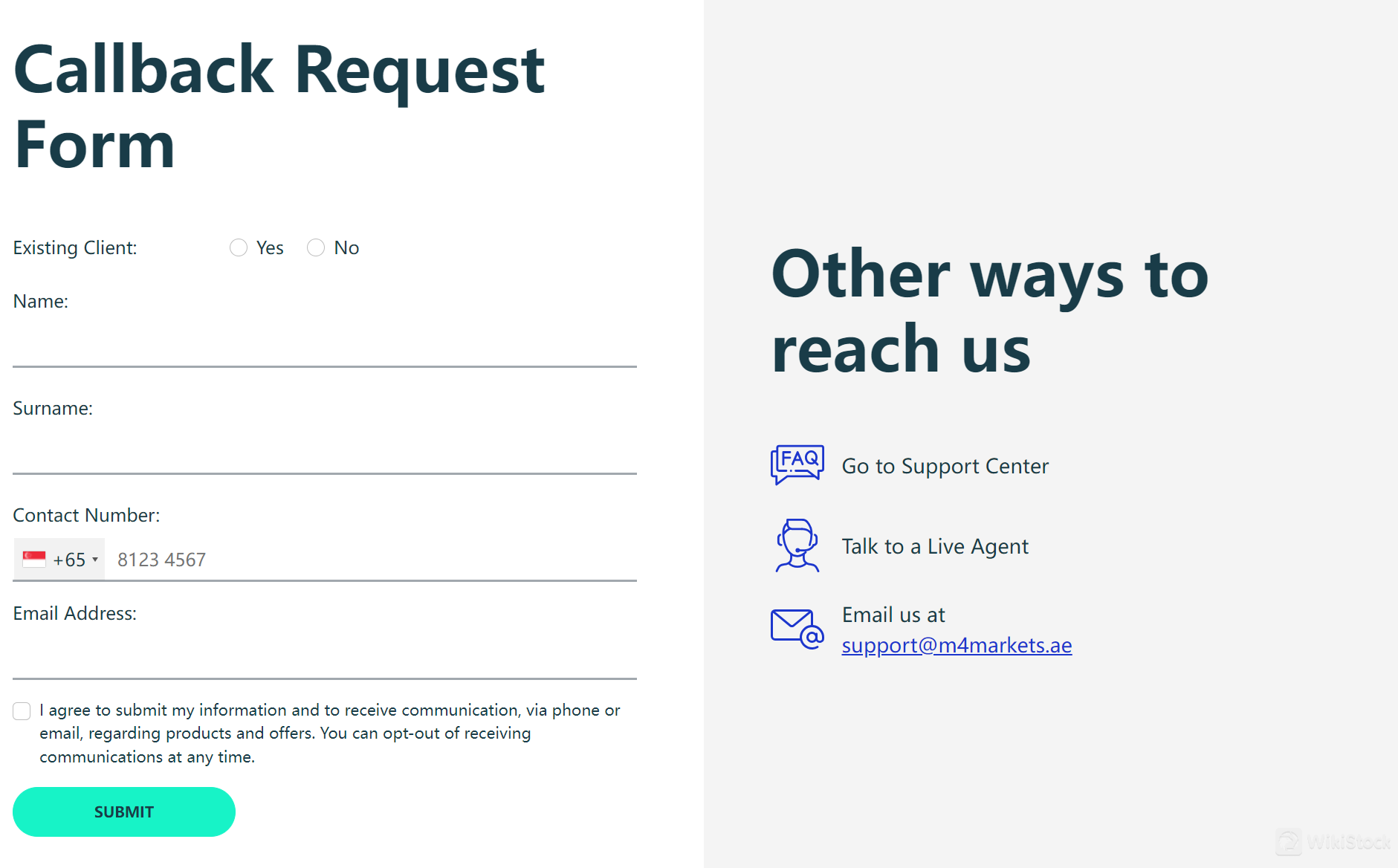

M4Markets มีสำนักงานที่ตั้งอยู่ที่ Central Park Towers, Office 42, Level 1, DIFC, Dubai, United Arab Emirates มีวิธีการหลายวิธีในการติดต่อลูกค้าและนักเทรดที่เป็นไปได้เพื่อรับการสนับสนุน

คุณสามารถขอให้ติดต่อกลับได้โดยกรอกแบบฟอร์มด้วยชื่อของคุณ เบอร์ติดต่อ และที่อยู่อีเมล และเลือกว่าคุณเป็นลูกค้าที่มีอยู่แล้ว หรือคุณสามารถติดต่อผ่านศูนย์สนับสนุนของพวกเขา พูดคุยกับตัวแทนสด หรือ ส่งอีเมลถึงพวกเขาที่ support@m4markets.ae ได้

นอกจากนี้พวกเขายังมีการใช้งานบนแพลตฟอร์มโซเชียลมีเดีย เช่น Facebook, Instagram, LinkedIn, Twitter, Telegram, และ YouTube

สรุป

M4Markets เป็นโบรกเกอร์ที่ได้รับการควบคุมโดย CySEC และได้รับการควบคุมจาก FSA นอกเกาะ พวกเขาให้บริการซื้อขายเงินตราต่างประเทศ สินค้าโภคภัณฑ์ ดัชนี และหุ้น ด้วยรูปแบบบัญชีทั้งสามและแพลตฟอร์ม cTrader พวกเขาให้ประสบการณ์การซื้อขายที่ใช้งานง่ายและหลากหลาย การปฏิบัติตามกฎระเบียบและการให้บริการผลิตภัณฑ์ทางการเงินที่หลากหลายเป็นจุดเด่น แม้ว่าการเล่นเลเวอเรจจะถูกจำกัดและมีข้อจำกัดในภูมิภาค โดยรวม M4Markets เป็นทางเลือกที่น่าเชื่อถือสำหรับนักเทรดที่กำลังมองหาสภาพแวดล้อมการซื้อขายที่ได้รับการควบคุมและหลากหลาย

คำถามที่พบบ่อย (FAQs)

M4Markets เป็นโบรกเกอร์ที่ได้รับการควบคุมหรือไม่?

ใช่ M4Markets ได้รับการควบคุมโดย CySEC และได้รับการควบคุมนอกเกาะโดย FSA

ผลิตภัณฑ์ทางการเงินที่ฉันสามารถซื้อขายกับ M4Markets ได้มีอะไรบ้าง?

ซื้อขายเงินตราต่างประเทศ สินค้าโภคภัณฑ์ ดัชนี และหุ้น ผ่านแพลตฟอร์มการซื้อขายของพวกเขา

แพลตฟอร์มการซื้อขายที่ M4Markets ใช้คืออะไร?

cTrader

ความต้องการฝากเงินขั้นต่ำเพื่อเปิดบัญชีกับ M4Markets คืออะไร?

M4Markets ต้องการเงินฝากขั้นต่ำสำหรับแต่ละประเภทบัญชี: 100 ดอลลาร์สหรัฐสำหรับบัญชีมาตรฐาน 5,000 ดอลลาร์สหรัฐสำหรับบัญชีพรีเมียม และ 10,000 ดอลลาร์สหรัฐสำหรับบัญชี VIP

M4Markets มีทรัพยากรการศึกษาหรือไม่?

ใช่ M4Markets มีหนังสืออิเล็กทรอนิกส์และเว็บบินาร์เพื่อสนับสนุนนักเทรดในการเพิ่มพูนความรู้และทักษะของพวกเขา

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้ไว้เป็นผลมาจากการประเมินของผู้เชี่ยวชาญของ WikiStock จากข้อมูลเว็บไซต์ของโบรกเกอร์และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการเสี่ยงที่สูง อาจ导致การสูญเสียเงินลงทุนทั้งหมดดังนั้นการเข้าใจความเสี่ยงที่เกี่ยวข้องก่อนที่จะเข้ามาเป็นสิ่งสำคัญ

อื่น ๆ

Registered region

เซเชลส์

ปีในธุรกิจ

2-5 ปี

ผลิตภัณฑ์ทางการเงิน

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

ธุรกิจที่เกี่ยวข้อง

ประเทศ

Company name

สมาคม

--

Oryx Finance Ltd

กลุ่มบริษัท

--

Harindale Ltd

กลุ่มบริษัท

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

Accuindex

คะแนน

Doto

คะแนน

FXPRIMUS

คะแนน

WisdomPointCapital

คะแนน

Amana

คะแนน

UBK Markets

คะแนน

Argus

คะแนน

Capex.com

คะแนน

GPB-Financial Services

คะแนน

XSpot Wealth

คะแนน