คะแนน

Concord Securities

https://www.concords.com.tw/english/

Website

ดัชนีคะแนน

การประเมินนายหน้า

อิทธิพล

B

ดัชนีอิทธิพล NO.1

ไต้หวัน

ไต้หวันความหลากหลาย

2

Futures、Stocks

ใบอนุญาตหลักทรัพย์

ขอรับใบอนุญาตหลักทรัพย์ 1

SFBอยู่ในการกำกับดูแล

ไต้หวันใบอนุญาตซื้อขายหลักทรัพย์

ข้อมูลโบรกเกอร์

More

ชื่อเต็มของบริษัท

Concord Securities Co Ltd

ชื่อย่อบริษัท

Concord Securities

ประเทศและภูมิภาคที่ลงทะเบียนแพลตฟอร์ม

ที่อยู่บริษัท

เว็บไซต์ของบริษัท

https://www.concords.com.tw/english/ตรวจสอบได้ทุกเมื่อที่คุณต้องการ

WikiStock APP

บริการนายหน้า

Internet Gene

Gene Index

คะแนนแอป

ดาวน์โหลดแอป

- รอบ

- ดาวน์โหลด

- 2024-05

- 31344

กฎ: ข้อมูลที่แสดงคือการดาวน์โหลดแอปในหนึ่งปีก่อนหน้าปัจจุบัน

ความนิยมในระดับภูมิภาคของแอป

- ประเทศ/ภูมิภาคดาวน์โหลดอัตราส่วน

อื่น ๆ

157520.52%ไต้หวัน

1417290.42%นิวซีแลนด์

12217.79%ภูฏาน

1991.27%

กฎ: ข้อมูลจะแสดงเป็นการดาวน์โหลดและส่วนแบ่งภูมิภาคของแอปในหนึ่งปีก่อนปัจจุบัน

คุณสมบัติของโบรกเกอร์

อัตราค่าคอมมิชชั่น

0.9263%

Funding Rate

4.5%

Margin Trading

YES

Long-Short Equity

YES

| Concord Securities |  |

| คะแนน WikiStock | ⭐⭐⭐ |

| แอป/แพลตฟอร์ม | แพลตฟอร์มการซื้อขายอิเล็กทรอนิกส์ |

| โปรโมชั่น | ไม่มี |

| การสนับสนุนลูกค้า | โทรศัพท์และอีเมล |

คำแนะนำเกี่ยวกับ Concord Securities

Concord Securities ซึ่งดำเนินธุรกิจภายใต้การกำกับดูแลของ SFB ของไต้หวันจีน ให้บริการทางการเงินที่หลากหลายและมีความแข็งแกร่ง รวมถึงการซื้อขายหลักทรัพย์ การโบรกเกอร์สินทรัพย์อนาคต และการบริหารจัดการทรัพย์สิน พวกเขาเชี่ยวชาญในการซื้อขายหลักทรัพย์ในประเทศและต่างประเทศ ให้การเข้าถึงตลาดเช่นหุ้นสหรัฐฯ ฮ่องกง และหุ้นจีน โดยมีการเน้นที่แข่งขันด้านนวัตกรรมดิจิทัลและการบริการลูกค้า Concord Securities รวมระบบการสนับสนุนแบบเรียลไทม์ที่ใช้ AI และการวางแผนการเงินอย่างครอบคลุม

ข้อดีและข้อเสียของ Concord Securities

| ข้อดี | ข้อเสีย |

| การบริการอย่างครบวงจร | ความท้าทายในการจัดการความเสี่ยง |

| การกำกับดูแลโดย SFB | ขึ้นอยู่กับช่องทางดิจิทัล |

| แนวทางดิจิทัลขั้นสูง | |

| ความเชี่ยวชาญในการ IPO และการบริการสถาบัน |

การบริการอย่างครบวงจร: Concord Securities ให้บริการทางการเงินที่หลากหลายรวมถึงการซื้อขายหลักทรัพย์ (ในประเทศและต่างประเทศ) การโบรกเกอร์สินทรัพย์อนาคต การบริหารจัดการทรัพย์สิน และการบริการสถาบันที่เชี่ยวชาญ

การกำกับดูแลโดย SFB: การได้รับการกำกับดูแลจากสำนักงานความปลอดภัยและการซื้อขายหลักทรัพย์ (SFB) รับรองว่า Concord Securities ปฏิบัติตามมาตรฐานการกำกับดูแลอย่างเข้มงวด

แนวทางดิจิทัลขั้นสูง: บริษัทใช้แพลตฟอร์มดิจิทัลขั้นสูงรวมถึงการสนับสนุนลูกค้าด้วย AI และเครื่องมือสื่อสารแบบเรียลไทม์เช่น Line@

ความเชี่ยวชาญในการ IPO และการบริการสถาบัน: Concord Securities เชี่ยวชาญในการบริการสถาบันเช่นการจัดการทรัพย์สิน การรับจำนอง และการให้คำปรึกษา

ข้อเสีย:ความท้าทายในการจัดการความเสี่ยง: เนื่องจากการมีส่วนร่วมในการซื้อขายเอง การรับจำนอง และสินทรัพย์อนุพันธ์ทางการเงิน การจัดการความเสี่ยงอย่างมีประสิทธิภาพเป็นสิ่งสำคัญ ความผิดพลาดใด ๆ อาจส่งผลกระทบต่อการลงทุนของลูกค้าในทางลบ

ขึ้นอยู่กับช่องทางดิจิทัล: ในขณะที่แนวทางดิจิทัลขั้นสูงเพิ่มความสะดวกในการเข้าถึงและประสิทธิภาพ มีความเสี่ยงที่เกี่ยวข้องกับการพึ่งพาบนแพลตฟอร์มเหล่านี้ ปัญหาทางเทคนิคหรือความเสี่ยงทางไซเบอร์อาจส่งผลกระทบต่อการให้บริการหรือความปลอดภัยของข้อมูลลูกค้า

Concord Securities ปลอดภัยหรือไม่?

Concord Securities ดำเนินธุรกิจภายใต้การกำกับดูแลของสำนักงานความปลอดภัยและการซื้อขายหลักทรัพย์ (SFB)ของไต้หวันจีน ถือใบอนุญาต เลขที่ 8450 คณะกรรมการกำกับดูแลทางการเงิน (FSC) ได้ก่อตั้งสำนักงานความปลอดภัยและการซื้อขายหลักทรัพย์ (SFB) เพื่อควบคุมและกำกับดูแลกิจกรรมภายในตลาดหลักทรัพย์และอนุพันธ์ รวมถึงบริษัทหลักทรัพย์และอนุพันธ์ สำนักงานควบคุมดูแลการกำหนด วางแผน และดำเนินการนโยบาย กฎหมาย และระเบียบข้อบังคับที่เกี่ยวข้องกับส่วนต่าง ๆ เพื่อให้การกำกับดูแลและการปฏิบัติตามอย่างถูกต้อง

หลักทรัพย์ที่สามารถซื้อขายกับ Concord Securities ได้คืออะไร?

Concord Securities ให้บริการหลากหลายประเภทของหลักทรัพย์รวมถึงหุ้นในประเทศและต่างประเทศ (หุ้นสหรัฐอเมริกา หุ้นฮ่องกง และหุ้นจีน (การเชื่อมต่อหุ้นระหว่างฮ่องกงและเซินเจิ้น-ฮ่องกงการเชื่อมต่อหุ้นเซินเจิ้น))), พันธบัตร และสินค้าอนุพันธ์ทางการเงิน กิจกรรมหลักของพวกเขาเกี่ยวข้องกับการซื้อขายหลักทรัพย์ที่ได้รับการอนุมัติจากหน่วยงานกำกับการเงินเพื่อสร้างกำไรจากการลงทุน

โดยเฉพาะพวกเขามีการเกี่ยวข้องกับการซื้อขายเป็นเจ้าของ, การรับประกัน, ผลิตภัณฑ์รายได้คงที่, และการจัดการสินค้าอนุพันธ์ทางการเงิน เช่นการป้องกันความเสี่ยง, การซื้อขายและการออกแบบผลิตภัณฑ์ บริษัท Concord Securities ยังดำเนินการจัดการ IPO ทั้งในประเทศและต่างประเทศ โดยระบุบริษัทเช่น Taiwan Steel Union, T3ex Global Holdings, และ Savior Lifetec Corporation บนตลาดหลักทรัพย์ไต้หวัน แผนกรายได้คงที่ ของพวกเขาให้คำปรึกษาและบริการขายในตลาดหลักและตลาดรองของพันธบัตร

บทวิจารณ์บริการ Concord Securities

Concord Securities ให้บริการทางการเงินหลายรูปแบบ

- ธุรกิจหลักทรัพย์:

Concord Securities ให้บริการหลากหลายประเภทและการปรึกษาการลงทุนที่ปรับให้เหมาะกับลูกค้า โดยใช้ช่องทางการซื้อขายหลักทรัพย์ที่มีรากฐานแข็งแรง พวกเขาใช้เทคโนโลยีการเงิน (Fintech) เพื่อให้บริการทางการเงินดิจิทัลผ่านอุปกรณ์เคลื่อนที่

บริการซื้อขาย: บริษัทได้พัฒนาแพลตฟอร์มการซื้อขายอิเล็กทรอนิกส์ที่มีอินเทอร์เฟซที่ยืดหยุ่นและกระบวนการจัดการความเสี่ยงที่เข้มงวดเพื่อให้บริการการซื้อขายที่เสถียรและมีความรับผิดชอบ

บริการดิจิทัล: พวกเขาใช้แอปพลิเคชันมือถือยอดนิยมเช่น Line@ เพื่อให้บริการราคาอย่างครอบคลุม ข้อมูลบัญชีและบัตรนามสกุลดิจิทัล

บริการลูกค้าด้วย AI: Concord Securities ใช้ AI ในการให้บริการลูกค้ารวมถึงระบบรายงานเสียงระบบอีเมล การสนทนาสดและการสนทนาอัจฉริยะ พวกเขาให้บริการสนับสนุนลูกค้าตลอด 24 ชั่วโมงพร้อมความสามารถในการสนับสนุนระยะไกล

- ธุรกิจฟิวเจอร์:

ตัวแทนผู้แนะนำฟิวเจอร์ (IB): Concord Securities ดำเนินการเป็นตัวแทนผู้แนะนำฟิวเจอร์ สร้างความสนใจให้กับนักลงทุนฟิวเจอร์และสนับสนุนการเปิดบัญชีและการดำเนินการสั่งซื้อในนามของผู้ค้าฟิวเจอร์ บริษัท Concord Futures จัดการบัญชีและการจัดการความเสี่ยงต่อไป

- ธุรกิจซับโบรกเกอร์:

การซื้อขายหลักทรัพย์ต่างประเทศผ่านโบรกเกอร์: Concord Securities ทำให้นักลงทุนในประเทศสามารถซื้อขายหลักทรัพย์ต่างประเทศได้โดยไม่ต้องเปิดบัญชีต่างประเทศ มีการเข้าถึงหุ้นสหรัฐอเมริกา ฮ่องกง และจีน

การลงทุนระดับโลกที่ง่ายดาย: บริษัทอำนวยความสะดวกในการลงทุนระดับโลก ช่วยให้ลูกค้าสามารถซื้อขายหุ้นของบริษัทชั้นนำ เช่น Apple, Facebook, Google, Tencent, Alibaba เป็นต้น ด้วยความสะดวกในการฝากเงินและฟังก์ชันการซื้อขายออนไลน์ที่ราบรื่น

- การบริหารจัดการทรัพย์สิน:

การลงทุนและบริการทางการเงินอย่างครบวงจร: ทีมงานการบริหารทรัพย์สินของ Concord Securities ให้คำแนะนำการลงทุนอย่างมืออาชีพและผลิตภัณฑ์ทางการเงินที่หลากหลายที่เหมาะกับกลุ่มลูกค้าที่แตกต่างกัน เช่น ลูกค้าที่มีสินทรัพย์สูงและลูกค้าผู้เกษียณ บริการรวมถึงการกระจายเงิน, หลักทรัพย์ที่เชื่อมโยงกับอัตราดอกเบี้ยหรืออัตราดอกเบี้ย, ผลิตภัณฑ์รายได้คงที่, ผลิตภัณฑ์ประกันและเครื่องมือการเงินอื่น ๆ ที่ได้รับการอนุมัติ

การคุ้มครองทรัพย์สินและการปกป้องทรัพย์สิน: พวกเขาให้คำแนะนำในการคุ้มครองทรัพย์สินและการสืบทอดทรัพย์สิน รวมถึงหุ้นและสินค้าอนุพันธ์

- บริการสำหรับสถาบัน:

บริการสำหรับสถาบันที่กำหนดเอง: Concord Securities ให้ทีมงานที่มีความเชี่ยวชาญเพื่อช่วยลูกค้าสถาบันในการประชุมนักลงทุนและการเยี่ยมชม

การให้คำปรึกษาอาชีพและการแข่งขันที่ไม่ใช่ราคา: พวกเขาให้บริการการปรึกษาอย่างครอบคลุม จัดงานและสร้างความภักดีของลูกค้าผ่านกลยุทธ์การแข่งขันที่ไม่ใช่ราคา

บทวิจารณ์แพลตฟอร์ม Concord Securities

Concord Securities ให้บริการแพลตฟอร์มการซื้อขายอิเล็กทรอนิกส์ที่มีคุณสมบัติครอบคลุมอย่างครบถ้วน มีอินเตอร์เฟซที่ยืดหยุ่นและข้อมูลบัญชีที่ครบถ้วน เพื่อตอบสนองความต้องการของลูกค้าในการซื้อขายและบัญชี แพลตฟอร์มนี้มีอินเตอร์เฟซต่างๆ เช่น เว็บ, API และแอปพลิเคชัน เน้นความเสถียรและความเร็ว กระบวนการทำธุรกรรมนำเข้าการจัดการความเสี่ยงอย่างเข้มงวดเพื่อให้บริการที่เชื่อถือได้และมีความรับผิดชอบ

บริการลูกค้า

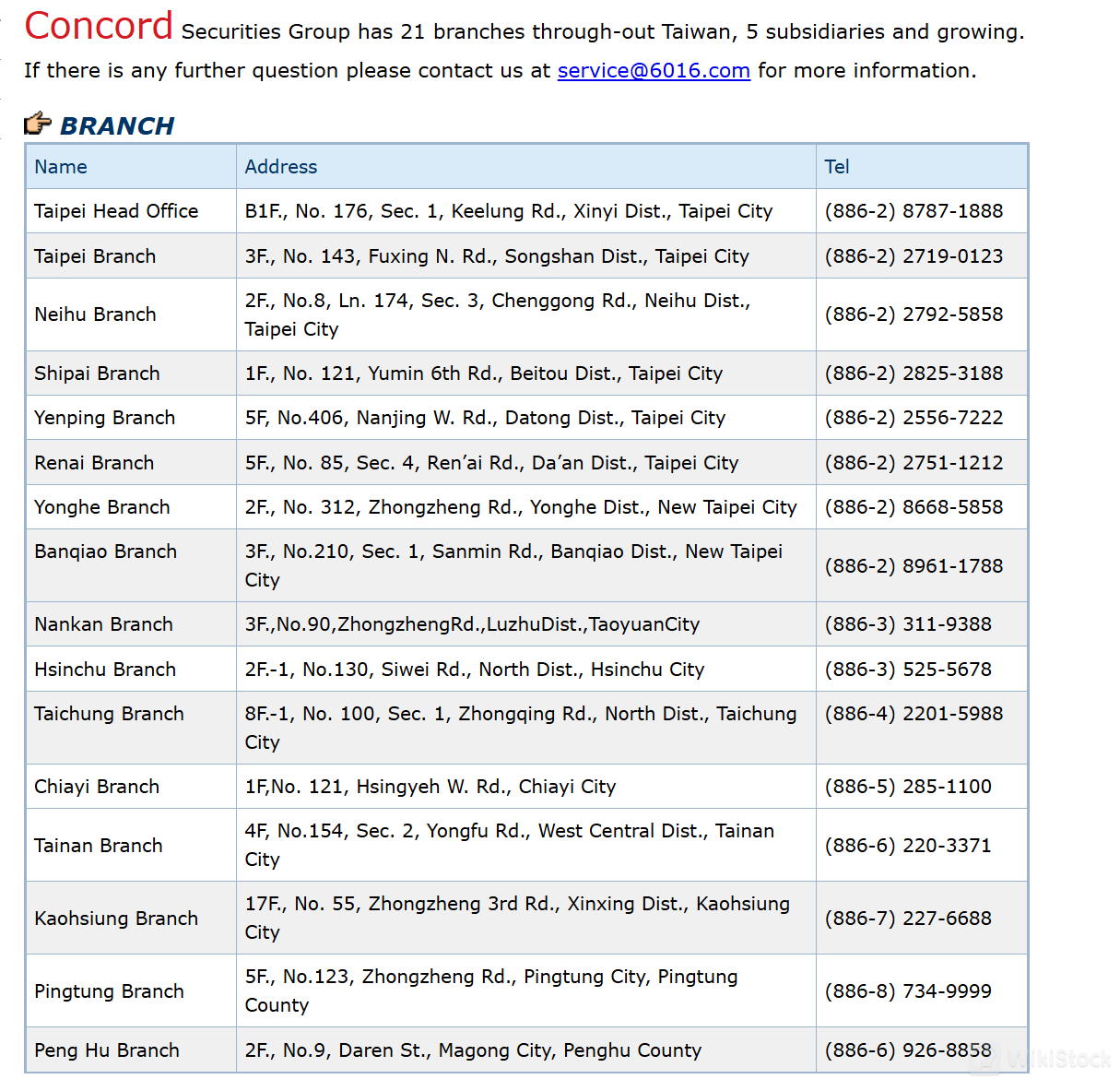

ลูกค้าสามารถเข้าชมสำนักงานหรือติดต่อสายบริการลูกค้าโดยใช้ข้อมูลดังต่อไปนี้:

โทรศัพท์: (886-2) 8787-1888

อีเมล: service@6016.com

ที่อยู่: ชั้น B1F., เลขที่ 176, ซอย 1, ถนนกีลง, เขตซินอี้, เมืองไทเป, กรุงไทเป (สำนักงานใหญ่)

สรุป

Concord Securities เป็นผู้ให้บริการบริการทางการเงินอย่างครอบคลุม มีลูกค้าที่หลากหลายรวมถึงนักลงทุนรายบุคคล บุคคลที่มีสุทธิสินทรัพย์สูง และลูกค้าสถาบัน ด้วยการให้บริการที่หลากหลายตั้งแต่การซื้อขายหลักทรัพย์ภายในและต่างประเทศ การบริหารจัดการทรัพย์สินที่ล้ำสมัยและการโบรกเกอร์สัญชาติ ทำให้ Concord Securities มีตำแหน่งที่ดีในการตอบสนองความต้องการที่ซับซ้อนของลูกค้า การเน้นบริการดิจิทัลที่ทันสมัยและการสนับสนุนลูกค้าด้วยปัญญาประดิษฐ์ AI ทำให้นักลงทุนทั้งรายย่อยและสถาบันได้รับการให้คำปรึกษาทางการเงินที่เหมาะสม มีประสิทธิภาพ และตอบสนองได้อย่างรวดเร็ว

คำถามและคำตอบ

Concord Securities ได้รับการควบคุมหรือไม่?

ใช่ มีการควบคุมโดย SFB

ฉันจะติดต่อ Concord Securities ได้อย่างไร?

คุณสามารถติดต่อผ่านทางโทรศัพท์: (886-2) 8787-1888 และอีเมล: service@6016.com

Concord Securities ให้บริการทางการเงินประเภทใดบ้าง?

บริษัทให้บริการหลักทรัพย์ภายในและต่างประเทศ พร้อมทั้งตราสารหนี้และสินทรัพย์ทางการเงิน

คำเตือนเกี่ยวกับความเสี่ยง

ข้อมูลที่ให้ไว้เป็นผลจากการประเมินของผู้เชี่ยวชาญของ WikiStock จากข้อมูลเว็บไซต์ของโบรกเกอร์และอาจมีการเปลี่ยนแปลง นอกจากนี้การซื้อขายออนไลน์เป็นการเสี่ยงที่มีความเสี่ยงสูง อาจ导致สูญเสียทั้งหมดของเงินลงทุน ดังนั้นความเข้าใจความเสี่ยงที่เกี่ยวข้องก่อนที่จะเข้ามามีความสำคัญ

อื่น ๆ

Registered region

ไต้หวัน

ปีในธุรกิจ

มากกว่า 20 ปี

ผลิตภัณฑ์ทางการเงิน

Futures、Stocks

ธุรกิจที่เกี่ยวข้อง

ประเทศ

Company name

สมาคม

--

Concord Asset Management Corp.

กลุ่มบริษัท

--

Concord Insurance Agent Corp.

กลุ่มบริษัท

--

Concord Capital Management Corp.

กลุ่มบริษัท

--

Concord Futures Corp.

กลุ่มบริษัท

รีวิว

ไม่มีความคิดเห็น

โบรกเกอร์ที่แนะนําMore

KGI

คะแนน

TCBS

คะแนน

中農證券

คะแนน

基富通

คะแนน

口袋證券

คะแนน

盈溢證券

คะแนน

京城證券

คะแนน

美好

คะแนน

日茂證券

คะแนน

元大期貨

คะแนน