Điểm

Chỉ số đánh giá

Thẩm định sàn chứng khoán

Mức ảnh hưởng

B

Chỉ số ảnh hưởng NO.1

Nhật Bản

Nhật BảnSản phẩm giao dịch

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Giấy phép chứng khoán

Sở hữu 1 giấy phép giao dịch

FSACó giám sát quản lý

Nhật BảnGiấy phép giao dịch chứng khoán

Thông tin sàn môi giới

More

Tên công ty

Centrade Securities Co., Ltd.

Viết tắt

Centrade

Quốc gia/Khu vực đăng ký

Địa chỉ công ty

Trang web của công ty

http://www.centrade.co.jp/Tra cứu mọi lúc mọi nơi chỉ với 1 cú chạm

WikiStock APP

Dịch vụ sàn chứng khoán

Internet GENE

Chỉ số GENE

Xếp hạng ứng dụng

| Centrade |  |

| Đánh giá WikiStock | ⭐⭐⭐ |

| Phí | Biến đổi |

| Quỹ hỗ trợ | Có |

| Ứng dụng/Nền tảng | Hệ thống giao dịch trực tuyến Centrade Securities Click Stock 365 |

| Khuyến mãi | Chưa có sẵn |

Centrade là gì?

Centrade, được quy định bởi Cơ quan Dịch vụ Tài chính (FSA) tại Nhật Bản, cung cấp một môi trường giao dịch an toàn và một nền tảng thân thiện với người dùng. Tuy nhiên, nó thiếu quyền truy cập vào Các phiên chào sàn công khai (IPO) và giao dịch tiền điện tử, hạn chế các lựa chọn đầu tư cho các nhà giao dịch.

Ưu điểm và nhược điểm của Centrade

Centrade mang đến một số lợi ích và hạn chế cho các nhà giao dịch. Mặt tích cực, sàn giao dịch này được quy định bởi Cơ quan Dịch vụ Tài chính (FSA) tại Nhật Bản, tạo niềm tin bằng cách tuân thủ các tiêu chuẩn quy định nghiêm ngặt và cung cấp một môi trường giao dịch an toàn. Ngoài ra, Centrade cung cấp một nền tảng thân thiện với người dùng, tạo điều kiện thuận lợi cho việc điều hướng mượt mà, thực hiện giao dịch và truy cập vào dữ liệu thị trường quan trọng, nâng cao trải nghiệm giao dịch tổng thể. Tuy nhiên, cũng có một số hạn chế cần xem xét. Centrade không cung cấp quyền truy cập vào Các phiên chào sàn công khai (IPO), hạn chế cơ hội cho các nhà giao dịch quan tâm đầu tư vào các cổ phiếu mới niêm yết. Hơn nữa, thiếu thông tin tài khoản được xác định rõ ràng có thể dẫn đến sự nhầm lẫn hoặc mơ hồ về chi tiết tài khoản, phí và yêu cầu. Hơn nữa, Centrade không cung cấp giao dịch tiền điện tử, điều này có thể ngăn cản các nhà giao dịch muốn đa dạng hóa danh mục đầu tư của họ với tài sản số.

| Ưu điểm | Nhược điểm |

|

|

|

|

|

Centrade có an toàn không?

Quy định

Centrade được cấp phép và quy định chính thức bởi Cơ quan Dịch vụ Tài chính Nhật Bản (FSA) dưới số giấy phép 関東財務局長(金商)第74号.

An toàn vốn

Centrade hợp tác với các công ty bảo hiểm được ủy quyền bởi FSA để cung cấp bảo hiểm cho vốn của khách hàng. Bảo hiểm bao gồm các tình huống sau: phá sản hoặc vỡ nợ của công ty, trộm cắp hoặc biển thủ của nhân viên, hỏng hóc hệ thống máy tính hoặc tấn công của hacker. Số tiền bảo hiểm có thể lên đến 20 triệu yên.

Biện pháp an toàn

Centrade sử dụng công nghệ mã hóa tiêu chuẩn ngành để bảo vệ thông tin tài khoản của khách hàng. Tất cả dữ liệu được mã hóa trong quá trình lưu trữ và được bảo vệ trong quá trình truyền. Centrade cũng cung cấp các tính năng bảo mật như xác thực hai yếu tố (2FA) để giúp bảo vệ tài khoản của khách hàng.

Các chứng khoán để giao dịch với Centrade là gì?

Centrade cung cấp một loạt các công cụ giao dịch, bao gồm cổ phiếu, trái phiếu, ngoại hối và quỹ hỗ trợ. Tuy nhiên, sàn giao dịch không cung cấp giao dịch tùy chọn hoặc các sản phẩm tài chính phái sinh khác.

Cổ phiếu là các chứng khoán do các công ty phát hành để huy động vốn, giá trị của chúng dao động dựa trên hiệu suất của công ty. Nhà đầu tư có thể thu lợi từ việc mua bán cổ phiếu, cũng như nhận cổ tức và lợi ích cổ đông.

Forex, hoặc giao dịch ký quỹ ngoại hối, liên quan đến việc mua bán tiền tệ như đô la, euro và yên. Lợi nhuận được tạo ra từ sự biến động của tỷ giá hối đoái, và việc sử dụng đòn bẩy cho phép nhà giao dịch tăng cường lợi nhuận với một khoản đầu tư ban đầu tương đối nhỏ.

Quỹ chung tổng hợp tiền từ nhiều nhà đầu tư để đầu tư vào một danh mục đa dạng gồm cổ phiếu, trái phiếu và tài sản khác, được quản lý bởi các chuyên gia. Sản phẩm này lý tưởng cho người mới bắt đầu vì chi phí tham gia thấp và quản lý chuyên nghiệp.

Đánh giá phí của Centrade

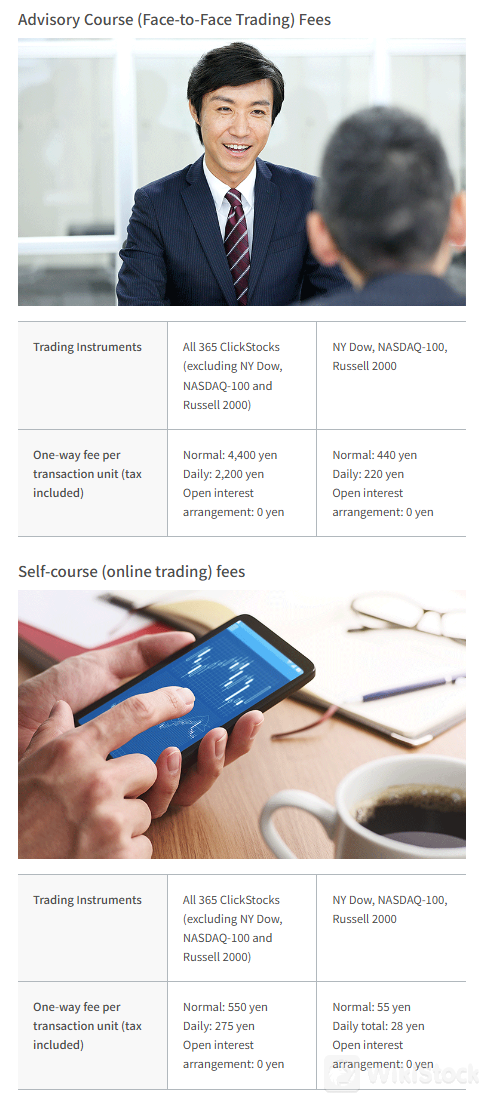

Centrade cung cấp hai cấu trúc phí cho giao dịch, dựa trên việc nhà giao dịch chọn Khóa hướng dẫn (Giao dịch Trực tiếp) hoặc Khóa tự học (Giao dịch Trực tuyến).

Đối với Khóa hướng dẫn, phí cho tất cả 365 ClickStocks (ngoại trừ NY Dow, NASDAQ-100 và Russell 2000) là 4.400 yen mỗi đơn vị giao dịch trong điều kiện bình thường, 2.200 yen mỗi đơn vị giao dịch cho giao dịch hàng ngày và 0 yen cho các sắp xếp lãi suất mở. Đối với NY Dow, NASDAQ-100 và Russell 2000, phí là 440 yen mỗi đơn vị giao dịch trong điều kiện bình thường, 220 yen mỗi đơn vị giao dịch cho giao dịch hàng ngày và 0 yen cho các sắp xếp lãi suất mở.

Đối với Khóa tự học (Giao dịch Trực tuyến) với Centrade, nhà giao dịch gặp phải một hệ thống phí cấu trúc thay đổi dựa trên các công cụ giao dịch được chọn. Khi giao dịch tất cả 365 ClickStocks, ngoại trừ NY Dow, NASDAQ-100 và Russell 2000, nhà giao dịch phải trả phí 550 yen mỗi đơn vị giao dịch cho giao dịch bình thường, trong khi giao dịch hàng ngày phải trả phí 275 yen mỗi đơn vị giao dịch. Đáng chú ý, không có phí cho các sắp xếp lãi suất mở trong tình huống này. Ngược lại, khi giao dịch NY Dow, NASDAQ-100 và Russell 2000, các khoản phí thấp hơn đáng kể. Giao dịch bình thường phải trả phí 55 yen mỗi đơn vị giao dịch, với tổng phí hàng ngày là 28 yen mỗi đơn vị giao dịch. Một lần nữa, không có phí bổ sung cho các sắp xếp lãi suất mở.

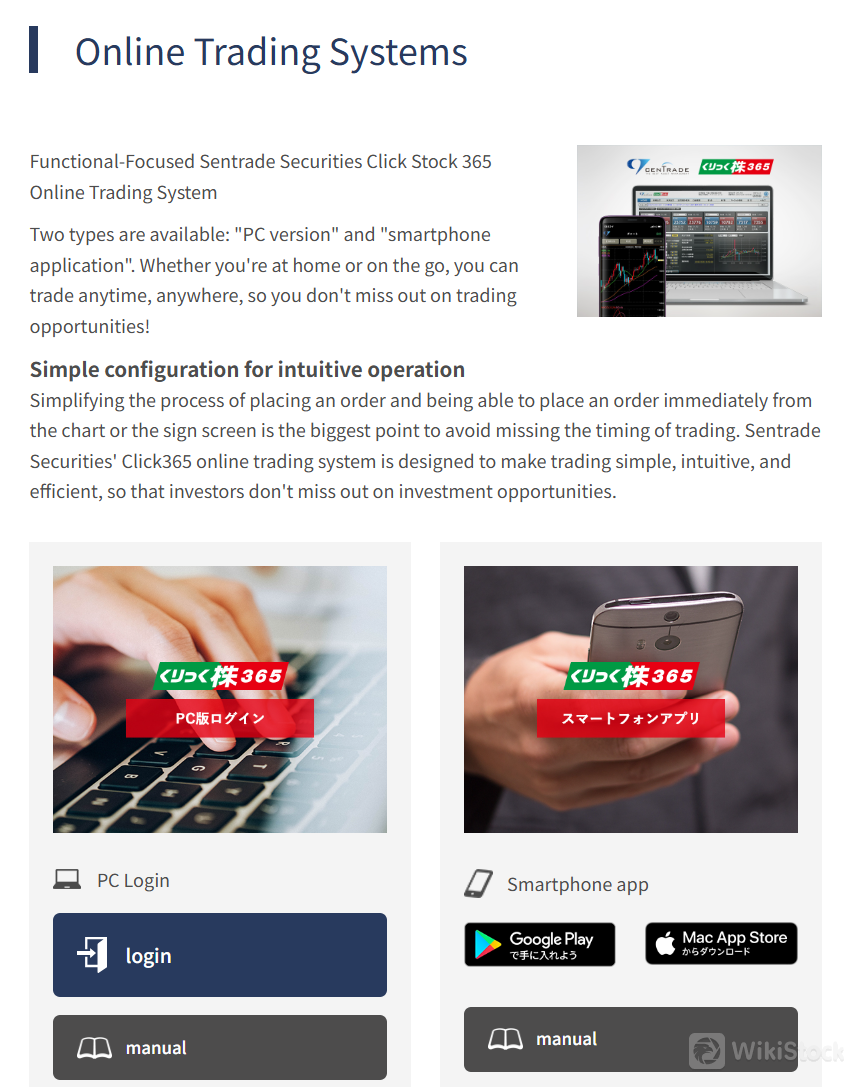

Đánh giá ứng dụng Centrade

Hệ thống giao dịch trực tuyến Click Stock 365 của Centrade Securities được thiết kế để phục vụ cả người dùng máy tính để bàn và di động, cung cấp hai phiên bản: phiên bản PC và ứng dụng điện thoại thông minh. Điều này đảm bảo nhà giao dịch có thể truy cập nền tảng bất cứ lúc nào và ở bất cứ đâu, mang lại sự linh hoạt để giao dịch ở nhà hoặc khi di chuyển.

Nền tảng này có cấu hình đơn giản cho hoạt động trực quan, cho phép người dùng đặt lệnh nhanh chóng và hiệu quả. Lệnh có thể được thực hiện trực tiếp từ biểu đồ hoặc màn hình đăng ký, giúp nhà giao dịch tận dụng cơ hội thị trường mà không bị trì hoãn. Phương pháp giao dịch tinh gọn này giảm thiểu sự phức tạp của giao dịch, giúp nhà đầu tư dễ dàng điều hướng hệ thống và thực hiện giao dịch kịp thời.

Centrade cung cấp một loạt các công cụ giao dịch tiên tiến để nâng cao trải nghiệm giao dịch cho người dùng.

Chart Plus

"Chart Plus" là một công cụ biểu đồ dựa trên web không yêu cầu cài đặt, truy cập trực tiếp thông qua trình duyệt. Nó cho phép người dùng hiển thị tối đa bốn biểu đồ cùng một lúc, tạo điều kiện cho phân tích kỹ thuật toàn diện. Công cụ này hỗ trợ phân tích tiên tiến với các thao tác đơn giản và cung cấp dữ liệu quý giá như khối lượng giao dịch, lãi suất mở qua giao dịch và tỷ lệ lãi suất mở.

e-ProfitFX Plus Stock 365

"e-ProfitFX Plus Stock 365" là một công cụ phân tích thông tin tinh vi, được cung cấp miễn phí cho khách hàng có tài khoản "Click Stock 365". Công cụ này cung cấp thông tin giá thị trường thời gian thực và cho phép người dùng theo dõi nhiều dữ liệu trên một màn hình duy nhất, bao gồm chỉ số chứng khoán, tin tức tài chính và kinh tế, các chức năng biểu đồ kỹ thuật đa dạng và báo cáo thị trường.

Nghiên cứu và Giáo dục

Centrade cung cấp cả các buổi hội thảo trong nhà và ngoại trường.

Buổi hội thảo trong nhà

Các buổi hội thảo này bao gồm từ những kiến thức cơ bản về cơ chế giao dịch đến các phương pháp vận hành cụ thể cho các giao dịch đảm bảo rủi ro hối đoái ngoại tệ.

Buổi hội thảo ngoại trường

Đối với những người muốn được hướng dẫn cá nhân hóa, Centrade cung cấp các buổi hội thảo ngoại trường, trong đó các chuyên gia đến tận nhà của khách hàng để cung cấp giải thích trực tiếp và cá nhân hóa về các giao dịch.

Dịch vụ khách hàng

Centrade cung cấp dịch vụ khách hàng để đảm bảo các nhà giao dịch nhận được sự hỗ trợ khi cần. Khách hàng có thể liên hệ với Centrade qua số điện thoại miễn cước (0120-160-151) để yêu cầu thông tin hoặc khi có bất kỳ thắc mắc nào, dù là sáng sớm hay khuya. Ngoài ra, trụ sở chính ở Tokyo có thể liên hệ qua số điện thoại 03-5649-9955 (điện thoại) và 03-5649-9977 (fax), trong khi chi nhánh Nagoya có sẵn qua số điện thoại 052-973-2300 (điện thoại) và 052-973-2301 (fax).

Kết luận

Centrade, được quy định bởi Cơ quan Dịch vụ Tài chính của Nhật Bản (FSA), cung cấp cho nhà giao dịch một môi trường giao dịch an toàn và được quy định. Với một nền tảng thân thiện với người dùng, điều hướng mượt mà và truy cập vào dữ liệu thị trường cần thiết, nó nâng cao trải nghiệm giao dịch tổng thể. Tuy nhiên, nó thiếu quyền truy cập vào Các phiên chào sàn công cộng (IPO) và giao dịch tiền điện tử. Centrade phù hợp với nhà giao dịch ưu tiên an ninh và đánh giá cao trải nghiệm giao dịch trực tiếp nhưng có thể không phù hợp cho những người quan tâm đến IPO hoặc đầu tư tiền điện tử.

Câu hỏi thường gặp

Centrade có an toàn để giao dịch không?

Có, Centrade là một công ty môi giới được quy định, đảm bảo bảo vệ nhà đầu tư trong trường hợp công ty môi giới gặp sự cố. Sự giám sát quy định này tạo thêm một lớp an toàn và bảo mật cho nhà giao dịch.

Centrade có phải là một nền tảng tốt cho người mới bắt đầu không?

Có, nền tảng cung cấp giao diện thân thiện với người dùng giúp đơn giản hóa quá trình giao dịch cho những nhà giao dịch mới. Ngoài ra, Centrade cung cấp tài nguyên giáo dục được thiết kế đặc biệt cho người mới bắt đầu.

Centrade có hợp pháp không?

Có, Centrade được cấp phép và quy định chính thức bởi Cơ quan Dịch vụ Tài chính của Nhật Bản (FSA) dưới số giấy phép 関東財務局長(金商)第74号.

Cảnh báo rủi ro

Thông tin được cung cấp dựa trên đánh giá chuyên gia của WikiStock về dữ liệu trang web của công ty môi giới và có thể thay đổi. Ngoài ra, giao dịch trực tuyến có rủi ro đáng kể, có thể dẫn đến việc mất toàn bộ vốn đầu tư. Do đó, hiểu rõ những rủi ro này trước khi tham gia vào hoạt động giao dịch là rất quan trọng.

Thông tin khác

Registered region

Nhật Bản

Số năm kinh doanh

15-20năm

Margin Trading

YES

Các quốc gia được quản lý

1

Sản phẩm giao dịch

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Tải ứng dụng

Đánh giá

Chưa có bình luận

Sàn giao dịch được đề xuấtMore

三菱UFJモルガン・スタンレー証券

Điểm

Nissan Securities

Điểm

水戸証券

Điểm

東洋証券株式会社

Điểm

豊証券株式会社

Điểm

Kyokuto Securities

Điểm

ちばぎん証券

Điểm

あかつき証券

Điểm

Money Partners

Điểm

岩井コスモ証券

Điểm