Điểm

Chỉ số đánh giá

Thẩm định sàn chứng khoán

Sản phẩm giao dịch

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Giấy phép chứng khoán

Sở hữu 1 giấy phép giao dịch

CYSECCó giám sát quản lý

SípGiấy phép giao dịch chứng khoán

Thông tin sàn môi giới

More

Tên công ty

Wise Wolves Finance Ltd

Viết tắt

WWF

Quốc gia/Khu vực đăng ký

Địa chỉ công ty

Trang web của công ty

https://wise-wolves.finance/Tra cứu mọi lúc mọi nơi chỉ với 1 cú chạm

WikiStock APP

Dịch vụ sàn chứng khoán

Internet GENE

Chỉ số GENE

Xếp hạng ứng dụng

Đặc điểm môi giới

Tỷ lệ hoa hồng

0.04%

Margin Trading

YES

Các quốc gia được quản lý

1

Sản phẩm giao dịch

6

| WWF |  |

| Đánh giá WikiStock | ⭐️⭐️⭐️⭐️ |

| Phí (Cổ phiếu) | 0,1% và 0,25% giá trị giao dịch |

| Quỹ hỗ trợ | Có |

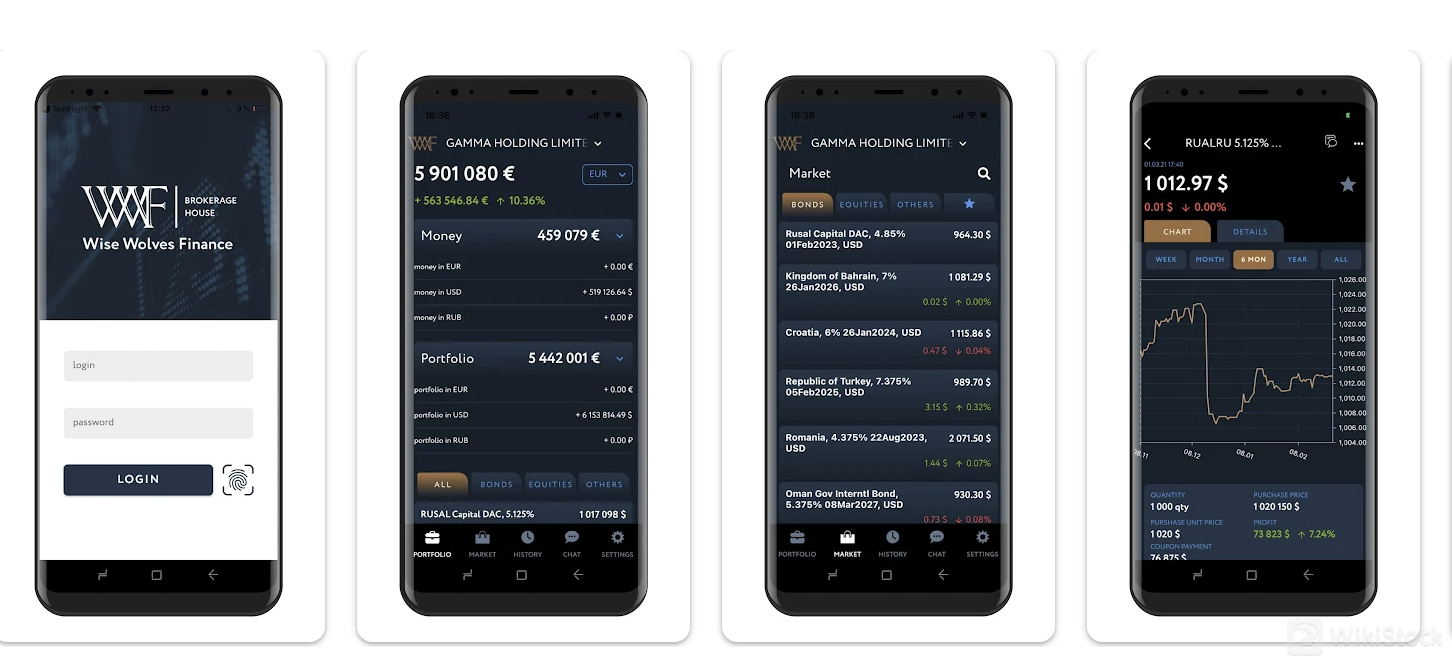

| Ứng dụng/Nền tảng | WWF Mobile Office |

Thông tin WWF

Wise Wolves Finance, được thành lập tại Síp (2016) dưới sự quản lý của Wise Wolves Group (WWG), cung cấp dịch vụ đầu tư trên thị trường chứng khoán quốc tế, tập trung vào Liên minh châu Âu và các quốc gia CIS. Họ hoạt động như một Công ty Đầu tư Síp được cấp phép (#337/17, CySEC, 2017-09-25).

Ưu điểm & Nhược điểm của WWF

| Ưu điểm | Nhược điểm |

| Đa dạng Sản phẩm Đầu tư | Hạn chế trong việc công khai biện pháp bảo mật |

| Ứng dụng di động quản lý danh mục | Phí cao cho nhà giao dịch tích cực |

| Quy định của CySEC | Hạn chế về Nghiên cứu và Tài liệu giáo dục |

Đa dạng Sản phẩm Đầu tư: WWF cung cấp quyền truy cập vào một loạt các lựa chọn đầu tư, bao gồm cổ phiếu, trái phiếu, công cụ tài chính phái sinh, quỹ đầu tư hợp danh và hoán đổi tiền tệ.

Ứng dụng di động quản lý danh mục: Ứng dụng WWF Mobile Office cho phép người dùng theo dõi danh mục đầu tư của họ theo thời gian thực, xem số dư tài khoản, theo dõi lợi nhuận và truy cập dữ liệu lịch sử.

Quy định của CySEC: WWF được cấp phép và quản lý bởi Ủy ban Chứng khoán và Giao dịch Síp.

Nhược điểm:Hạn chế trong việc công khai biện pháp bảo mật: Thông tin về các biện pháp bảo mật cụ thể mà WWF sử dụng để bảo vệ dữ liệu và tài sản của khách hàng không dễ dàng tìm thấy.

Phí cao cho nhà giao dịch tích cực: Phí giao dịch của WWF được phân loại theo công cụ và giá trị giao dịch. Trong khi cạnh tranh với nhà đầu tư ít thường xuyên, nhà giao dịch tích cực có thể phải chịu chi phí đáng kể.

Hạn chế về Nghiên cứu và Tài liệu giáo dục: WWF không cung cấp tài liệu nghiên cứu hoặc giáo trình giành riêng cho nhà đầu tư.

WWF có an toàn không?

Quy định

Wise Wolves Finance Ltd, hoạt động dưới tên kinh doanh WWF, được quy định bởi Ủy ban Chứng khoán và Giao dịch Síp (CySEC) như một Công ty Đầu tư Síp. Số giấy phép của họ là 337/17, được cấp vào ngày 25 tháng 9 năm 2017. Giấy phép CySEC này cho phép WWF cung cấp dịch vụ đầu tư trong một khung pháp lý, mang đến một số đảm bảo cho khách hàng về việc công ty tuân thủ các quy định tài chính do các cơ quan Síp đặt ra.

Các Chứng khoán để Giao dịch với WWF là gì?

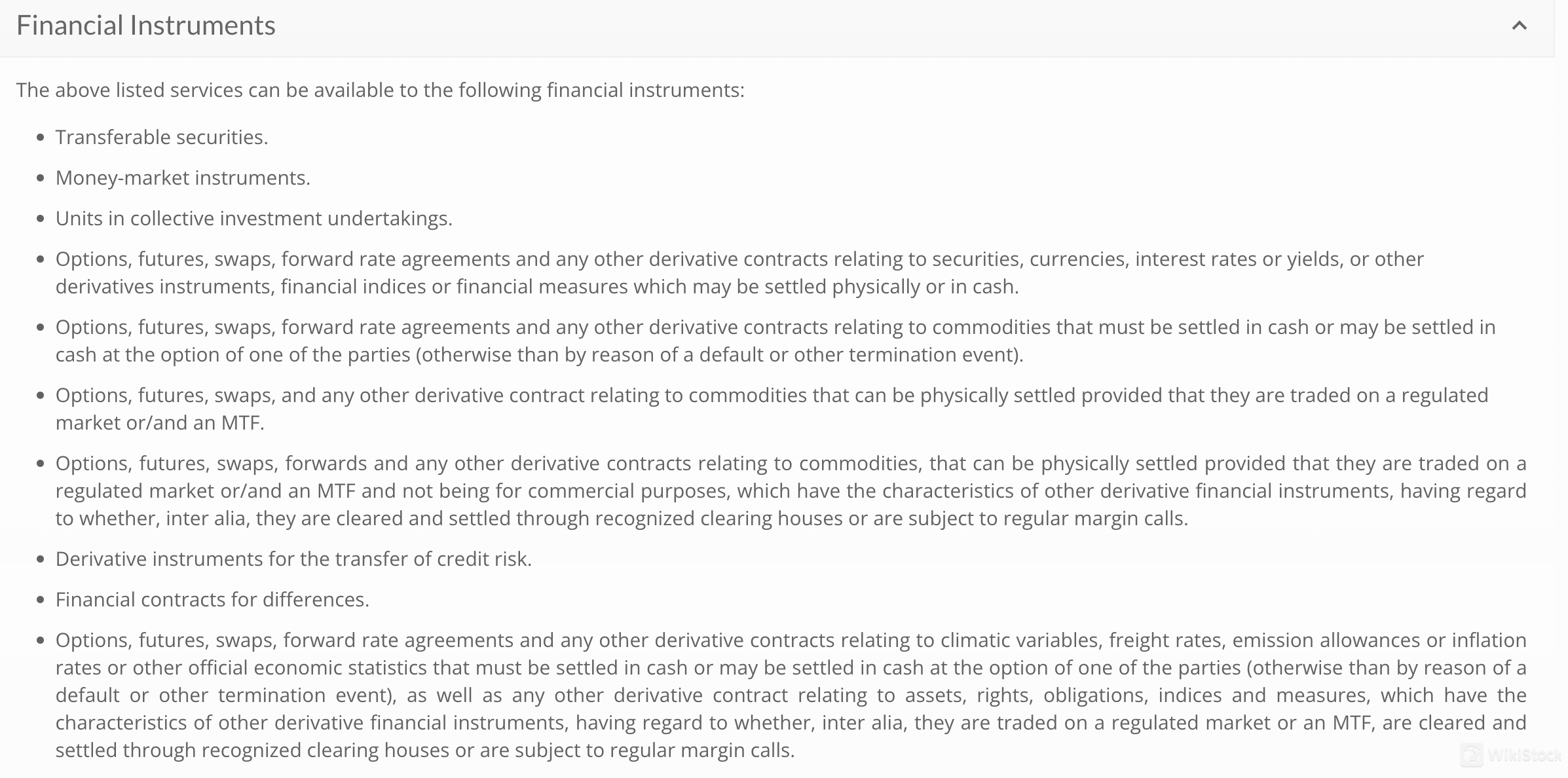

WWF cung cấp một loạt các sản phẩm đầu tư được phân loại là "chứng khoán chuyển nhượng". Điều này bao gồm các tài sản truyền thống như cổ phiếu và trái phiếu, cũng như các công cụ tài chính khác được sử dụng cho mục đích đầu tư và quản lý rủi ro.

- Chứng khoán vốn và nợ: Điều này bao gồm cổ phiếu và trái phiếu do các công ty và chính phủ phát hành, cho phép nhà đầu tư đầu tư vào sở hữu hoặc cho vay tiền để có lợi nhuận.

- Quỹ đầu tư chung: Đây là các phương tiện đầu tư được hợp nhất nơi tiền của nhà đầu tư được kết hợp với tiền của nhà đầu tư khác và được quản lý bởi một chuyên gia. Ví dụ bao gồm quỹ hỗn hợp và quỹ giao dịch trao đổi (ETF).

- Chứng quyền: Đây là các hợp đồng được tạo ra từ giá trị của tài sản cơ bản như chứng khoán, tiền tệ, hàng hóa hoặc thậm chí chỉ số kinh tế. Chúng có thể được sử dụng cho các mục đích khác nhau như đảm bảo rủi ro, đầu cơ trên biến động giá hoặc tăng cường đầu tư của nhà đầu tư.

Tài khoản WWF

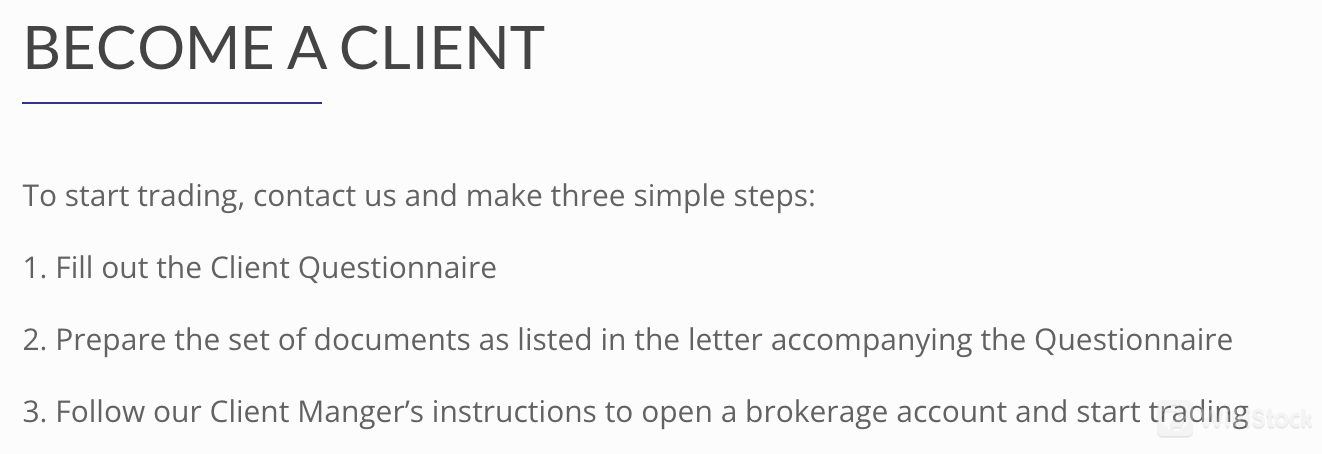

WWF cung cấp một quy trình mở tài khoản đơn giản để bắt đầu giao dịch chứng khoán.

- Bảng câu hỏi khách hàng: Bước đầu tiên là hoàn thành một bảng câu hỏi để đánh giá kiến thức đầu tư, kinh nghiệm và khả năng chịu rủi ro. Điều này giúp WWF hiểu về hồ sơ tài chính của khách hàng và đề xuất các lựa chọn đầu tư phù hợp.

- Chuẩn bị tài liệu: Dựa trên bảng câu hỏi và các yếu tố khác, WWF sẽ cung cấp danh sách tài liệu cần thiết để mở tài khoản của khách hàng. Những tài liệu này được sử dụng để xác minh danh tính và tình hình tài chính.

- Mở tài khoản với quản lý khách hàng: Với bảng câu hỏi hoàn thành và các tài liệu cần thiết, một quản lý khách hàng của WWF sẽ hướng dẫn khách hàng qua các bước cuối cùng để mở tài khoản môi giới.

Đánh giá phí WWF

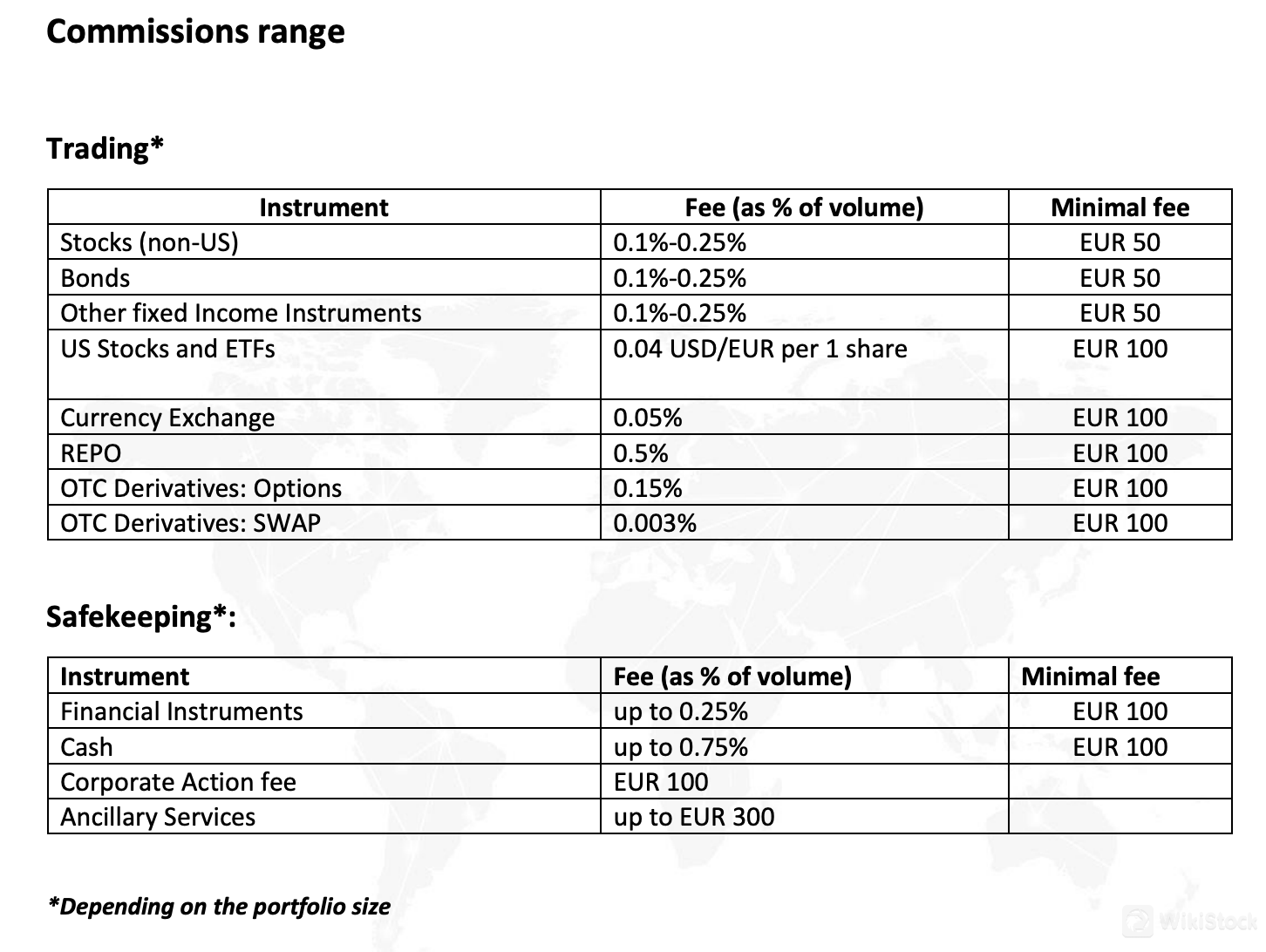

WWF tính phí khác nhau cho việc giao dịch và bảo quản tài sản của khách hàng.

Phí giao dịch: Chi phí giao dịch thay đổi tùy thuộc vào công cụ được giao dịch. Cổ phiếu (ngoại trừ cổ phiếu Mỹ), trái phiếu và các công cụ thu nhập cố định khác chịu phí từ 0.1% đến 0.25% giá trị giao dịch, với mức phí tối thiểu là EUR 50. Cổ phiếu Mỹ và ETF có mức phí trên mỗi cổ phiếu là 0.04 USD/EUR, với mức phí tối thiểu là EUR 100. Giao dịch hoán đổi tiền tệ có mức phí 0.05%, tối thiểu là EUR 100 . Giao dịch REPO chịu mức phí 0.5%, cũng với mức phí tối thiểu là EUR 100. Phí cho các công cụ tài chính OTC cũng được phân loại, với hợp đồng tùy chọn thu hút mức phí 0.15% và hợp đồng SWAP thu hút mức phí 0.003%, cả hai đều có mức phí tối thiểu là EUR 100.

Phí bảo quản: WWF tính phí cho việc giữ tài sản của khách hàng trong tài khoản của họ. Các khoản phí này dựa trên loại tài sản được giữ. Các công cụ tài chính được bảo quản chịu phí lên đến 0.25% giá trị tài sản, với mức phí tối thiểu là EUR 100. Tiền mặt được giữ chịu mức phí bảo quản lên đến 0.75%, cũng với mức phí tối thiểu là EUR 100. Một khoản phí cố định là EUR 100 áp dụng cho việc xử lý các hoạt động doanh nghiệp như chia cổ phiếu, sáp nhập hoặc trả cổ tức. Đối với các dịch vụ bổ sung liên quan đến tài sản an toàn, WWF tính phí lên đến EUR 30.

Đánh giá ứng dụng WWF

WWF cung cấp một ứng dụng di động có tên là "WWF Mobile Office" cho cả thiết bị iOS và Android. Ứng dụng này cho phép người dùng quản lý danh mục đầu tư của họ khi di chuyển.

Tổng quan danh mục: Ứng dụng cung cấp thông tin thời gian thực về danh mục đầu tư, bao gồm số dư tài khoản, lợi nhuận hiện tại, dữ liệu lịch sử và hiệu suất tài sản cá nhân (giá mua, lợi nhuận hiện tại và giá trị hiện tại).

Trực quan hóa dữ liệu: Ứng dụng cung cấp các biểu đồ khác nhau để trực quan hóa hiệu suất danh mục theo các khung thời gian khác nhau (hàng tuần, hàng tháng, hàng năm) cùng với lịch sử đặt lệnh.

Tùy chỉnh và Danh sách theo dõi: Người dùng có thể thêm các cổ phiếu và trái phiếu cụ thể vào danh sách "yêu thích" của họ thông qua chức năng tìm kiếm tiện lợi, giúp truy cập dễ dàng vào các khoản đầu tư được theo dõi thường xuyên.

Dịch vụ khách hàng

WWF cung cấp nhiều kênh để khách hàng liên hệ với đội ngũ dịch vụ khách hàng của họ.

Địa chỉ: Spyrou Kyprianou 61, Mesa Geitonia, 4003 Limassol, Cyprus.

Điện thoại:+357 25 366336.

Fax:+357 25 355233.

Email:wwf@wise-wolves.com.

Kết luận

WWF, hoạt động dưới giấy phép CySEC (số 337/17), cung cấp một loạt sản phẩm đầu tư bao gồm cổ phiếu, trái phiếu, công cụ tài chính và quỹ chung. Đây là một sàn giao dịch lý tưởng cho nhà đầu tư quan tâm đến thị trường Liên minh châu Âu và CIS.

Câu hỏi thường gặp

WWF có an toàn để giao dịch không?

Mặc dù WWF có giấy phép CySEC, cho thấy sự giám sát quy định, thông tin về các biện pháp bảo mật cụ thể để bảo vệ dữ liệu và tài sản của khách hàng hạn chế.

WWF có phải là một nền tảng tốt cho người mới bắt đầu không?

Mặc dù WWF cung cấp ứng dụng di động để quản lý danh mục, sự thiếu hụt tài nguyên giáo dục sẵn có và chi tiết tài khoản không rõ ràng làm cho nó ít phù hợp cho người mới bắt đầu.

WWF có hợp pháp không?

Có. WWF có giấy phép CySEC (số 337/17), cho thấy họ hoạt động trong một khung pháp lý.

Cảnh báo rủi ro

Thông tin được cung cấp dựa trên đánh giá chuyên gia của WikiStock về dữ liệu trang web của sàn giao dịch và có thể thay đổi. Ngoài ra, giao dịch trực tuyến có rủi ro lớn, có thể dẫn đến mất toàn bộ số vốn đầu tư, vì vậy việc hiểu rõ các rủi ro liên quan trước khi tham gia là rất quan trọng.

Thông tin khác

Registered region

Síp

Số năm kinh doanh

5-10năm

Sản phẩm giao dịch

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Đánh giá

Chưa có bình luận

Sàn giao dịch được đề xuấtMore

Globalaurus

Điểm

Fx Portugal

Điểm

FXPRIMUS

Điểm

XM

Điểm

Tickmill

Điểm

Investing24

Điểm

ATFX

Điểm

Tickmill

Điểm

Amana Capital

Điểm

FXTM

Điểm