天眼評分

評分指數

券商鑒定

影響力

D

影響力指數 NO.1

中國香港

中國香港交易品種

5

現金業務、證券諮詢、股票、指數型基金、共同基金

交易牌照

擁有1個交易牌照

中國香港SFC證券交易執照

券商信息

更多

公司全稱

Preferred Investment Advisors (HK) Ltd

公司簡稱

保富

平台註冊國家、地區

公司地址

隨時想查就查

WikiStock APP

互聯網基因

基因指數

APP評分

注意:本評論中提供的信息可能因公司服務和政策的不斷更新而有所變動。此外,生成評論的日期也是需要考慮的重要因素,因為信息可能已經發生變化。因此,建議讀者在做出任何決定或採取任何行動之前,始終直接向公司核實最新信息。本評論提供的信息的使用責任完全由讀者承擔。

在本評論中,如果圖像與文本內容存在衝突,應以文本內容為準。但我們建議您打開官方網站進行進一步諮詢。

| Preferred |  |

| WikiStock 評級 | ⭐⭐⭐ |

| 最低帳戶金額 | 未提及 |

| 費用 | 未提及 |

| 未投資現金的利息 | 未提及 |

| 保證金利率 | 未提及 |

| 提供的共同基金 | 未提及 |

| 應用程式/平台 | 未提及 |

| 促銷活動 | 不可用 |

Preferred 是什麼?

Preferred Investment Advisors (HK) Ltd,通常稱為 Preferred,是一家知名的金融公司,致力於提供全面的投資解決方案。Preferred 受到證券及期貨事務監察委員會(SFC)的監管,提供多樣化的投資機會,包括香港股票、全球股票、債券基金、股票基金、替代基金和與指數相關和利率敏感的結構性產品。

除了強大的投資組合產品外,Preferred 還擅長提供針對個人金融目標和風險偏好量身定制的投資諮詢服務。

優點與缺點

| 優點 | 缺點 |

| 受 SFC 監管 | 缺乏具體的費用信息 |

| 多樣化的證券範圍 | 有關共同基金和平台的信息有限 |

| 強大的研究和教育資源 | 無促銷優惠 |

| 全面的客戶服務 |

受 SFC 監管:受到 SFC(牌照號碼 APY827)的監管,確保遵守嚴格的投資者保護和市場完整性標準。

多樣化的證券範圍:提供包括香港股票、全球股票、債券基金和結構性產品在內的多種投資選擇。

強大的研究和教育資源:提供全面的教育資源和市場新聞。

全面的客戶服務:通過電子郵件、地址、電話和傳真等多種渠道提供可靠的支持網絡。

缺點缺乏具體的費用信息:未提及重要細節,如最低帳戶金額、費用(包括帳戶費用和保證金利率)以及未投資現金的利息。

有關共同基金和平台的有限資訊:未提供有關所提供的共同基金類型以及有關其交易平台或應用程序的具體細節。

無促銷優惠:缺乏促銷活動可能會阻礙尋找新賬戶的介紹性激勵措施或獎金的客戶。

Preferred是否安全?

Preferred受到證券及期貨事務監察委員會(SFC)的監管,持有牌照編號APY827。這一監管框架確保公司遵守嚴格的標準,旨在保護投資者並維護金融市場的完整性。通過遵守這些規定,Preferred確保其業務以最高的專業水準和責任感進行,為客戶和利益相關者注入信心。

Preferred可以交易哪些證券?

Preferred提供多樣化的證券,滿足廣泛的投資偏好。從香港股票到全球股票,Preferred提供了包括全球債券市場和國際股票交易所在內的各種市場的機會。此外,投資者還可以探索債券基金、股票基金、替代基金和結構性產品,如指數連結、利率敏感和匯率挂鉤工具。

研究和教育

Preferred在提供豐富的教育資源方面表現出色,旨在賦予投資者知識和見解。他們的投資諮詢服務提供針對個人財務目標和風險配置的個性化指導。此外,Preferred提供及時的市場新聞和分析,確保客戶了解影響其投資的發展動態。

客戶服務

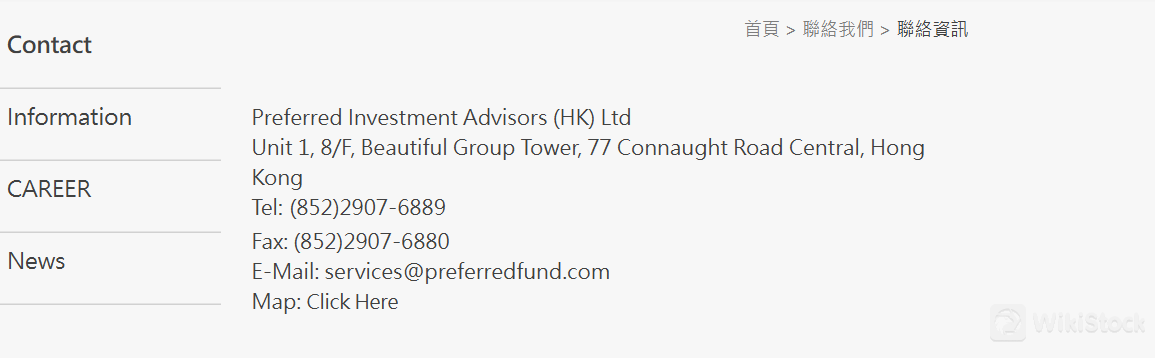

Preferred提供全面且便利的客戶支援網絡。客戶可以通過不同渠道聯繫到他們的支援團隊,以便提供最大的便利。

地址:香港干諾道中77號美麗集團大廈8樓1室,Preferred Investment Advisors (HK) Ltd

電話:(852)2907-6889

傳真:(852)2907-6880

電子郵件:services@preferredfund.com

結論

總之,Preferred是一個受監管且全面的交易平台,提供多樣化的投資服務,以滿足投資者和投資組合經理的不同需求。然而,缺乏詳細的費用信息和平台具體細節可能會阻礙交易者的決策過程。現在,輪到您決定是選擇這家經紀商還是探索其他選擇。希望本評論能為您的決策過程提供一些幫助。

常見問題

Preferred適合初學者嗎?

由於缺乏詳細的費用信息和有關交易平台的透明度,Preferred不是初學者的最佳選擇。

Preferred是否合法?

是的,Preferred受到SFC的監管。

我可以用Preferred交易哪些類型的證券?

Preferred 提供多種證券,包括香港股票、全球股票、債券基金、股票基金、另類基金以及結構性產品,如指數連結和利率敏感工具。

風險警告

所提供的信息基於WikiStock對經紀商網站數據的專家評估,並可能會有所變動。此外,網上交易涉及重大風險,可能導致投資資金的全部損失,因此在參與之前了解相關風險至關重要。

其他信息

註冊地

中國香港

經營時間

10-15年

新股交易

是

受監管國數量

1

可交易品類

現金業務、證券諮詢、股票、指數型基金、共同基金

相關企業

國家

公司名稱

關聯關係

--

Preferred International Financial Holding (Asia) Ltd

母公司

--

Preferred International Financial Group

母公司

評價

暫無評價

推薦券商更多

瑞達國際

天眼評分

Huajin International 華金金融國際

天眼評分

CLSA

天眼評分

Sanfull Securities 新富

天眼評分

DL Securities 德林證券

天眼評分

嘉信

天眼評分

GF Holdings (HK) 廣發控股(香港)

天眼評分

China Taiping 中國太平

天眼評分

Capital Securities 群益證券

天眼評分

乾立亨證券

天眼評分