Score

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

Japan

JapanProducts

7

Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

FPG Securities Co., Ltd

Abbreviation

FPG証券

Platform registered country and region

Company address

Company website

https://www.fpgsec.jp/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

FPG証券 Earnings Calendar

Currency: JPY

Cycle

Q1 FY2024 Earnings

2024/01/30

Revenue(YoY)

24.39B

+40.06%

EPS(YoY)

74.74

+39.96%

FPG証券 Earnings Estimates

Currency: JPY

- DateCycleRevenue/Estimated

- 2024/01/302024/Q124.393B/0

- 2023/07/302023/Q315.676B/0

- 2023/01/302023/Q117.416B/0

- 2022/07/282022/Q316.346B/0

- 2022/01/302022/Q115.673B/0

Internet Gene

Gene Index

APP Rating

| FPG Securities |  |

| WikiStocks Rating | ⭐⭐⭐ |

| Fees | 0 Commissiosn For Investment |

| Interests on uninvested cash | 1.26% |

| Mutual Funds Offered | Yes |

FPG Securities Information

FPG Securities offers zero commission on investments and provides an interest rate of 1.26% on uninvested cash, appealing to customers looking for cost-effective investment avenues. The company also offers a variety of mutual funds.

However, it currently lacks a dedicated trading platform or app, which impacts customers seeking a highly digital service experience.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | No onilne trading platform |

| Various financial(Including MA adivisory,Insurance,Lease Fund)) | Uncertain fee structure for other fees |

| 0 commissions for investment | Complex corporate organizational structure |

Pros:

The company is regulated by the FSA, ensuring compliance with stringent regulatory standards, which enhances investor protection. It offers a diverse range of financial services, including mergers and acquisitions advisory, insurance, and lease fund options. Additionally, the firm promotes cost-efficiency by offering zero commissions on investments, making it an attractive choice for cost-conscious investors.

Cons:

One significant drawback is the lack of an online trading platform, which can hinder the accessibility and ease of trading for tech-savvy clients. The fee structure for services other than investments is also unclear, which leads to potential transparency issues for clients trying to understand the full cost implications of their financial activities. Moreover, the complex corporate organizational structure can complicate decision-making processes and customer service, potentially affecting operational efficiency.

Is FPG Securities Safe?

Regulations:

FPG Securities is regulated by the Japan Financial Services Agency (FSA), holding a license number 関東財務局長(金商)第153号. The FSA's stringent oversight includes the supervision of financial services providers, the inspection of financial institutions, and the enforcement of Japan's financial laws.

Funds Safety:

FPG Securities demonstrates a strong commitment to funds safety through its Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) policies. These policies ensure thorough vetting of transactions and customer relationships to prevent financial crimes, indirectly contributing to the overall safety of client funds by ensuring operational integrity and compliance with stringent regulatory standards.

Safety Measures:

FPG Securities adheres to strict safety protocols to secure client funds and information. This includes employing encryption technologies to safeguard data storage and implementing account safety measures to prevent unauthorized access and data breaches. Their proactive approach in aligning with legal and regulatory standards further supports the security framework, ensuring a robust defense against potential cybersecurity threats and data leakage.

What are securities to trade with FPG Securities?

At FPG Securities, clients have the opportunity to invest in a variety of leasing and real estate fund products:

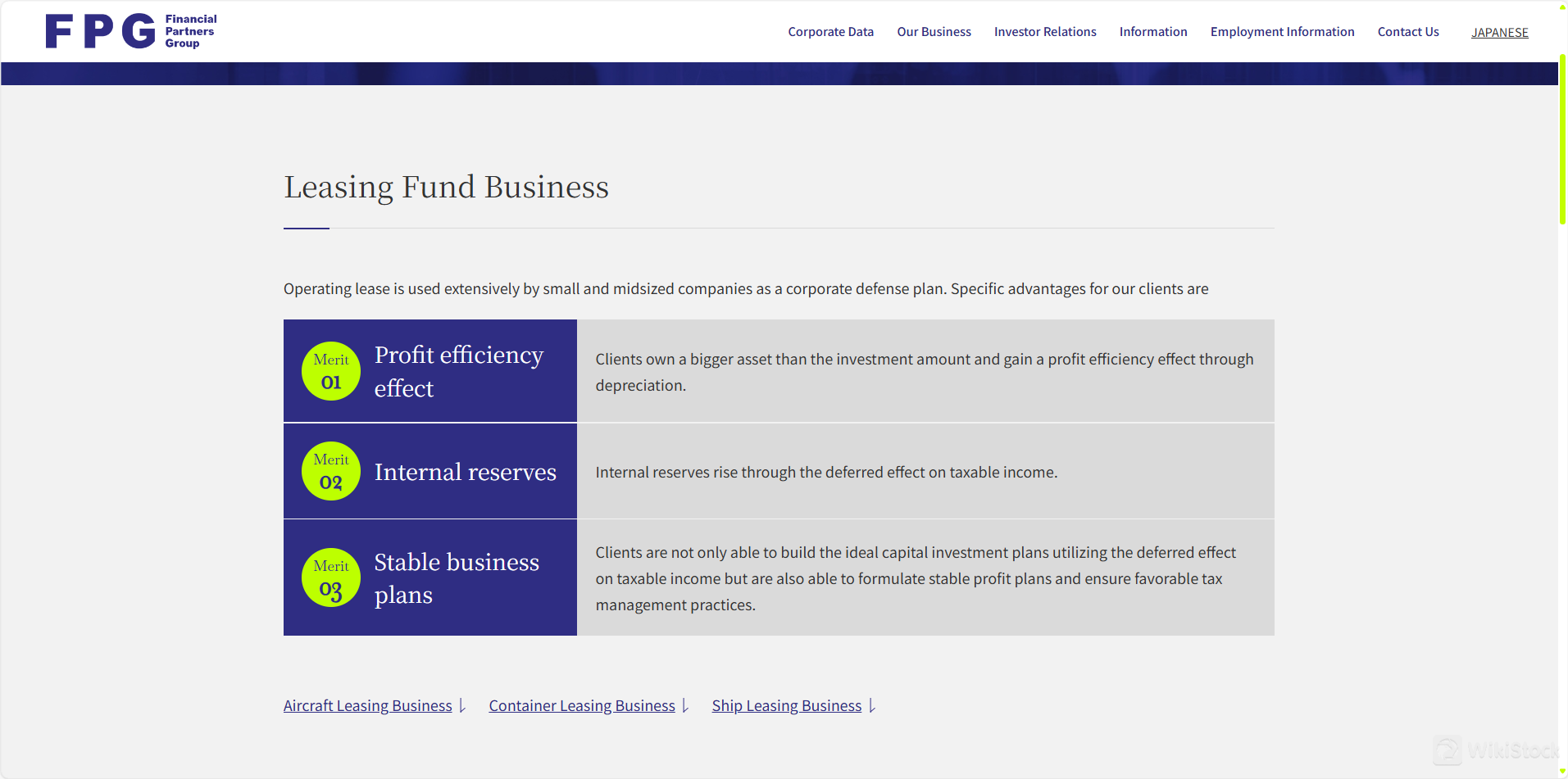

- Leasing Fund Business: This includes investments in operating leases across different high-value assets such as aircraft, marine containers, and ships. These funds allow clients to invest in assets that have significant long-term use and stability in market value, providing a profit efficiency effect through depreciation, internal reserves from deferred taxable income, and the ability to build stable business and profit plans.

- Real Estate Fund Business: FPG offers investments in domestic real estate through fractional ownership, particularly in high-net-worth individual markets. The “Premium Asset Series” allows investors to buy into prime city-center real estate expected to yield stable returns, with the added benefit of asset management and succession planning. This includes U.S. real estate investment opportunities that focus on properties in growth areas, leveraging economic and population growth to drive demand and ensure high occupancy rates.

- Insurance Sales Business: FPG Securities offers a large range of insurance products tailored for corporate clients. These plans consider factors like business security, inheritance and succession planning, employee welfare, and tax benefits, ensuring optimal solutions are available for each unique business need.

- Mergers and Acquisitions (M&A) Business: FPG assists small and medium-sized enterprise (SME) owners in navigating business succession challenges, providing both advisory and asset management services post-M&A. This service is crucial for companies without a clear succession plan, helping to facilitate the transition through strategic financial planning and implementation.

- Arrangement Fees and Related Expenses: Investors do not pay commissions directly to FPG Securities. Instead, the investment amount incorporates fees paid to the arranger and other related fees concerning the structuring of the project. This can include residual value guarantee fees and other expenses incurred during the setup and operation of the lease arrangement.

- Accrued Interest: The price of transferring the status to an anonymous partnership includes an amount equivalent to the accrued interest from the business start date to the investment date. This accrued interest amount is retained by the company as the transferor of the status.

- Direct Fees Under Partnership Agreements: When investing under a voluntary partnership agreement or investing under trust beneficiary rights, the investor will be required to pay certain fees directly to the company.

- Seminars for Accounting Firms: FPG offers targeted educational seminars for accounting firms, which likely cover a range of topics including financial regulations, the latest accounting practices, and sector-specific insights pertinent to FPG's business activities such as leasing and investment management.

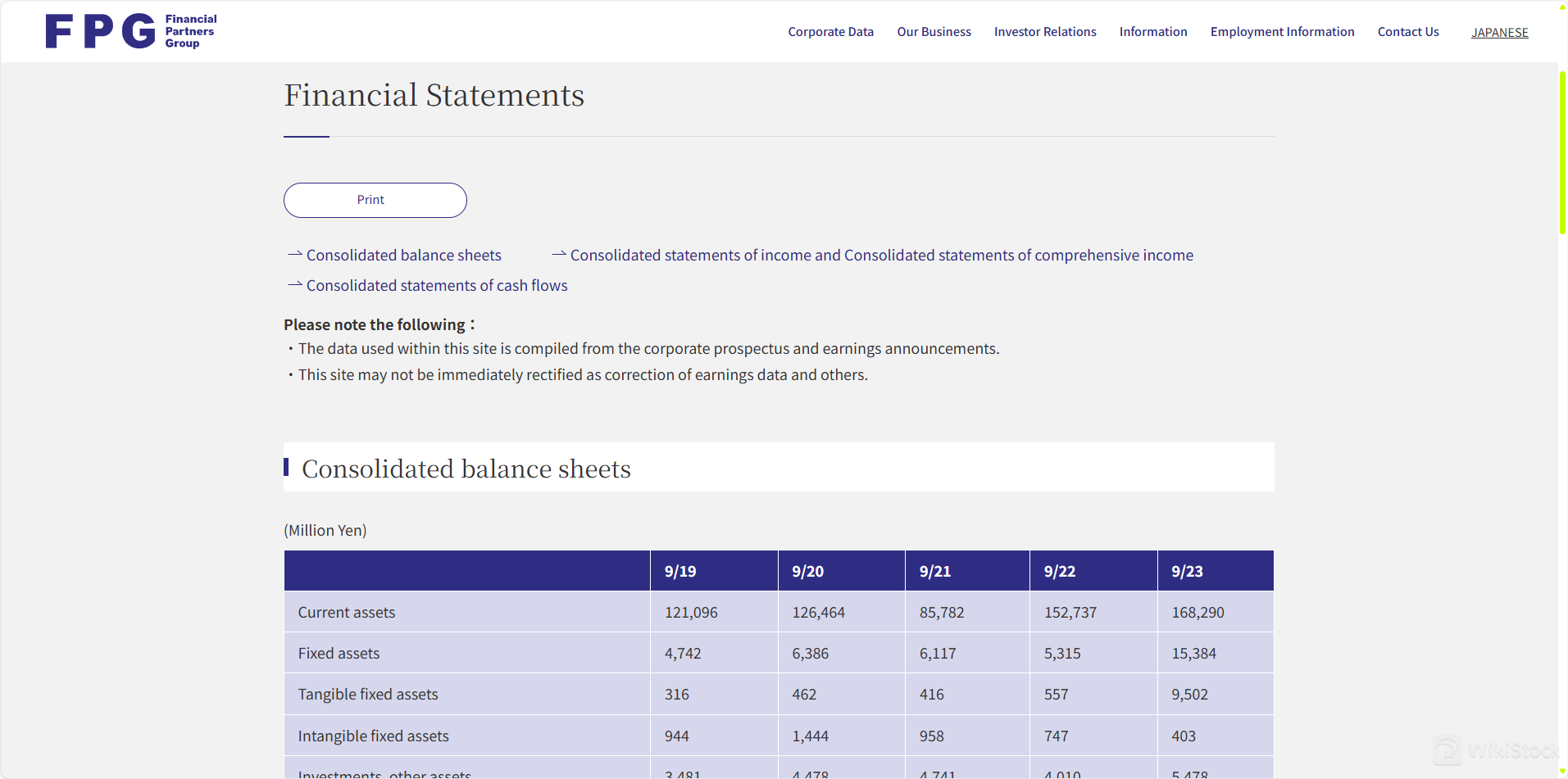

- Investor Education: Through its investor relations activities, FPG provides detailed financial statements and performance data to educate investors about the companys financial health and market activities. This includes consolidated balance sheets, income statements, and cash flow statements, helping investors make informed decisions.

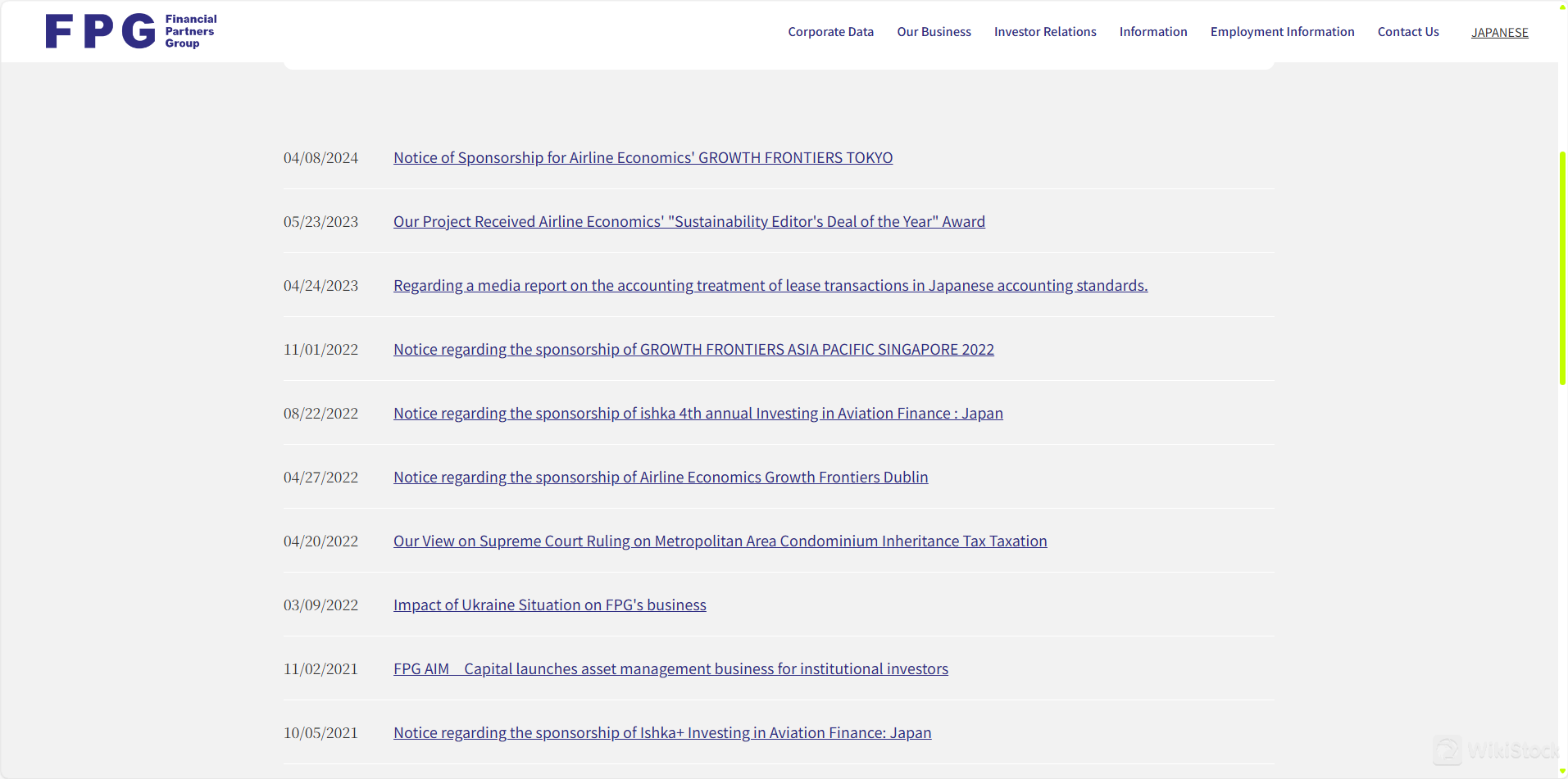

- Public Information Sessions and Sponsorships: FPG sponsors industry events like Airline Economics' Growth Frontiers and Ishka Investing in Aviation Finance, which serve as educational platforms for industry stakeholders to learn about market trends, investment opportunities, and new technologies in aviation finance.

- FPG Securities offers a range of securities for trading, including investments in real estate, aircraft, ships, and containers through various leasing fund businesses.

- FPG Securities follows stringent regulations set by the Financial Services Agency of Japan and implements robust anti-money laundering and counter-terrorism financing policies.

- If you receive a suspicious email related to recruitment, please verify its authenticity by contacting FPG directly at recruit@fpg.jp.

Services

In addition to offering tradable securities in leasing funds and real estate investments, FPG Securities provides a range of other services designed to meet various financial needs:

FPG Securities Fee Review

The fee structure of FPG Securities for its operating lease business under anonymous partnership investments is detailed as follows:

Research & Education

FPG Financial Partners Group actively engages in research and education initiatives, particularly focusing on economic sectors relevant to its business operations such as the operating lease and investment sectors.

Customer Service

FPG Financial Partners Group offers dedicated customer support through specialized email contacts for different inquiries.

For general investor relations, interested parties can reach out via email at ir@fpg.jp and the phone number is 03-5220-4200. Similarly, recruitment-related queries should be directed to recruit@fpg.jp.

Conclusion

FPG Financial Partners Group is a well-established financial services provider, registered with the Kanto Local Finance Bureau, offering a diverse range of investment opportunities particularly in leasing and real estate.

With a strong focus on ethical business practices, FPG champions transparency and customer-centric operations, evidenced by their detailed financial disclosures and commitment to educating both investors and professional partners through seminars and sponsorships.

Their active involvement in industry events and caution against fraudulent recruitment practices further demonstrate their dedication to integrity and client safety.

FAQs

1. What types of securities can I trade with FPG Securities?

2. How does FPG Securities ensure the safety of client funds?

3. What should I do if I receive a suspicious recruitment email from someone claiming to be from FPG?

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

10-15 years

Regulated Countries

1

Products

Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

東海東京証券

Score

Mita Securities

Score

GMOクリック証券

Score

Matsui

Score

Okasan Securities

Score

丸三証券

Score

安藤証券

Score

アイザワ証券

Score

SMBC

Score

今村証券

Score