Score

昇悅證券

https://www.priorsecurities.com.hk/

Website

Rating Index

Brokerage Appraisal

Products

1

Stocks

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 02026

Brokerage Information

More

Company Name

Prior Securities Limited

Abbreviation

昇悅證券

Platform registered country and region

Company address

Company website

https://www.priorsecurities.com.hk/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Trading Fee

$0

Platform Service Fee

HK$0

Commission Rate

0.25%

New Stock Trading

Yes

| WikiStock Rating | ⭐⭐⭐ |

| Fees | 0.005% of trading fees, $1.50 per lot of scrip fee, 0.5% of total dividend amount (min. $20) , 0.008% Central Clearing Fee |

| Account Fees | $20 per year of Inactive Account Fee |

| App/Platform | Web-based |

| Customer Support | Phone, fax, email and online messaging |

What is Prior Securities Limited?

Prior Securities Limited, overseen by the SFC, provides a broad spectrum of financial services, covering brokerage fees, stamp duty, transaction levies, and related charges. However, their website does not explicitly detail specific securities products offered.

| Pros | Cons |

| Regulated by SFC | Strict Deposit Deadlines |

| Clear Fee structure | Not Detailing Specific Securities Products |

Regulated by SFC: Prior Securities Limited operates under the strict regulatory oversight of the Securities and Futures Commission (SFC).

Clear Fee Structure: The company provides a transparent fee structure, detailing costs such as brokerage fees, stamp duty, transaction levies, and other charges, offering clarity for clients on financial transactions.

Cons:Strict Deposit Deadlines: Clients must adhere to stringent deadlines for depositing funds, typically requiring clearance by 4:00 p.m. on the day of deposit. This may pose challenges for clients managing time-sensitive transactions.

Not Detailing Specific Securities Products: The company does not explicitly list or detail specific securities products offered on their website, which may require potential clients to inquire directly for comprehensive product information and offerings.

Is Prior Securities Limited Safe?

Prior Securities Limited operates under the supervision of the Securities and Futures Commission (SFC) with License No. BEG494. The SFC, as a prominent financial regulator in a global financial hub, is committed to enhancing and safeguarding the reliability and stability of Hong Kong's securities and futures markets.

Prior Securities Limiteds fee structure includes charges for brokerage, stamp duty, transaction levies, corporate actions, stock deposit and withdrawal, order handling, account maintenance, and various service fees.

| Category | Detail |

| Transaction Fees | |

| Brokerage | 0.25% of transaction value ($100 minimum for phone orders, $50 for online orders) |

| Stamp Duty | 0.13% of transaction value, minimum $1 |

| Transaction Levy | 0.0027% of transaction value |

| Trading Fee | 0.005% of transaction value |

| Financial Reporting Bureau Transaction Levy | 0.00015% of transaction value |

| Central Clearing Fee | 0.008% of transaction value ($5 minimum, $300 maximum) |

| Trading System Usage Fee | Free |

| Stock Deposit | |

| Depositing Physical Stock | Transfer Deed Stamp Duty: $5 per stock certificate |

| Withdrawing Physical Stock | $5 per lot (minimum $100), or $5 per stock if not a whole lot |

| Order Fees | |

| S.J. (Sell Instruction) | Free for Korean stocks, 0.01% of previous closing price (min. $100 for other stocks) |

| I.S.J. (Investor Settlement Instruction) | Free for transferring in, 0.01% of previous closing price (min. $20 for transferring out) |

| Agent and Corporate Action Fees | |

| Scrip Fee | $1.50 per lot |

| Cash Dividend or Stock Dividend Collection | 0.5% of total dividend amount (min. $20) + 0.12% Central Clearing Fee |

| Red Stock Collection Fee | $20 |

| Subscription Rights/Warrants Collection | $1.50 per lot + Central Clearing Fee |

| Exercising Subscription Rights/Warrants | $1 per lot + Central Clearing Fee |

| Bull/Bear Certificate Redemption/Warrant Fee | 0.5% of face value (min. $20) + Central Clearing Fee |

| Share Consolidation/Split | Free |

| Backstopped Put/Guaranteed Call Fee | Minimum fee applies |

| Attending/Authorizing AGM | $30 per person |

| Mandatory Buy-in Fee | $200 handling fee plus charges |

| Loan and Other Fees | |

| New Share Subscription (IPO) | $100 per application |

| Inactive Cash Account Interest | Rate + 4% per year |

| Individual Stock Account and Statement Fee | $50 per month per account |

| Mailed Daily/Monthly Statements Fee | $20 per month |

| Inactive Account Fee | $20 per year |

| Company Registration Fee | $200 per company |

| Bank Service Fees | Various charges |

| Bond/Fund and Others | |

| Buying/Selling Transaction Fee (Bond/Fund) | 1.5% of transaction value |

| Bond Custody Fee | 0.15% of face value per month |

| Redemption Fee (Bonds/Funds) | Fixed amount or as negotiated |

| Interest/Corporate Action Collection Fee | 0.5% of total dividend amount (min. $100) + institutions fees |

-

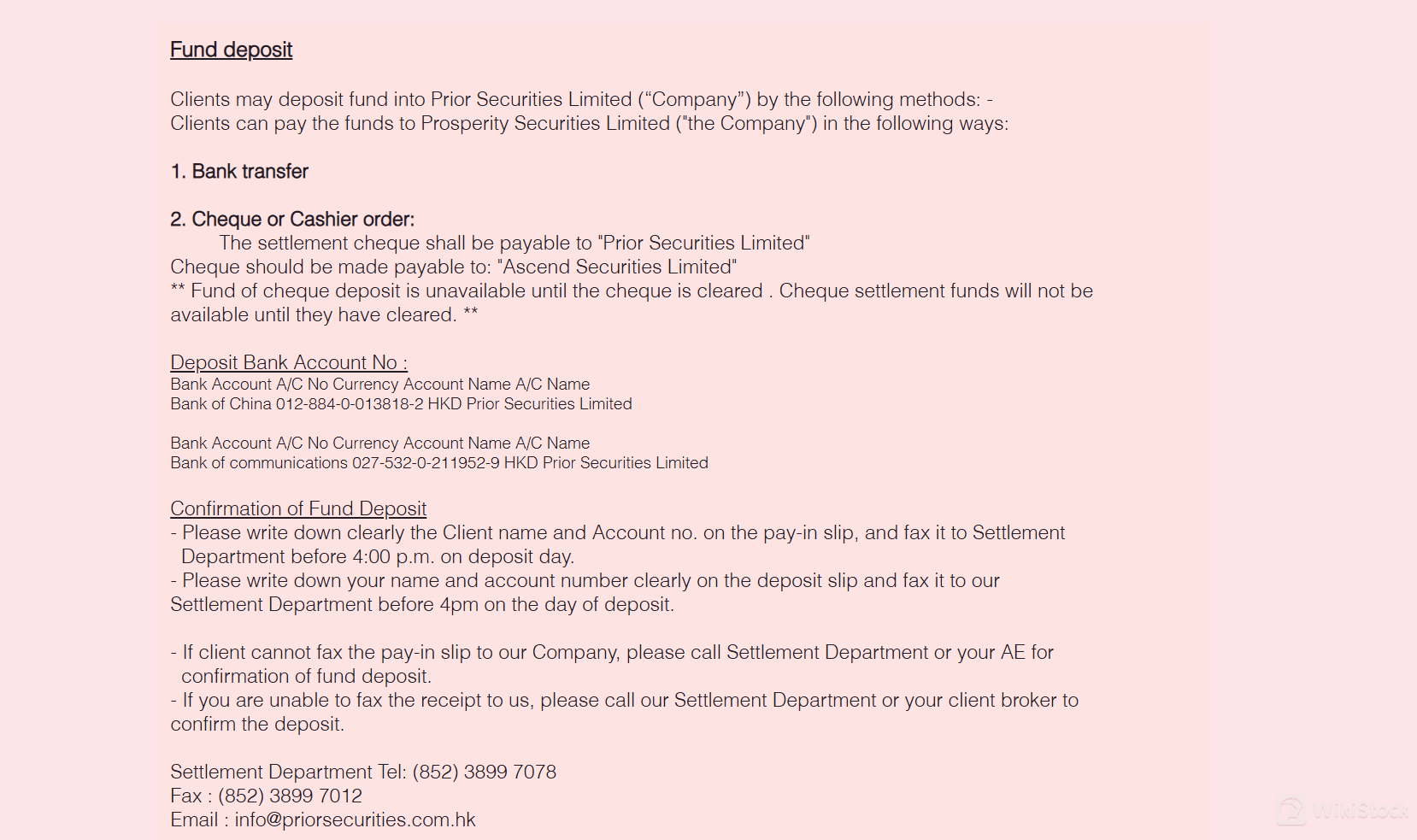

Fund Deposits:

Clients can deposit funds through: Bank transfer to designated accounts.

Cheque or cashiers order made payable only to “Prior Securities Limited”. Note that funds from cheque deposits are only available after clearance.

Notes: Funds must be deposited before 4:00 p.m. on the deposit day (T) to ensure timely settlement. Failure to settle by 10:00 a.m. on T+3 results in forced sale of stocks. Third-party deposits are not accepted.

Fund Withdrawals:Clients can withdraw surplus funds by: Contacting the Settlement Department or their Account Executive (AE). Completing a “Fund Withdrawal Form” and faxing it to the Settlement Department.

Notes: Withdrawal requests must be submitted before 11:00 a.m. on weekdays for same-day processing.

Cheques for withdrawals are issued only to the client and not to third parties.

Stock Deposits:Stocks can be deposited via: Physical Stock Deposit: Requires completing specific forms which are then faxed to the Settlement Department. Stocks become tradable after acceptance by the Share Registrar, typically within 7 working days.

Settlement Instruction (SI): Involves completing an SI form, which facilitates the transfer of stocks from other licensed institutions via CCASS.

Notes: Stocks deposited physically require completion of forms before noon for same-day settlement. Acceptance by the Share Registrar is necessary before trading.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +852 3899 7000

Fax: +852 3899 7012

Email: info@priorsecurities.com.hk

Address: Units 1505-1507, 15/F, Shui On Centre, 6-8 Harbour Road, Wan Chai, Hong Kong

Prior Securities Limited offers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform.

Prior Securities Limited stands out in Hong Kong's financial landscape under the SFC. They offer a comprehensive range of financial services with a clear fee structure, which enhances transparency for clients. However, the lack of specific details about securities products on their website may require potential clients to seek additional information directly. Therefore, Prior Securities Limited is a viable option for clients seeking regulated financial services.

Frequently Asked Questions (FAQs)

Is Prior Securities Limited regulated?

Yes. It is regulated by SFC.

How can I contact Prior Securities Limited?

You can contact via telephone: +852 3899 7000, fax: +852 3899 7012, email: info@priorsecurities.com.hk and online messaging.

When I can submit the withdrawal requests from Prior Securities Limited?

Withdrawal requests must be submitted before 11:00 a.m. on weekdays.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

瑞达国际

Score

Huajin International

Score

CLSA

Score

Sanfull Securities

Score

DL Securities

Score

嘉信

Score

GF Holdings (HK)

Score

China Taiping

Score

Capital Securities

Score

乾立亨證券

Score