Nilai

昇悅證券

https://www.priorsecurities.com.hk/

Website

Peringkat indeks

Penilaian Broker

Produk

1

Stocks

Lisensi sekuritas

dapatkan 1 lisensi sekuritas

SFCTeregulasi

Hong KongLisensi Perdagangan Sekuritas

Kursi Global

Memiliki 1 kursi

Hong Kong HKEX

Nomor Kursi. 02026

Informasi Pialang

More

Nama perusahaan

Prior Securities Limited

Singkatan

昇悅證券

Negara dan wilayah terdaftar platform

Alamat perusahaan

Situs Perusahaan

https://www.priorsecurities.com.hk/Periksa kapanpun Anda mau

WikiStock APP

Layanan Broker

Gene Internet

Indeks Gene

Peringkat APP

Fitur broker

Komisi

$0

Biaya layanan platform

HK$0

Tarif komisi

0.25%

New Stock Trading

Yes

| Peringkat WikiStock | ⭐⭐⭐ |

| Biaya | 0,005% dari biaya perdagangan, biaya $1,50 per lot saham, 0,5% dari total jumlah dividen (min. $20), Biaya Pembersihan Pusat 0,008% |

| Biaya Akun | Biaya Akun Tidak Aktif $20 per tahun |

| Aplikasi/Platform | Berbasis Web |

| Dukungan Pelanggan | Telepon, faks, email, dan pesan online |

Apa itu Prior Securities Limited?

Prior Securities Limited, yang diawasi oleh SFC, menyediakan berbagai layanan keuangan, termasuk biaya pialang, cukai cap, bea transaksi, dan biaya terkait. Namun, situs web mereka tidak secara eksplisit menjelaskan produk sekuritas spesifik yang ditawarkan.

| Kelebihan | Kekurangan |

| Diatur oleh SFC | Batas Waktu Deposit Ketat |

| Struktur Biaya yang Jelas | Tidak Menjelaskan Produk Sekuritas Spesifik |

Diatur oleh SFC: Prior Securities Limited beroperasi di bawah pengawasan ketat dari Securities and Futures Commission (SFC).

Struktur Biaya yang Jelas: Perusahaan ini menyediakan struktur biaya yang transparan, menjelaskan biaya seperti biaya pialang, cukai cap, bea transaksi, dan biaya lainnya, memberikan kejelasan bagi klien dalam transaksi keuangan.

Kekurangan:Batas Waktu Deposit Ketat: Klien harus mematuhi batas waktu yang ketat untuk melakukan deposit dana, biasanya membutuhkan klarifikasi sebelum pukul 16:00 pada hari deposit. Hal ini dapat menimbulkan tantangan bagi klien yang mengelola transaksi yang membutuhkan waktu yang sensitif.

Tidak Menjelaskan Produk Sekuritas Spesifik: Perusahaan tidak secara eksplisit mencantumkan atau menjelaskan produk sekuritas spesifik yang ditawarkan di situs web mereka, yang mungkin memerlukan calon klien untuk menanyakan langsung informasi produk dan penawaran yang komprehensif.

Apakah Prior Securities Limited Aman?

Prior Securities Limited beroperasi di bawah pengawasan Securities and Futures Commission (SFC) dengan Nomor Lisensi BEG494. SFC, sebagai regulator keuangan terkemuka di pusat keuangan global, berkomitmen untuk meningkatkan dan menjaga keandalan dan stabilitas pasar sekuritas dan berjangka Hong Kong.

Struktur biaya Prior Securities Limited termasuk biaya untuk pialang, cukai cap, biaya transaksi, tindakan korporat, deposit dan penarikan saham, penanganan pesanan, pemeliharaan akun, dan berbagai biaya layanan.

| Kategori | Detail |

| Biaya Transaksi | |

| Pialang | 0,25% dari nilai transaksi ($100 minimum untuk pesanan telepon, $50 untuk pesanan online) |

| Cukai Cap | 0,13% dari nilai transaksi, minimum $1 |

| Biaya Transaksi | 0,0027% dari nilai transaksi |

| Biaya Perdagangan | 0,005% dari nilai transaksi |

| Biaya Transaksi Biro Pelaporan Keuangan | 0,00015% dari nilai transaksi |

| Biaya Kliring Pusat | 0,008% dari nilai transaksi ($5 minimum, $300 maksimum) |

| Biaya Penggunaan Sistem Perdagangan | Gratis |

| Deposit Saham | |

| Deposit Saham Fisik | Cukai Cap Surat Transfer: $5 per sertifikat saham |

| Penarikan Saham Fisik | $5 per lot (minimum $100), atau $5 per saham jika bukan lot lengkap |

| Biaya Pesanan | |

| S.J. (Instruksi Jual) | Gratis untuk saham Korea, 0,01% dari harga penutup sebelumnya (min. $100 untuk saham lain) |

| I.S.J. (Instruksi Penyelesaian Investor) | Gratis untuk transfer masuk, 0,01% dari harga penutup sebelumnya (min. $20 untuk transfer keluar) |

| Biaya Agen dan Tindakan Korporat | |

| Biaya Saham Fisik | $1,50 per lot |

| Pengumpulan Dividen Tunai atau Dividen Saham | 0,5% dari total jumlah dividen (min. $20) + 0,12% Biaya Kliring Pusat |

| Biaya Pengumpulan Saham Merah | $20 |

| Biaya Pengumpulan Hak Langganan/Warrant | $1,50 per lot + Biaya Kliring Pusat |

| Penggunaan Hak Langganan/Warrant | $1 per lot + Biaya Kliring Pusat |

| Biaya Penebusan Sertifikat Bull/Bear/Warrant | 0,5% dari nilai nominal (min. $20) + Biaya Kliring Pusat |

| Konsolidasi/Pemecahan Saham | Gratis |

| Biaya Put Backstopped/Garansi Panggilan | Berlaku biaya minimum |

| Menghadiri/Mengotorisasi RUPS | $30 per orang |

| Biaya Pembelian Wajib | Biaya penanganan $200 ditambah biaya lainnya |

| Biaya Pinjaman dan Lainnya | |

| Langganan Saham Baru (IPO) | $100 per aplikasi |

| Bunga Rekening Tunai Tidak Aktif | Suku bunga + 4% per tahun |

| Biaya Akun Saham Individu dan Laporan | $50 per bulan per akun |

| Biaya Pernyataan Harian/Bulanan yang Dikirimkan | $20 per bulan |

| Biaya Akun Tidak Aktif | $20 per tahun |

| Biaya Pendaftaran Perusahaan | $200 per perusahaan |

| Biaya Layanan Bank | Berbagai biaya |

| Obligasi/Dana dan Lainnya | |

| Biaya Transaksi Pembelian/Penjualan (Obligasi/Dana) | 1,5% dari nilai transaksi |

| Biaya Penyimpanan Obligasi | 0,15% dari nilai nominal per bulan |

| Biaya Penebusan (Obligasi/Dana) | Jumlah tetap atau sesuai negosiasi |

| Biaya Pengumpulan Bunga/Tindakan Korporat | 0,5% dari total jumlah dividen (min. $100) + biaya institusi |

-

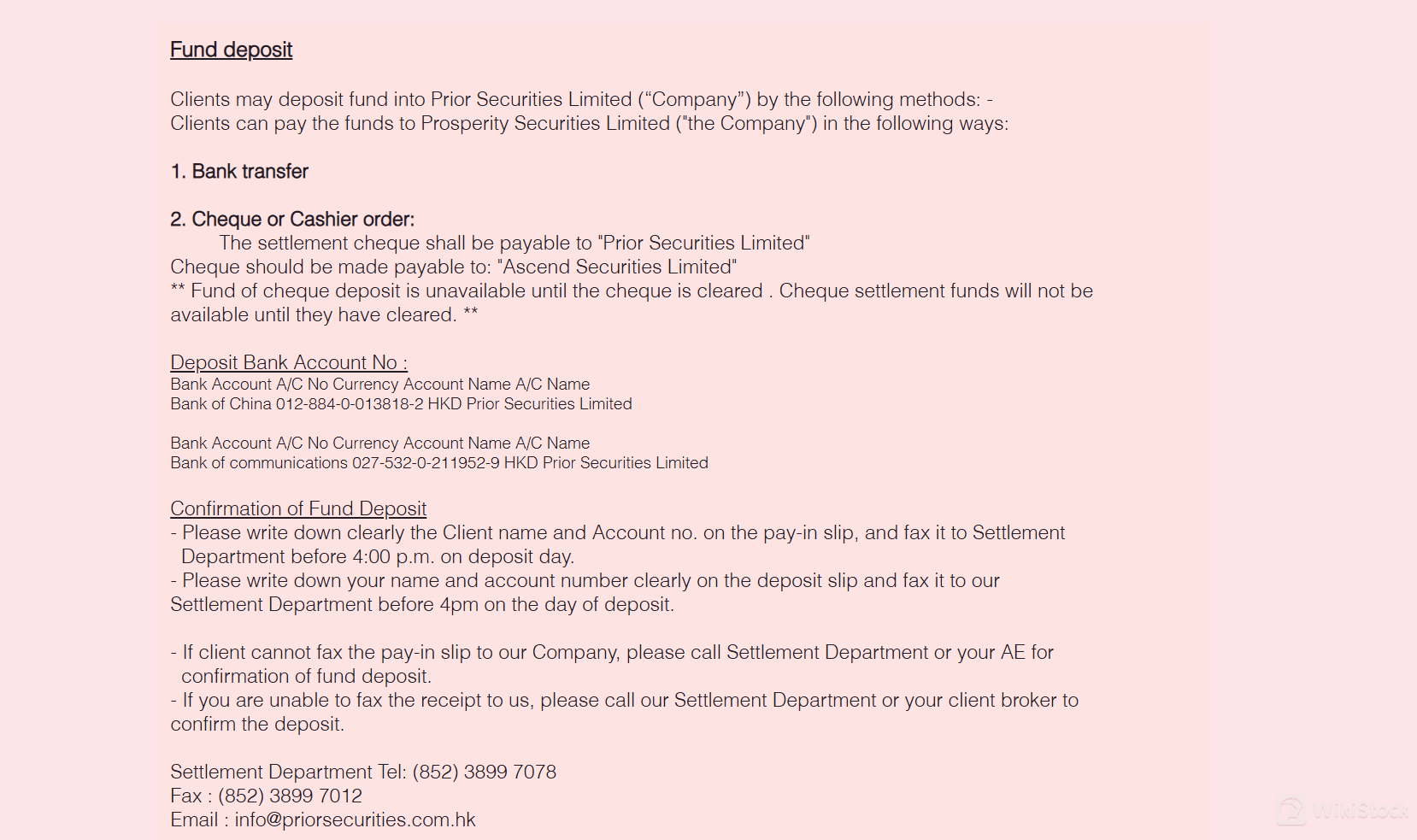

Penyetoran Dana:

Klien dapat melakukan deposit dana melalui: Transfer bank ke rekening yang ditentukan.

Cek atau surat perintah kasir yang hanya dibayarkan kepada "Prior Securities Limited". Harap dicatat bahwa dana dari deposit cek hanya tersedia setelah penyelesaian.

Catatan: Dana harus disetor sebelum pukul 4:00 sore pada hari deposit (T) untuk memastikan penyelesaian tepat waktu. Kegagalan penyelesaian hingga pukul 10:00 pagi pada T+3 akan mengakibatkan penjualan paksa saham. Deposit pihak ketiga tidak diterima.

Penarikan Dana:Klien dapat menarik dana surplus dengan: Menghubungi Departemen Penyelesaian atau Eksekutif Akun (AE) mereka. Mengisi "Formulir Penarikan Dana" dan mengirimkannya melalui faks ke Departemen Penyelesaian.

Catatan: Permintaan penarikan harus diajukan sebelum pukul 11:00 pagi pada hari kerja untuk diproses pada hari yang sama.

Cek untuk penarikan hanya diterbitkan kepada klien dan bukan kepada pihak ketiga.

Deposit Saham:Saham dapat di deposit melalui: Deposit Saham Fisik: Membutuhkan pengisian formulir khusus yang kemudian dikirimkan melalui faks ke Departemen Penyelesaian. Saham menjadi dapat diperdagangkan setelah diterima oleh Registrar Saham, biasanya dalam waktu 7 hari kerja.

Instruksi Penyelesaian (SI): Melibatkan pengisian formulir SI, yang memfasilitasi transfer saham dari lembaga berlisensi lain melalui CCASS.

Catatan: Saham yang didepositkan secara fisik harus mengisi formulir sebelum tengah hari untuk penyelesaian pada hari yang sama. Penerimaan oleh Registrar Saham diperlukan sebelum berdagang.

Pelanggan dapat mengunjungi kantor mereka atau menghubungi layanan pelanggan menggunakan informasi yang disediakan di bawah ini:

Telepon: +852 3899 7000

Faks: +852 3899 7012

Email: info@priorsecurities.com.hk

Alamat: Units 1505-1507, 15/F, Shui On Centre, 6-8 Harbour Road, Wan Chai, Hong Kong

Prior Securities Limited menawarkan pesan daring sebagai bagian dari platform perdagangan mereka. Ini memungkinkan para trader untuk berkomunikasi langsung dengan dukungan pelanggan atau trader lain melalui platform tersebut.

Prior Securities Limited menonjol dalam lanskap keuangan Hong Kong di bawah SFC. Mereka menawarkan berbagai layanan keuangan dengan struktur biaya yang jelas, yang meningkatkan transparansi bagi klien. Namun, kurangnya detail spesifik tentang produk sekuritas di situs web mereka mungkin memerlukan calon klien untuk mencari informasi tambahan secara langsung. Oleh karena itu, Prior Securities Limited adalah pilihan yang layak bagi klien yang mencari layanan keuangan yang diatur.

Pertanyaan yang Sering Diajukan (FAQ)

Apakah Prior Securities Limited diatur?

Ya. Itu diatur oleh SFC.

Bagaimana cara menghubungi Prior Securities Limited?

Anda dapat menghubungi melalui telepon: +852 3899 7000, faks: +852 3899 7012, email: info@priorsecurities.com.hk, dan pesan daring.

Kapan saya dapat mengajukan permintaan penarikan dari Prior Securities Limited?

Permintaan penarikan harus diajukan sebelum pukul 11:00 pagi pada hari kerja.

Peringatan Risiko

Informasi yang disediakan didasarkan pada evaluasi ahli WikiStock terhadap data situs web pialang dan dapat berubah. Selain itu, perdagangan daring melibatkan risiko yang substansial, yang dapat mengakibatkan kerugian total dari dana yang diinvestasikan, sehingga memahami risiko terkait sebelum terlibat sangat penting.

Lainnya

Registered region

Hong Kong

Jam kerja

2-5 tahun

Produk

Stocks

Download App

Review

Tidak ada rating

Perusahaan Pialang yang DirekomendasikanMore

瑞达国际

Nilai

Huajin International

Nilai

CLSA

Nilai

Sanfull Securities

Nilai

DL Securities

Nilai

嘉信

Nilai

GF Holdings (HK)

Nilai

China Taiping

Nilai

Capital Securities

Nilai

乾立亨證券

Nilai