West Bull Securities (“West Bull”) specializes in providing securities brokerage service and we are committed to provide quality account management and customer service to meet our clients’ needs. West Bull Securities is licensed by the Hong Kong Securities and Futures Commission to conduct Type 1 (Dealing in Securities), Type 4 (Advising on securities) and Type 9 (Asset management) regulated activities (CE No.: BHT553) and is a participant of the Hong Kong Exchanges and Clearing (HKEx). West Bull Financial Limited (as a member of the West Bull Group Capital) is responsible for providing professional financial advisory services and is licensed by the Hong Kong Securities and Futures Commission to engage in Type 6 (advising on corporate finance) regulated activities (CE No. BRZ822).

What is West Bull Securities?

West Bull Securities is recognized with a three-star rating from WikiStocks and offers an attractive interest rate of 5.32% on uninvested cash, which can be appealing for investors looking to gain returns on idle balances. The firm also provides access to mutual funds, meeting diverse investment needs.

Additionally, it supports trading via the West Bull Trading App available on Android, iOS, and PC platforms, enhancing accessibility and trading convenience.

Pros & Cons

Pros:

West Bull Securities is regulated by the SFC, ensuring compliance with financial regulations, and offers specialized services in charity and wealth management. The firm also boasts a unique trading platform, enhancing user experience.

Cons:

However, West Bull Securities does not offer diverse account types or direct tradable securities, limiting investment options. Additionally, there is a lack of educational resources and analysis tools, which could be a drawback for new investors seeking to learn.

Is West Bull Securities Safe?

Regulations:

West Bull Securities is regulated by the Securities and Futures Commission (SFC) of Hong Kong under license number BHT553. The SFC, established in 1989, is an independent statutory body responsible for overseeing and regulating Hong Kong's securities and futures markets.

Funds Safety:

West Bulls is being regulated by the SFC generally implies stringent requirements on capital adequacy and the segregation of client funds. These regulations are designed to protect client assets and ensure that the firm can meet its financial obligations to clients under all circumstances.

Safety Measures:

Typical practices under SFC regulation include the use of robust encryption methods to secure online transactions and data storage. Additionally, regulated entities are expected to have risk management procedures and cybersecurity measures in place to prevent unauthorized access and data breaches, safeguarding client information and financial assets.

What are securities to trade with West Bull Securities?

With the additional information, here is the expanded overview of the securities and services offered by West Bull securities:

Hong Kong Securities Trading: Clients can engage in the buying and selling of stocks listed on the Hong Kong Stock Exchange (HKEx), which includes a wide array of Hong Kong-based companies.

Initial Public Offerings (IPO) Subscription: Investors have the opportunity to subscribe to newly issued shares during the IPO process on the HKEx, gaining early access to new public offerings.

Placement: This involves the direct sale of securities from an issuer to selected investors, facilitated by the brokerage, often targeting pre-selected, qualified clients.

Discretionary Managed Accounts: Under asset management services, West Bull offers tailored portfolio management where the Asset Management Team customizes investment portfolios based on individual client objectives, risk tolerance, and expected returns.

Fund Management: The firm provides fund management services, including discretionary portfolio management, leveraging their licensed expertise to handle various investment funds.

Wealth Management and Immigration Planning Services: Beyond traditional asset management, West Bull provides specialized services for wealth accumulation and inheritance. This includes immigration services tailored around investment requirements that align with specific programs such as Hong Kongs investment immigration program.ng.

Services

West Bull Securities offers a range of services designed to attract the investment needs of various clients, from high-net-worth individuals to corporate entities. Here's a breakdown of the key services they provide:

Asset Management Services: West Bull offers bespoke portfolio management services, tailored specifically to the financial goals and risk tolerances of high-net-worth individuals and corporate clients. These services are designed to maximize returns while managing risk effectively.

Securities Brokerage Service: Clients have access to a professional sales team and an easy-to-use trading platform available on both desktop and mobile devices (Android & iOS). This service allows for secure and efficient trading on the Hong Kong stock market, ensuring clients can execute transactions swiftly and safely.

Investment Advisory Service: West Bull provides a suite of market information and research reports. This service is aimed at helping clients identify and capitalize on investment opportunities by staying well-informed about market trends and potential investment avenues.

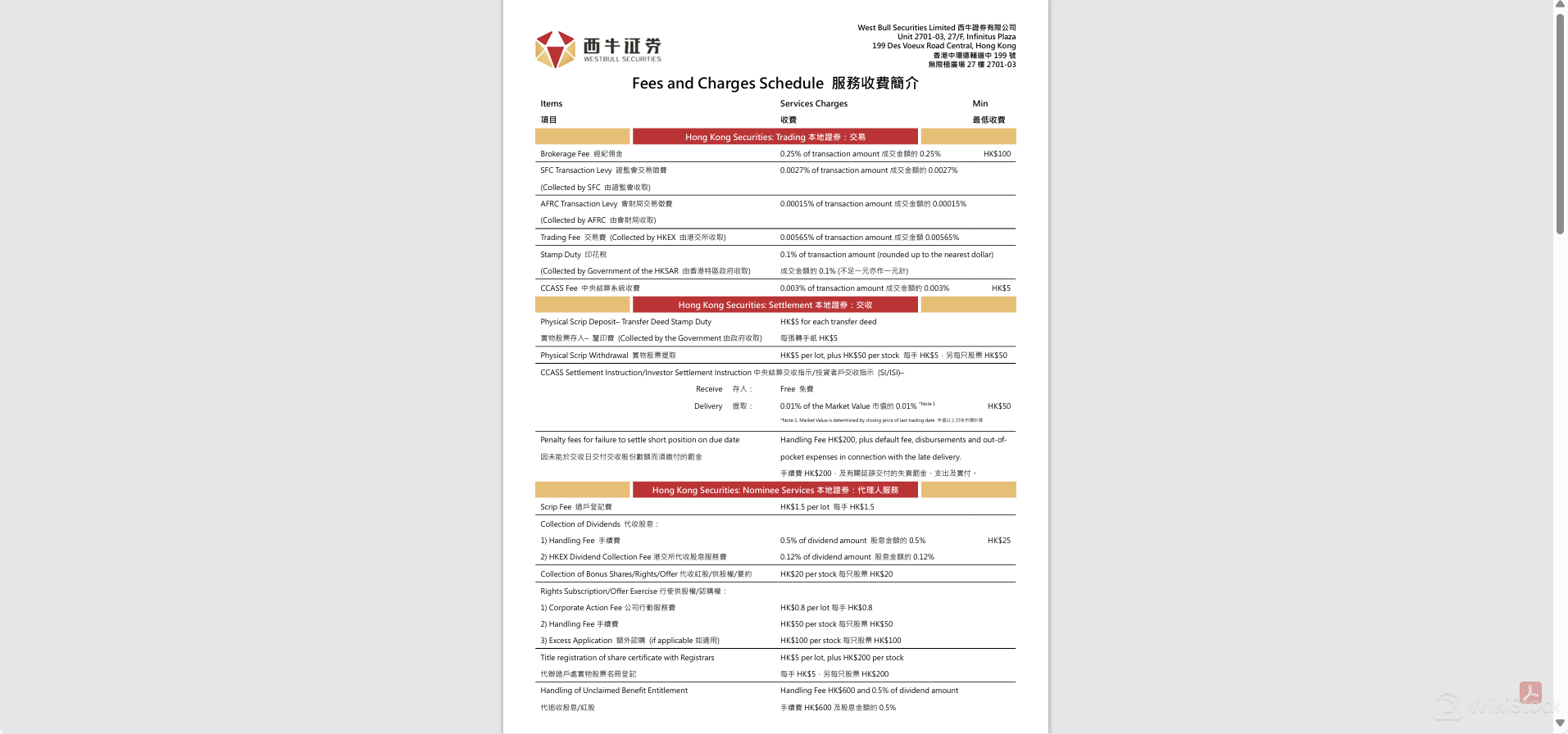

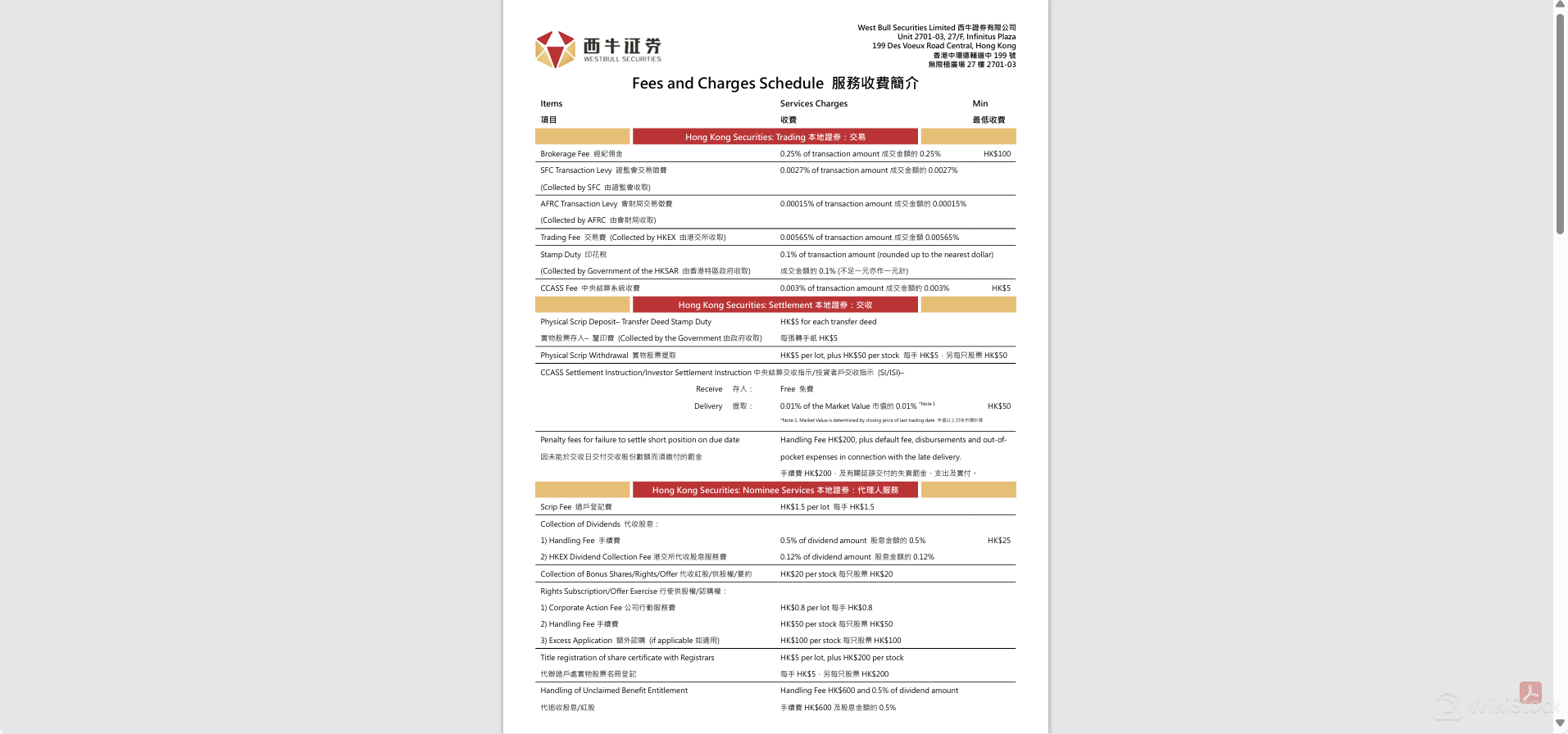

West Bull Securities Fees Review

West Bull Securities Limited charges a variety of fees for securities trading and settlement, including a brokerage fee of 0.25% with a minimum charge, alongside specific levies and fees collected by regulatory and exchange bodies, and offers additional nominee and remittance services with associated costs.

Hong Kong Securities Trading:

For trading Hong Kong securities, West Bull Securities charges a brokerage fee of 0.25% per transaction with a minimum of HK$100. Additional fees include the SFC Transaction Levy at 0.0027%, AFRC Transaction Levy at 0.00015%, Trading Fee of 0.00565% collected by HKEX, and Stamp Duty of 0.1% collected by the HKSAR Government. There's also a CCASS Fee of 0.003% per transaction, with a minimum fee of HK$5.

Hong Kong Securities Settlement:

The settlement of Hong Kong securities involves fees such as HK$5 per transfer deed for physical scrip deposits and HK$5 per lot plus HK$50 per stock for physical scrip withdrawals. CCASS Settlement Instructions for delivery incur a 0.01% fee of the market value with a minimum of HK$50. Penalty fees for failure to settle a short position include a handling fee of HK$200 plus additional default and late delivery fees.

Nominee Services for Hong Kong Securities:

Nominee services fees include a Scrip Fee of HK$1.5 per lot and dividend collection fees comprising a 0.5% handling fee plus a 0.12% HKEX dividend collection fee, with a minimum of HK$25. Collection fees for bonus shares, rights, or offers are HK$20 per stock. Rights subscription or offer exercise fees include a corporate action fee of HK$0.8 per lot and a handling fee of HK$50 per stock, with an excess application fee of HK$100 per stock.

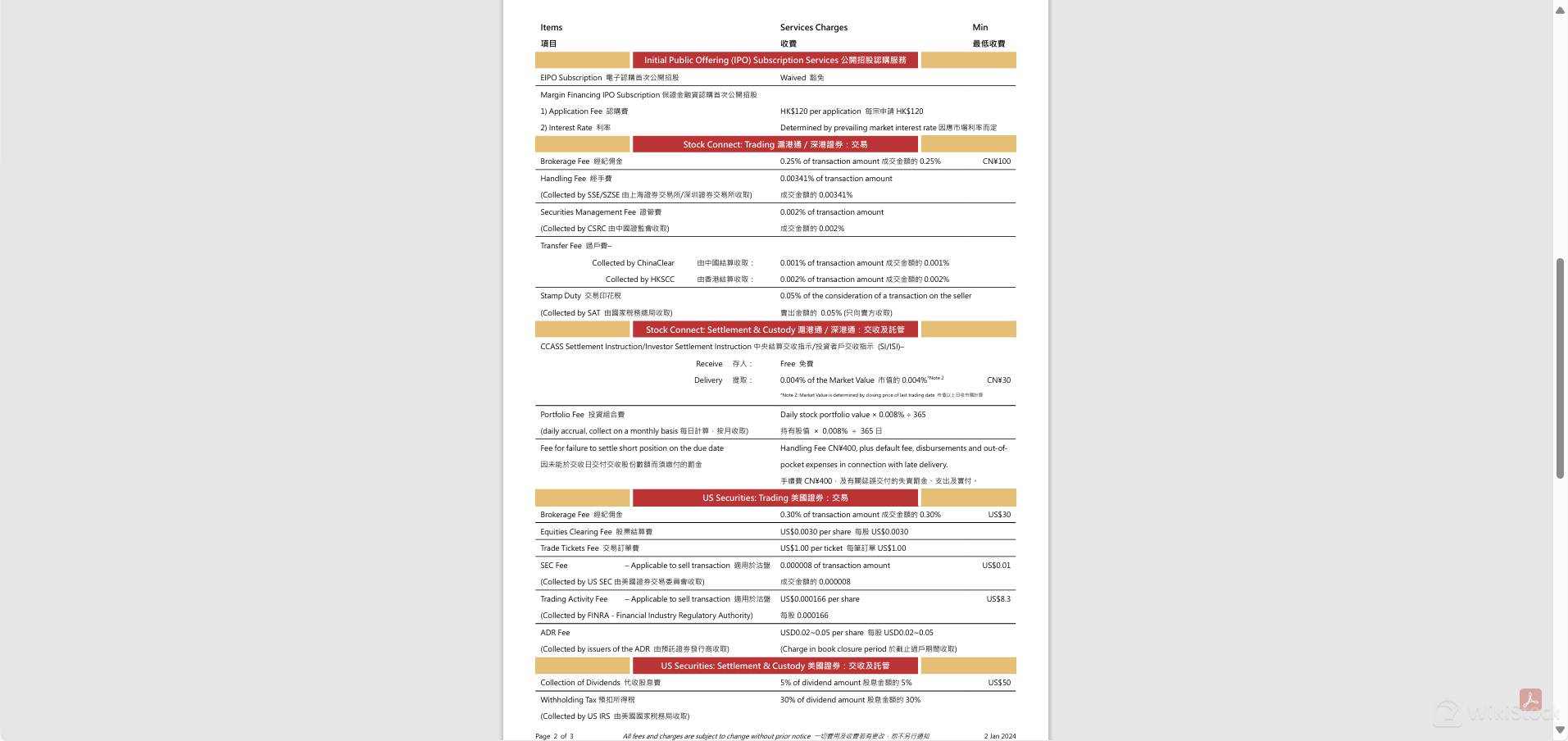

IPO Subscription Services:

IPO subscription services include an electronic IPO subscription fee which is waived, while margin financing for IPOs has an application fee of HK$120, and the interest rate is determined by prevailing market rates.

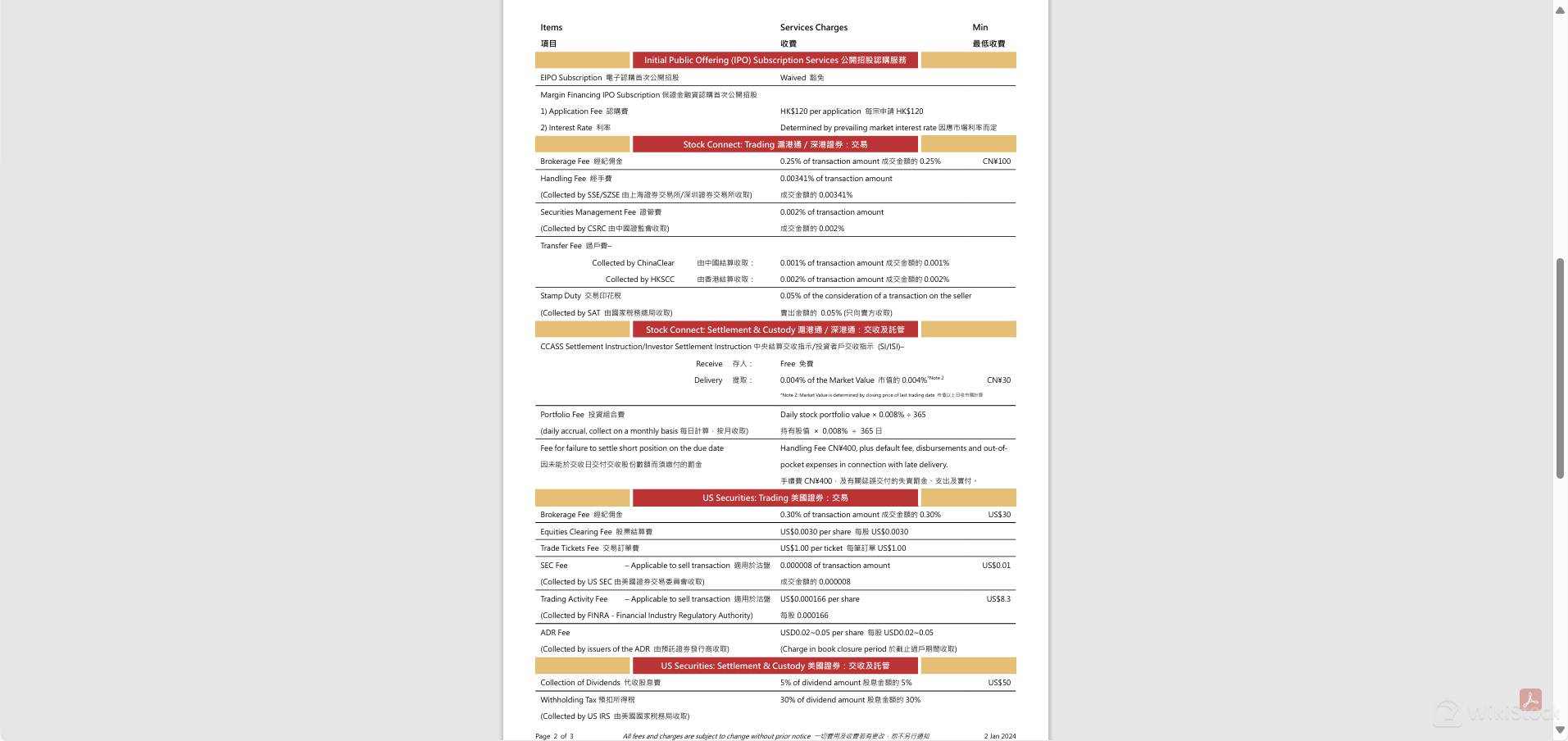

Stock Connect Trading and Settlement:

For Stock Connect trading, brokerage fees are 0.25% of the transaction amount with a minimum of CN¥100. Additional fees include a handling fee of 0.00341%, securities management fee of 0.002%, and transfer fees of 0.001% collected by ChinaClear and 0.002% by HKSCC. Stamp duty is 0.05% on the sellers side. Settlement includes a fee of 0.004% of the market value for deliveries, with a minimum of CN¥30.

US Securities Trading and Settlement:

US securities trading includes a brokerage fee of 0.30% per transaction with a minimum of US$30, an equities clearing fee of US$0.0030 per share, and a trade tickets fee of US$1.00 per ticket. The SEC Fee applicable to sell transactions is 0.000008 of the transaction amount, and the Trading Activity Fee is US$0.000166 per share with a maximum of US$8.3. ADR fees range from US$0.02 to US$0.05 per share.

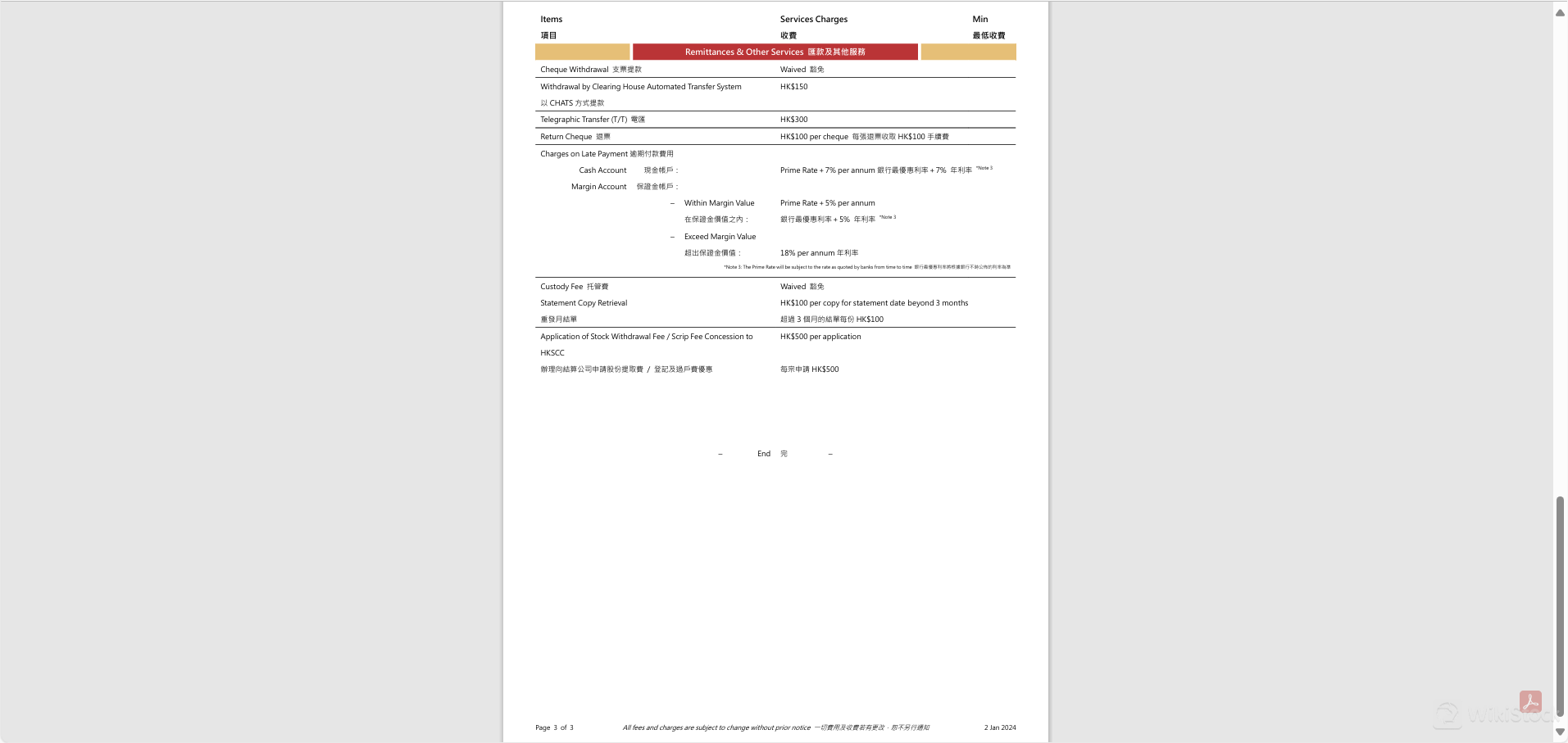

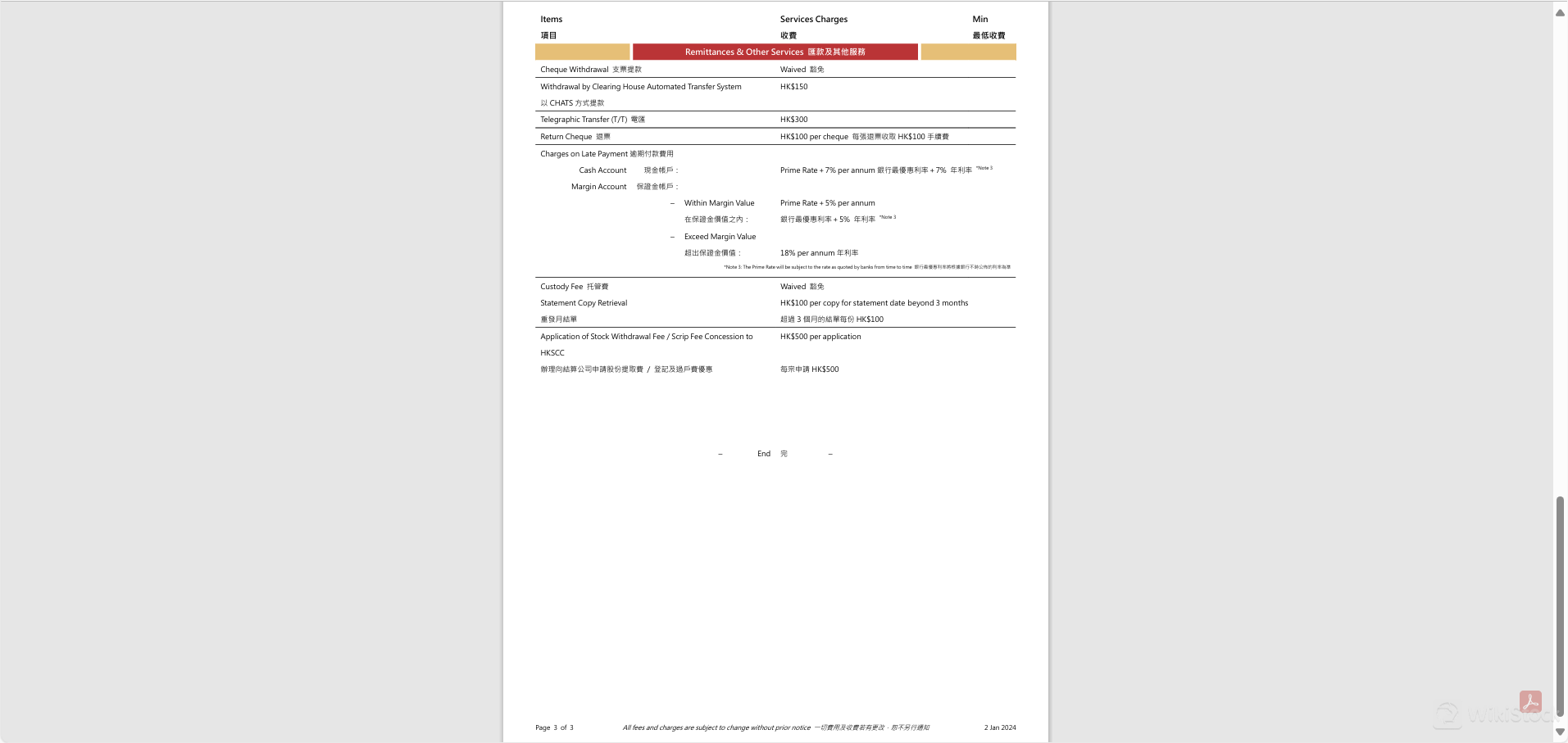

Remittances and Other Services:

Services include cheque withdrawal (waived), withdrawal by CHATS at HK$150, and telegraphic transfer at HK$300. A return cheque fee is HK$100 per cheque. Late payment charges on cash accounts are the prime rate plus 7% per annum, and for margin accounts, it's the prime rate plus 5% or 18% per annum if exceeding the margin value.

West Bull Securities Trading Platform Review

West Bull Securities offers a sophisticated mobile trading platform that is accessible through various methods tailored to meet the needs of modern investors. Key features of this trading platform include:

Mobile Trading Apps: Available for download from the Apple App Store, Google Play Store, and directly as an Android APK, facilitating easy access across different mobile operating systems.

Advanced Features: The platform provides advanced Hong Kong Stock LV2 real-time quotes, which offer detailed market data crucial for making informed trading decisions.

IPO Subscriptions: Users can conveniently subscribe to new Hong Kong stocks with a one-click feature, simplifying the process of participating in initial public offerings.

Quick Account Opening: The platform allows for rapid account opening within three minutes, with no capital threshold required, making it highly accessible to a wide range of investors.

Safe and Reliable: The app adheres to the rigorous regulatory standards set by the Hong Kong Securities and Futures Commission (SFC) and holds licenses for Type 1 (Dealing in Securities), Type 4 (Advising on Securities), and Type 9 (Asset Management) regulated activities, ensuring a secure trading environment.

Research & Education

West Bull Securities offers a robust education and research framework to support its clients investment decisions. This includes:

Research Reports: West Bull Securities provides detailed research reports authored by analysts like Brian Ngo, covering various companies and industries. Recent reports have analyzed sectors such as medical imaging with Jiangxi Rimag Group and technology assessments for new market entrants like Pentamaster. These reports are designed to offer insights and forecasts to aid investors in making informed decisions.

Investment Advisory Service: The firm offers a range of market information and timely research reports to help clients seize investment opportunities. This service is tailored to provide strategic advice based on current market trends and detailed analyses.

Educational Resources: While specific educational programs or materials are not explicitly mentioned, the investment advisory service likely includes educational aspects to help clients understand market dynamics and investment strategies.

Customer Service

West Bull Securities offers dedicated customer support to assist clients with their inquiries and provide service-related assistance.

Clients can reach the support team through multiple contact methods, including two phone numbers: (852) 3896 2968 and (852) 3896 2900, ensuring accessible communication.

Additionally, for email inquiries or support, clients can contact the customer service team at cs@westbullsec.com.hk.

Conclusion

West Bull Securities is a financial services provider licensed by the Hong Kong Securities and Futures Commission, offering specialized services in asset management, securities brokerage, and investment advisory.

With a focus on high-net-worth individuals and corporate clients, West Bull provides tailored investment solutions backed by professional research and a secure, user-friendly trading platform.

The firm ensures robust client support through dedicated communication channels, enhancing client engagement and satisfaction.

FAQs

China Taiwan

China TaiwanObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--