Score

昊天國際金融

http://haotianfin.com/tc/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China Hong Kong

China Hong Kong Products

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 2 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Fund Management License

Brokerage Information

More

Company Name

昊天國際金融控股有限公司

Abbreviation

昊天國際金融

Platform registered country and region

Company address

Company website

http://haotianfin.com/tc/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

昊天國際金融 Earnings Calendar

Currency: HKD

Cycle

H1 FY2024 Earnings

2019/06/10

Revenue(YoY)

86.00M

-30.08%

EPS(YoY)

-0.01

-194.12%

昊天國際金融 Earnings Estimates

Currency: HKD

- DateCycleRevenue/Estimated

- 2019/06/102019/FY176.518M/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.25%

Funding Rate

4%

New Stock Trading

Yes

Margin Trading

YES

| Hao Tian Financial |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | N/A |

| Trading Fees | 0.25% commission fee per transaction |

| Account Related Fees | Not required |

| Interests on Uninvested Cash | No |

| Margin Interest Rates | Prime Rate + 4% per annum |

| Mutual Funds Offered | Yes |

| App/Platform | Speed Station+ |

| Promotion | No |

Hao Tian Financial Information

Hao Tian Financial, based in Hong Kong, offers a range of services including securities trading and asset management. Their tradable securities include stocks, bonds, mutual funds, and ETFs.

Commission fees are disclosed, with a general rate of 0.25% per transaction. Established in an undisclosed year, they provide customer support and a mobile trading app. Regulated by the Securities and Futures Commission (SFC), they prioritize security measures to safeguard client assets and transactions.

Pros and Cons

Hao Tian Financial boasts regulation by the Securities and Futures Commission (SFC), a vital reassurance of its adherence to regulatory standards, which fosters trust and confidence among investors. Additionally, the platform prioritizes robust security measures, ensuring the safety of client information and transactions. The availability of customer support adds further value, offering assistance and guidance to users when needed. Moreover, Hao Tian Financial provides a mobile trading app, enhancing accessibility and convenience for investors who prefer trading on-the-go.

Despite its regulatory oversight, Hao Tian Financial suffers from a limited range of tradable securities, potentially restricting investment options for clients seeking diversification. The absence of educational resources further hampers user experience, as investors lack essential information for informed decision-making. Additionally, while the platform offers customer support, its commission fee, 0.25%, is not as competitive as those of other brokerage firms, potentially deterring cost-conscious investors from utilizing its services.

| Pros | Cons |

| Regulated by SFC | Limited range of tradable securities |

| Strong security measures | No educational resources provided |

| Customer support availability | Commissions not so competitive (0.25%) |

| Mobile trading app provided |

Is Hao Tian Financial Safe?

- Regulations:

- Funds Safety:

- Safety Measures:

- Commissions and Fees

- Commission Charges: A general commission fee of 0.25% of the transaction amount is levied, with a minimum charge of HK$100 per transaction.

- Transaction Fees and Other Transaction Levy: Various fees include Stamp Duty (0.1% of transaction amount), SFC Transaction Levy (0.0027% of transaction amount), HKEX Trading Fee (0.00565% of transaction amount), FRC Transaction Levy (0.00015% of transaction amount), and CCASS Fee (0.002% of transaction amount), with minimum charges ranging from HK$2 to HK$100 per transaction.

- Physical Scrip Deposit/Transfer Deed Fee:HK$5 per transfer deed.

- Withdrawal of Physical Scrip: HK$5 per board lot with an additional HK$50 per each stock withdrawal.

- Settlement Instruction (S.I.): Free for deposit and 0.05% of previous market value of each stock transfer out, with a minimum charge of HK$50 per transaction.

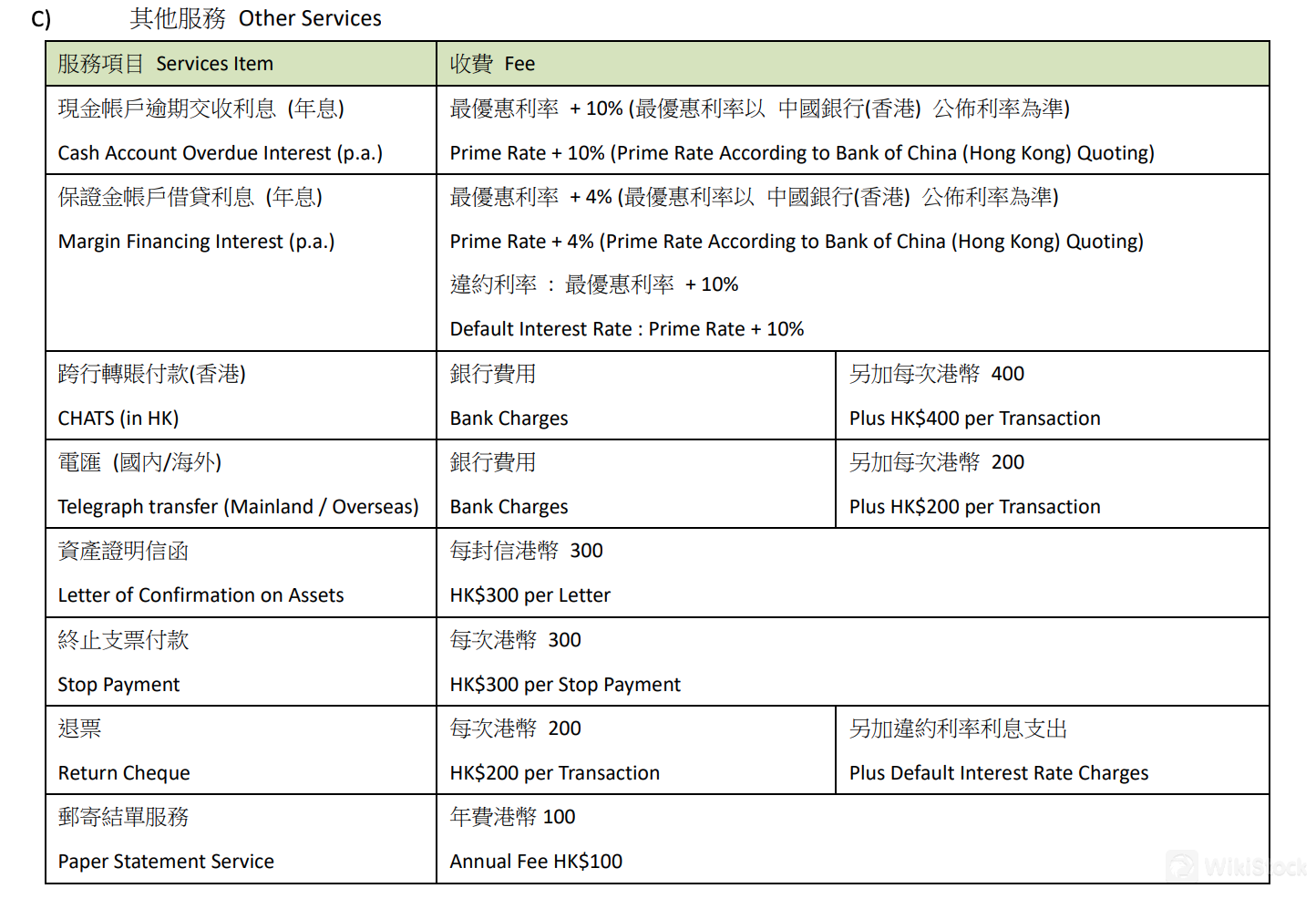

- Cash Account Overdue Interest (p.a.):Prime Rate + 10%.

- Margin Financing Interest (p.a.):Prime Rate + 4%.

- Bank Charges: HK$400 per transaction for CHATS, HK$200 per transaction for telegraph transfer (Mainland/Overseas), and various fees ranging from HK$200 to HK$300 per transaction for services like stop payment and return cheque.

- Margin Interest Rate

- Is it safe to trade on Hao Tian Financial?

- Is Hao Tian Financial a good platform for beginners?

- Is Hao Tian Financial legit?

- Is Hao Tian Financial good for investing/retirement?

Hao Tian Financial holds two securities licenses issued by the Securities and Futures Commission (SFC).

These licenses affirm its status as a regulated entity in the financial sector. The first license, the Securities Trading License, bears the identifier ABQ901, while the second license, the Fund Management License, is identified as BHP076.

These licenses underscore Hao Tian Financial's compliance with regulatory standards and authorize its operations in securities trading and fund management within the purview of SFC oversight.

Hao Tian Financial does not provide information regarding insurance coverage for customer account balances.

Hao Tian Financial implements various security measures to safeguard client information and transactions. These include encryption protocols to protect sensitive data during transmission, multi-factor authentication for account access, regular security audits, and compliance with industry standards such as GDPR and PCI DSS. Additionally, they employ intrusion detection systems and firewalls to prevent unauthorized access to their systems.

What are Securities to Trade with Hao Tian Financial?

Hao Tian Financial offers a selection of tradable securities to its clients, albeit with a limited range. These include Hongkong stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

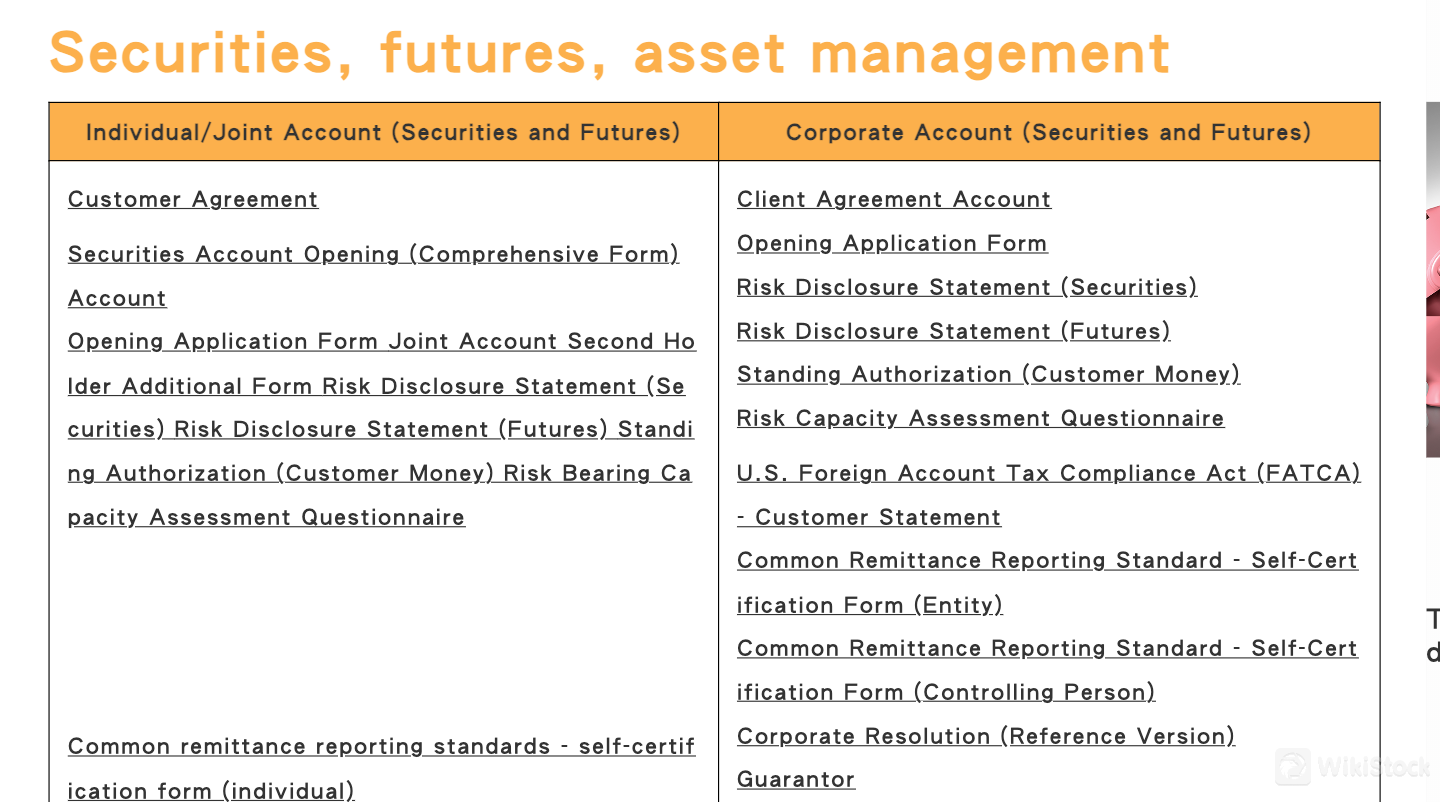

Hao Tian Financial Accounts

Hao Tian Financial offers a range of account types tailored to different user groups and financial needs.

For individuals or joint account holders interested in securities and futures trading, the Individual/Joint Account is suitable. This account type provides access to trading securities and futures products, catering to individual investors seeking to manage their portfolios. Similarly, the Corporate Account is designed for businesses or corporate entities engaged in securities and futures trading, offering features and services tailored to their organizational requirements.

On the asset management front, Hao Tian Financial provides both Individual/Joint Account and Company Account options. The Individual/Joint Account for asset management is ideal for individual investors or joint account holders looking to engage in professionally managed investment portfolios. It offers personalized asset management services tailored to individual financial goals and risk profiles. Conversely, the Company Account for asset management caters to corporate entities seeking professional asset management solutions for their financial assets.

Hao Tian Financial Fees Review

A) Securities Trading Charges:

B) Nominees Services and Corporate Actions Fees:

C) Other Services:

Comparing these fees with popular brokers, the commission charges of 0.25% for securities trading fall within the average range. However, some additional fees, such as the SFC Transaction Levy and HKEX Trading Fee, might slightly elevate the overall trading cost.

| Fee Type | Amount |

| General Commission Fee | 0.25% of Transaction Amount (Minimum HK$100 per Transaction) |

| Stamp Duty | 0.1% of Transaction Amount (Rounded Up to The Nearest Dollar) |

| SFC Transaction Levy | 0.0027% of Transaction Amount |

| HKEX Trading Fee | 0.00565% of Transaction Amount |

| FRC Transaction Levy | 0.00015% of Transaction Amount |

| CCASS Fee | 0.002% of Transaction Amount (Minimum HK$2, Maximum HK$100) |

| Physical Scrip Deposit/Transfer Deed Fee | HK$5 per Transfer Deed |

| Withdrawal of Physical Scrip | HK$5 per Board Lot, Plus HK$50 per Each Stock Withdrawal |

| Settlement Instruction | Free for Deposit, 0.05% of Previous Market Value of Each Stock Transfer Out (Minimum HK$50) |

| Collection of Dividend/Stock in Lieu of Cash | 0.50% of Dividend (Minimum HK$20) |

Hao Tian Financial's Margin Interest Rate is Prime Rate + 4% per annum. This rate is applied to margin financing, providing leverage for investors. It aligns with prevailing market rates, offering competitive terms for clients engaging in margin trading activities within their investment portfolios.

Hao Tian Financial App Review

The app offered by Hao Tian Financial, called Speed Station+, is a securities online trading system designed to facilitate streamlined trading experiences.

Its key features include a simple trading interface, enabling users to execute trades efficiently. To download the app, users can visit the respective app store relevant to their device platform, whether it's the Apple App Store for iOS devices or the Google Play Store for Android devices.

Research & Education

Hao Tian Financial's research report offers a robust blend of macroeconomic analysis and tailored solutions.

Its multi-faceted approach, encompassing macroeconomic, securities, foreign exchange, commodity, and credit market analyses, provides comprehensive insights for decision-making. By incorporating perspectives from accounting, regulations, and arithmetic models, they deliver nuanced advice tailored to individual needs.

Customer Service

Hao Tian Financial offers customer support through its hotline at (852) 2127 5788, operating during standard business hours.

For domestic inquiries within China, customers can reach them at (86) 152 1795 8665. You can also send a fax to them at (852) 2127 5799.

Conclusion

In conclusion, Hao Tian Financial offers advantages such as regulated operations, robust security measures, and a mobile trading app for convenient access. However, its limited range of tradable securities and comparatively higher commission fees pose challenges for investors seeking various investment options and cost-effective trading. Despite these drawbacks, the platform suits experienced investors who prioritize regulatory compliance and security in their trading activities.

FAQs

Yes, Hao Tian Financial implements robust security measures to safeguard client information and transactions, ensuring a safe trading environment.

Hao Tian Financial offers customer support and educational resources to assist beginners, making it a suitable platform for those new to trading.

Yes, Hao Tian Financial is regulated by the Securities and Futures Commission (SFC), affirming its legitimacy and adherence to regulatory standards.

Hao Tian Financial provides a range of investment options and services, making it suitable for long-term investing and retirement planning. However, individuals should conduct thorough research and consider their financial goals before investing.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

--

昊天國際建設投資集團有限公司

Parent company

--

昊天資產管理有限公司

Subsidiary

--

昊天國際財務有限公司

Subsidiary

--

昊天國際期貨有限公司

Subsidiary

--

昊天國際證券有限公司

Subsidiary

Review

No ratings

Recommended Brokerage FirmsMore

潮商金融控股有限公司

Score

MGHL

Score

Open Securities

Score

DA International

Score

Bluemount Financial

Score

盛源

Score

HKIFS

Score

Yunfeng Financial Group

Score

Forwin Holding Limited

Score

中國公平集團

Score