DA International (DA International Financial Service Ltd.), found in 2011 in HKSAR, is a Licensed Corporation which provides integrated financial services with proprietary technology. We are devoted to provide investment solutions from services to trading platform for our clients.

What is DA International?

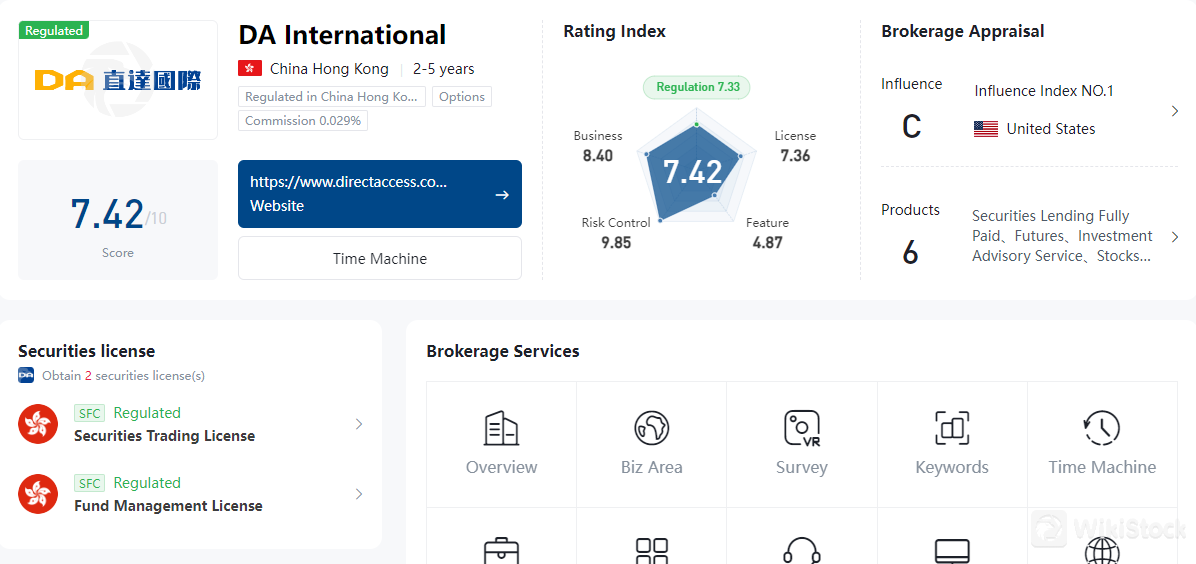

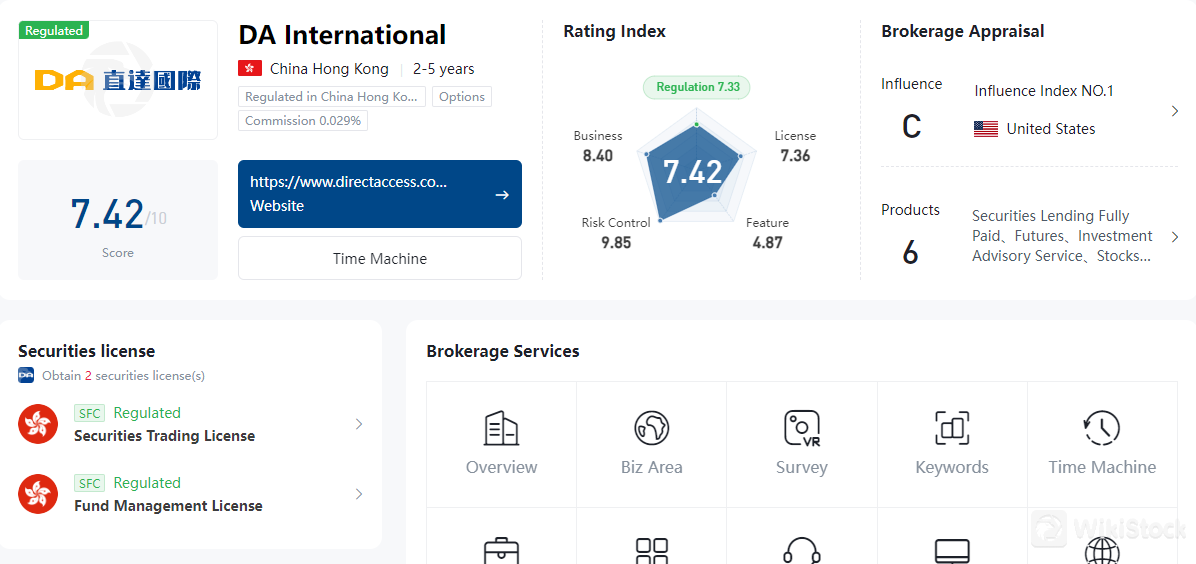

DA International is a Hong Kong-based trading platform regulated by the SFC, offering a wide range of financial products including futures, Hong Kong stocks, U.S. stocks, and more. The platform features competitive fees, advanced trading tools, and a user-friendly app with real-time data. However, its educational and research materials are primarily available in Chinese, which may limit accessibility for non-Chinese speaking users.

Pros and Cons of DA International

DA International offers a robust and versatile trading platform with numerous advantages, including comprehensive regulatory compliance, a wide range of trading products, competitive fees, and extensive customer support. However, it does have some limitations, such as resources primarily available in Chinese and potentially higher costs for certain trading activities. Below is a detailed table summarizing the pros and cons of DA International.

Is DA International safe?

DA International ensures the safety and security of its clients through stringent regulations, robust fund safety measures, and advanced security protocols.

Regulations

DA International is regulated by the Securities and Futures Commission (SFC) of Hong Kong. This regulation mandate that client funds and securities be segregated and stored in designated trust accounts and locations. This segregation ensures that client assets are protected and not used for any unauthorized purposes by the firm.

Funds Safety

In terms of fund safety, DA International follows the requirements set by the Hong Kong government and the SFC to provide comprehensive protection for investors. The Investor Compensation Fund established by the Hong Kong government compensates investors for financial losses resulting from misconduct by licensed entities, up to a limit of HKD 500,000 per person for securities and futures contracts traded on the Hong Kong Exchange. This compensation scheme is designed to protect investors from losses due to regulatory breaches by licensed firms.

Safety Measures

DA International employs advanced encryption technologies to safeguard client funds and ensure the secure storage of financial data. The company implements strict internal controls and risk management practices to prevent unauthorized access and data breaches. These measures include the separation of roles within business operations, transaction settlement, and security monitoring to maintain the integrity and safety of client assets. By adhering to these high standards of security and compliance, DA International ensures that client information and funds are well-protected, thereby fostering investor confidence and trust.

What are securities to trade with DA International?

DA International offers a broad array of trading products designed to meet the needs of various investors and traders, encompassing futures, stocks from multiple markets, and unique financial instruments. Here's a detailed overview of their offerings:

Futures

DA International provides an extensive selection of futures contracts, catering to traders with varying experience levels and trading volumes. The futures products include standard, mini, and micro mini contracts across multiple asset classes such as currencies, commodities, and indices. The commission structure for these futures is tiered, with reduced rates for higher trading volumes, encouraging more active trading. Additionally, they offer special futures products, including cryptocurrency futures like Bitcoin and Ether, which have fixed commission rates. This variety allows traders to diversify their portfolios and manage risk effectively.

Hong Kong Stocks

For those interested in the Hong Kong stock market, DA International offers comprehensive access to a wide range of stocks listed on the Hong Kong Stock Exchange (HKEX). Investors can trade blue-chip stocks, mid-caps, and emerging companies across various sectors, benefiting from one of Asia's most dynamic markets. The platform provides real-time market data, advanced trading tools, and in-depth research to support informed decision-making.

U.S. Stocks

DA International also caters to investors looking to trade U.S. equities, offering access to major stock exchanges like the NYSE and NASDAQ. Clients can trade a broad spectrum of stocks, including large-cap technology companies, financial institutions, and innovative startups. The platform supports trading during pre-market and post-market hours, providing flexibility for investors across different time zones. Additionally, advanced order types and robust analytical tools help traders execute their strategies efficiently.

A Shares

Through the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect programs, DA International provides access to China's A-share market. Investors can trade stocks listed on the Shanghai and Shenzhen Stock Exchanges, gaining exposure to one of the world's largest and fastest-growing economies. This access allows international investors to diversify their portfolios with Chinese equities, benefiting from the economic growth and market opportunities in China.

Korean Stocks

For those interested in the South Korean market, DA International offers access to stocks listed on the Korea Exchange (KRX). Clients can trade leading South Korean companies across various sectors, including technology, automotive, and consumer goods. The platform provides essential market insights and trading tools, helping investors capitalize on opportunities in one of Asia's key markets.

Singapore Stocks

DA International also provides trading access to the Singapore Exchange (SGX), allowing clients to invest in Singaporean stocks. This market offers a range of investment opportunities in sectors such as finance, real estate, and technology. The platform supports seamless trading, coupled with comprehensive market analysis and research, enabling investors to make informed decisions in the Singaporean market.

DA International's diverse range of trading products spans multiple asset classes and global markets, providing investors and traders with numerous opportunities to diversify their portfolios and implement various trading strategies. Whether trading futures, Hong Kong stocks, U.S. stocks, A-shares, Korean stocks, or Singaporean stocks, clients benefit from advanced trading platforms, real-time data, and in-depth research, ensuring a comprehensive trading experience.

DA International Fees Review

DA International provides a detailed and tiered fee structure for its diverse range of trading products, designed to accommodate various trading volumes and product types. Here's a comprehensive overview of their fee structure:

Futures Trading Fees

DA International offers a tiered commission structure for futures trading, excluding special products. The commission rates are based on the total monthly trading volume and are denominated in various currencies, including USD, HKD, EUR, GBP, AUD, JPY, TWD, CNH, SGD, and MYR. The standard contracts have four levels:

Level 1 (0-1000 contracts): For example, in USD, the commission is 0.90 per contract.

Level 2 (1001-5000 contracts): The commission reduces to 0.70 per contract.

Level 3 (5001-20,000 contracts): The commission further reduces to 0.50 per contract.

Level 4 (>20,000 contracts): The lowest commission rate is 0.30 per contract.

Mini and micro mini futures contracts have similar tiered structures with lower commission rates, making them suitable for traders with smaller trading volumes. For mini futures, the commission in USD ranges from 0.45 to 0.15 per contract, while for micro mini futures, it ranges from 0.23 to 0.08 per contract, depending on the trading volume.

Special Products Fees

Special products, such as cryptocurrency futures (e.g., Bitcoin, Ether), have fixed commission rates irrespective of the trading volume. For instance, Bitcoin futures on the CME have a fixed commission of 21.50 USD per contract. Other special products like micro Bitcoin and micro Ether futures also have fixed rates, ensuring transparency and simplicity in cost calculation.

Hong Kong Stocks

For Hong Kong stocks, DA International charges a commission of 0.029% of the transaction amount for online trading, with a minimum fee of HKD 10 per transaction. Additional charges include the SFC transaction levy (0.0027%), the Central Clearing and Settlement System (CCASS) fee (0.002%, with a minimum of HKD 2 and a maximum of HKD 100), the Hong Kong Stock Exchange trading fee (0.00565%), the Financial Secretarys Office trading levy (0.00015%), and a stamp duty of 0.1% of the transaction amount. Phone trading incurs a higher commission rate of 0.2%, with a minimum of HKD 100 per transaction.

U.S. Stocks

For U.S. stocks, DA International charges a commission of 0.0045 USD per share for online trading, with a minimum fee of 0.8 USD per transaction. There is an additional platform usage fee, which matches the commission rate. Phone trading incurs a higher commission of 0.045 USD per share, with a minimum fee of 8 USD per transaction. Other costs include settlement fees (0.003 USD per share) and FINRA transaction activity fees (0.000166 USD per share sold).

A Shares

Through the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, DA International provides access to China's A-shares with commissions of 0.029% for online trading (minimum 20 RMB per transaction) and 0.2% for phone trading (minimum 100 RMB per transaction). Additional fees include handling fees (0.00341% of the transaction amount), central clearing fees (0.002%), A-shares settlement fees (0.001%), and a stamp duty of 0.05% on the seller's transaction amount.

Korean Stocks

For South Korean stocks, the commission is set at 0.25% of the transaction amount, with an additional sales tax of 0.3% applied to sell transactions. This flat rate simplifies the fee structure for trading in the Korean market.

Singapore Stocks

DA International charges a commission of 0.18% of the transaction amount for Singapore stocks, with a minimum fee of 5 SGD for SGD-denominated products and 4 USD for USD-denominated products. Additional fees include the SGX trading fee (0.034775% of the transaction amount) and the SGX access fee (0.008025%).

DA International's fee structure is meticulously designed to cater to various trading volumes and product types. The tiered commission structure for futures incentivizes higher trading volumes by reducing fees as the volume increases, while fixed fees for special products ensure transparency. The comprehensive fee details for stocks across different markets provide clarity and allow traders to understand the cost implications of their trades. This approach ensures that both high-volume traders and those trading smaller quantities can benefit from competitive and transparent pricing.

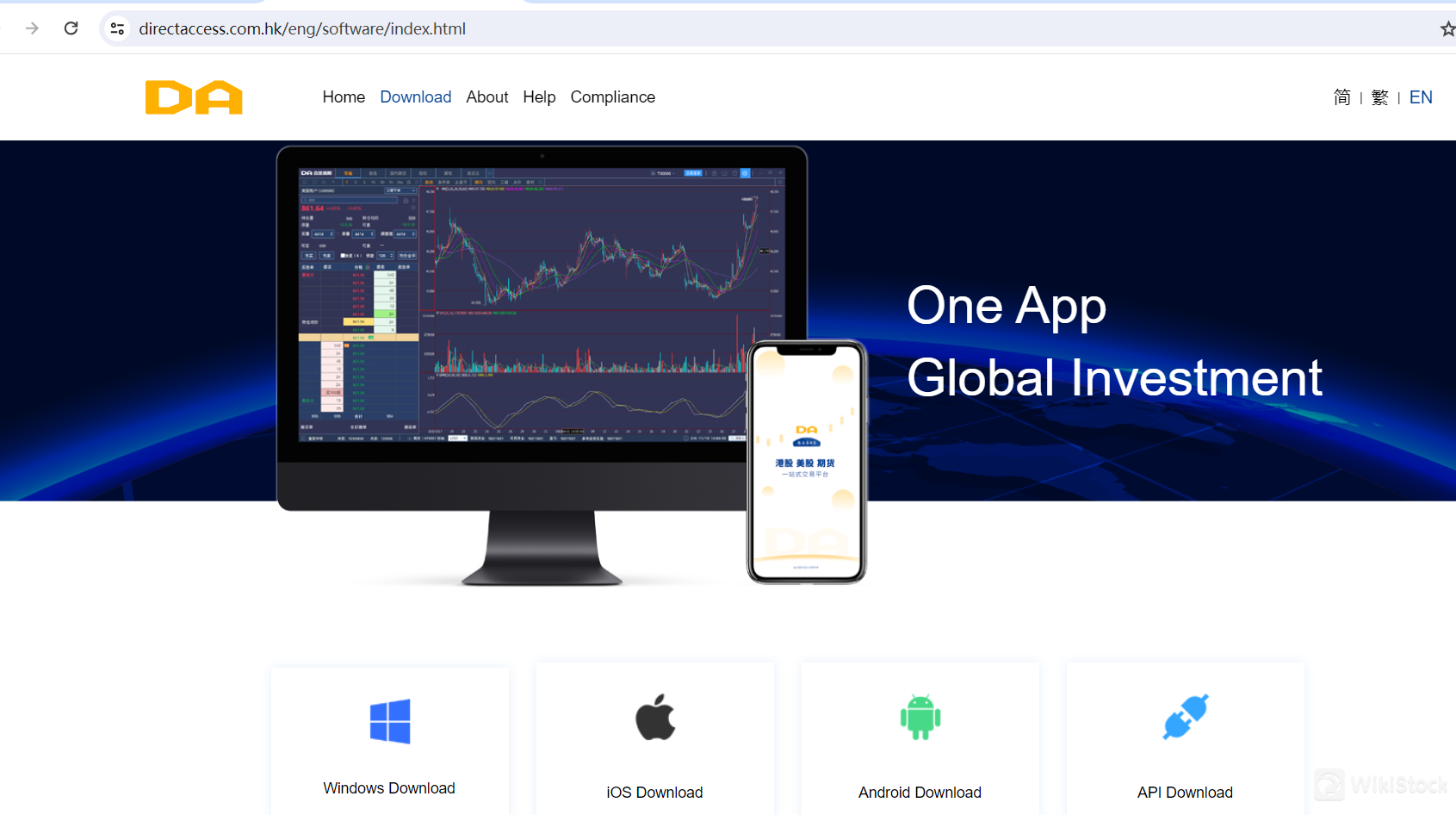

DA International App Review

DA International's trading platform, “Zhida International,” is designed for trading Hong Kong stocks, U.S. stocks, and futures. It supports Simplified Chinese, Traditional Chinese, and English, and is available on iOS, Android, Windows, and through API interfaces.

The platform offers free real-time Level 2 market data for major exchanges like CME, EUREX, HKEX, and SGX. It includes professional charting and analysis tools, and executes orders very quickly, often within forty milliseconds.

Traders can use one account to trade in over twenty markets and more than four hundred futures products. The platform supports automatic currency conversion, making it easy to manage funds and investments in one place. It is accessible on both mobile devices and desktops.

New futures customers can enjoy promotions like six months of free market data, commission-free vouchers up to two thousand five hundred Hong Kong dollars, and cash rewards up to six thousand Hong Kong dollars. The platform also includes features like cloud-based stop-loss and conditional orders, innovative order modes, and offline automated trading systems.

Customer service is available twenty-four by seven, and data security is a priority. Qualified users can get free API access for real-time quotes and trading interfaces. DA Internationals platform is advanced yet easy to use, providing a seamless trading experience across multiple markets.

Research and Eduation

DA International's education and research section, accessible at DA International School, provides a variety of resources aimed at enhancing trading knowledge and skills. The section includes:

Articles: In-depth written content covering various aspects of trading, market analysis, and investment strategies.

Videos: Educational videos that offer visual and auditory learning experiences on topics like market trends, trading techniques, and platform tutorials.

Research Reports: Detailed reports that provide insights into market conditions, financial instruments, and economic factors influencing trading decisions.

These resources are primarily available in Chinese, which may limit accessibility for non-Chinese speaking users. The materials are designed to support both novice and experienced traders in making informed decisions and improving their trading strategies.

Customer Service

DA International provides extensive customer support to ensure a seamless trading experience for its clients. They offer multiple communication channels, including a hotline available at 00852-3919 9110 and 400-119-8833, and an email contact at cs@directaccess.com.hk. Clients can also reach out through QQ at 400-639-1818 for real-time support and through WeChat using the handle DA-International.

For in-person consultations, clients can visit their office located at Room 3211-18, 32nd Floor, Shui On Centre, 6-8 Harbour Road, Wan Chai, Hong Kong. The company also provides a fax service at 00852-3919 9111.

For complaints, DA International offers several channels to ensure issues are addressed promptly. Customers can contact the official customer service via QQ at 400-639-1818, call the customer service hotline at 00852-39199110, send an email to compliance@directaccess.com.hk, or mail a written complaint to their office address in Wan Chai, Hong Kong. When filing a complaint, customers are requested to provide their account number and a detailed description of the issue to facilitate investigation and resolution.

DA International aims to respond to general complaints within three business days. If the response is unsatisfactory, clients can further escalate their complaints through the provided channels or seek assistance from the Financial Dispute Resolution Centre in Hong Kong.

Conclusion

DA International is a highly-rated trading platform offering a wide range of financial products with competitive fees and no account minimums. It provides advanced trading tools and a user-friendly app available on iOS, Android, Windows, and API. The platform also features attractive promotions for new futures customers. However, details on interest for uninvested cash and specific mutual fund offerings are not specified, and educational materials are primarily in Chinese.

FAQs

Is DA International safe to trade? Yes, DA International is safe to trade. It is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring that client funds and securities are segregated and stored securely in designated trust accounts. The platform also employs advanced encryption technologies and strict internal controls to protect client assets and information.

Is DA International a good platform for beginners? Yes, DA International is suitable for beginners. It offers a user-friendly trading app with advanced tools and real-time market data. The platform also provides extensive customer support and promotional benefits for new futures customers, making it accessible and beneficial for novice traders.

Is DA International good for investing/retirement? Yes, DA International is a strong option for investing and retirement due to its wide range of financial products, competitive fees, and regulatory compliance by the SFC. The platform offers advanced trading tools and robust customer support, although its educational materials are primarily in Chinese, which may limit accessibility for non-Chinese speakers. Overall, it is suitable for investors comfortable with its language offerings and seeking a diverse, secure trading platform.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)