Bluemount Financial Group Limited (hereinafter referred to as “Bluemount Financial”) is a comprehensive financial group integrating securities brokerage and asset management. The Group is well funded, familiar with the operation of markets and has rigorous internal control systems. The Group continues to innovate and provide financial products, services and solutions to meet customers’ needs.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

What is Bluemount Financial?

Bluemount Financial is a regulated financial services provider under the supervision of the Securities and Futures Commission of Hong Kong (SFC). It offers a diverse range of securities for trading, including Hong Kong shares, securities trading, IPOs, fund products, private equity fund management, and investment advisory services. They also provide IPO financing services, discretionary account services, and comprehensive customer support through various channels with a transparent fee structure and innovative Bluemount Financial App.

Pros & Cons

Pros

Regulated by SFC: Bluemount Financial operates under the oversight of the Securities and Futures Commission of Hong Kong, ensuring compliance with regulations for investor protection and market integrity.

Diverse Range of Securities: Bluemount Financial offers a comprehensive suite of financial services, including trading in Hong Kong shares, securities, IPOs, fund products, and private equity fund management, catering to a wide range of investment needs.

Transparent Fee Structure: Bluemount Financial provides a transparent fee structure, enabling clients to understand and anticipate the costs associated with their transactions and services.

Innovative Bluemount Financial App: The Bluemount Financial App offers a user-friendly platform with intuitive features for managing finances, tracking expenses, setting budgets, and monitoring investments in real-time.

Extensive Research and Education: Bluemount Financial offers a wealth of research reports and knowledge resources, aiding clients in making informed investment decisions and navigating the financial markets effectively.

Comprehensive Customer Support: Bluemount Financial provides accessible customer support through various channels, including a customer hotline, email, and physical address, ensuring prompt assistance and guidance for clients.

Cons

Limited Account Information: Some essential account information such as account minimums, fees, interests on uninvested cash, and mutual funds offered are not explicitly mentioned, leading to uncertainty for clients.

Lack of Promotions: Bluemount Financial does not offer promotions, which may be a downside for clients seeking incentives or special offers for their financial activities.

Is Bluemount Financial Safe?

Bluemount Financial is a regulated financial services provider operating under the stringent oversight of the Securities and Futures Commission of Hong Kong (SFC), holding license No. BHR496 and No. BHR495. This regulatory framework underscores Bluemount Financial's commitment to upholding the highest standards of integrity, transparency, and investor protection. By adhering to the regulations set forth by the SFC, Bluemount Financial ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with Bluemount Financial?

Bluemount Financial offers a comprehensive suite of financial services, catering to a wide range of investment needs:

Hong Kong Shares: They provide access to trading and investing in Hong Kong-listed companies.

Securities Trading: This encompasses trading various securities like stocks, bonds, and other financial instruments.

Hong Kong Shares IPO: They assist clients in participating in initial public offerings (IPOs) of Hong Kong companies.

Fund Products: Bluemount offers a selection of investment funds, including mutual funds, ETFs, and other types.

Private Equity Fund Management and Investment Advisory Services: This service caters to clients seeking to invest in private equity funds and receive expert investment advice.

IPO Financing Services (Margin Financing): They offer margin financing to support clients' participation in IPOs.

Discretionary Account Services: This service allows clients to delegate investment decisions to a professional money manager.

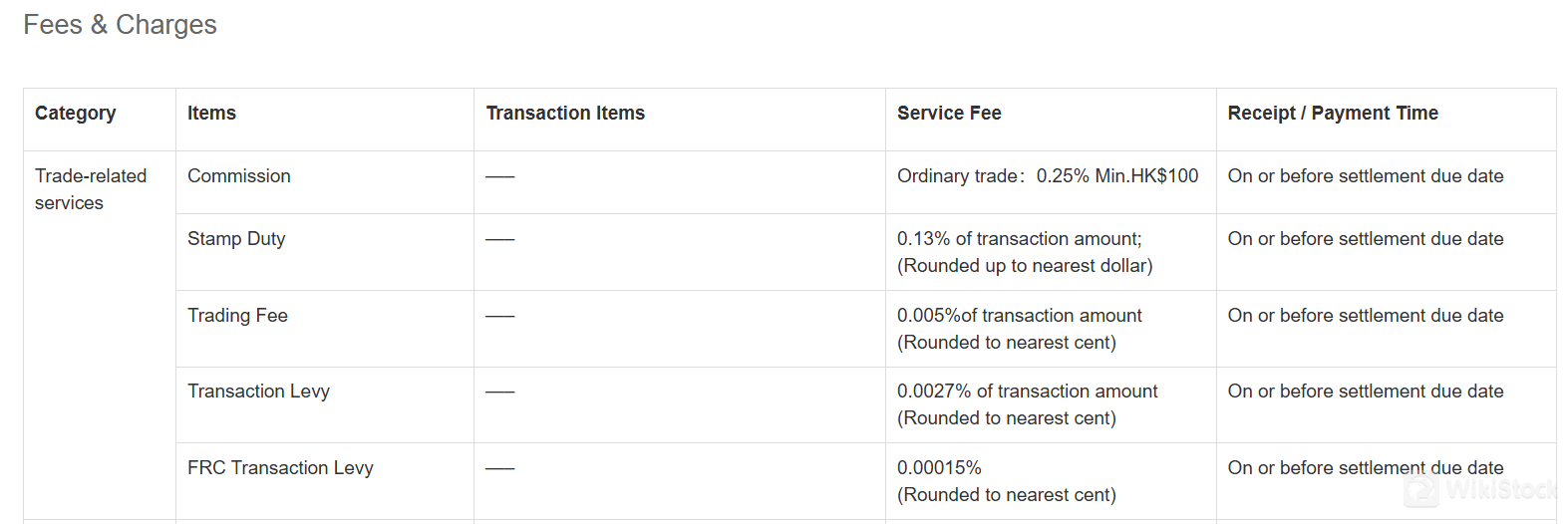

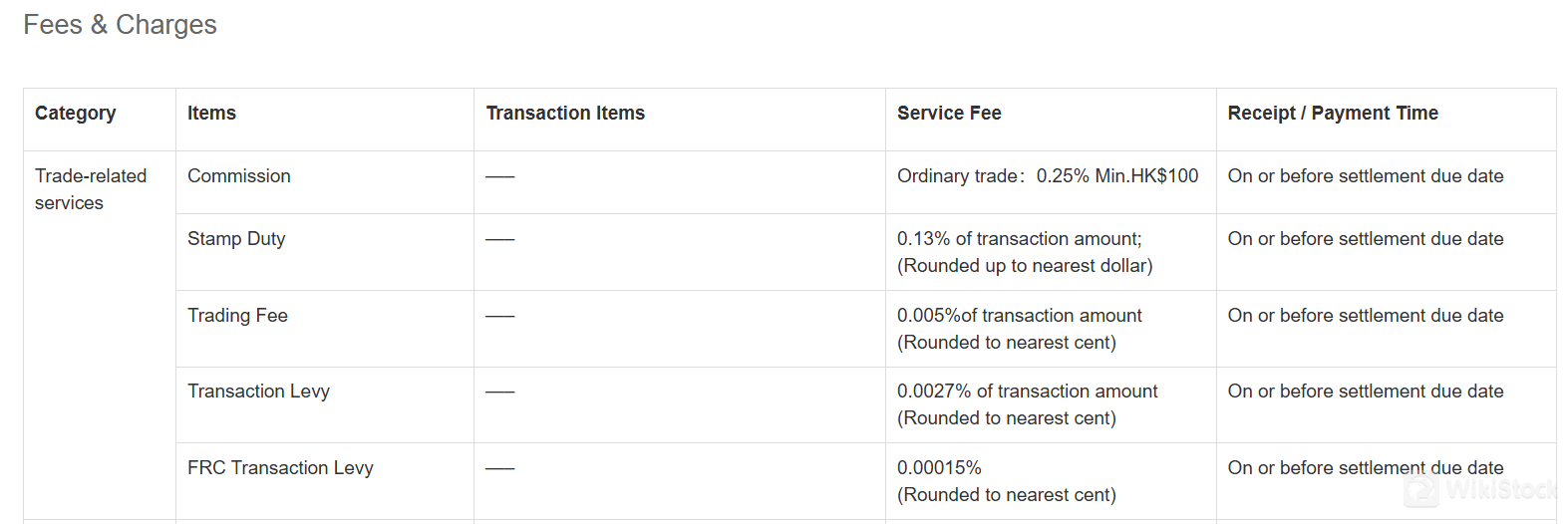

Bluemount Financial Fees Review

Bluemount Financial offers a transparent fee structure for its various services, ensuring clarity and predictability for its clients.

Commission:

Service Fee: Ordinary trade: 0.25% of transaction amount, minimum HK$100.

Receipt/Payment Time: On or before settlement due date.

Stamp Duty:

Trading Fee:

Transaction Levy:

FRC Transaction Levy:

The above charges are subject to revision from time to time without prior notice. For inquiries, please contact the Customer Services Hotline.

For additional information and further insights into Bluemount Financial's fees and charges, interested individuals are encouraged to visit their website.

Bluemount Financial App Review

Bluemount Financial App is a user-friendly and innovative platform designed to streamline financial management and empower users to take control of their finances with ease. With intuitive features and a sleek interface, Bluemount offers a comprehensive suite of tools to help users track expenses, set budgets, and monitor investments in real-time. Additionally, the app offers advanced security features to ensure the safety of users' financial data, providing peace of mind in an increasingly digital world.

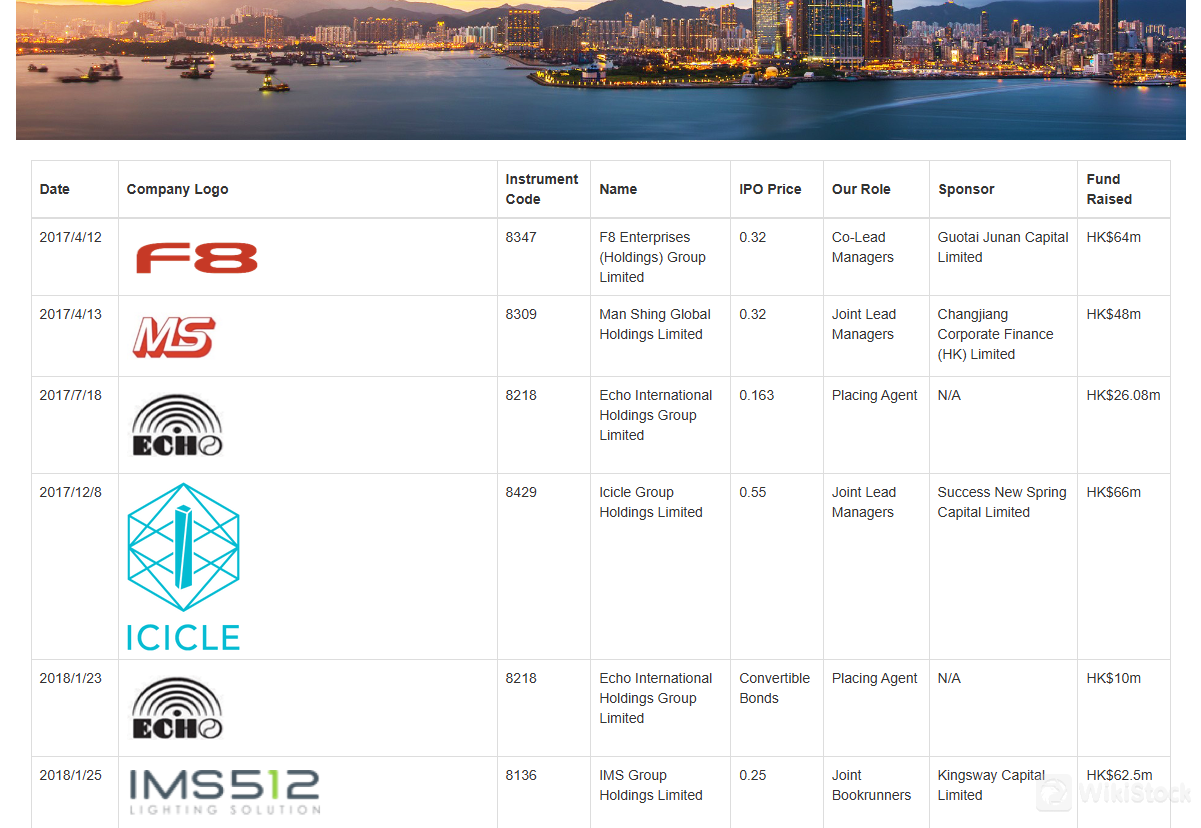

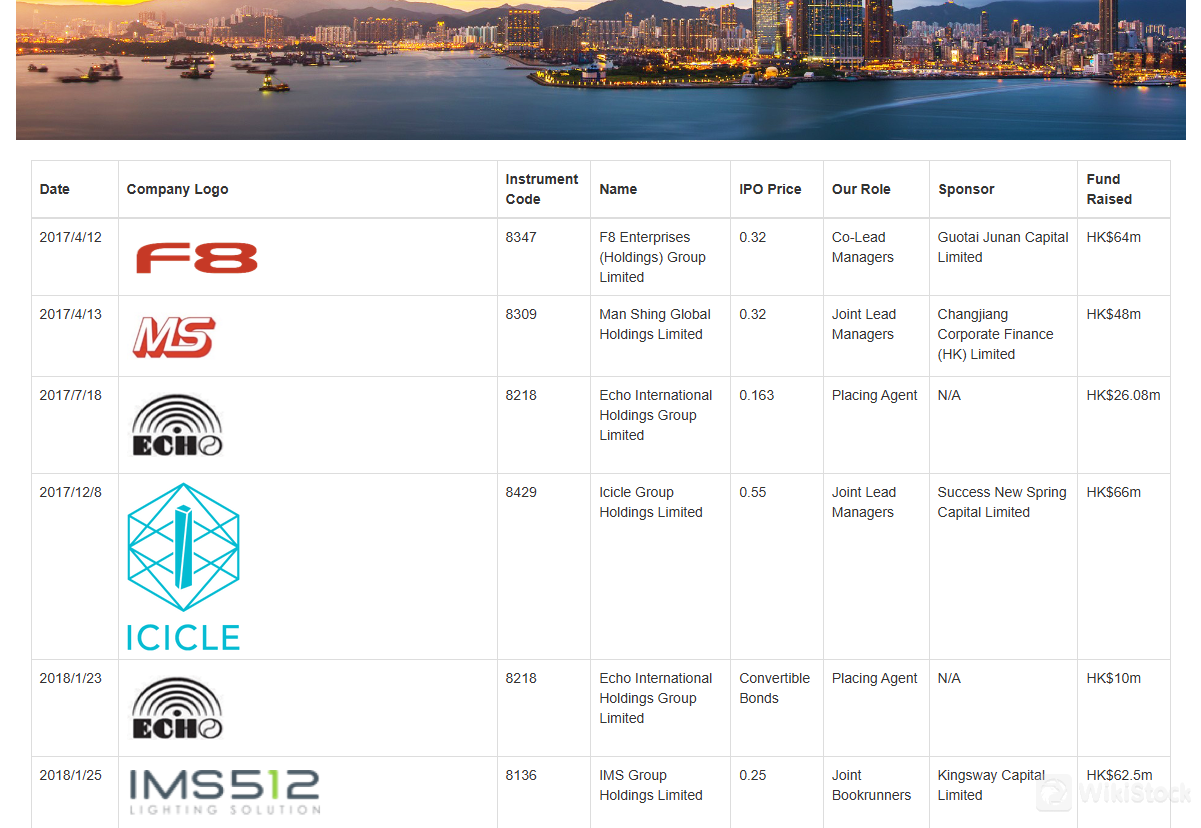

Research & Education

Bluemount Financial offers a comprehensive array of research reports and knowledge resources, particularly concerning Business Introduction. Within these documents, there is a detailed table showcasing Bluemount Financial's active participation in numerous Hong Kong IPOs. This table serves as a testament to Bluemount Financial's extensive involvement and expertise in navigating the intricacies of the IPO landscape in Hong Kong.

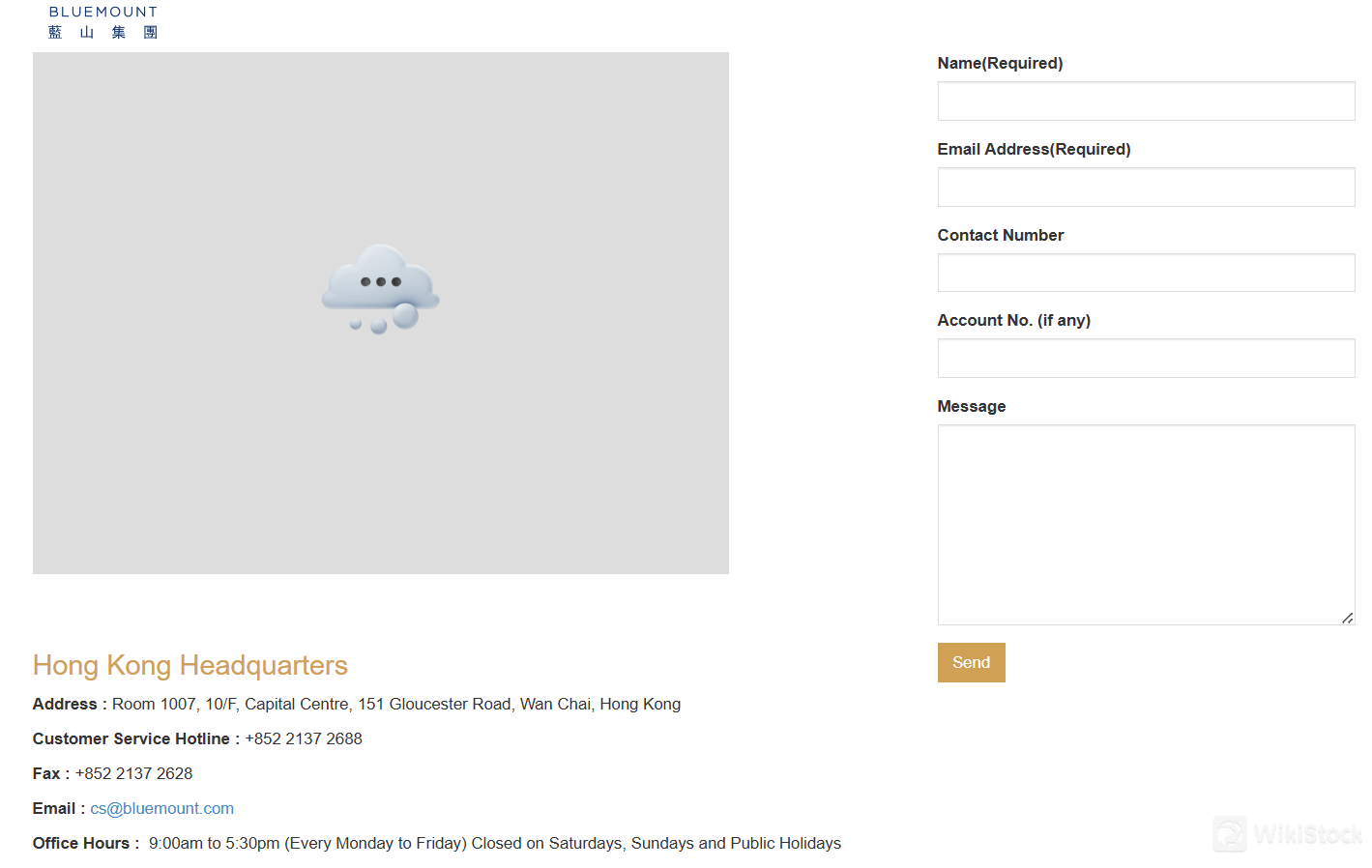

Customer Service

Bluemount Financial provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Customer Hotline:+852 2137 2688

Fax:+ 852 2137 2628

Email: cs@bluemount.com

Address : Room 1007, 10/F, Capital Centre, 151 Gloucester Road, Wan Chai, Hong Kong

Office Hours : 9:00am to 5:30pm (Every Monday to Friday) Closed on Saturdays, Sundays and Public Holidays

Contact form

Conclusion

In conclusion, Bluemount Financial emerges as a reputable financial services provider, regulated by SFC, instilling confidence in clients through adherence to stringent regulatory standards. Offering a diverse array of financial services, Bluemount caters to a broad spectrum of investment needs. Its transparent fee structure and user-friendly Bluemount Financial App further enhance the client experience, facilitating seamless financial management and investment tracking.

However, while the platform boasts extensive research resources and comprehensive customer support, the absence of certain account details and promotional offers may leave some clients seeking further information or incentives. Overall, Bluemount Financial stands as a reliable choice for individuals seeking secure and transparent financial services in Hong Kong. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is Bluemount Financial suitable for beginners?

Bluemount Financial is suitable for beginners. The platform offers a user-friendly Bluemount Financial App, which can simplify financial management and investment tracking for novice users.

Is Bluemount Financial legit?

Yes, Bluemount Financial operates under the supervision of the Securities and Futures Commission of Hong Kong (SFC), holding license numbers BHR496 and BHR495.

What services does Bluemount Financial offer?

Bluemount Financial offers a wide range of financial services, including securities trading, IPO participation, private equity fund management, fund products, discretionary account services, and more.

Does Bluemount Financial provide a mobile app?

Yes, Bluemount Financial offers a mobile app for convenient access to financial management tools, real-time investment monitoring, and account management.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Russia

RussiaObtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--

Positive

Positive