In 1987, M&F Asset Management Limited was established in Hong Kong. It has over 30 years of history since its foundation. Our Company has officially renamed as M&F Asset Management Limited (abbreviated as “MFAM”) in 2022. We provide securities trading services, private wealth management, multi-asset funds, asset management and specialized corporate finance advisory services.

What is MFAM?

M&F Asset Management Co., Ltd. was established in Hong Kong, China in 1987 and has a history of more than 30 years.They are an exchange participant of The Stock Exchange of Hong Kong Limited (No. B01308) and a licensed corporation registered with the Securities and Futures Commission (CE No. AAD002) to engage in dealing in securities (Type 1), provision of securities The regulated activities of advice (Type 4) and provision of asset management (Type 9) mainly provide clients with securities trading, private wealth management, multi-asset funds, professional asset management and corporate financial advisory services. Their operation team is composed of senior professional financial management elites. They will tailor high-quality financial investment services or provide objective and professional investment advice to customers.

Pros and Cons of MFAM

Pros

Personalized Service: As a wealth management firm, M&F Asset Management offers personalized investment strategies and financial planning tailored to your needs and goals.

Expertise in Wealth Management: They have experienced investment professionals who manage investment portfolios for high-net-worth individuals.

Access to a Wider Range of Investments: They offers investment opportunities beyond basic stocks and bonds, potentially including alternative assets like private equity or real estate.

Licensed Brokerage: M&F Asset Management is a licensed brokerage firm regulated by the Hong Kong Securities and Futures Commission (SFC). This offers a level of security and oversight for investors.

Cons

Limited Online Information: Their website lacks information regarding key details like account minimums, fee structures, and investment philosophy. This makes it difficult to assess their services thoroughly.

Focus on High-Net-Worth Individuals: They are suitable for a specific clientele with substantial investable assets, and minimum investment requirements could be high.

Limited Educational Information: Their website doesn't show a section for educational articles, webinars, or market analysis tools.

Is MFAM safe?

Regulations

M&F Asset Management Limited operates under stringent regulations established by the Securities and Futures Commission (SFC) in Hong Kong, ensuring compliance with national financial laws and industry standards.

Safety Measures

M&F Asset Management provides notes for online security for traders to raise their safety awareness.

What are securities to trade with MFAM?

MFAM allows you to trade a variety of securities, with a focus on offerings in the Hong Kong and China markets. Here's a breakdown of the main options:

Hong Kong Stocks: This is their primary focus, allowing you to trade stocks listed on the Hong Kong Stock Exchange (HKEX).

Bonds: Debt instruments issued by governments or corporations, offering regular interest payments and a return of principal at maturity.

Mutual Funds: Diversified investment vehicles holding a basket of stocks, bonds, or other assets, offering exposure to a specific market segment or asset class.

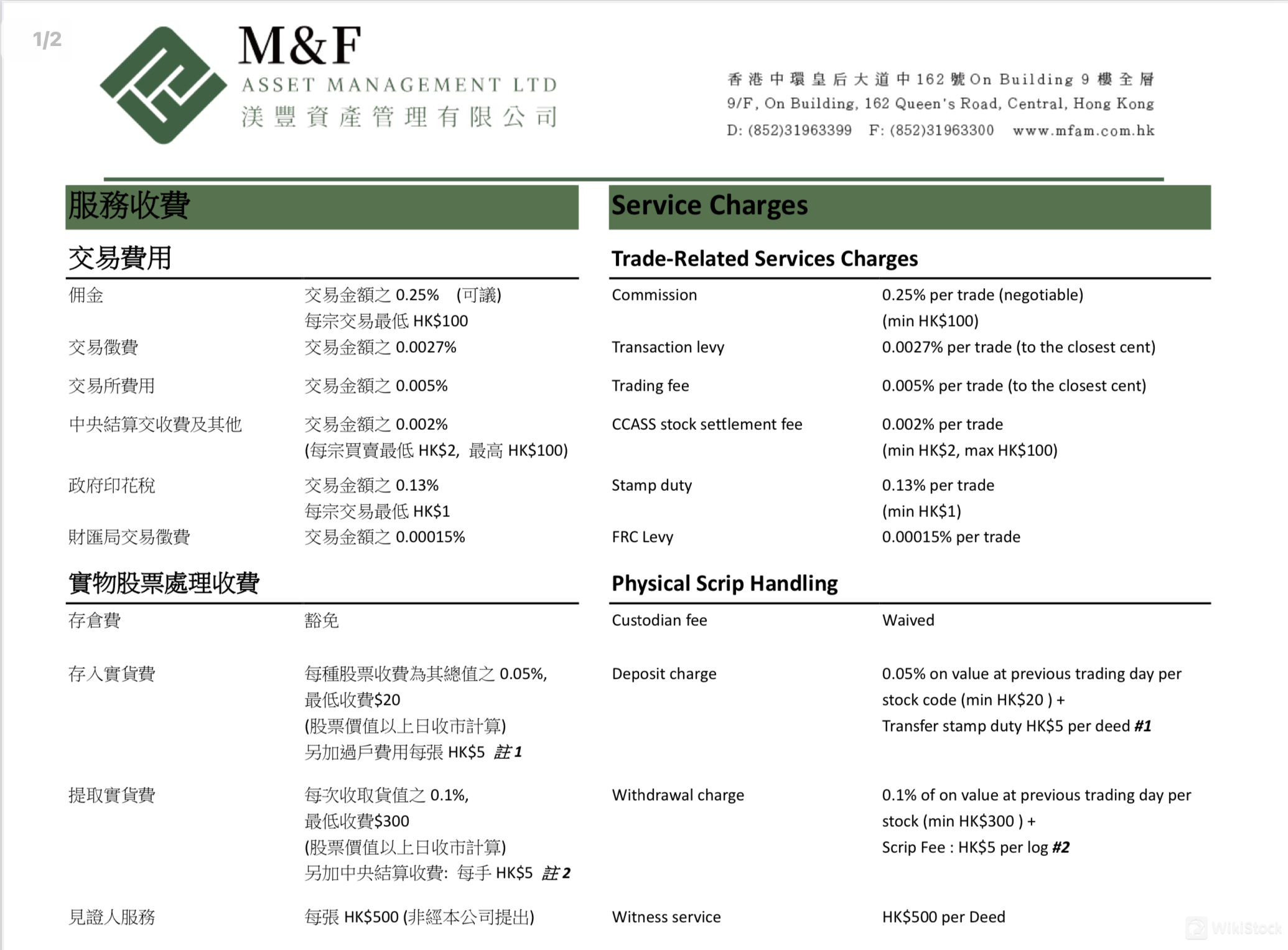

MFAM Fees Review

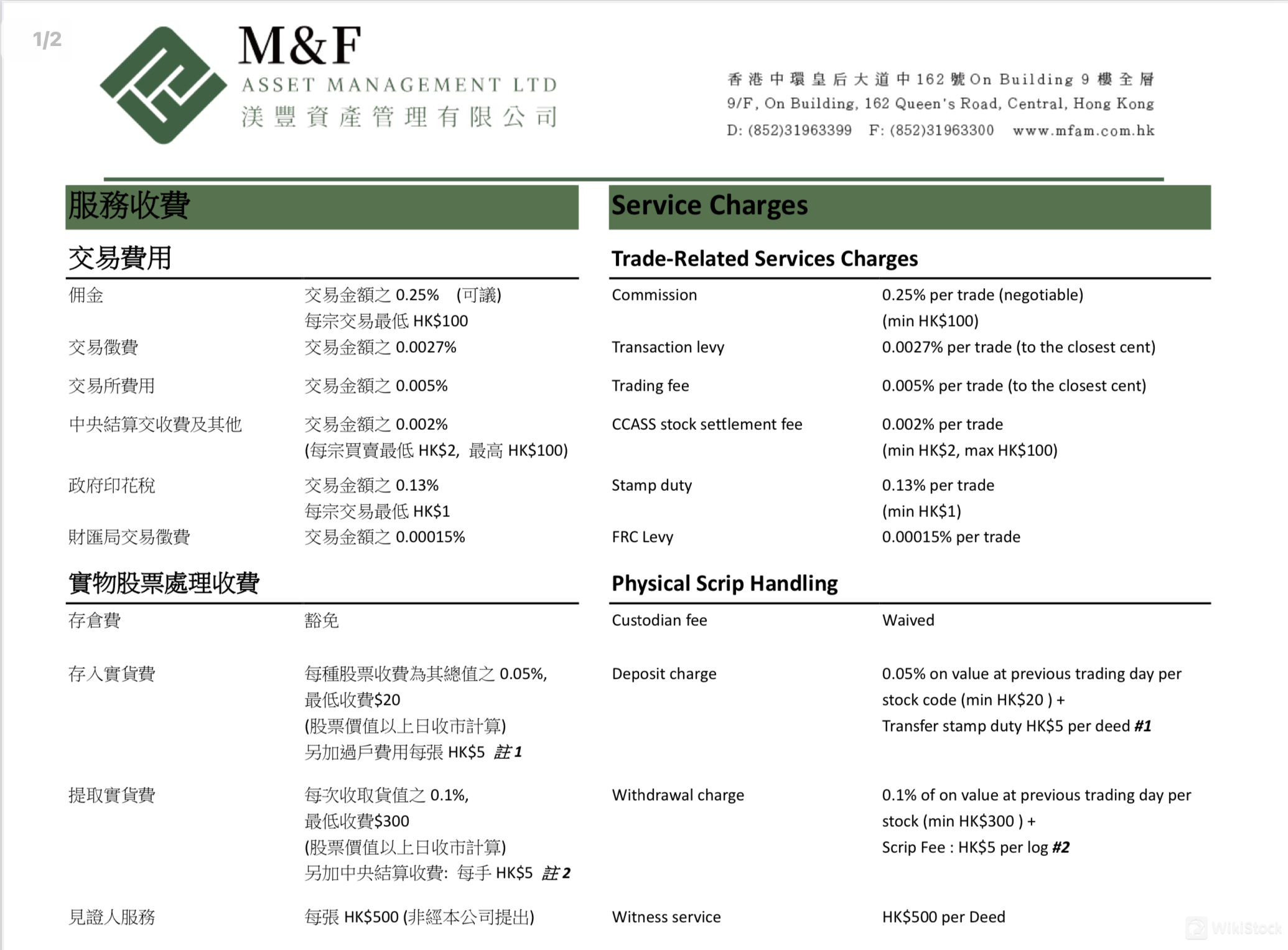

Summary of fees charged by MFAM:

Commission: Charged at 0.25% of the trade amount (negotiable) with a minimum fee of HK$100 per trade.

Transaction Levy: 0.0027% of the trade amount, rounded to the nearest cent.

Trading Fee: 0.005% of the trade amount, rounded to the nearest cent.

CCASS Stock Settlement Fee: 0.002% of the trade amount, with a minimum of HK$2 and a maximum of HK100 per trade.

Stamp Duty: 0.13% of the trade amount, with a minimum fee of HK$1 per trade.

FRC Levy: 0.00015% of the trade amount.

Additional fees include:

Deposit Charge for physical scripts: 0.05% of the value at the previous trading day per stock code, with a minimum fee of $20.

Withdrawal Charge for physical scripts: 0.1% of the value at the previous trading day per stock, with a minimum fee of $300.

Transfer Stamp Duty: HK$5 per deed.

Scrip Fee: HK$1.5 per log

Witness Service: HK$500 per deed, if not initiated by the company.

The schedule also mentions that custodian fees are waived, indicating no storage charges for clients' securities.

MFAM App Review

MFAM provides a web-based platform and a mobile app named M&F Asset Management Limited for traders. Meanwhile, by using “MFAM Authentication Code” Mobile App, a Two-Factor Authentication provides a more secure and convenience trading platform, which can be downloaded on both Google Play Store and App Store.

Research and Eduation

Unfortunately, M&F Asset Management doesn't offer dedicated educational resources for investors. Here's why:

Focus on Wealth Management: Wealth management firms typically satisfy high-net-worth individuals who may already have some investment knowledge. They often focus on personalized investment strategies rather than general investor education.

Limited Website Information: Their website doesn't show a section for educational articles, webinars, or market analysis tools.

Customer Service

MFAM offers three channels for traders to contact them, including phone, fax and email:

Phone: (852) 3196 3399

Fax: (852) 3196 3300

Email: info@mfam.com.hk

Conclusion

M&F Asset Management is a Hong Kong-based wealth management firm catering to high-net-worth individuals. While they offer personalized investment strategies, access to a wider range of assets, and expertise for managing larger portfolios, there are some drawbacks. Their website lacks transparency regarding account minimums and investment philosophy. Additionally, they don't have educational resources for beginners. M&F Asset Management could be suitable for those with substantial investable assets seeking a tailored wealth management approach, but the lack of online information makes it crucial to thoroughly research them and compare them with other wealth management firms or robo-advisors before entrusting them with your funds.

FAQs

Is MFAM safe to trade?

While M&F Asset Management might be a legitimate firm with some regulatory safeguards in place, the lack of online transparency is a problem. For safe trading, prioritize clarity about fees, investment strategies, and how they protect your assets. Consider exploring other wealth management firms or robo-advisors with a stronger online presence and clear information about security measures.

Is MFAM a good platform for beginners?

No, while M&F Asset Management offers potentially personalized wealth management and a wider range of investments, the lack of transparency about fees, minimums, and educational resources makes it a poor fit for beginners. The focus on high-net-worth clients and potentially complex strategies might be overwhelming.

Is MFAM good for investing/retirement?

M&F Asset Management offers personalized investment strategies and access to a wider range of assets, which could be beneficial for retirement planning. However, the lack of transparency about minimum investment requirements, and their investment philosophy makes it a risky choice.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)