The UGM Securities Broker Company was established taking into account the current realities in the World Economy and Finance. We meet all needs and expectations of investors whose interests are related to the rational and optimal financial management for the purpose of capital preservation and future benefits for themselves and the next generation.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

What is UGM Securities?

UGM Securities is a distinguished investment services provider renowned for its commitment to excellence and client-centric approach. Operating under the rigorous regulatory oversight of the Cyprus Securities and Exchange Commission (CYSEC), UGM Securities caters to the diverse needs of investors, ranging from individual traders to institutional clients. The firm's core services encompass brokerage, execution of orders, and personalized investment advice. Additionally, UGM Securities offers ancillary services such as safekeeping and administration, foreign exchange, and REPO transactions, further enhancing its value proposition.

Pros & Cons

Pros Regulatory Oversight: Regulated by CYSEC, ensuring adherence to stringent standards. $100.00 fee for sending or refusing settlement instructions.

Comprehensive Services: Wide range of services including order execution, investment advice, safekeeping, and foreign exchange.

Competitive Brokerage Fees: 0.2% fee on order amounts, offering good value for trade execution.

Transparent Fee Structure: Clear and competitive fees across various services.

Accessible Customer Support: Multiple channels for customer support including phone and email.

Cons Platform Information Not Provided: There is no detailed information about the trading platform, including its features, usability, and accessibility. This can be a significant disadvantage for traders who rely on robust and user-friendly platforms for their trading activities.

No Promotions Available: The absence of promotions or incentives for new clients can make the brokerage less attractive compared to competitors who offer bonuses or reduced fees as part of promotional campaigns.

Is UGM Securities Safe?

UGM Securities is regulated by the oversight of the oversight of the Cyprus Securities and Exchange Commission (CYSEC), holding license No. 352/17. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, UGM Securities ensures that its operations are conducted with the utmost professionalism and accountability.

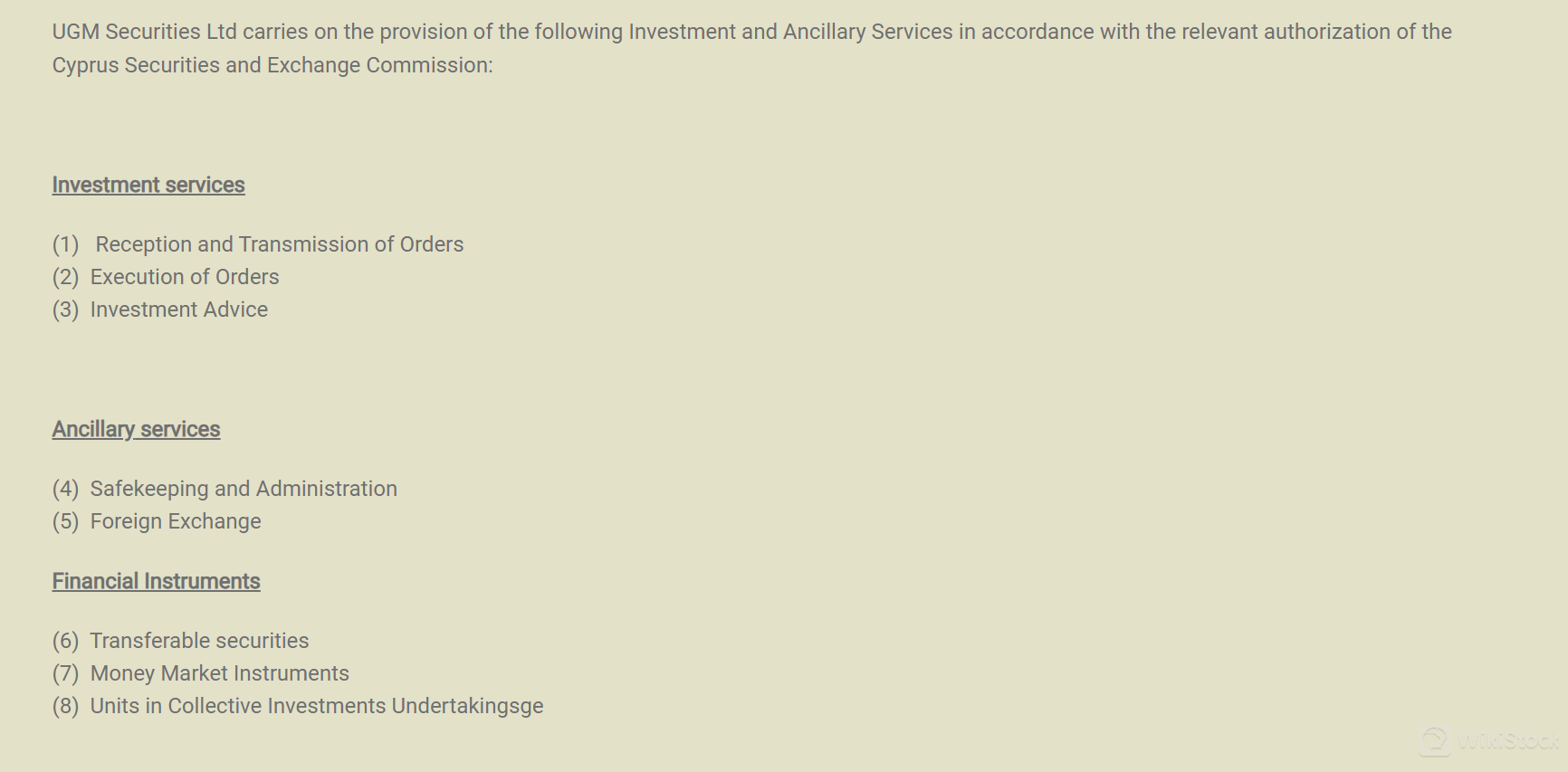

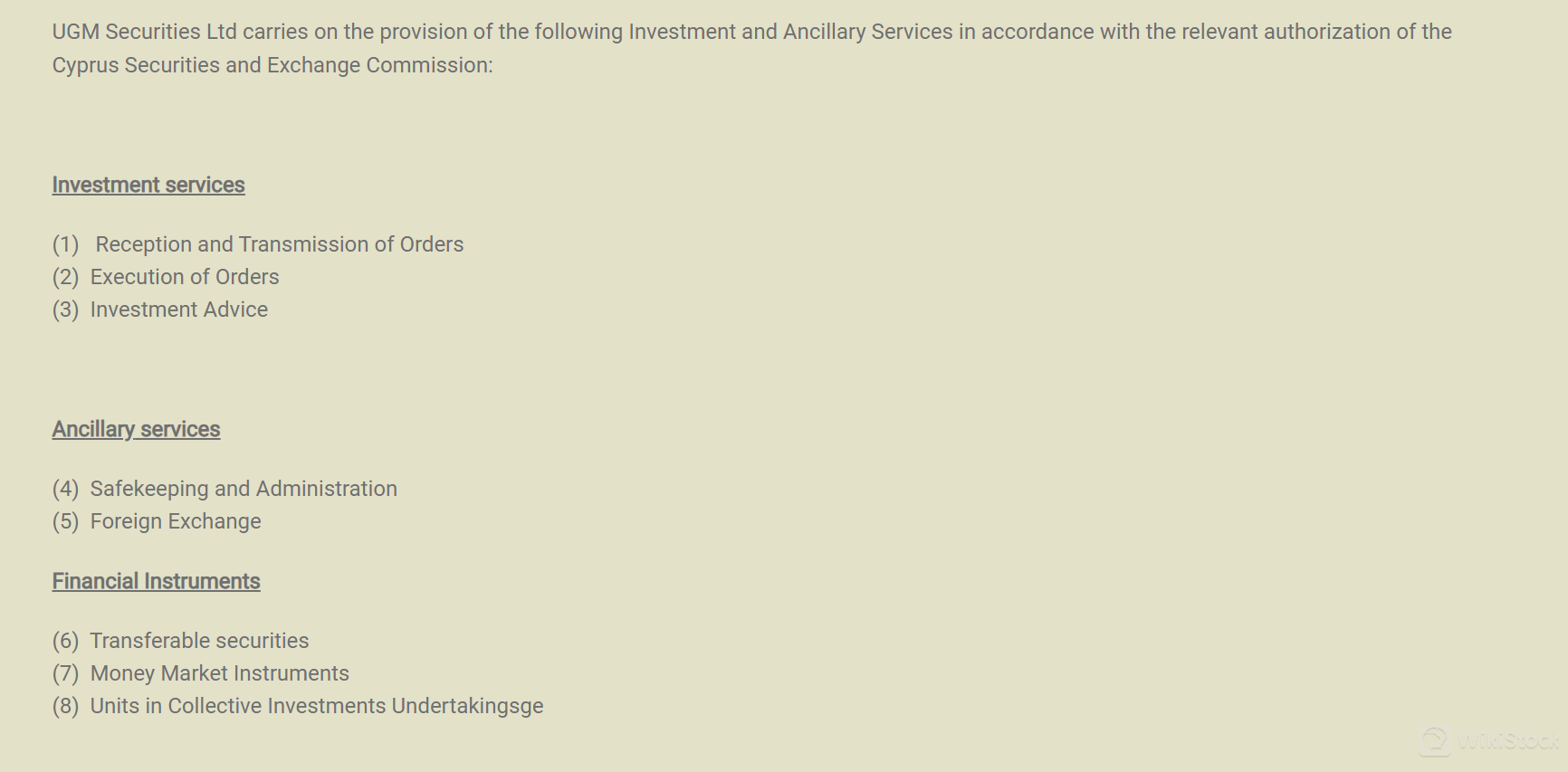

What are Securities to Trade with UGM Securities?

UGM Securities offers a comprehensive suite of investment services tailored to meet the diverse needs of its clients.

Reception and Transmission of Orders

UGM Securities ensures accurate and prompt handling of client orders. Utilizing advanced technology, the firm prioritizes speed and precision in receiving and transmitting instructions for execution.

Execution of Orders

The firm's execution services provide clients with access to a wide array of financial markets. UGM Securities leverages cutting-edge trading platforms and reliable market networks to ensure competitive pricing and swift transaction processing.

Investment Advice

UGM Securities offers personalized investment advice, helping clients make informed decisions. Experienced advisors provide tailored recommendations based on clients' financial goals and risk tolerance, guiding them toward their long-term aspirations.

Ancillary Services: Safekeeping and Administration

UGM Securities provides safekeeping and administration services, ensuring secure and meticulous management of client assets. Rigorous procedures and advanced security measures protect clients' investments, ensuring their integrity.

Ancillary Services: Foreign Exchange

UGM Securities facilitates seamless currency transactions with competitive rates and efficient execution. This service supports clients engaging in global markets, enabling effective currency risk management.

Financial Instruments

UGM Securities offers access to a diverse range of financial instruments, including transferable securities, money market instruments, and units in collective investment undertakings.

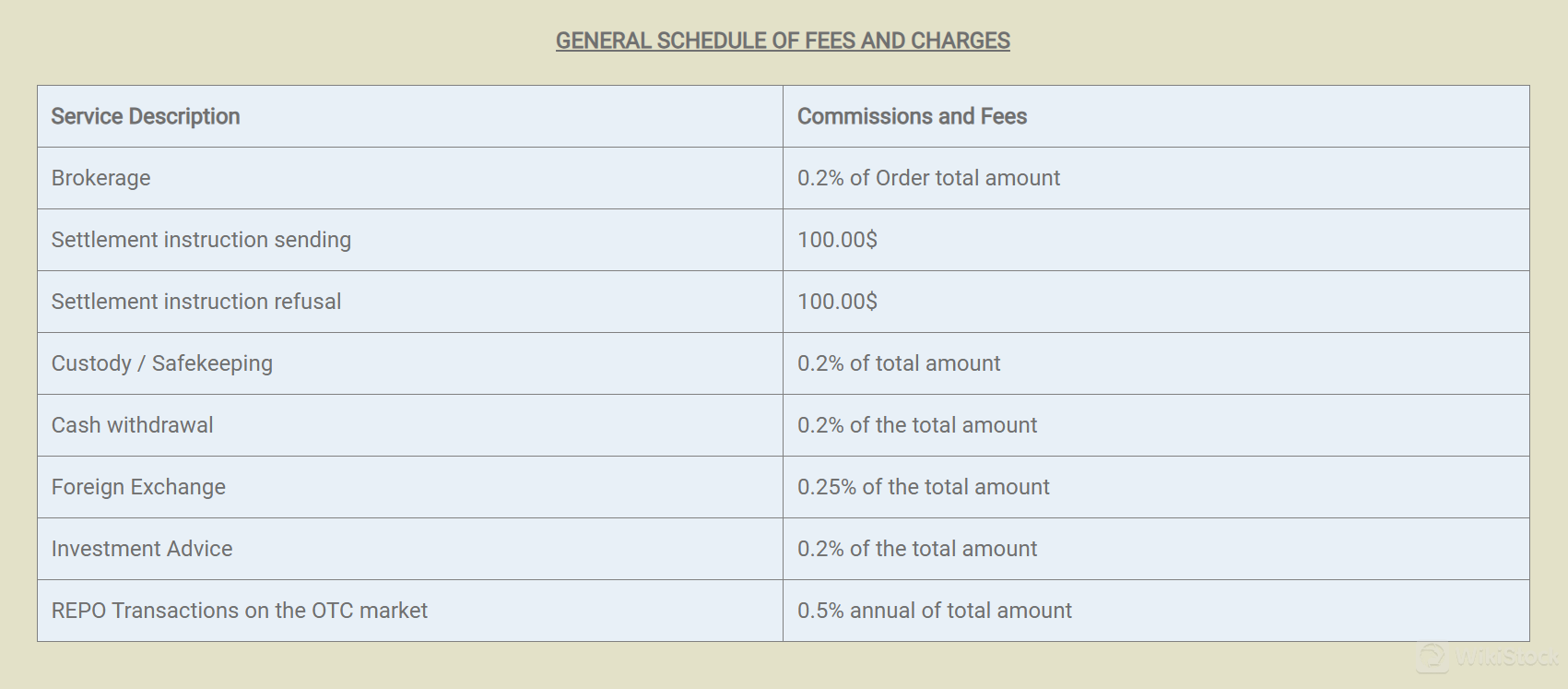

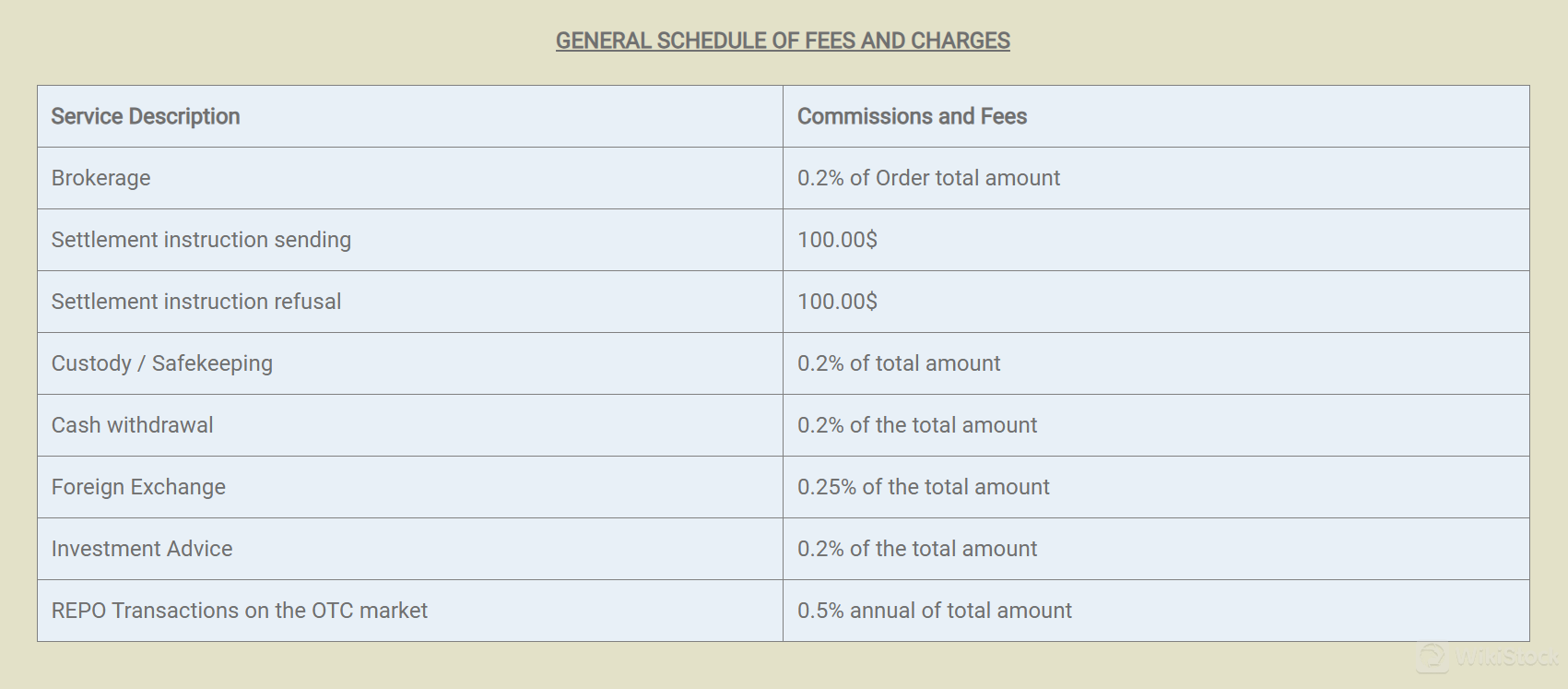

UGM Securities Fees Review

UGM Securities maintains a transparent and competitive fee structure, ensuring clients are fully informed about the costs associated with their trading and investment activities.

Brokerage Fees:

For brokerage services, UGM Securities charges a fee of 0.2% of the total order amount. This competitive rate ensures clients receive excellent value for the execution and management of their trades, supported by the firms advanced trading platforms and expert market access.

Settlement Instruction Fees

UGM Securities charges a flat fee of $100.00 for sending settlement instructions. In the case of settlement instruction refusal, the same flat fee of $100.00 applies. These fees cover the administrative costs associated with ensuring accurate and timely settlement of trades, maintaining the integrity of clients transactions.

Custody/Safekeeping Fees

To provide secure custody and safekeeping of client assets, UGM Securities charges 0.2% of the total amount. This fee supports the firms robust security measures and meticulous asset management practices, offering clients peace of mind regarding the safety of their investments.

Cash Withdrawal Fees

For cash withdrawals, UGM Securities charges a fee of 0.2% of the total amount. This fee ensures that the process of withdrawing funds is handled efficiently and securely, reflecting the firms commitment to providing reliable and convenient financial services.

Foreign Exchange Fees

When engaging in foreign exchange transactions, clients are charged 0.25% of the total amount. UGM Securities competitive foreign exchange fee enables clients to conduct currency transactions seamlessly, supported by favorable exchange rates and efficient execution.

Investment Advice Fees

UGM Securities offers personalized investment advice at a fee of 0.2% of the total amount. This fee covers the provision of tailored recommendations and expert guidance from the firms seasoned advisors, helping clients make informed and strategic investment decisions.

REPO Transactions Fees

For REPO (Repurchase Agreement) transactions on the OTC market, UGM Securities charges an annual fee of 0.5% of the total amount. This fee reflects the specialized nature of REPO transactions and the firms expertise in managing these complex financial instruments, providing clients with reliable and efficient service in the OTC market.

Customer Service

UGM Securities provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Address: UGM Securities LTD, Office 102, Spyrou Kyprianou 20, Nicosia, Cyprus, 1075

Tel: +35722257670

E-mail: info@ugm.com.cy, support@ugm.com.cy, complaints@ugm.com.cy

Conclusion

In summary, UGM Securities stands out as a reliable and well-regulated investment service provider, governed by CYSEC. The firm offers a comprehensive suite of service. Clients benefit from competitive brokerage fees and access to a wide range of financial instruments.

Despite the lack of detailed platform information and promotions, UGM Securities transparent fee structure and accessible customer support make it a strong contender for investors seeking professionalism, security, and comprehensive service in their financial endeavors.

Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is UGM Securities suitable for beginners?

Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with detailed fee structure.

Is UGM Securities legit?

Yes, UGM Securities is regulated by the Cyprus Securities and Exchange Commission (CYSEC) under license No. 352/17.

What services does UGM Securities offer?

UGM Securities provides a range of services including the reception and transmission of orders, execution of orders, investment advice, safekeeping and administration of assets, and foreign exchange services.

Are there any fees for settlement instructions?

Yes, UGM Securities charges a flat fee of $100.00 for both sending and refusing settlement instructions.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Qatar

QatarObtain 1 securities license(s)