APME FX TRADING EUROPE LIMITED (CIF license number 335/17), is regulated by the Cyprus Securities and Exchange Commission (CySEC) to provide Investment services in the EU Member States.

Our professional and licensed portfolio managers work on behalf of clients. Individuals are able to choose to build and manage their own portfolios.

In the area of brokerage our main duty is to act as a middleman that connects buyers and sellers to facilitate a transaction with the best interests for the clients.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

What is APME FX?

APME FX is a leading brokerage firm offering comprehensive financial services and solutions to traders and investors worldwide. Regulated by the Cyprus Securities and Exchange Commission (CYSEC), APME FX ensures adherence to stringent standards, guaranteeing investor protection and market integrity. The company's Portfolio Management services offer individuals the flexibility to build and manage their investment portfolios according to their financial goals and risk preferences, with three distinct approaches available. APME FX utilizes the advanced MetaTrader 5 (MT5) trading platform.

Pros & Cons

Pros Regulated by CYSEC: Regulatory oversight ensures compliance with standards, protecting investors.

Provides comprehensive Portfolio Management services: Tailored approaches cater to different risk appetites and investment objectives.

Utilizes MetaTrader 5 (MT5) trading platform: MT5's features and interface enhance trading experience and analysis capabilities.

Offers educational resources: Offers educational resources through its blog, catering to traders of all levels of expertise.

Comprehensive Customer Support: Offers multiple contact methods including phone, email, and an online contact form, ensuring accessible customer support.

Cons Unclear fee structure: Detailed information on fees, account fees, interest on uninvested cash, and margin interest rates is not readily available. This lack of transparency can make it challenging for clients to fully understand the cost of trading and investing with APME FX.

No promotions available: The absence of promotions or incentives for new clients can make the brokerage less attractive compared to competitors who offer bonuses or reduced fees as part of promotional campaigns.

Is APME FX Safe?

APME FX is regulated by the oversight of the oversight of the Cyprus Securities and Exchange Commission (CYSEC), holding license No. 335/17. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, APME FX ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with APME FX?

APME FX offers comprehensive brokerage services tailored to meet the diverse needs of traders in the financial markets. As a leading brokerage firm, APME FX provides access to a wide range of trading instruments, including forex, stocks, commodities, indices, and cryptocurrencies.

APME FX Portfolio Management

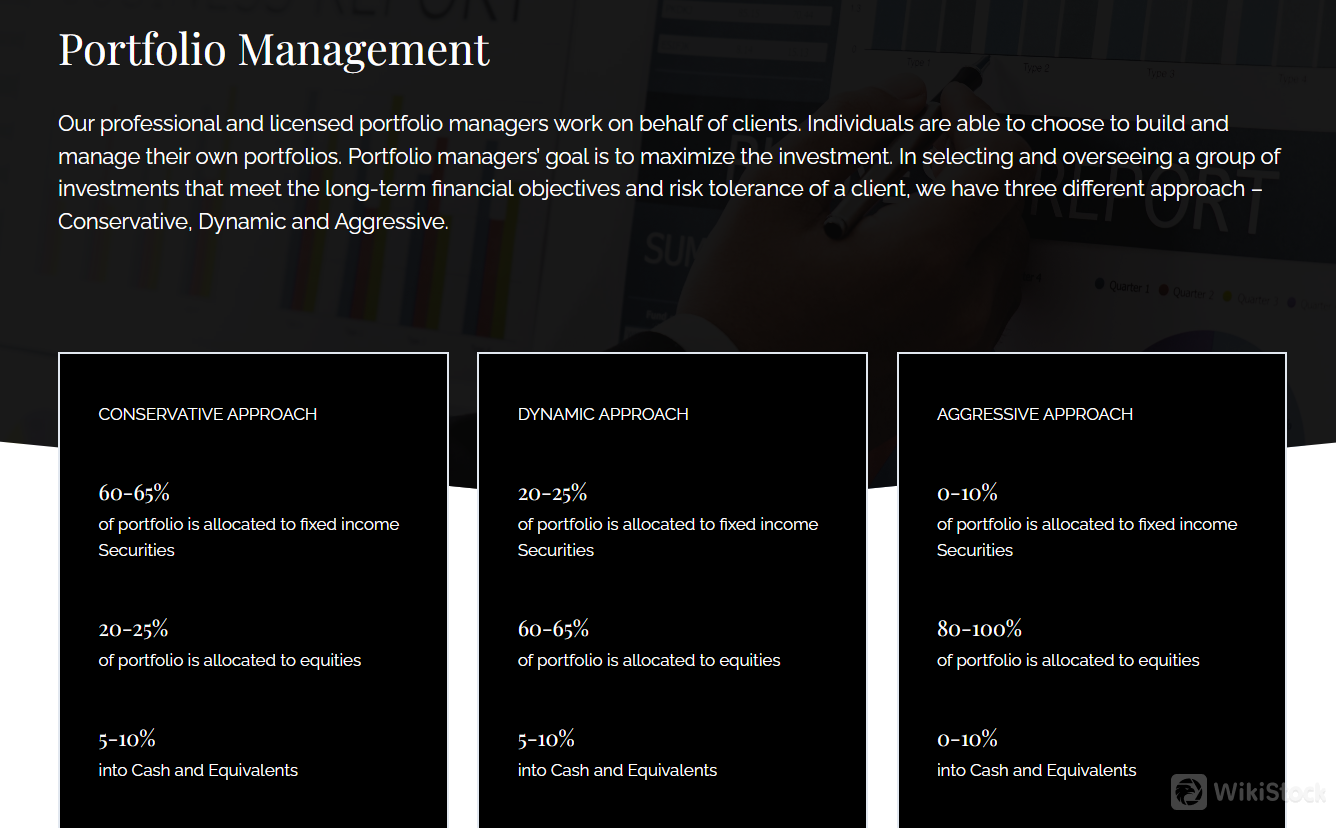

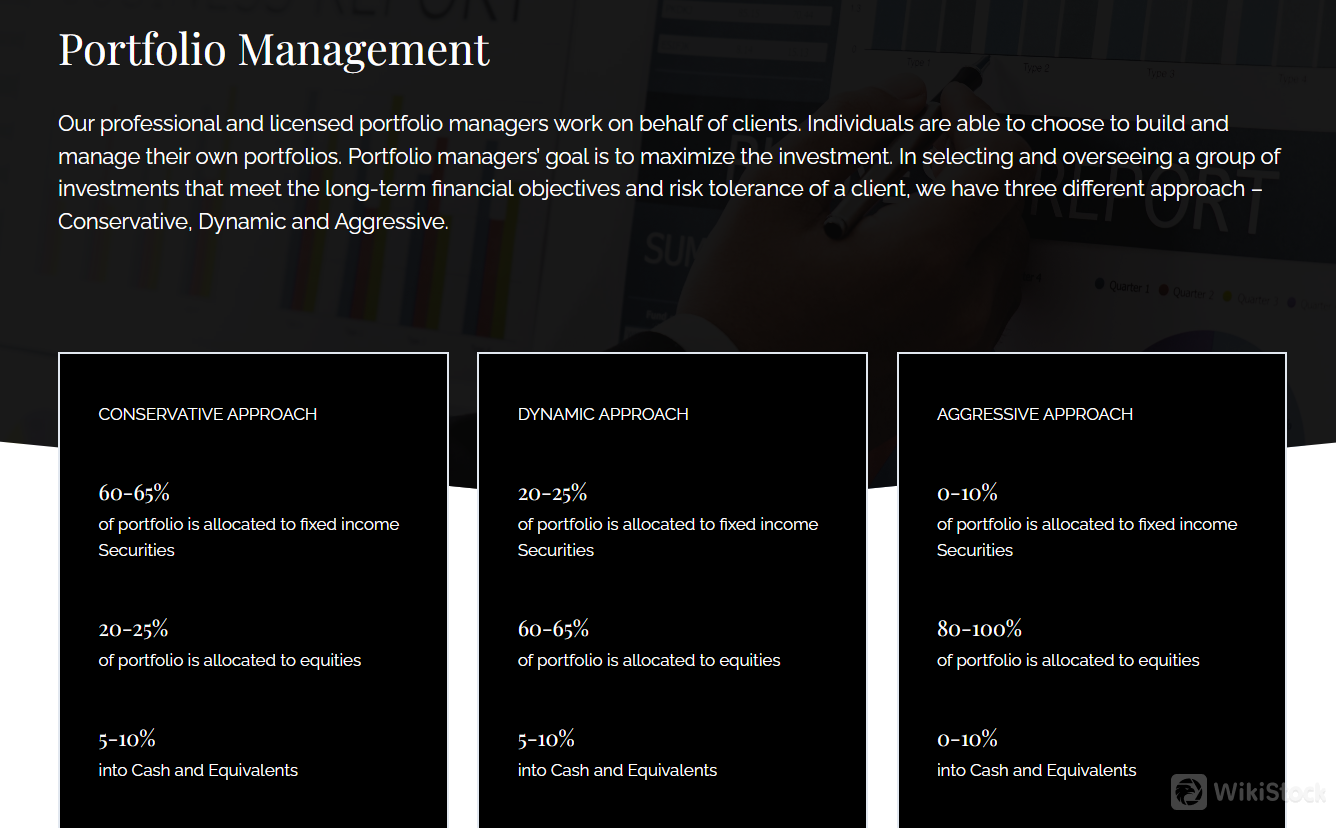

APME FX provides a comprehensive Portfolio Management service, offering individuals the flexibility to build and manage their own investment portfolios according to their financial objectives and risk tolerance. With the goal of maximizing investment returns, APME FX offers three distinct approaches: Conservative, Dynamic, and Aggressive.

Under the Conservative approach, a significant portion (60-65%) of the portfolio is allocated to fixed income securities, providing stability and steady returns. Equities make up 20-25% of the portfolio, offering growth opportunities, while 5-10% is held in cash and equivalents for liquidity and risk mitigation.

For investors seeking a more balanced approach, the Dynamic approach allocates a higher percentage (60-65%) of the portfolio to equities, allowing for growth while still maintaining a portion (20-25%) in fixed income securities for stability. Cash and equivalents make up the remaining 5-10% of the portfolio.

Meanwhile, the Aggressive approach is tailored for investors with a higher risk tolerance and a focus on capital appreciation. Here, a minimal portion (0-10%) of the portfolio is allocated to fixed income securities, with the majority (80-100%) invested in equities to capture high returns. A small portion (0-10%) is held in cash and equivalents for liquidity purposes.

APME FX Platform Review

APME FX offers traders access to the advanced MetaTrader 5 (MT5) trading platform, known for its robust features and user-friendly interface. With MT5, traders can execute trades across various financial markets, including forex, stocks, commodities, and indices, all from a single platform. The platform provides powerful analytical tools, customizable charts, and a wide range of technical indicators, allowing traders to conduct thorough market analysis and make informed trading decisions.

Research & Education

APME FX's education resources, available through its blog, serve as a valuable asset for traders at all levels of expertise. The blog features a diverse range of articles, tutorials, market insights, and trading strategies. Whether you're a novice trader looking to grasp the basics of forex trading or an experienced investor seeking advanced techniques, APME FX's blog provides comprehensive and up-to-date information to help you succeed in the financial markets.

Customer Service

APME FX provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Address: APME FX TRADING EUROPE LTD, Spyrou Kyprianou 25, Floor 1/Office 103, 3070, Limassol, Cyprus

Head Offices Number: +357 25 054 734

Phone order placement tel: +357 25 054 739

Fax: +357 22 266 678

Email: info@apmefx.com

Conclusion

In summary, APME FX offers regulated trading services with access to diverse financial instruments, advanced trading platforms, and educational resources. However, there's a lack of detailed information on certain aspects such as fees and promotions. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is APME FX suitable for beginners?

Yes, APME FX is suitable for beginners. Its user-friendly MetaTrader 5 platform, educational blog resources, and customizable portfolio management options make it accessible for new traders. Additionally, regulatory oversight by the Cyprus Securities and Exchange Commission ensures transparency and reliability.

Is APME FX legit?

Yes, APME FX is regulated by the Cyprus Securities and Exchange Commission (CYSEC).

What trading platform does APME FX provide?

APME FX provides access to the advanced MetaTrader 5 (MT5) trading platform, known for its robust features and user-friendly interface.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Poland

PolandObtain 1 securities license(s)