RED MARS Capital LTD is regulated by the Cyprus Securities and Exchange Commission, as a Cyprus Investment Firm.License number: 396/21

RED MARS Information

RED MARS is a Cyprus-based brokerage firm regulated by the Cyprus Securities and Exchange Commission (CySEC). Established with a registered office in Limassol, Cyprus, the company operates within the framework of CySEC's regulatory standards. RED MARS offers a range of financial services, including securities lending fully paid, futures trading, and investment in stocks, ETFs, and mutual funds.

Pros & Cons of RED MARS

Pros:

Regulation and Compliance: RED MARS is regulated by the Cyprus Securities and Exchange Commission (CySEC) and offers oversight and investor protection.

Rich Experience: RED MARS operates with an experienced team knowledgeable in international equities, Eurobonds, structured products, and portfolio management.

Client-Centric Approach: RED MARS emphasizes a client-centric approach, which focuses on reliability, capability, and dynamic portfolio management services tailored.

Cons:

Service Limitations: While they offer a broad range of products, specific details on service execution, fees, and margin rates are not extensively detailed.

Is RED MARS Safe?

RED MARS Capital LTD, regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 396/21. CySEC, as the financial regulator of Cyprus. This regulatory oversight provides a level of assurance regarding RED MARS' adherence to industry standards.

What are Securities to Trade with RED MARS?

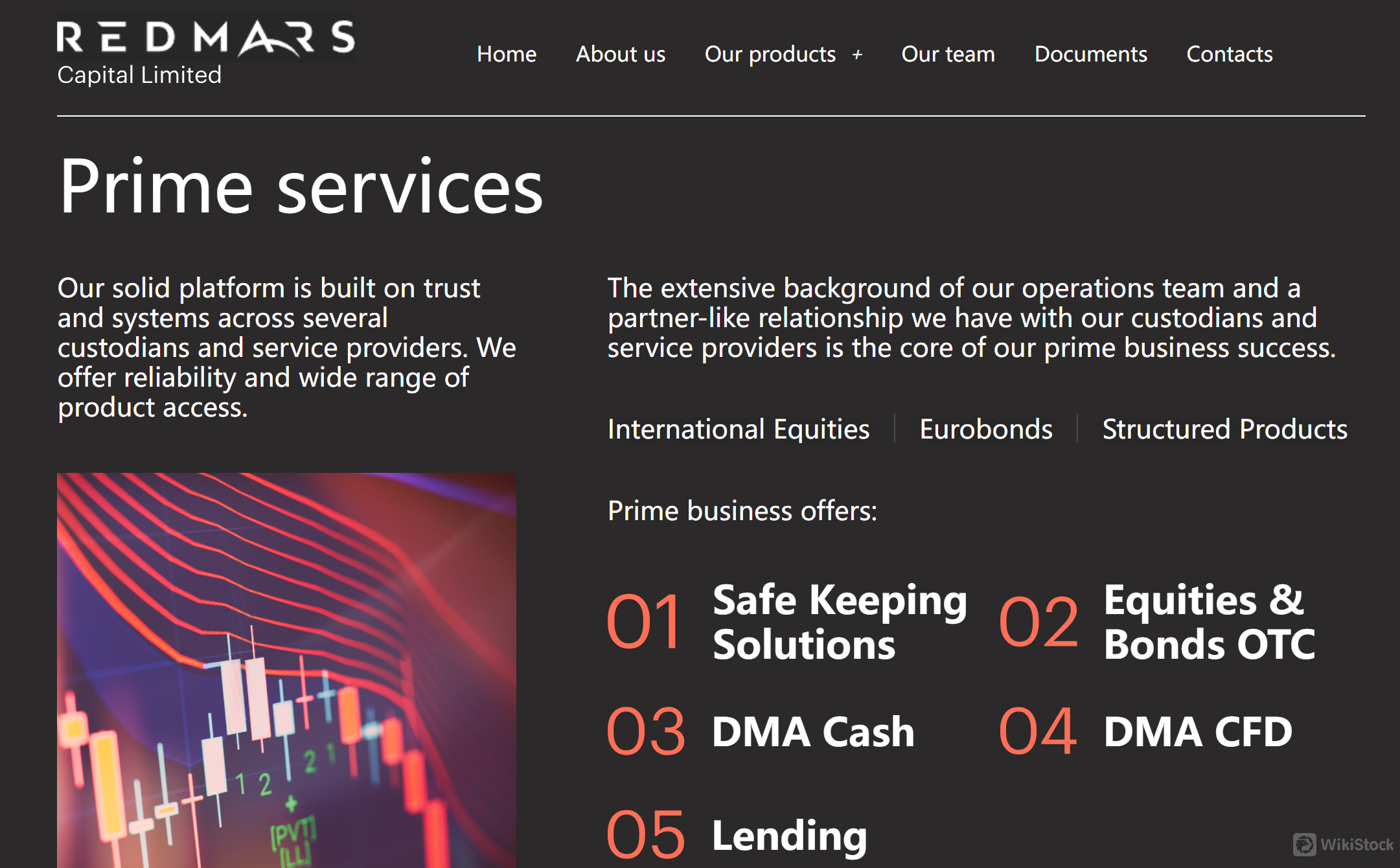

RED MARS provides a diverse selection of securities for trading. One of the primary offerings includes International Equities, which encompass stocks traded on major international exchanges. This allows investors to participate in the performance of companies from various industries and regions around the world.

In addition to equities, Eurobonds provide investors with the opportunity to invest in fixed-income securities across different European markets, Structured Products, which are tailored financial instruments designed to meet specific investment objectives. These products typically combine traditional securities with derivatives, offering unique risk-return profiles that can be customized to meet the specific needs and preferences of investors.

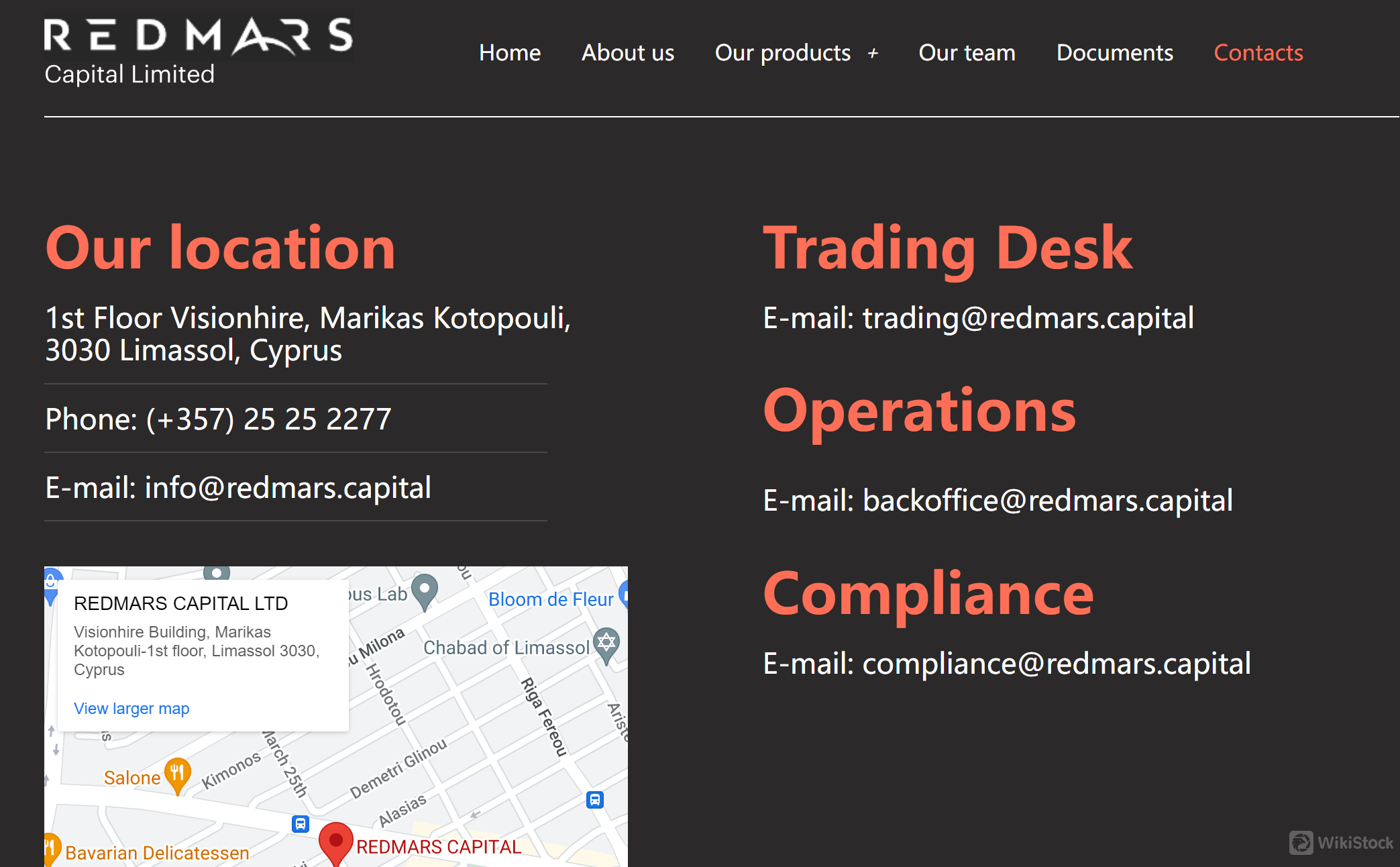

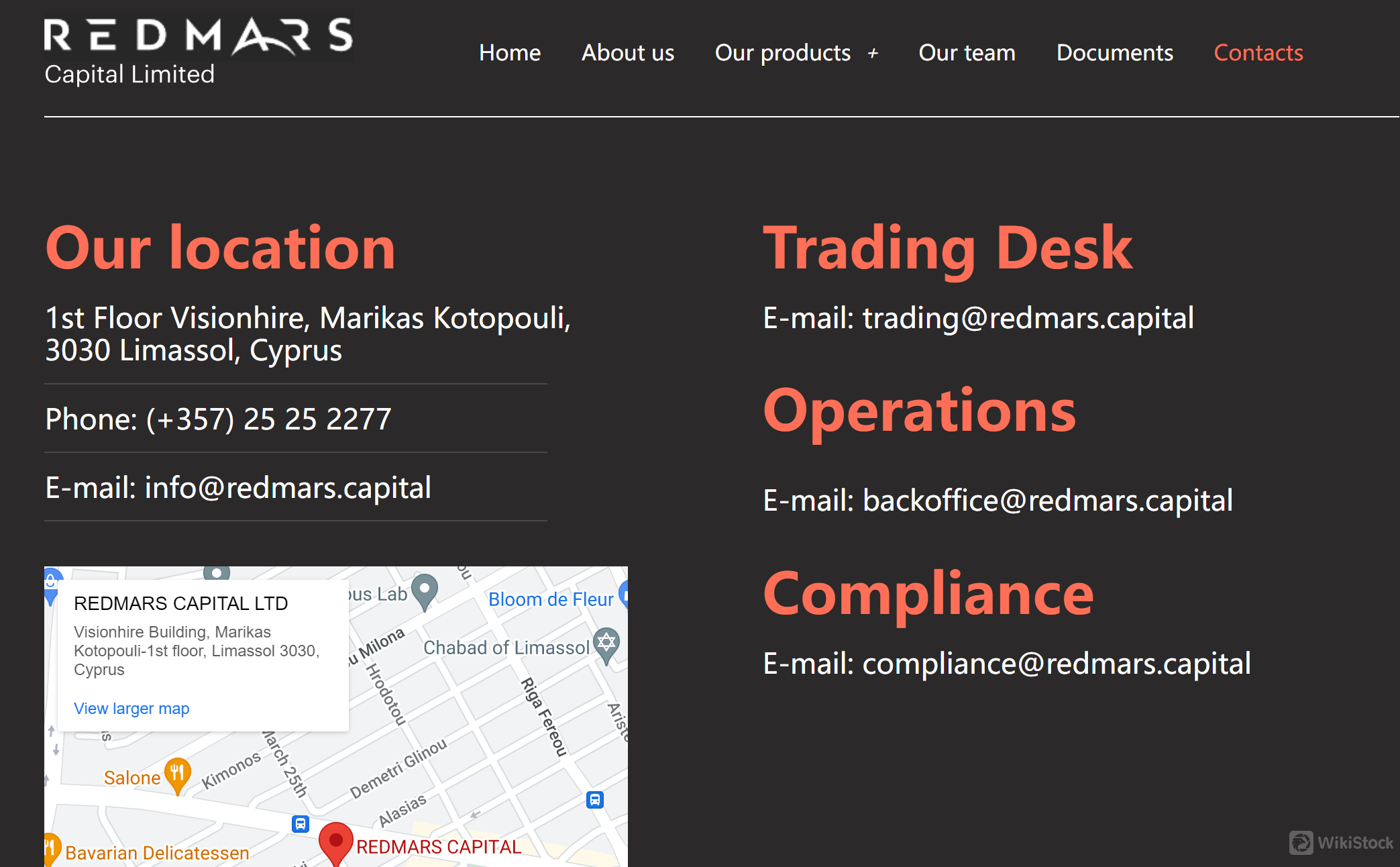

Customer Service

Customer can contact the main office via phone at (+357) 25 25 2277 or reach out via email at info@redmars.capital. These channels provide direct access to information regarding services offered, account management, and general company information.

Specific queries related to trading activities are handled through the trading desk at trading@redmars.capital. This specialized service ensures that clients receive prompt assistance with trading-related matters, including execution, order inquiries, and market information. Operational issues, such as account maintenance and transaction processing, are managed through the back office team, accessible at backoffice@redmars.capital. Inquiries or concerns regarding regulatory matters can be directed to compliance@redmars.capital.

Conclusion

RED MARS presents itself as a reputable player in the financial services industry. RED MARS offers a diverse array of financial products, including international equities, Eurobonds, structured products, and portfolio management services. RED MARS provides a client-centric approach, delivering reliable and dynamic portfolio management solutions tailored to individual client goals.

Frequently Asked Questions (FAQs)

What financial products does RED MARS offer?

International equities, Eurobonds, structured products, and portfolio management services.

How can I contact RED MARS for support?

You can contact RED MARS through phone at (+357) 25 25 2277 or via email at info@redmars.capital. Specific queries related to trading can be directed to trading@redmars.capital, and compliance matters to compliance@redmars.capital.

How secure is my investment with RED MARS?

RED MARS operates under CySEC regulation. However, all investments carry inherent risks, and clients should be aware of these risks before investing.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)