patronfx.com/eu is operated by Forex TB Limited, a Cyprus Investment Firm, authorised and regulated by the Cyprus Securities and Exchange Commission. The company’s CIF licence number is 272/15.

PatronFX Infomation

PatronFX is a forex and CFD broker based in Cyprus, regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 272/15. They offer a variety of investment products for trading, including forex, commodities, stocks, indices, and cryptocurrencies.

Pros & Cons of PatronFX

Pros:

Wide Range of Investment Products: PatronFX offers a diverse selection of tradable assets, including forex, commodities, stocks, indices, and cryptocurrencies.

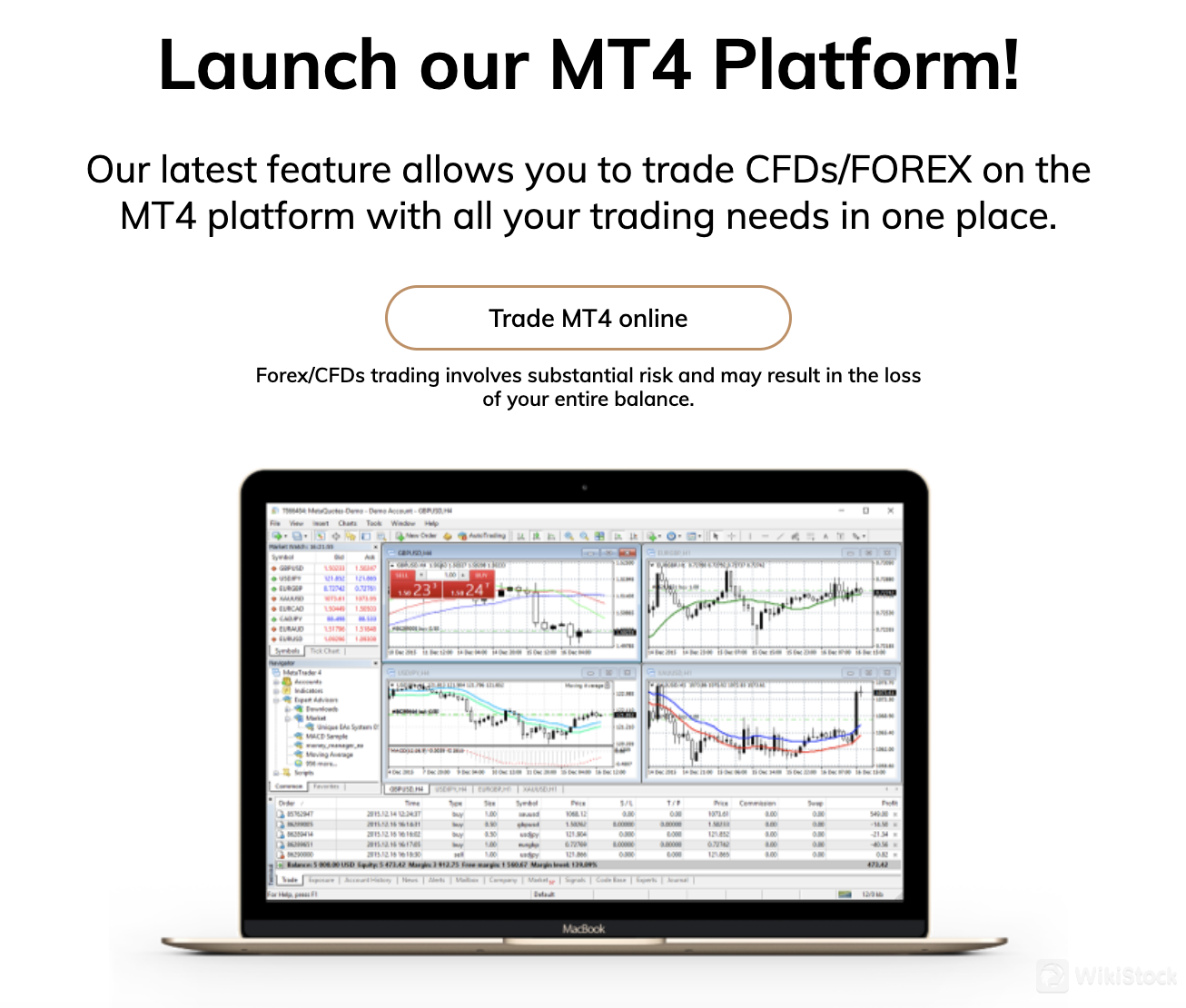

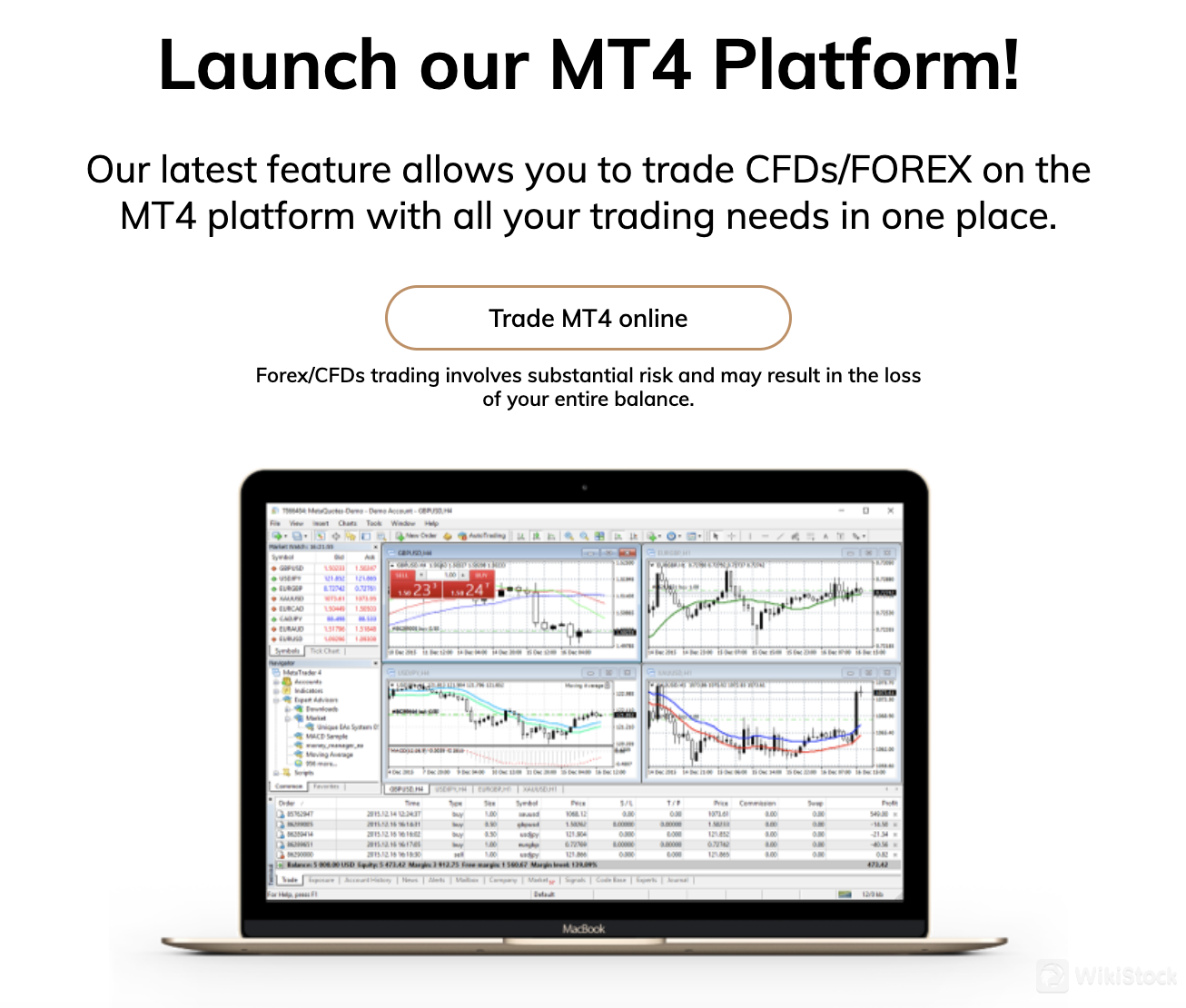

MT4 Platform: PatronFX utilizes the MetaTrader 4 platform, a popular choice among forex brokers. MT4 offers features such as multi-asset trading and market analysis tools.

Segregated Accounts: PatronFX holds client funds in segregated accounts separate from their own funds, which reduces the risk of misuse of client money.

Educational Resources: PatronFX offers some educational materials like CFD Trading Tips, a Glossary, and sections on Technical Analysis, Fundamental Analysis, and the Economic Calendar. These resources can be helpful for new investors or those seeking to learn more about trading strategies and market analysis.

Cons:

Limited Customer Service: While PatronFX provides a phone number and email address for contacting customer service, details regarding customer support hours or response times are not available.

Inactive Account Fees: PatronFX reserves the right to charge a monthly inactivity fee on accounts with no trading activity for one month or more.

Is PatronFX Safe?

Regulation

PatronFX is regulated by the Cyprus Securities and Exchange Commission (CySEC), a European Union regulatory body. Their license number is 272/15. CySEC regulation offers some assurance that PatronFX operates within a regulatory framework and adheres to certain standards.

Safety Measures

PatronFX mentions security measures to protect client funds. Client funds are reportedly held in separate accounts from PatronFX's own funds, reducing the risk of misuse. These segregated accounts are held with reputable investment-grade banks, which can imply a certain level of security.

PatronFX mentions using a PCI scan, which helps identify vulnerabilities in their payment card processing systems. Additionally, they claim to use SSL certificates, which encrypt communication between customers' device and their servers, safeguarding their data during transmission.

What are Securities to Trade with PatronFX?

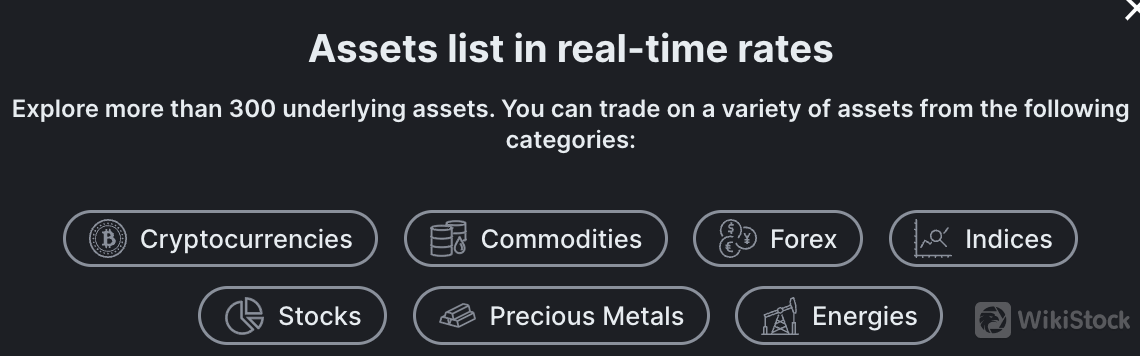

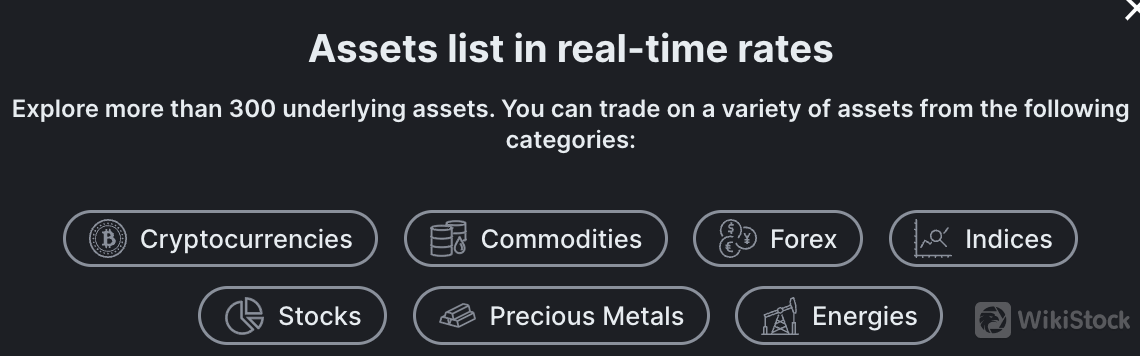

PatronFX offers a wide range of investment products for trading:

Forex: Customers can speculate on currency movements of major currency pairs like EUR/USD or GBP/JPY.

Commodities: Trade contracts for physical commodities, including precious metals (gold, silver), energies (oil, natural gas), and agricultural products.

Stocks: Invest in individual stocks of companies listed on various exchanges.

Indices: Gain exposure to a basket of stocks by trading popular stock market indexes.

Cryptocurrencies: PatronFX now includes cryptocurrencies like Bitcoin and Ethereum, allowing investors to speculate on the price movements of digital assets.

PatronFX Accounts

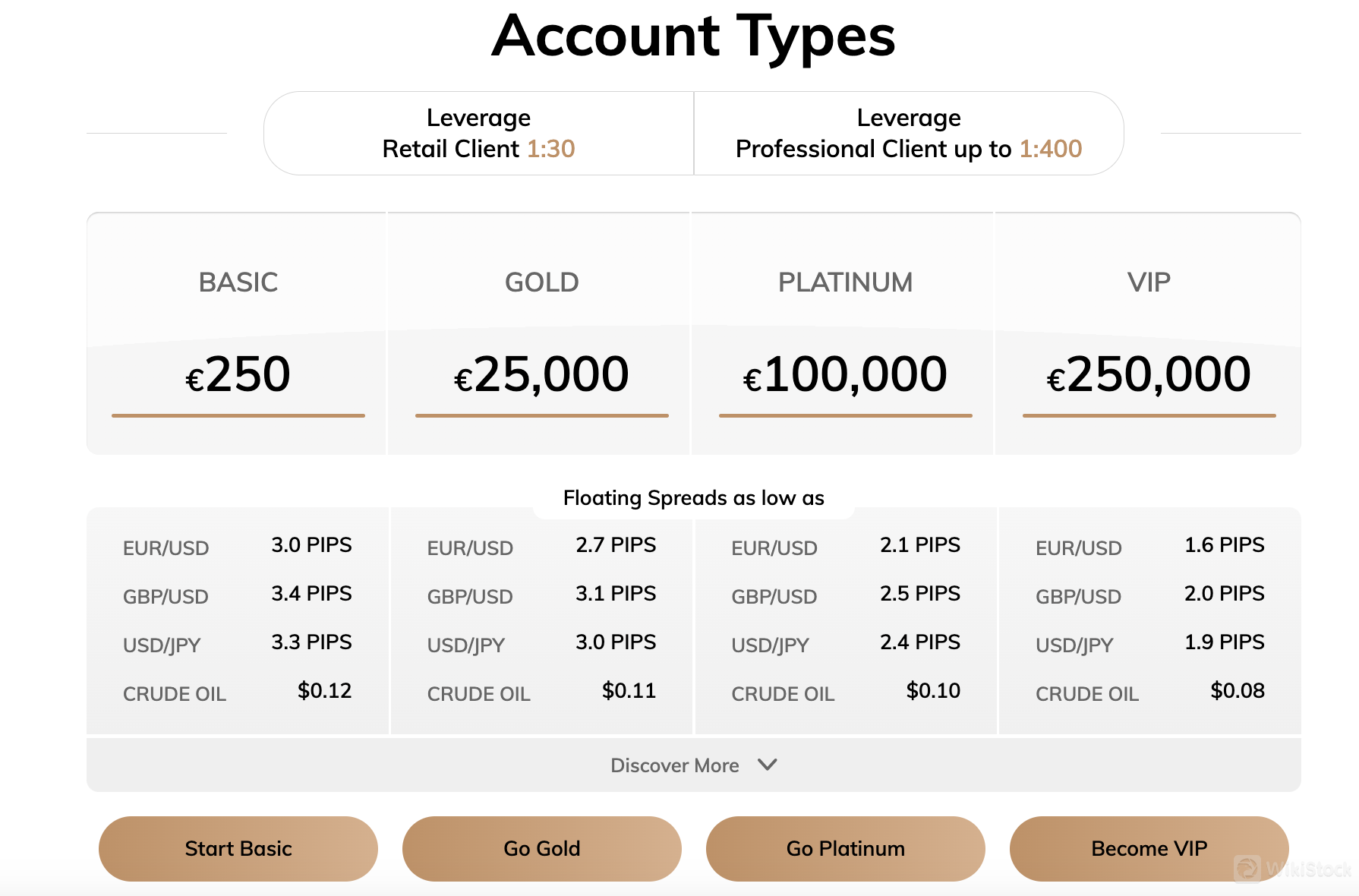

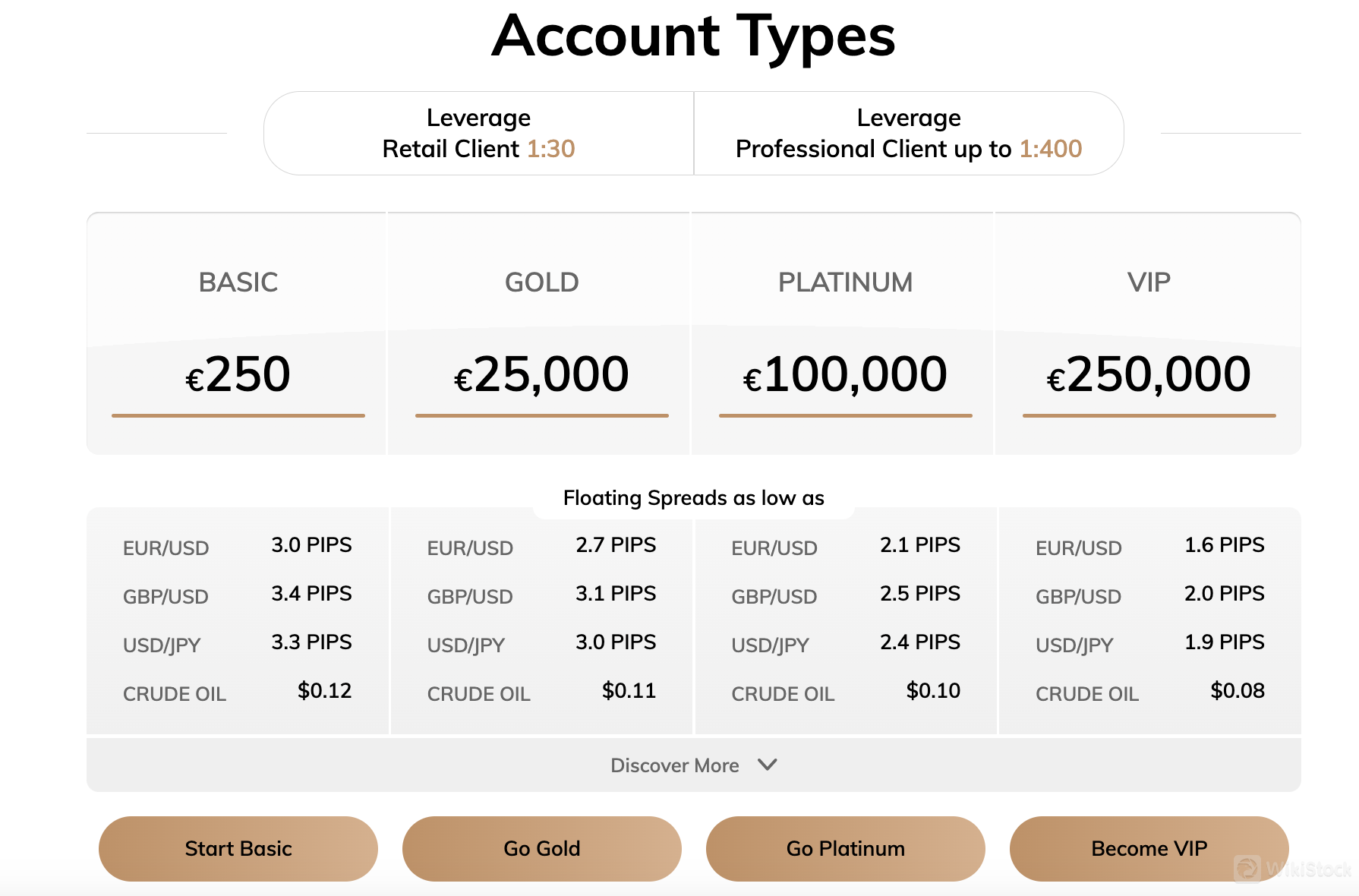

PatronFX offers several account types with varying minimum deposit requirements and benefits:

Basic Account: Minimum deposit of €250. Floating spreads are as low as 3.0 pips for the EUR/USD currency pair.

Gold Account: Minimum deposit of €25,000. Offers tighter spreads of at least 2.7 pips on EUR/USD.

Platinum Account: Minimum deposit of €100,000. Offers even lower spreads of at least 2.1 pips on EUR/USD.

VIP Account: Minimum deposit of €250,000. Boasts the tightest spreads of at least 1.6 pips on EUR/USD.

PatronFX offers leverage for both retail and professional clients on their forex trades.

Retail Client Leverage: Retail clients have access to leverage of up to 1:30. This means that for every $1 deposited, investors can control a position worth up to $30.

Professional Client Leverage: PatronFX offers leverage of up to 1:400 for clients who qualify as professionals under CySEC regulations.

PatronFX Fees Review

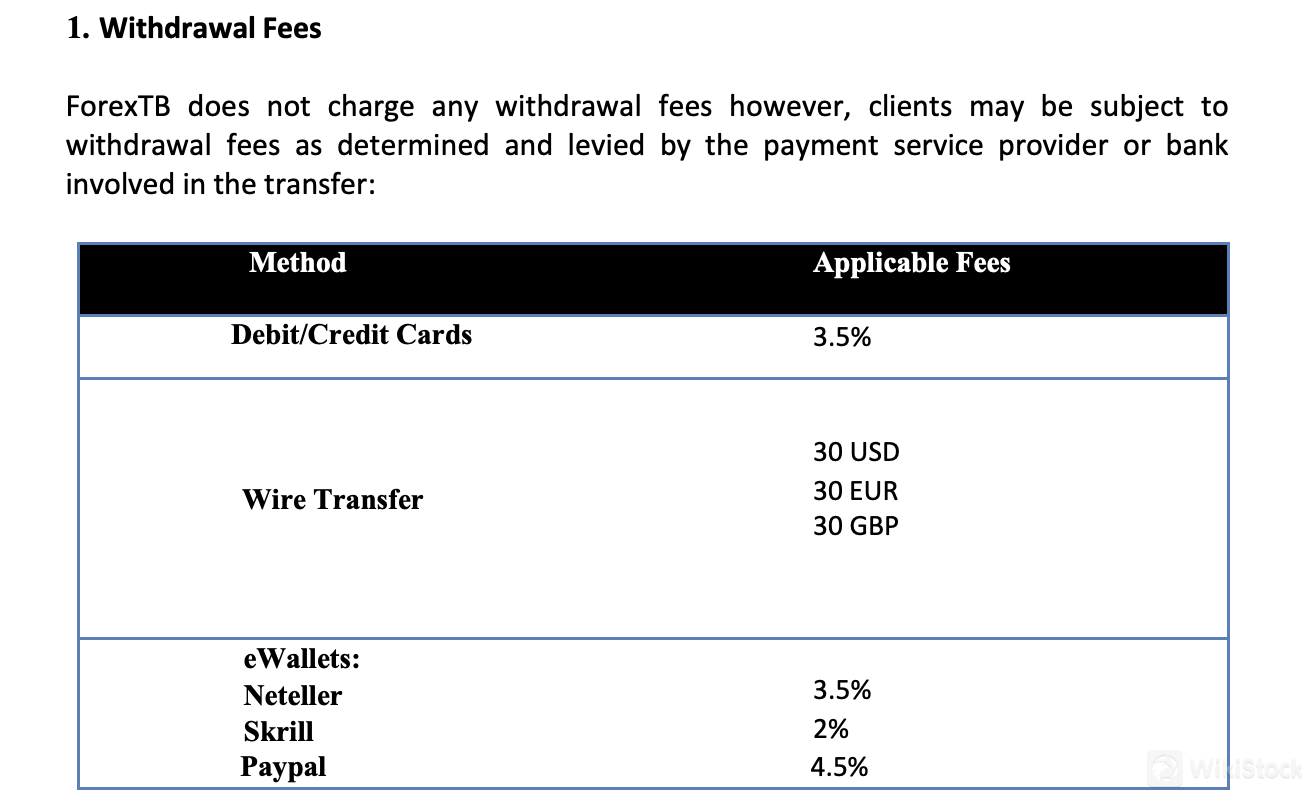

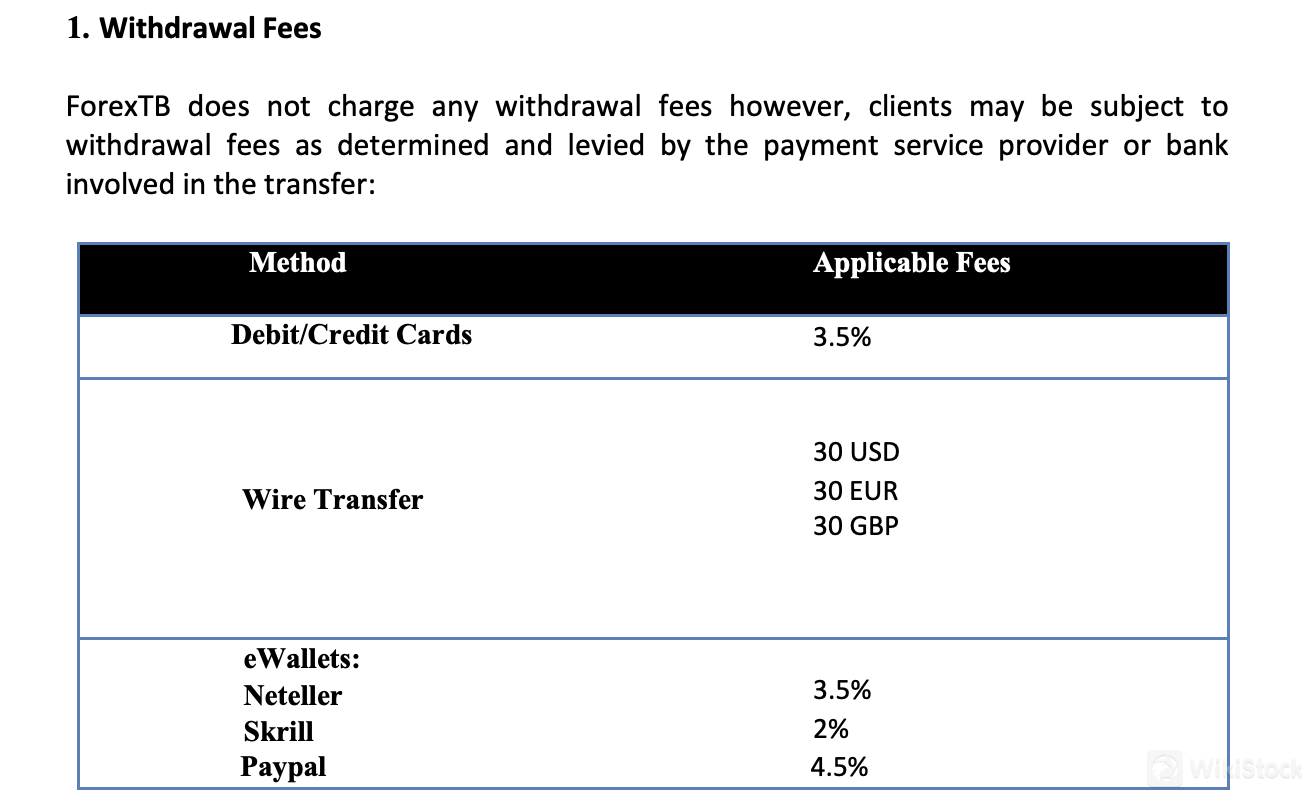

PatronFX's fee structure involves a combination of account management fees, trading costs, and external charges.

Account Management: PatronFX doesn't charge fees for opening or maintaining accounts. However, an inactivity fee of 20 EUR per month applies after one month without any deposits, withdrawals, or trading activity. This fee can be waived if customers experience unforeseen circumstances (natural disasters, etc.) and can provide valid proof.

Trading Fees: PatronFX avoids commission fees on trades. The primary trading cost is the spread, which represents the difference between the buy and sell price of an instrument. These spreads vary depending on the instrument customers trade and can be viewed on the PatronFX platform. Another cost to consider is the swap fee, an interest charge/credit applied for holding positions overnight. Swap rates are subject to market fluctuations and are also available on the platform.

External Fees: While PatronFX itself doesn't charge withdrawal fees, customers' bank or payment processors will. It's important to factor in these external charges when considering overall costs.

PatronFX App Review

PatronFX offers the MetaTrader 4 platform for trading. MT4 is a popular platform used by many forex brokers. MT4 features various tools to help analyze market prices. This includes charts, technical indicators, and drawing tools to identify potential trends and make informed trading decisions. The platform allows for the use of automated trading tools like Expert Advisors. These are pre-programmed algorithms that can execute trades based on set parameters. MT4 features can help investors monitor trends through technical analysis tools and potentially identify profitable trading opportunities.

Research & Education

PatronFX provides access to educational materials like CFD Trading Tips, a Glossary, and sections on Technical Analysis, Fundamental Analysis, and the Economic Calendar. These resources are helpful for new investors or those seeking to learn more about trading strategies and market analysis. Additionally, PatronFX also offers webinars as a way to educate clients and provide market insights.

Customer Service

PatronFX offers two methods for contacting their customer service department:

Phone: They provide a phone number (+357 25 262 681) for direct contact. This can be a convenient option for those who prefer to speak with a representative directly.

Email: For written communication, PatronFX offers an email address (info@patronfx.com).

Conclusion

PatronFX offers a variety of investment products. It offers several account tiers with varying minimum deposits and potential benefits. These range from the Basic Account (€250 minimum) to the VIP Account (€250,000 minimum), with tighter spreads offered for higher tiers. They utilize the MetaTrader 4 (MT4) platform, a popular choice among forex brokers, for trade execution. MT4 boasts features for multi-asset trading, market analysis, and automated trading tools.

FAQs

Is PatronFX safe to trade?

PatronFX is regulated by CySEC, a European Union regulatory body, offering assurance. PatronFX uses a PCI scan and SSL certificates, encrypting communication between customers' device and their servers, and safeguarding their data during transmission.

Is PatronFX a good platform for beginners?

Yes. PatronFX offers educational resources and the MT4 platform, which are friendly for beginners.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)