Mind Money (ex Zerich Securities) is a leading European investment technology and financial engineering hub headquartered in Limassol, Cyprus, and regulated by CySEC CIF License 115/10. Mind Money provides seamless access to stocks, exchange-traded funds, bonds on major stock markets, and opportunities for pre-IPO and IPO investments in the global markets. The company’s classic financial instruments, complemented by a scientific approach and advanced technologies, also encompass custody and portfolio management for clients and tax planning, allowing for the swift movement of funds between different financial markets and institutions in varying tax jurisdictions.

What is Zerich Securities?

Zerich Securities operates in the international stock market, providing investment services like trading in various financial instruments such as stocks, bonds, ETFs, futures, and options. The company serves investors who prefer managing their capital and making investment decisions independently.

A key offering from Zerich Securities is its online trading platform, enabling clients to access global stock markets and execute trades conveniently. It is licensed and regulated by CYSEC.

Pros & Cons of Zerich Securities

Pros:

Diverse Investment Options: Zerich Securities offers a wide range of financial instruments, including stocks, bonds, ETFs, futures, and options.

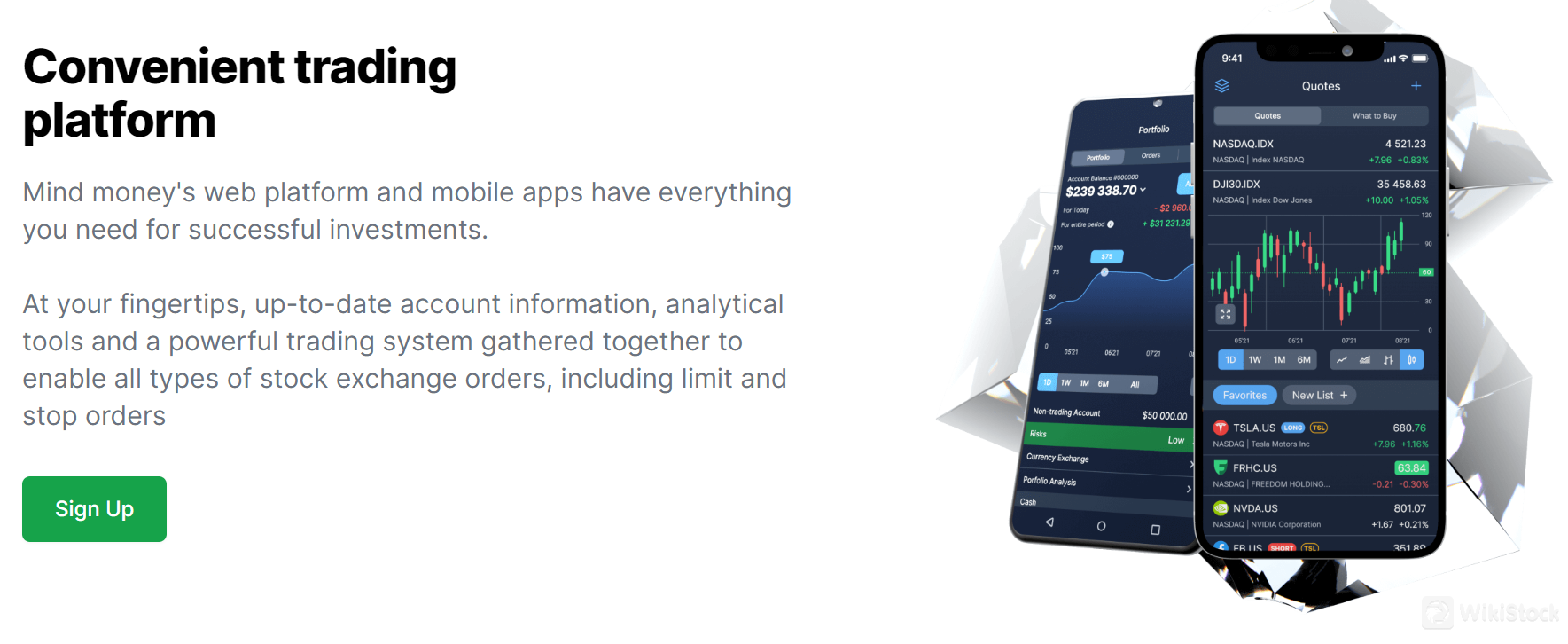

Online Trading Platform: The company's online platform, Mind money, allows for convenient access to global stock markets and easy execution of trades.

Regulatory Compliance: Being licensed and regulated by CYSEC ensures that the company adheres to regulatory standards, providing a level of security for investors.

Cons:

High Margin Rates: The margin rate (14%) is on the higher side compared to some other brokers. This means that clients borrowing funds to trade on margin will incur higher interest costs.

Is Zerich Securities Safe?

Regulatory oversight provides a level of safety assurance to clients. Zerich Securities is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 115/10. As a licensed and regulated entity under CYSEC, Zerich Securities must adhere to strict regulatory standards, which includes maintaining a certain level of financial stability and implementing security measures to protect client funds and data.

What are Securities to Trade with Zerich Securities?

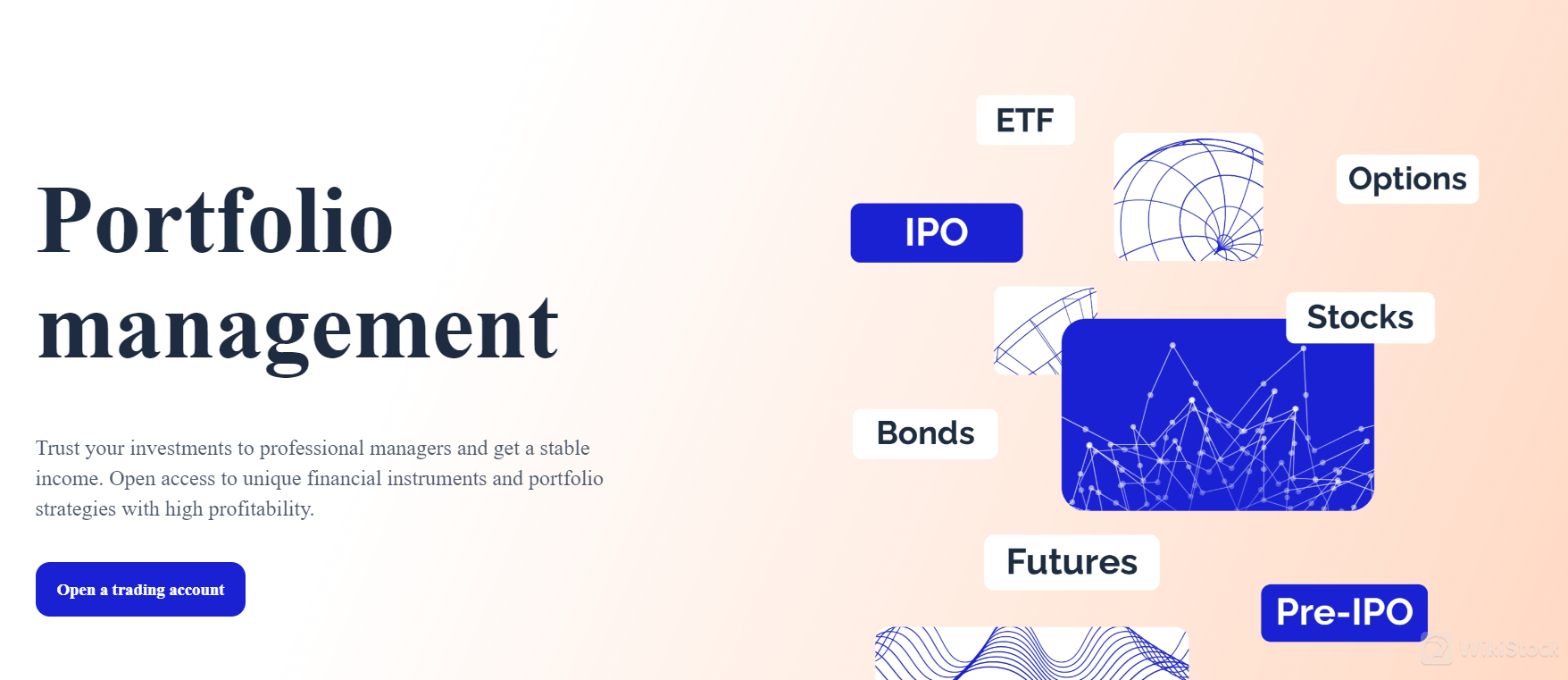

Zerich Securities offers a range of securities for trading, providing clients with diverse investment opportunities.

Stocks: Individual shares of ownership in companies traded on various stock exchanges worldwide.

Bonds: Debt instruments issued by governments or corporations, offering a fixed interest rate and repayment of the principal amount at maturity.

Exchange-Traded Funds (ETFs): Baskets of securities that track a specific index or sector, offering diversification and ease of trading.

Futures Contracts: Agreements to buy or sell security at a predetermined price on a specific future date. Used for speculation or hedging other holdings.

Options Contracts: Contracts that give the buyer the right, but not the obligation, to buy or sell a security at a certain price by a certain date. Used for various strategies like income generation or portfolio protection.

Additionally, it also supports OTC trading. This refers to trading securities that are not listed on a formal exchange. It can include stocks, bonds, and other instruments.

Zerich Securities Accounts

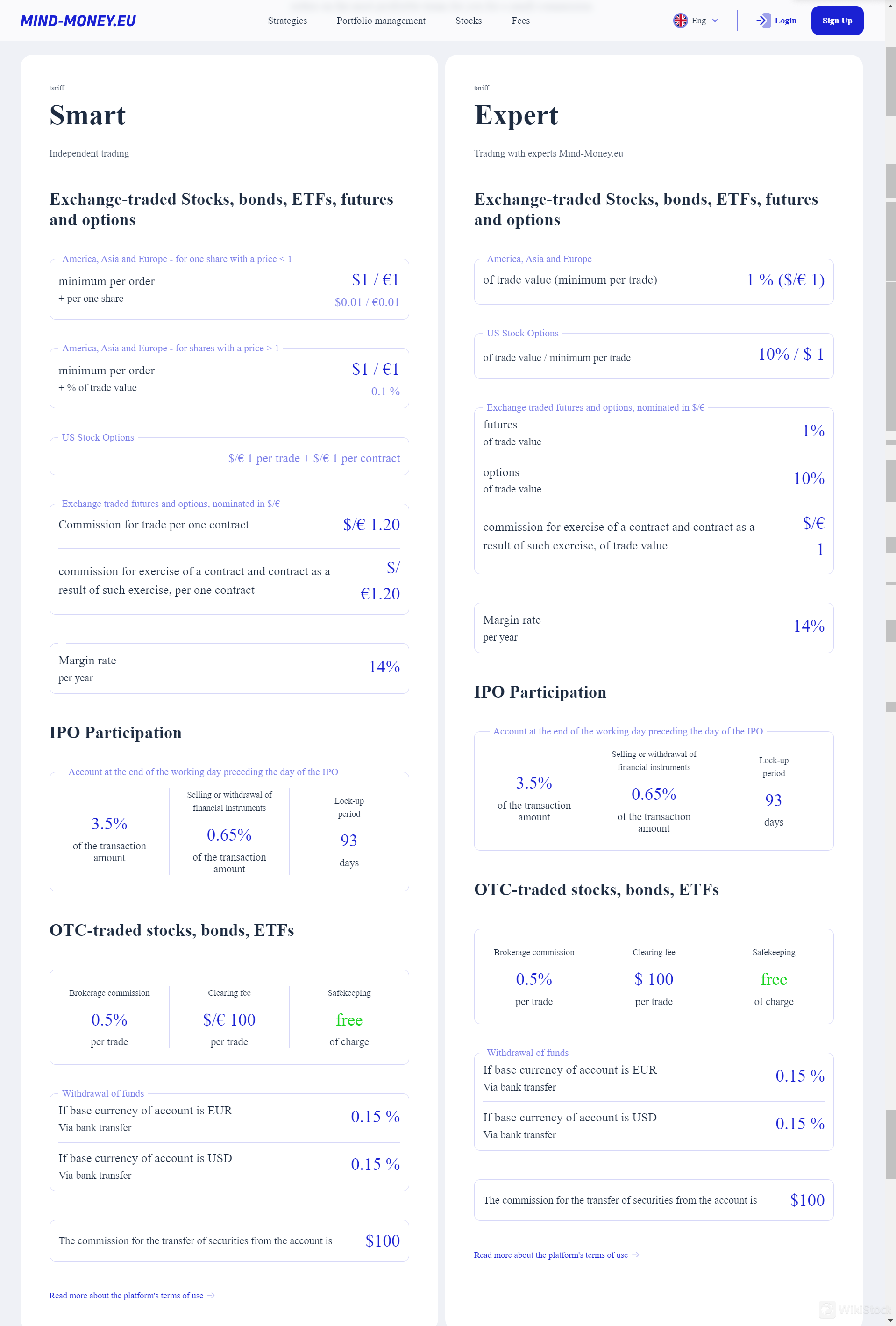

Zerich Securities offers two main types of accounts: Smart and Expert. Clients can choose the account type that best suits their investment goals and trading preferences.

Smart Account: The Smart account is designed for independent traders who prefer to manage their own investments. It offers competitive rates and allows traders to execute trades independently using Zerich Securities' online trading platform.

Expert Account: The Expert account is designed for traders who prefer to receive guidance and support from experienced professionals. This account offers access to the same range of financial instruments as the Smart account but provides additional services such as investment advisory services and personalized portfolio management.

Zerich Securities Fees Review

Zerich Securities' fee structure is relatively competitive and transparent, with some key considerations for potential investors.

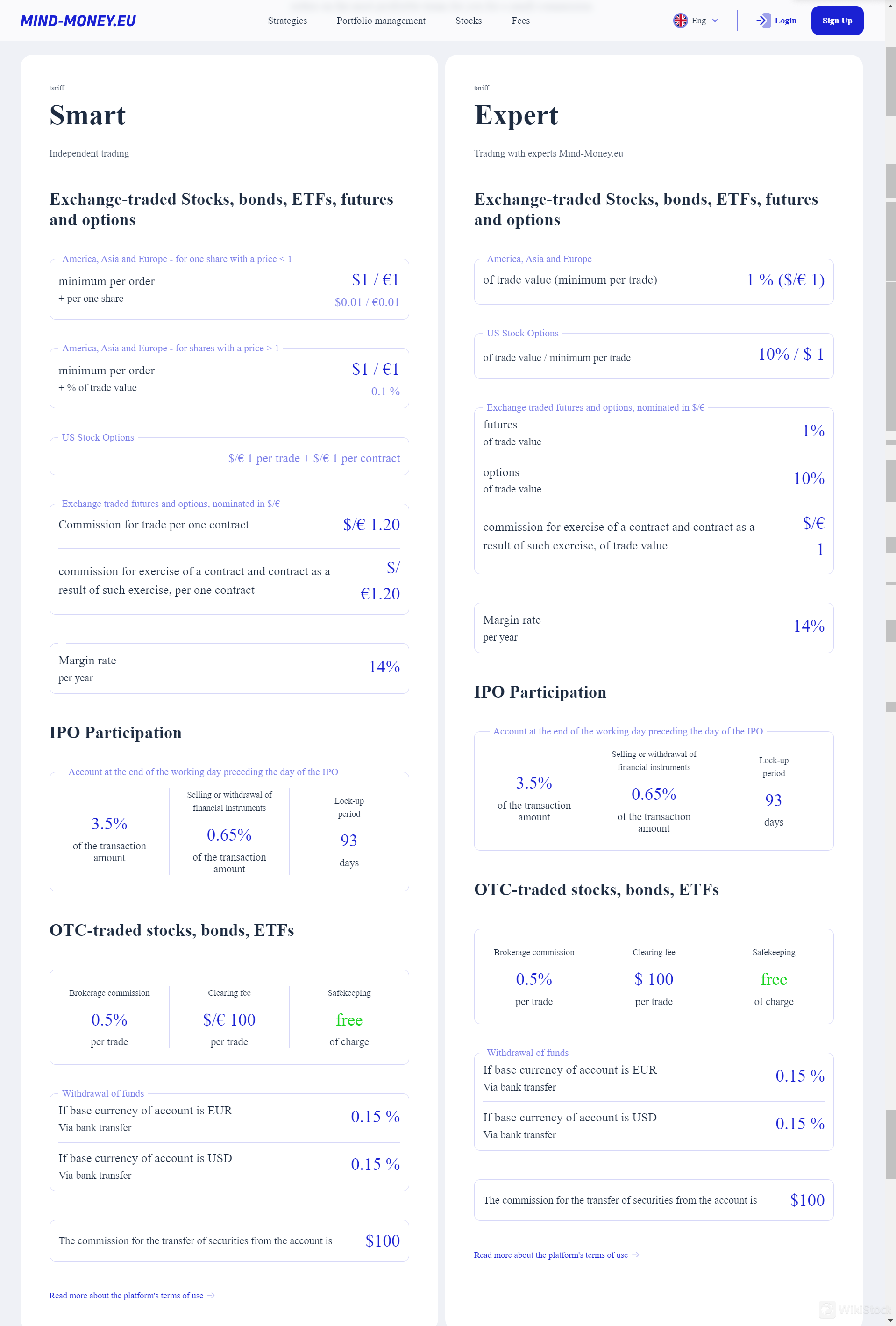

Trading Fees: Zerich Securities charges a 1% transaction fee for exchange-traded stocks in the United States, Asia, and Europe for the Expert account. For the Smart account, the commission for stocks with a price < 1 is $1/€1 per order plus $0.01/€0.01 per share, and for stocks with a price > 1, it's $1/€1 per order plus 0.1% of the trade value.

OTC Trading Fees: For over-the-counter (OTC) trading, Zerich Securities charges a commission of 0.5% for the Expert account and 0.5% per trade plus a $100 clearing fee for the Smart account.

Margin Interest Rates: Zerich Securities charges a margin interest rate of 14% per year, which is on the higher side compared to some other brokers.

Withdrawal Fees: There is a fee of 0.15% for withdrawing funds via bank transfer, regardless of the account type or region.

Other Fees: Zerich Securities charges fees for various other services, such as IPO participation (3.5% of the transaction amount), selling or withdrawal of financial instruments (0.65% of the transaction amount), and a $100 fee for the transfer of securities from the account.

Zerich Securities App Review

Mind Money serves as Zerich Securities' versatile platform, enabling online trading accessible through web browsers and mobile applications. It grants users access to a diverse range of financial instruments and markets, allowing them to engage in trading activities with ease. The platform is equipped with a suite of tools designed to facilitate analysis and trading, such as real-time market data, advanced charting functionalities, and various order options like limit and stop orders.

Customer Service

Zerich Securities is located at 13-15 Grigory Afxentiou Street, I.D.E. Ioannou Building - Office 202, Mesa Geitonia, CY-4003 Limassol, Cyprus.

The headquarters can be contacted at +357 25 755 337, while customer support is available at +35725030992.

For general inquiries, you can email cyprus@zerichsecurities.com.

If you have any complaints, you can email complaints@zerichsecurities.com.

You can also use the contact form on their website to send your name, email, phone number, and message, and they will get back to you as soon as possible.

Conclusion

In summary, Zerich Securities is a regulated brokerage offering a range of financial instruments for independent traders. Its online platform, Mind Money, provides access to global markets. While it has competitive fees and diverse investment options, its high margin rates may be a concern for some traders. Overall, it's a solid choice for those looking for independent trading opportunities with regulatory oversight.

Frequently Asked Questions (FAQs)

What financial instruments can I trade with Zerich Securities?

Stocks, bonds, ETFs, futures, and options, as well as OTC trading.

Is Zerich Securities regulated?

Yes, Zerich Securities is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC).

What is the fee structure at Zerich Securities?

1% transaction fee for exchanged-traded stocks in the Expert Account and 0.5% commissions for OTC trading. Margin interest rates are 14%.

What is the platform offered by Zerich Securities?

Mind Money is Zerich Securities' online trading platform.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Russia

RussiaObtain 1 securities license(s)