EXANTE is an online trading and global investment platform that gives users access to trade global securities from a single account. The platform allows investors to invest in Securities Lending Fully Paid, Futures, Stocks,and more from over 50 foreign exchanges directly from their website or app. Its trading software supports iOS and Android versions, and the website is compatible with Windows, MacOS, and Linux systems. Only one account is needed on its official trading software to achieve global portfolio diversification, and the commission fees are also very competitive. EXANTE currently supports deposits and withdrawals in 30 fiat currencies. However, compared with professional brokers, the platform may not support as many local securities as professional brokers.

One of the major pros of EXANTE is its ability to globally diversify investment portfolios in a low-cost manner. With just one account, users can trade assets from all over the world. EXANTE also offers competitive commission fees compared to traditional brokers. However, the platform may not support as many local securities compared to specialized brokers. Customer support is also only available during business hours.

Yes, EXANTE is a global investment company that provides direct access to the financial markets through our client-centric trading and investment solutions. With over a decade of experience delivering bespoke service to clients, EXANTE is authorized and regulated by the FCA (UK), CySEC (Cyprus), and SFC (Hong Kong) and our footprint extends across 30+ global locations Funds are segregated from the company's operating balance for additional protection. EXANTE also uses bank-grade encryption for data and finances. Two-factor authentication is mandatory for logging into the account to prevent unauthorized access. Overall, EXANTE maintains a safe and secure environment for global investing.

Trading Account:

An all-in-one multi-currency trading account that allows clients to trade over 1,000,000 financial instruments across stocks, ETFs, currencies, commodities, futures, options, and more directly from a single account.

Covers 50+ global markets including the US, Europe, Asia, and beyond.

Client Types:

Private Investors - For individual traders and investors.

Wealth Managers - Bring in clients and manage multiple client accounts at ease. Sign up with a globally regulated broker, and access a reliable counterparty network out of the box. Match your clients with a plethora of classic and innovative instruments: stocks and ETFs, fixed income/bonds, options, hedge funds, futures, metals, currencies, and more.

Family Offices - Access new classes of assets for your clients and make private equity deals. Tap into a variety of instruments — from stocks to currencies. Ensure the utmost protection for your clients assets with a globally licensed broker (SFC Hong Kong, CySEC). Get the IT front/back office from EXANTE for fast operations and reporting.

Banks and Financial Companies - As an institutional client of EXANTE, who can benefit from flexible onboarding, regulatory compliance, omnibus account, granular reporting, and tier 1 clearing.

Trading Technology:

FIX and HTTP APIs for algorithmic and automated traders to seamlessly integrate with EXANTE platforms.

Cross-platform support via apps on App Store, Google Play, and desktop versions for Windows, MacOS, and Linux.

Ensures fastest execution speeds through a network of over 1,100 global servers.

Other Services:

So in summary, EXANTE offers a one-stop financial services platform along with dedicated pre and post-trade support.

EXANTE Accounts

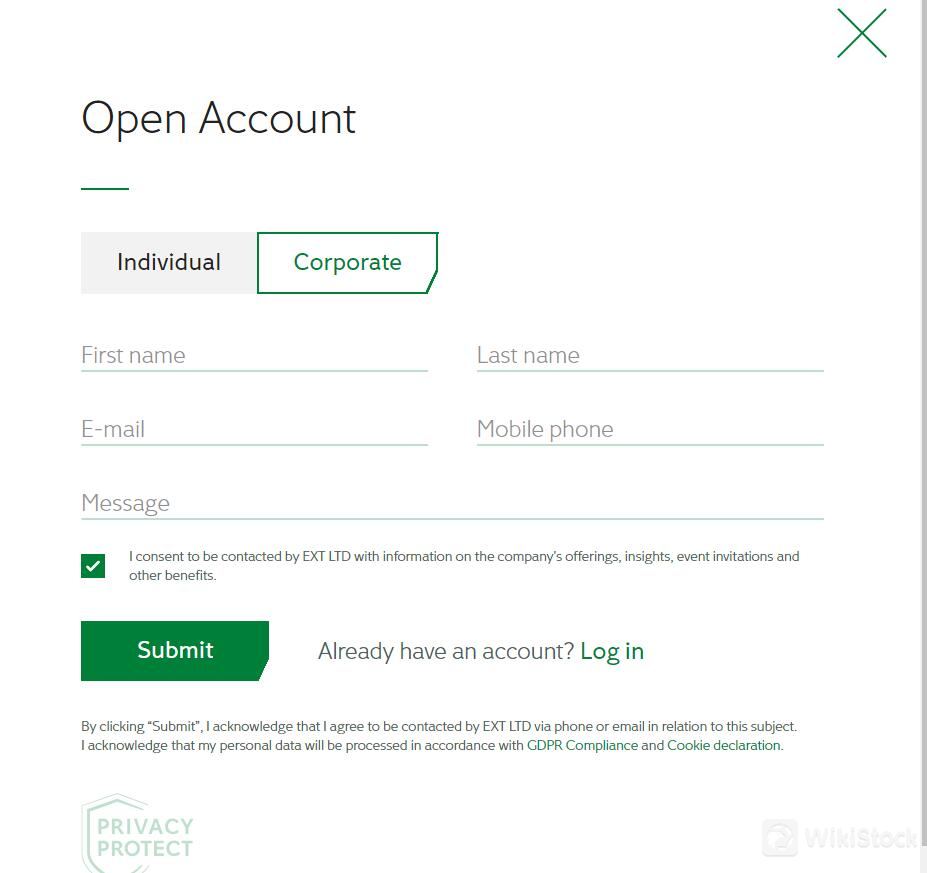

Individual account:

Provide the correct mobile phone number and email address when registering; Fill out a questionnaire to explain your trading experience and areas of interest to open an account that matches your needs; Upload your ID card and address proof materials to achieve real-name authentication, which is usually completed within 1 working day; Make a minimum deposit of 10,000 euros or equivalent currency; After the authentication is passed, you can trade on the client or app.

Corporate account:

Register a company and provide company-related certification materials such as registration certificate and establishment documents; Provide the ID card and address proof materials of directors and shareholders (holding more than 25%); Upload the ultimate beneficial owner certificate; The power of attorney grants the signatory to operate the account on behalf of the company; Make a minimum deposit of 50,000 euros or equivalent currency; After the authentication is passed, it is the same as the personal account process

Joint account:

Each participant opens a personal account separately and passes KYC; Appoint an account manager to open a joint account and upload all participant information; Funds can be transferred from the participant account or directly to the joint account; Up to 4 approved personal accounts can participate in a joint account; The account manager operates the joint account on behalf of all participants

In addition, EXANTE does not charge account opening and fund transfer fees and provides free trading leverage and API access services.

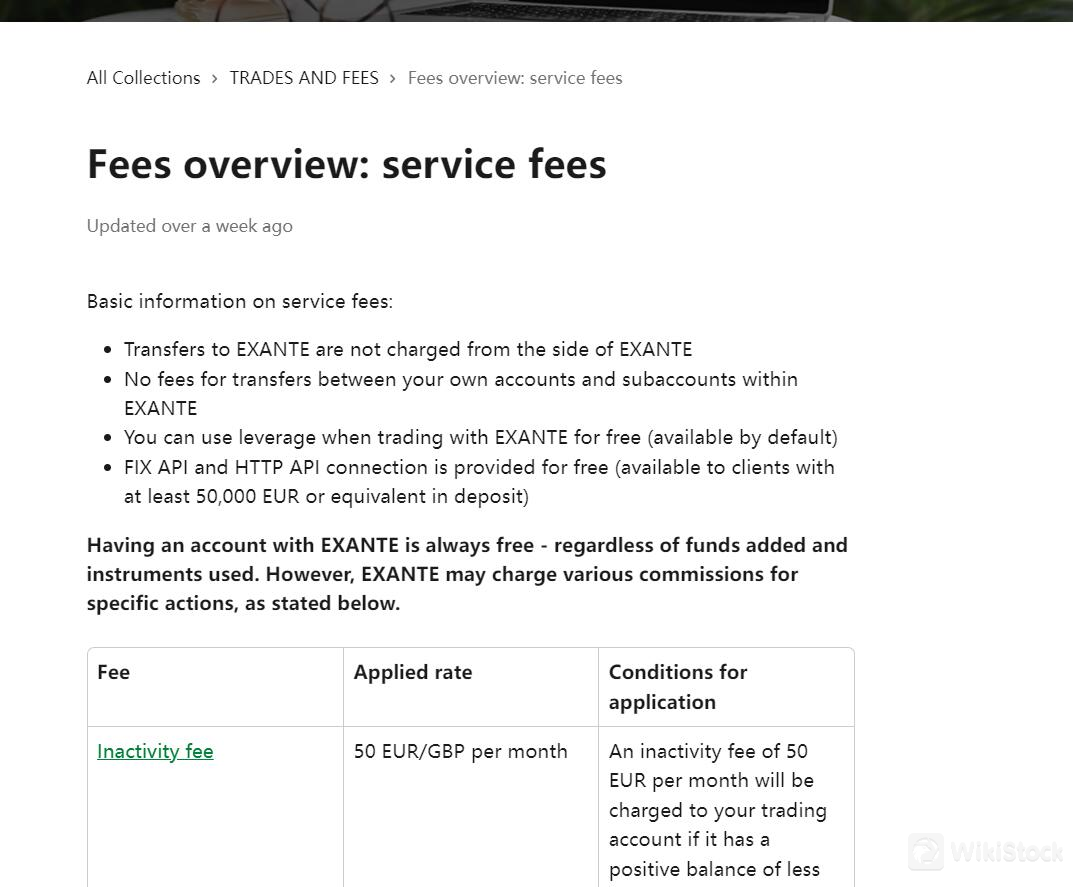

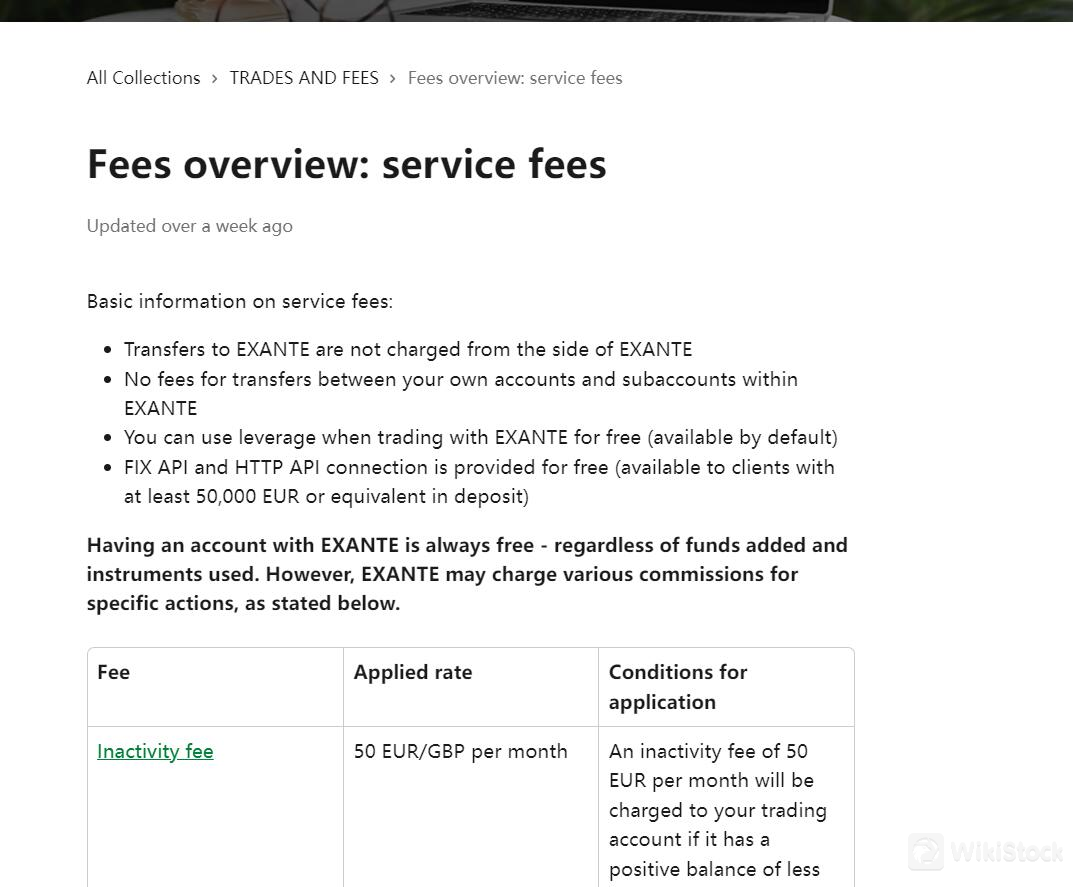

EXANTE Fees Review

Commission fees on EXANTE are amongst the lowest in the industry, ranging from $2-10 depending on the trade size and type. In addition, there are no monthly, yearly, or inactivity fees. Swap interest rates for forex and futures are also competitive. Deposits and withdrawals are free for wire transfers and supported digital currencies like Bitcoin. This makes EXANTE very cost-effective for global traders.

Commissions and Fees:

Exchange-imposed fees vary from 0.02% to 0.2% for stocks, and 0.1% to 0.1927% for Asian exchanges. Futures range from $1.5 to 22.54 HKD per contract. The cash conversion fee is 0.25% for major currencies and 0.4% for others. No fee for conversions via account. Bonds trade from 9 bps, and currency pairs from 0.2 pips spread. Overnight fees apply to short positions and vary by currency/market. The manual voice trade commission is 90 EUR/GBP.

Stocks/ETFs: Major US exchanges charge $0.02/share. Europe ranges from 0.02-0.18%. Exchanges like Euronext are 0.05%.

Asia: Tokyo is 0.1%, Hong Kong is 0.1927%.

Futures: US exchanges are typically $1.5/contract. Major Europe is 1.5 EUR. Others range from $2-22.54 HKD.

Currency pairs have a variable spread from 0.2 pips for major pairs.

Bonds trade from 0.09% of the transaction value.

Cash conversion within the account is free. Otherwise, it's 0.25% for major currencies and 0.4% for others.

Data vendor real-time market fees range from $6-150/month depending on the type of data and account.

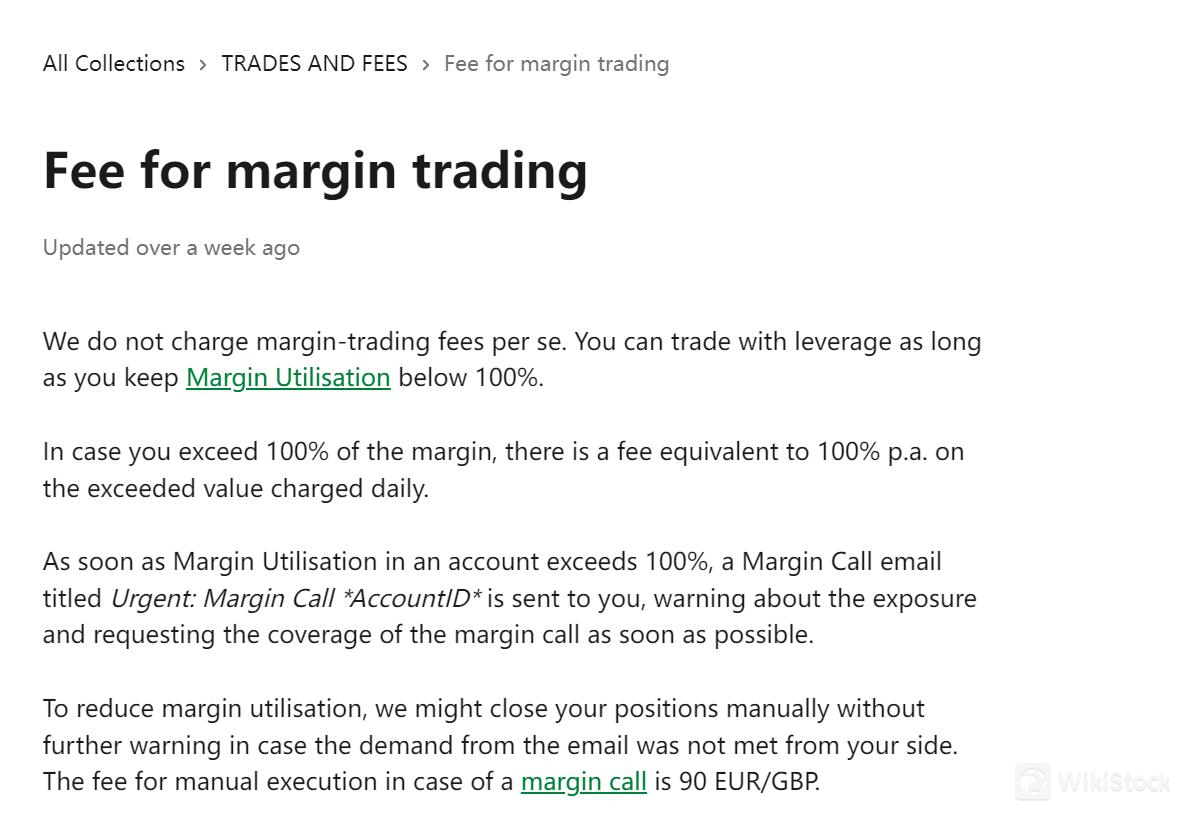

Margin Rates:

No margin fees if utilization stays below the 100% threshold.

Above 100%, daily interest of 100% annualized is charged on the exceeded amount.

Margin call issued at 100% threshold via email, requests resolution.

Manual closeout for unresolved calls triggers a 90 EUR/GBP fee.

Stock short rates default to 12% annually but fluctuate by instrument.

Negative cash balances in currency incur interest rates visible in the account.

Bonds held charged an annual 0.3% custody fee similar to overnight fees.

Third-party bank wire deposits may involve transmission fees from sending/receiving banks.

Rates are subject to change depending on market conditions.

So in summary, commissions are charged per trade while marginal rates apply to overnight, negative balance, and high utilization scenarios.

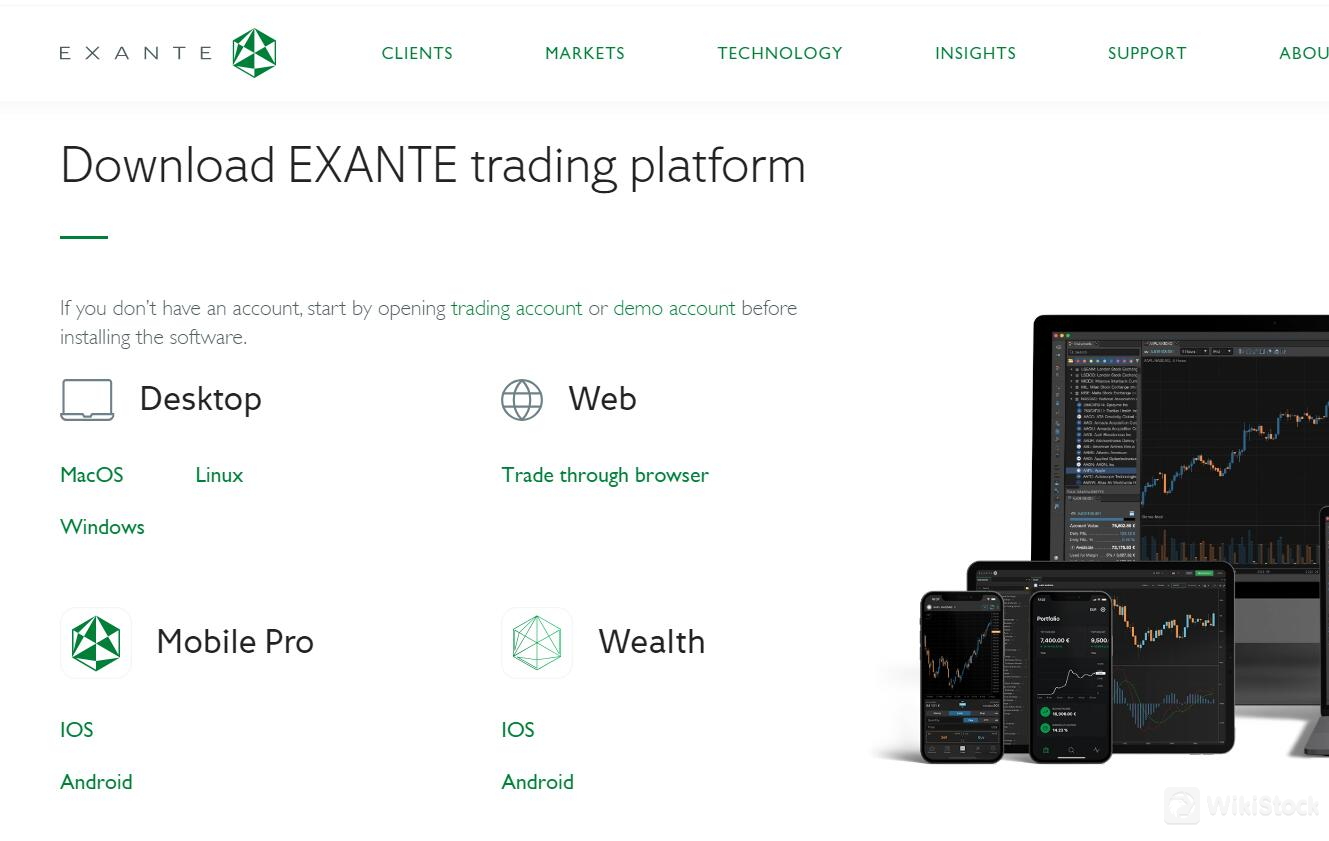

EXANTE App Review

Desktop version:

The desktop version includes three operating system versions: MacOS, Linux and Windows

You need to register an account on the website and download and install it for use

It provides complete futures, foreign exchange, and other financial product trading functions similar to MT4

The interface is easy to operate and supports local strategy development and automatic trading

Web-version:

The web version can be traded directly online on any device through a browser without installation

The functions are the same as the desktop version, and the operation is slightly worse than the local program

Suitable for users who need to trade anytime and anywhere

Mobile Pro:

Professional trading app, IOS and Android system versions

Provide functions such as chat, in-depth marketing, and mobile strategy management

Support local and cloud strategy settings on the mobile phone

The interface is simple and clear, and the operation experience is good

Wealth:

Wealth is a financial file management app

IOS and Android system versions

Can manage assets, bonds, and funds in different accounts around the world

Understand the overall asset allocation and assist in financial decision-making

The function focuses on comprehensive financial management rather than professional trading

In general, EXANTE provides multiple terminals and multiple versions to meet the needs of different users. The Web version has the lowest threshold, the Mobile Pro version has the most powerful functions, and the Desktop version has the highest degree of localization.

Research and Education

In addition to facilitating global investment, EXANTE aims to educate traders through various resources. An economic calendar, trading guides, and articles help users stay on top of market events and strategies. Advanced traders can consult weekly analytical reports for insights. Regular webinars with industry experts offer learning opportunities. Beginners can use paper trading to gain experience without risk. Comprehensive learning resources assist all levels of investors.

Education and other resources:

Provide various intraday technical analysis reports to interpret the daily fluctuations of the financial market.

Regularly publish thematic columns to deeply interpret economic events and their possible impacts.

Rich video tutorials and e-book resources to introduce various trading strategies and theoretical knowledge.

The headquarters regularly holds various online and offline seminars and training courses.

Introduce a professional Q&A community in the APP to maintain a user communication and learning platform.

The official website includes a large number of relevant research reports and industry analysis downloads.

Third-party research:

EXANTE invites many independent analysts and institutions to write special research reports.

This part of the research content is not developed by EXANTE itself, but commissioned by a third-party institution.

The research scope includes various topics such as macroeconomics, industry trends, and individual projects.

Help users obtain professional research and judgment references from multiple angles.

In short, EXANTE also regularly introduces and publishes independent research results of some third-party institutions based on its research.

Customer Service

While only available during business hours, EXANTE customer support aims to provide timely assistance. Questions can be addressed through live chat, email, and telephone. Response times are generally good with issues usually resolved promptly. Customer feedback and reviews have been largely positive regarding the helpfulness of EXANTE representatives. Multilingual support is also available in several key languages for global traders.

Specific customer service support methods:

Help Center: Users can browse the rich knowledge base online to find answers

24-hour customer service support: Users need to log in to contact the customer service team

Contact the account manager: Users can provide personal information for more help

Address:28 October Avenue, 365 Vashiotis Seafront Building, 3107, Limassol, Cyprus

Telephone:+357 2534 2627

Web: www.exante.eu

Specific customer service support hours:

The Help Center can be queried 24 hours a day

If the Help Center cannot solve the problem, you can contact manual customer service

Contact the account manager for consultation and provide services during working hours

In general, EXANTE provides customer service support through multiple channels, including the Help Center and Contact the Manager support all day, and the customer service support time is 24 hours a day, and there is no clear statement of service hours during holidays.

Conclusion

In conclusion, EXANTE continues to establish itself as a trusted platform for global investing with low fees, robust tools, and a commitment to education. It provides diversified access to a wide range of securities across over 50 exchanges worldwide through a single account. This makes EXANTE well-suited for active traders seeking international opportunities as well as novice investors looking to build globally diversified portfolios cost-effectively. For traders and investors seeking integrated global market exposure, EXANTE deserves strong consideration.

FAQs

Is EXANTE a good platform for beginners?

EXANTE provides various educational resources like webinars, articles, and simulator trading tools to help beginning traders learn. Its intuitive interfaces also make the platform easy for novices to use.

Is EXANTE legit?

Yes, EXANTE is a fully licensed and regulated broker. EXANTE is authorized and regulated by the FCA (UK), CySEC (Cyprus), and SFC (Hong Kong). Customer funds are securely held to protect investments.

Is EXANTE good for investing/retirement?

While beginner-friendly, EXANTE can also be used by long-term investors and retirement planning due to its low fees, wide choice of ETFs, and globally diversified opportunities. Its tools and consolidated account access make it suitable for buy-and-hold strategies.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to a total loss of invested funds, so comprehending associated risks before engaging is crucial.

Poland

PolandObtain 1 securities license(s)