Grandis Securities Ltd is an EU regulated Investments Firm providing investment services. Grandis Securities Ltd is licensed as a Cyprus Investment Firm and is regulated by the Cyprus Securities and Exchange Commission (“CySEC”) under the Authorisation CIF 343/17.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

What is Grandis Securities?

Grandis Securities is a regulated financial services provider based in Nicosia, Cyprus, operating under the license of the Cyprus Securities and Exchange Commission (CYSEC). The company offers a comprehensive range of investment services tailored to meet the diverse needs of its clients. These services include the reception and transmission of orders, execution of orders on behalf of clients, and ancillary services such as safekeeping and administration of financial instruments, as well as foreign exchange services.

Grandis Securities facilitates trading in a variety of financial instruments, including transferable securities, money-market instruments, units in collective investment undertakings, and a wide array of derivative contracts.

Pros & Cons

Pros Regulated by CYSEC: Grandis Securities is regulated by the Cyprus Securities and Exchange Commission (CYSEC), ensuring adherence to stringent standards for investor protection and market integrity.

Comprehensive Financial Instruments: Provides access to a variety of financial instruments such as transferable securities, money-market instruments, units in collective investment undertakings, and a wide array of derivative contracts.

Strong Ancillary Services: Offers robust ancillary services including safekeeping and administration of financial instruments, and foreign exchange services connected to investment services.

Informative NEWS Section: The NEWS section provides timely and relevant market news, expert analysis, in-depth reports, and commentary, helping investors make informed decisions.

Cons Limited Information on Fees: There is no detailed information provided about account fees, margin interest rates, or other costs, which could be a concern for clients.

App/Platform Not Mentioned: There is no specific mention of a proprietary trading platform or mobile app, which is a drawback for tech-savvy investors looking for on-the-go trading solutions.

Lack of Promotions: Currently, there are no available promotions or special offers for new or existing clients, which could make the service less attractive compared to competitors offering bonuses or discounts.

Customer Support Details Sparse: While contact details are provided, there is no mention of support hours, languages available, or additional customer service features like live chat, which could affect customer experience.

Unmentioned Account Minimums: There is no information on the minimum account balance required, which might be critical for investors to know before opening an account.

Is Grandis Securities Safe?

Grandis Securities is a regulated financial services provider operating under the oversight of the Cyprus Securities and Exchange Commission (CYSEC) in Australia, holding license No. 343/17. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations set forth by CYSEC, Grandis Securities ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with Grandis Securities?

Grandis Securities offers a wide range of investment services and financial instruments to cater to diverse client needs.

Investment Services

1. Reception and Transmission of Orders

2. Execution of Orders

Ancillary Services

1. Safekeeping and Administration

2. Foreign Exchange Services

Financial Instruments

1. Transferable Securities

2. Money-Market Instruments

3. Units in Collective Investment Undertakings

4. Derivative Contracts

Options, Futures, Swaps, Forward Rate Agreements:

Contracts related to securities, currencies, interest rates, yields, or other financial indices/measures.

Can be settled either physically or in cash.

Commodities:

Derivative contracts related to commodities, including those settled in cash or physically traded on regulated markets or MTFs.

Includes physically settled commodity contracts not otherwise mentioned and those with characteristics similar to other derivatives.

Credit Risk Transfer:

Financial Contracts for Differences (CFDs):

Miscellaneous Derivatives:

Contracts relating to climatic variables, freight rates, emission allowances, inflation rates, or other official economic statistics.

Also includes contracts on various assets, rights, obligations, indices, and measures, provided they have characteristics of other derivative financial instruments and are traded on regulated markets or MTFs, or cleared and settled through recognized clearing houses.

Research & Education

Grandis Securities' NEWS section is a comprehensive resource designed to keep investors informed and up-to-date with the latest developments in the financial world. This section offers timely and relevant market news, covering a wide range of topics including economic updates, corporate earnings reports, regulatory changes, and global market trends. The NEWS section aims to provide investors with the insights they need to make informed decisions, featuring expert analysis, in-depth reports, and commentary on significant market movements.

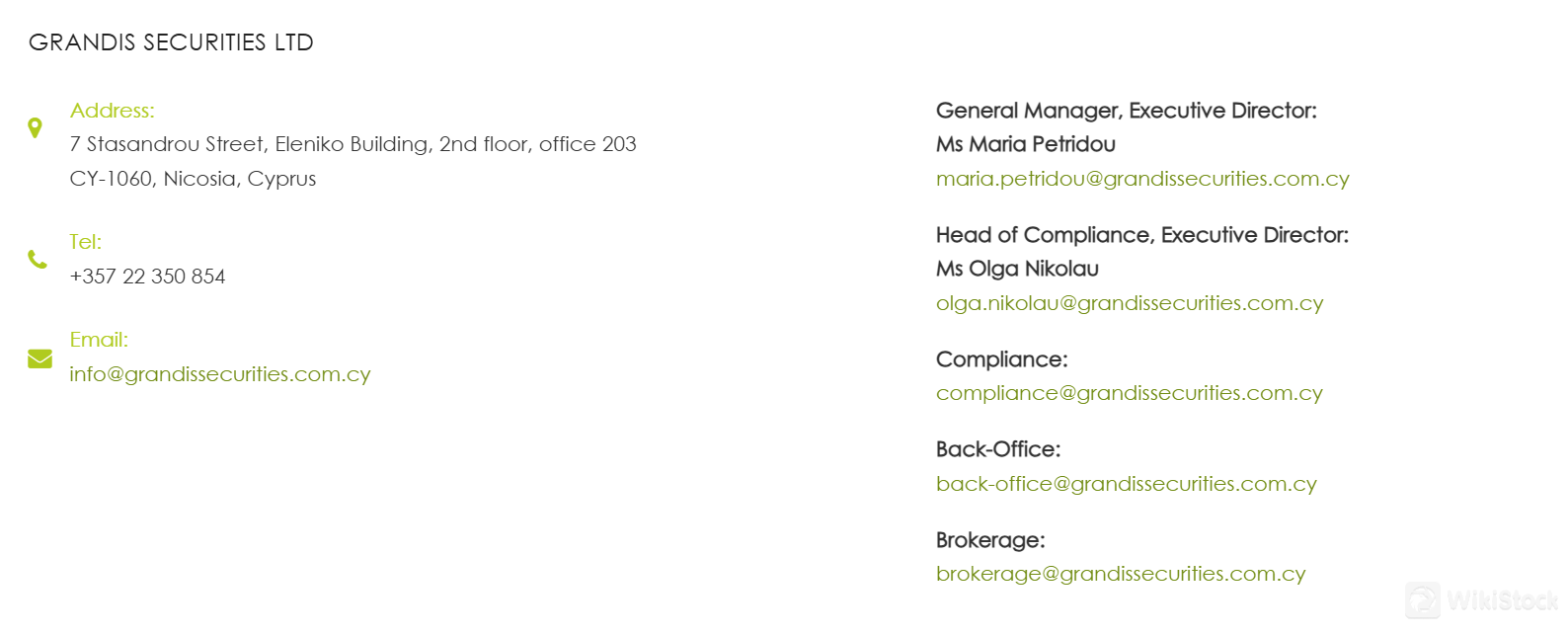

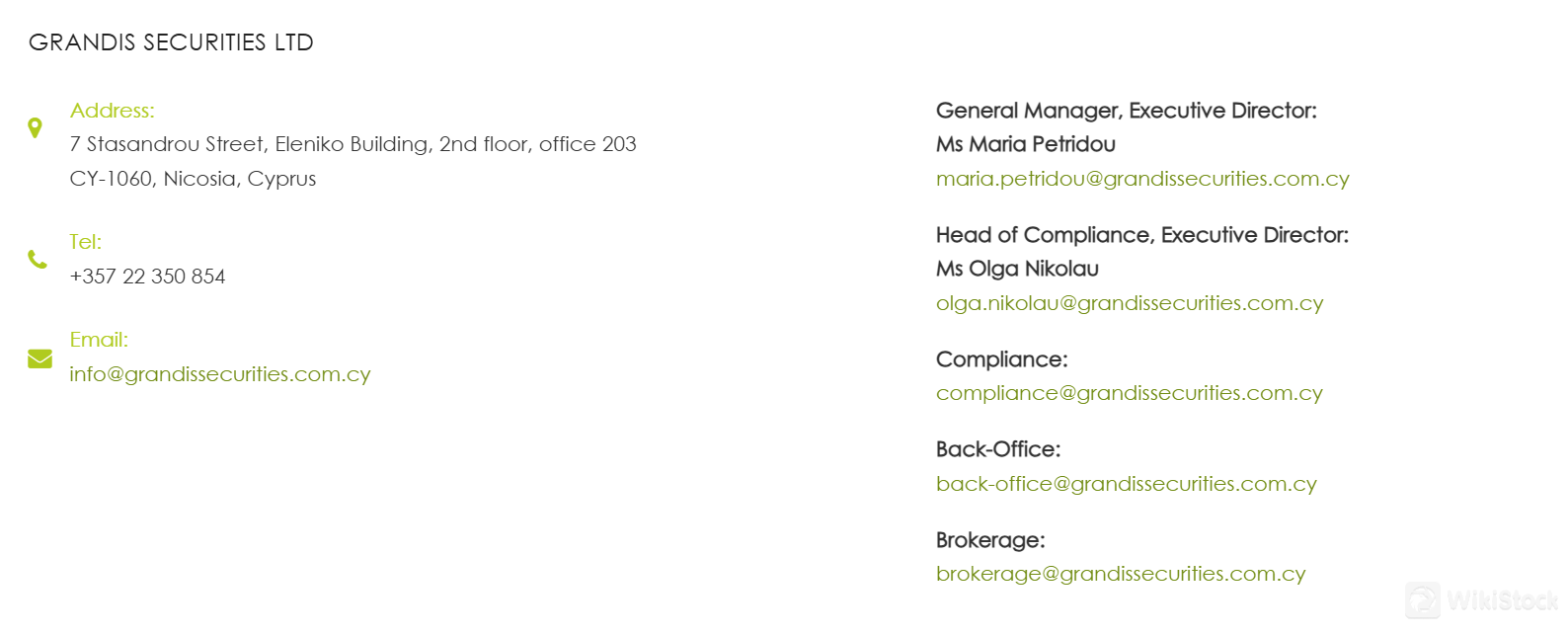

Customer Service

Grandis Securities provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Address: 7 Stasandrou Street, Eleniko Building, 2nd floor, office 203, CY-1060, Nicosia, Cyprus

Phone: +357 22 350 854

Fax: +357 22 283 651

Email: info@grandissecurities.com.cy

Conclusion

In conclusion, Grandis Securities offers a broad range of investment services and financial instruments, providing comprehensive support for diverse client needs. Operating under the regulation of CYSEC in Australia, it adheres to strict standards aimed at protecting investors and maintaining market integrity.

However, the platform lacks transparency in key areas such as fees, margin interest rates, and account minimums, which could pose challenges for clients. Additionally, the absence of a proprietary trading platform or mobile app, along with limited information on customer support and promotions, may deter tech-savvy investors seeking robust, accessible trading solutions.

Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is Grandis Securities suitable for beginners?

Grandis Securities is not the most suitable option for beginners due to the lack of specific information provided regarding account minimums, fees, and educational resources tailored for novice investors. Additionally, the wide range of financial instruments and complex derivative contracts offered may be overwhelming for those new to trading.

Is Grandis Securities legit?

Yes, Grandis Securities is regulated by the Cyprus Securities and Exchange Commission (CYSEC) in Australia, holding license No. 343/17.

What types of investment services does Grandis Securities offer?

Grandis Securities provides a range of investment services including the reception and transmission of orders, and the execution of orders on behalf of clients.

Does Grandis Securities offer trading in commodities?

Yes, Grandis Securities offers trading in commodities through derivative contracts, including options, futures, and swaps. These can be settled either in cash or physically and are traded on regulated markets or MTFs.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)