Variable Fees: Fees for services such as bond listings can vary based on factors like issuer status and asset backing, adding complexity to cost estimation.

Is It Safe?

Regulation:

Eurivex operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CYSEC) with license no. 114/10, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores Eurivex's commitment to integrity and credibility in its services.

Safety Measures:

Eurivex employs robust security measures through a stringent privacy policy including encryption protocols, firewall protection, and regular security audits to safeguard client information. Access controls and strict data handling procedures ensure compliance with stringent privacy standards and protect against unauthorized access or breaches.

What are Securities to Trade with Eurivex?

Eurivex offers a comprehensive suite of services across multiple financial categories.

Investment Products

Shares: Eurivex allows companies based in the EEA to issue shares, offering options such as ordinary, preference, or other types of shares, even for startups without prior history.

Bonds: Eurivex specializes in listing various types of bonds, including traditional bonds with fixed coupons, floating rates, zero-coupon bonds, and performance-linked notes on the Vienna MTF.

Fundraising Solutions

Seed Funding, Early Funding, Growth Funding: Eurivex assists startups and high-growth companies in raising funds by providing a structured approach, including preparation, strategy consultation, and network engagement to achieve funding goals.

Financial Market Listings

Bond Listings on Vienna MTF: Eurivex helps international companies list debt instruments on the Vienna MTF quickly and at competitive rates. The process does not require a prospectus but instead uses an Information Memorandum. Bonds can be listed in various forms, including traditional bonds with fixed coupons, floating rates, zero-coupon bonds, and performance-linked notes. Eurivex ensures a streamlined process, usually securing listing approval within 10 working days. Additionally, Eurivex handles all necessary preparations, including ISIN and CFI code acquisition, bond registry dematerialization, and submission to the Vienna Stock Exchange.

Registry Setup in Euroclear and CREST: Eurivex prepares necessary documentation, secures ISINs, and facilitates the dematerialization and electronic delivery of bonds for listing approval and trading. The issuer has the option to decide the clearing system, such as Euroclear or CREST.

Depository Services

Depository for AIFs & RAIFs: Authorized by CySEC, Eurivex acts as a depository for Alternative Investment Funds (AIFs) and Registered AIFs (RAIFs), focusing on investor protection and regulatory compliance.

Custodian Services: Eurivex provides safekeeping, record-keeping, and verification services for assets not eligible for custody, along with cash monitoring and due diligence on third-party service providers.

Trading and Settlement

Trading Bonds on Vienna MTF: Eurivex offers trading services for bonds listed on the Vienna MTF, ensuring compliance with exchange rules and providing options for clearing through systems like Euroclear and CREST.

Custodian Services and Safe Custody: Eurivex holds financial instruments in safe custody and offers a complete package for bond listing, custody, and trading.

Additional Services

Pre-IPO Planning: Eurivex supports equity issues to prepare companies for IPOs on recognized EU stock exchanges, providing comprehensive guidance throughout the process.

Alternative Investment Products: Eurivex provides expertise in listing various financial instruments such as shares, bonds, notes, and funds on EU stock exchanges, ensuring regulatory approval and broad investor access.

Fees Review

Eurivex charges fees for its diffeerent services. The fees to raise funds start from as low as 1%, with the exact rate dependent on various factors such as the Issuers brand recognition, asset backing, previous track record, the company's registration status, and the profiles of the directors and team members.

For trading activities, retail investors typically do not incur brokerage fees, while well-informed and professional investors will face brokerage fees, which are said to be displayed on the Eurivex electronic platform prior to investment. Since no trading platform link on its website, you should make clear of these fees by contacting with the company directly for trading platform account before trading.

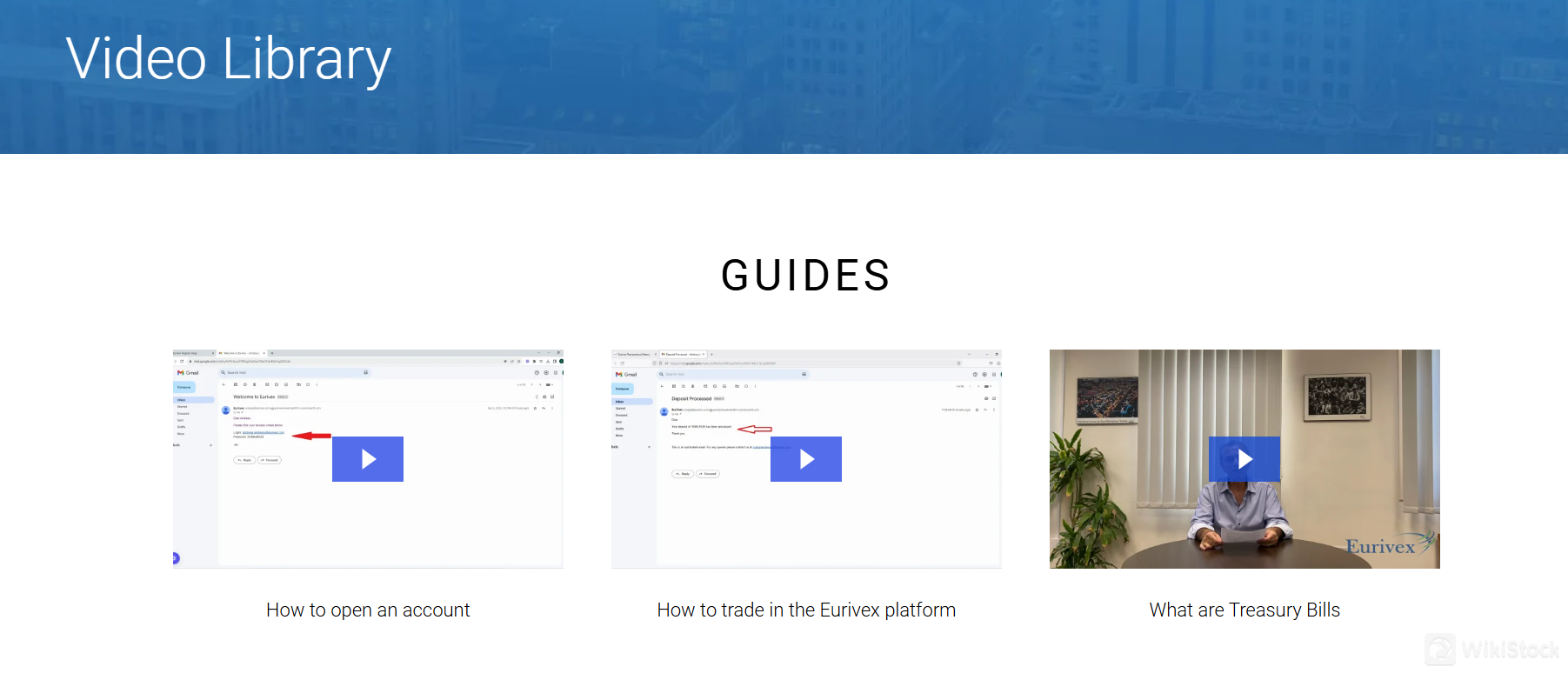

Research & Eduation

Eurivex offers educational resources primarily focused on video content. They provide tutorials on topics such as account opening procedures and navigating their trading platform. Additionally, their educational offerings include explanations of financial instruments like Treasury Bills.

Customer Service

Eurivex provides multiple customer service channels to support its clients.

They can be reached by phone at +357-22028830 and by email at info@eurivex.comfor direct inquiries.

Additionally, clients can use a contact form available on their website for more specific requests.

Eurivex maintains a presence on social media platforms including Facebook, Twitter, LinkedIn, and Instagram for updates and engagement.

An FAQ section on their website offers quick answers to common questions.

Their physical address is 18 Kyriacou Matsi Ave, Victory Tower, 1st floor, Nicosia 1082, Cyprus for personal visit and communication face to face.

Conclusion

Eurivex stands as a reputable financial services firm offering a broad range of investment and fundraising solutions, bond listings and comprehensive depository services. Its commitment to integrity, credibility, and regulatory compliance is underscored by its operation under the Cyprus Securities and Exchange Commission (CySEC) with license no. 114/10. This regulatory adherence ensures that Eurivex provides secure and trustworthy services to its clients, solidifying its position as a leader in the financial services industry.

Frequently Asked Questions (FAQs)

Obtain 1 securities license(s)