Wisdompoint Capital Ltd. is a Cypriot Investment Firm (CIF) incorporated in the Republic of Cyprus on May 30, 2012 with the registration no. HE 307126. Being regulated by the Cyprus Securities and Exchange Commission (CySEC) under license no. 219/13, Wisdompoint Capital Ltd. offers cross-border services to Member States and to countries outside the European Union.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Wisdompoint Capital Information

Wisdompoint Capital is a regulated financial services firm authorized by the Cyprus Securities and Exchange Commission (CySEC). Based in Limassol, Cyprus, Wisdompoint Capital offers services that include the reception and transmission of orders for various financial instruments, safekeeping and administration of client assets, and facilitation of credit and foreign exchange transactions. The firm also engages in derivative contracts across securities, commodities, and interest rates.

Pros & Cons

Pros

Regulated by CySEC: Being authorized by the Cyprus Securities and Exchange Commission (CySEC) ensures that Wisdompoint Capital operates under stringent regulatory standards.

Comprehensive Investment Services: Offers a wide range of investment services including order transmission, safekeeping, credit facilities, foreign exchange, and derivative contracts.

Transparent Fee Structure: Clearly outlines fees for exchange-traded and OTC securities, ensuring clients have visibility into costs associated with their investments.

Cons

Limited Information on Platforms: Details about trading platforms or mobile apps are not provided, requiring further inquiry for clarity on usability and features.

Fee for Dormant Accounts: Imposes a fee for dormant accounts, which could affect clients who do not actively trade or maintain regular account activity.

Is Wisdompoint Capital Safe?

Wisdompoint Capital is regulated by the oversight of the oversight of the Cyprus Securities and Exchange Commission (CySEC), holding license No. 219/13. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, Wisdompoint Capital ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with Wisdompoint Capital?

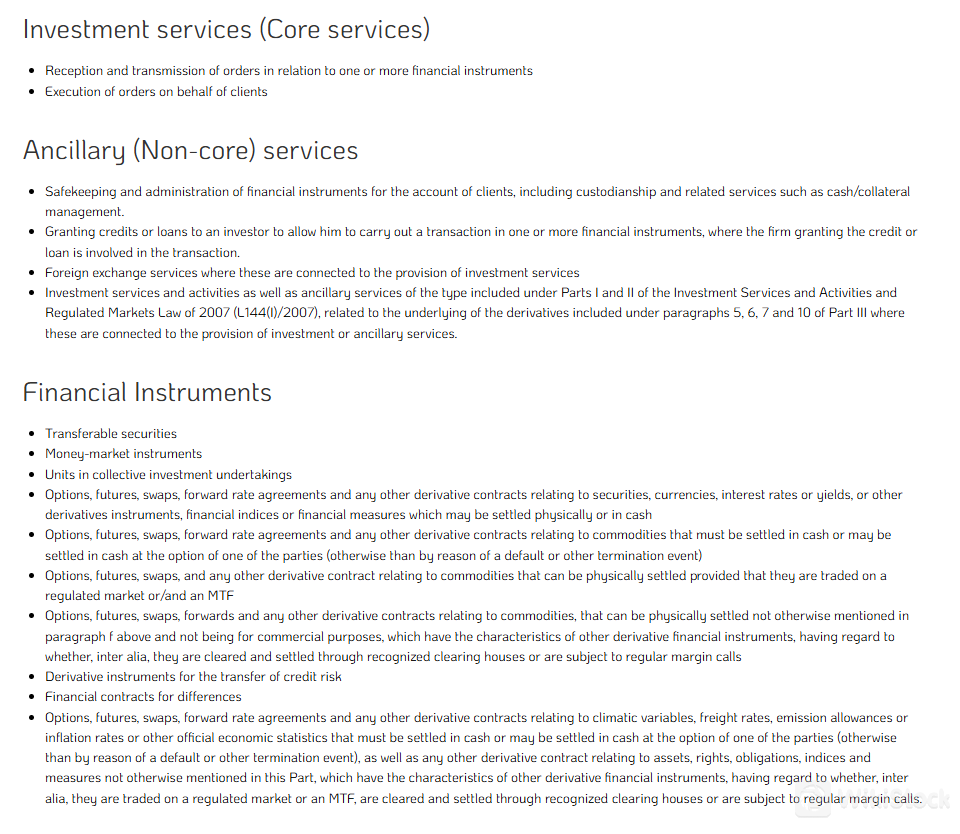

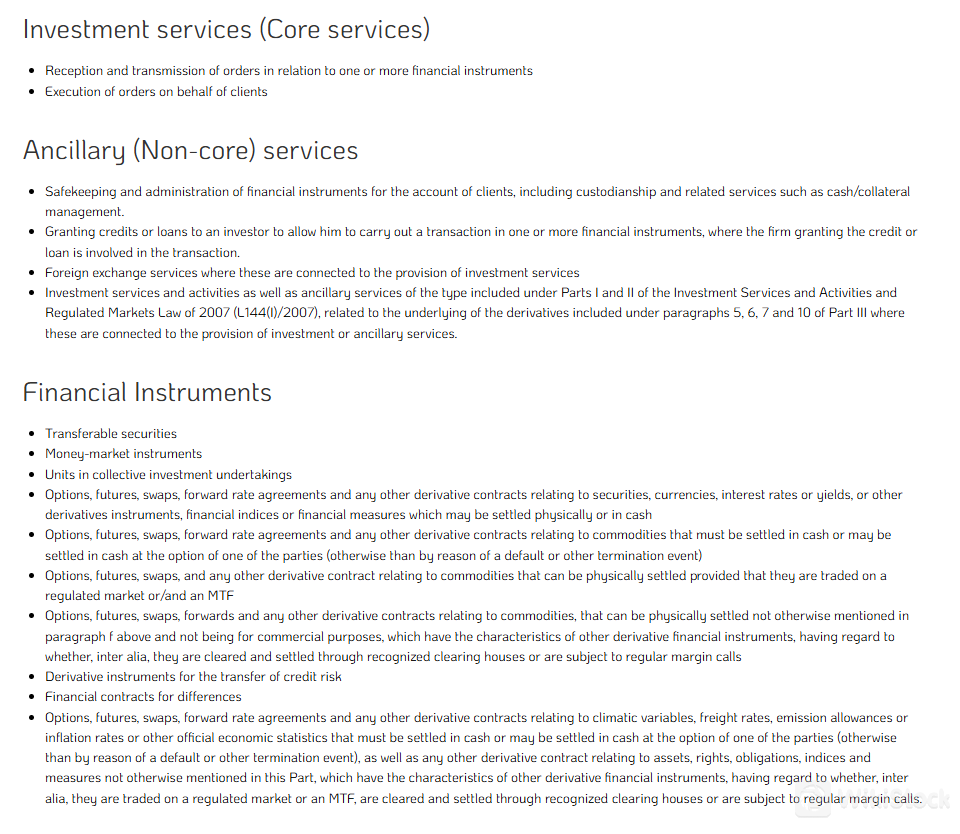

Investment Services: Wisdompoint Capital offers a comprehensive range of investment services. These core services include reception and transmission of orders in relation to various financial instruments, ensuring efficient execution of client orders on their behalf.

Ancillary Services: In addition to core investment services, Wisdompoint Capital provides ancillary services such as safekeeping and administration of financial instruments for clients. This includes custodianship and related services like cash and collateral management, ensuring the security and efficient management of client assets.

Credit Facilities: Wisdompoint Capital also facilitates credit or loans to investors, enabling them to conduct transactions in financial instruments where the firm is involved in the transaction. This service enhances liquidity and flexibility for clients engaging in investment activities.

Foreign Exchange Services: Wisdompoint Capital offers foreign exchange services linked to its investment offerings, providing seamless integration for clients requiring currency transactions in the context of their investment portfolios.

Derivative Contracts: Wisdompoint Capital engages in investment services and activities related to derivative contracts, covering a wide spectrum including securities, commodities, interest rates, and other financial indices. These derivatives can be settled physically or in cash, depending on client preferences and market conditions.

Wisdompoint Capital Fees Review

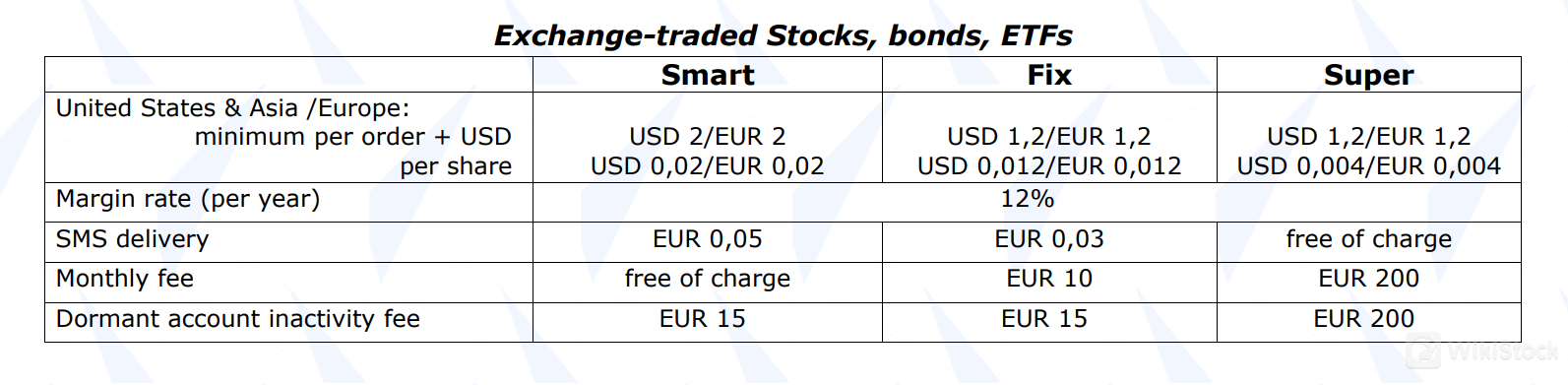

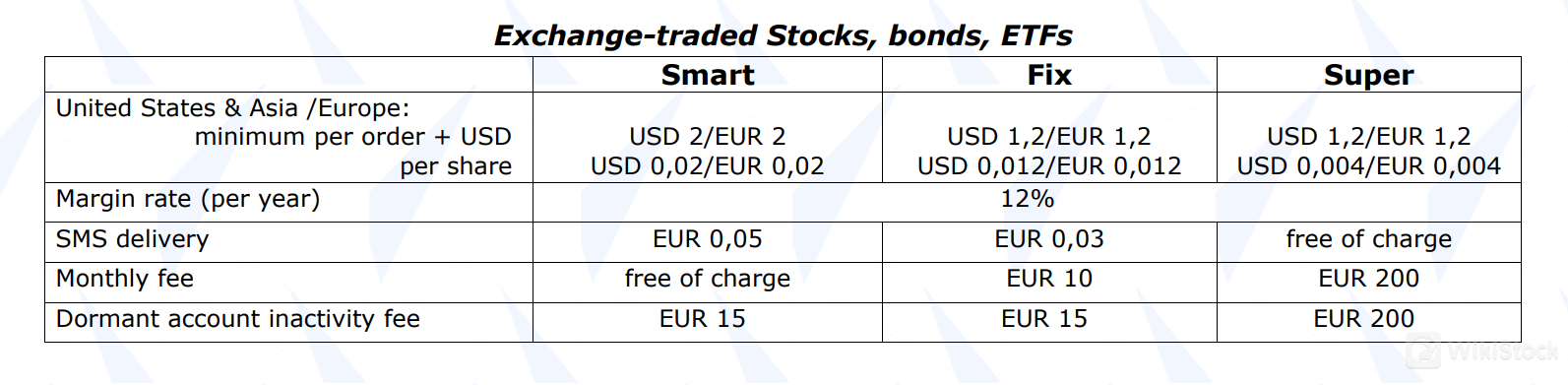

Exchange-Traded Stocks, Bonds, ETFs:

- Minimum Per Order:

- United States & Asia/Europe: USD 2 / EUR 2

- Per Share Cost:

- United States & Asia/Europe: USD 0.02 / EUR 0.02

- Margin Rate (Per Year): 12%

- SMS Delivery:

- EUR 0.05 / USD 0.03 (free of charge option available)

- Monthly Fee:

- Free of charge (EUR 10 / USD 200 for other regions)

- Dormant Account Inactivity Fee:

- EUR 15 / USD 15 / EUR 200

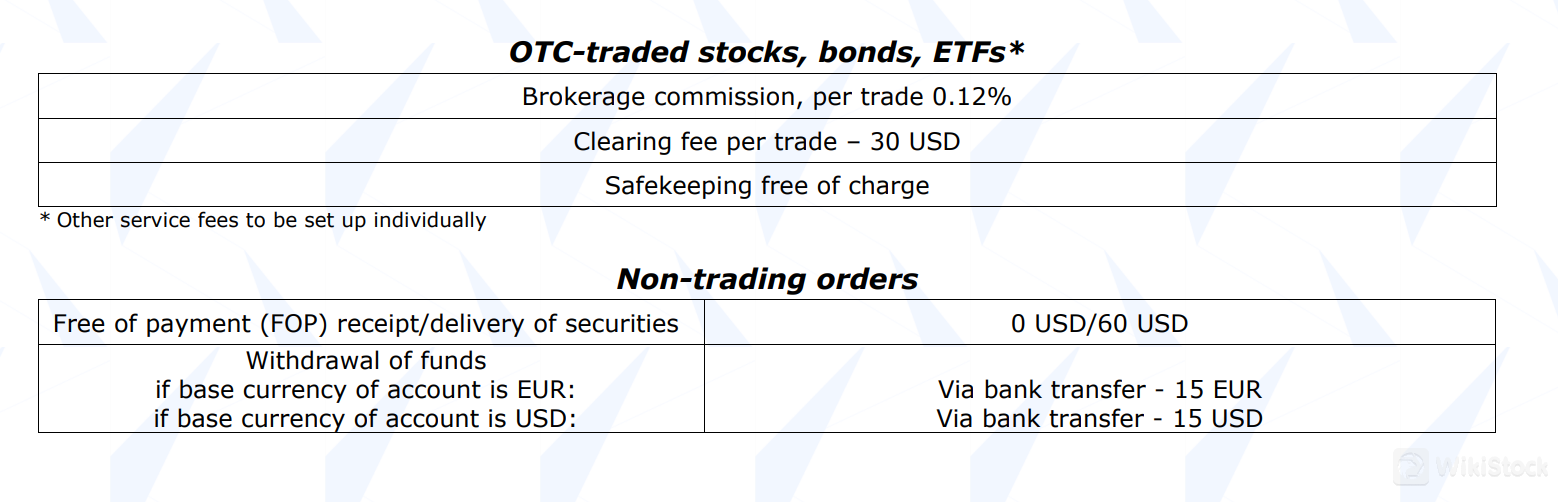

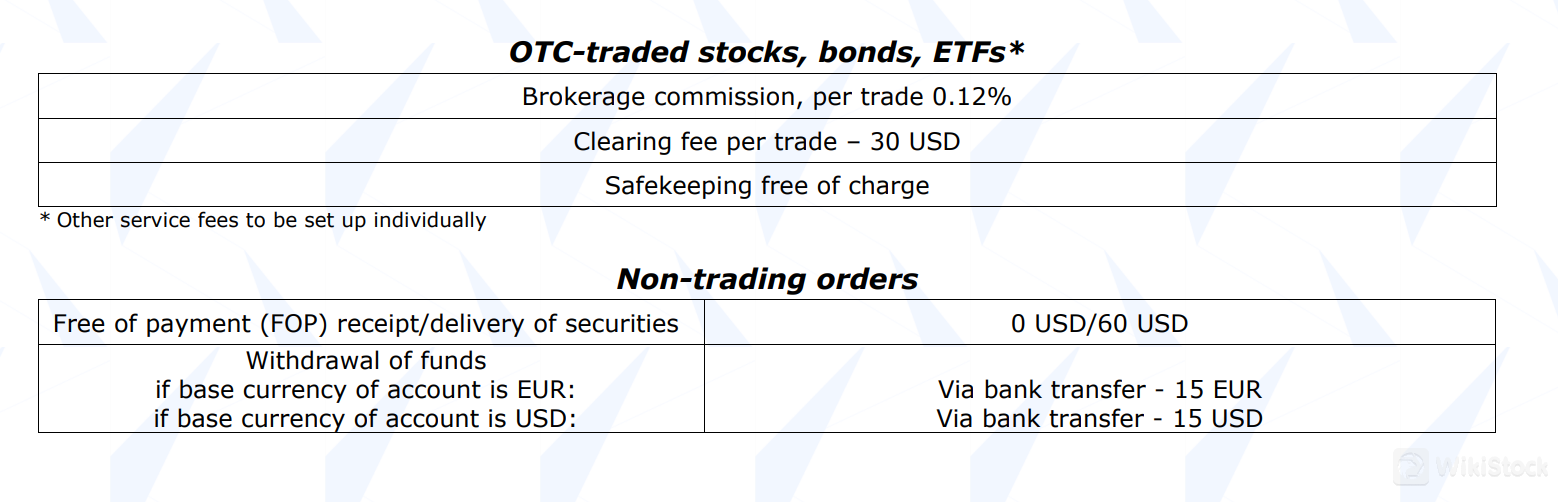

OTC-Traded Stocks, Bonds, ETFs:

- Brokerage Commission (Per Trade): 0.12%

- Clearing Fee (Per Trade): USD 30

- Safekeeping: Free of charge

- Non-Trading Orders:

- Free of Payment (FOP) Receipt/Delivery of Securities: USD 0 / USD 60

- Withdrawal of Funds:

- If base currency of account is EUR: EUR 15 via bank transfer

- If base currency of account is USD: USD 15 via bank transfer

Customer Service

Wisdompoint Capital's support team can be reached through:

- Head Office: Andrea Zappa 1, Office 9, 4040, Limassol, Cyprus

- Phone: +357 25010750

- Email: customers@wisdompointcapital.com

Conclusion

In conclusion, Wisdompoint Capital presents itself as a regulated and reliable financial services provider, authorized by CySEC. Its comprehensive range of investment services, including order transmission, safekeeping, and credit facilities, offers clients diverse avenues for managing their investments with transparent fee structures.

However, clients should be mindful of charges for dormant accounts and the lack of detailed fee information and platform specifics. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

Frequently Asked Questions (FAQs)

Is Wisdompoint Capital suitable for beginners?

No, Wisdompoint Capital is not the best choice for beginners due to its complex range of services, limited information on platforms, and the lack of specific educational support tailored for new investors.

Is Wisdompoint Capital legit?

Yes, Wisdompoint Capital is regulated by CySEC.

What services does Wisdompoint Capital offer?

Order transmission, safekeeping of financial instruments, credit facilities, foreign exchange services, and engagement in derivative contracts across various asset classes.

Are there any additional charges or fees I should be aware of?

Wisdompoint Capital imposes fees for SMS delivery, dormant account inactivity, and withdrawal of funds depending on the base currency of your account. It's advisable to review the fee schedule carefully and consult with customer support for clarification.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)