Colmex Pro is a brokerage firm based in Cyprus, specializing in providing stock and contract for difference (CFD) trading services. It has gained a good reputation in the industry for its strict regulation and wide range of trading tools. Its services include direct market access trading, real-time quotes, financial news, etc., providing investors with a comprehensive trading and investment experience.

What is Colmex Pro?

Colmex Pro is a trading platform known for its competitive trading fees, with CFDs starting at just $0.01 per share and equity trades at $0.007 per share.

It offers a robust range of platforms including Colmex Pro 2.0, Meta Trader 4, and MultiTrader available on web, mobile, and desktop, satisfying various trading preferences.

However, a potential downside is the relatively high account fees, requiring $500 for CFDs and $1000 for equity accounts, which might be a barrier for some traders.

Pros & Cons

Pros:

Colmex Pro offers a wide variety of tradable securities, including over 3,000 US stocks and more than 4,000 CFDs, satisfying diverse trading preferences. It is regulated by CYSEC, ensuring a level of trust and regulatory compliance.

The platform boasts low trading fees starting from $0.007, enhancing its appeal to cost-conscious traders. Colmex Pro supports trading on multiple unique platforms, accessible across different devices, and provides 24/7 online customer support. Additionally, it offers six diverse account types, accommodating different investor needs and strategies.

Cons:

However, Colmex Pro does not provide analysis tools, which can be a significant disadvantage for traders who rely on such tools for making informed decisions. The platform only accepts deposits via bank transfer, limiting flexibility for traders who prefer other deposit methods.

Its fee structure is complex, which might confuse new users or those unfamiliar with its pricing model. Furthermore, the high account minimum fees, starting at $500, may deter smaller investors or beginners from signing up.

Is Colmex Pro Safe?

Regulations:

Colmex Pro is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 123/10. CySEC is a well-established regulatory body responsible for overseeing the investment services market in Cyprus, which includes supervision of transactions in transferable securities.

This regulatory status indicates that Colmex Pro operates under strict guidelines aimed at ensuring transparency and fairness in trading.

Funds Safety:

Colmex Pro is a member of the Investor Compensation Fund, which provides a layer of financial protection to its clients. This membership means that clients' funds have a safety net in case the firm fails to fulfill its financial obligations, although specific coverage amounts were not detailed. This is a common practice among regulated brokers to protect client investments.

Safety Measures:

While the detailed specifics of their security measures were not disclosed, as a regulated broker, Colmex Pro is required to adhere to certain standards regarding the security of client funds and data.

These typically include employing encryption technologies for securing client transactions and safeguarding personal and financial information to prevent unauthorized access and data leaks. Additionally, the use of multi-factor authentication (2FA) as indicated in their trading system downloads suggests a proactive approach to enhancing account security.

What are securities to trade with Colmex Pro?

Colmex Pro offers a wide range of securities for trading, meeting various investment preferences and strategies.

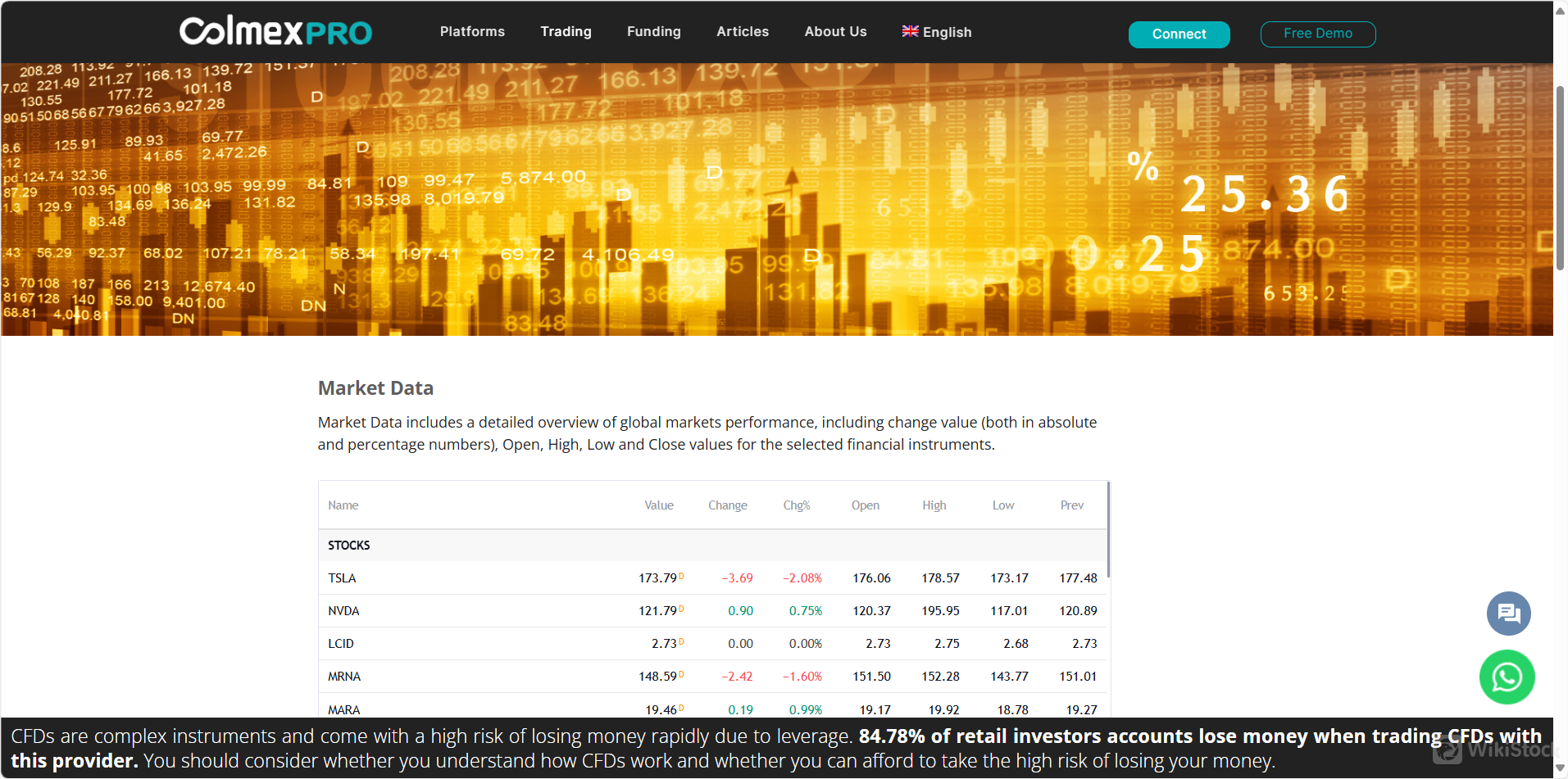

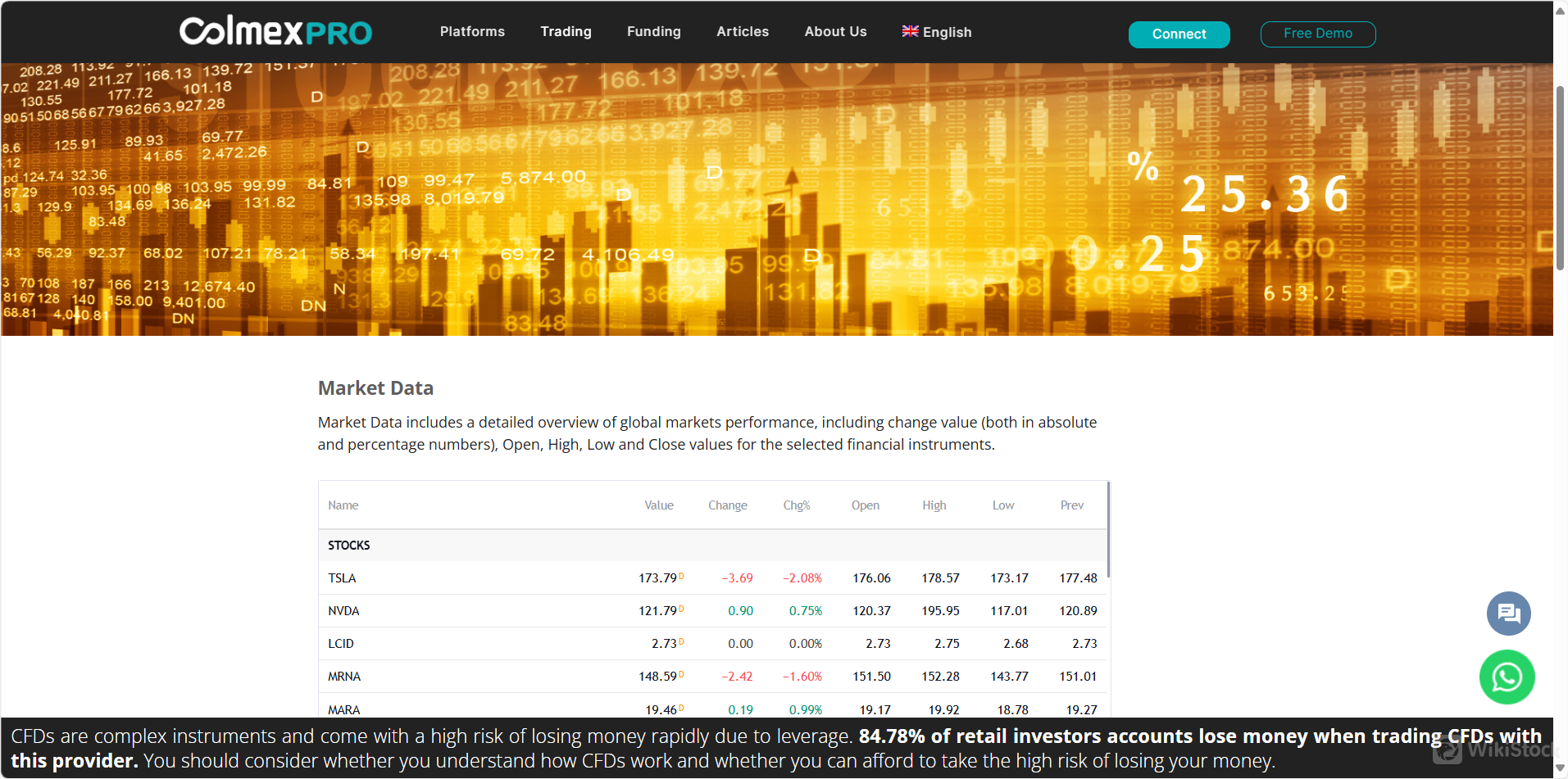

Stocks: Colmex Pro provides access to more than 3,000 US stocks, allowing traders to invest in a broad spectrum of companies listed in major US stock exchanges.

CFDs (Contracts for Difference): With over 4,000 CFDs available, traders can engage in transactions across different markets without actually owning the underlying assets. This includes CFDs on stocks, forex, commodities, and indices.

Options: Colmex Pro offers trading in options, which are financial derivatives that provide the right, but not the obligation, to buy or sell an asset at a specified price before the option expires. This includes stock options and index options.

Futures: Traders can also participate in futures trading, which involves contracts that obligate the purchase or sale of an asset at a future date at a predetermined price. Available futures include stock futures, index futures, dividend futures, currency futures, interest rate futures, agricultural and food futures, as well as energy and metal futures.

Forex: The platform enables trading in the forex market, providing opportunities to trade various currency pairs and benefit from the fluctuations in exchange rates.

Commodities: Traders can invest in commodity markets, trading essential goods such as gold, oil, and other valuable resources.

Indices: Trading on major market indices is also available, which allows traders to speculate on the performance of specific index groups like the S&P 500 or the Dow Jones.

IPOs: Colmex Pro offers its clients the opportunity to invest in initial public offerings (IPOs), allowing both retail and institutional traders to purchase new stock issues from the first day they are traded on the market.

Colmex Pro Account Review

Colmex Pro offers a tiered account structure that attracts different levels of traders, from beginners to advanced.

Margin Account

The Margin Account is an entry-level option suitable for those new to trading or with lower capital, requiring a minimum deposit of $1,000. It allows trading on margin with basic day and overnight leverage options, supported by standard trading tools on both desktop and mobile platforms.

Bronze Account

The Bronze Account steps up with a minimum deposit of $3,000, offering slightly better trading conditions and lower fees per share. It's designed for more active traders who can handle increased leverage, with full access to desktop and mobile trading platforms.

Silver Account

For advanced traders, the Silver Account requires a $10,000 minimum deposit and offers reduced fees and higher leverage ratios. This account attracts experienced traders looking for more aggressive trading strategies and includes enhanced support services.

Gold Account

The Gold Account is tailored for high-volume traders with a minimum deposit of $25,000, providing lower transaction costs and the highest available leverage ratios. It includes support and trading capabilities, suitable for serious investors.

VIP Account

The VIP Account is designed for elite traders, requiring a $100,000 minimum deposit. It offers the lowest fees and trading conditions, including personalized support from a dedicated account manager and access to all platform features with the best possible trading terms.

Colmex Pro Fee Review

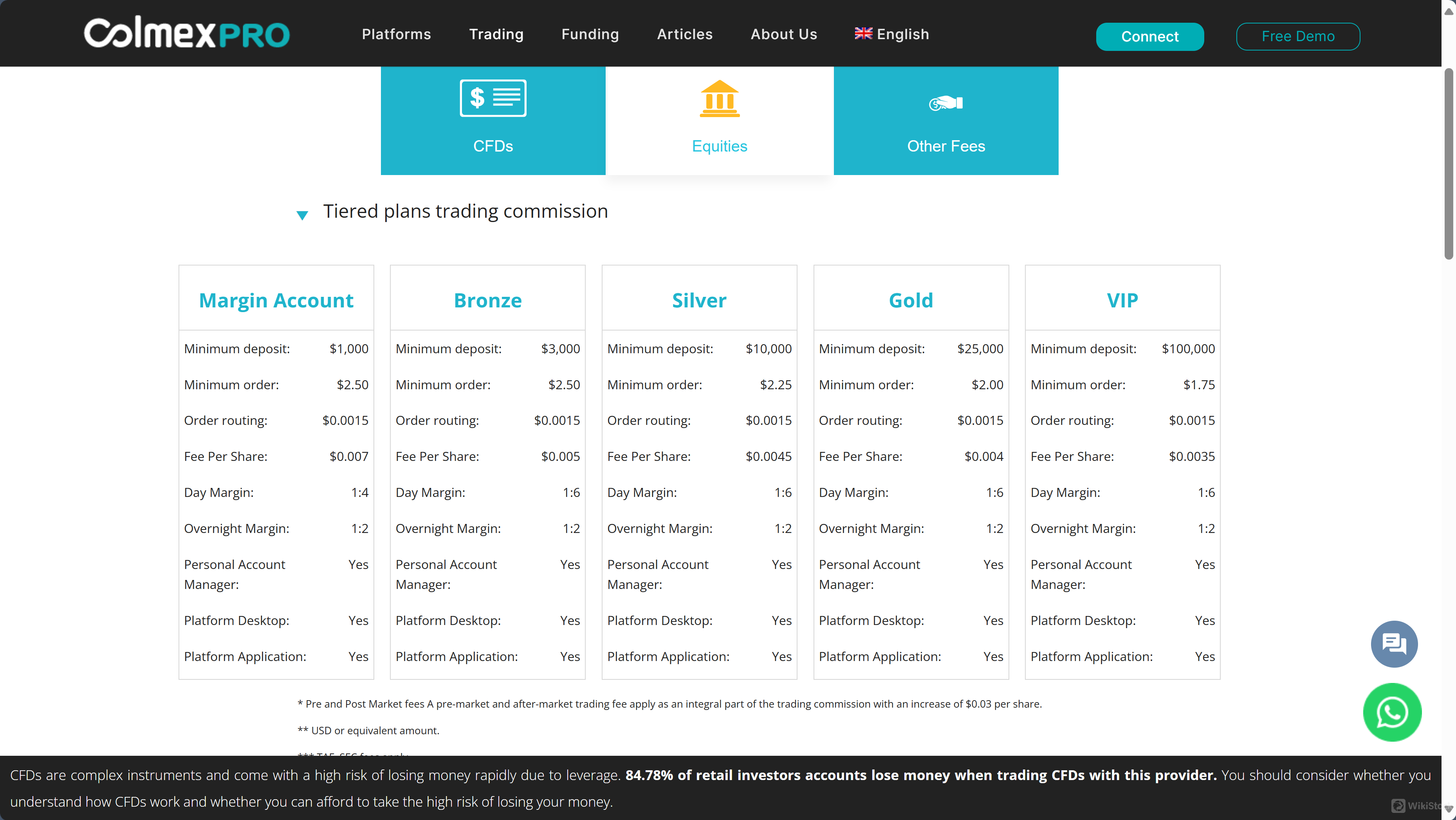

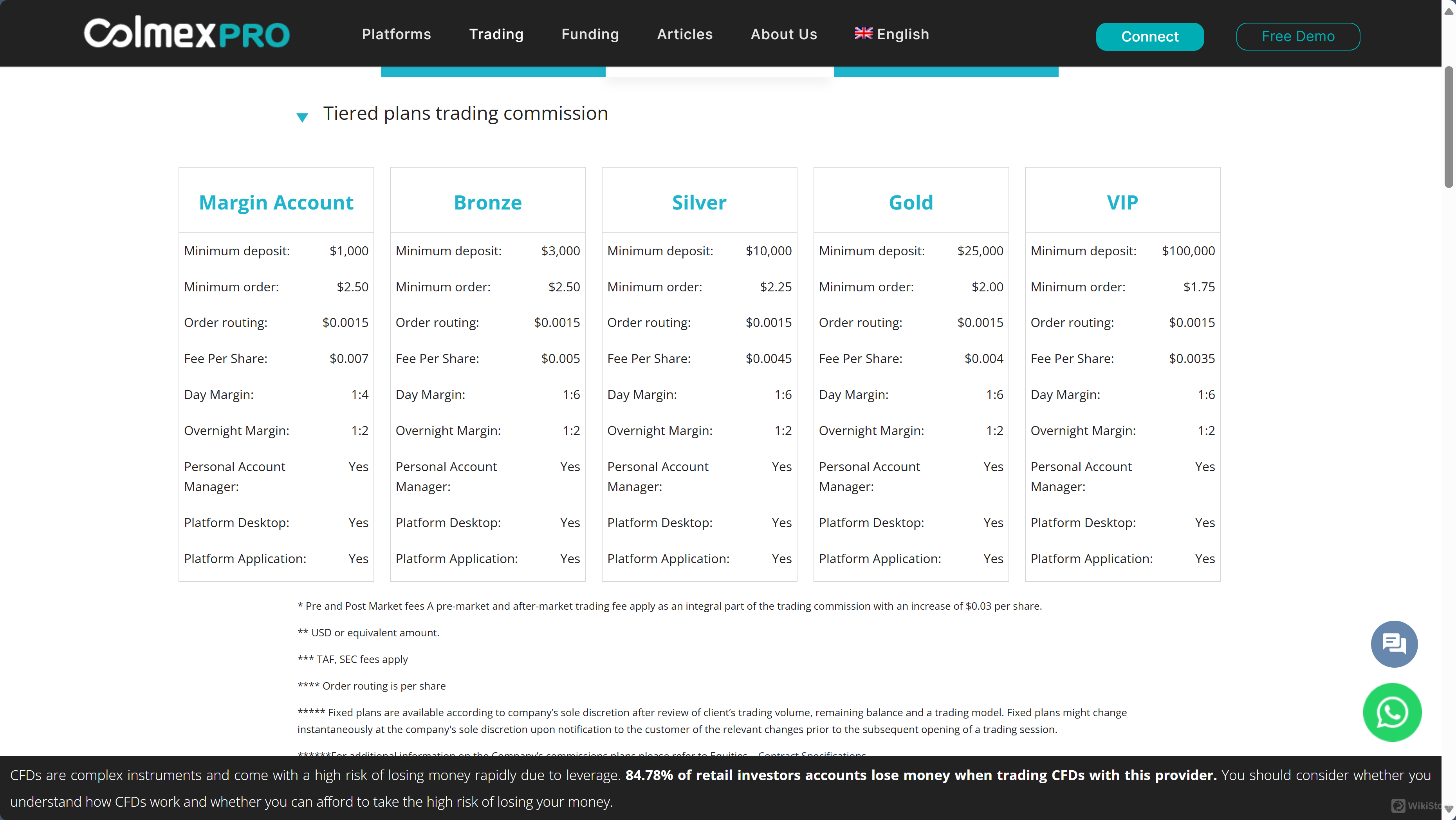

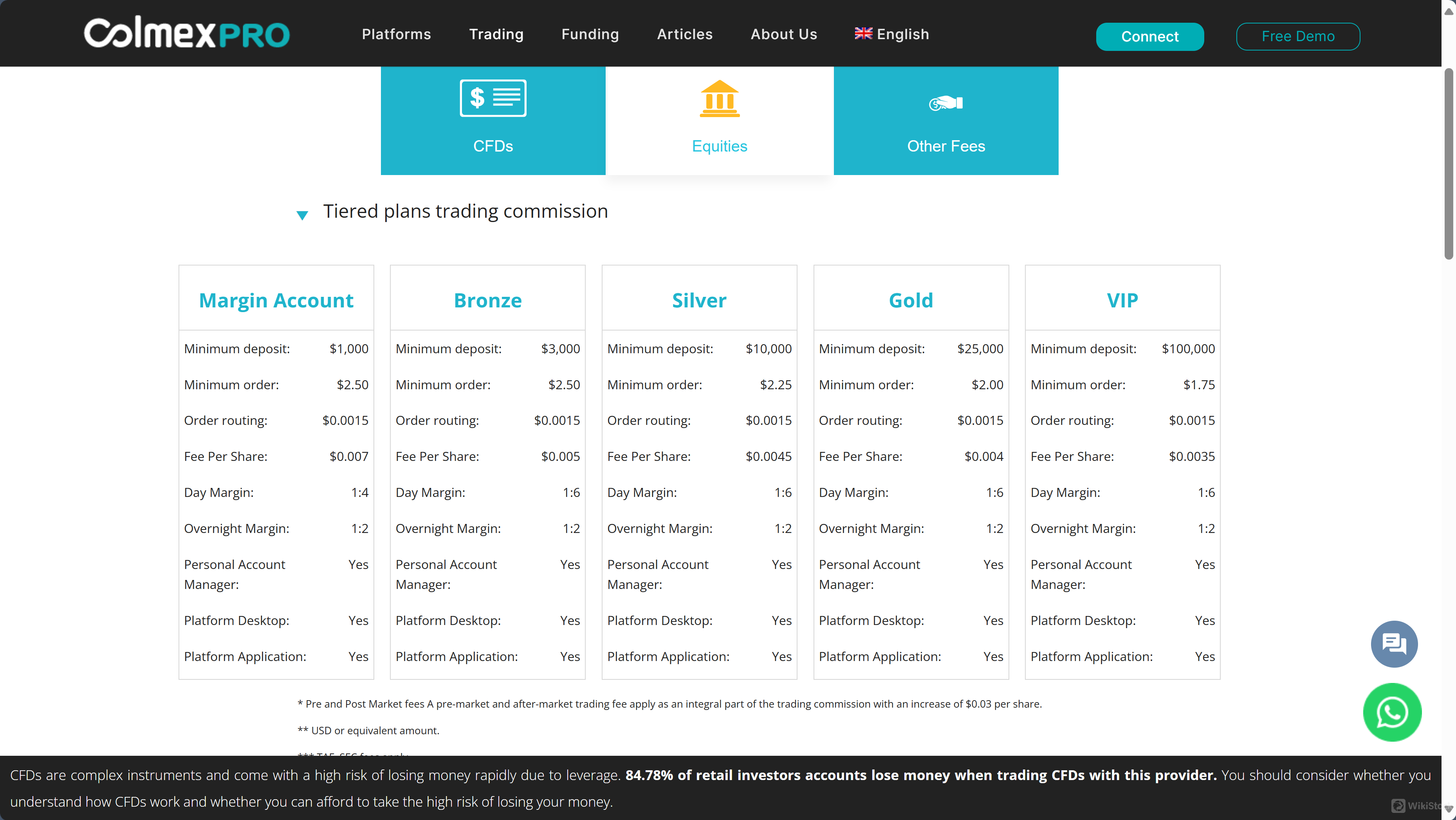

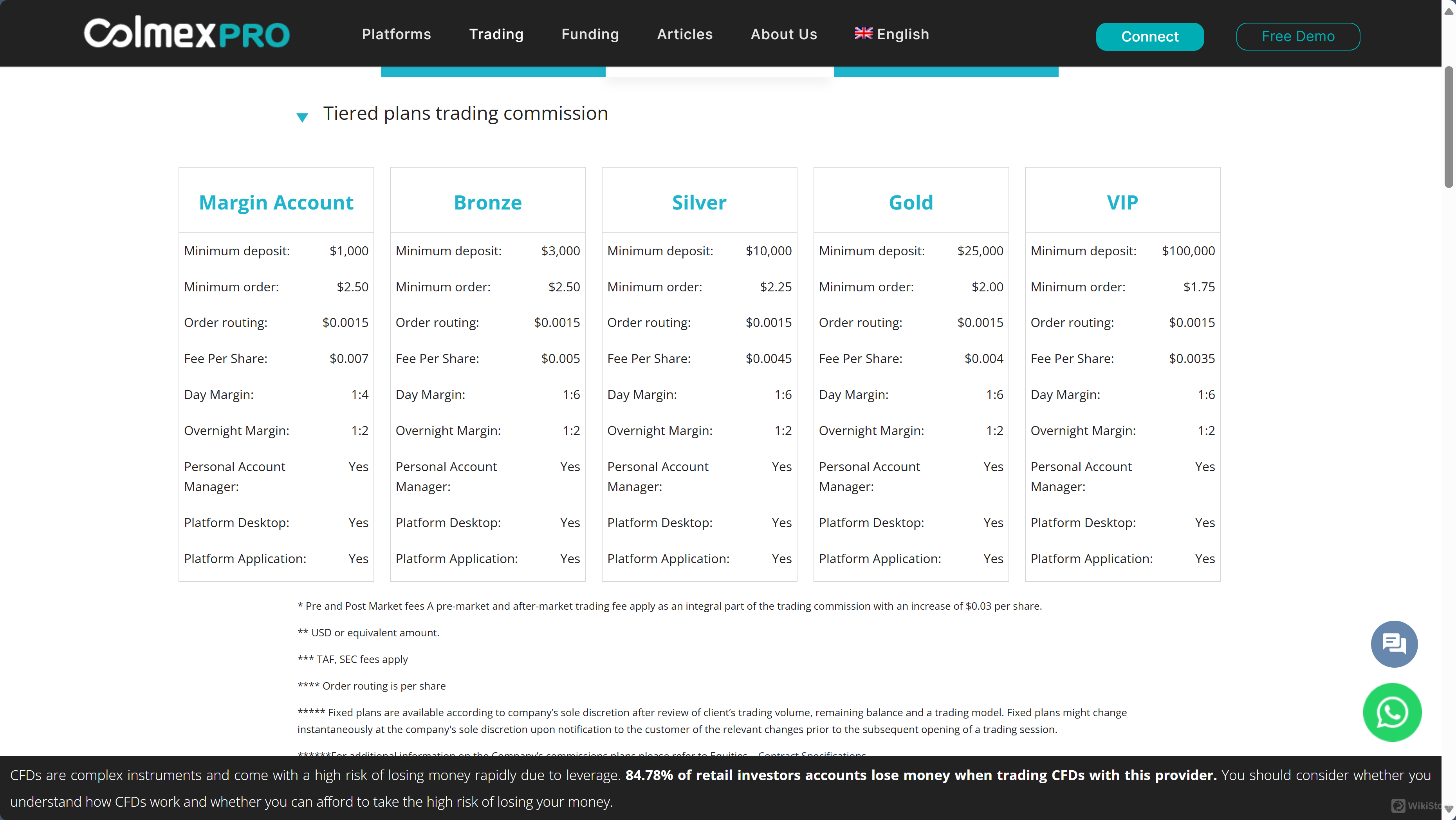

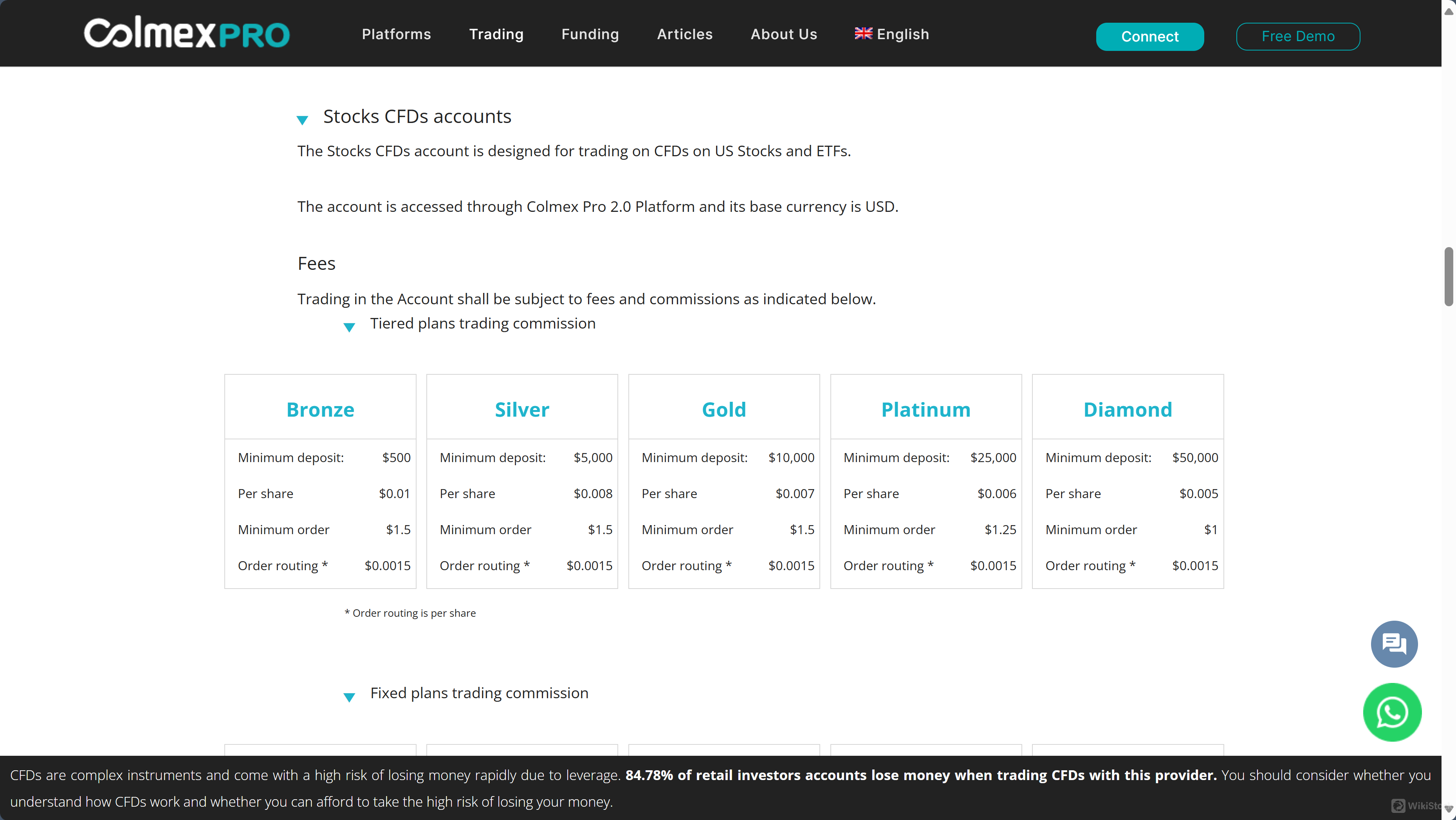

Colmex Pro offers a detailed and tiered fee structure tailored to different trading volumes and account types.

Tiered Trading Commissions

Margin Account: Charges $0.007 per share with a minimum order fee of $2.50.

Bronze: Charges $0.005 per share with a minimum order fee of $2.50.

Silver: Charges $0.0045 per share with a minimum order fee of $2.25.

Gold: Charges $0.004 per share with a minimum order fee of $2.00.

VIP: Charges $0.0035 per share with a minimum order fee of $1.75.

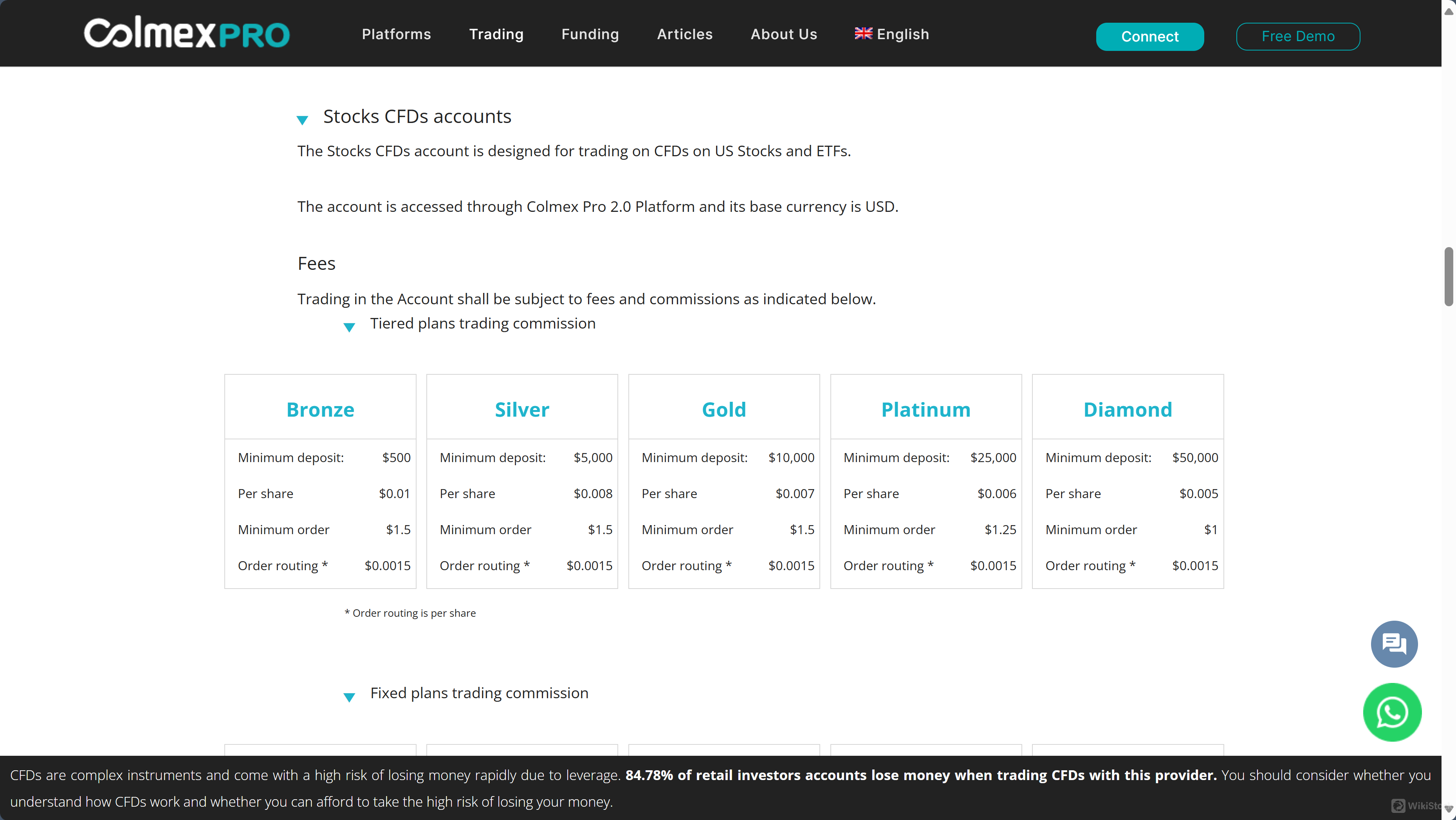

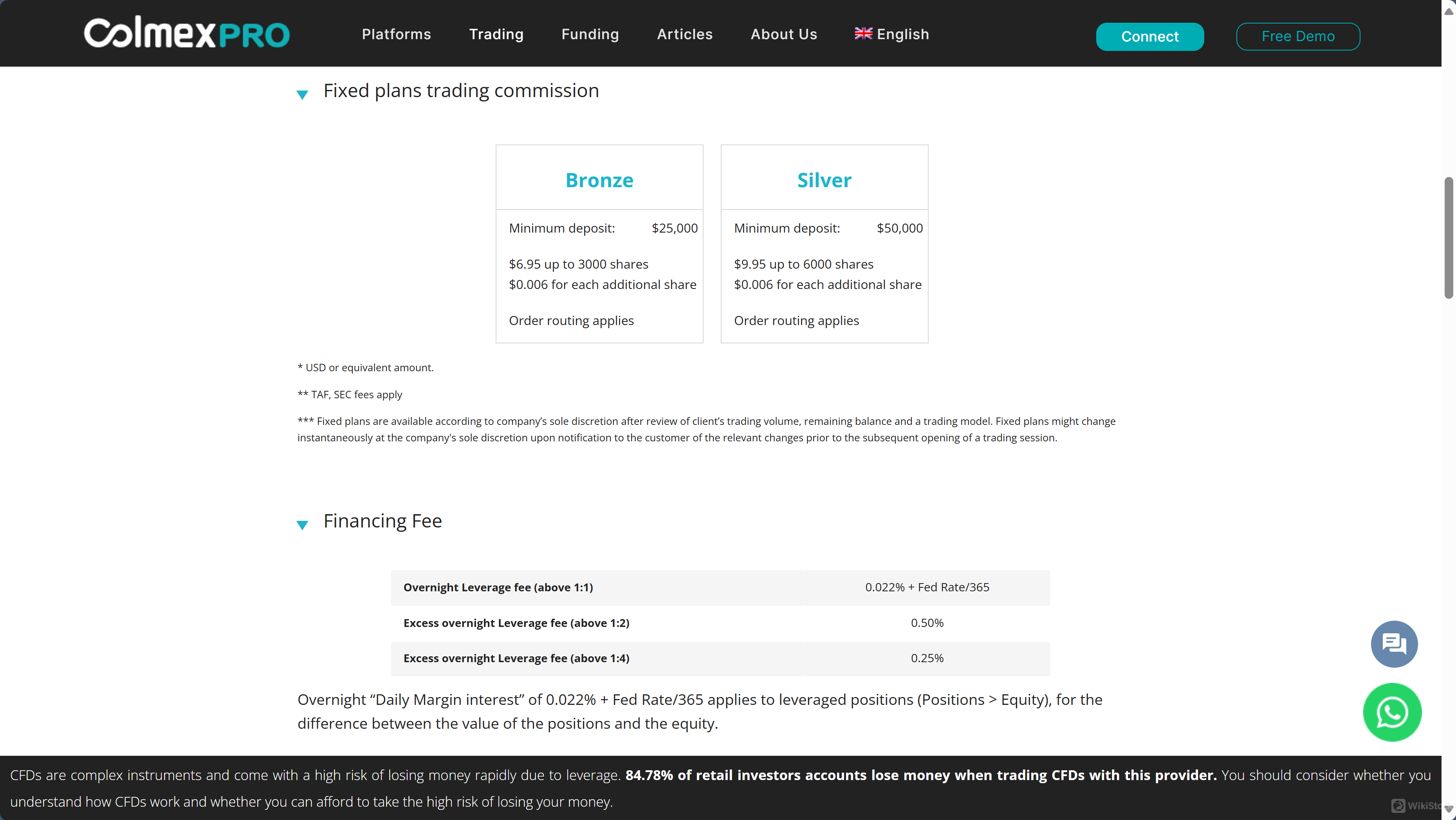

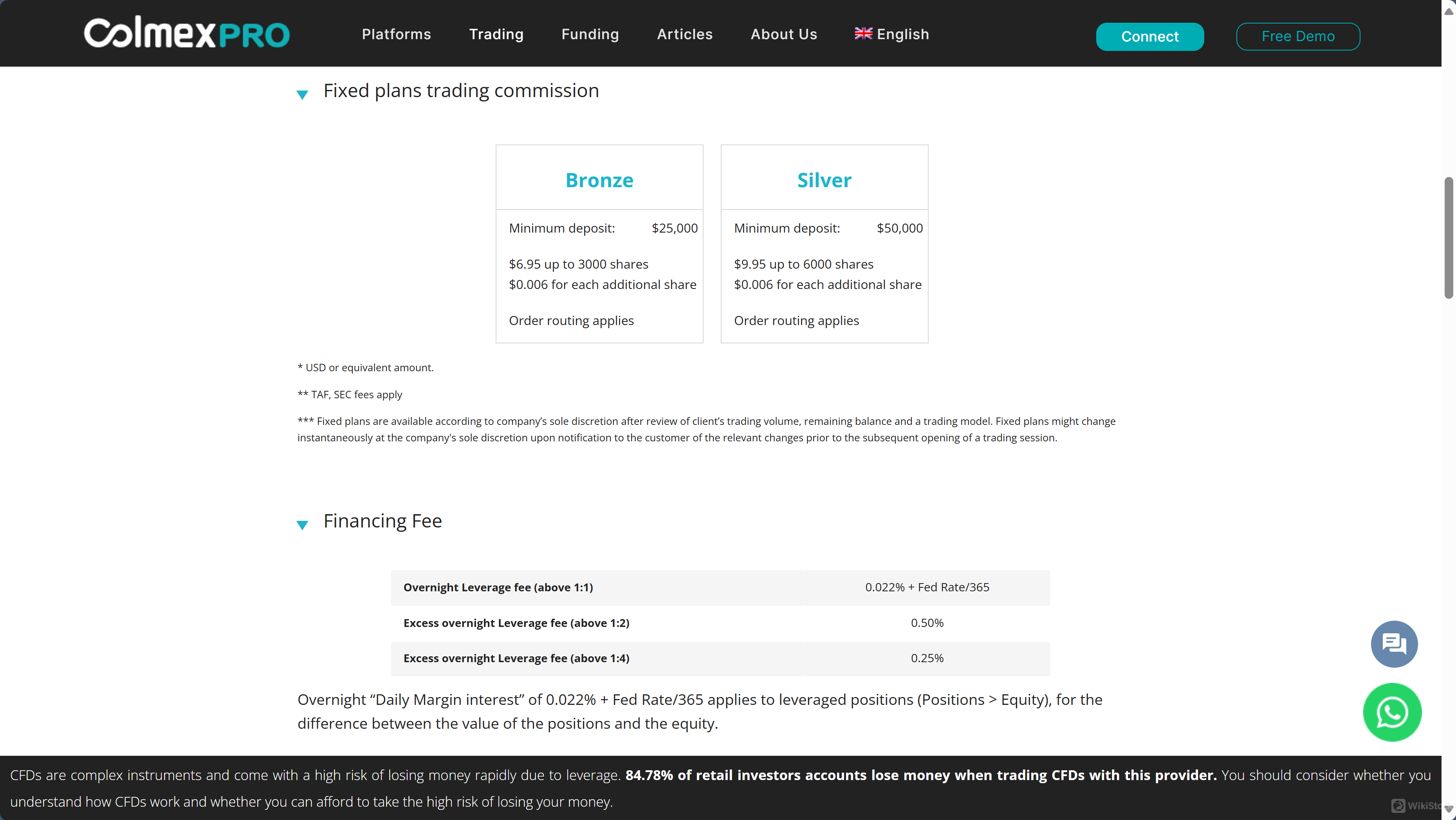

Fixed Trading Commissions

Bronze: $6.95 for up to 3000 shares, then $0.006 per additional share.

Silver: $9.95 for up to 6000 shares, then $0.006 per additional share.

Financing Fees

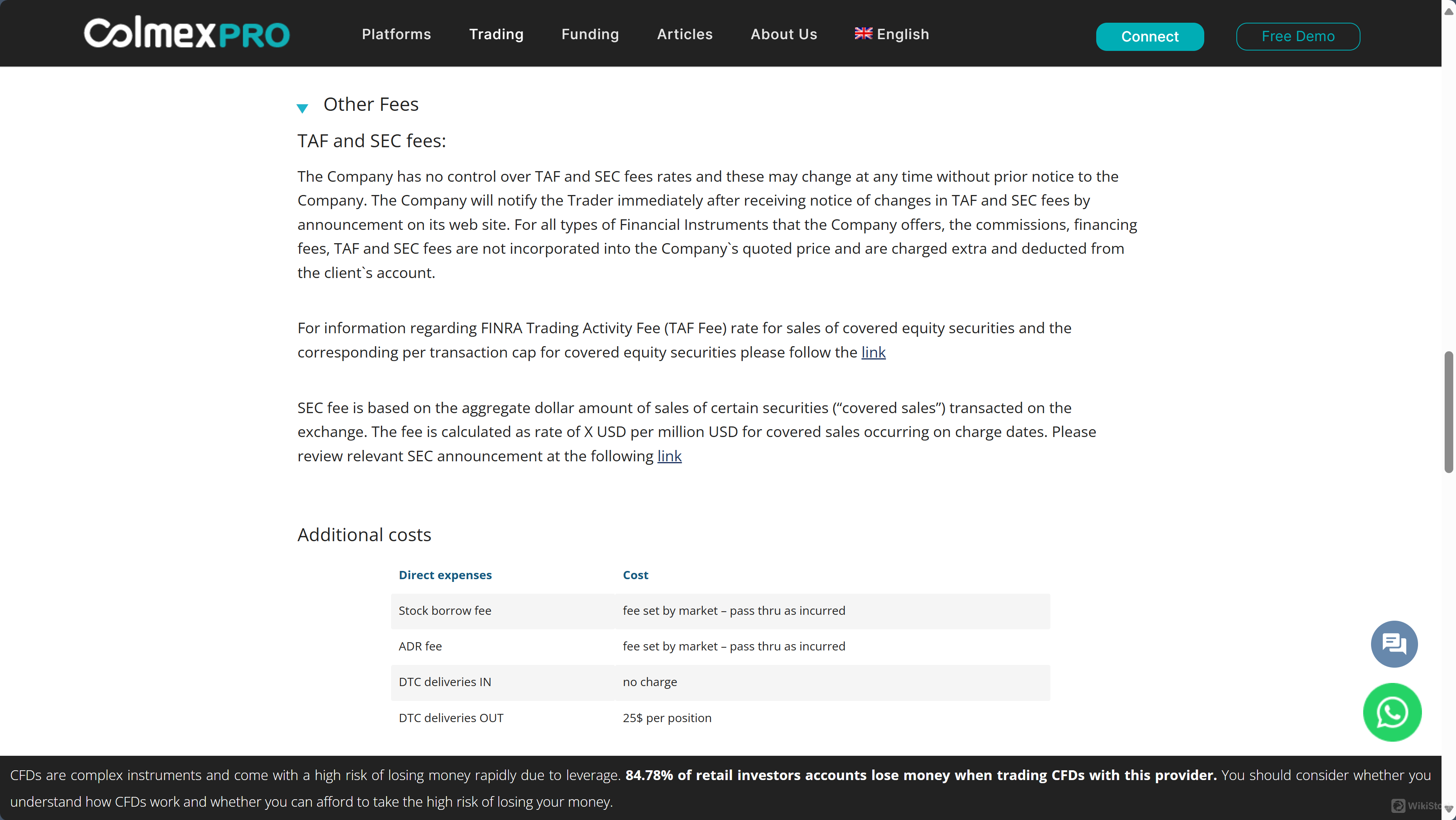

Other Fees

Pre and Post Market Trading: An additional fee of $0.03 per share is charged for trades made outside of regular trading hours.

Withdrawal Fees: The first withdrawal of the month under $500 is free; otherwise, a $40 fee applies.

Corporate Action Fees: Varies based on the type of corporate action, with specific charges for mandatory, voluntary, and “mandatory with choice” corporate actions.

Real-time Data Feed: Fees for Nasdaq OMX and other market data, with specifics depending on the data package subscribed.

Additional Notes:

Corporate Actions: Fees vary; mandatory actions may incur a processing fee of $5, no more than 50% of the dividend value.

Real-time Data Feed: Charges for Nasdaq OMX and other data feeds.

Stop-out Levels: Automatic stop-out at 50% for retail clients; professional clients have different conditions.

Colmex Pro Trading Platform Review

Colmex Pro offers several trading platforms designed to meet the needs of diverse traders, providing robust features and analytical tools to enhance trading efficiency and decision-making:

Colmex Pro MultiTrader Web

This web-based platform can be accessed from any computer or smartphone and is localized into ten languages. It includes a range of features:

Portfolio Management Tools: Monitor and manage your positions effectively.

Watchlists: Create custom watchlists to track your favorite stocks and monitor portfolio performance.

News Feed: Integrated news feed provides updates related to your portfolio directly on the platform, simplifying research.

Options Radar: Analyze put-to-call ratios on thousands of stocks, ETFs, and indices.

Sector Performance: Sort and identify top-performing sectors and the leading stocks within those sectors.

Stock Screener: A customizable stock screener helps filter stocks based on specific investing criteria.

Colmex Pro 2.0

A versatile trading platform available for desktop and mobile, offering advanced trading tools and resources to attract both novice and experienced traders.

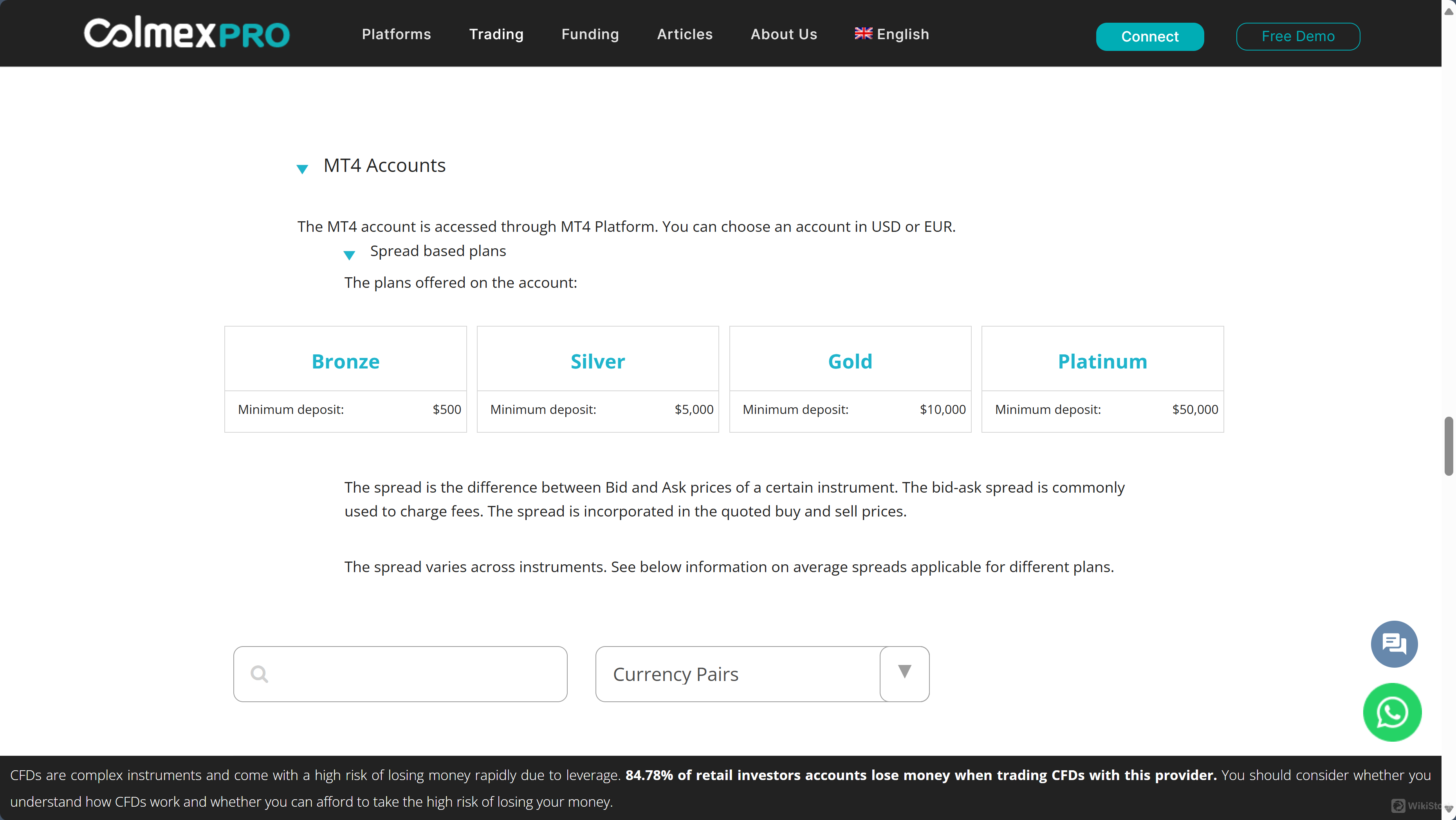

Meta Trader 4

Widely recognized for Forex and CFD trading, Meta Trader 4 is available on both desktop and mobile devices. It provides advanced charting tools, automated trading capabilities, and a vast array of analytical tools.

MultiTrader

Available in web, desktop, and mobile versions, MultiTrader offers trading tools, making it suitable for traders who manage multiple assets or engage in complex trading strategies.

Research & Education

Colmex Pro offers a robust selection of research and educational resources through its blog and articles, which are crafted by its Investment Research Department. These resources aim to educate traders on various aspects of the capital markets and improve their trading skills. Heres an overview of the types of content provided:

Israel

IsraelObtain 1 securities license(s)