eFinno operates under the regulatory jurisdiction of prominent global financial authorities. In Cyprus, it is regulated by the Cyprus Securities and Exchange Commission (CYSEC) under license No. 376/19. This regulatory background underscores eFinno's commitment to adhering to the highest standards of financial operations, ensuring a reliable trading environment for its clients.

eFinno prioritizes the protection of client funds through a multi-faceted approach to security. Committed to ensuring the utmost reliability and privacy, eFinno implements rigorous security protocols across its platform. This includes robust financial principles, such as maintaining sufficient liquid capital as mandated by regulatory requirements and being a member of the Investor Compensation Fund.

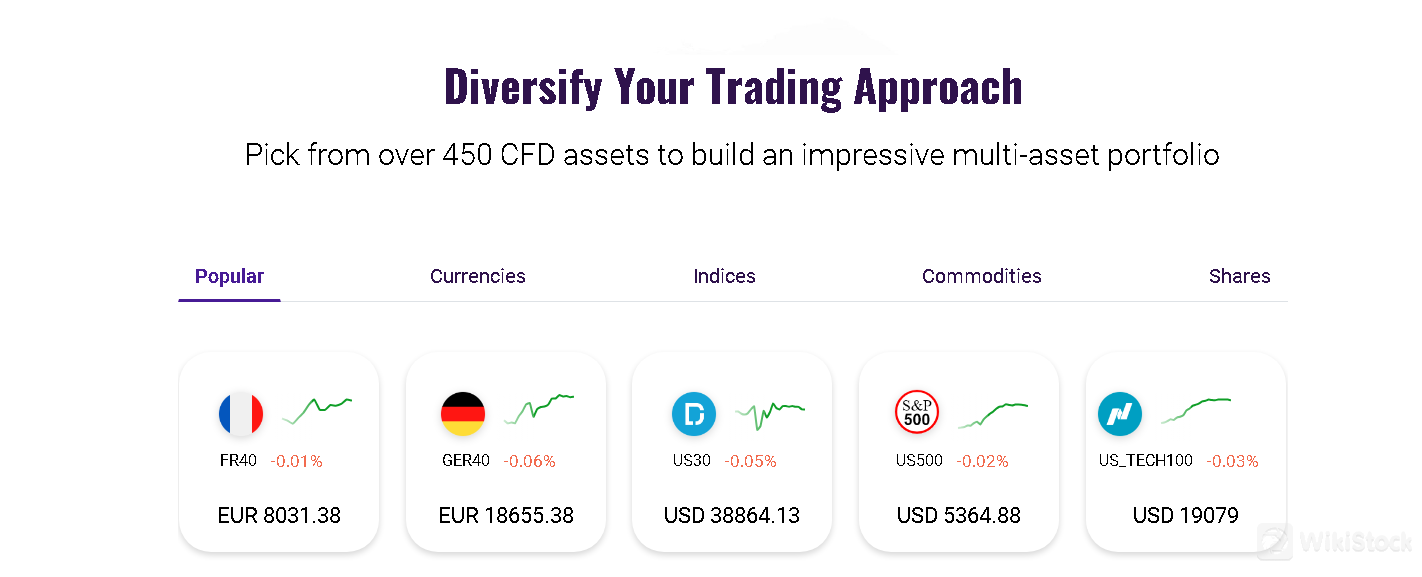

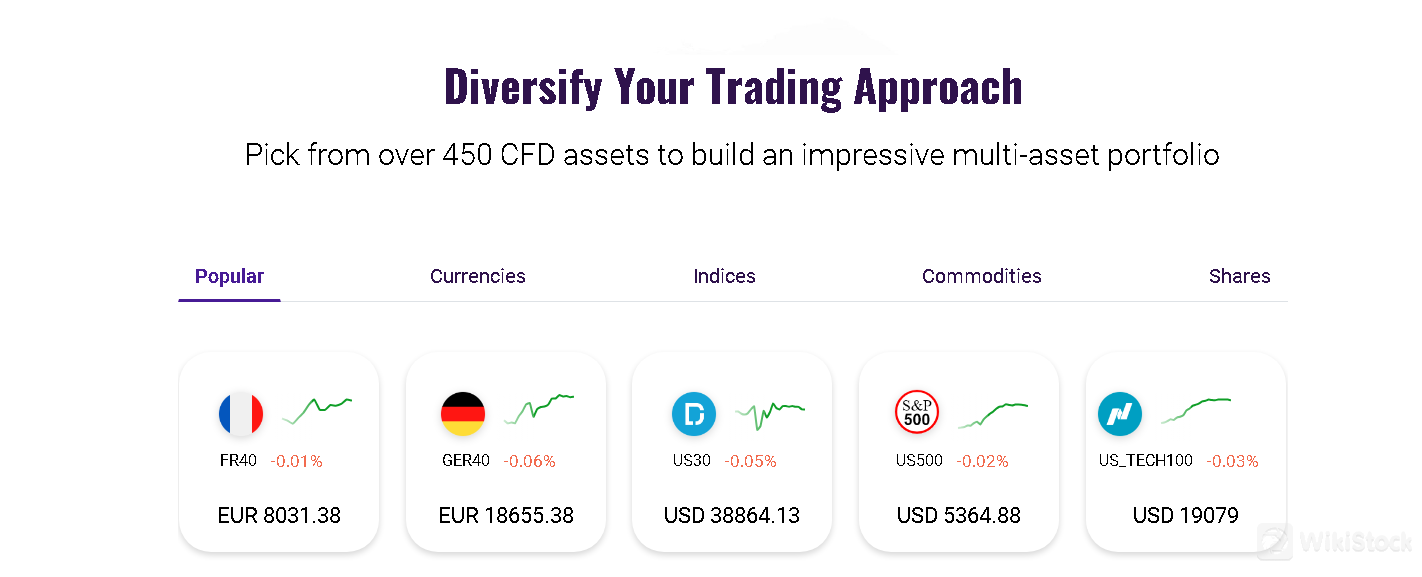

Efinno offers a comprehensive range of market instruments, providing traders with a diverse array of options to construct a robust and dynamic portfolio. With over 450 CFD assets available, Efinno facilitates trading across multiple asset classes, catering to various investment strategies and risk appetites.

Currencies: Efinno enables trading in a wide range of currency pairs, allowing investors to capitalize on fluctuations in global forex markets. Whether it's major pairs like EUR/USD or exotic pairs, traders have the flexibility to engage in currency trading strategies based on macroeconomic trends and geopolitical developments.

Indices: Traders can access major stock indices from around the world through Efinno's platform. From the S&P 500 and FTSE 100 to the Nikkei and DAX, investors can take positions on broad market movements, sectoral trends, or regional economic outlooks, providing opportunities for both short-term and long-term trading strategies.

Commodities: Efinno offers a range of commodities for trading, including precious metals like gold and silver, energy commodities such as crude oil and natural gas, as well as agricultural products like wheat and corn. These commodities serve as essential components of global trade and economic activity, presenting traders with opportunities to hedge against inflation, geopolitical risks, and supply-demand dynamics.

Shares: Through Efinno, traders can access a diverse selection of individual stocks from major global exchanges. Whether it's tech giants like Apple and Google, blue-chip companies like Coca-Cola and Walmart, or emerging market darlings, investors can build a portfolio tailored to their specific sectoral or thematic preferences, leveraging opportunities for capital appreciation and dividend income.

Bonds: Efinno provides access to bond CFDs, allowing traders to speculate on the performance of government bonds or other fixed-income securities. Bond trading offers opportunities for income generation, portfolio diversification, and risk management, with varying yields and durations to suit different investment objectives.

Crypto: Efinno facilitates trading in a selection of cryptocurrencies, including popular digital assets like Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading offers investors exposure to a high-growth, volatile asset class, with opportunities for capital gains, portfolio diversification, and hedging against traditional financial market risks.

For whole list of its instrument CFDs, you can visit https://www.efinno.com/instruments.

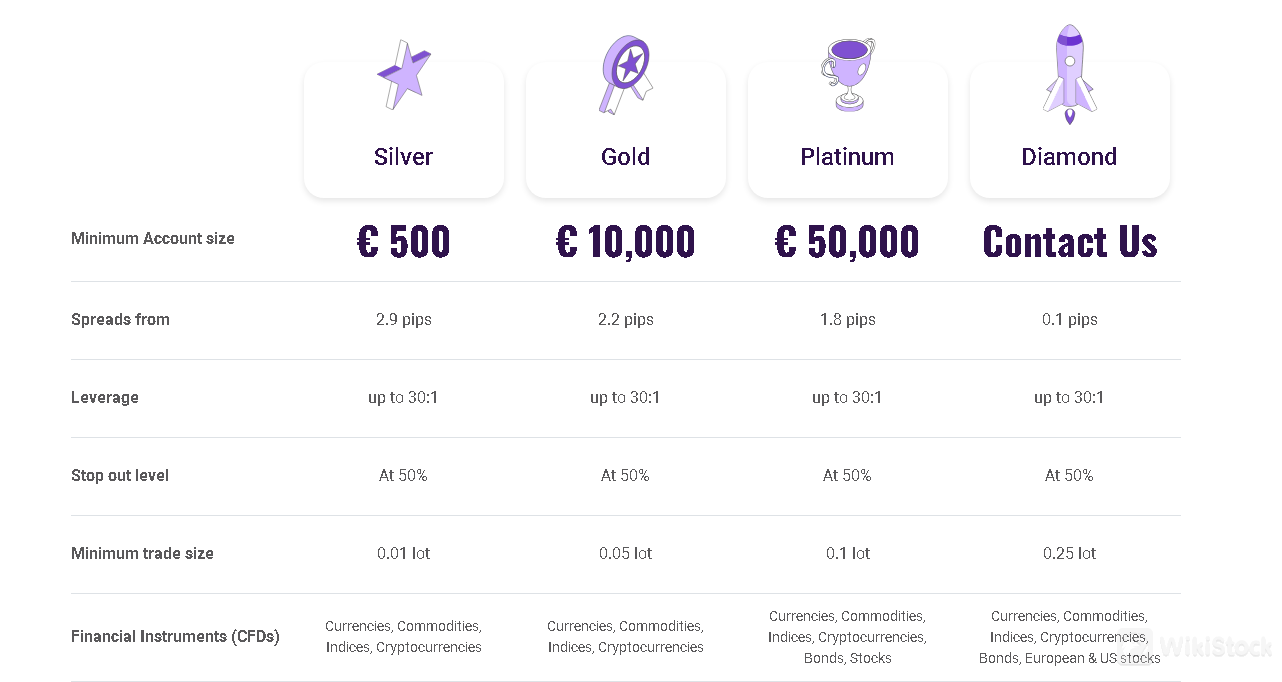

Account Types

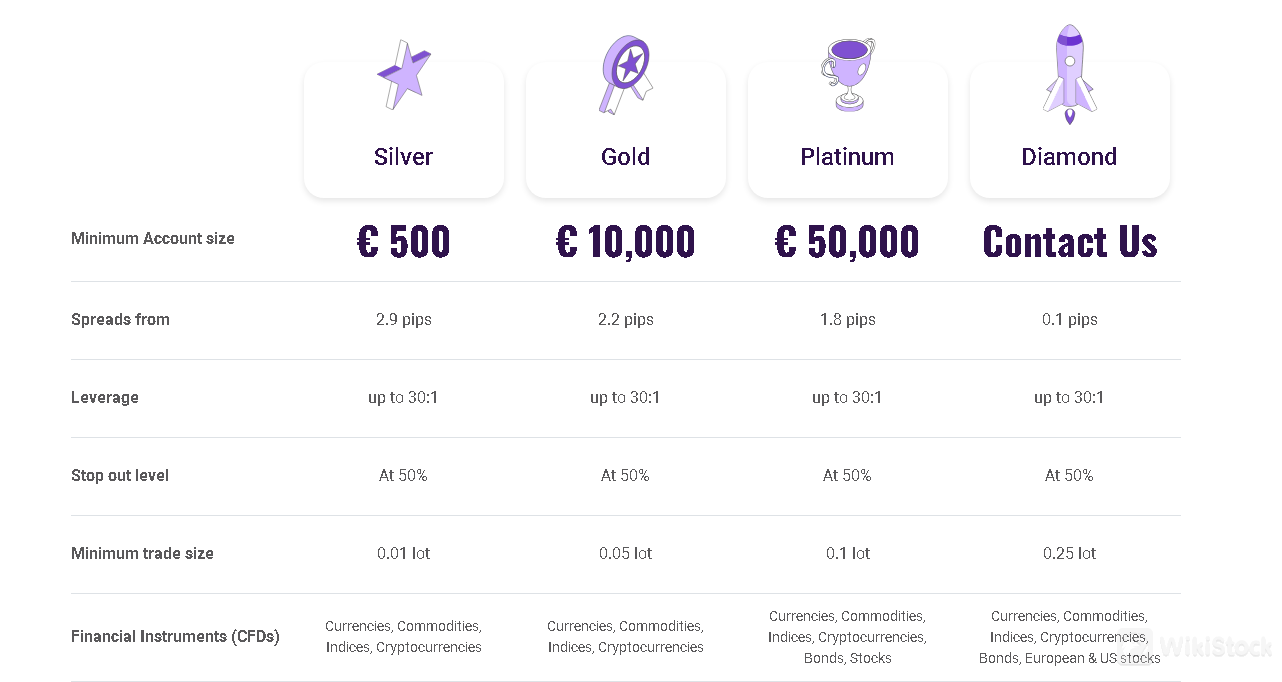

eFinno offers a range of account types tailored to suit varying trading needs and preferences.

Starting with the Silver account, requiring a minimum deposit of €500, traders can access spreads from 2.9 pips.

Moving up the tiers, the Gold account demands a minimum deposit of €10,000 with spreads from 2.2 pips.

For those seeking more extensive trading capabilities, the Platinum account, with a minimum deposit of €50,000, offers spreads from 1.8 pips.

Finally, the Diamond account, tailored for high-volume traders, requires a minimum deposit above €50,000 and provides the tightest spreads starting from 0.1 pips, along with an array of financial instruments including currencies, commodities, indices, cryptocurrencies, bonds, and stocks from European and US markets.

Furthermore, it offers leverage up to 30:1 for retail customers and 300:1 for professional customers over all account types.

Additionally, eFinno offers educational resources tailored to each account type, with durations ranging from 30 days to lifetime access.

For more details about spreads for different specific products, you can visit https://www.efinno.com/spread-and-commission and look up.

eFinno App Review

eFinno offers traders a versatile trading platform accessible via both mobile application and web interface.

With eFinno App, users can seamlessly manage their portfolios in real-time, whether on their smartphones or through web browsers. The mobile app features one-click execution for swift trade execution directly from chart windows and advanced charting tools with multiple formats and technical indicators.

Insightful analytics provide access to analyst ratings, aiding in informed decision-making. Real-time notifications keep traders updated on market movements, while robust risk management tools ensure prudent trading strategies. Biometric account security adds an extra layer of protection, allowing access via fingerprint or facial recognition.

Traders can conveniently manage their accounts by adding funds or initiating withdrawals directly from the app. The platform is optimized for both Android and iOS devices, ensuring a consistent user experience across different platforms.

With an intuitive dashboard, users can also track their positions and pending orders effortlessly, empowering them to navigate the financial markets effectively.

Customer Service

eFinno offers comprehensive customer service through various channels. Whether contacting them via email at info@efinno.com, filling out a contact form on their website, or reaching out through social media platforms like Twitter, Facebook, YouTube, and Instagram, they prioritize responsiveness and assistance.

Their headquarters in Limassol, Cyprus, also provides a physical address for direct inquiries.

With a dedicated team, eFinno ensures that customers receive prompt and effective support for any queries or concerns they have regarding their trading experience.

Headquarters: 16th June 1943, Gladstonos Court No16, Office 101, 3022, Limassol, Cyprus.

Tel : +35725055782.

Conclusion

eFinno stands out as a reliable and comprehensive trading platform, offering a wide range of financial instruments across multiple asset classes including currencies, indices, commodities, shares, bonds, and cryptocurrencies. Regulated by the Cyprus Securities and Exchange Commission (CYSEC), eFinno prioritizes client safety through robust security measures and investor protection protocols.

With a diverse array of account types tailored to different trading needs, coupled with leverage options and educational resources, eFinno ensures accessibility and support for traders of all levels. Their user-friendly mobile application and web interface, along with responsive customer service channels, further enhance the trading experience.

Overall, eFinno provides a dependable and feature-rich platform for traders to navigate the financial markets effectively and confidently.

Frequently Asked Questions (FAQs)

Is eFinno regulated by any financial authority?

Yes, eFinno operates under the regulatory jurisdiction of the Cyprus Securities and Exchange Commission (CYSEC) under license No. 376/19.

What types of products can I invest in with eFinno?

Currencies, indices, commodities, shares, bonds, and cryptocurrencies.

Is eFinno suitable for beginners?

Yes, eFinno caters to traders of all levels, including beginners. Regulated by CYSEC, along with a user-friendly platform, educational resources tailored to each account type, and access to a wide range of financial instruments, eFinno provides the necessary tools and support for beginners to learn and navigate the financial markets effectively.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Germany

GermanyObtain 1 securities license(s)