High Inactivity Fees: IBO charges an inactivity fee of EUR 80 per month if there are no transactions on the account for at least one month, adding costs for traders.

Service Area Restrictions: IBOs services are restricted to clients within the European Economic Area and Switzerland, limiting its global reach.

Withdrawal Fees: Although IBO does not charge withdrawal fees, clients will incur fees from intermediary banks or electronic money institutions.

Is It Safe?

Regulation:

OBRinvest operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CYSEC) with license no. 217/13, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores OBRinvest's commitment to integrity and credibility in its services.

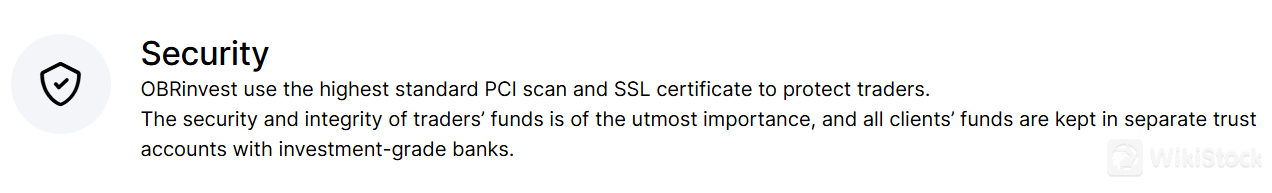

Safety Measures:

OBRinvest prioritizes the security and integrity of traders' funds with robust measures in place.

Utilizing the highest standard PCI scans and SSL certificates, the broker ensures secure transactions and protects sensitive data from unauthorized access.

All client funds are segregated into separate trust accounts held with reputable, investment-grade banks. This segregation safeguards funds against operational risks, ensuring they are kept separate from OBRinvest's own operational funds.

What are Securities to Trade with OBRinvest?

OBRinvest offers a diverse selection of market instruments for a wide range of trading preferences.

Traders can engage in cryptocurrency trading, taking advantage of the volatile price movements in this emerging asset class.

Currency markets, known for their deep liquidity, provide opportunities to trade major and minor currency pairs.

Commodities such as gold, silver, crude oil, cocoa, and coffee are also available as CFDs, allowing traders to speculate on their price fluctuations.

Additionally, OBRinvest offers CFDs on stocks, providing access to global equities without the complexities of traditional brokerage accounts.

Traders can also trade indices like the S&P 500 and FTSE 100, capitalizing on market movements in these benchmark indices.

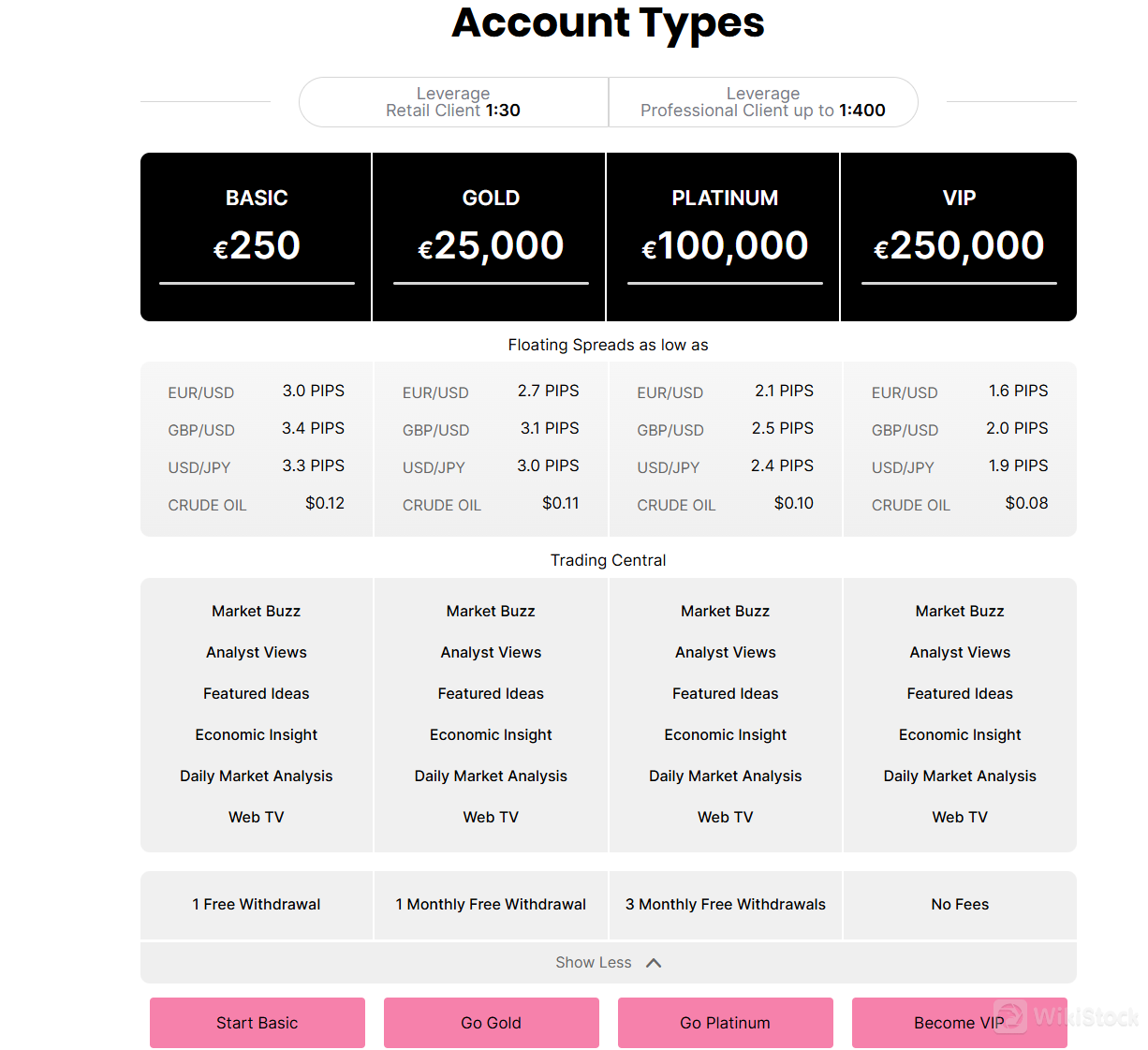

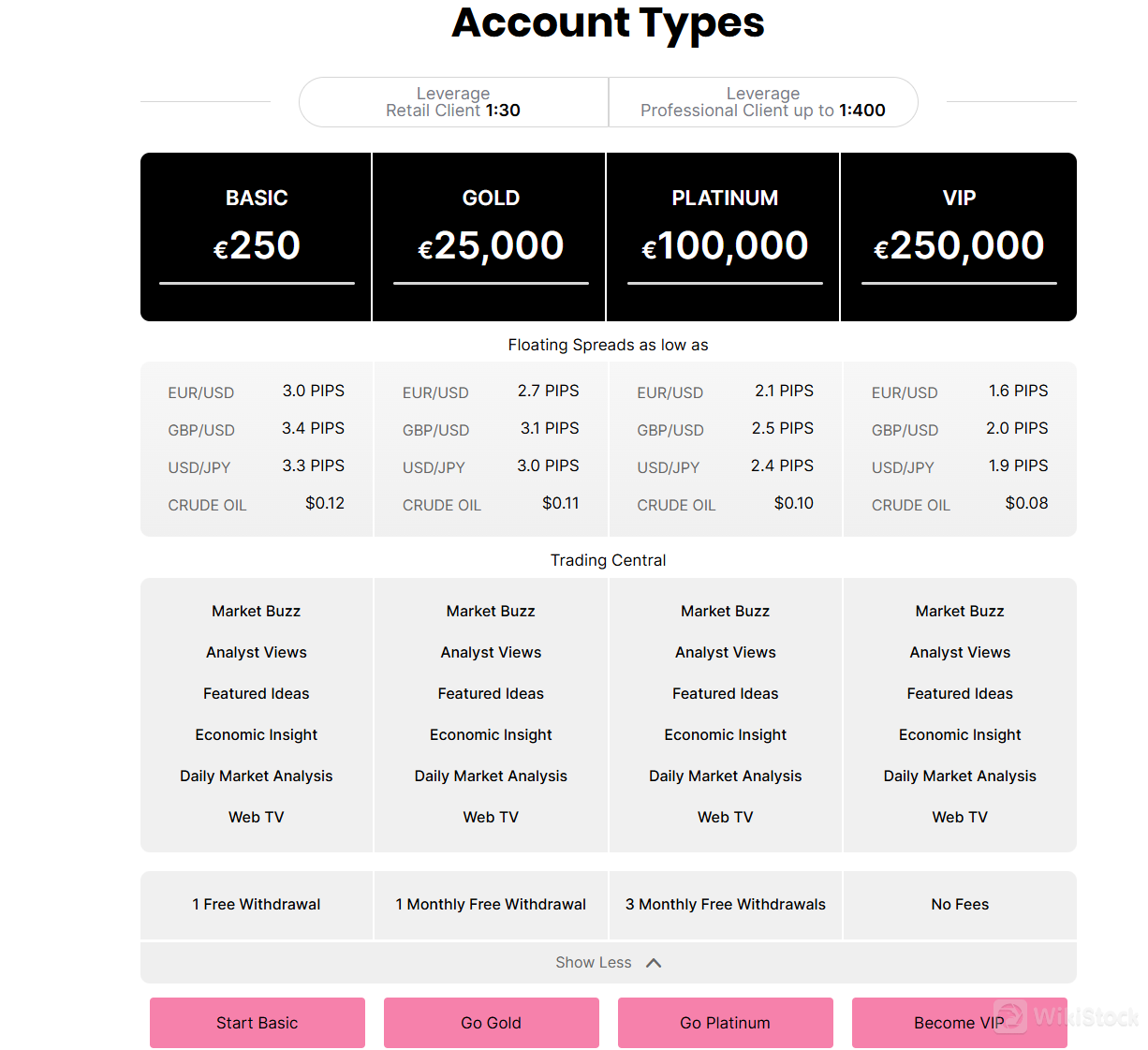

Accounts

OBRinvest offers a range of account types.

The Basic account requires a minimum deposit of €250, providing access to floating spreads on major currency pairs starting from 3.0 pips for EUR/USD.

As traders progress to higher tiers like Gold (€25,000), Platinum (€100,000), and VIP (€250,000), they benefit from tighter spreads and additional perks such as reduced trading costs and increased leverage. Professional clients can access leverage up to 1:400.

Each account type includes features like Trading Central analysis, market insights, and a 1-3 months of free withdrawals.

Fees Review

OBRinvest offers a transparent fee structure aimed at providing clarity and ensuring clients understand the costs associated with trading.

There are no deposit or commission fees, making it cost-effective for traders to participate in various markets such as cryptocurrencies, currencies, commodities, stocks, and indices. However, clients should be aware of fees for withdrawals, particularly when using debit/credit cards (3.5%), Neteller (3%), Moneybookers (2%) or wire transfers (30 USD, EUR, or GBP).

Additionally, an inactivity fee of 80 EUR per month applies if there are no transactions on the trading account for at least one month, highlighting the importance of regular trading activity or proper account management to avoid unnecessary charges.

App Review

OBRinvest provides a versatile range of trading platforms.

Their platform, WebTrader, is a 100% web-based solution accessible from desktop devices, offering full responsiveness and an advanced trading experience.

Additionally, OBRinvest claims to offer on-the-go platforms optimized for smartphones and tablets, including MetaTrader 4, however, we advise you to confirm the functionality of MT4 through direct consultation with OBRinvest due to the invalid link.

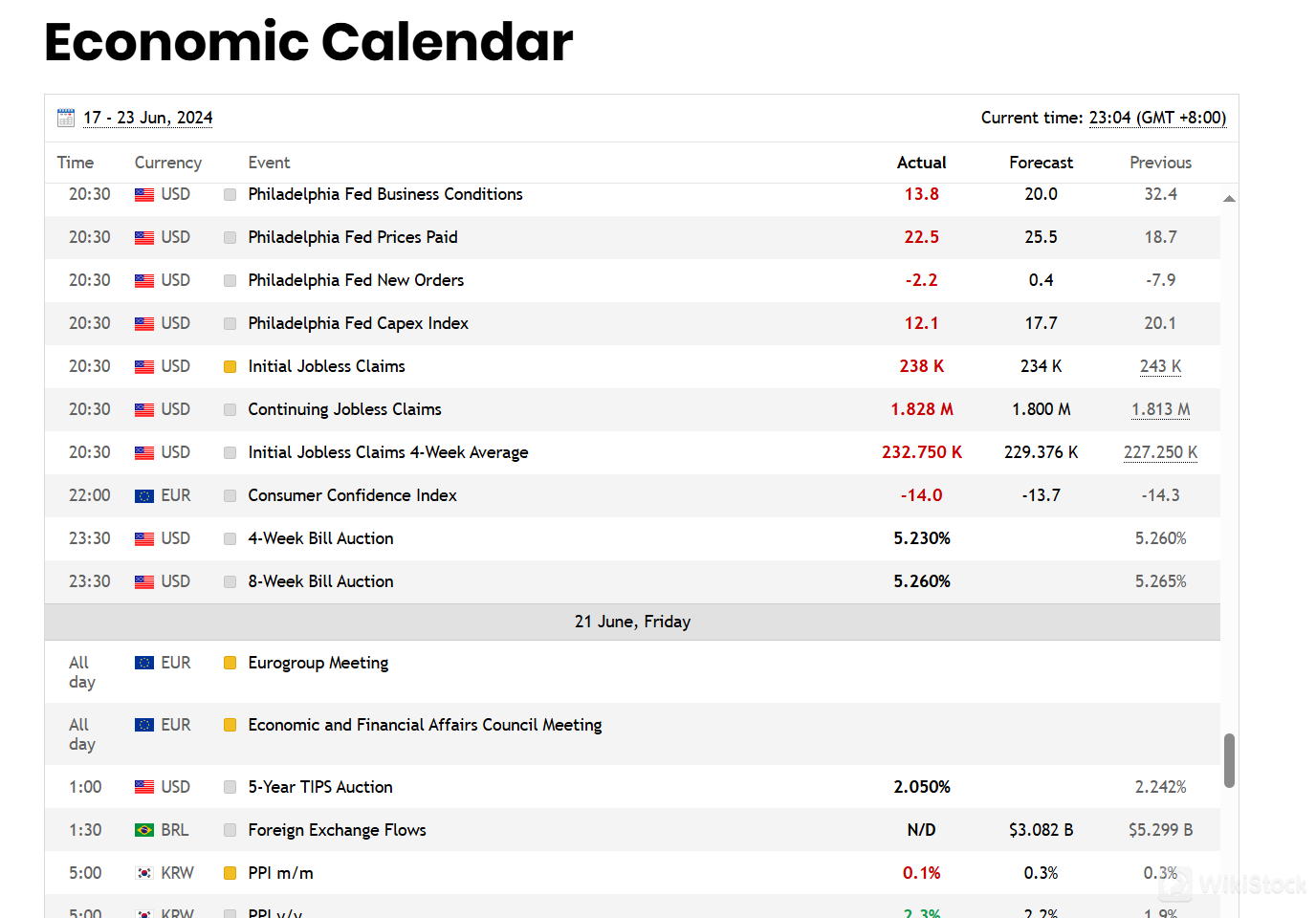

Trading Tools

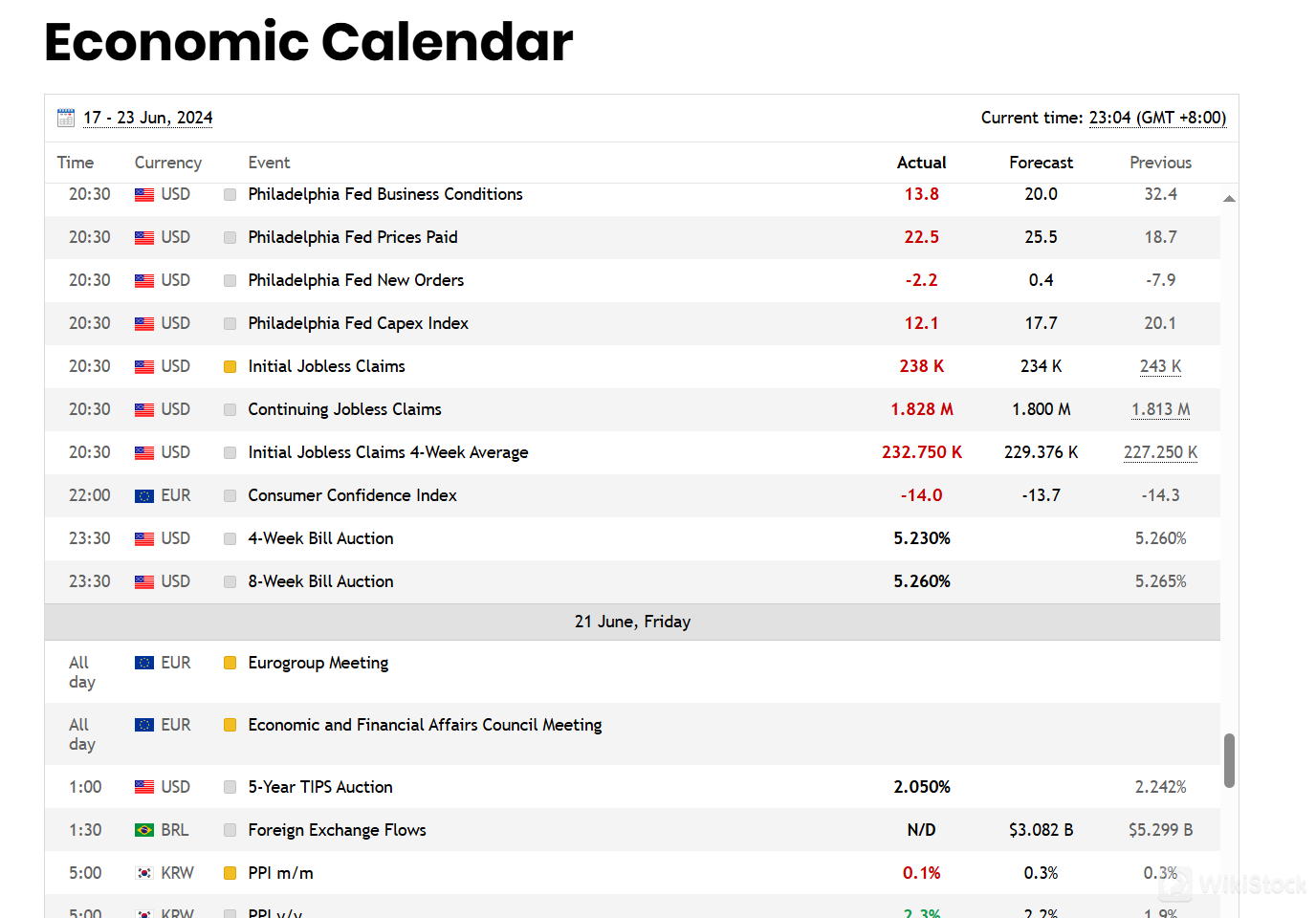

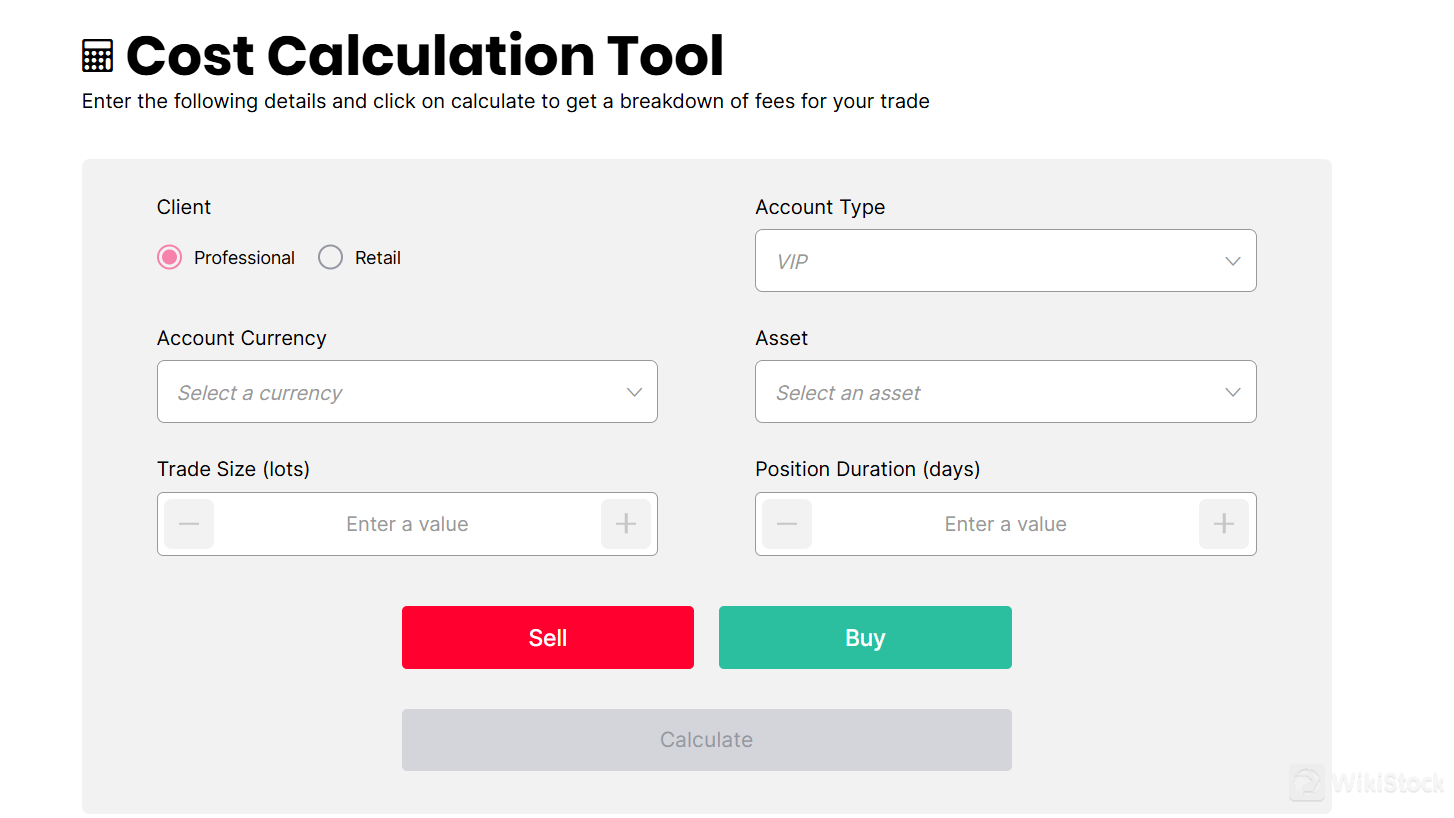

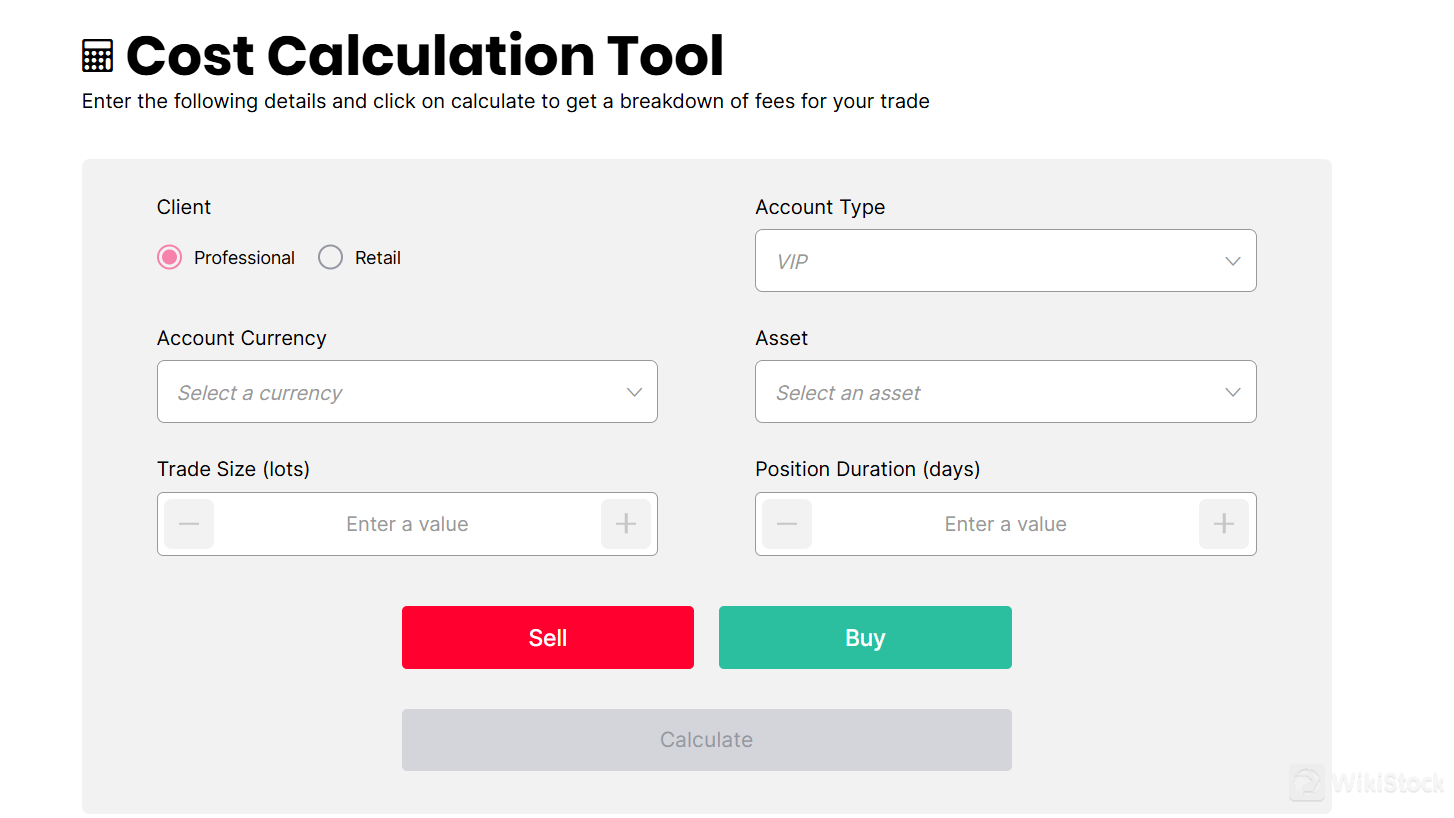

IBO provides a comprehensive suite of trading tools designed to enhance the trading experience and support informed decision-making.

Key tools include the Economic Calendar, which helps traders stay updated on important market-moving events and announcements globally.

Additionally, IBO offers a Cost Calculation Tool, enabling traders to input trade details such as account curency, trade size etc. and calculate potential fees, ensuring transparency and better financial planning.

Research & Eduation

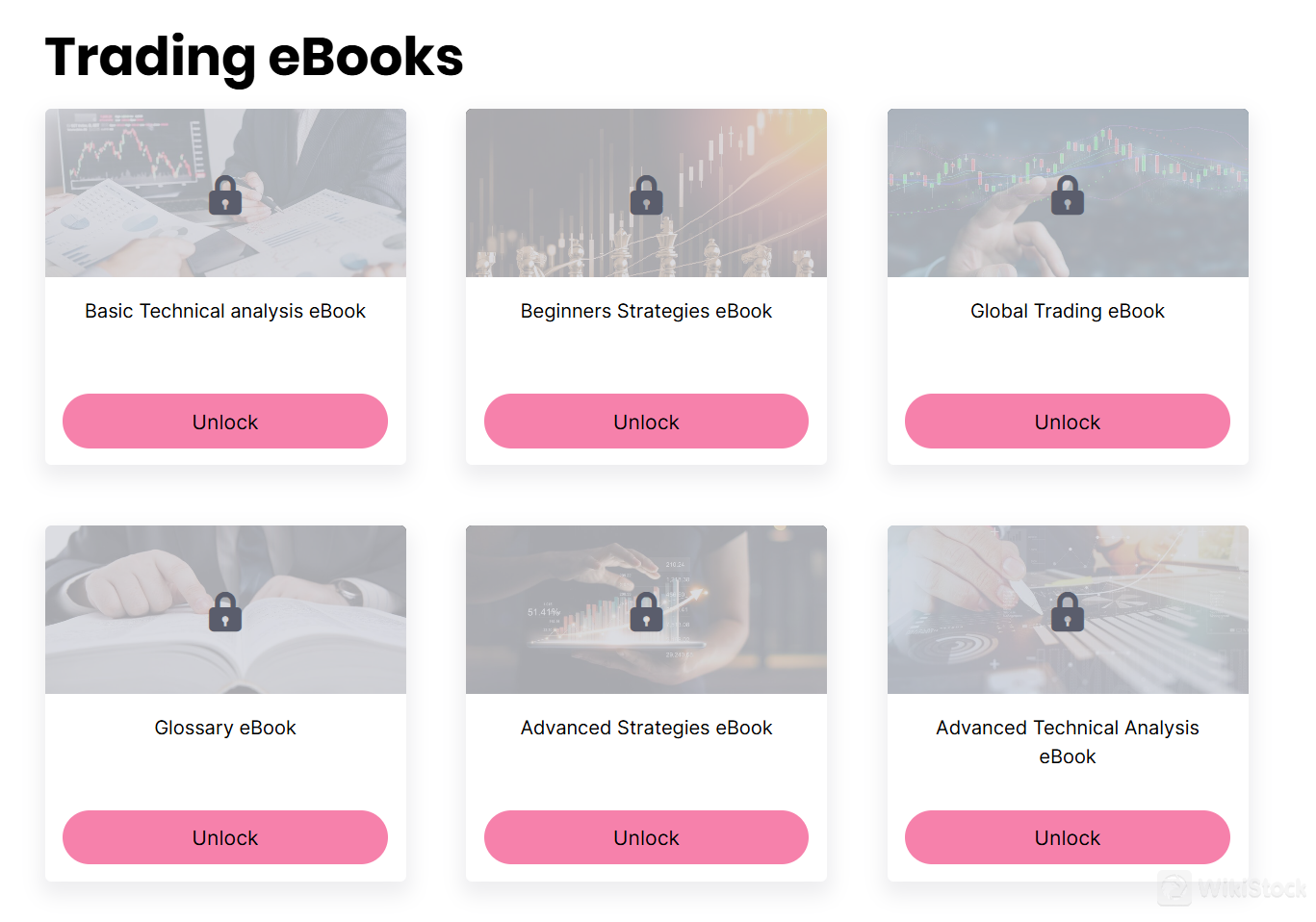

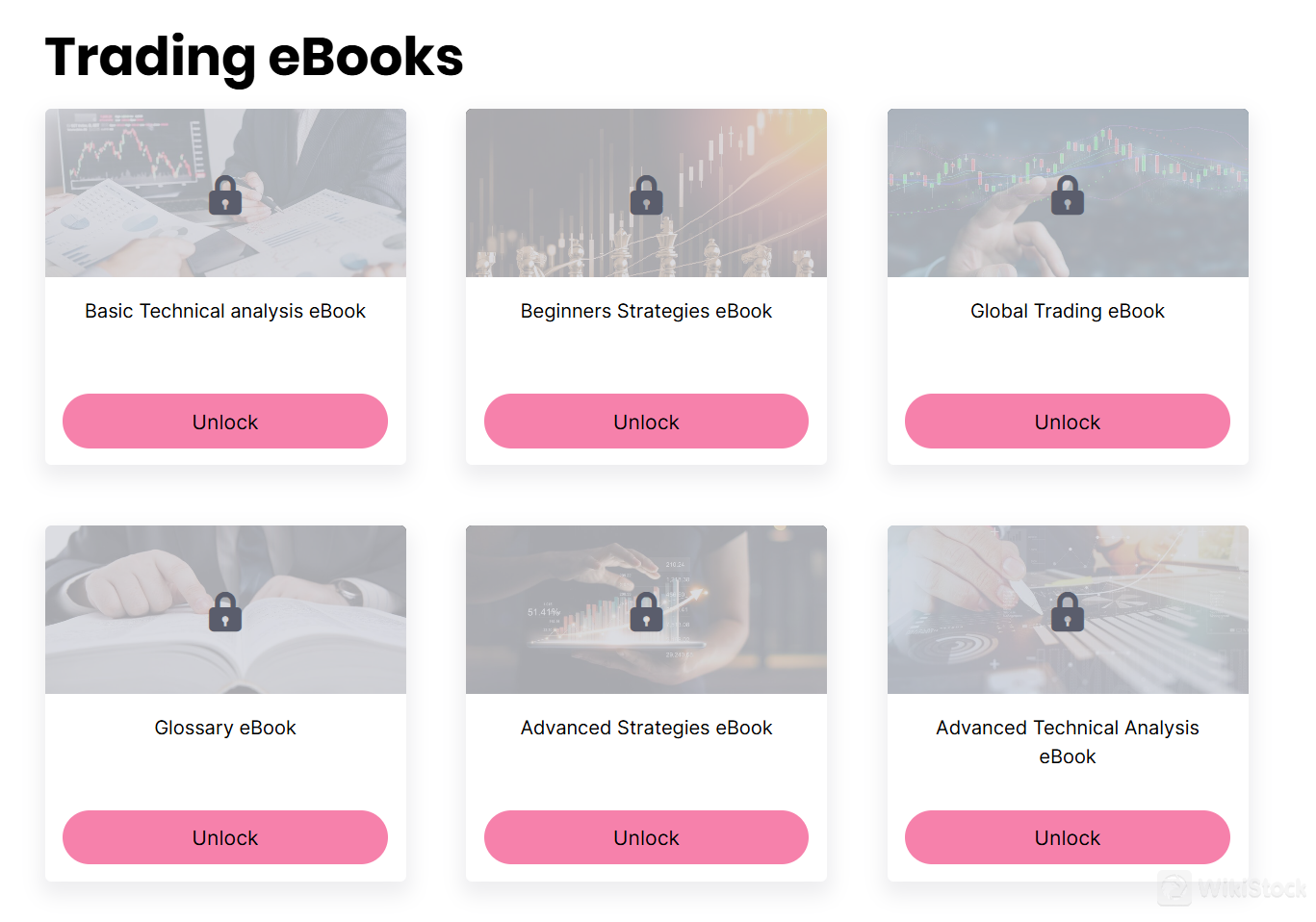

OBRinvest provides a comprehensive suite of research and educational resources designed to support traders at all levels.

The offerings include a variety of trading eBooks such as Basic Technical Analysis, Beginners Strategies, Global Trading, and Advanced Strategies etc. These eBooks cover essential topics like market analysis, capital management, and trading psychology and a glossary page for beginners learning.

Additionally, OBRinvest offers insights into fundamental and technical analysis, helping traders make informed decisions.

Customer Service

OBRinvest offers multiple customer service channels to ensure efficient and effective support for its clients.

Located at 161 Makarios III Avenue, 3027, 6th Floor, Akapnitis Court, Limassol, Cyprus, the company can be reached via telephone at +357 25763605 for direct inquiries. For written communication, clients can email at info@obrinvest.com. Additionally, OBRinvest provides a live chat feature on its website, allowing for real-time assistance and immediate resolution of trading-related queries.

Conclusion

OBRinvest offers a wide range of trading services across cryptocurrencies, currencies, commodities, stocks, and indices. With a minimum account deposit of €250, zero commission, and no deposit/withdrawal fees, it provides accessible trading options.

Besides, the platform is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 217/13, ensuring compliance with stringent regulatory standards that enhance its credibility and reliability in the financial markets.

Frequently Asked Questions (FAQs)

Obtain 1 securities license(s)