Score

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

Japan

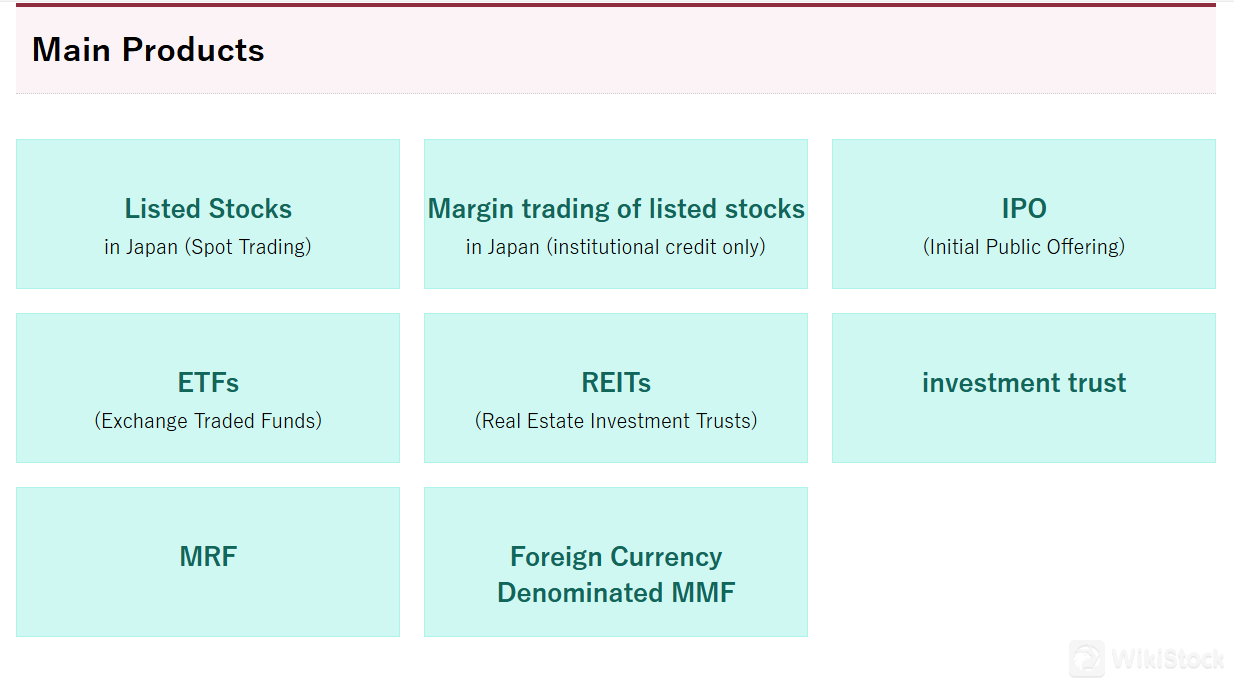

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

武甲証券株式会社

Abbreviation

武甲証券

Platform registered country and region

Company address

Company website

https://buko.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.264%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Buko Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

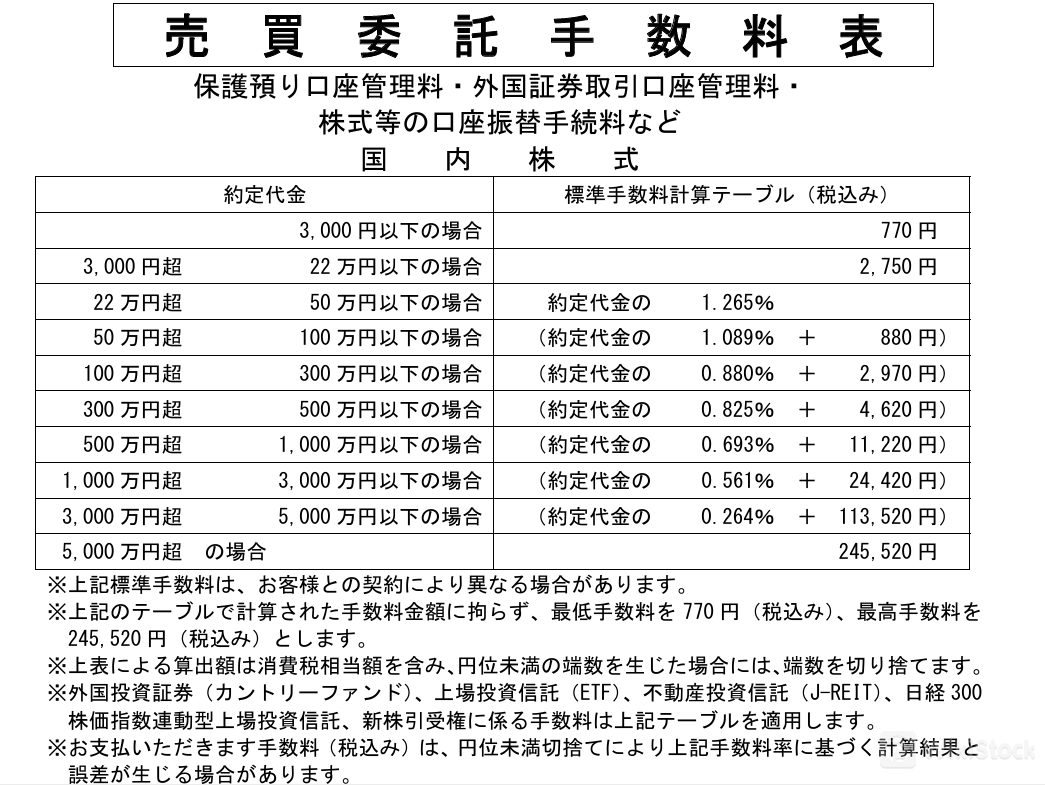

| Fees | Stock: up to 1.265%, min. 770 yen (tax included) |

| Mutual Funds Offered | Not available |

Buko Securities Information

Buko Securities is a Japanese securities firm located in Chichibu City, Saitama Prefecture, offering a variety of investment services. They can be reached at 0494-24-3611 for any inquiries. The brokerage operates from 8:00 AM to 6:00 PM, with weekends and holidays designated as their days off.

Pros & Cons of Buko Securities

| Pros | Cons |

| Good Regulation and Reputation | None |

| Multiple Trading Categories | |

| Various Account Types |

Pros:

- Brokerage Information: Buko Securities is recognized for its integrity within the Japanese financial sector, upholding a strong reputation. The firm operates under a regulatory framework that ensures investor protection and fosters market stability. Robust security protocols, including data encryption and secure login mechanisms, are in place to protect client assets and privacy.

- Multiple Trading Categories: Buko Securities provides investors with a diverse array of tradable assets, encompassing stocks, bonds, and mutual funds.

- Various Account Types: The firm accommodates a wide range of investor profiles by offering various account types, including those designed for individual, joint, and corporate investment needs.

- Stocks: Shares in publicly traded companies, allowing investors to own a piece of the company and potentially benefit from capital gains and dividends.

- Bonds & Fixed Income: Debt securities issued by governments or corporations, providing a fixed income to investors in the form of interest payments.

- ETFs: Investment funds that are traded on stock exchanges, similar to individual stocks, and offer diversified exposure to various asset classes, sectors, or commodities.

- Options: Financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specific period.

- Individual Accounts: Designed for personal investment, these accounts have different tiers based on the minimum account balance and the services offered.

- Joint Accounts: Allowing multiple parties to manage and trade within the same account, these accounts are subject to specific requirements and benefits.

- Securities Commission: Ranges from 770 yen for small transactions to a maximum of 245,520 yen for large contracts.

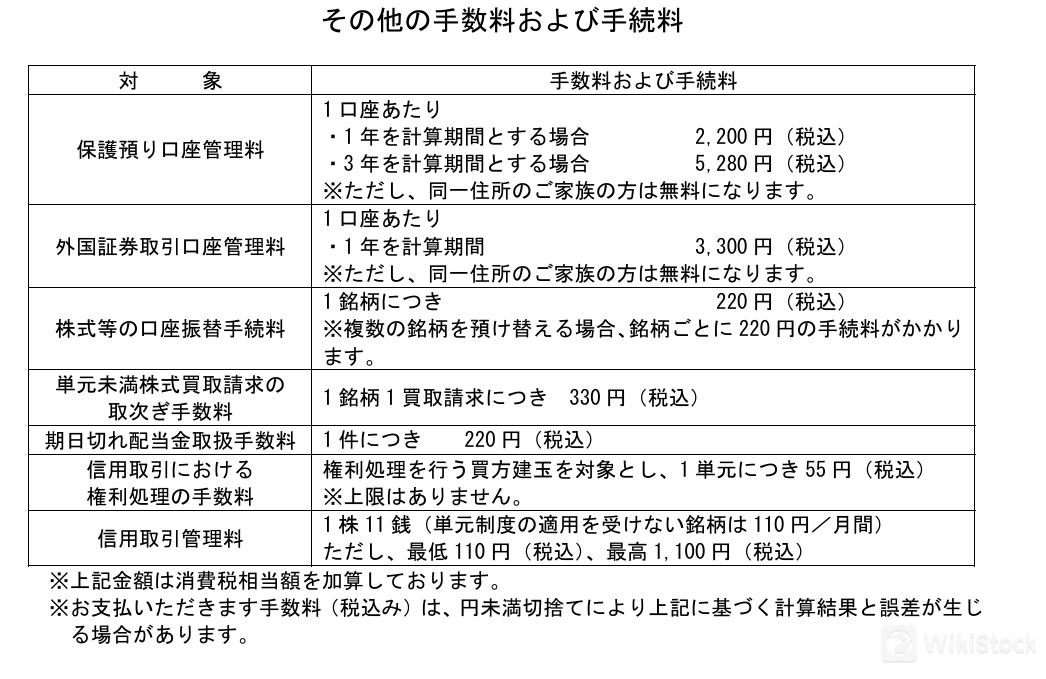

- Account Management Fees: Annual fee at 2,200 yen and triennial fee at 5,280 yen, with family discounts.

- Foreign Securities Trading Account Fee: 3,300 yen annually, with family discounts.

- Stock Transfer Fee: A flat rate of 220 yen per transaction.

- Fractional Stock Withdrawal: 330 yen per request.

- Dividend Payment Transfer Fee: 220 yen per item.

- Credit Trading Profit Processing Fee: Starts at 55 yen per unit, with an upper limit.

- Profit Processing Fee: Varies between 110 to 1,100 yen, depending on the stock and system applied.

- Is Buko Securities legit?

- Yes, Buko Securities is a legitimate (regulated by FSA), government-registered firm with the necessary licenses to operate in the financial industry.

- How about the fee structure of Buko Securities?

- It offers transparent fees, and you can find detailed info on fees at 'Buko Securities Fees Review' section.

Is Buko Securities Safe?

Regulations:Buko Securities is regulated by the Japan Financial Services Agency (FSA), which is the primary financial regulator in Japan. This regulatory status ensures that the company adheres to strict compliance and oversight, protecting client assets and maintaining high industry standards. The FSA's oversight provides a framework for financial institutions to operate with transparency and integrity.Buko Securities is identified as a regulated entity with a specific License No.: “開束财务局長(金商)第154号”. The effective date of this regulation is September 30, 2007. This regulatory certification is a testament to the firm's commitment to industry regulations and investor protection.

What are Securities to Trade with Buko Securities?

Buko Securities offers a range of financial instruments for trading, which includes stocks, bonds, ETFs (Exchange Traded Funds), and options. The firm does not provide mutual funds, futures, or securities lending services.

Buko Securities Accounts

Buko Securities Fees Review

Customer Service

Buko Securities provides customer support through various means, including a dedicated phone line and possibly email, as suggested by the contact information on their website. For immediate assistance or inquiries, clients can call the customer service hotline at 0494-24-3611. The physical address for Buko Securities is 11-12 Ueno-cho, Chichibu-shi, Saitama 368-0031, Japan. The customer service team is available during business hours, which are 8 a.m. to 6 p.m., and the office is closed on Saturdays, Sundays, and holidays.

Conclusion

Buko Securities is a regulated brokerage firm with a solid reputation in the Japanese financial community. Its core strengths lie in providing a secure trading environment and a range of tradable securities. The firm is particularly suitable for investors who prioritize regulatory compliance and are interested in stocks, bonds, ETFs, and options trading.

Frequently Asked Questions (FAQs)

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

Plus500

Score

BlackRock

Score

SBI THAI ONLINE

Score

Schroders

Score

AVA Trade

Score

Hantec Financial

Score

Monex

Score

Rakuten Trade

Score

LEADING

Score

auカブコム証券

Score