Score

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

Japan

JapanProducts

6

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

Kyowa Securities Co., Ltd.

Abbreviation

共和証券株式会社

Platform registered country and region

Company address

Company website

http://www.kyowa-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| Kyowa Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Fees | Japan Stock Commission, Bond Trading Commission, Stock Price Index Options Trading Commission, Foreign Stock Domestic Brokerage Fee: vary on the contract amount, see details in 'Fees Review' section |

| Products | Securities Lending Fully Paid, Bonds & Fixed Income, Futures, Investment Advisory Service, Options, Stocks |

| Customer Support | Tel: 03-3666-1381 |

| Fax: 03-3667-5526 |

Kyowa Introduction

Kyowa Securities is a Japanese brokerage firm established in 1933. Under the regulation of Japan Financial Services Agency(FSA), it offers a broad range of financial services, including securities trading, underwriting, debt lending and brokerage. Kyowa Securities also handles real estate, life insurance, and trust contract agency business.

Pros & Cons of Kyowa Securities

| Pros | Cons |

| Extensive Services | Only Japanese Supported |

| Strong Capital Adequacy | |

| Regulated and Trusted |

Pros:

Extensive Services: Kyowa Securities offers a wide range of financial services, including securities trading, underwriting, brokerage, real estate, and life insurance services.

Strong Capital Adequacy: With an equity capital of 6,833 million yen and a capital adequacy ratio of 207.9%, the firm demonstrates strong financial stability.

Regulated and Trusted: The firm is regulated by the Japan Financial Services Agency(FSA) and participates in major exchanges like the Tokyo Stock Exchange and Osaka Exchange, ensuring adherence to stringent standards.

Cons:

Only Japanese Supported: Kyowa Securities exclusively supports services in Japanese.

Is Kyowa Securities Safe?

With a license of No. 関東財務局長(金商)第64号, Kyowa Securities is regulated by Japan Financial Services Agency(FSA). To protect client interests and ensure dispute resolution, the company has designated the NPO Securities and Financial Products Mediation and Consultation Center as its official dispute resolution agency. Additionally, it holds memberships in Japan Securities Dealers Association, and Japan Investment Advisers Association.

What are Securities to Trade with Kyowa Securities?

Kyowa Securities offers a wide range of services including Securities Lending Fully Paid, Bonds & Fixed Income, Futures, Investment Advisory Service, Options, and Stocks.

- Securities Lending Fully Paid: Kyowa Securities offers lending services with a focus on brokered loans. The broker fee is calculated as the loan amount multiplied by a commission rate of 5.00%. For dispute resolution, the designated institution is the Japan Lending Association's Consultation and Dispute Resolution Center.

- Bonds & Fixed Income: Investors can trade in bonds, which are fixed-income securities issued by governments or corporations. Bonds provide a regular income stream through interest payments and are generally considered less risky than stocks.

- Futures: Kyowa Securities offers futures trading, involving standardized contracts to buy or sell an asset at a predetermined price on a specified future date. Futures can be used for hedging against price fluctuations or for speculative purposes.

- Investment Advisory Service: Kyowa Securities provides personalized investment advice, assisting investors in making informed decisions and optimizing their portfolios.

- Options: Trading options at Kyowa Securities grants the holder the right, but not the obligation, to buy or sell an asset at a specified price within a defined timeframe. Options can be used for hedging or speculation.

- Stocks: Kyowa Securities provides access to trade in shares of publicly listed companies, enabling investors to participate in the equity markets and potentially benefit from stock price movements.

Fees Review

Brokerage commissionof Kyowa Securities designed for various financial instruments, including domestic and foreign stocks, bonds, and stock index options, with rates dependent on transaction amounts and specific securities involved, emphasizing minimum and maximum fee thresholds. Following is its brokerage commission table:

Japan Stock Commission Table

| Contract Amount | Proportional Method |

| Up to 1 million yen | Contract Amount x 1.265% |

| Over 1 million yen, up to 3 million yen | Contract Amount x 0.935% + 3,300 yen |

| Over 3 million yen, up to 5 million yen | Contract Amount x 0.924% + 4,620 yen |

| Over 5 million yen, up to 10 million yen | Contract Amount x 0.715% + 14,080 yen |

| Over 10 million yen, up to 30 million yen | Contract Amount x 0.594% + 26,180 yen |

| Over 30 million yen, up to 50 million yen | Contract Amount x 0.352% + 98,780 yen |

| Over 50 million yen | Contract Amount x 0.11% + 219,780 yen |

- If the amount equivalent to Contract Amount x 1.265% is less than 750 yen, it will be 750 yen. Maximum 299,750 yen.

- A 5% discount on domestic stock brokerage fees applies to clients who open a “Securities Comprehensive Account.”

- Listed index-linked investment trusts (ETFs) and real estate investment trusts (REITs) follow the domestic stock brokerage fee schedule.

- For fractional share transactions (selling odd-lot shares), calculate the transaction fee for one unit and allocate it based on the number of fractional shares.

- During calculations, any fractional remainders will be rounded off.

Convertible Bond New Stock Subscription Rights Corporate Bond Commission Table

| Contract Amount | Proportional Method |

| Up to 1 million yen | Contract Amount x 1.10% |

| Over 1 million yen, up to 5 million yen | Contract Amount x 0.99% + 1,100 yen |

| Over 5 million yen, up to 10 million yen | Contract Amount x 0.77% + 12,100 yen |

| Over 10 million yen, up to 30 million yen | Contract Amount x 0.605% + 28,600 yen |

| Over 30 million yen, up to 50 million yen | Contract Amount x 0.44% + 78,100 yen |

| Over 50 million yen, up to 100 million yen | Contract Amount x 0.275% + 160,600 yen |

| Over 100 million yen, up to 10 billion yen | Contract Amount x 0.22% + 215,600 yen |

| Over 10 billion yen | Contract Amount x 0.165% + 765,600 yen |

Bond Trading Commission Table (Per 100 Yen)

| Amount Total | National Bonds | Local Bonds, Foreign Bonds, Foreign Local Bonds, Other Securities | Other Bonds |

| up to 1 million yen | 44 sen | 66 sen | 88 sen |

| Over 1 million yen, up to 10 million yen | 38.5 sen | 55 sen | 71.5 sen |

| Over 10 million yen, up to 50 million yen | 33 sen | 44 sen | 55 sen |

| Over 50 million yen, up to 100 million yen | 27.5 sen | 38.5 sen | 38.5 sen |

| Over 100 million yen, up to 10 billion yen | 11 sen | 16.5 sen | 22 sen |

| Over 10 billion yen | 5.5 sen | 11 sen | 16.5 sen |

Stock Price Index Options Trading Commission Table

| Trading Price or Amount Generated by Exercising Rights | Proportional Method |

| up to 1 million yen | Transaction price x 4.4% |

| Over 1 million yen, up to 3 million yen | Transaction price x 3.3% + 11,000 yen |

| Over 3 million yen, up to 5 million yen | Transaction price x 2.2% + 44,000 yen |

| Over 5 million yen, up to 10 million yen | Transaction price x 1.65% + 71,500 yen |

| Over 10 million yen, up to 30 million yen | Transaction price x 1.32% + 104,500 yen |

| Over 30 million yen, up to 50 million yen | Transaction price x 0.99% + 203,500 yen |

| Over 50 million yen | Transaction price x 0.66% + 368,500 yen |

Foreign Stock Domestic Brokerage Fee Table

Trading with East Asian Securities

| Transaction Amount | Proportional Method |

| Up to 1 million yen | yen conversion price x 0.88% |

| Over 1 million yen, up to 2 million yen | yen conversion price x 0.770% + 1,100 yen |

| Over 2 million yen, up to 3 million yen | yen conversion price x 0.660% + 3,300 yen |

| Over 3 million yen, up to 5 million yen | yen conversion price x 0.550% + 6,600 yen |

| Over 5 million yen, up to 10 million yen | yen conversion price x 0.440% + 12,100 yen |

| Over 10 million yen | 56,100 yen |

Trading with Iwai Cosmo Securities

| Transaction Amount | Proportional Method |

| Up to 25,000 yen | yen conversion price x 11% |

| Over 25,000 yen | (yen conversion price x1.20%yen) x 1.1 |

Trading with Daiwa Securities

| Transaction Amount | Proportional Method |

| Up to 1 million yen | yen conversion price x 0.990% |

| Over 1 million yen, up to 3 million yen | yen conversion price x 0.880% + 1,100 yen |

| Over 3 million yen, up to 5 million yen | yen conversion price x 0.715% + 6,050 yen |

| Over 5 million yen, up to 10 million yen | yen conversion price x 0.660% + 8,800 yen |

| Over 10 million yen, up to 30 million yen | yen conversion price x 0.550% + 19,800 yen |

| Over 30 million yen, up to 50 million yen | yen conversion price x 0.440% + 52,800 yen |

| Over 50 million yen, up to 100 million yen | yen conversion price x 0.385% + 80,300 yen |

| Over 100 million yen | yen conversion price x 0.330% + 135,300 yen |

For more detailed information, please visit their official website:https://kyowa-sec.co.jp/files/202207-itakutesuuryou.pdf

Services Review

Kyowa Securities offers a wide range of services including trading securities, intermediation, brokerage, and agency for buying and selling securities. They also provide securities underwriting, secondary offerings, and handle public and secondary offerings of securities.

Additionally, they offer mediation and introduction services for other businesses, trust contract agency business, real estate sales, rentals, and brokerage services. Kyowa Securities is also involved in money lending and intermediary services, life insurance solicitation, and other business activities permissible under the Financial Instruments and Exchange Act.

Customer Service

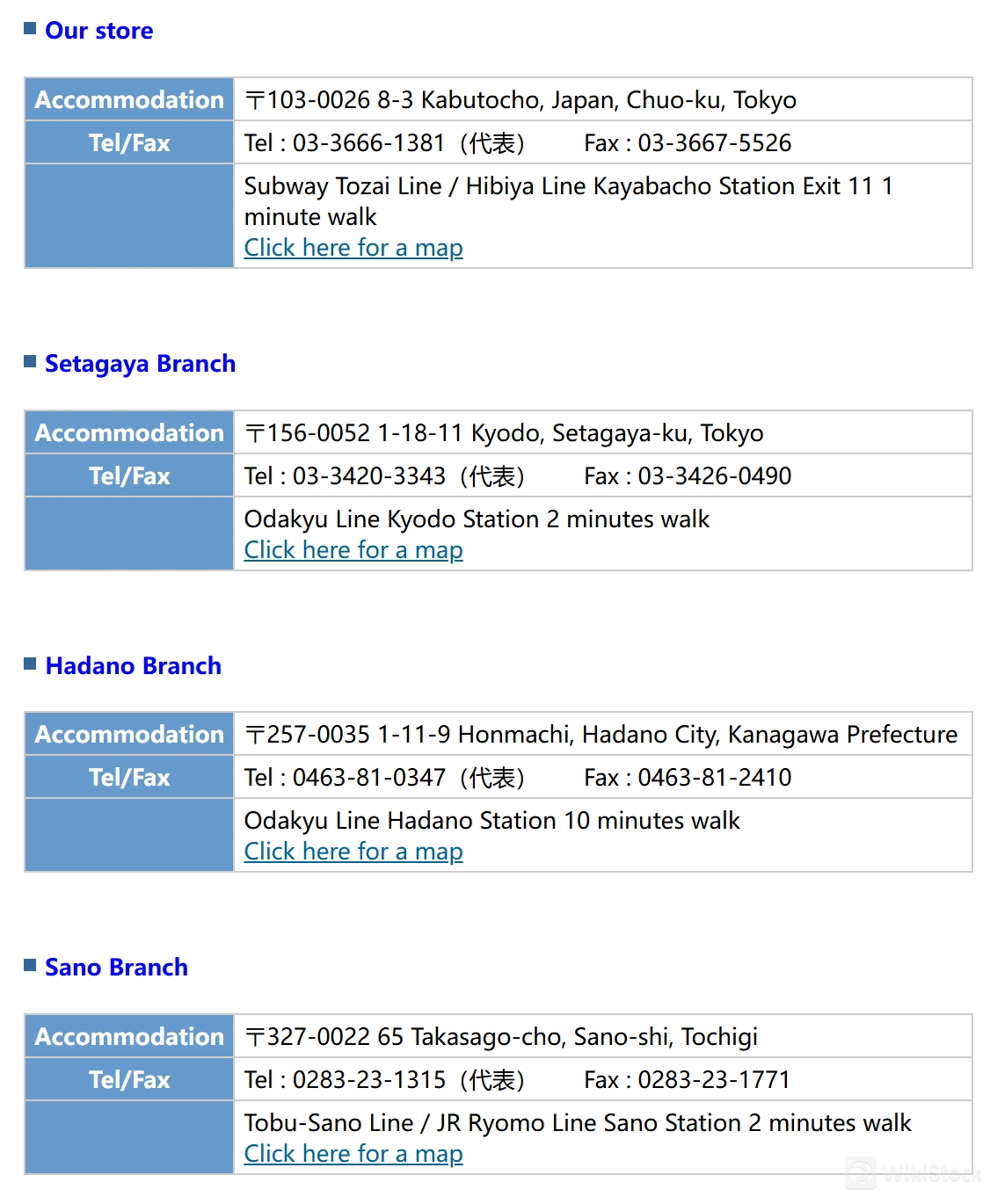

Kyowa Securities offers several contact options for clients needing assistance. Following is information about their main store.

Address: 103-0026, 8-3 Nihonbashi Kabutocho, Chuo-ku, Tokyo

Tel: 03-3666-1381

Fax: 03-3667-5526

In addition, several branch locations with contact information for customer assistance are offered, you can find contact details on other branches onhttps://www.kyowa-sec.co.jp/tenpo.html

Conclusion

In summary, Kyowa Securities is a reliable Japan-based brokerage firm governed by stringent regulations of the Japan Financial Services Agency (FSA). It offers a wide range of securities, fortified by an official dispute resolution mechanism. Despite this, if you are interested in this broker, you should still be cautious, conducting thorough research and verifying the latest information from Kyowa Securities. Hopefully, this overview has shed some light on your decision-making process.

Frequently Asked Questions (FAQs)

What services does Kyowa Securities offer?

Securities Trading, Investment Advisory, Securities Underwriting, Trust Contract Agency Business, Real Estate Services, Life Insurance Solicitation, and more.

Is Kyowa Securities a legitimate operation?

Yes, it is regulated by the Japan Financial Services Agency (FSA).

How about the fee structure of Kyowa Securities?

It's complex and you can find detailed info in 'Fees Review' section.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

10-15 years

Regulated Countries

1

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Investment Advisory Service、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

寿証券

Score

Centrade

Score

めぶき証券

Score

浜銀TT証券

Score

おきぎん証券

Score

ワンアジア証券

Score

木村証券

Score

西日本シティTT証券

Score

Kuni Umi AI Securities

Score

香川証券

Score