Ueda Yagi Securities, a subsidiary of Ueda Yagi Tanshi, excels in fund sales, offering expert investment management for diverse entities, prioritizing investor interests with a diligent approach and a strong network. With over 20 years of experience, they stand out in alternative investments, adapting to market changes to connect consumers with varied financial products.

What is UYS?

Ueda Yagi Securities Co., Ltd. (UYS) is a Japan-based broker with a strong focus on alternative investments. Established as a subsidiary of Ueda Yagi Tanshi Co., Ltd., UYS has been operational since 2007, specializing in the distribution of privately placed investment trusts and hedge funds. The company caters primarily to institutional investors, providing a broad range of investment opportunities.

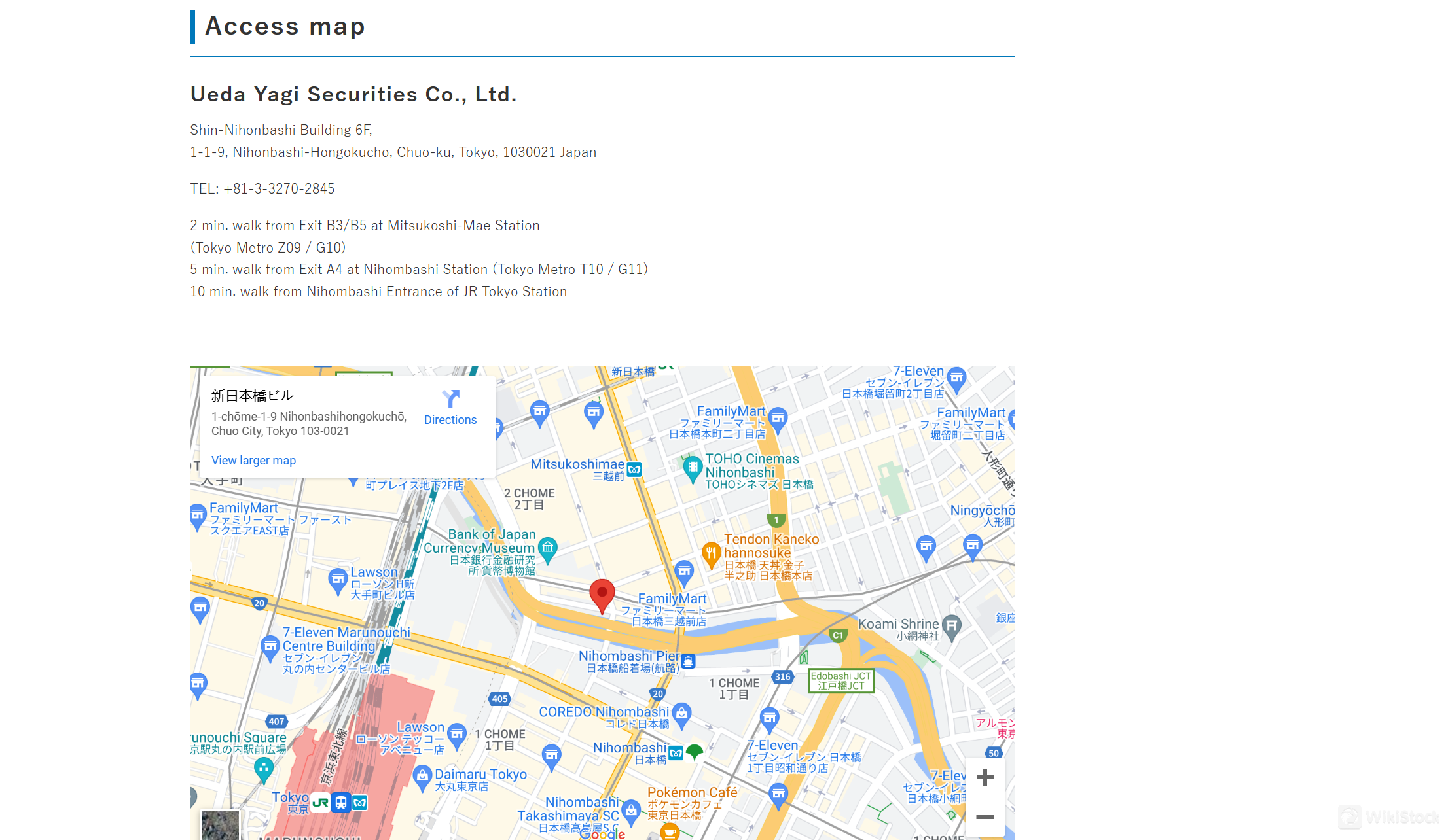

With its headquarters in Tokyo, UYS prides itself on offering high-liquidity and transparent investment products. The firm's commitment to integrity, competence, and respect forms the core of its business philosophy.

Pros and Cons of UYS

Ueda Yagi Securities (UYS) presents a unique investment approach with a strong focus on alternative assets. This focus can offer diversification benefits and potential for higher returns for investors. Their commitment to transparency in fee structures is commendable, ensuring clients understand the costs involved. Moreover, UYS fosters long-term relationships with fund management companies, prioritizing trust and open communication, which can contribute to better investment decisions.

However, UYS primarily caters to institutional investors, making it less accessible for individual retail clients who may have limited investment capital. Additionally, the lack of readily available details about their trading platform and limited research and educational resources on the website can be frustrating for potential clients who want to understand their services fully before investing.

Is UYS safe?

Regulations

UYS is officially licensed and regulated by The Japan Financial Services Agency (FSA) under license number 関東財務局長(金商)第29号 for a wide range of business activities.

Funds Safety

UYS prioritizes the safety of its clients' funds by adhering to stringent regulatory standards. The company uses segregated accounts to separate client funds from its operational funds, minimizing the risk of any potential misuse. Additionally, UYS is a member of the Japan Securities Dealers Association, which further reinforces its commitment to maintaining high standards of financial integrity.

Safety Measures

In terms of safety measures, UYS implements advanced security protocols to protect client information and transactions. The broker employs robust encryption technologies and secure data centers to safeguard against cyber threats. Regular audits and compliance checks are conducted to ensure adherence to regulatory guidelines and internal policies. Moreover, UYS has a diverse risk management system in place, designed to monitor and mitigate potential financial risks. These measures collectively contribute to creating a secure trading environment for its clients.

What are securities to trade with UYS?

Ueda Yagi Securities Co., Ltd. offers a diverse range of investment products primarily targeted at institutional investors. These include:

Offshore Hedge Funds: UYS provides access to a variety of hedge funds, allowing investors to diversify their portfolios and leverage sophisticated investment strategies.

Private Asset Products: The broker offers private asset products, including private equity and real estate investments, which are designed to deliver long-term capital appreciation.

Japanese Domestic Privately Placed Investment Trusts: UYS specializes in distributing privately placed investment trusts within Japan. These trusts offer high liquidity and transparency, making them attractive to institutional investors.

UYS Fees Review

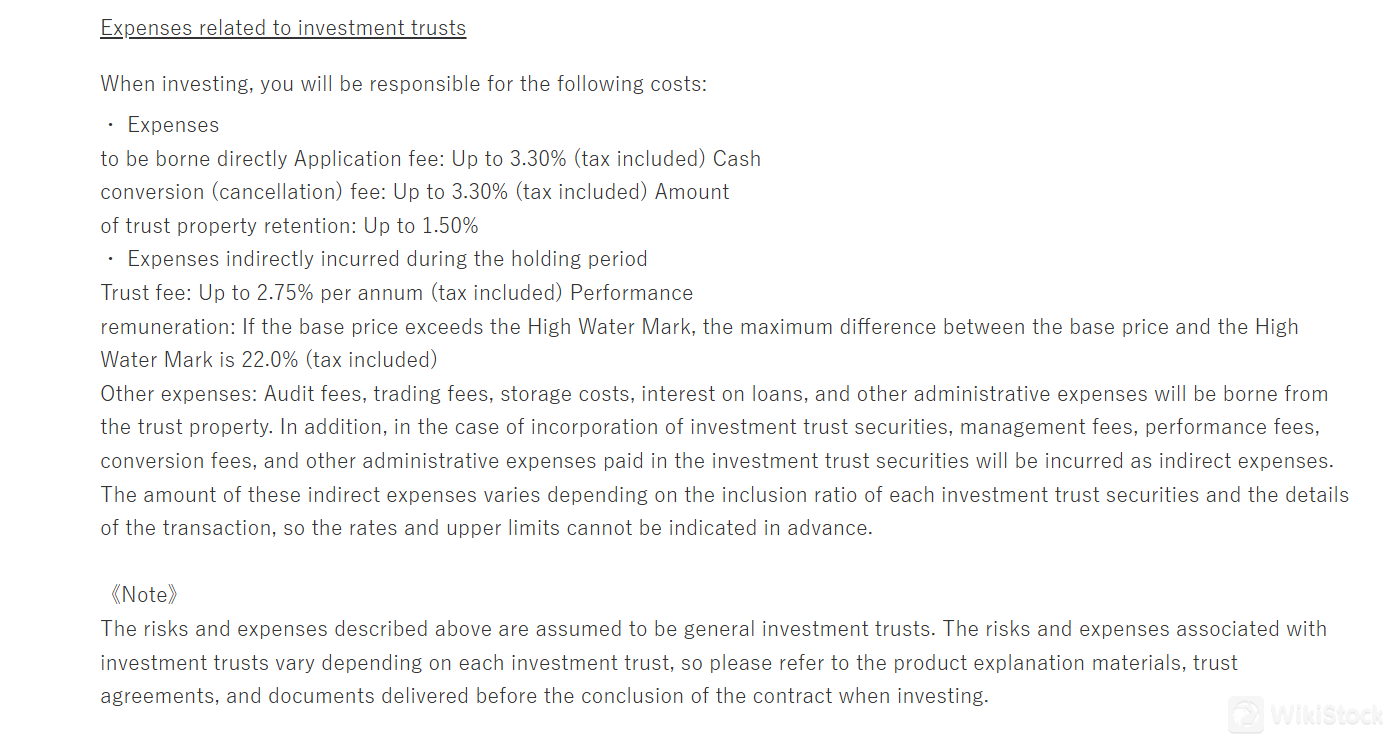

UYS imposes both direct and indirect trading fees on its investors. Direct fees include an application fee and a cash conversion fee, both of which can reach up to 3.30%. Additionally, up to 1.50% of the trust property may be retained. These costs are incurred at the beginning and end of the investment period.

During the holding period, investors indirectly incur expenses such as an annual trust fee of up to 2.75%. If the investment performs well, a performance remuneration of up to 22.0% may be applied. Other indirect costs, such as audit fees, trading fees, storage costs, and interest on loans, are also deducted from trust property. These indirect expenses can vary significantly depending on the specific investment trusts and transactions involved, making it difficult to estimate the exact amount in advance.

Research and Education

Unfortunately, UYS does not appear to provide research or educational resources on their website, which could be a disadvantage for beginner investors.

Customer Service

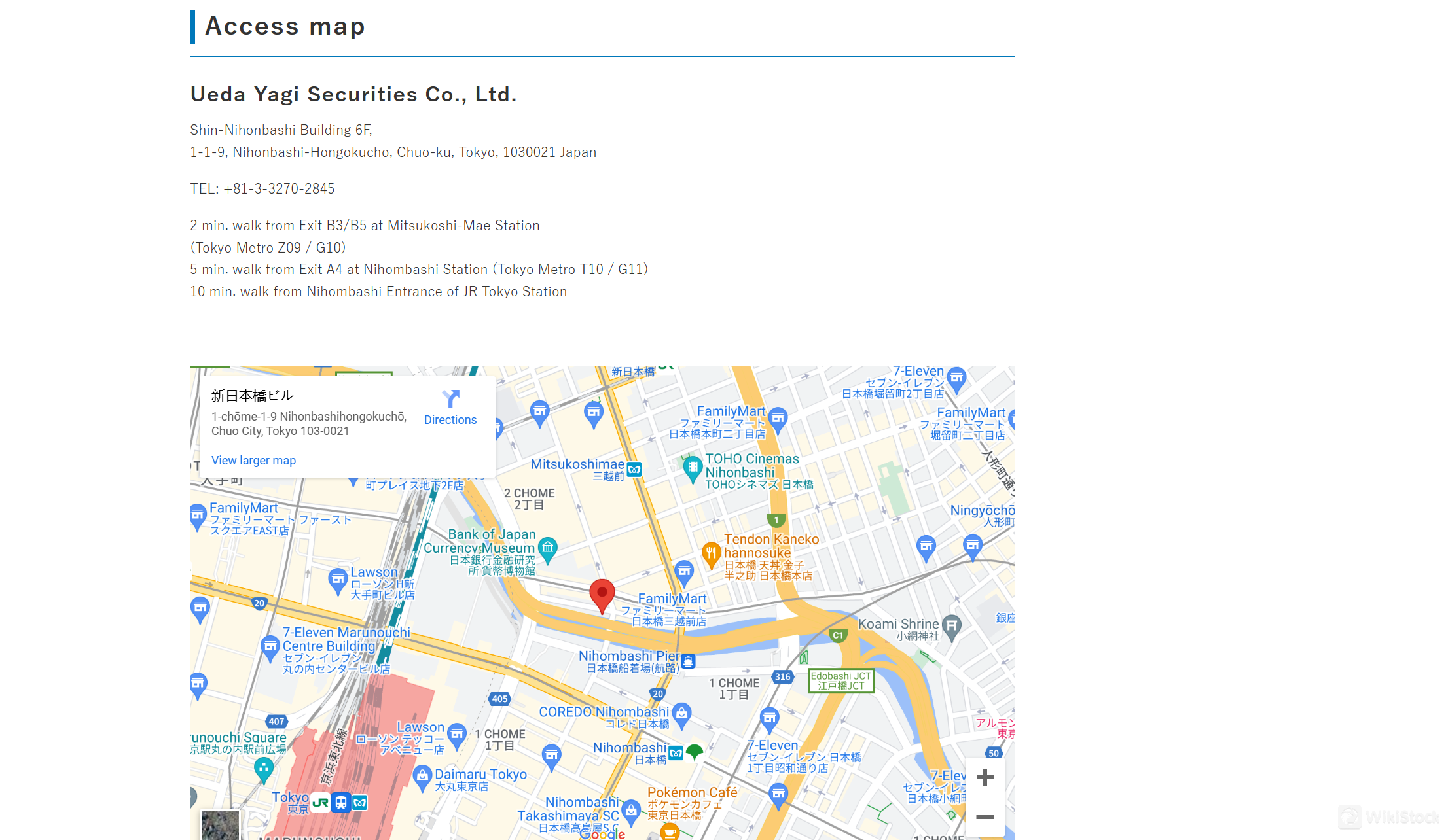

Ueda Yagi Securities Co., Ltd. is committed to providing excelent customer service to its clients. The broker offers dedicated client support teams who are available to assist with account management, trading inquiries, and other investment-related needs. Clients can contact the support team via phone (+81-3-3270-2845). UYS strives to provide timely and accurate responses to client queries, ensuring a high level of client satisfaction.

Conclusion

UYS stands out as a reputable broker with a strong focus on alternative investments and institutional clients. The firm's commitment to integrity and transparent fee structure make it partner for sophisticated investors. While the broker's services are primarily tailored for institutional clients, those who meet the requirements can benefit from a wide range of investment opportunities and dedicated support.

FAQs

What types of investments does Ueda Yagi Securities Co., Ltd. offer?

UYS offers offshore hedge funds, private asset products, and Japanese domestic privately placed investment trusts, primarily for institutional investors.

Is Ueda Yagi Securities Co., Ltd. regulated?

Yes, UYS is regulated by the Financial Services Agency of Japan and is a member of the Japan Securities Dealers Association.

What are the trading fees at Ueda Yagi Securities Co., Ltd.?

Trading fees at UYS include management fees, performance fees, custody fees, and transaction fees, which vary based on the type of investment product and account.

Risk Warning

WikiStock's expert assessment of the brokerage's website data is subject to change and should not be taken as financial advice. Online trading carries substantial risks, including the potential loss of all invested capital, and it's crucial to fully understand these risks before investing.

Japan

JapanObtain 1 securities license(s)