Customers' account balances in Questrade are insured. Questrade is a member of the Canadian Investor Protection Fund (CIPF), which provides insurance coverage of up to $1 million per account in case of a broker's insolvency, ensuring the protection of clients' assets and investments.

Safety Measures:

Questrade uses advanced encryption technology to secure online transactions and sensitive information. Questrade also conducts regular security audits and vulnerability assessments to identify and address potential risks. Additionally, Questrade ensures compliance with industry regulations and standards, such as those set by IIROC.

What are Securities to Trade with Questrade?

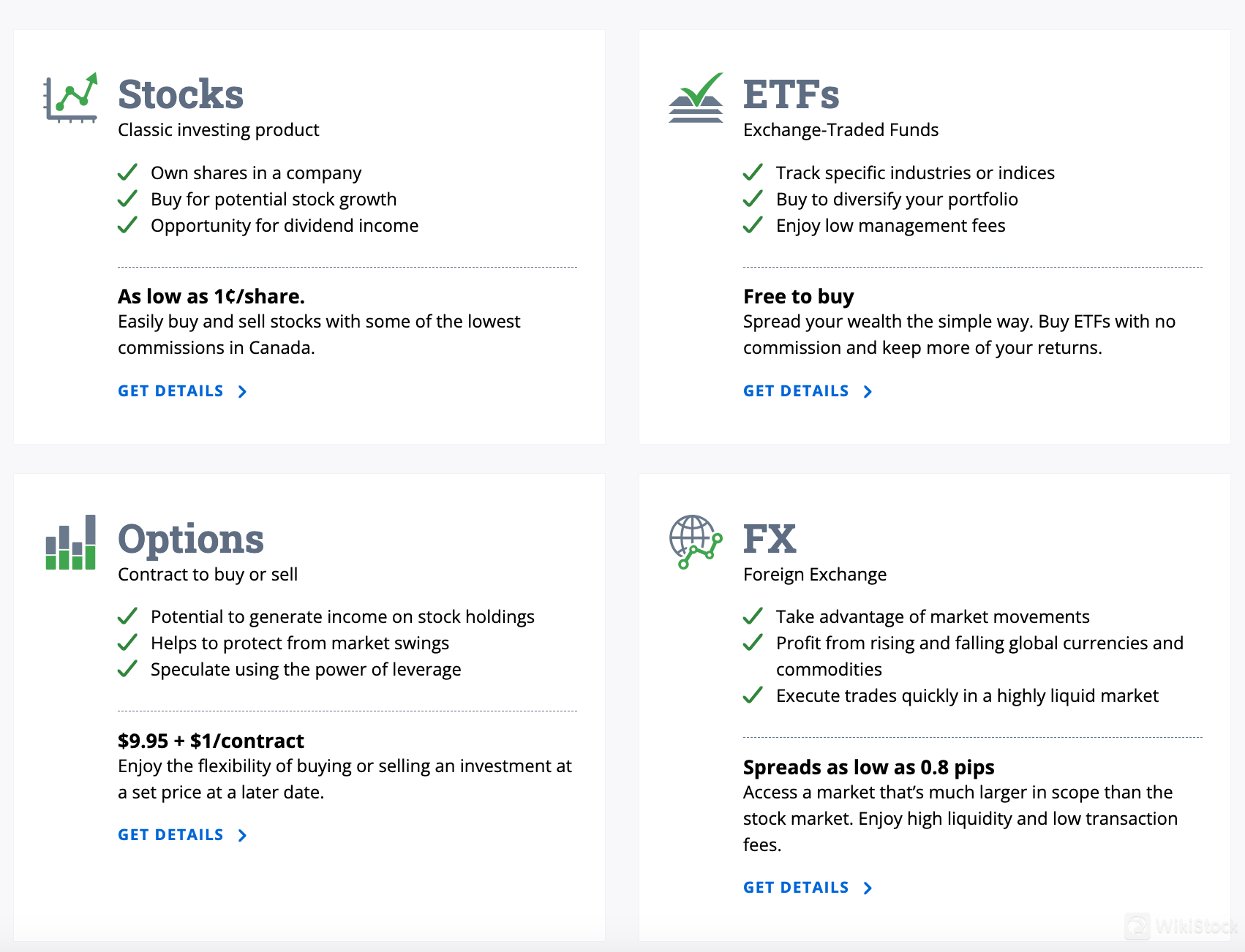

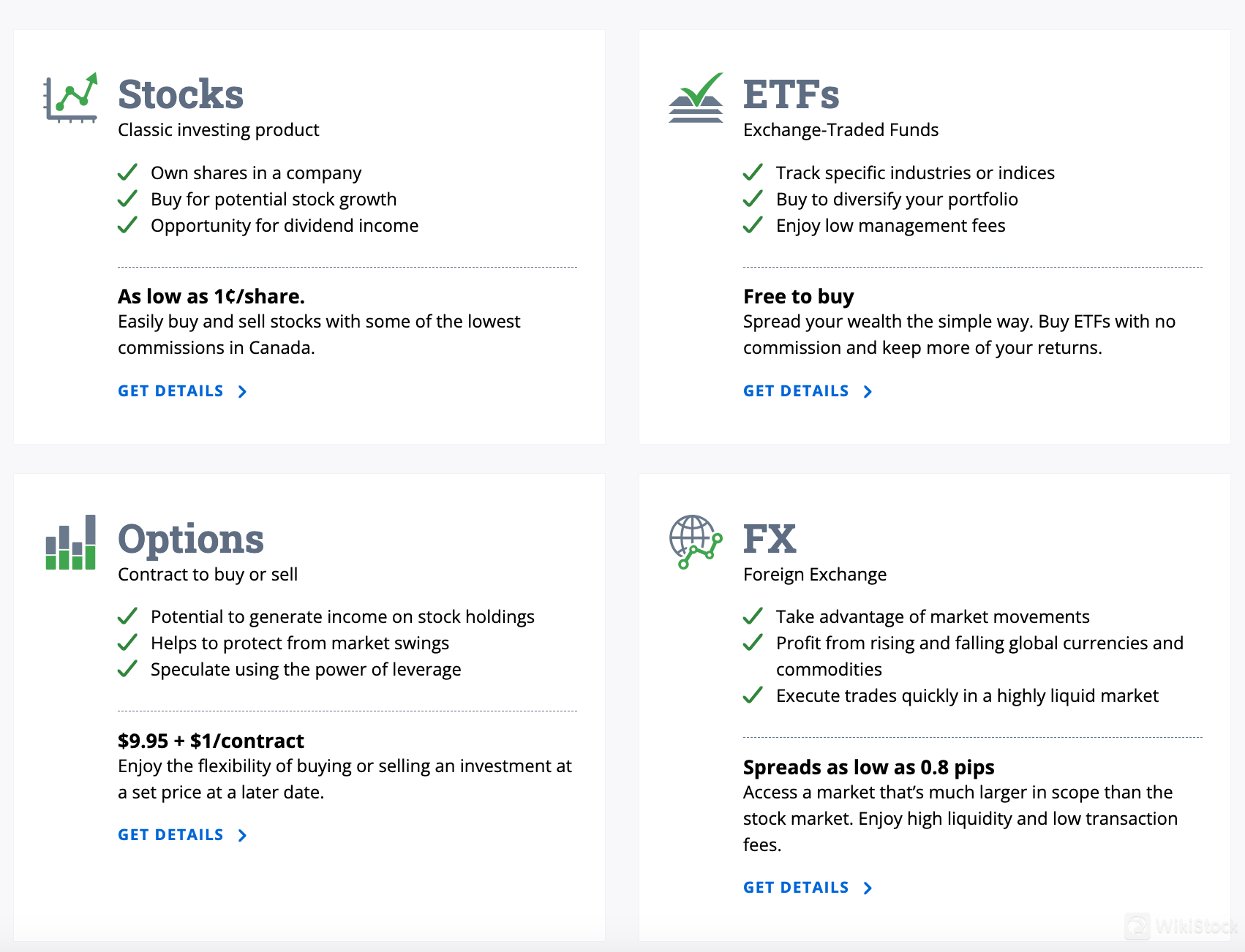

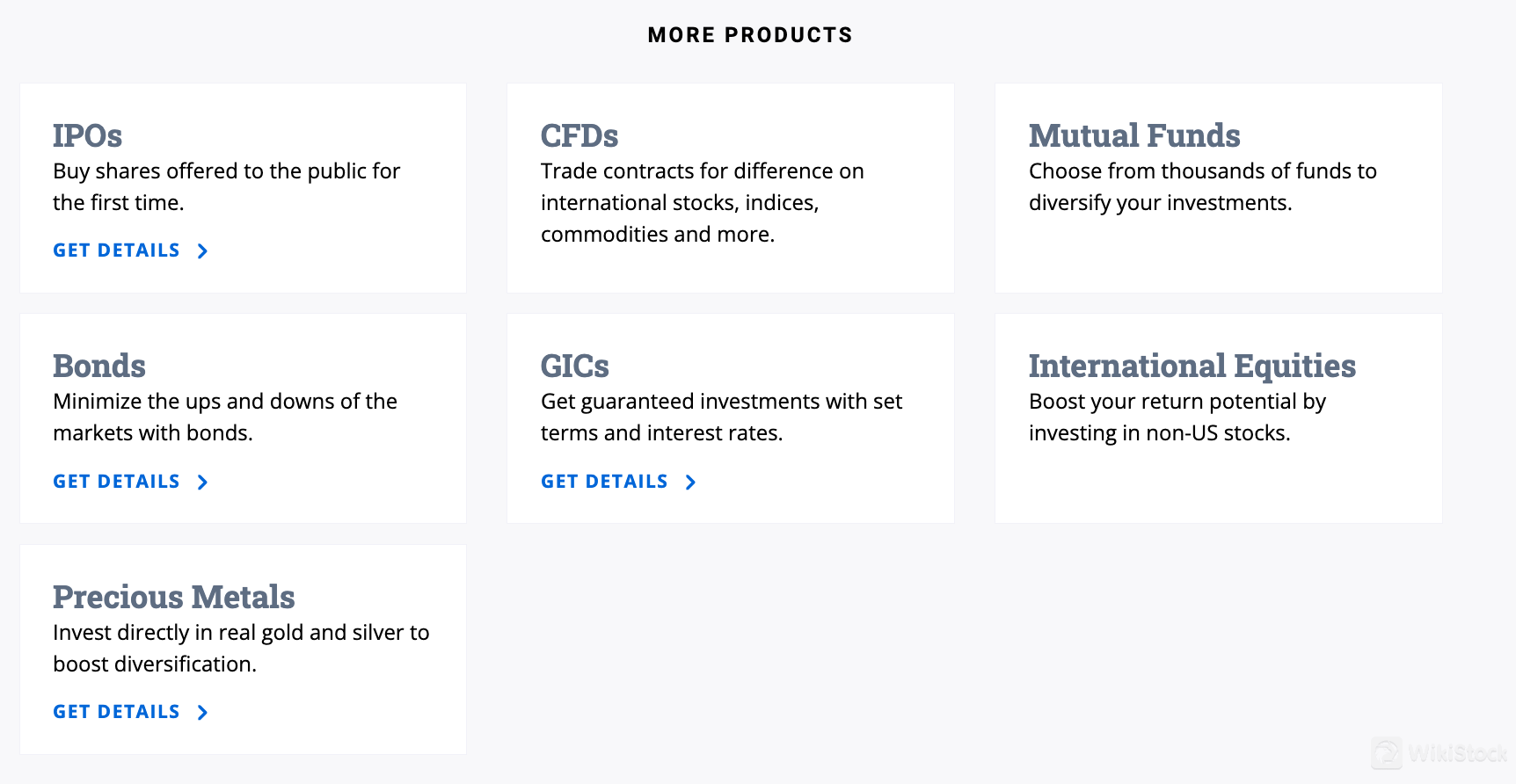

Questrade provides traders with assets including Stocks, ETFs, Options, FX (Foreign Exchange), IPOs, CFDs, Mutual Funds, Bonds, GICs, International Equities, Precious Metals.

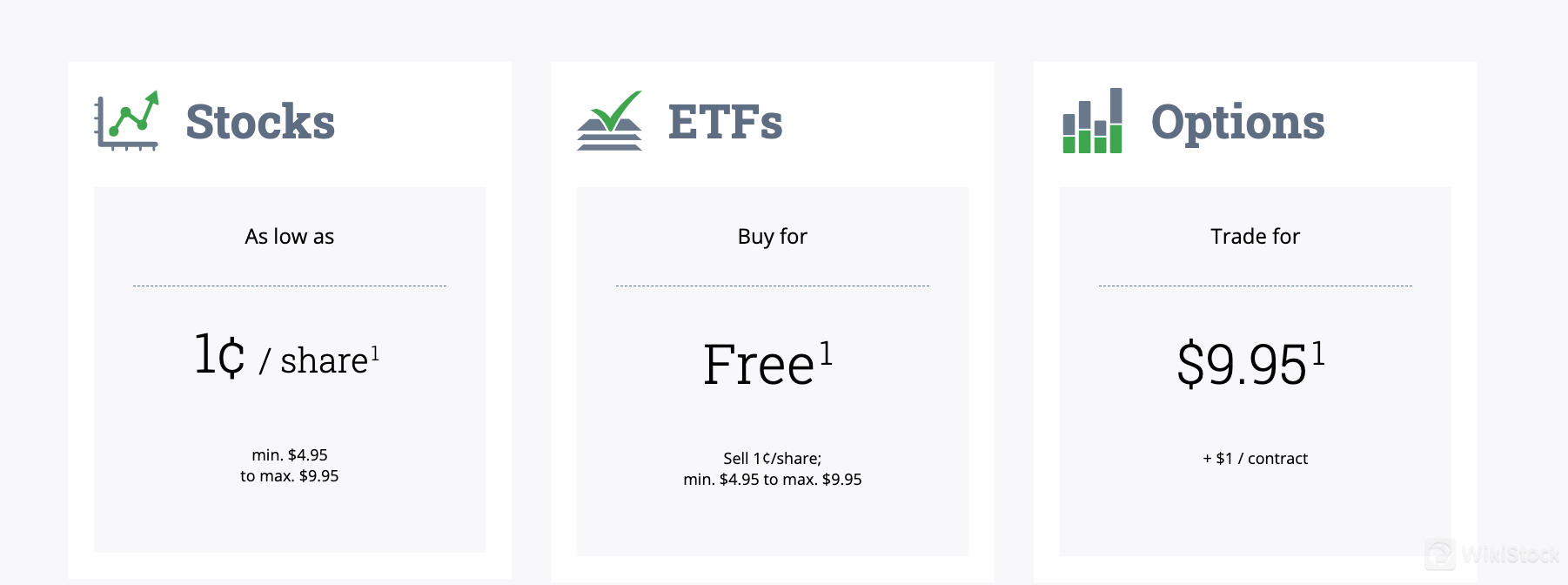

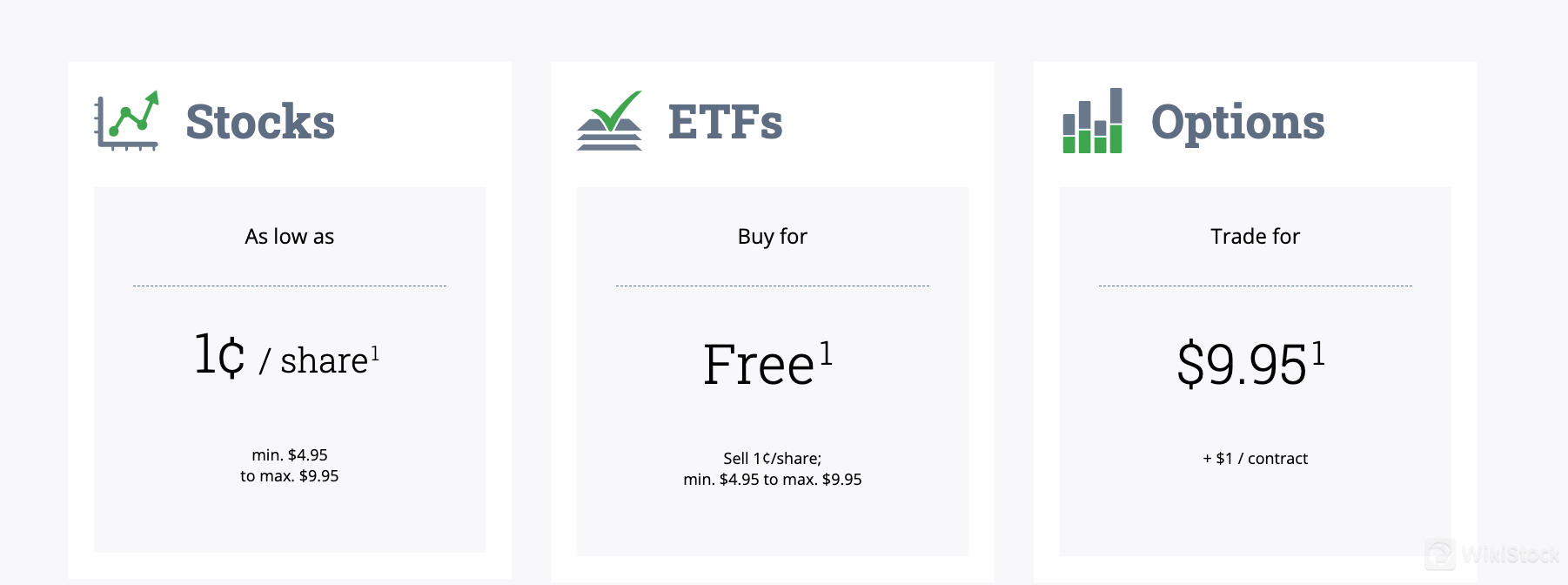

Stocks: Classic investing product allowing individuals to own shares in a company. Investors buy stocks for potential growth and the opportunity for dividend income, with fees as low as 1¢ per share. Questrade offers easy buying and selling of stocks with some of the lowest commissions in Canada.

ETFs (Exchange-Traded Funds): These track specific industries or indices, offering diversification for portfolios with low management fees. Questrade allows free buying of ETFs, enabling investors to spread their wealth easily without commission charges.

Options: Contracts to buy or sell, providing potential income generation on stock holdings and protection from market swings. Investors can speculate using leverage, with fees starting at $9.95 plus $1 per contract. Options offer flexibility in buying or selling investments at predetermined prices in the future.

FX (Foreign Exchange): Enables taking advantage of market movements and profiting from changes in global currencies and commodities. Questrade offers low spreads starting at 0.8 pips, facilitating quick trades in a highly liquid market with low transaction fees.

Additional Products: Questrade provides access to IPOs, CFDs (contracts for difference), mutual funds, bonds, GICs (guaranteed investment certificates), international equities, and precious metals, offering investors a wide range of options to diversify their portfolios and potentially enhance returns.

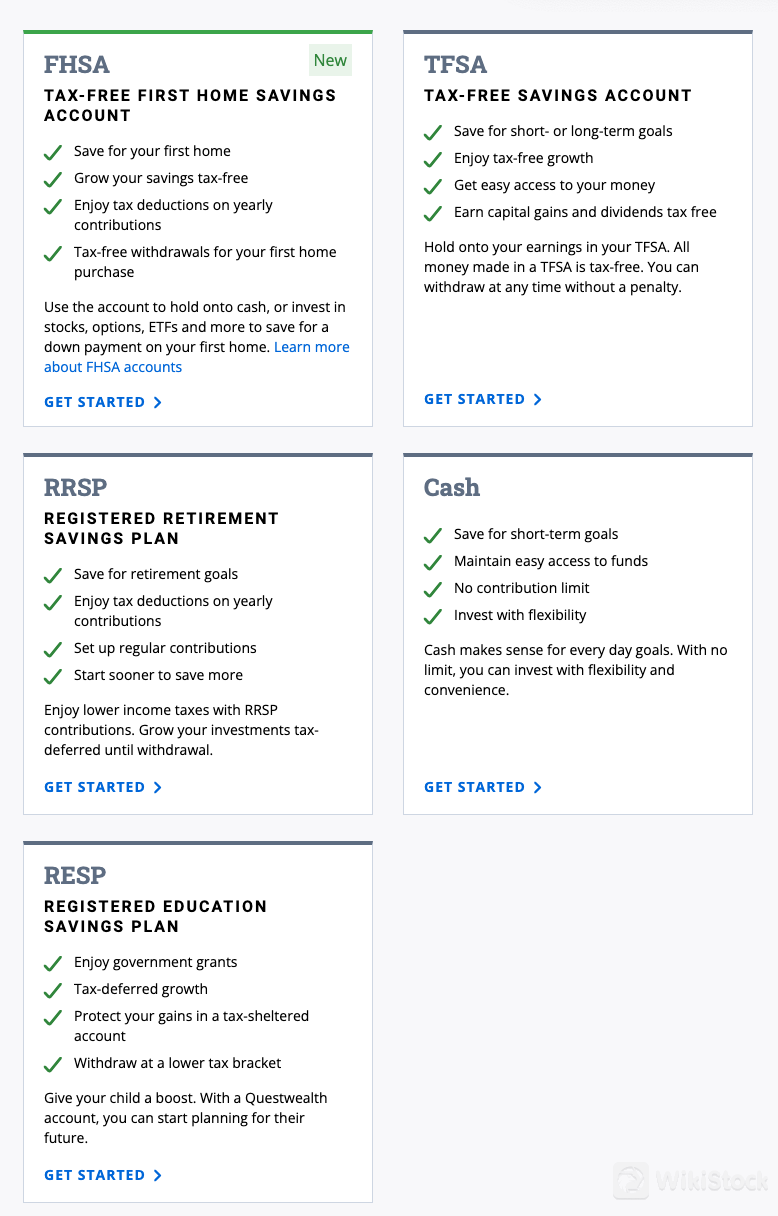

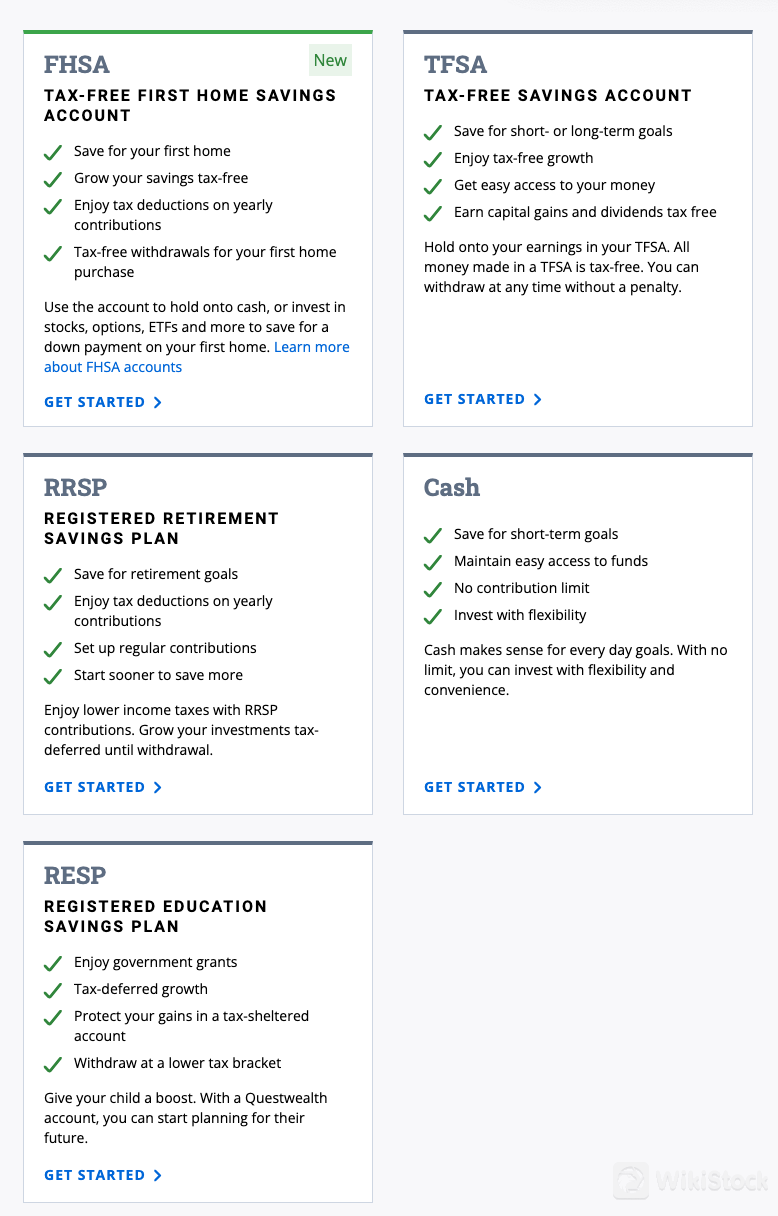

Questrade Accounts

Questrade offers a range of account types tailored to various financial goals and lifestyles. Let's explore the suitability of each account type for different user groups:

The FHSA (Tax-Free First Home Savings Account) is ideal for new homeowners who want to save for their first home while enjoying tax benefits on contributions and withdrawals.

TFSA (Tax-Free Savings Account) serves individuals seeking tax-free growth and easy access to funds for short- or long-term financial goals, providing flexibility in investment choices.

RRSP (Registered Retirement Savings Plan) targets those planning for retirement, offering tax deductions on contributions and tax-deferred growth until withdrawal to maximize savings.

Cash accounts provide easy access to funds with no contribution limit, suitable for individuals saving for short-term goals and seeking flexibility in investment opportunities.

RESP (Registered Education Savings Plan) is designed for parents planning for their child's education, offering government grants and tax-deferred growth to secure their child's future education expenses.

Questrade Fees Review

Questrade's fee structure encompasses a variety of charges for trading assets and account management services.

For stock transactions, Questrade levies a commission starting at 1¢ per share, with minimum fees ranging from $4.95 to a maximum of $9.95 per trade.

ETF purchases are commission-free, while sales incur a charge of 1¢ per share, with corresponding minimum and maximum trade fees.

Options trading entails a flat fee of $9.95 per trade, along with an additional charge of $1 per contract.

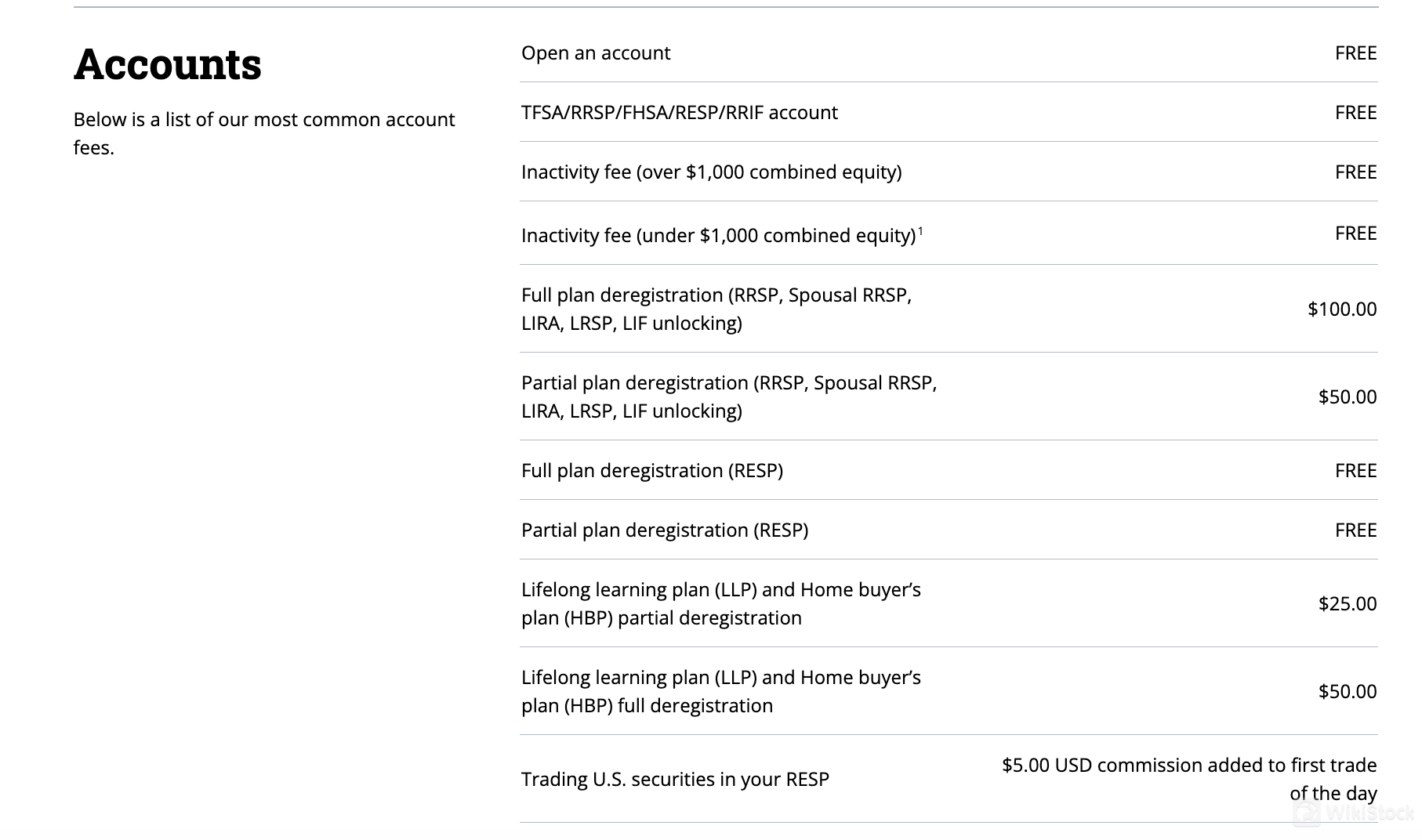

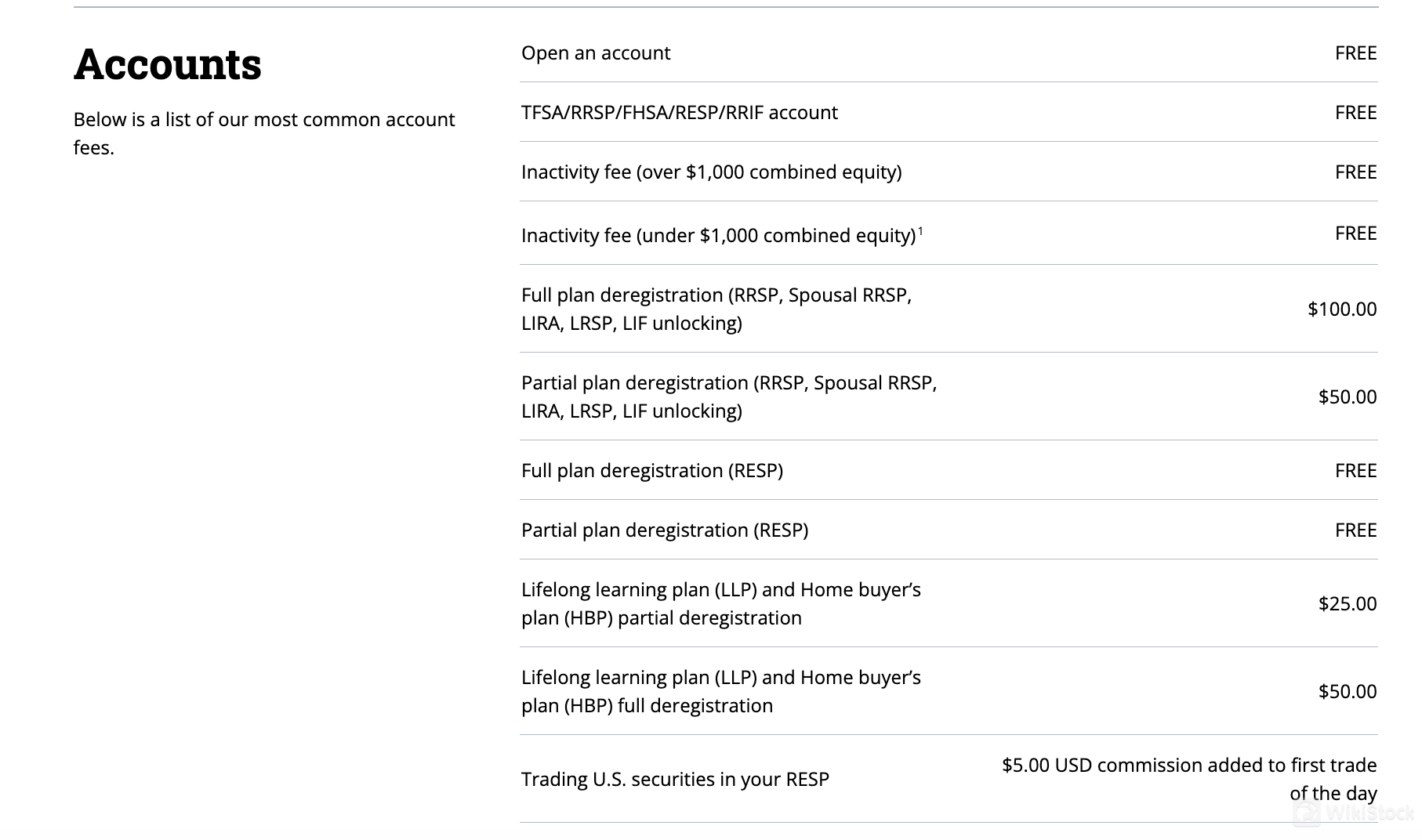

Alongside trading fees, Questrade imposes various account management charges. Opening an account is free, as is maintenance for TFSA/RRSP/FHSA/RESP/RRIF accounts. Inactivity fees are waived for balances over $1,000, but charges apply for balances below this threshold.

Other fees include charges for plan deregistration, with fees ranging from $25 to $100 depending on the type of account and transaction. Questrade also imposes a $5.00 USD commission for trading U.S. securities in RESP accounts.

While Questrade's fees for stock and ETF trading are competitive, its options trading fees tend to be slightly higher compared to some discount brokers. However, its account management fees offer a blend of free services and reasonable charges, providing a comprehensive fee structure overall.

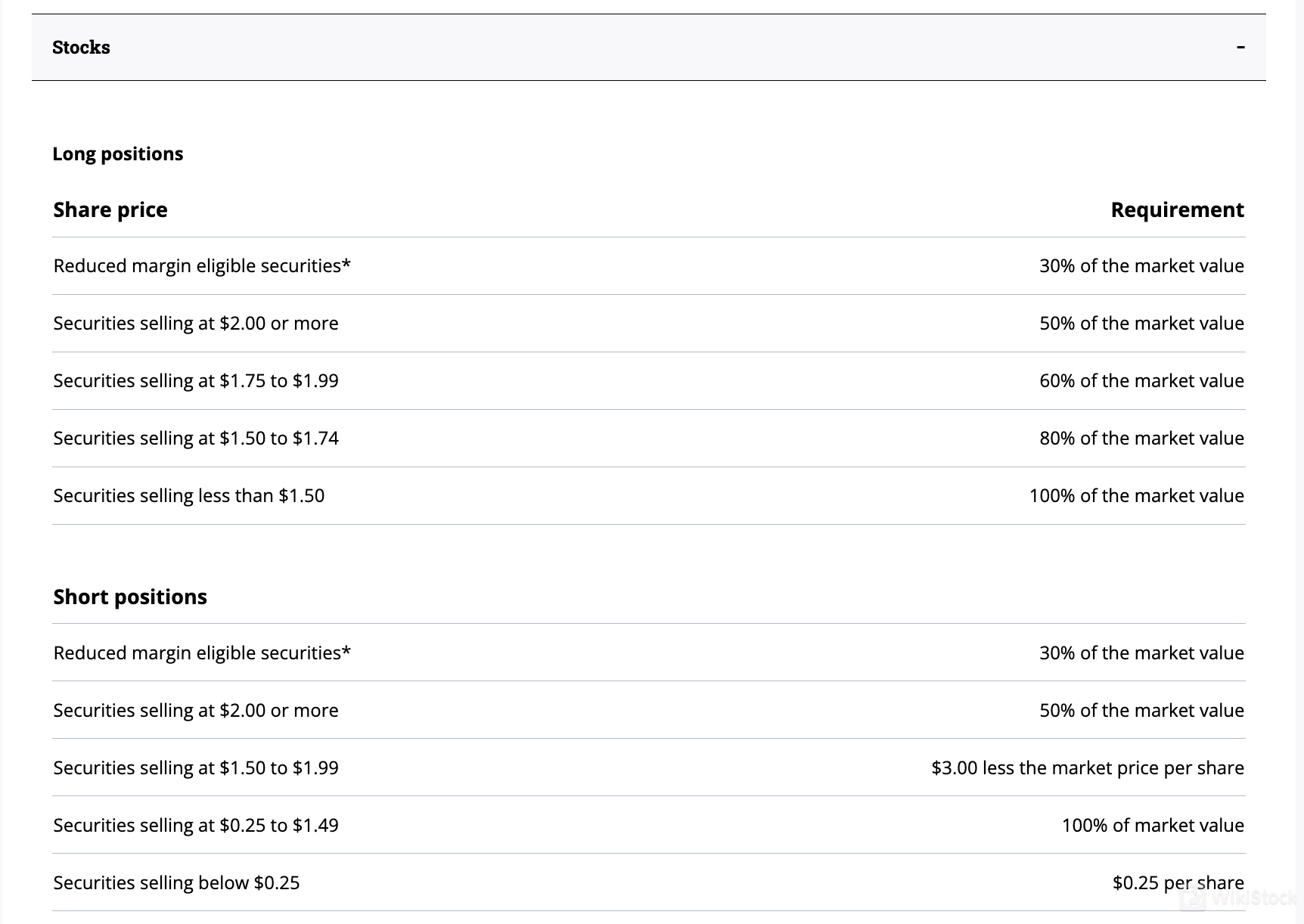

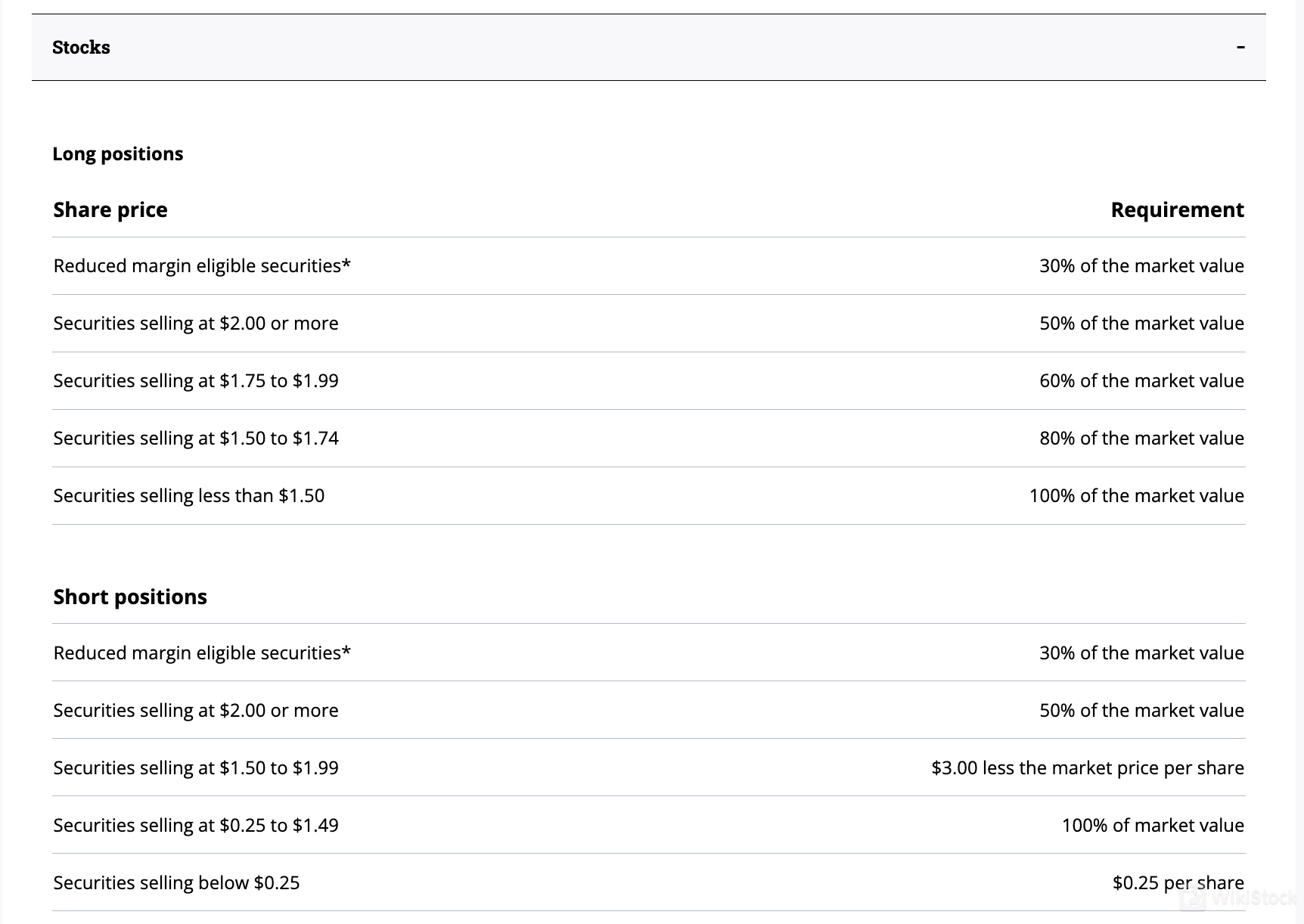

Questrade's Margin Interest Rates vary based on long and short positions and the market value of securities. For long positions, reduced margin eligible securities require 30% of the market value, while those selling at $2.00 or more need 50%. Short positions on such securities require 30% and 50% respectively.

However, for securities selling at $1.50 to $1.99, short positions incur $3.00 less the market price per share, and those selling below $0.25 face a flat fee of $0.25 per share.

Questrade App Review

Questrade Edge Mobile is offered by Questrade for active traders, offering advanced order types and lightning-fast speed for on-the-go trading.

With a sleek user interface, it provides direct order routing and features like stop and trailing stop orders, option orders, and bracket orders. Multi-leg options orders can be easily created, and full-screen charting allows for in-depth analysis. The app offers customizable detail views for watchlists, positions, and orders, along with synced alerts across devices.

To download Questrade Edge Mobile, simply visit the App Store (for iOS devices) or Google Play Store (for Android devices), search for “Questrade Edge Mobile,” and follow the prompts to install.

Research & Education

Questrade offers a variety of educational resources to help investors enhance their knowledge and make informed decisions.

From platform tutorials to investment concepts and market insights, Questrade Basics provides essential information for beginners, while advanced topics serves seasoned investors.

Goal tracking tools assist users in aligning their investments with their financial objectives.

Customer Service

For Questrade's customer support, assistance is available via email at support@questrade.com, online chat, or by phone at 1.833.588.6914. Their team offers in-depth technical support and troubleshooting.

Phone support is available during regular business hours, typically from Monday to Friday, 8:00 AM to 8:00 PM ET.

Conclusion

Questrade offers a robust trading platform with competitive fees, including stock trades starting at 1¢ per share and free ETF purchases, making it cost-effective for active traders and investors looking for various assets. Its comprehensive educational resources and advanced mobile app accommodates both beginners and experienced investors.

However, the $1,000 minimum deposit and inactivity fees for low balances could be a barrier for new or infrequent traders.

FAQs

1. Is it safe to trade on Questrade?

Yes, Questrade is regulated by IIROC and is a member of the Canadian Investor Protection Fund (CIPF), ensuring the safety and security of users' investments.

2. Is Questrade a good platform for beginners?

Questrade offers comprehensive educational resources and user-friendly tools, making it suitable for beginners learning to invest.

3. Is Questrade legit?

Yes, Questrade is a legitimate brokerage founded in 1999 and operates under Canadian regulatory authorities, including IIROC.

4. Is Questrade good for investing and retirement planning?

Questrade provides various accounts like TFSA and RRSP, which are ideal for tax-efficient investing and retirement planning.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Canada

CanadaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--

--