Kernaghan & Partners Ltd is a full service brokerage firm offering advisory services on a global range of products to both retail as well as Institutional investors. We have a history of transacting in our business dating back three generations. Our personal contact, along with our experience and wide range of products, enables us to compete with other large investment firms. Our History, together with the ever changing economic environment, makes us committed to constantly deliver professional forward looking solutions to our clientele.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Kernaghan & Partners Information

Kernaghan & Partners Ltd is a reputable financial services firm specializing in institutional trading, private client advisory, and corporate finance. It also offers expertise in optimizing order execution, constructing personalized investment plans, and facilitating complex corporate transactions. Regulated by the Investment Industry Regulatory Organization of Canada (IIROC), the firm adheres to stringent standards ensuring investor protection and market integrity.

Pros & Cons

Pros Regulatory by IIROC: Kernaghan & Partners is regulated by IIROC, ensuring adherence to strict standards that protect investors and maintain market integrity.

Specialized Services: Offers specialized trading for institutional clients, personalized investment solutions for private clients, and comprehensive corporate finance advisory.

Diverse Account Offerings: Provides a wide range of registered and non-registered accounts, catering to various financial goals such as retirement savings and educational investments.

Comprehensive Customer Support: Offers accessible customer service through multiple channels.

Cons Limited Transparency on Fees and Rates: Specific details such as account minimums, fees, interest rates on uninvested cash, and margin interest rates are not mentioned, requiring direct inquiry for clarification.

Platform Information Not Provided: Information regarding the trading platform used is not provided, which limits transparency and comparison with other firms.

Is Kernaghan & Partners Legit?

Kernaghan & Partners is regulated by the oversight of the oversight of the Investment Industry Regulatory Organization of Canada (IIROC). This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, Kernaghan & Partners ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

What are Securities to Trade with Kernaghan & Partners?

Institutional:

Kernaghan & Partners offers specialized trading services tailored to institutional clients. Their team of seasoned traders focuses on tracking liquidity, maintaining anonymity, and minimizing market impact to ensure optimal order execution. Institutional clients benefit from personalized strategies designed to meet their specific trading needs, backed by extensive market expertise and a commitment to achieving superior results in the financial markets.

Private Client:

At Kernaghan & Partners, every client receives personalized attention to create tailored investment solutions. Their advisors engage clients in thorough discussions to understand individual financial goals and current circumstances. This personalized approach allows Kernaghan & Partners to construct customized investment plans that align with each client's unique objectives, ensuring a comprehensive and effective wealth management strategy.

Corporate Finance:

Kernaghan & Partners provides a wide range of corporate finance services designed to meet the diverse needs of corporate clients. Their experienced team offers comprehensive underwriting and advisory solutions, whether assisting with capital raising through an initial public offering (IPO), advising on mergers and acquisitions, or navigating complex restructuring processes.

Kernaghan & Partners Accounts

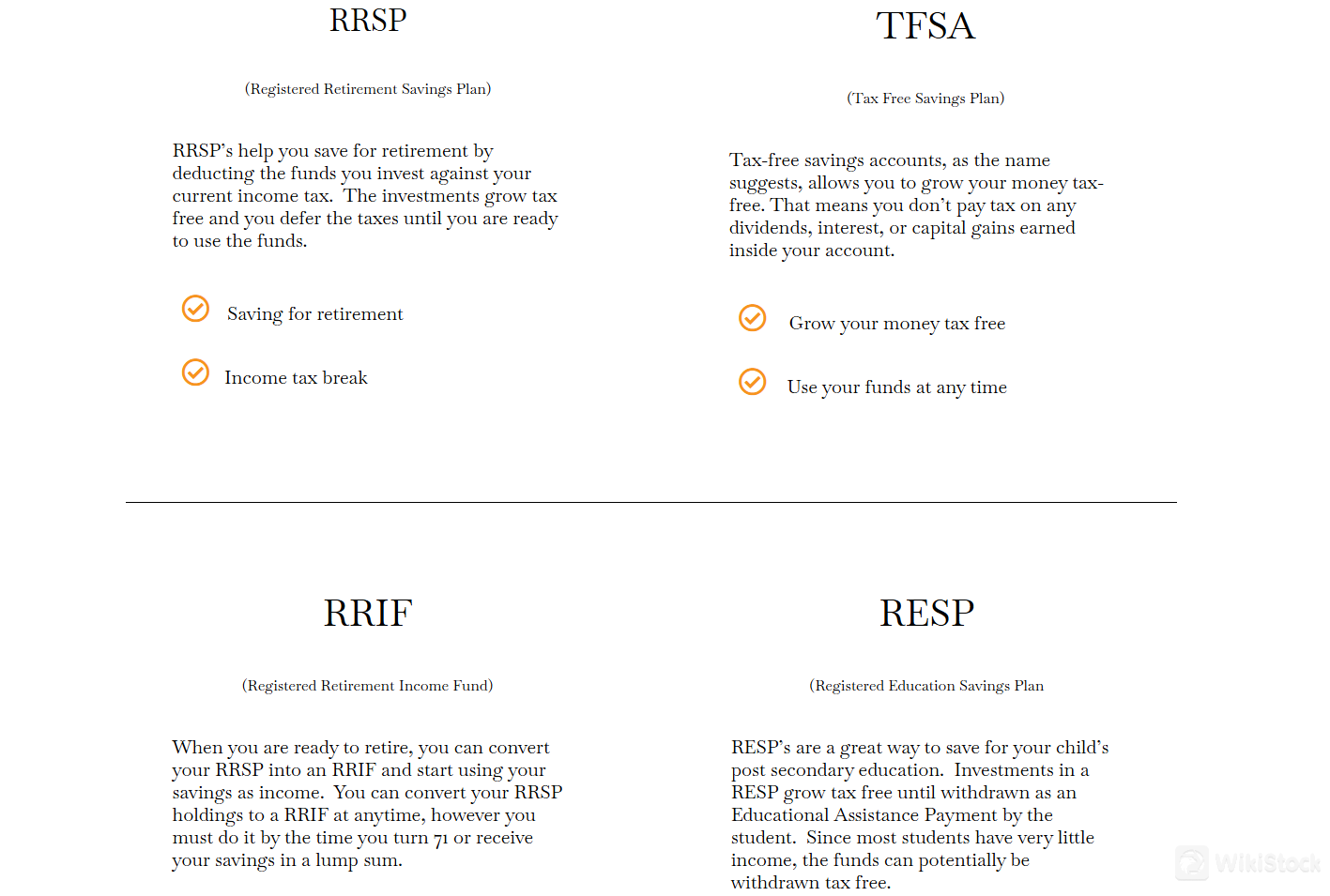

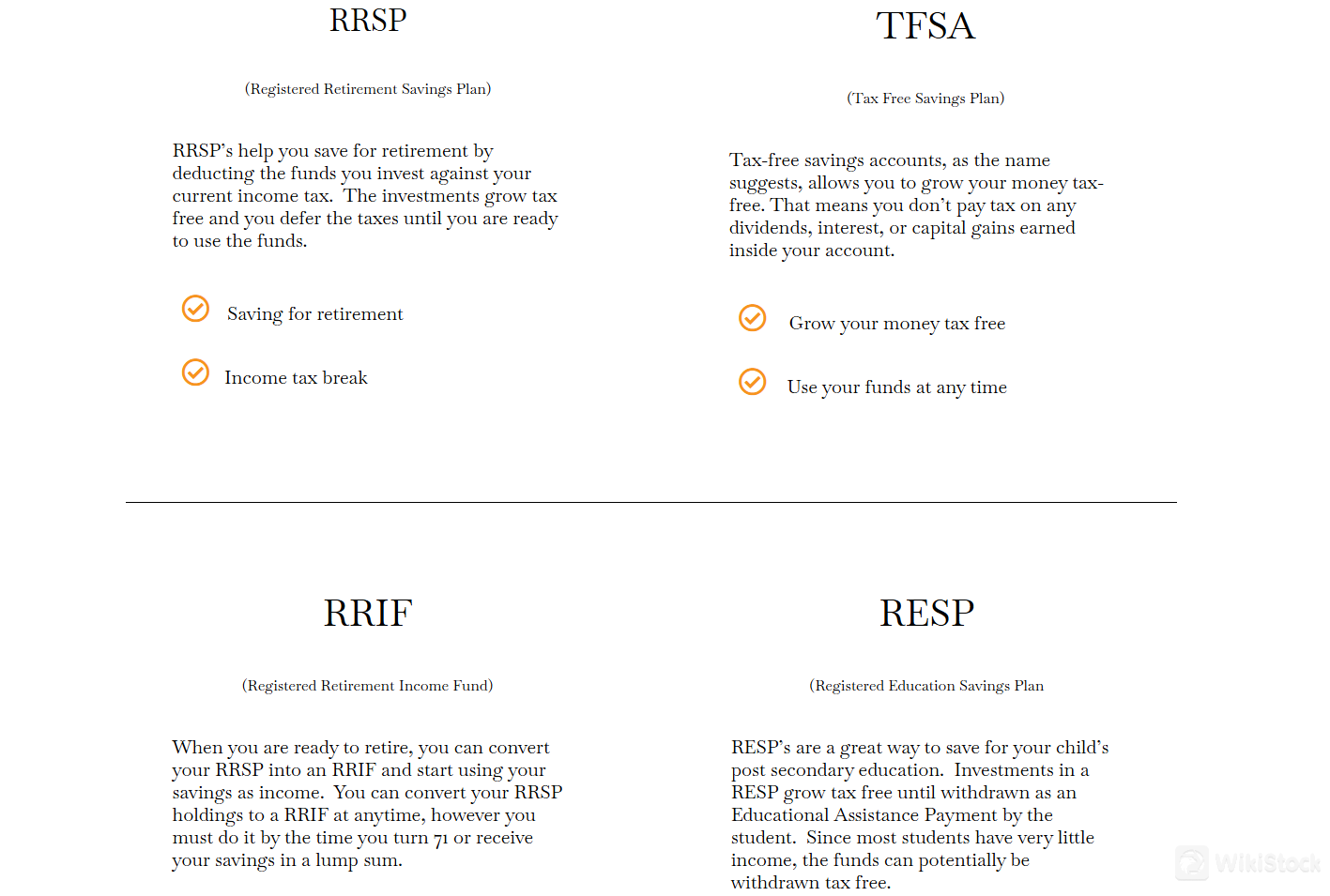

Registered Accounts:

Kernaghan & Partners offers a range of registered accounts designed to meet long-term financial planning needs. Their Registered Retirement Savings Plans (RRSPs) provide clients with immediate tax benefits by allowing deductions against current income. Investments within RRSPs grow tax-free until withdrawal, offering a tax-efficient way to save for retirement.

TFSAs allow individuals to earn income on investments without incurring taxes on dividends, interest, or capital gains within the account. Unlike registered retirement accounts, TFSAs permit withdrawals at any time without penalty, making them ideal for both short-term savings and long-term wealth accumulation strategies.

Clients can seamlessly convert their RRSPs into Registered Retirement Income Funds (RRIFs) to continue benefiting from tax-sheltered growth and receive income during retirement. Additionally, their Registered Education Savings Plans (RESPs) facilitate tax-deferred growth for educational savings, complemented by government grant opportunities to enhance savings potential.

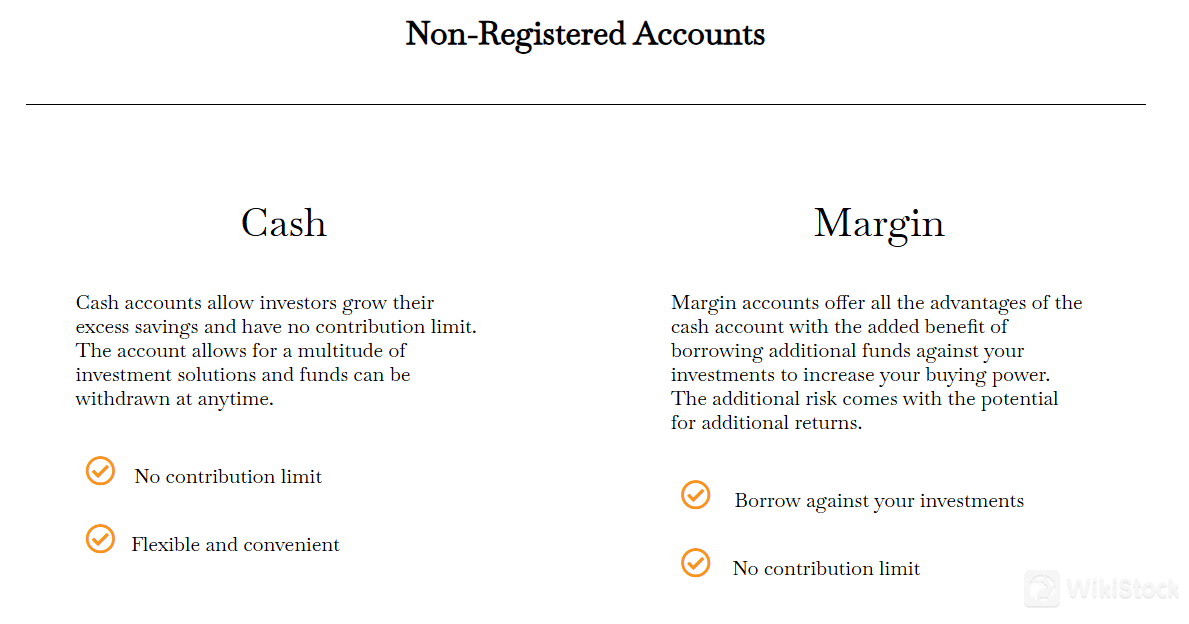

Non-Registered Accounts:

For flexible investment options, Kernaghan & Partners offers non-registered accounts that cater to diverse financial goals. Their Cash accounts feature unlimited contribution capabilities and provide easy access to a variety of investment solutions, making them suitable for both short-term needs and long-term wealth accumulation strategies.

Clients seeking to leverage their investments can opt for Margin accounts, which allow borrowing against their portfolio to amplify buying power and increase returns. While these accounts entail additional risk, they offer opportunities for growth and financial flexibility tailored to individual investment objectives.

Customer Service

Kernaghan & Partners provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Tel: (416) 423-3251

Email: info@kernaghanpartners.com

Address: 79 Wellington St West Suite #605 P.O. Box 346 TD South Tower Toronto, Ontario M5K 1K7

Contact form

Conclusion

In conclusion, Kernaghan & Partners presents itself as a regulated and comprehensive trading platform, offering a diverse range of investment services tailored to meet the varying needs of investors and portfolio managers.

However, the lack of detailed fee information and platform specifics can hinder a trader's decision-making process. Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is Kernaghan & Partners suitable for beginners?

No. Kernaghan & Partners is not the best choice for beginners due to the lack of detailed fee information and transparency regarding its trading platform.

Is Kernaghan & Partners legit?

Yes, Kernaghan & Partners is regulated by IIROC.

What types of accounts does Kernaghan & Partners offer?

It offers a range of registered accounts such as RRSPs, TFSAs, RRIFs, and RESPs. They also provide non-registered accounts including cash accounts and margin accounts for flexible investment options.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Canada

CanadaObtain 1 securities license(s)