FXPRIMUS is a globally renowned online trading broker, offering various financial products such as Bitcoin, foreign exchange, commodities, and stock indices. The company has established a good reputation in the industry with its advanced technology, professional services, and standardized operational principles. FXPRIMUS places great importance on the security of client assets and takes multiple measures to ensure secure transactions, making it a trusted choice for investors

What is FXPRIMUS?

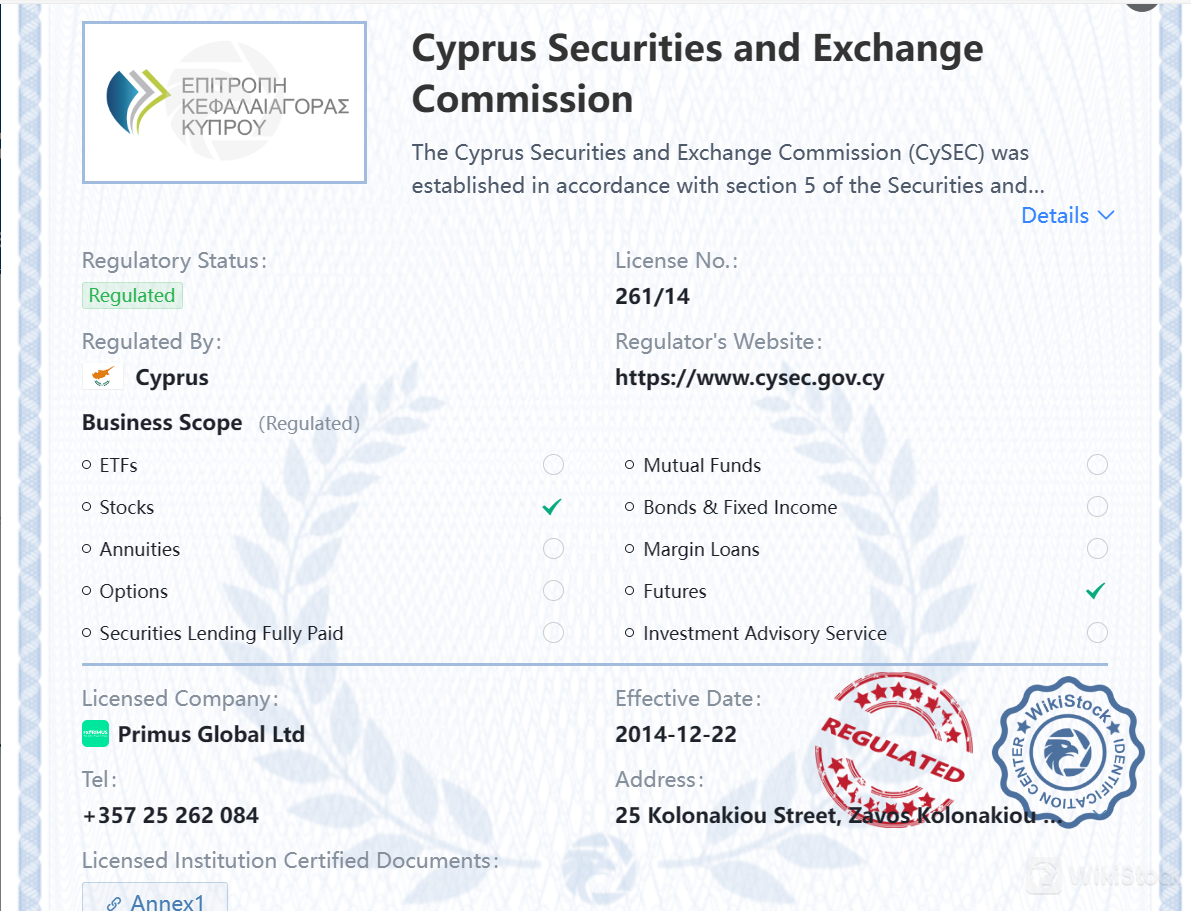

FXPRIMUS is an established online trading platform regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring adherence to strict regulatory standards. The platform prioritizes client safety, offering features such as Negative Balance Protection and third-party monitoring of withdrawals. Traders can choose from various account types tailored to their needs, with options for different spreads, commissions, and leverage levels.

Pros & Cons of FXPRIMUS

Pros:

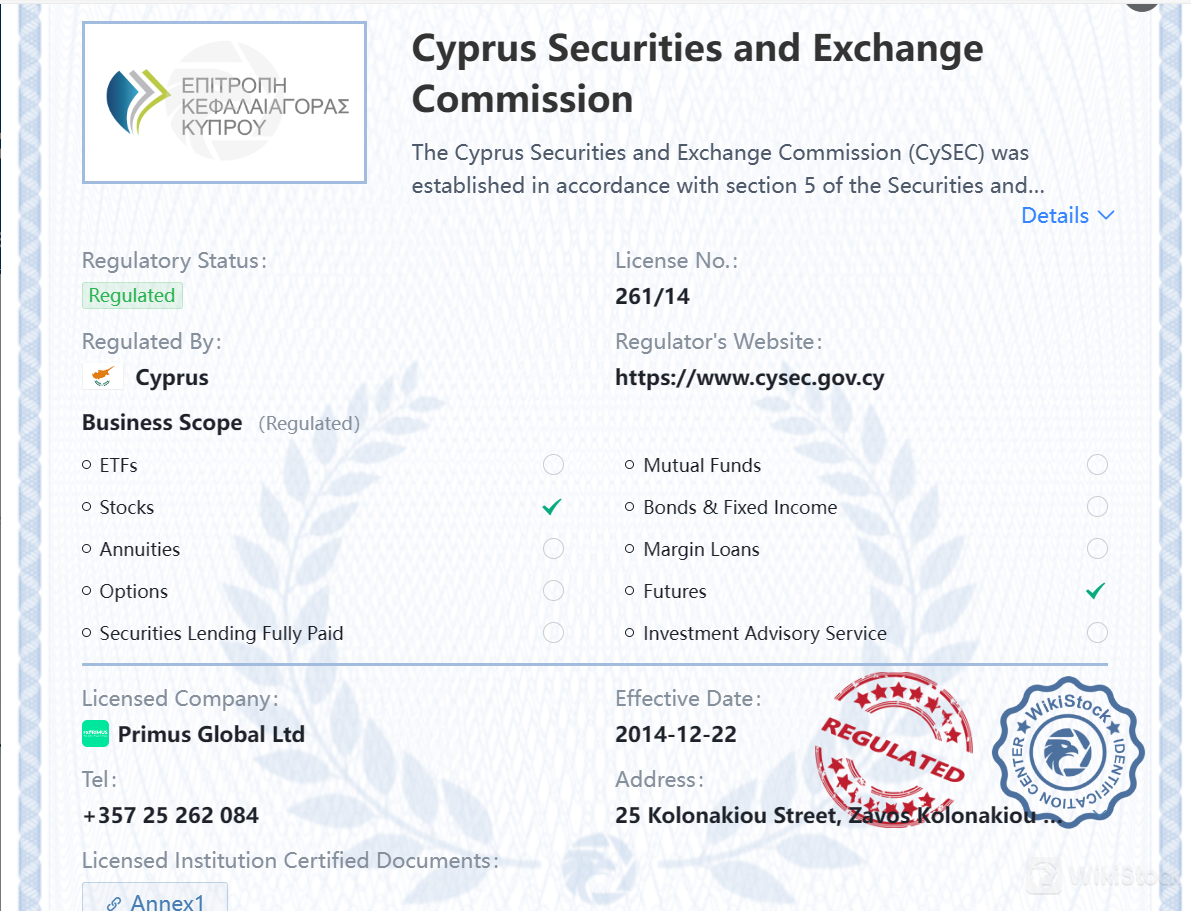

Regulatory Compliance: FXPRIMUS is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring that it operates in accordance with strict regulatory standards, providing traders with a sense of security and trust.

Client Safety Measures: The platform offers Negative Balance Protection, safeguarding traders from losing more than their initial investment, and implements third-party monitoring of withdrawals for added security.

Range of Account Types: FXPRIMUS provides various account types to cater to different trading needs, offering options with varying spreads, commissions, and leverage levels.

MetaTrader 4 Platform: Traders have access to the popular MT4 trading platform, known for its advanced charting tools, technical analysis capabilities, and user-friendly interface.

Cons:

Limited Asset Diversity: While FXPRIMUS offers trading in forex, indices, and commodities, the range of available financial instruments is limited compared to other platforms.

Is FXPRIMUS Safe?

FXPRIMUS is considered safe due to its regulation by the Cyprus Securities and Exchange Commission (CySEC) with a Cyprus Securities Trading License of No.261/14, which sets strict standards for financial services. Additionally, the platform offers Negative Balance Protection, segregates client funds, and monitors withdrawals by third parties for added security. This further adds safety.

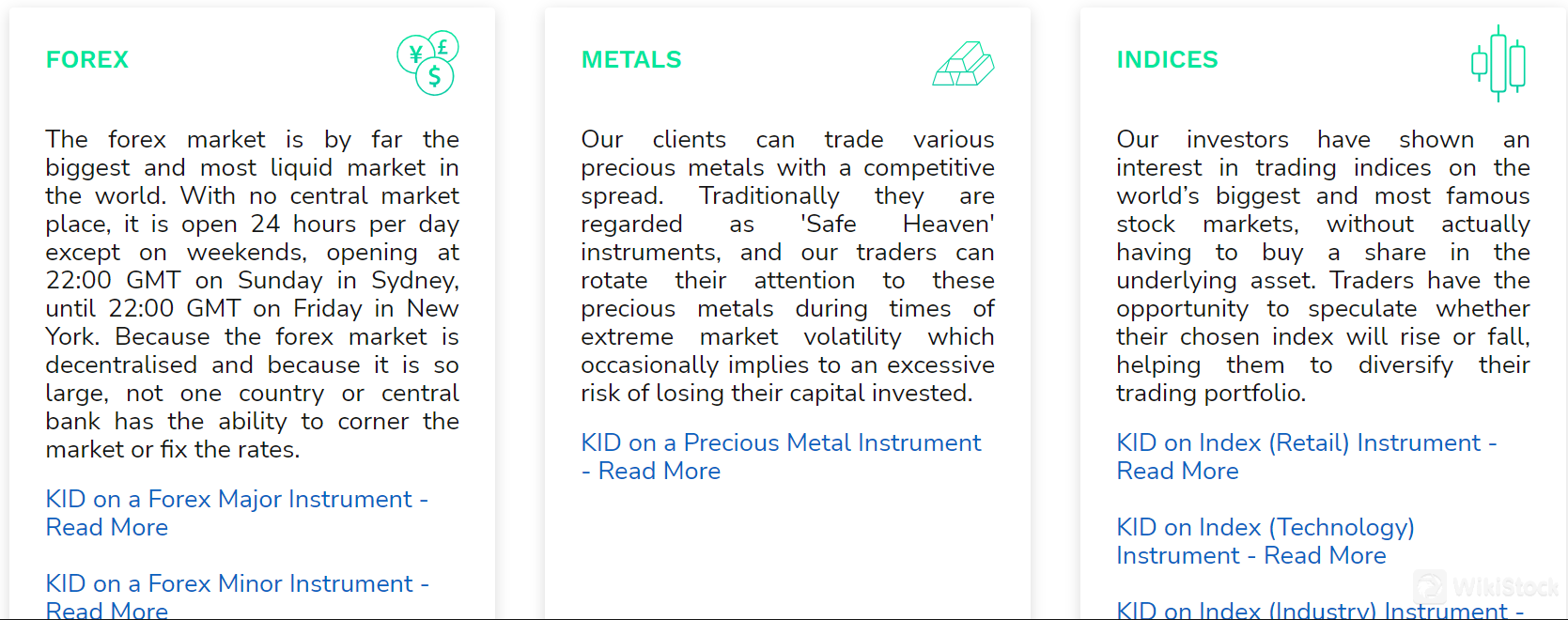

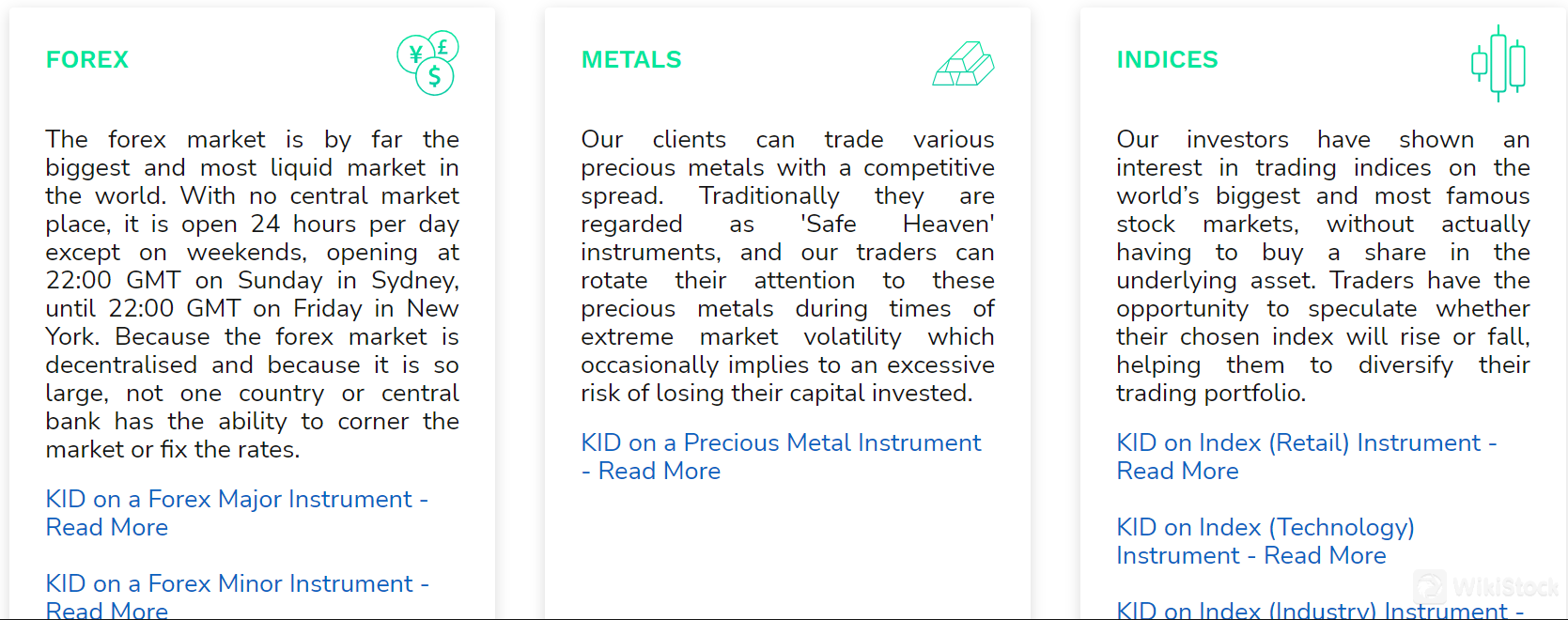

Market Instruments

FXPRIMUS offers a variety of trading instruments across different markets. These market instruments suit traders looking for diverse trading opportunities across different asset classes.

Forex: The forex market is the largest and most liquid market globally, open 24 hours a day from Sunday to Friday. FXPRIMUS provides trading opportunities in major, minor, and exotic currency pairs, allowing traders to speculate on currency price movements.

Metals: FXPRIMUS enables clients to trade precious metals like gold and silver, offering competitive spreads. These metals are considered safe-haven assets and can be a valuable addition to a trader's portfolio, particularly during times of market volatility.

Indices: Traders can access major stock market indices without owning the underlying shares. This allows for speculation on whether an index will rise or fall, providing a way to diversify trading activities and profit from market movements.

FXPRIMUS Accounts

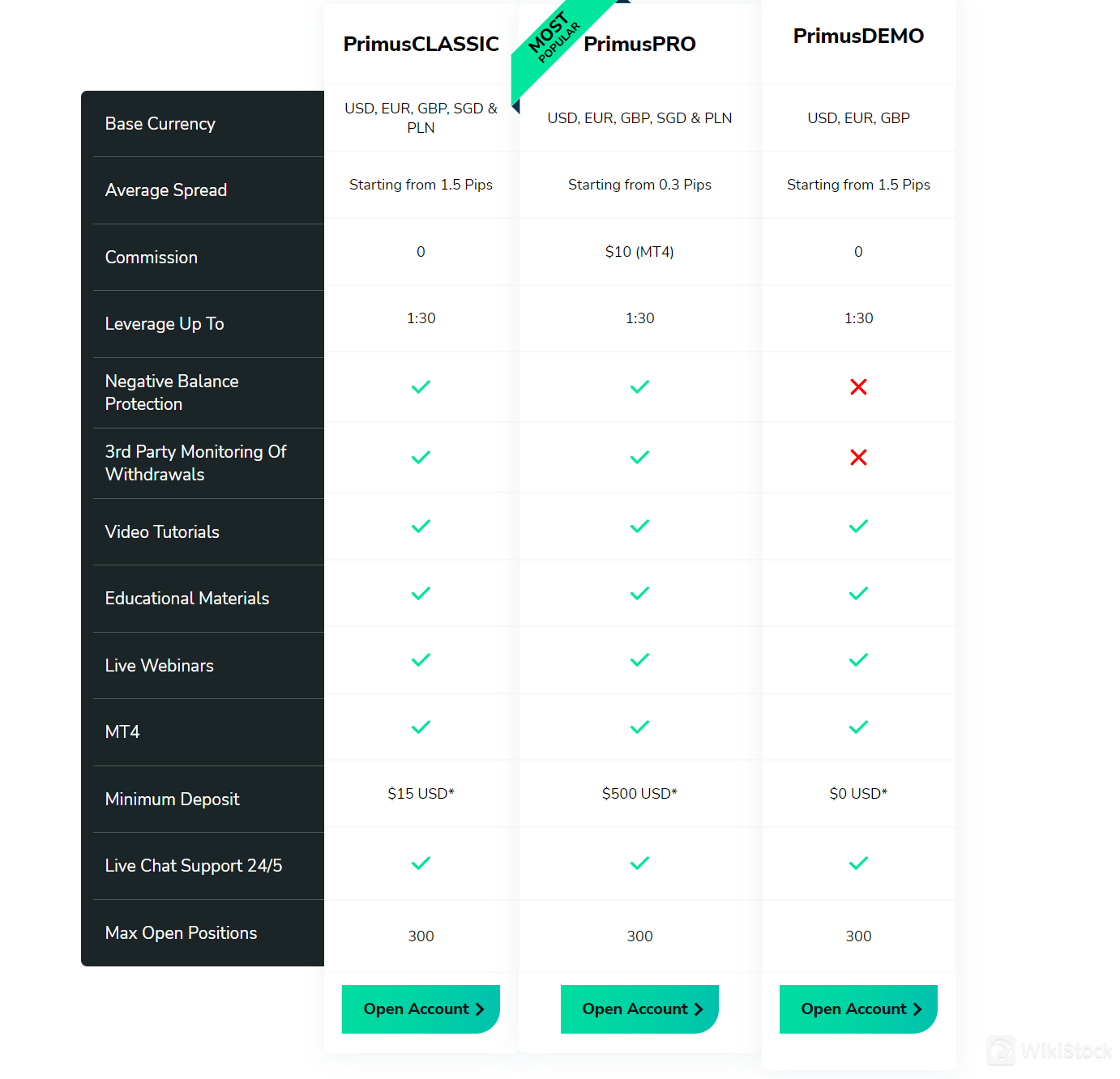

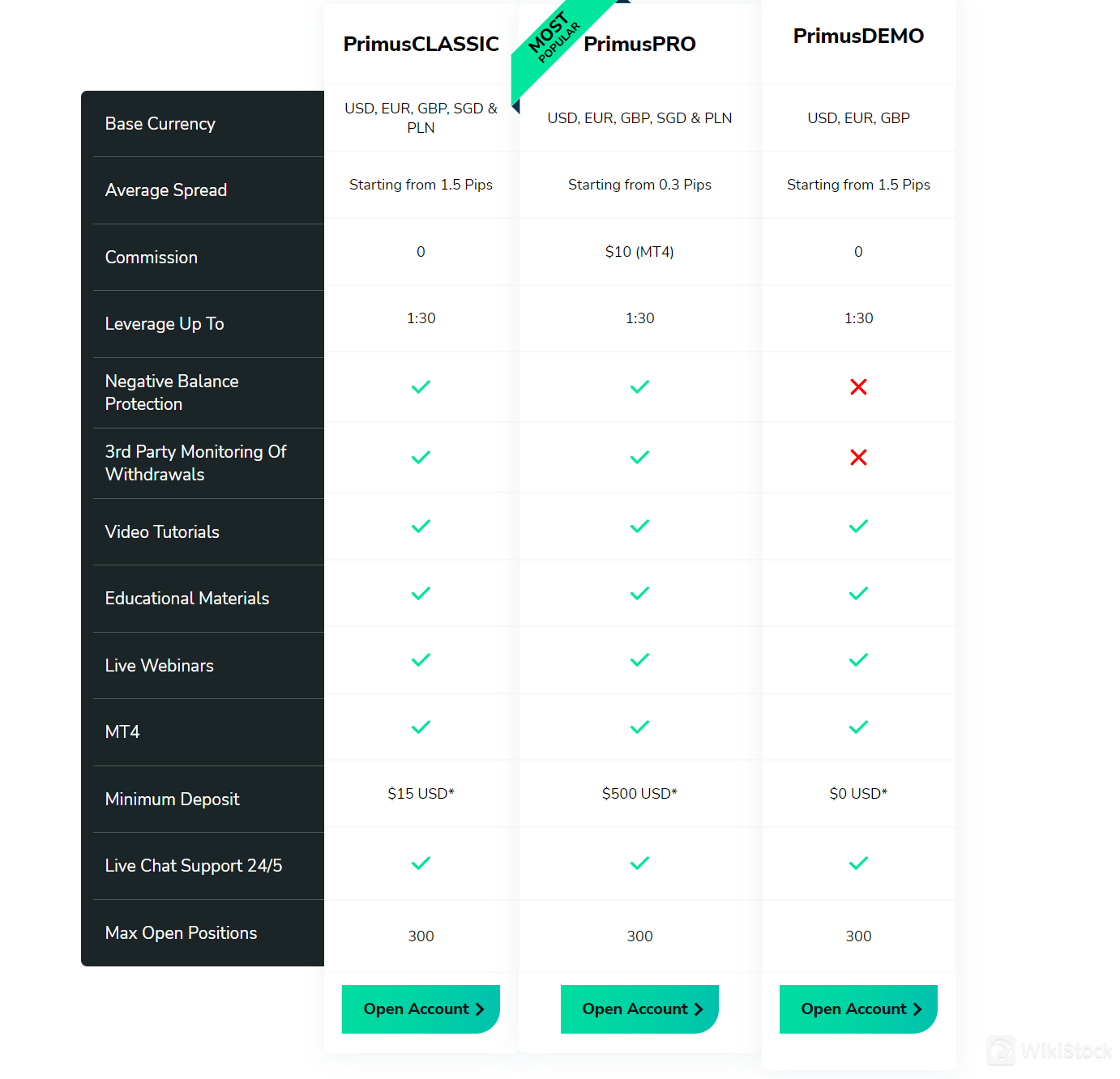

FXPRIMUS offers different account types with varying minimum deposit requirements to suit the needs of different traders.

The Primus Classic account has a minimum deposit of $15, making it accessible to beginners and traders looking for a low-cost entry into trading. This account is suitable for those who are new to trading or have limited trading capital.

On the other hand, the Primus Pro account requires a minimum deposit of $500 and is designed for more experienced traders.

Additionally, FXPRIMUS offers a demo account with no minimum deposit requirement. The demo account allows traders to practice trading strategies in a risk-free environment using virtual funds.

FXPRIMUS Fees Review

FXPRIMUS charges fees primarily through spreads and commissions, varying based on the account type chosen. FXPRIMUS charges a commission on trades for the Primus Pro account, starting from $10 per lot traded on MT4. The spreads for this account are from 0.3 pips. The Primus Classic account does not have a commission but has slightly wider spreads from 1.5 pips.

Additionally, FXPRIMUS does not charge fees for deposits or withdrawals. The fees imposed by the third-party payment are also covered by FXPRIMUS.

FXPRIMUS App Review

FXPRIMUS offers MetaTrader 4 (MT4) platform for trading. MT4 is available for Windows, Android, and iOS devices, providing a comprehensive range of trading tools and features. Additionally, the MT4 WebTrader platform allows traders to trade directly from their web browser without the need for any downloads, offering all types of trading orders, one-click trading, 30 indicators, and 24 graphical objects for technical analysis, as well as real-time quotes and a history of trading operations.

Research & Education

FXPrimus provides a comprehensive education section covering various aspects of forex trading, catering to traders of all levels. Beginners can benefit from guides on how to trade forex, an introduction to forex trading, and identifying their trader type. For more advanced traders, there are resources on trading strategies, risk management, currency correlations, margins, leverage, common trading mistakes to avoid, and understanding support and resistance levels. Additionally, there are tips for navigating the currency markets with confidence, offering valuable insights for traders looking to enhance their trading skills and knowledge.

Customer Service

You can contact FXPRIMUS for support through various channels. They offer 24/5 live chat support on their website. Additionally, you can reach them via email at support@fxprimus.eu. Fill out the contact form on their website with your first name, last name, email, country, contact number, and message, and they will get back to you.

Conclusion

In summary, FXPRIMUS is a regulated online trading platform that prioritizes client safety and offers a range of account types to suit different trading needs. The platform provides access to forex, metals, and indices markets, along with a user-friendly MetaTrader 4 platform. FXPRIMUS also offers educational resources and responsive customer support. Overall, FXPRIMUS is a reliable choice for traders seeking a secure trading environment.

Frequently Asked Questions (FAQs)

Is FXPRIMUS regulated?

Yes, FXPRIMUS is regulated by the Cyprus Securities and Exchange Commission (CySEC).

What is the minimum deposit required to open an account with FXPRIMUS?

The minimum deposit for a Primus Classic account is $15, while for a Primus Pro account, it is $500.

Does FXPRIMUS offer a demo account?

Yes.

What trading platforms are available on FXPRIMUS?

FXPRIMUS offers the MetaTrader 4 (MT4) platform for trading, available for Windows, Android, and iOS devices, as well as a WebTrader version.

Does FXPRIMUS charge fees for deposits or withdrawals?

No, FXPRIMUS does not charge fees for deposits or withdrawals. Additionally, fees imposed by third-party payment providers are covered by FXPRIMUS.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Turkey

TurkeyObtain 1 securities license(s)