We are offering high quality services to both individual and corporate Clients, while being fully compliant with all the relevant Laws and Regulations. As a mature and experienced Company, we understand the nature of the Forex industry, as well as the needs and demands of its Clients. For that reason, we have created a secure trading network consisting of high-end trading technology and prestigious partnerships, which has enabled us to become a secure, transparent and reliable broker.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Investing24 Information

Investing24 is a regulated online brokerage firm known for providing a comprehensive range of trading services and tools. Offering access to global financial markets, Investing24 facilitates trading in currencies, commodities, shares, cryptocurrencies, metals, and indices through its intuitive MetaTrader 4 platform. The firm emphasizes client-centricity with competitive pricing and multiple trading tools.

Pros & Cons

Pros Regulated by CySEC: Investing24 is regulated by the Cyprus Securities and Exchange Commission (CySEC), holding license No. 182/12, ensuring adherence to stringent financial standards and investor protection.

Diverse Range of Trading Instruments: Investing24 offers a wide variety of financial instruments including currencies, commodities, shares, cryptocurrencies, metals, and indices.

MetaTrader 4 Platform: The MetaTrader 4 (MT4) platform is widely recognized for its user-friendly interface, advanced charting tools, and comprehensive order management capabilities.

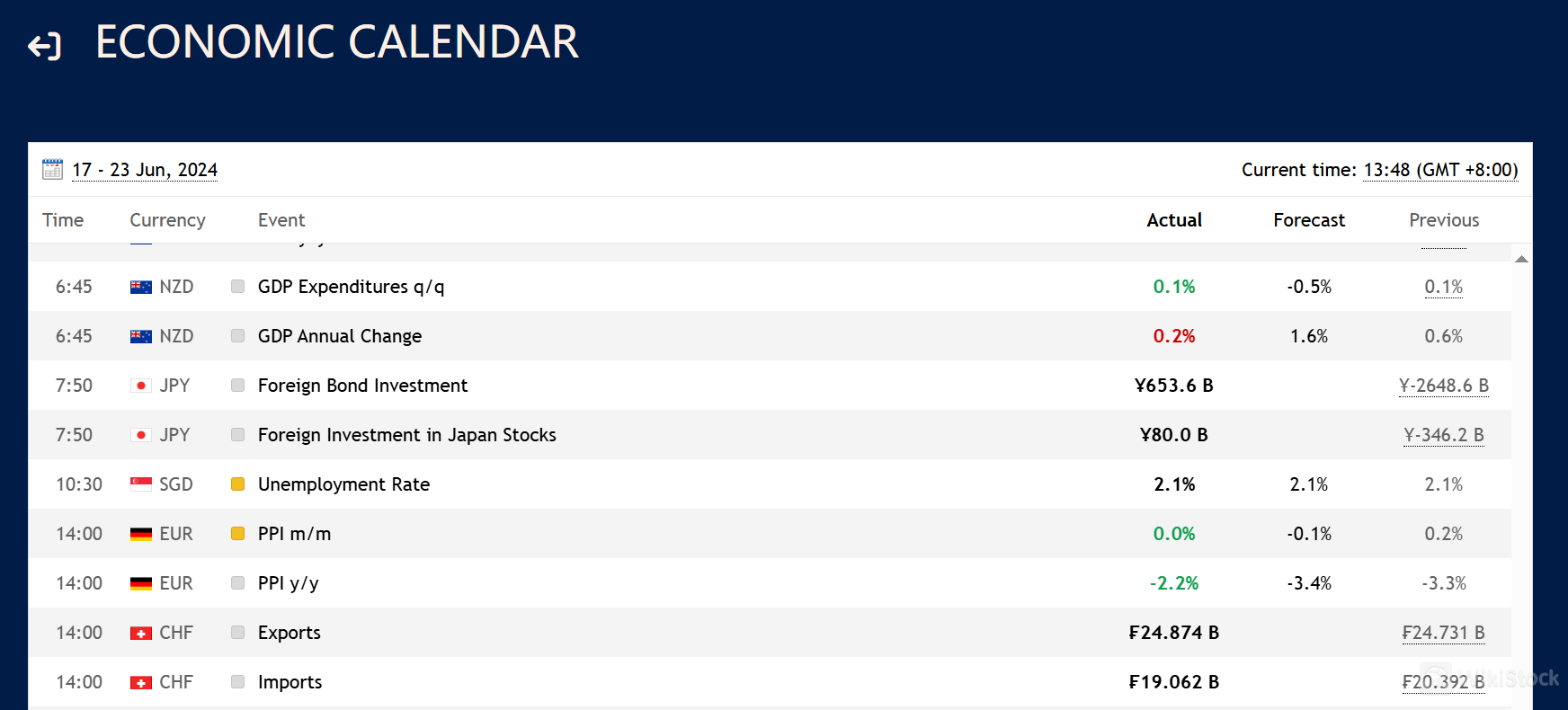

Economic and Holiday Calendars: Provides traders with essential tools like the Economic Calendar for tracking key economic events and the Holiday Calendar for staying informed about market closures and trading hours during holidays.

Cons Limited Brokerage Support Hours: Investing24 offers brokerage support 24/5, which may not cover all trading sessions or immediate assistance needs during off-hours.

Higher Minimum Deposit for Premium Accounts: While the MICRO account has a lower minimum deposit requirement, the PREMIUM and PLATINUM accounts require higher initial deposits, limiting accessibility for some traders.

Is Investing24 Legit?

Investing24 is regulated by the oversight of the oversight of the Cyprus Securities and Exchange Commission (CySEC), holding license No. 182/12. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market.

What are Securities to trade with Investing24?

Investing24 provides a diverse range of trading instruments.

Currencies: Investors can trade a wide array of currencies, including major pairs like EUR/USD and GBP/JPY, allowing for strategic forex trading to capitalize on global economic trends and geopolitical events.

Commodities: With Investing24, traders can access commodities such as gold, silver, oil, and agricultural products.

Shares: Investing24 offers an extensive range of shares from global markets, enabling investors to trade stocks of leading companies across sectors like technology, healthcare, finance, and more.

Cryptocurrencies: In the fast-evolving realm of digital assets, Investing24 provides opportunities to trade popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This sector appeals to investors seeking high volatility and potential for significant returns.

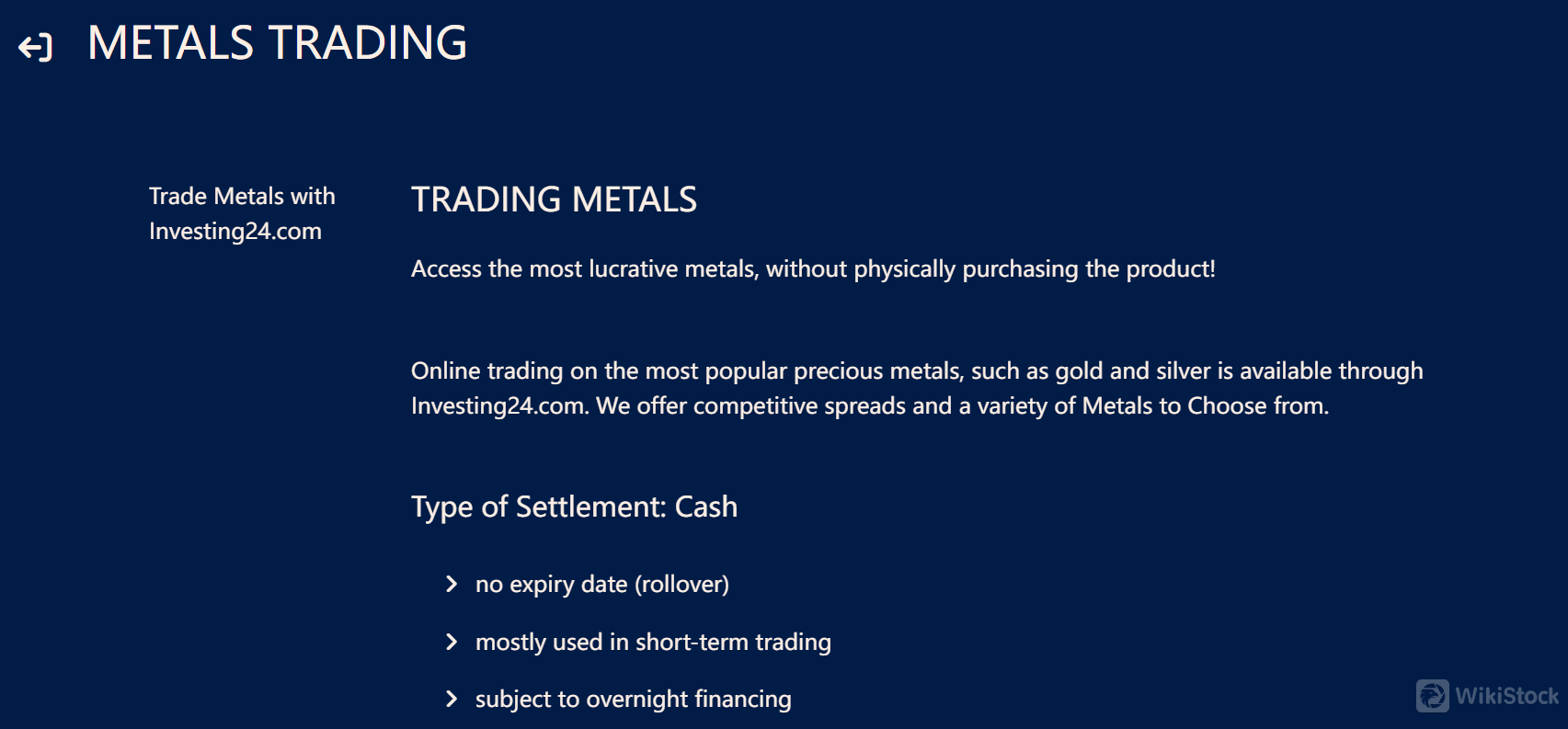

Metals: Precious metals such as gold, silver, platinum, and palladium are available for trading on Investing24. These commodities are favored for their intrinsic value and are often considered safe-haven assets during times of economic uncertainty.

Indices: Investing24 offers trading on global indices like the S&P 500, FTSE 100, and Nikkei 225, allowing investors to speculate on the performance of entire markets rather than individual stocks.

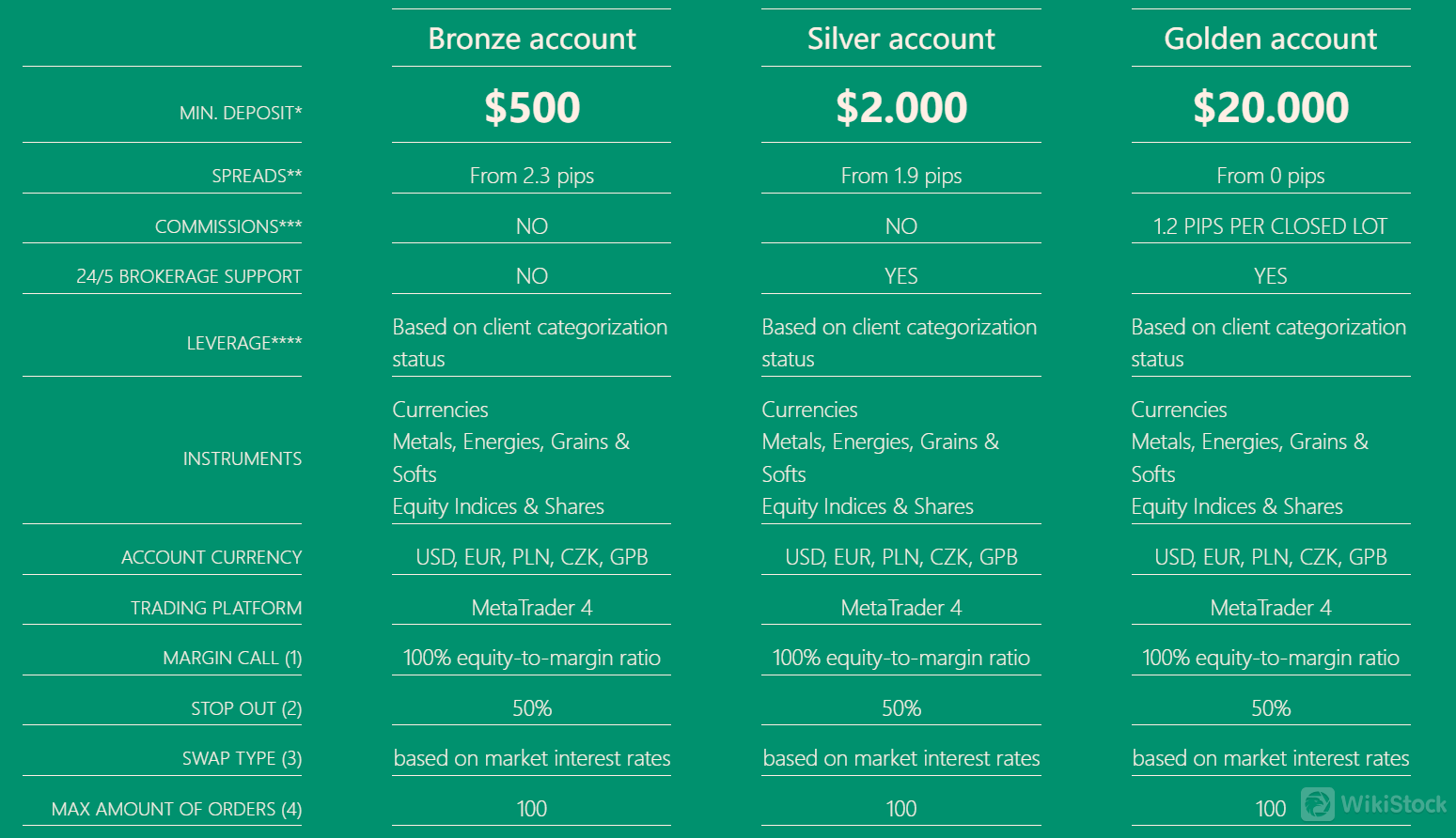

Investing24 Accounts

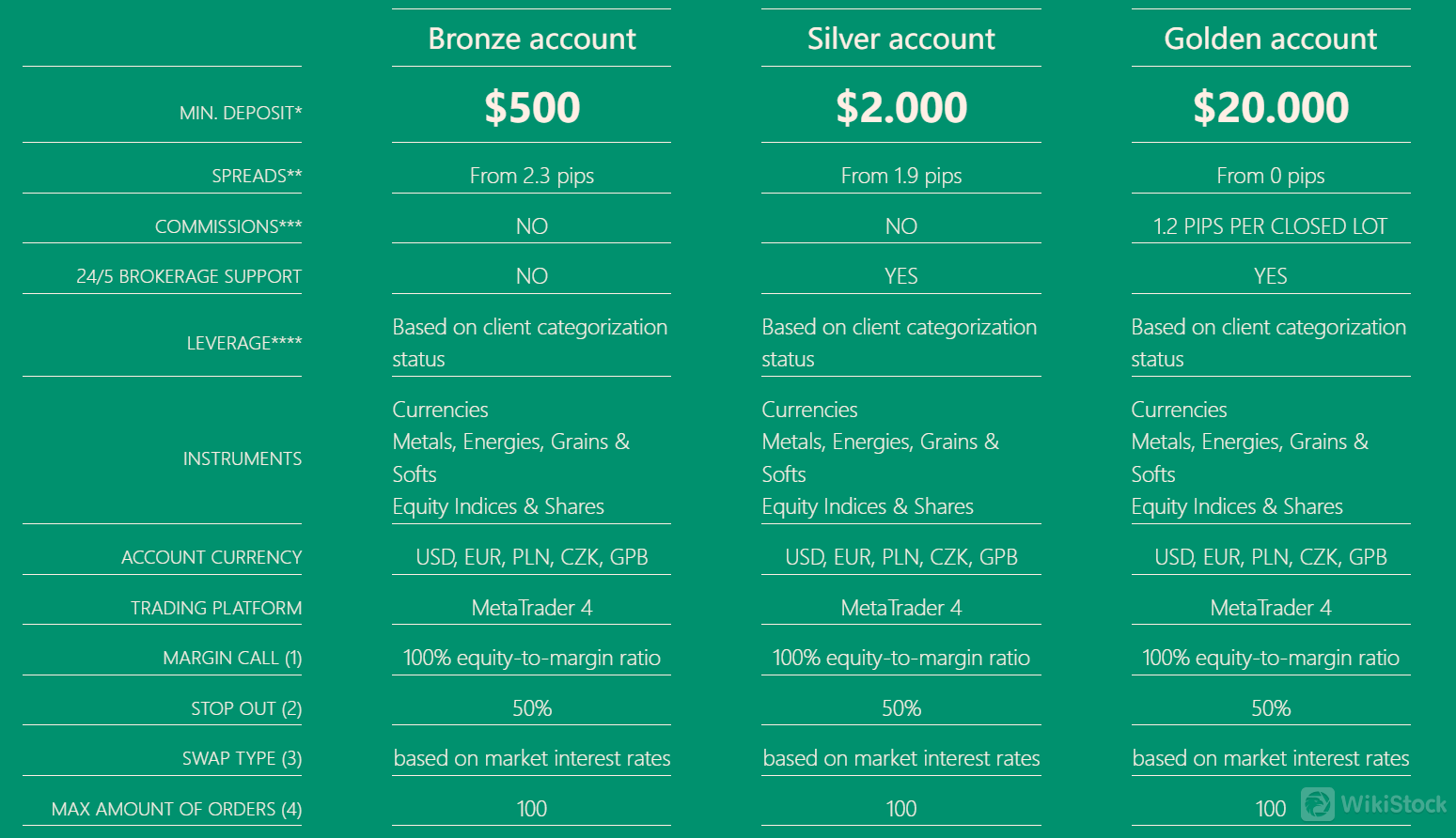

Bronze account Silver account Golden account

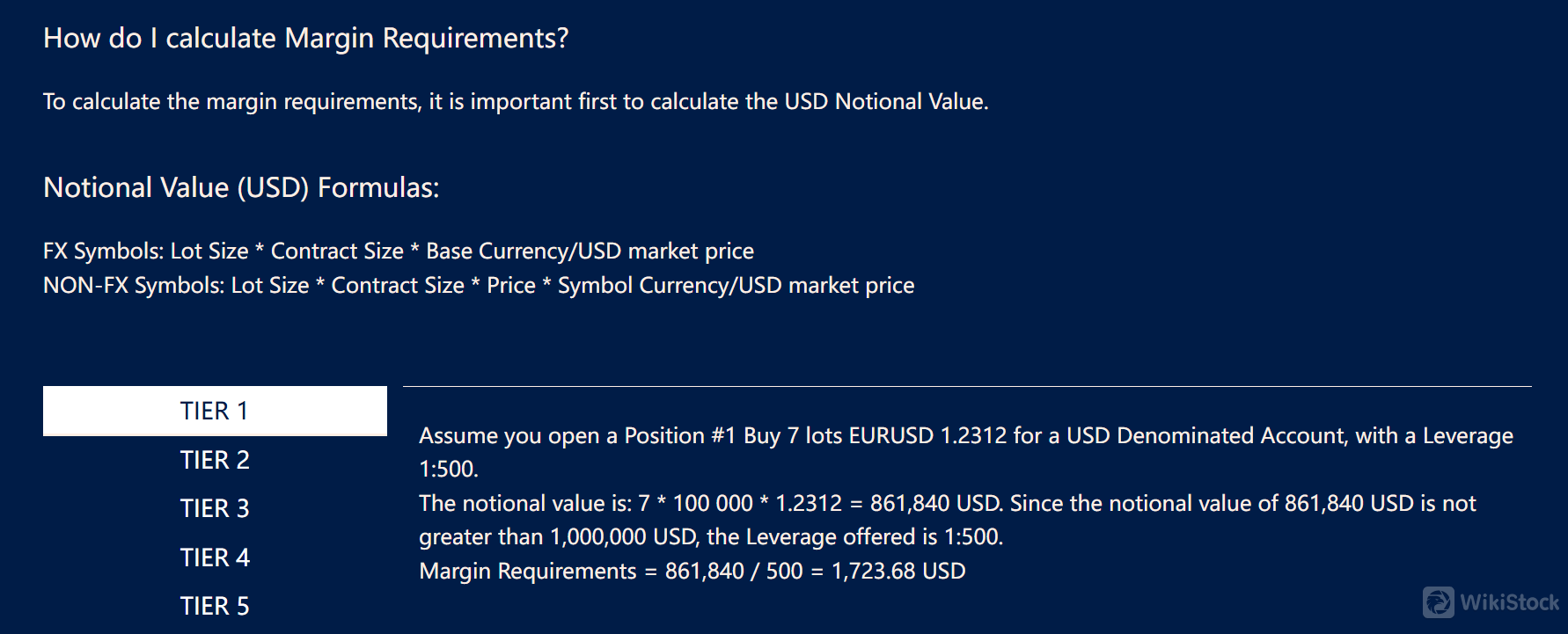

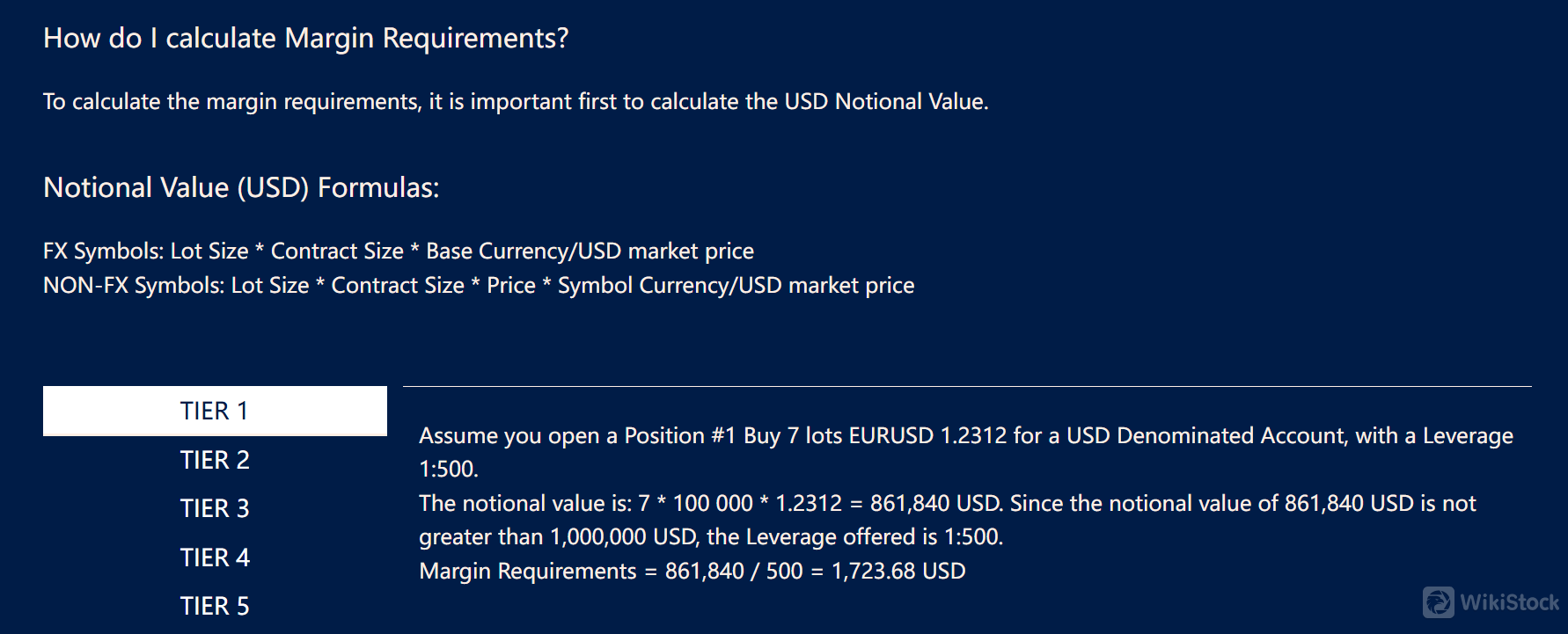

Margin Requirements

Themargin requirementsfor trading AUD-denominated currency pairs on Investing24 vary based on the USD notional value of the trade.

Notional Value (USD) Formulas: FX Symbols: Lot Size * Contract Size * Base Currency/USD market price

Lot Size: The number of units of the base currency being traded.

Contract Size: The standardized contract size of the Forex pair.

Base Currency: The first currency listed in the Forex pair (e.g., EUR in EUR/USD).

USD Market Price: The current market exchange rate for 1 USD against the base currency.

NON-FX Symbols Formulas: Lot Size * Contract Size * Price * Symbol Currency/USD market price

Lot Size: The number of lots or units being traded.

Contract Size: The standardized contract size of the symbol being traded.

Price: The current market price of the symbol.

Symbol Currency: The currency in which the symbol is denominated (e.g., USD for US stocks, EUR for European indices).

USD Market Price: The current market exchange rate for 1 USD against the symbol currency.

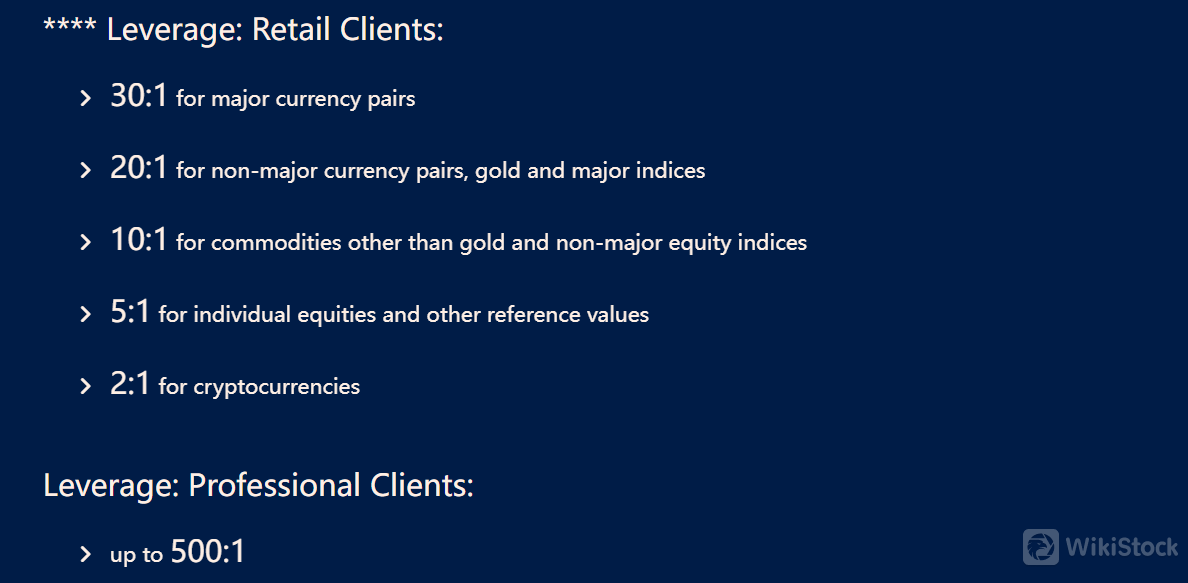

Investing24 Leverage Review

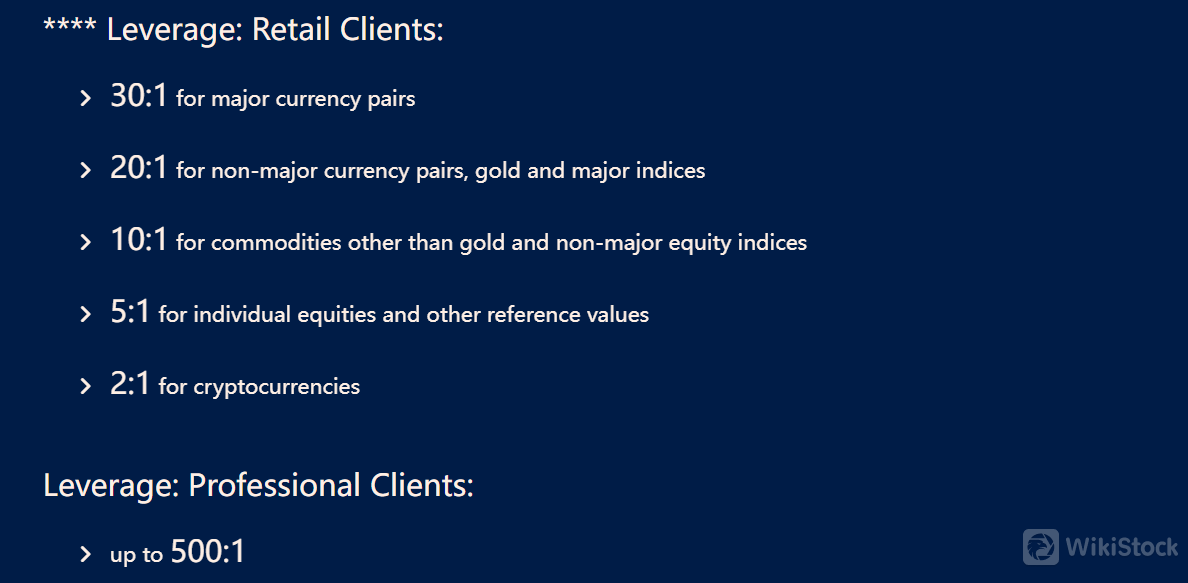

Investing24 offers varying leverage options tailored to different client classifications. For retail clients, the leverage is regulated and set at specific levels: up to 30:1 for major currency pairs, 20:1 for non-major currency pairs, gold, and major indices, 10:1 for commodities other than gold and non-major equity indices, 5:1 for individual equities and other reference values, and 2:1 for cryptocurrencies.

In contrast, professional clients can access higher leverage, with levels reaching up to 500:1, allowing for greater flexibility and exposure in their trading activities. This dual-tiered approach ensures that both retail and professional clients can choose leverage options that best suit their trading strategies while adhering to regulatory requirements.

Investing24 Platform Review

Investing24 provides a robust trading experience through the MetaTrader 4 (MT4) platform, accessible across multiple devices including desktop computers, iPhone/iPad, and Android devgices. The platform offers advanced charting tools, customizable indicators, and a wide range of order types, facilitatin precise trade execution and comprehensive market analysis.

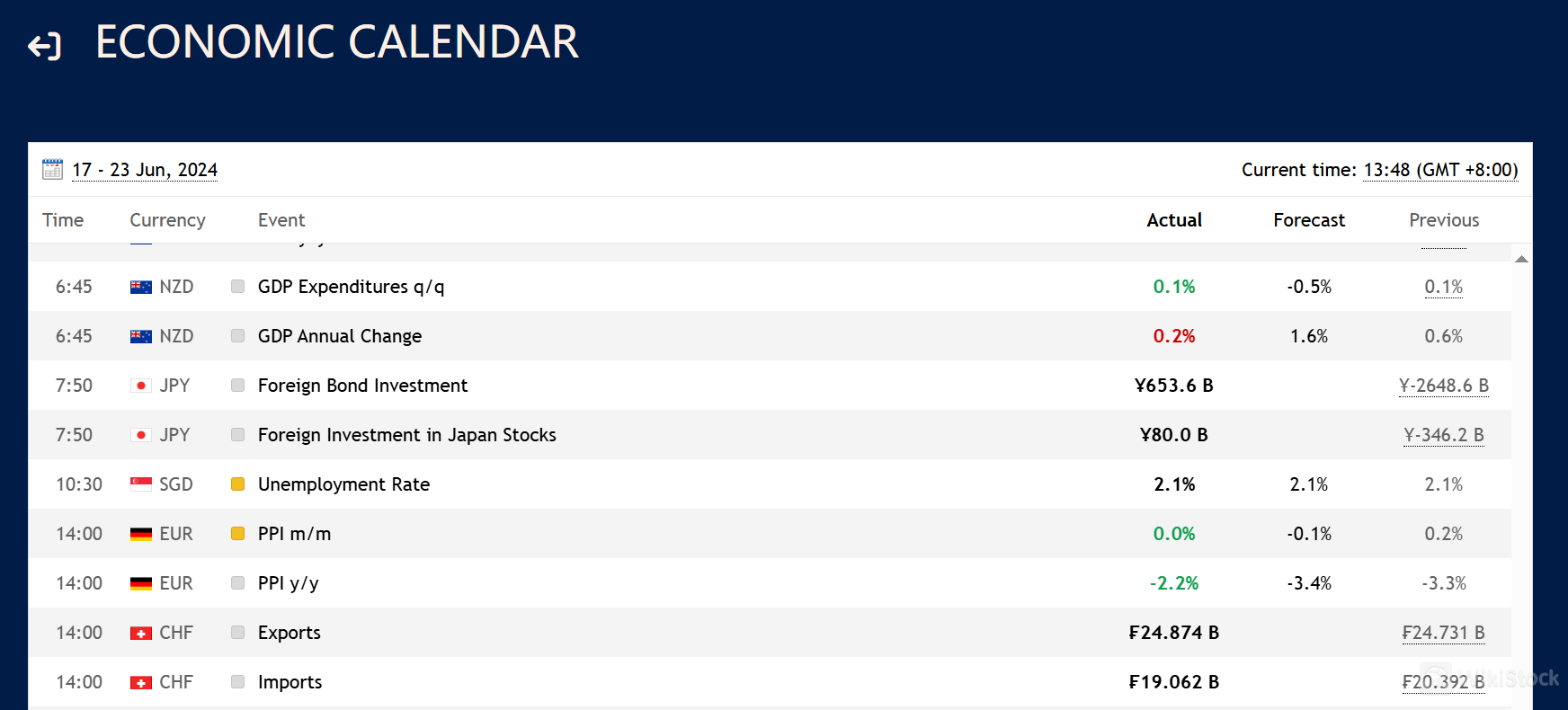

Trading Tools

Investing24 equips traders with essential tools to stay informed and enhance their trading decisions. The Economic Calendar provides up-to-date information on key economic events and data releases globally, helping traders anticipate market movements and adjust their strategies accordingly. This tool is crucial for understanding how economic indicators such as GDP, employment reports, and interest rate decisions may impact currency pairs, commodities, and indices.

Additionally, the Holiday Calendar keeps traders informed about market closures and trading hours during major holidays, ensuring they can plan their trading activities effectively. These tools combined empower Investing24 clients with the knowledge and insights needed to navigate volatile market conditions and optimize their trading opportunities.

Customer Service

Investing24 provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Tel: +357 25 022 870

Email: support@investing24.com

Company HQ: 4 Theklas Lysioti St, Harmony House Office 31, 3rd Floor, 3030 Limassol, Cyprus

PO BOX: PO BOX 58287, Post Office 5040, Agios Nikolaos, Georgiou Griva Digeni 82, 3101 Limassol, Cyprus

Working Hours: Monday-Friday: 07:00 - 16:00 GMT, Saturday - Sunday : Closed

Contact form

Conclusion

In conclusion, Investing24 emerges as a competitive choice in the online brokerage space, offering a robust suite of trading tools and a diverse range of financial instruments through the widely acclaimed MetaTrader 4 platform. However, traders are supposed to consider the higher minimum deposit requirements for premium accounts and the limited support hours.

Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is Investing24 suitable for beginners?

Yes. Investing24 is suitable for beginners due to its user-friendly platform, multiple trading tools, and comprehensive customer support.

Is Investing24 legit?

Yes, Investing24 is regulated by CySEC.

What account types does Investing24 offer?

Investing24 offers Bronze account, Silver account, and Golden account.

What trading platforms does Investing24 support?

Investing24 supports the MetaTrader 4 (MT4) platform, available for desktop computers, iPhone/iPad, and Android devices.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)