Score

天风国际

https://sf.tfisec.com/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China Hong Kong

China Hong Kong Products

3

Futures、Investment Advisory Service、Stocks

Surpassed 22.17% brokers

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01963

Brokerage Information

More

Company Name

天风国际证券与期货有限公司

Abbreviation

天风国际

Platform registered country and region

Company address

Company website

https://sf.tfisec.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.25%

Funding Rate

3%

New Stock Trading

Yes

Margin Trading

YES

| TFI Securities and Futures |  |

| WikiStock Rating | ⭐️⭐️⭐️ |

| Account Minimum | $0 |

| Fees | Fund Commission: Minimum $0 per transaction;Hong Kong stocks Commission:Minimum $0.01 per transaction;U.S. stock Commission:Minimum $15 per transaction;Shanghai and Shenzhen stock exchange Commission:Minimum ¥100 per transaction;Futures Commission:Minimum $10 per transaction; |

| Account Fees | Varies by transactions and services |

| Interests on uninvested cash | No |

| Margin Interest Rates | No |

| Mutual Funds Offered | Yes |

| App/Platform | Available on Android, Windows, iphone |

| Promotions | No |

What is TFI Securities and Futures?

TFI Securities and Futures is a brokerage platform offering a wide range of investment opportunities. It boasts a $0 account minimum and competitive fee structures tailored to different types of transactions, including minimum charges for various exchanges. Although it doesn't offer interest on uninvested cash or margin interest rates,TFI Securities and Futures provides access to mutual funds.

Pros and Cons of TFI Securities and Futures

TFI Securities and Futures presents a compelling platform for investors with its array of investment opportunities spanning stocks, mutual funds, and futures. The low account minimum ensures accessibility for all, while its competitive fee structure keeps costs in check. Additionally, while TFI Securities and Futures offers various investment options, the lack of promotional offers might disappoint those looking for extra incentives. Furthermore, the varied nature of account fees could introduce unpredictability into overall costs, which might be a consideration for some investors.

| Pros | Cons |

|

|

|

|

|

|

Is TFI Securities and Futures safe?

Regulation

TFI Securities and Futures is currently licensed and regulated by the Securities and Futures Commission (SFC) under license number BAV573.

What are securities to trade with TFI Securities and Futures?

TFI Securities and Futures provides a diverse range of investment products including Hong Kong stocks, U.S. stocks, A-share, futures and warrants. However, it does not currently offer options, bonds, or forex, limiting the scope for investors interested in these specific asset classes.

Hong Kong stocks: These are shares of companies that are listed and traded on the Hong Kong Stock Exchange (HKEX), which is one of the major financial markets in Asia.

U.S. stocks: These refer to shares of companies that are listed and traded on stock exchanges in the United States, such as the New York Stock Exchange (NYSE) or NASDAQ.

A-shares: A-shares are shares of mainland Chinese companies that are traded on the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE), denominated in Chinese yuan (CNY).

Futures: Futures are financial contracts where parties agree to buy or sell an asset (like commodities, currencies, or financial instruments) at a predetermined price at a specified future date.

Warrants: Warrants are financial instruments that give the holder the right (but not the obligation) to buy or sell an underlying asset at a predetermined price before a specified expiration date. They are often used in equity markets to leverage potential gains.

Futures: Futures contracts are agreements to buy or sell a specific asset at a predetermined price on a future date. They are commonly used to hedge against price fluctuations or to speculate on the future price movements of commodities, currencies, or financial instruments.

TFI Securities and Futures Fees Review

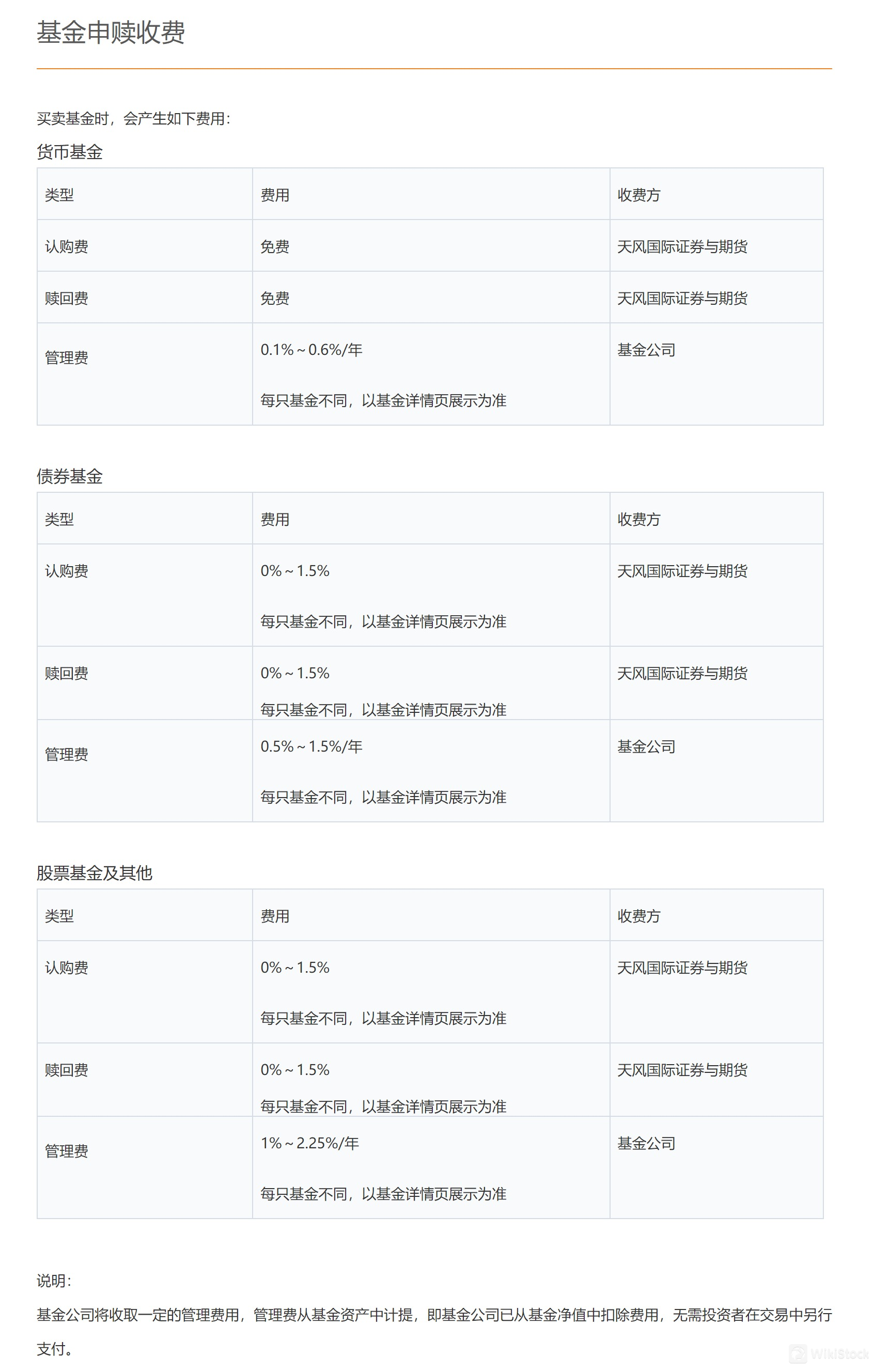

TFI Securities offers a tiered fee structure for mutual fund investments, tailored to different fund types. Money market funds incur no subscription or redemption fees, with annual management fees ranging from 0.1% to 0.6%. Bond funds have subscription and redemption fees of 0% to 1.5%, and annual management fees between 0.5% and 1.5%. For equity funds and others, subscription and redemption fees also range from 0% to 1.5%, while annual management fees are higher at 1% to 2.25%. Notably, subscription and redemption fees are collected by TFI Securities, while management fees go to the fund companies

Hong Kong stock trading fees

For Hong Kong stock trading, the brokerage commission is 0.25% of the transaction amount, with a minimum of HK$100 for both online and phone trades. Additional fees include a 0.00565% trading fee (min HK$0.01) to the Hong Kong Exchange, a 0.0027% transaction levy (min HK$0.01) to the SFC, and a 0.002% settlement fee (min HK$2, max HK$100) to Hong Kong Clearing. The Hong Kong government levies a 0.1% stamp duty, rounded up to the nearest dollar. A Financial Reporting Council transaction levy of 0.00015% is also applied.

IPO Subscriptions Fees

For IPO subscriptions. A flat handling fee of HK$100 per application is charged by TFI Securities, regardless of the subscription outcome. For successful allocations, an additional 1.0077% of the transaction amount is levied, encompassing the transaction levy, trading fee, and brokerage commission. This composite fee is split between the Securities and Futures Commission, the Hong Kong Exchange, and the brokerage firm.

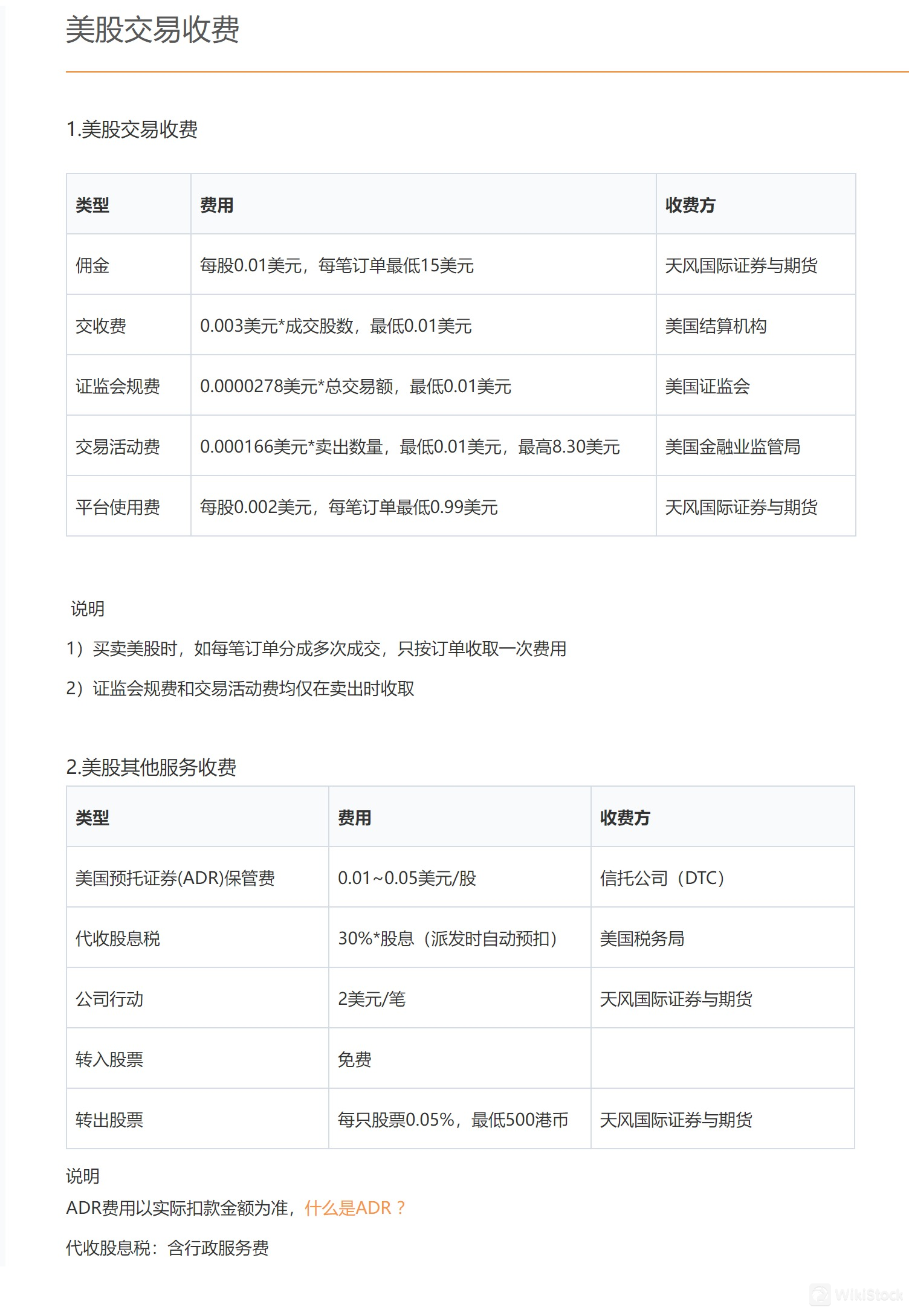

U.S. stock trading fees

For U.S. stock trading and related services. For trades, they charge $0.01 per share with a $15 minimum per order, plus a platform fee of $0.002 per share (minimum $0.99). Additional regulatory fees include a $0.003 per share settlement fee, a 0.0000278% SEC fee, and a $0.000166 per share trading activity fee (capped at $8.30).

For other services, ADR custody fees range from $0.01 to $0.05 per share, dividends are subject to a 30% withholding tax, and corporate actions incur a $2 fee. Stock transfers into the account are free, while outbound transfers cost 0.05% of the stock value with a minimum of HK$500 per security.

Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect trading fees

For trading via Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect programs. The brokerage commission is 0.25% with a minimum of 100 RMB per trade. Additional fees include a 0.00341% handling fee (0.004% for ETFs), a 0.002% securities management fee (waived for ETFs), a 0.001% transfer fee (waived for ETFs), and a 0.002% registration fee. A 0.05% stamp duty applies to sell orders only (waived for ETFs). A daily portfolio fee of 0.008%/365 is calculated on held securities and charged monthly. Dividends are subject to a 10% withholding tax.

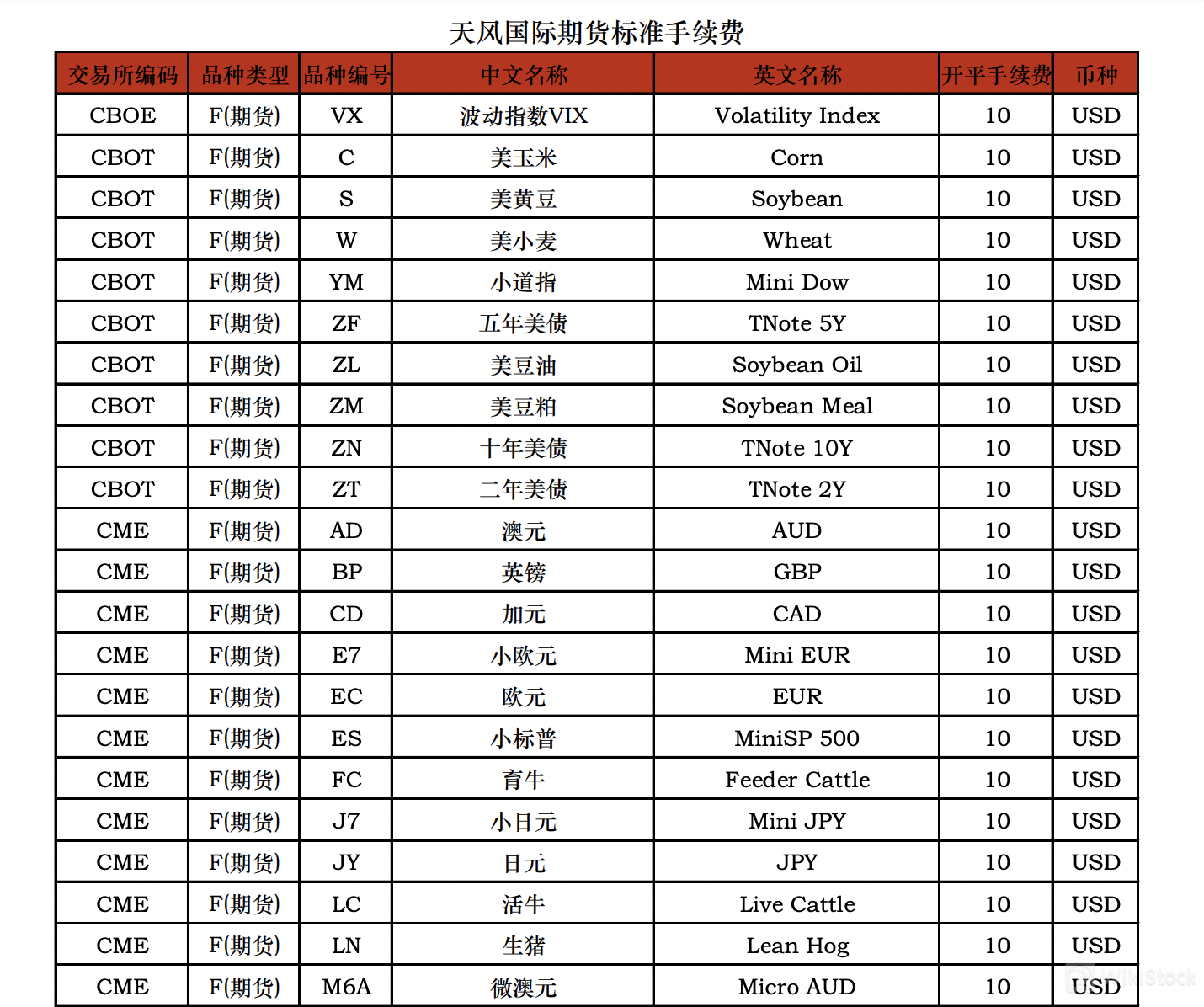

Future trading fees

TFI Securities charges a flat rate of 10 USD per contract for opening and closing positions on most futures products, including major indices, currencies, commodities, and treasury bonds from exchanges such as CBOE, CBOT, CME, and COMEX. Notable exceptions include the S&P 500 futures (SP) with a 20 USD fee, and the Micro E-mini Nasdaq 100 (MNQ) at 8 USD. For EUREX products, the fee is 10 EUR per contract. This pricing model covers a wide array of instruments, from agricultural commodities like corn and soybeans to financial products such as the VIX volatility index and various international currency pairs.

TFI Securities and Futures App Review

TFI Securities and Futures offers a versatile app available on Android, Windows, and iPhone, providing investors with access to their accounts and the financial markets anytime, anywhere. With a seamless interface and robust features, the app enables users to execute trades, monitor their portfolios, access real-time market data, and stay informed with news and research. Investors can rely on the TFI Securities app to stay connected to their investments anytime.

Research and Eduation

TFI Securities and Futures provides a comprehensive research and education platform for investors to navigate the financial markets. Through the “Stock School” program, investors can access a variety of courses covering essential topics and advanced topics, such as understanding initial public offerings (IPOs), navigating the process of applying for new stock subscriptions and so on.

Customer Service

TFI Securities prides itself on providing comprehensive customer service support to its clients.

Address: 16/F, Two Pacific Place, 88 Queensway, Hong Kong,

Phone: +852 3187 8778

Fax: +852 2116 9415

Email address:cs_tfisf@tfisec.com.

Conclusion

TFI Securities stands out as a brokerage platform, offering investment options and competitive fee structures. With its low account minimum and accessibility across multiple platforms, it provides an attractive opportunity for both novice and experienced investors alike. It provides stocks, mutual funds, and futures, allowing investors to tailor their portfolios to their individual preferences and risk tolerances. TFI Securities is particularly suitable for investors seeking a versatile and user-friendly platform to navigate the financial markets efficiently, whether they are looking to build a diversified portfolio or engage in more advanced trading strategies.

FAQs

Is TFI Securities and Futures safe to trade?

TFI Securities places a high priority on the security and integrity of its platform. With robust encryption protocols and stringent security measures in place, including firewalls and multi-factor authentication, TFI Securities ensures the safety of clients' sensitive information and transactions. Additionally, TFI Securities is regulated by relevant financial authorities, further enhancing its commitment to maintaining a secure trading environment.

Is TFI Securities and Futures a good platform for beginners?

Yes, TFI Securities is an excellent platform for beginners due to its user-friendly interface and educational resources. The platform provides access to a wide range of investment products, including stocks, mutual funds, and futures, allowing beginners to build diversified portfolios according to their investment goals and risk tolerance. Moreover, TFI Securities offers comprehensive educational materials, tutorials, and customer support to assist beginners in navigating the complexities of the financial markets and making informed investment decisions.

Is TFI Securities and Futures legit?

Yes, TFI Securities is a legitimate brokerage platform that operates under the regulations and oversight of relevant financial authorities. It adheres to strict compliance standards and regulatory requirements to ensure transparency, integrity, and legality in its operations. Additionally, TFI Securities has a solid reputation within the investment community and has been serving clients for years, further validating its legitimacy and trustworthiness as a brokerage service.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Futures、Investment Advisory Service、Stocks

Relevant Enterprises

Countries

Company name

Associations

--

天风国际证券集团有限公司

Parent company

Download App

Review

No ratings

Recommended Brokerage FirmsMore

電訊證券

Score

Prudential Brokerage

Score

中原證券

Score

國農證券

Score

Synerwealth

Score

BaoQiao Partners

Score

雅景證券

Score

CS Wealth

Score

Plutus

Score

Tiger Faith Holdings

Score